Market Overview:

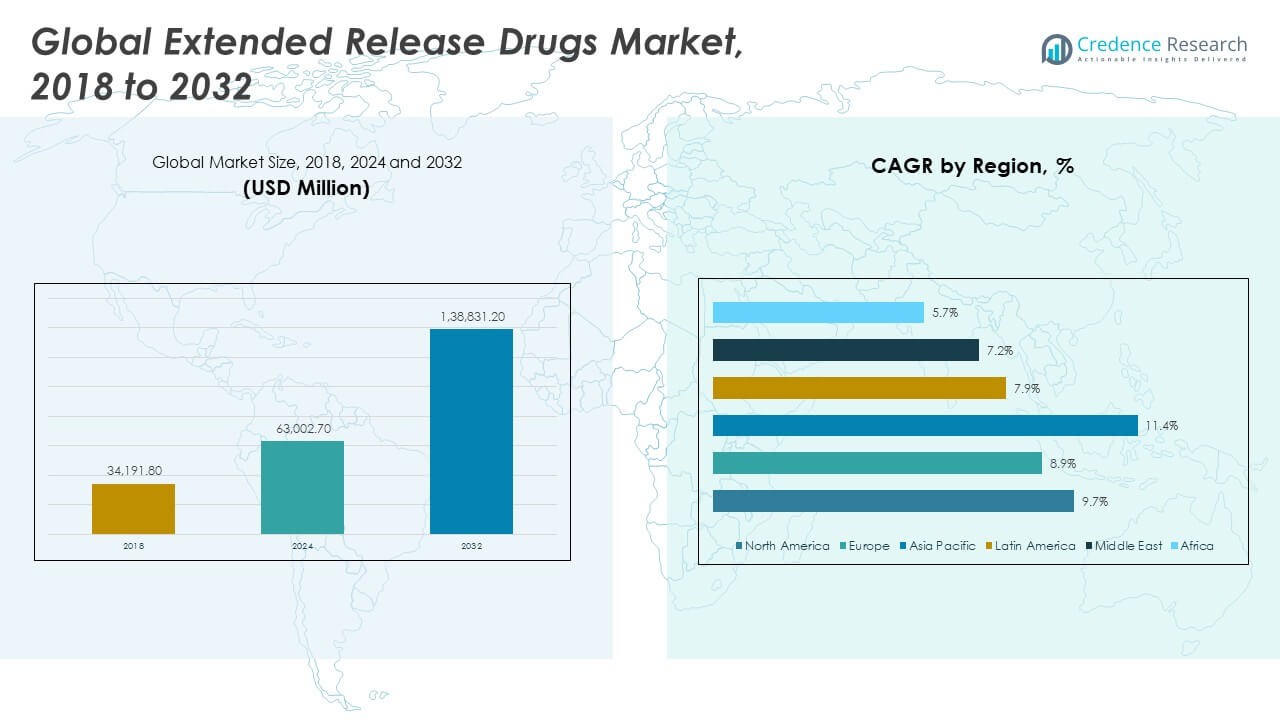

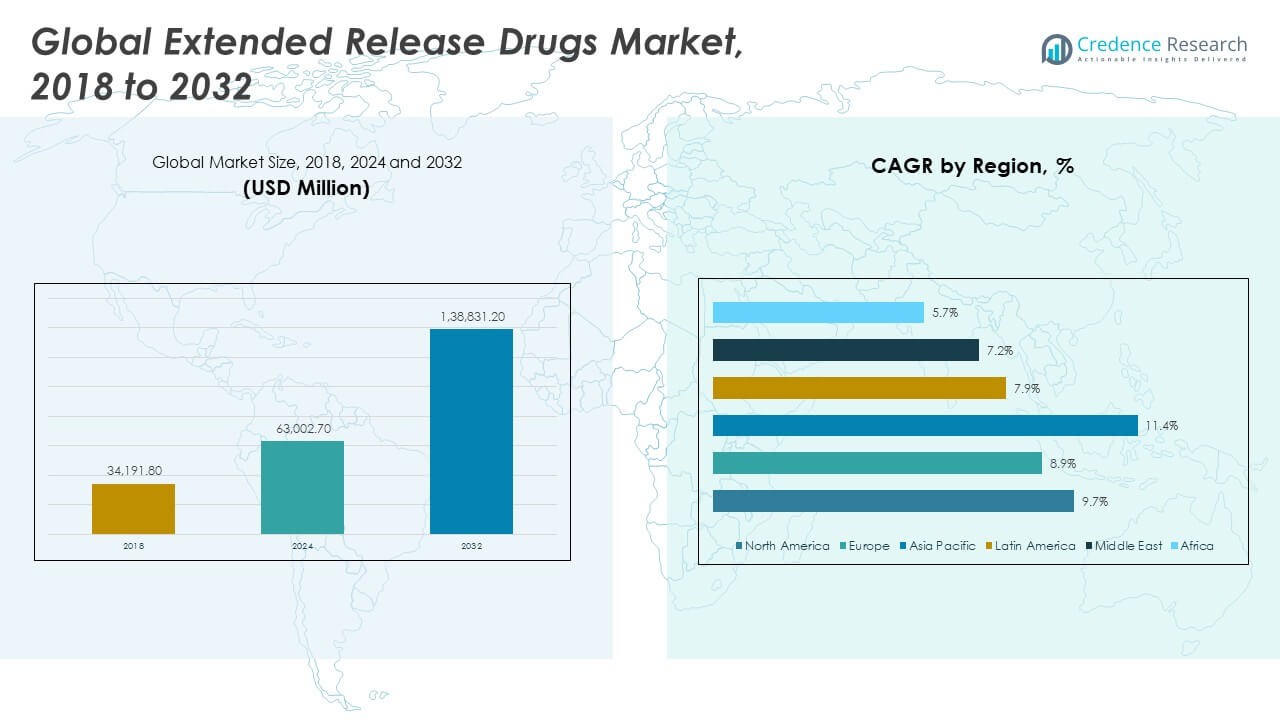

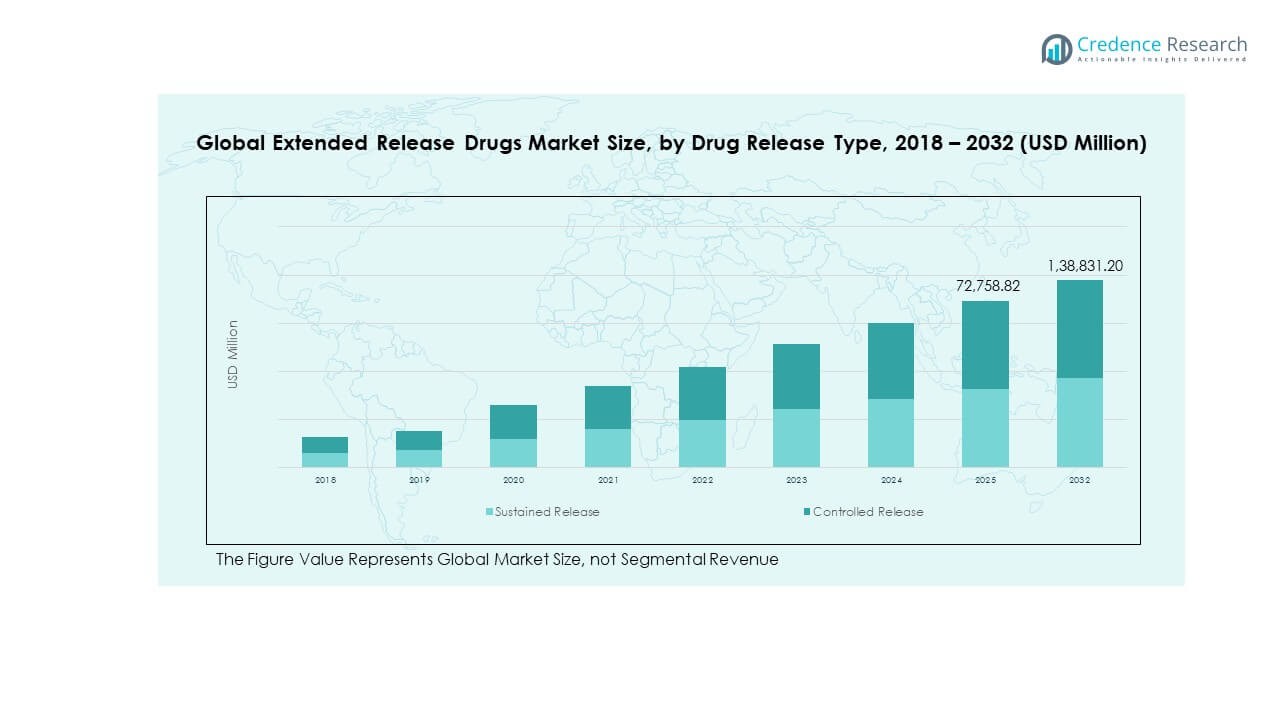

The Global Extended Release Drugs Market size was valued at USD 34,191.80 million in 2018 to USD 63,002.70 million in 2024 and is anticipated to reach USD 138,831.20 million by 2032, at a CAGR of 9.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Extended Release Drugs Market Size 2024 |

USD 63,002.70 Million |

| Extended Release Drugs Market, CAGR |

9.67% |

| Extended Release Drugs Market Size 2032 |

USD 138,831.20 Million |

The Global Extended Release Drugs Market is driven by rising demand for controlled and sustained drug delivery solutions that improve patient compliance and reduce dosing frequency. Growing cases of chronic diseases such as cardiovascular, neurological, and psychiatric disorders are fueling adoption. Pharmaceutical advancements in polymer science, nanotechnology, and formulation design have enabled precise drug release mechanisms. The growing preference for personalized and long-acting therapies across healthcare systems also supports strong market expansion.

