Market Overview

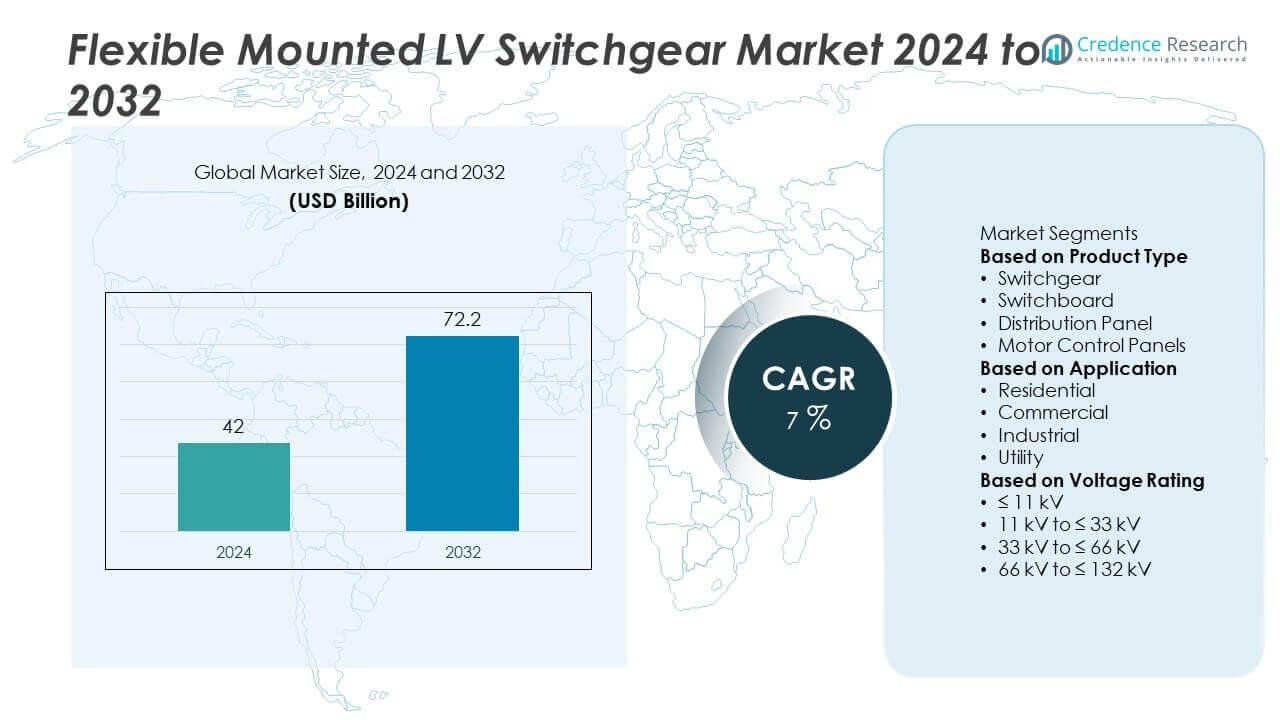

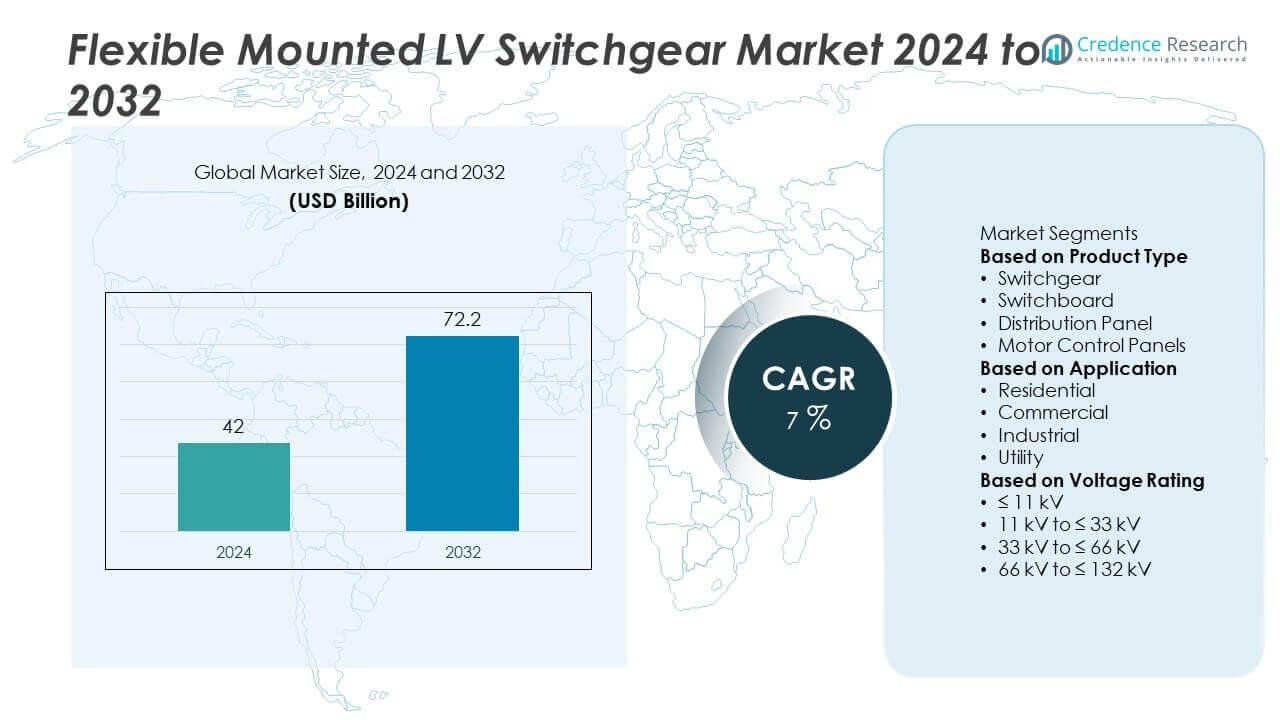

Flexible Mounted LV Switchgear Market was valued at USD 42 billion in 2024 and is projected to reach USD 72.2 billion by 2032, registering a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Mounted LV Switchgear Market Size 2024 |

USD 42 Billion |

| Flexible Mounted LV Switchgear Market, CAGR |

7% |

| Flexible Mounted LV Switchgear Market Size 2032 |

USD 72.2 Billion |

The Flexible Mounted LV Switchgear Market grows with rising demand for reliable power distribution, energy efficiency, and modernization of aging infrastructure. Expanding industrialization, smart city projects, and integration of renewable energy accelerate adoption across sectors.

The Flexible Mounted LV Switchgear Market demonstrates strong regional growth led by advanced infrastructure and industrial expansion. North America drives adoption through investments in smart grids, renewable energy, and industrial automation, while Europe emphasizes sustainability and eco-friendly designs supported by strict regulatory standards. Asia-Pacific emerges as the fastest-growing region, with large-scale urbanization, renewable projects, and rising demand from data centers and smart city developments. Latin America and the Middle East & Africa progress steadily with modernization of utilities and infrastructure electrification. Key players shaping the market landscape include ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, and Mitsubishi Electric Corporation. These companies focus on digital integration, modular designs, and energy-efficient technologies to strengthen their portfolios. Their global presence and continuous investment in product innovation position them as leading suppliers meeting evolving needs across residential, commercial, industrial, and utility applications in diverse geographies.

Market Insights

- The Flexible Mounted LV Switchgear Market was valued at USD 42 billion in 2024 and is projected to reach USD 72.2 billion by 2032, registering a CAGR of 7% during the forecast period.

- Growth is driven by demand for energy efficiency, reliable power distribution, and modernization of outdated electrical infrastructure across residential, commercial, industrial, and utility applications.

- Key trends include rising adoption of smart and digital switchgear technologies, integration with IoT platforms, and the use of predictive maintenance and remote monitoring to reduce downtime.

