Market Overview:

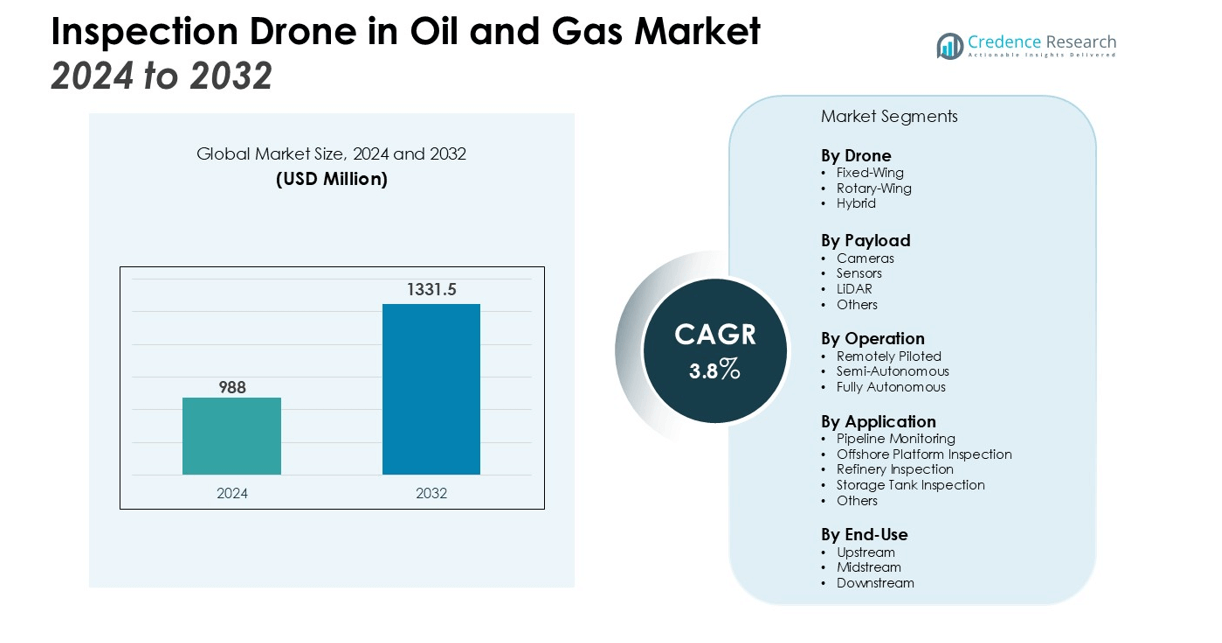

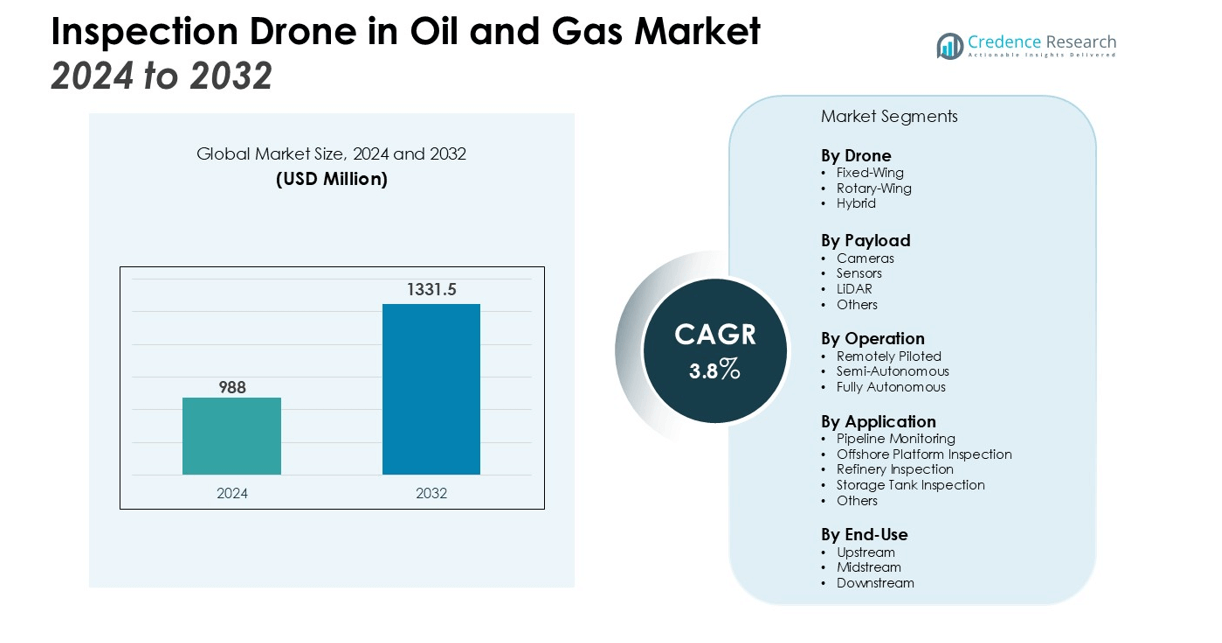

The Inspection Drone in Oil and Gas Market size was valued at USD 988 million in 2024 and is anticipated to reach USD 1331.5 million by 2032, at a CAGR of 3.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Inspection Drone in Oil and Gas Market Size 2024 |

USD 988 million |

| Inspection Drone in Oil and Gas Market, CAGR |

3.8% |

| Inspection Drone in Oil and Gas Market Size 2032 |

USD 1331.5 million |

The inspection drone in oil and gas market is growing steadily, driven by the increasing need for real-time asset monitoring and improved safety through remote inspections. Advances in drone technology, including high-resolution sensors, AI integration, and advanced data analytics, are enhancing efficiency and accuracy, making drones an essential tool for inspection processes. The industry’s focus on reducing downtime and improving asset management further accelerates the adoption of drone-based inspection solutions.

The market shows strong presence across key regions, with North America holding a leading position supported by strict regulatory frameworks and widespread adoption of advanced technologies. Companies in the region are prioritizing operational efficiency and leveraging AI-enabled drone solutions to meet stringent safety and inspection requirements. Meanwhile, Asia-Pacific and Europe are witnessing rising demand, fueled by expanding oil and gas infrastructure and growing investments in digital transformation of inspection processes. This regional momentum underscores the critical role of drones in ensuring cost-effective, safe, and efficient operations across the global oil and gas sector.

Market Insights:

- The Inspection Drone in Oil and Gas Market was valued at USD 988 million and is expected to reach USD 1331.5 million by 2032, growing at a CAGR of 3.8%.