North America leads the Global Extended Release Drugs Market, supported by robust R&D infrastructure, high healthcare spending, and favorable regulatory approvals. Europe follows, driven by established pharmaceutical players and a strong focus on chronic disease management. The Asia-Pacific region is emerging rapidly due to expanding healthcare access, growing patient awareness, and increasing investment in generic extended-release formulations by regional manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

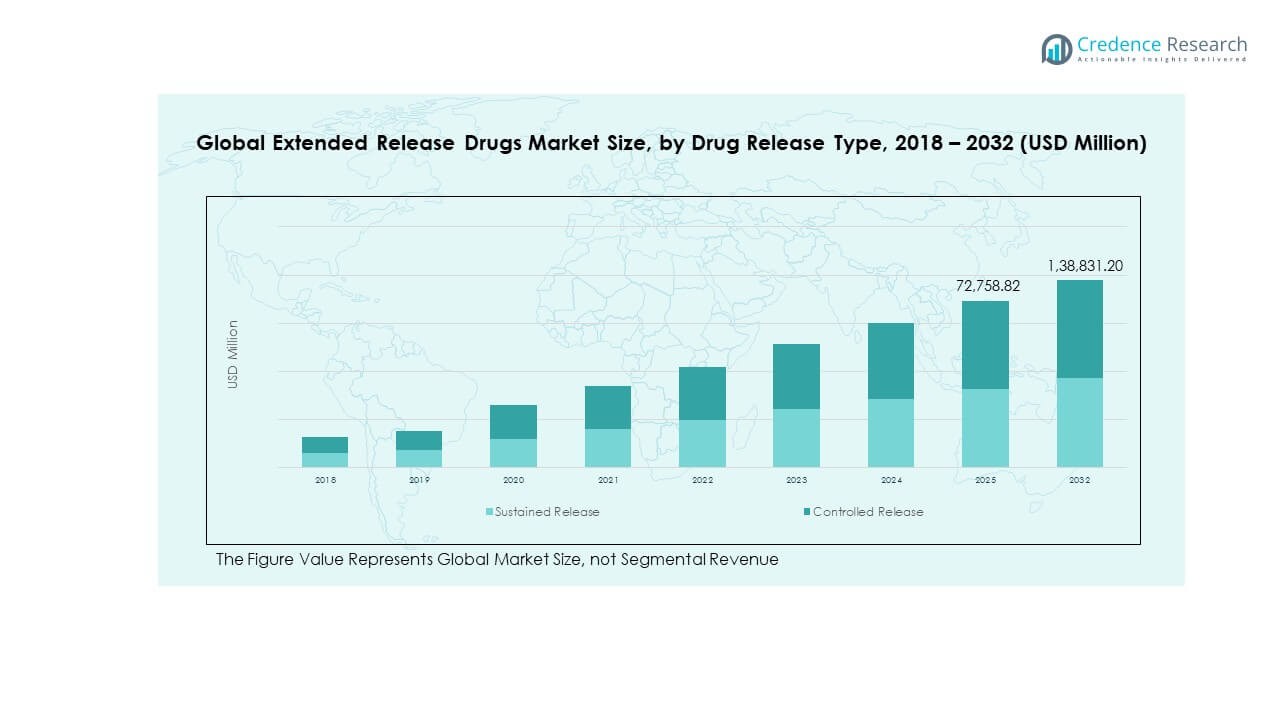

- The Global Extended Release Drugs Market was valued at USD 34,191.80 million in 2018, reached USD 63,002.70 million in 2024, and is projected to reach USD 138,831.20 million by 2032, expanding at a CAGR of 9.67% during the forecast period.

- North America (44%), Europe (26%), and Asia Pacific (20%) collectively dominate the market, driven by advanced healthcare systems, strong R&D investments, and the rising prevalence of chronic diseases requiring long-acting therapies.

- Asia Pacific, the fastest-growing region, is expanding rapidly due to improved healthcare infrastructure, growing pharmaceutical manufacturing capacity, and increasing demand for affordable generic extended-release drugs.

- In terms of segmental contribution, Sustained Release formulations account for around 60% of total revenue, supported by their extended therapeutic performance and reduced dosing frequency.

- Controlled Release formulations hold nearly 40% share, fueled by advancements in polymer science and precision-controlled drug delivery systems enhancing treatment efficiency and patient safety.

Market Drivers:

Rising Prevalence of Chronic and Lifestyle-Related Disorders Driving Demand for Extended Drug Delivery

The Global Extended Release Drugs Market is witnessing strong growth due to the increasing burden of chronic diseases, including diabetes, cardiovascular ailments, and neurological disorders. Extended-release formulations improve treatment adherence by reducing dosing frequency, which supports better disease management. It also helps maintain consistent therapeutic levels in the bloodstream, minimizing side effects. The growing aging population further amplifies the need for long-acting medications. Rising healthcare awareness among patients has encouraged doctors to prescribe sustained-release options. The shift toward preventive and long-term therapies supports continuous product innovation. These factors are collectively strengthening market penetration across hospitals and retail pharmacies.

