Market Overview:

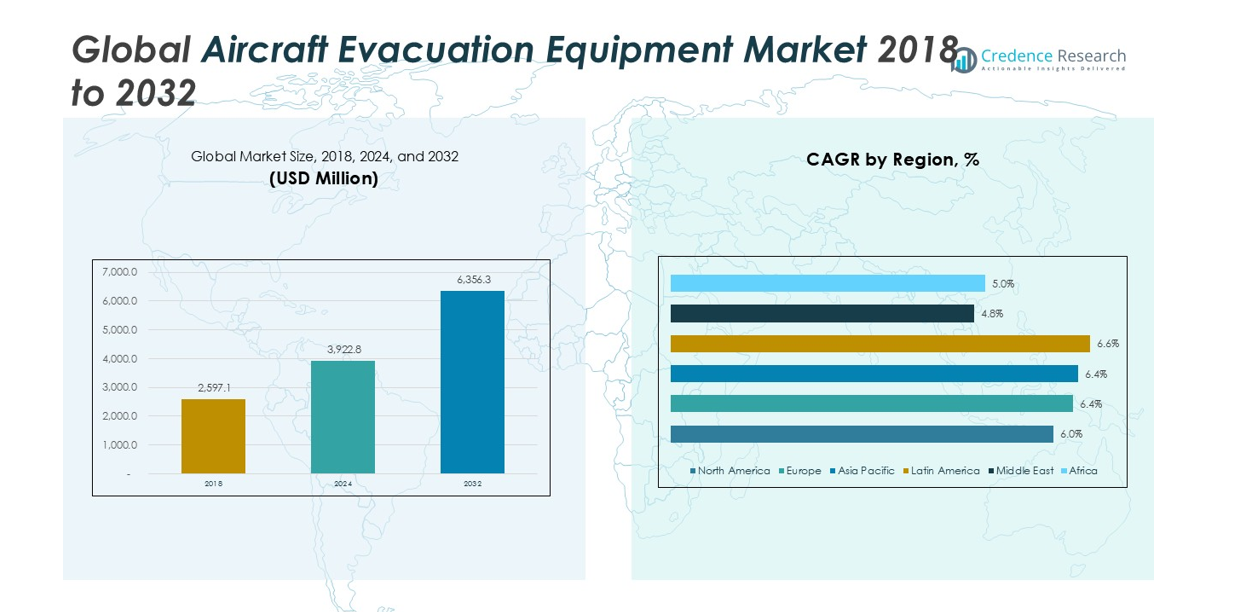

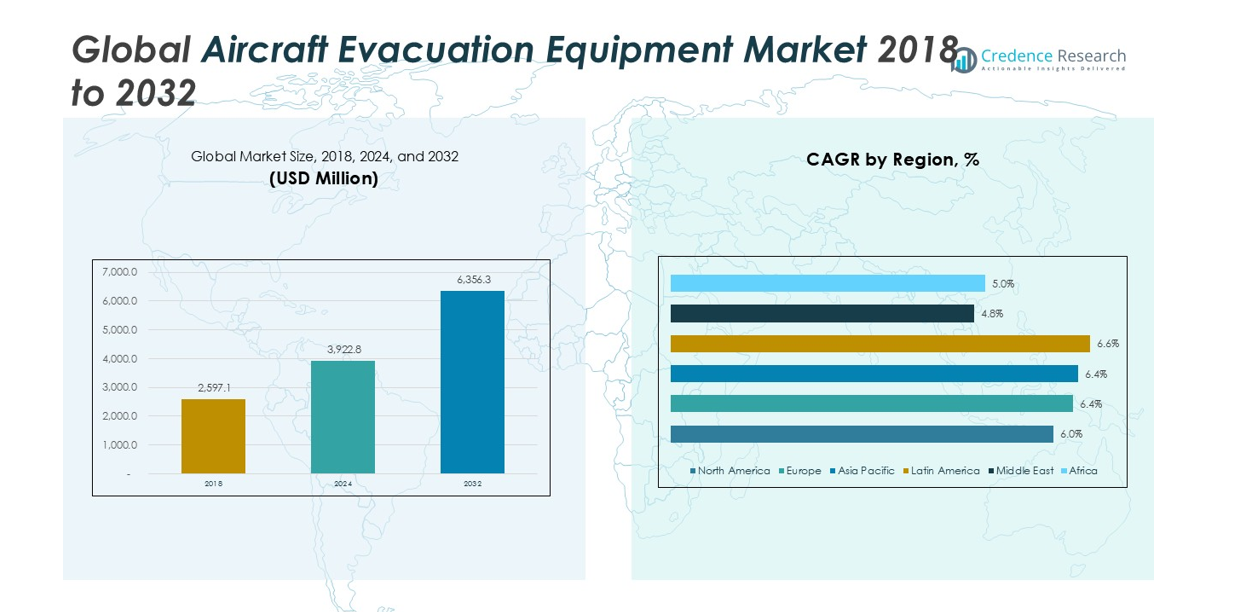

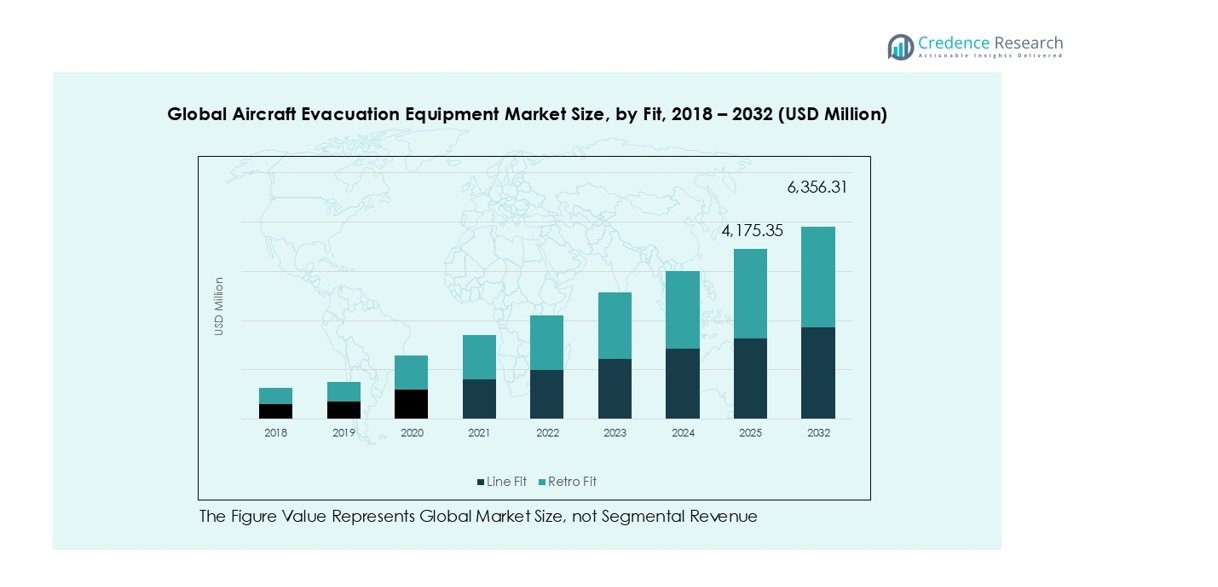

Aircraft Evacuation Equipment Market size was valued at USD 2,597.1 Million in 2018, growing to USD 3,922.8 Million in 2024, and is anticipated to reach USD 6,356.3 Million by 2032, at a CAGR of 6.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Evacuation Equipment Market Size 2024 |

USD 3,922.8 Million |

| Aircraft Evacuation Equipment Market, CAGR |

6.19% |

| Aircraft Evacuation Equipment Market Size 2032 |

USD 6,356.3 Million |

The Aircraft Evacuation Equipment Market is highly competitive, led by key players such as Zodiac Aerospace, Liferaft Systems International, MES (Marine Escape Systems), Air Cruisers, Survitec Group, Safran Aerosystems, and Collins Aerospace. These companies strengthen their market positions through strategic product innovations, technological advancements, and extensive global presence across commercial, military, and private aviation sectors. Focus areas include advanced evacuation slides, life vests, ejection seats, and emergency flotation devices designed for rapid deployment, reliability, and lightweight performance. Line-fit installations and retrofitting of older aircraft drive adoption, supported by stringent international aviation safety standards. Regionally, North America dominates the market with a 32% share, benefiting from a robust aviation infrastructure, high passenger traffic, and proactive fleet modernization. The combination of regulatory compliance, R&D investments, and strategic collaborations positions these top players to sustain growth in the evolving global market.