- The competitive landscape is shaped by global leaders such as ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, and Mitsubishi Electric Corporation, who focus on product innovation, modular solutions, and digital integration to strengthen their portfolios.

- Challenges include high initial investment, complex installation processes, and supply chain disruptions impacting availability of specialized components required for advanced switchgear systems.

- Regional analysis highlights North America’s focus on smart grids and industrial automation, Europe’s sustainability-driven adoption, Asia-Pacific’s rapid growth through urbanization and renewable projects, and steady expansion in Latin America and the Middle East & Africa through utility modernization.

- Opportunities lie in renewable energy integration, smart city projects, data center expansion, and industrial automation, creating strong prospects for suppliers offering scalable, modular, and energy-efficient switchgear solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Energy Efficiency and Reliable Power Distribution

The Flexible Mounted LV Switchgear Market benefits from the global shift toward efficient power distribution. Growing demand for energy savings across residential, commercial, and industrial facilities supports adoption. These systems reduce energy loss and enhance operational reliability in dense electrical networks. Governments promote smart grids and low-voltage solutions to optimize power flow. Rising awareness of sustainability compels end users to replace outdated equipment with advanced switchgear. The market gains strength from the growing emphasis on reducing carbon footprints while maintaining uninterrupted supply.

- For instance, ABB introduced its SF6-free AirPlus switchgear technology, a pioneering gas mixture with a global warming potential (GWP) of less than one. By replacing the potent greenhouse gas SF6, this technology significantly reduces the environmental impact of electricity distribution.

Expansion of Industrialization and Infrastructure Development Projects

Rapid growth in infrastructure projects directly drives the Flexible Mounted LV Switchgear Market. Urban expansion, transportation upgrades, and industrial zone construction require stable and scalable electrical systems. Manufacturing hubs rely on low-voltage switchgear for safe and efficient operations. Demand rises in utility-scale applications where uninterrupted supply ensures smooth functioning of heavy equipment. Investments in renewable energy plants create further scope for advanced switchgear integration. Large-scale development activities enhance the long-term growth outlook for the industry.

- For instance, ABB partnered with Liander utility in the Netherlands from 2015 to 2018 to install four SafeRing AirPlus ring-main units in wind-farm substations—and long-term monitoring confirmed the gas’s performance remained stable throughout the period

Integration of Digital Monitoring and Smart Control Features

The Flexible Mounted LV Switchgear Market grows through adoption of digital and intelligent features. Advanced monitoring enables predictive maintenance, reducing downtime in critical applications. Remote control capabilities support operators in managing power networks with precision. Integration with IoT and cloud-based platforms allows real-time performance tracking. These features improve efficiency, reduce maintenance costs, and ensure safety. Smart functionalities make flexible switchgear suitable for modern industries requiring reliability and automation.

Supportive Regulatory Policies and Safety Standards Implementation

The Flexible Mounted LV Switchgear Market expands under strong regulatory guidance. Governments enforce strict safety and energy-efficiency standards across electrical systems. Compliance requirements encourage replacement of traditional switchgear with modern alternatives. Utilities and industries align with these standards to enhance workplace and operational safety. Incentives and subsidies for smart grid adoption strengthen uptake in multiple regions. Regulatory frameworks create a secure environment for sustained investment and adoption of advanced solutions.

Market Trends

Adoption of Smart and Digital Switchgear Technologies

The Flexible Mounted LV Switchgear Market evolves with the adoption of smart technologies. Digital features enable remote monitoring, automation, and predictive maintenance in electrical networks. Smart switchgear reduces downtime and improves asset management across industries. Utilities adopt digitalized systems to support grid modernization and efficiency. Integration with IoT platforms enhances data-driven decision-making and operational transparency. The trend strengthens demand for flexible solutions that align with advanced power distribution needs.