- For instance, Assertio Therapeutics’s once-daily gabapentin extended-release formulation for postherpetic neuralgia demonstrates how companies are responding to chronic pain management needs by improving dosing schedules. Extended-release formulations improve treatment adherence by reducing dosing frequency, which supports better disease management.

Technological Advancements in Formulation and Delivery Systems Enhancing Treatment Efficiency

Continuous innovation in drug formulation and polymer technologies is enhancing precision in drug release timing and absorption. It allows pharmaceutical companies to design controlled-release systems that target specific sites in the body. The development of advanced excipients and coating materials has improved product stability and bioavailability. Smart polymers and microencapsulation techniques are gaining importance for achieving predictable drug release. These innovations also help reduce dosage-related complications. The Global Extended Release Drugs Market benefits from collaborations between technology firms and drug manufacturers. Such partnerships are promoting advanced drug delivery systems for complex diseases. Growing research investments in nanotechnology and bioengineered carriers are further driving efficiency in drug performance.

- For instance, Merck Group’s collaboration with InnoCore Pharmaceuticals uses the SynBiosys® biodegradable polymer platform to enable sustained-release injectable biologicals, illustrating how companies are expanding delivery systems. It allows pharmaceutical companies to design controlled-release systems that target specific sites in the body.

Growing Patient Preference for Improved Convenience and Compliance Boosting Market Expansion

Patients increasingly prefer therapies that simplify treatment routines and reduce the number of daily doses. Extended-release formulations offer this convenience, enhancing compliance among patients with chronic conditions. Healthcare professionals are recommending these formulations to minimize dosing errors and improve long-term outcomes. The Global Extended Release Drugs Market is gaining traction as healthcare systems promote self-management and adherence programs. Improved patient satisfaction rates are prompting pharmaceutical brands to expand their long-acting product lines. Insurance providers are also encouraging adoption due to reduced hospital readmissions. Convenience-driven formulations are helping transform the overall patient experience. This trend is reshaping prescribing patterns across global healthcare systems.

Supportive Regulatory Frameworks and Industry Collaborations Strengthening Product Development

Supportive regulatory pathways have accelerated the approval process for extended-release products. Authorities recognize their role in improving therapeutic outcomes and reducing medication misuse. The Global Extended Release Drugs Market benefits from rising industry-academia partnerships fostering drug delivery research. Pharmaceutical companies are collaborating with research institutes to create cost-efficient and scalable release systems. Favorable patent extensions for sustained-release technologies are also encouraging innovation. Governments in developed economies are investing in healthcare infrastructure that supports advanced therapies. Companies are leveraging these favorable conditions to introduce next-generation delivery solutions. This synergy between regulators and innovators continues to expand the market’s innovation capacity.

Market Trends:

Adoption of Smart Drug Delivery and Nanotechnology in Extended-Release Formulations

The Global Extended Release Drugs Market is experiencing rapid integration of nanotechnology and smart materials in formulation design. Nanocarriers allow targeted delivery, improving the precision of drug absorption and bioavailability. The use of liposomes, microspheres, and biodegradable polymers enables longer therapeutic action. Artificial intelligence is being employed to optimize drug kinetics and formulation modeling. Digital monitoring tools are helping track patient adherence to extended therapies. Pharmaceutical firms are also investing in data-driven development pipelines. These innovations are advancing performance consistency and patient safety. Continuous improvements in nanomedicine are defining a new era for sustained-release therapeutics.

- For instance, Teva Pharmaceutical Industries Ltd. and MedinCell launched UZEDY™, an extended-release risperidone injectable suspension that achieved up to an 80% reduction in relapse versus placebo, showing how long-acting technologies drive therapeutic benefits. Nanocarriers allow targeted delivery, improving the precision of drug absorption and bioavailability.

Expansion of Biologics and Specialty Drugs into Extended-Release Formats

The market is seeing strong movement toward converting biologics and specialty drugs into extended-release versions. It helps improve patient access and ease administration for conditions like rheumatoid arthritis, cancer, and multiple sclerosis. The Global Extended Release Drugs Market is evolving as companies explore long-acting injectables and implantable systems. Biopharma players are using sustained platforms to improve drug stability and extend dosing intervals. This transition aligns with the growing trend toward personalized medicine. The shift is also driven by high patient demand for non-invasive treatment options. Continuous innovation in protein stabilization and delivery systems supports this expansion. The biologics segment is expected to become a major contributor to future market growth.