Market Insights

- The Aircraft Evacuation Equipment Market was valued at USD 3,922.8 Million in 2024 and is projected to reach USD 6,356.3 Million by 2032, growing at a CAGR of 6.19%, with Evacuation Slides holding the largest segment share of 35%.

- Market growth is driven by rising air passenger traffic, fleet expansion, and stringent aviation safety regulations, which increase demand across commercial, military, and private aircraft.

- Key trends include retrofitting older aircraft with modern evacuation systems and rising demand for specialized equipment for helicopters and offshore operations, particularly in Asia Pacific and the Middle East.

- The competitive landscape features leading players such as Zodiac Aerospace, Liferaft Systems International, MES, Air Cruisers, Survitec Group, Safran Aerosystems, and Collins Aerospace, focusing on technological innovation, partnerships, and line-fit installations.

- Regionally, North America dominates with a 32% market share, followed by Europe at 27% and Asia Pacific at 22%, while Latin America, the Middle East, and Africa contribute smaller but growing shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

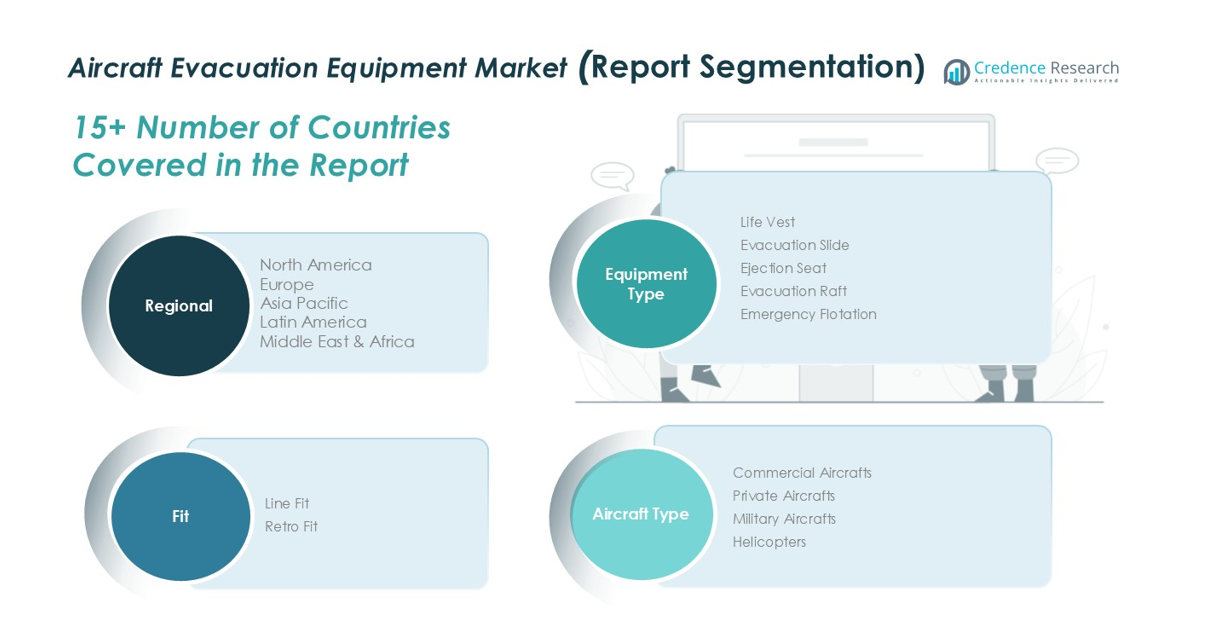

Market Segmentation Analysis:

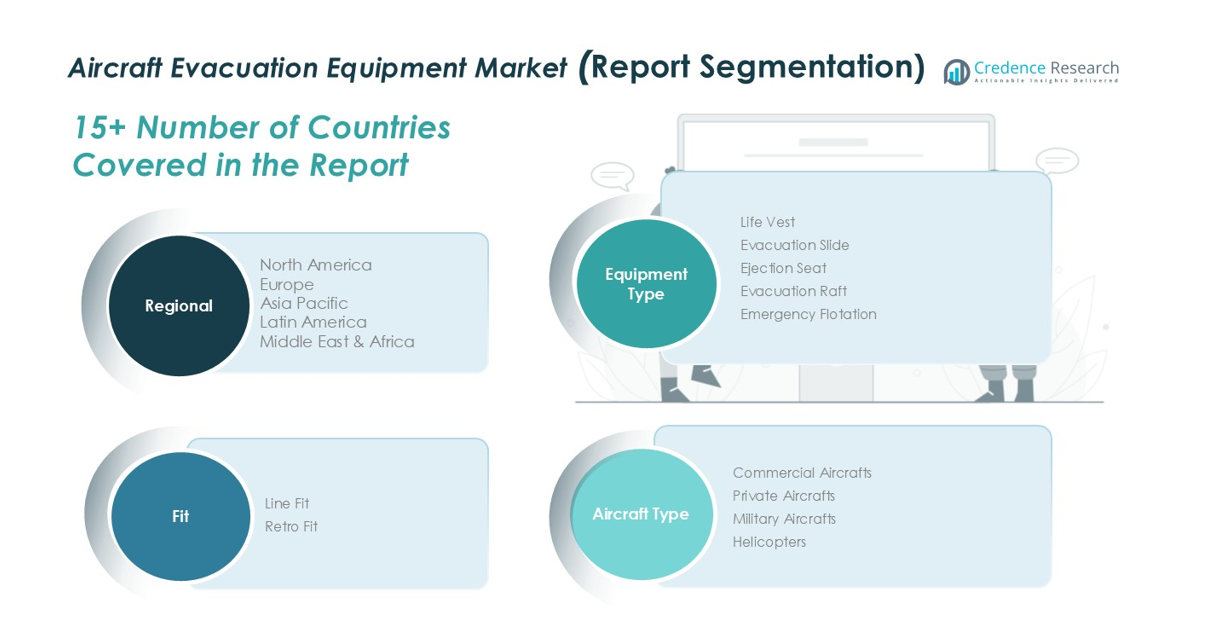

By Equipment Type

The Aircraft Evacuation Equipment Market by equipment type is dominated by Evacuation Slides, holding a 35% share, followed by Life Vests at 25%. Slides are essential for rapid egress during emergencies, especially in commercial aviation, while Life Vests and Evacuation Rafts are critical for over-water safety. Ejection Seats and Emergency Flotation devices are primarily used in military aircraft and helicopters. Market growth is driven by increasing air passenger traffic, stringent safety regulations, and technological advancements in lightweight, efficient, and automated evacuation systems.

- For instance, Safran Aerosystems, a global leader in aviation safety systems, supplies evacuation slides for most commercial aircraft platforms, including Boeing, Airbus, and Comac models, as well as military aircraft like the Boeing KC-135 and KC-46 tankers.