- For instance, Siemens supplies its SIPROTEC digital protection relays to utilities, enabling them to modernize medium- and low-voltage switchgear to improve grid reliability. As part of these solutions, Siemens has noted that advanced grid management can reduce outage times by a significant margin.

Focus on Renewable Energy Integration and Sustainable Power Systems

The Flexible Mounted LV Switchgear Market aligns with rising renewable energy projects. Solar, wind, and distributed energy systems require efficient low-voltage distribution. Flexible switchgear supports variable power loads and ensures grid stability. Governments encourage clean energy adoption, boosting demand for compatible equipment. Sustainable design with low environmental impact drives preference for eco-friendly switchgear. It positions the market as a key enabler of the transition to green power.

- For instance, Hitachi Energy announced delivery of the world’s first SF₆-free 550 kV GIS to China’s State Grid, and it had already deployed over 1,000 EconiQ high-voltage units across 26 countries by mid-2024.

Growth of Modular and Compact Design Solutions

The Flexible Mounted LV Switchgear Market shows rising preference for modular systems. Compact designs save space in urban infrastructure and industrial facilities. Modular configurations simplify installation, maintenance, and upgrades in dynamic applications. Industries adopt these solutions to optimize footprint and reduce costs. Demand increases in smart buildings, data centers, and transport networks. It reflects a strong shift toward adaptable and scalable electrical infrastructure.

Increasing Importance of Safety, Reliability, and Regulatory Compliance

The Flexible Mounted LV Switchgear Market experiences steady growth from safety-driven trends. Advanced switchgear integrates arc-flash protection and fault-detection mechanisms. Compliance with global standards ensures safe operations in high-demand environments. End users focus on reliability to prevent costly downtime in critical sectors. Safety certifications drive replacement of aging switchgear in both utilities and industries. It reinforces the role of advanced switchgear in delivering secure and reliable power supply.

Market Challenges Analysis

High Initial Investment and Complex Installation Requirements

The Flexible Mounted LV Switchgear Market faces challenges due to high capital costs. Installation of advanced systems requires significant investment in equipment and skilled labor. Smaller businesses and cost-sensitive sectors hesitate to adopt such technologies. Complex installation procedures add time and technical demands, limiting faster deployment. Maintenance and upgrades also involve expenses that discourage frequent adoption. It creates barriers for new buyers, particularly in emerging economies with limited budgets.

Supply Chain Disruptions and Dependence on Specialized Components

The Flexible Mounted LV Switchgear Market encounters risks from global supply chain volatility. Dependence on specialized components and raw materials impacts manufacturing timelines. Disruptions in logistics or shortages raise production costs and delay deliveries. Regional differences in sourcing further create uncertainty for manufacturers and suppliers. Limited availability of high-quality components can restrict scalability of projects. It compels industry participants to adopt localized sourcing strategies to mitigate risks and maintain reliability.

Market Opportunities

Rising Demand from Renewable Energy and Smart Grid Expansion

The Flexible Mounted LV Switchgear Market presents opportunities through integration with renewable energy systems. Solar and wind installations require efficient low-voltage distribution to manage variable loads. Smart grid expansion across developed and emerging economies increases adoption of advanced switchgear. Utilities seek flexible solutions to enhance reliability and support distributed power networks. Growth in energy storage projects further strengthens the need for modern equipment. It positions the market as a central enabler of sustainable and intelligent power infrastructure.

Growing Investments in Industrial Automation and Urban Infrastructure

The Flexible Mounted LV Switchgear Market gains prospects from industrial automation and urban growth. Automated manufacturing facilities require stable power distribution for uninterrupted operations. Smart cities expand demand for compact and modular switchgear in transportation, buildings, and utilities. Rising data center construction boosts adoption of advanced electrical systems with safety and monitoring features. Governments and private investors prioritize reliable infrastructure to support economic growth. It creates sustained opportunities for suppliers offering innovative and cost-efficient solutions.