Rise of Combination Therapies and Customized Release Profiles Across Therapeutic Areas

Combination drug products that integrate multiple active ingredients into a single extended-release dosage form are gaining popularity. They simplify treatment schedules and enhance patient compliance while improving therapeutic outcomes. The Global Extended Release Drugs Market benefits from the adoption of tailored release profiles for specific disease conditions. Pharmaceutical developers are designing products that address multi-symptom management, particularly in cardiovascular and psychiatric disorders. Controlled co-delivery systems are improving synergistic effects of medications. This approach is enhancing drug efficacy and minimizing side effects. Personalized medicine initiatives are encouraging companies to focus on patient-specific release kinetics. Such customization strengthens competitiveness among manufacturers.

Growing Focus on Oral and Injectable Extended-Release Formats Across Healthcare Settings

Oral and injectable formulations remain the dominant focus areas for extended-release innovations. Oral dosage forms are preferred for convenience, while injectables provide sustained systemic effects for chronic treatments. The Global Extended Release Drugs Market is witnessing increasing R&D into once-weekly and once-monthly injectable solutions. These formats reduce treatment fatigue among patients requiring lifelong therapies. Pharmaceutical companies are developing depot injections and subdermal implants to ensure steady plasma concentrations. Hospitals and clinics favor these products for improved patient management and reduced follow-up frequency. Evolving clinical trial outcomes continue to validate their safety and efficacy. The ongoing shift toward low-maintenance therapy options supports their widespread adoption.

Market Challenges Analysis:

High Manufacturing Costs and Complex Formulation Processes Limiting Product Accessibility

The Global Extended Release Drugs Market faces challenges linked to the high cost of production and complex formulation requirements. Designing controlled-release systems requires precision engineering, advanced materials, and costly validation processes. Pharmaceutical firms need specialized facilities to ensure consistent drug release profiles and stability. These factors often increase development timelines and expenses. Smaller manufacturers struggle to compete due to limited resources and technical expertise. Pricing pressures from healthcare systems further reduce profit margins. It also becomes difficult for generic producers to match the innovation pace of larger players. Balancing affordability and quality remains a persistent obstacle in market expansion.

Stringent Regulatory Approvals and Limited Bioequivalence Data Slowing Market Growth

Regulatory authorities impose rigorous requirements for extended-release drug approvals due to the complexity of their pharmacokinetics. The Global Extended Release Drugs Market experiences delays in commercialization because of prolonged clinical evaluations. Demonstrating bioequivalence between generic and branded formulations poses major hurdles. Variations in release mechanisms demand detailed safety and efficacy data, extending submission timelines. Limited harmonization among regional regulations complicates global product launches. Companies often face repeated testing to meet distinct country-specific criteria. These challenges increase compliance costs and discourage smaller entrants. Strengthening international regulatory alignment could help streamline future growth.

Market Opportunities:

Rising Demand for Personalized and Long-Acting Therapeutic Solutions Creating Innovation Potential

The Global Extended Release Drugs Market presents opportunities through expanding interest in personalized and precision-based therapies. Healthcare providers are increasingly prescribing customized release systems that match individual metabolic and disease profiles. Pharmaceutical innovators are integrating digital health tools to track dosing and optimize treatment outcomes. The growing focus on chronic disease management in aging populations supports demand for extended formulations. Investment in AI-driven formulation design is expected to enhance release accuracy. Expanding telemedicine services are also promoting awareness about patient-friendly drug formats. This evolution is encouraging long-term partnerships between tech developers and pharmaceutical companies.

Emerging Markets Offering New Avenues for Generic and Affordable Extended-Release Drugs

Emerging economies across Asia-Pacific, Latin America, and the Middle East are opening new opportunities for market expansion. The Global Extended Release Drugs Market is witnessing increasing investment from regional generic drug manufacturers. Affordable alternatives to branded extended-release drugs are in high demand due to large patient bases and improving healthcare infrastructure. Governments are supporting domestic production through favorable policies and incentives. Local firms are collaborating with international players to access technology and expertise. Rising healthcare expenditure and patient awareness in these regions are driving market penetration. This dynamic shift is expanding the global reach of sustained-release therapeutics.

Market Segmentation Analysis:

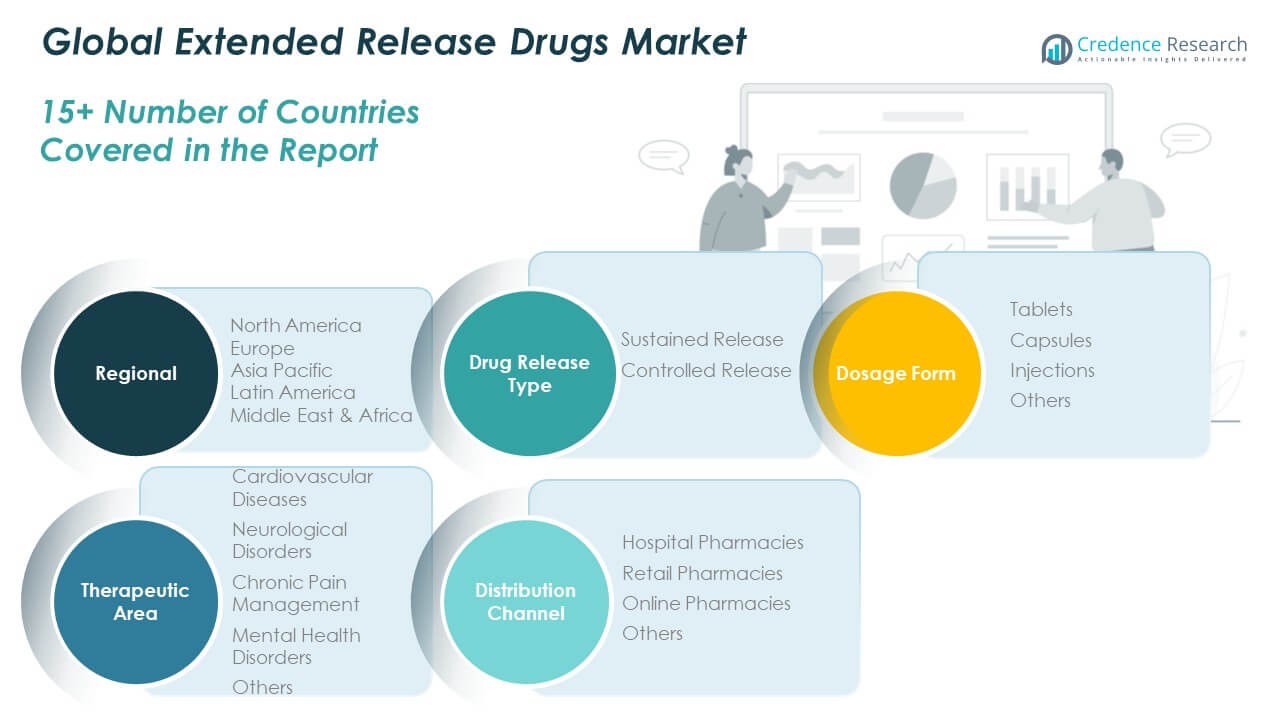

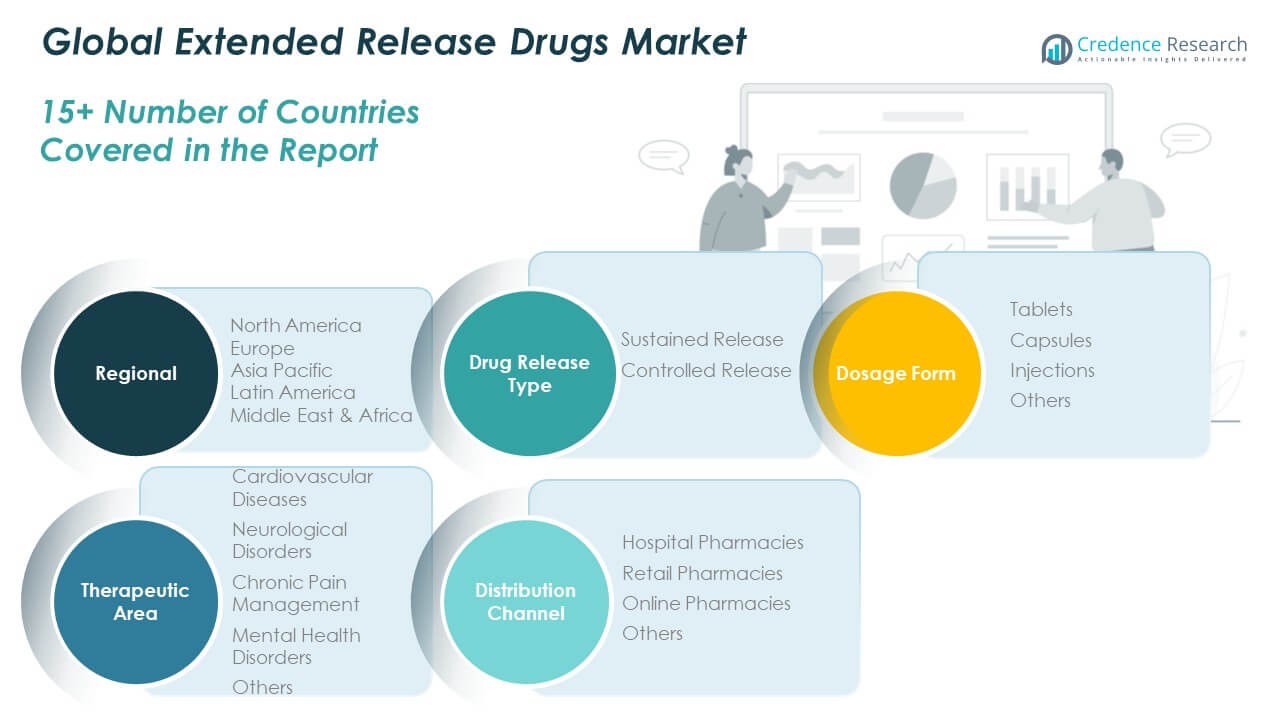

By Drug Release Type

The Global Extended Release Drugs Market is divided into sustained release and controlled release formulations. Sustained release drugs dominate due to their ability to maintain therapeutic levels for longer durations, improving patient compliance. Controlled release drugs are gaining traction in precision medicine applications where dosing accuracy is vital. Pharmaceutical advancements in polymer technology and coating systems support both segments. Companies are investing in extended drug release platforms that optimize bioavailability and safety. The shift toward long-acting treatments continues to expand across multiple therapeutic areas.