- Rising demand for real-time asset monitoring and worker safety is driving widespread adoption of drone-based inspections.

- Technological advances such as thermal imaging, AI-enabled analytics, and high-resolution sensors are enhancing inspection accuracy and efficiency.

- The market benefits from the industry’s focus on reducing downtime, lowering operational costs, and improving asset management.

- Regulatory challenges, limited flight time, and complex data management remain barriers to large-scale deployment of inspection drones.

- North America leads the market with 32% share, supported by strong regulations, digital infrastructure, and high adoption of advanced inspection technologies.

- Europe holds 28% share, while Asia-Pacific accounts for 25%, with both regions showing strong growth driven by sustainability goals, infrastructure expansion, and digital transformation in energy operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Real-Time Asset Monitoring and Safety

The Inspection Drone in Oil and Gas Market benefits from growing demand for continuous asset monitoring. Operators use drones to detect leaks, corrosion, and structural issues without exposing workers to dangerous conditions. Real-time data capture improves decision-making and helps reduce costly equipment failures. Safety improvements remain a central factor driving adoption, as companies seek to minimize accidents during inspection processes.

Technological Advancements Enhancing Drone Capabilities

The market expands through steady improvements in drone design and functionality. High-resolution sensors, thermal imaging, and AI-enabled analytics strengthen the accuracy of data collected. These technologies allow detection of minute anomalies that traditional inspection methods often miss. It provides oil and gas operators with actionable insights that improve maintenance efficiency and extend asset lifespan.