Market Segmentation Analysis:

By Product Type

The Flexible Mounted LV Switchgear Market is segmented into switchgear, switchboard, distribution panel, and motor control panels. Switchgear dominates due to its critical role in protecting and controlling electrical systems. Switchboards hold steady demand in commercial and industrial buildings where reliable load management is required. Distribution panels gain traction for residential and small-scale utility projects with compact designs and cost efficiency. Motor control panels see adoption in manufacturing and processing industries where automation and energy efficiency are priorities. It creates a diverse product landscape that serves both high-demand industrial sectors and everyday residential needs.

- For instance, Schneider Electric’s PrismaSeT Active low-voltage switchboards provide real-time monitoring and predictive maintenance features to help reduce operational interruptions.

By Application

The Flexible Mounted LV Switchgear Market demonstrates broad adoption across residential, commercial, industrial, and utility applications. Residential projects drive growth through urban expansion and smart housing developments. Commercial applications rely on reliable switchgear for uninterrupted operations in offices, retail complexes, and healthcare facilities. Industrial facilities demand advanced systems to ensure continuous power supply for automated equipment and heavy machinery. Utility-scale adoption increases with grid modernization and integration of renewable energy projects. It positions the market as a critical component across every application spectrum, from households to high-voltage industrial systems.

- For instance, Eaton’s Magnum PXR low-voltage switchgear supports up to 10,000 A main bus rating and short-circuit withstand capability up to 100 kA, serving diverse sectors including data centers and petrochemical plants.

By Voltage Rating

The Flexible Mounted LV Switchgear Market segments by voltage rating into ≤ 11 kV, > 11 kV to ≤ 33 kV, > 33 kV to ≤ 66 kV, and > 66 kV to ≤ 132 kV. Systems rated ≤ 11 kV dominate residential and small commercial applications where compact, low-capacity solutions meet demand. The > 11 kV to ≤ 33 kV category supports larger commercial and mid-scale industrial facilities requiring higher load management. Switchgear in the > 33 kV to ≤ 66 kV range serves heavy industrial applications including oil, gas, and manufacturing plants. The > 66 kV to ≤ 132 kV segment grows with large-scale utility networks, renewable energy projects, and infrastructure upgrades. It ensures scalability across different capacities, meeting varied requirements from small-scale distribution to high-load power management.

Segments:

Based on Product Type

- Switchgear

- Switchboard

- Distribution Panel

- Motor Control Panels

Based on Application

- Residential

- Commercial

- Industrial

- Utility

Based on Voltage Rating

- ≤ 11 kV

- 11 kV to ≤ 33 kV

- 33 kV to ≤ 66 kV

- 66 kV to ≤ 132 kV

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% share of the Flexible Mounted LV Switchgear Market, supported by robust infrastructure development and strict energy regulations. The United States leads adoption with strong investment in grid modernization, smart cities, and renewable integration. Canada follows with rising demand from hydro and wind power facilities, along with growing commercial building projects. Utilities across the region adopt flexible switchgear to strengthen reliability and reduce outage risks in urban and industrial areas. Industrial automation in automotive, aerospace, and oil and gas also accelerates market growth. It demonstrates the region’s strong focus on energy efficiency and advanced power distribution technologies, ensuring steady long-term demand.

Europe

Europe holds 27% share of the Flexible Mounted LV Switchgear Market, driven by regulatory emphasis on sustainability and eco-friendly power systems. Countries such as Germany, the UK, and France lead adoption through renewable energy expansion and smart building initiatives. Investments in offshore wind farms and energy-efficient urban infrastructure boost demand for advanced low-voltage systems. Industrial sectors in Eastern Europe also expand adoption to support manufacturing growth and modernization. The region benefits from policies that encourage replacement of outdated equipment with digital and modular solutions. It reflects a strong alignment with green energy goals, while ensuring compliance with strict safety standards.