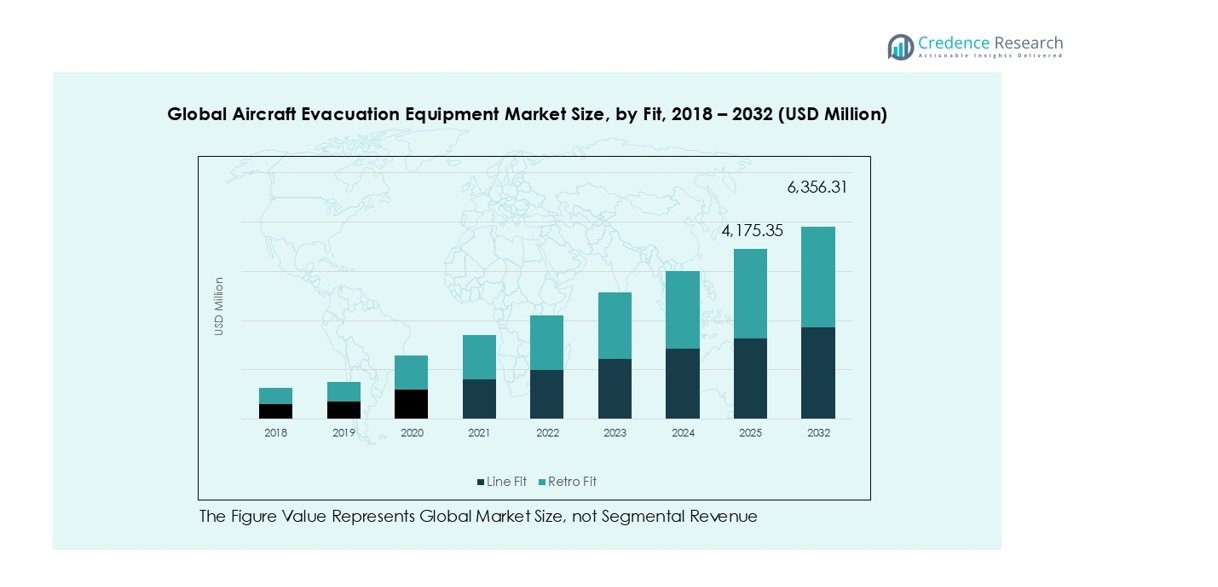

By Fit

In terms of fit, Line Fit leads with a 60% share, as aircraft manufacturers integrate evacuation systems during production to comply with safety mandates and optimize installation efficiency. Retro Fit holds the remaining 40%, catering to fleet modernization and regulatory upgrades for older aircraft. Growth in both segments is fueled by airline investments in new aircraft, retrofitting older fleets, and the continuous emphasis on passenger safety standards globally.

- For instance, Airbus integrates advanced evacuation slides directly into the A380 during manufacturing, including the Tribrid Inflation System developed by Goodrich Aircraft Interior Products, which automatically extends slide length if the aircraft is in an abnormal attitude during evacuation, ensuring ground contact.

By Aircraft Type

The Commercial Aircraft segment dominates with a 50% share, driven by high passenger volumes and strict international evacuation requirements. Military Aircraft account for 25%, with demand focused on ejection seats and mission-critical safety systems. Private Aircraft and Helicopters share the remaining 25%, benefiting from customized evacuation solutions and offshore operations. Growth across all aircraft types is propelled by fleet expansion, regulatory compliance, and adoption of advanced evacuation technologies that enhance operational efficiency and passenger safety.

Key Growth Drivers

Rising Air Passenger Traffic and Fleet Expansion

The surge in global air travel has driven airlines to expand and modernize their fleets, directly boosting demand for aircraft evacuation equipment. Commercial aircraft require advanced life vests, evacuation slides, and rafts to comply with safety regulations. Military and private aviation sectors are also upgrading equipment to improve operational safety. Growing flight volumes and passenger numbers worldwide sustain consistent adoption of safety solutions, supporting market expansion across equipment types and aircraft segments.

- For instance, Korean Air announced in August 2025 a landmark purchase of 103 Boeing aircraft worth over $36 billion, part of which includes integrating advanced cabin safety technologies and replacing older aircraft to enhance emergency readiness.

Stringent Aviation Safety Regulations

Mandatory compliance with international aviation safety standards remains a key market driver. Regulatory authorities such as the FAA and EASA require all commercial, private, and military aircraft to be equipped with certified evacuation systems. This accelerates line-fit installations on new aircraft and retrofitting of older fleets. Continuous updates in safety mandates, including evacuation time and over-water survival requirements, encourage operators to adopt technologically advanced, reliable equipment efficiently.

- For instance, EASA’s CS-25 regulations stipulate that each crew and passenger area must have emergency means to allow rapid evacuation in crash landings, considering the possibility of the aeroplane being on fire.

Technological Advancements in Evacuation Equipment

Innovation in materials, automated deployment mechanisms, and compact designs has enhanced the efficiency and usability of aircraft evacuation systems. Modern slides, life vests, and ejection seats provide faster deployment, higher reliability, and easier maintenance. The integration of smart sensors and multifunctional flotation devices improves passenger safety while reducing operational downtime, fueling market growth across aircraft types and regions.

Key Trends and Opportunities

Trend Toward Retrofitting Legacy Fleets

Airlines increasingly retrofit older aircraft with modern evacuation systems to meet updated safety standards and extend service life. Retrofits include life vests, evacuation slides, and flotation devices optimized for easy integration, installation, and maintenance. This trend is particularly strong in regions with aging fleets, such as Europe and North America, creating consistent demand for advanced evacuation solutions without requiring new aircraft investments, while also enhancing passenger safety and operational efficiency.