- For instance, a drone equipped with a Teledyne FLIR optical gas imaging (OGI) camera can inspect five storage tanks in approximately 20 minutes.

Operational Efficiency and Cost Optimization Priorities

The Inspection Drone in Oil and Gas Market gains traction from the industry’s focus on reducing downtime and inspection costs. Drones offer faster coverage of pipelines, rigs, and storage facilities compared to manual methods. Companies reduce operational expenses by limiting the need for scaffolding, helicopters, and extensive manpower. It also supports compliance with maintenance schedules while improving inspection frequency.

Regulatory Compliance and Sustainability Objectives

Regulatory pressure to maintain strict safety and environmental standards supports drone adoption. Authorities emphasize risk reduction and sustainability in oil and gas operations. Drones provide reliable data that supports compliance audits and reduces the risk of environmental incidents. It strengthens corporate reputation while aligning with industry-wide goals of safer and more sustainable energy production.

- For instance, the DJI U10, a laser-based methane gas detector, has a minimum detection sensitivity of 5 parts per million-meter (ppm·m).

Market Trends:

Expansion of Advanced Sensing Capabilities and Extended Flight Operations

The Inspection Drone in Oil and Gas Market is witnessing strong adoption of advanced sensing technologies, including thermal imaging, LiDAR, methane detection, and high-resolution optical gas imaging. These capabilities allow operators to identify leaks, corrosion, and emissions with improved precision, raising inspection reliability. Drones are now capable of extended flight operations beyond visual line of sight, supported by AI and onboard data processing. Companies deploy them for both routine inspections and urgent responses, reducing risks to human personnel. Operators customize drone systems for specific inspection needs while integrating the collected data with asset management platforms to generate actionable insights. Improved connectivity through 4G, 5G, and wireless networks supports long-range flights and stable performance. It enhances operational safety and enables continuous surveillance of critical infrastructure across remote energy assets.

- For instance, DJI’s Matrice 30T drone enhances inspection reliability with its integrated 640×512 pixel resolution thermal camera, allowing for the precise identification of leaks across critical infrastructure.

Emphasis on Automation, Regulatory Compliance and Operational Resilience

The market continues to advance toward autonomous drone operations designed to meet stringent safety and environmental requirements. Automated inspection systems improve efficiency while ensuring compliance with regulatory frameworks for monitoring and reporting. It strengthens workforce safety by reducing dependence on manual inspections in hazardous areas. Predictive maintenance is gaining traction as inspection data integrates with digital platforms, enabling early detection of potential equipment failures. Remote monitoring of pipelines, tanks, and offshore sites is increasingly supported by autonomous scheduling and centralized oversight. This trend reduces downtime, supports sustainable operations, and enhances resilience against disruptions. The focus on automation, compliance, and efficiency highlights the critical role of drones in shaping the future of oil and gas inspections.

- For instance, the DJI Matrice 30T drone is equipped with a 640×512 thermal camera that enhances thermal inspections by detecting subtle heat variations, which can indicate equipment malfunctions or leaks in pipelines and facilities.

Market Challenges Analysis:

Regulatory Barriers and Airspace Restrictions Limiting Deployment

The Inspection Drone in Oil and Gas Market faces hurdles from complex regulatory frameworks and strict airspace restrictions. Government agencies impose rules on beyond visual line of sight operations and altitude limits, creating delays in widespread adoption. It restricts operators from deploying drones at scale across pipelines, offshore platforms, and remote fields. Compliance with aviation standards requires significant investment in certifications, licenses, and safety protocols. Smaller companies struggle to meet these requirements, limiting market entry and growth potential. Regulatory uncertainty across different regions further complicates international operations. These challenges slow the pace of integration despite the clear benefits drones deliver.

Operational Limitations and Data Management Concerns Affecting Adoption

The market also contends with operational challenges such as limited flight time, battery capacity, and performance under extreme weather conditions. It prevents drones from completing long-range inspections in a single mission, raising the need for multiple flights. Harsh environments in oil and gas operations add risks of equipment damage and data loss. Processing and managing the massive volume of data captured during inspections creates another barrier. Companies require advanced analytics systems and skilled personnel to interpret this data effectively. High costs of maintenance, software integration, and workforce training further increase operational complexity. These obstacles highlight the need for continued innovation and support to achieve large-scale deployment.