- For instance, SEROQUEL XR (quetiapine fumarate extended-release by AstraZeneca PLC) enables once-daily dosing (400-800 mg/day range) in adult schizophrenia, replacing multiple doses of the immediate‐release form. Controlled release drugs are gaining traction in precision medicine applications where dosing accuracy is vital. For example, polymer-based matrices in newer formulations allow steady drug release over 12 to 24 hours via zero-order kinetics.

By Dosage Form

Tablets represent the largest segment owing to their affordability, stability, and ease of administration. Capsules are favored for drugs requiring gradual release and improved gastrointestinal tolerance. Injections are expanding rapidly in chronic and specialty care due to enhanced systemic absorption. The Global Extended Release Drugs Market benefits from innovations in oral and parenteral drug delivery mechanisms. Other dosage forms, such as implants and patches, are emerging for targeted therapy applications. Growing patient preference for reduced dosing frequency drives product diversification.

- For example, ZILRETTA (triamcinolone acetonide extended-release injectable suspension by Flexion Therapeutics, Inc.) delivers a single intra-articular dose of 32 mg/5 mL for knee osteoarthritis pain and shows sustained benefits over 5-6 months.

By Therapeutic Area

Extended release drugs are widely used in cardiovascular and neurological disorders due to long-term treatment requirements. Chronic pain management and mental health therapies also adopt extended-release formulations for sustained relief and consistent plasma levels. The Global Extended Release Drugs Market sees strong demand from multi-drug chronic disease regimens. Research efforts focus on tailoring release kinetics to match specific pathologies. Continuous clinical validation supports market penetration across therapeutic domains.

By Distribution Channel

Hospital pharmacies hold a dominant role in dispensing extended-release drugs for critical and long-term treatments. Retail pharmacies remain vital for outpatient therapies and chronic disease management. The Global Extended Release Drugs Market is witnessing fast growth through online pharmacies offering convenient access and digital prescription models. Expanding e-commerce infrastructure and awareness about medication adherence are supporting this trend. Pharmaceutical companies are adapting supply strategies to meet evolving distribution preferences.

Segmentation:

- By Drug Release Type

- Sustained Release

- Controlled Release

- By Dosage Form

- Tablets

- Capsules

- Injections

- Others

- By Therapeutic Area

- Cardiovascular Diseases

- Neurological Disorders

- Chronic Pain Management

- Mental Health Disorders

- Others

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Extended Release Drugs Market size was valued at USD 15,261.34 million in 2018 to USD 27,835.22 million in 2024 and is anticipated to reach USD 61,503.61 million by 2032, at a CAGR of 9.7% during the forecast period. North America holds around 44% of the total market share. The region leads due to advanced pharmaceutical R&D infrastructure, high healthcare expenditure, and strong regulatory support from the FDA. The U.S. dominates the market with extensive adoption of extended-release formulations for chronic diseases. Growing preference for long-acting therapies in cardiovascular, neurological, and psychiatric conditions is boosting demand. Canada contributes steadily, driven by patient awareness and increasing geriatric populations. The presence of major pharmaceutical companies ensures consistent innovation. Expanding clinical trials and government incentives for drug development continue to support market growth in this region.

Europe

The Europe Global Extended Release Drugs Market size was valued at USD 9,790.65 million in 2018 to USD 17,396.16 million in 2024 and is anticipated to reach USD 36,112.45 million by 2032, at a CAGR of 8.9% during the forecast period. Europe accounts for approximately 26% of the total market share. The region benefits from a well-structured healthcare system and increasing focus on cost-effective, patient-centric medication. The UK, Germany, and France are key contributors owing to their strong clinical research bases. Pharmaceutical companies are expanding their extended-release portfolios in line with chronic disease management programs. Regulatory frameworks from the EMA encourage innovation and quality assurance. Aging populations and high prevalence of lifestyle diseases continue to drive demand. The rise of personalized medicine is also encouraging adoption of controlled-release therapies across Europe.

Asia Pacific

The Asia Pacific Global Extended Release Drugs Market size was valued at USD 6,310.68 million in 2018 to USD 12,644.77 million in 2024 and is anticipated to reach USD 31,700.99 million by 2032, at a CAGR of 11.4% during the forecast period. The region holds around 20% of the global market share. Rapid industrialization, improving healthcare infrastructure, and rising disposable incomes are driving market expansion. Countries such as China, Japan, and India are major growth hubs due to growing patient populations and government healthcare initiatives. The demand for affordable extended-release generics is rising significantly. Local manufacturers are investing in advanced formulation technologies to meet international standards. The Global Extended Release Drugs Market in this region benefits from high adoption rates in urban areas. Increasing awareness about treatment adherence further supports growth prospects.