- For instance, Air India has retrofitted 15 A320neo aircraft with upgraded cabins and evacuation systems, including life vests and evacuation slides, aiming to complete retrofit for the remaining planes by September 2025.

Rising Demand for Offshore and Helicopter Safety Solutions

Growth in offshore operations, including oil & gas, search and rescue, and private aviation, has significantly increased the need for specialized helicopter evacuation equipment. Life vests, emergency flotation devices, and compact evacuation rafts are crucial for survival in over-water emergencies, ensuring rapid and safe passenger extraction. Manufacturers are designing lightweight, automated systems tailored for helicopters and small aircraft, incorporating advanced materials, easy deployment mechanisms, and enhanced durability. These innovations offer substantial market expansion opportunities, particularly in Asia Pacific and the Middle East, driven by rising offshore activities, increasing safety regulations, and growing investment in aviation infrastructure.

- For instance, Survitec launched the Halo Passenger Flotation Device a life vest designed specifically for offshore helicopter crew, featuring automatic inflation and a slim profile to ensure unrestricted movement.

Key Challenges

High Costs of Advanced Evacuation Systems

Advanced evacuation systems involve significant manufacturing and maintenance costs due to lightweight materials, automated deployment, and multifunctional designs. Smaller airlines and private operators may struggle to adopt these high-cost solutions, especially when balancing budget constraints with operational priorities. Initial investment and ongoing maintenance can slow retrofitting initiatives and limit market penetration, particularly in emerging economies, despite rising safety awareness, stringent regulatory requirements, and increasing demand for enhanced passenger protection. Additionally, the need for specialized training and certification for crew members adds further financial and logistical challenges, potentially hindering widespread adoption of these advanced systems.

Stringent Compliance and Certification Requirements

Aircraft evacuation equipment must meet strict international and regional standards for performance, durability, and reliability, requiring extensive testing and certification. Regulatory delays can affect production timelines and market entry, while frequent updates in safety mandates necessitate continuous redesigns, increasing operational complexity and costs. Companies must invest heavily in R&D, advanced materials, and rigorous certification processes to remain competitive, creating a significant barrier to new entrants and limiting rapid expansion of product lines in an evolving and highly regulated market.

Regional Analysis

North America

North America dominates the Aircraft Evacuation Equipment Market with a market share of 32% in 2024, reflecting the region’s extensive commercial and military aviation infrastructure. The market grew from USD 833.94 million in 2018 to USD 1,249.36 million in 2024 and is projected to reach USD 2,002.24 million by 2032, at a CAGR of 6.0%. Growth is driven by rising air passenger traffic, fleet modernization, and stringent aviation safety regulations in the U.S. and Canada. Technological adoption of line-fit evacuation systems and retrofitting of older aircraft supports continuous demand across commercial, private, and military aviation sectors.

Europe

Europe holds a market share of 27% in 2024, growing from USD 686.94 million in 2018 to USD 1,047.34 million in 2024, with projections reaching USD 1,718.11 million by 2032 at a CAGR of 6.4%. The region’s growth is fueled by modern fleet expansion, strict European Union aviation safety standards, and retrofitting of legacy aircraft. Commercial aviation dominates, while military and private aircraft contribute to incremental demand. Increased investments in advanced evacuation technologies, such as automated slides and multifunctional flotation devices, further support regional market expansion.

Asia Pacific

Asia Pacific accounts for a market share of 22% in 2024, increasing from USD 565.65 million in 2018 to USD 866.50 million in 2024 and expected to reach USD 1,430.17 million by 2032 at a CAGR of 6.4%. Rapid air travel growth, fleet expansions, and rising defense procurement in countries such as China, Japan, and India drive demand. Regulatory compliance, technological adoption of advanced evacuation equipment, and investments in both commercial and military aircraft fleets fuel market growth. The region also benefits from increasing private aviation and helicopter operations, particularly in offshore and urban mobility sectors.

Latin America

Latin America captures a market share of 11% in 2024, with the market growing from USD 286.20 million in 2018 to USD 443.22 million in 2024 and projected to reach USD 741.78 million by 2032 at a CAGR of 6.6%. Growth is supported by expanding commercial aviation in Brazil and Argentina, modernization of regional fleets, and adoption of safety-compliant evacuation equipment. Increasing air passenger traffic and retrofitting of older aircraft drive demand for life vests, evacuation slides, and rafts. Investments in regional airline safety infrastructure and regulatory alignment with international standards further accelerate market expansion.