Market Opportunities:

Integration of Artificial Intelligence and Advanced Analytics Creating New Growth Prospects

The Inspection Drone in Oil and Gas Market offers significant opportunities through the integration of artificial intelligence and advanced analytics. AI-driven algorithms enhance image recognition, fault detection, and predictive maintenance, enabling operators to act before failures occur. It supports faster decision-making and reduces reliance on manual review of inspection data. Combining drone inspections with machine learning platforms allows continuous improvement of inspection accuracy and operational efficiency. Companies can also integrate drone data into digital twins, creating virtual models of assets for long-term monitoring. The use of advanced analytics strengthens asset lifecycle management while lowering maintenance costs. This integration positions drones as essential tools for the future of digital oilfield operations.

Expanding Adoption Across Offshore and Remote Energy Infrastructure

Opportunities also emerge from the growing need to monitor offshore rigs, subsea pipelines, and remote energy facilities. The Inspection Drone in Oil and Gas Market benefits from the ability of drones to reach inaccessible areas quickly and safely. It provides reliable inspection in environments where human access is difficult, costly, or dangerous. Offshore operators view drones as effective tools to meet safety standards and reduce downtime. Expanding global investment in deepwater exploration and remote pipeline networks increases demand for drone-based inspections. The capability to operate in hazardous locations strengthens resilience and improves operational performance. This trend highlights the growing role of drones in securing efficiency and safety across the energy value chain.Top of Form

Market Segmentation Analysis:

By Drone

The Inspection Drone in Oil and Gas Market is segmented into fixed-wing, rotary-wing, and hybrid models. Rotary-wing drones dominate due to their ability to hover and perform close inspections. Fixed-wing drones are suited for long-distance monitoring of extensive pipeline networks. Hybrid models are gaining demand as they combine endurance with precision maneuvering. It supports efficient inspections across both onshore and offshore facilities.

- For instance, a FlyLogix drone completed a record-breaking 185-kilometer round trip for BP to monitor methane emissions on the Clair offshore platform, demonstrating its long-distance capabilities.

By Payload

The market is classified into cameras, sensors, LiDAR, and others. High-resolution cameras and thermal imaging systems hold a significant share, providing clear visuals of structural integrity. Gas detection sensors are vital for identifying leaks and monitoring emissions in real time. LiDAR technology ensures accurate mapping and supports predictive maintenance programs. It enhances inspection capabilities by delivering precise and actionable data.

- For instance, the Flyability Elios 3 inspection drone is equipped with a 4K camera and a LiDAR sensor that generates 3D models with an accuracy of 1 centimeter.

By Operation

The market is divided into remotely piloted, semi-autonomous, and fully autonomous drones. Remotely piloted systems remain widely used due to lower operational costs and ease of deployment. Semi-autonomous models improve safety by blending manual control with automated navigation features. Fully autonomous drones are expanding quickly, driven by AI-powered decision-making and advanced flight systems. It ensures consistent, reliable monitoring of assets with reduced human involvement, improving safety and efficiency.

Segmentations:

By Drone

- Fixed-Wing

- Rotary-Wing

- Hybrid

By Payload

- Cameras

- Sensors

- LiDAR

- Others

By Operation

- Remotely Piloted

- Semi-Autonomous

- Fully Autonomous

By Application

- Pipeline Monitoring

- Offshore Platform Inspection

- Refinery Inspection

- Storage Tank Inspection

- Others

By End-Use

- Upstream

- Midstream

- Downstream

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America Leading Adoption Through Regulatory Support and Technological Advancement

North America held 32% share of the Inspection Drone in Oil and Gas Market. The region benefits from strong regulatory support and early adoption of advanced technologies. Operators in the United States and Canada deploy drones to inspect pipelines, refineries, and offshore platforms with high efficiency. It leverages a mature digital ecosystem that integrates drones with asset management systems. Strict safety and environmental compliance standards encourage companies to replace manual inspections with automated solutions. Expanding infrastructure projects and investment in predictive analytics continue to drive regional growth.