Latin America

The Latin America Global Extended Release Drugs Market size was valued at USD 1,512.46 million in 2018 to USD 2,749.90 million in 2024 and is anticipated to reach USD 5,315.47 million by 2032, at a CAGR of 7.9% during the forecast period. The region represents nearly 4% of the total market share. Market growth is driven by expanding healthcare coverage, improved access to prescription drugs, and an increasing burden of chronic conditions. Brazil and Mexico are leading markets due to their growing pharmaceutical industries. Rising awareness of long-acting therapies among healthcare professionals is influencing prescribing patterns. Multinational companies are entering partnerships with local firms to enhance distribution networks. The ongoing transition toward modernized healthcare policies is improving patient outcomes. Despite challenges in pricing and reimbursement, demand for sustained-release formulations continues to strengthen.

Middle East

The Middle East Global Extended Release Drugs Market size was valued at USD 900.78 million in 2018 to USD 1,508.19 million in 2024 and is anticipated to reach USD 2,768.09 million by 2032, at a CAGR of 7.2% during the forecast period. The region captures about 3% of the global market share. Increasing investments in healthcare infrastructure and pharmaceutical manufacturing are fueling regional expansion. The GCC countries, led by Saudi Arabia and the UAE, are key contributors due to strong public health initiatives. Hospitals are adopting advanced drug delivery systems to enhance patient care. The Global Extended Release Drugs Market is supported by government programs promoting chronic disease management. Pharmaceutical imports remain essential, but local production is gradually increasing. Growth in insurance penetration and modern retail pharmacies is further improving accessibility.

Africa

The Africa Global Extended Release Drugs Market size was valued at USD 415.89 million in 2018 to USD 868.46 million in 2024 and is anticipated to reach USD 1,430.59 million by 2032, at a CAGR of 5.7% during the forecast period. The region holds roughly 3% of the global market share. Africa’s market growth is moderate but steady, supported by expanding urbanization and improved access to healthcare services. South Africa leads regional adoption due to advanced pharmaceutical distribution networks. Rising prevalence of chronic diseases such as diabetes and hypertension is fueling gradual demand. The Global Extended Release Drugs Market in Africa faces challenges related to affordability and supply chain limitations. Government initiatives aimed at improving local drug manufacturing are creating future opportunities. Growing collaboration with international health organizations is enhancing the availability of modern therapies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AstraZeneca PLC

- Merck & Co., Inc.

- Sanofi S.A.

- Eli Lilly and Company

- AbbVie Inc.

- Pfizer, Inc.

- Novartis AG

- Bristol-Myers Squibb

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

Competitive Analysis:

The Global Extended Release Drugs Market is highly competitive, featuring established pharmaceutical giants and specialized biotech firms. It is characterized by extensive R&D activities focused on enhancing drug bioavailability, safety, and patient adherence. Companies are expanding portfolios through controlled-release, sustained-release, and combination therapies across therapeutic areas. Strategic collaborations and licensing agreements are common to accelerate innovation and regulatory approvals. Market players focus on patent protection and formulation technology to maintain a competitive edge. Continuous investments in clinical research and advanced manufacturing facilities strengthen their global presence.

Recent Developments:

- In June 3 2025, Eli Lilly and Company entered a collaboration and licensing agreement with Camurus for long-acting FluidCrystal® technology covering four proprietary drug compounds, committing up to USD 870 million in total development and sales-based milestone payments.

- Teva and MedinCell announced the FDA’s acceptance for filing of the supplemental New Drug Application (sNDA) for UZEDY® for maintenance treatment of bipolar I disorder in adults on February 25, 2025. The FDA later approved this expanded indication on October 10, 2025.

- On May 29 2024, Teva Pharmaceutical Industries Ltd. announced that its extended-release formulation AUSTEDO XR® (deutetrabenazine extended-release tablets) received U.S. FDA approval in multiple strengths (30, 36, 42, 48 mg/day) as a once-daily treatment option for tardive dyskinesia and Huntington’s disease.

Report Coverage:

The research report offers an in-depth analysis based on Drug Release Type and Dosage Form. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for long-acting therapies will continue to boost market expansion.

- Increased R&D investment will improve formulation accuracy and drug efficiency.

- AI and nanotechnology integration will redefine drug release systems.

- Partnerships between pharma and biotech firms will accelerate innovation.

- Regulatory harmonization will simplify product approval and international trade.

- Growing chronic disease prevalence will sustain long-term product demand.

- Personalized medicine will drive development of targeted release mechanisms.

- Expansion in emerging markets will enhance global revenue distribution.

- Growth of online pharmacies will strengthen global product accessibility.

- Sustainability in production and packaging will gain industry-wide focus.