Middle East

The Middle East represents a market share of 4% in 2024, growing from USD 124.14 million in 2018 to USD 174.40 million in 2024 and expected to reach USD 254.25 million by 2032 at a CAGR of 4.8%. Market growth is supported by fleet expansions in GCC countries, including commercial and military aircraft, alongside increasing helicopter operations for offshore oil & gas transport. Investments in advanced evacuation systems, regulatory compliance with international aviation standards, and adoption of life vests, evacuation slides, and rafts drive regional demand, although slower growth relative to other regions reflects smaller fleet sizes and market scale.

Africa

Africa holds a market share of 3% in 2024, with the market growing from USD 100.25 million in 2018 to USD 142.01 million in 2024 and projected to reach USD 209.76 million by 2032 at a CAGR of 5.0%. Growth is driven by commercial fleet expansion in South Africa, Egypt, and other key countries, along with modernization of aging aircraft. Regulatory compliance with international aviation safety standards and increasing adoption of life vests, evacuation slides, and emergency flotation devices fuel market demand. Military and private aviation also contribute to incremental growth, particularly in training and offshore operations.

Market Segmentations:

By Equipment Type

- Life Vest

- Evacuation Slide

- Ejection Seat

- Evacuation Raft

- Emergency Flotation

By Fit

By Aircraft Type

- Commercial Aircraft

- Private Aircraft

- Military Aircraft

- Helicopters

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Aircraft Evacuation Equipment Market features leading players such as Zodiac Aerospace, Liferaft Systems International, MES (Marine Escape Systems), Air Cruisers, Inc., Survitec Group, Safran Aerosystems and B/E Aerospace. These companies dominate through strategic product innovations, technological advancements, and a strong global presence across commercial, military, and private aviation segments. Market competition is driven by continuous R&D investment to enhance life vests, evacuation slides, ejection seats, and flotation devices with improved reliability, lightweight materials, and automated deployment systems. Partnerships, acquisitions, and collaborations with airlines and OEMs further strengthen their market position. Players focus on line-fit installations for new aircraft as well as retrofitting older fleets to comply with stringent international safety regulations. Regional expansion and customized solutions for helicopters and offshore operations also remain key strategies to capture market share in emerging and mature aviation markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zodiac Aerospace

- Liferaft Systems International

- MES (Marine Escape Systems)

- Air Cruisers, Inc.

- Survitec Group

- Safran Aerosystems

- Rockwell Collins (Collins Aerospace)

- B/E Aerospace (now part of Collins Aerospace)

- Others

Recent Developments

- In August 2025, Knight Aerospace secured a 20-year contract with Embraer to supply modular medical suites and evacuation systems for the KC-390 Millennium aircraft.

- In August 2024, Air New Zealand introduced a new 787 Cabin Emergency Evacuation Trainer at its Auckland Training Centre. This state-of-the-art facility provides realistic training environments for cabin crew and pilots, enhancing emergency preparedness.

- In 2023, Embraer delivered the newly certified Phenom 300MED to GrandView Aviation. This aircraft is equipped with advanced medical evacuation systems, accommodating two stretchers and additional medical equipment, tailored for air ambulance service

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Fit, Aircraft Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing air passenger traffic will drive continuous demand for advanced evacuation systems.

- Fleet expansion and modernization in commercial and military aviation will support market growth.

- Technological innovations in lightweight, automated, and compact evacuation equipment will enhance adoption.

- Retrofitting older aircraft with modern safety solutions will create sustained market opportunities.

- Regulatory compliance with international aviation safety standards will remain a key growth driver.

- Growth in offshore and helicopter operations will increase demand for specialized flotation and evacuation devices.

- Emerging markets in Asia Pacific and Latin America will provide new growth avenues.

- Strategic partnerships, acquisitions, and collaborations among key players will strengthen competitive positions.

- Increasing awareness of passenger and crew safety will encourage widespread adoption of advanced equipment.

- Continuous R&D investments will drive product innovation and improved operational efficiency across all aircraft types.