Europe Strengthening Market Growth Through Sustainability and Efficiency Goals

Europe accounted for 28% share of the Inspection Drone in Oil and Gas Market. Growth is influenced by sustainability goals and strict energy regulations across key markets. Operators in the United Kingdom, Germany, and Norway deploy drones to monitor offshore rigs and manage aging assets. It provides reliable inspection capabilities while reducing carbon-intensive practices. Integration of drone data with digital twins supports predictive maintenance and operational efficiency. Regional investments in renewable energy and modernization of oil and gas infrastructure sustain steady adoption.

Asia-Pacific Emerging as a Fast-Growing Market with Expanding Infrastructure

Asia-Pacific represented 25% share of the Inspection Drone in Oil and Gas Market. Demand is fueled by large-scale infrastructure expansion and growing investment in energy projects. Countries such as China, India, and Australia utilize drones to inspect pipelines, offshore rigs, and remote facilities. It supports safer and cost-effective operations in areas that are difficult to access. Government programs promoting digital transformation in energy industries accelerate market development. Rising focus on efficiency and safety ensures long-term adoption of drone inspection technologies in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DJI Enterprise

- Cyberhawk

- FLIR Systems

- IdeaForge

- Vantage Robotics

- Percepto

- PrecisionHawk

- Terra Drone

- senseFly

- Sky-Futures (ICR Group)

Competitive Analysis:

The Inspection Drone in Oil and Gas Market is characterized by intense competition with global and regional players focusing on technology-driven solutions. Leading companies emphasize innovation in sensors, AI-based analytics, and automation to strengthen inspection accuracy and operational efficiency. It reflects a strong commitment to addressing industry needs for safety, reliability, and cost reduction. Strategic collaborations with oil and gas operators, along with partnerships for regulatory compliance, remain common growth strategies. Firms are also investing in advanced payload systems such as LiDAR, thermal cameras, and gas detection modules to expand service capabilities. The competitive landscape highlights growing interest in autonomous and semi-autonomous drones, supported by AI integration and predictive maintenance applications. It creates opportunities for companies that can combine advanced hardware with data-driven software solutions, ensuring long-term value for energy operators and reinforcing their role in modernizing asset management practices.

Recent Developments:

- In September 2025, ESB, Ireland’s national electricity utility, appointed Cyberhawk under a five-year agreement to conduct inspections of its electrical transmission and distribution network to enhance grid resilience.

- In May 2025, Teledyne FLIR OEM announced a collaboration with AerialOGI for the launch of the AerialOGI-N, the first optical gas imaging (OGI) camera module designed for both handheld devices and drones.

- In August 2025, ideaForge launched its versatile new mapping UAV, the Q6V2 GEO, designed for a wide range of geospatial intelligence applications including industrial corridor monitoring and urban surveying.

Report Coverage:

The research report offers an in-depth analysis based on Drone, Payload, Operation, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Inspection Drone in Oil and Gas Market will expand through higher adoption of AI-powered analytics for predictive maintenance.

- Companies will increase reliance on autonomous drones to enhance safety and reduce human exposure in hazardous zones.

- Integration of digital twin technology with drone data will support accurate modeling of assets for long-term monitoring.

- It will benefit from rising demand for cost-effective inspection methods that reduce downtime and extend asset lifespan.

- Drones equipped with advanced payloads such as LiDAR and methane detection sensors will gain wider usage.

- Regulatory frameworks are expected to evolve, enabling broader deployment of drones in restricted airspaces.

- It will see strong growth in offshore inspections as energy companies invest in deepwater exploration and production.

- Adoption will increase in developing regions where expanding infrastructure creates demand for modern inspection solutions.

- Data management platforms linked with drones will strengthen decision-making and improve operational transparency.

- Sustainability goals will drive operators to adopt drone solutions that align with environmental and safety standards.