Asia-Pacific

Asia-Pacific represents 29% share of the Flexible Mounted LV Switchgear Market, marking the fastest-growing region due to large-scale urbanization and industrial expansion. China drives the market with extensive renewable installations, high-speed rail projects, and new manufacturing hubs. India follows with government-led investments in housing, smart cities, and energy infrastructure. Japan and South Korea adopt advanced switchgear for automation and reliability in high-tech industries. Growing demand for compact and modular systems supports expansion across dense urban areas. It highlights Asia-Pacific as a dynamic hub for innovation and large-scale adoption, with strong opportunities in both residential and industrial sectors.

Latin America

Latin America contributes 6% share of the Flexible Mounted LV Switchgear Market, supported by ongoing infrastructure modernization and industrial growth. Brazil leads adoption with investment in power distribution for utilities and expanding industrial clusters. Mexico follows with rising demand in commercial construction and renewable energy projects, particularly solar and wind. Smaller economies in the region adopt switchgear gradually through government-backed electrification programs. The industrial sector increases reliance on advanced systems to ensure efficiency and workplace safety. It creates consistent opportunities, although growth remains slower compared to developed regions.

Middle East & Africa

The Middle East & Africa account for 6% share of the Flexible Mounted LV Switchgear Market, driven by power-intensive industries and large-scale infrastructure projects. Gulf countries such as Saudi Arabia and the UAE invest heavily in smart cities and industrial zones. Africa witnesses demand through electrification initiatives and growing adoption of renewable energy plants. Utilities and oil and gas facilities in the Middle East require advanced switchgear for operational reliability. Rising urbanization and population growth further increase demand for residential and commercial applications. It demonstrates steady progress, with opportunities centered around industrial projects and modern grid development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions Corporation

- General Electric (GE) Grid Solutions

- Larsen & Toubro (L&T) Electrical & Automation

- Hitachi Energy Ltd.

- Powell Industries, Inc.

Competitive Analysis

The competitive landscape of the Flexible Mounted LV Switchgear Market features leading players such as ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, General Electric (GE) Grid Solutions, Larsen & Toubro Electrical & Automation, Hitachi Energy Ltd., and Powell Industries, Inc. These companies focus on advancing product portfolios with digital monitoring, modular designs, and IoT-enabled solutions to meet rising demand for efficiency and safety. They emphasize research and development to introduce innovations that reduce downtime, improve reliability, and support smart grid integration. Strategic investments in renewable energy projects, urban infrastructure, and industrial automation strengthen their market presence across diverse regions. Many players also expand through mergers, partnerships, and collaborations to extend reach and enhance technological capabilities. Strong manufacturing capabilities, global supply chains, and after-sales service networks give these firms a competitive edge in meeting customer expectations. The market remains highly consolidated, with competition centered on innovation, cost efficiency, and compliance with strict energy and safety regulations. This competitive environment positions the leading players to drive long-term growth through sustainable solutions and customer-focused strategies.

Recent Developments

- In March 2025, ABB Ltd. announced a USD 120 million investment in the U.S. to expand production of low-voltage electrification products, including projects in Tennessee and Mississippi to meet growing demand.

- In 2025, Schneider Electric SE signed a long-term framework agreement with E.ON to supply SF₆-free medium-voltage switchgear, enabling early adoption of sustainable infrastructure.

- In 2024, Mitsubishi Electric Corporation signed a co-development agreement with Siemens Energy Global to create DC switching station and DC circuit breaker specifications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Voltage Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing electricity demand and ongoing grid modernization will drive market growth.

- Smart grid adoption and renewable energy integration will boost demand for intelligent switchgear.

- Modular and compact switchgear designs will gain preference in urban and industrial infrastructure.

- Rising data center construction and commercial building projects will sustain product adoption.

- Focus on safety and eco-friendly designs will accelerate the shift toward SF₆-free technologies.

- Digital features such as remote monitoring and predictive maintenance will become standard offerings.

- Infrastructure investments and electrification programs in emerging economies will create strong opportunities.

- Industrial automation and Industry 4.0 trends will increase the need for intelligent LV switchgear.

- Regulatory frameworks and sustainability goals will push replacement of outdated electrical systems.

- Standardization and global collaboration among manufacturers will support scalability and competitiveness.