Market Overview:

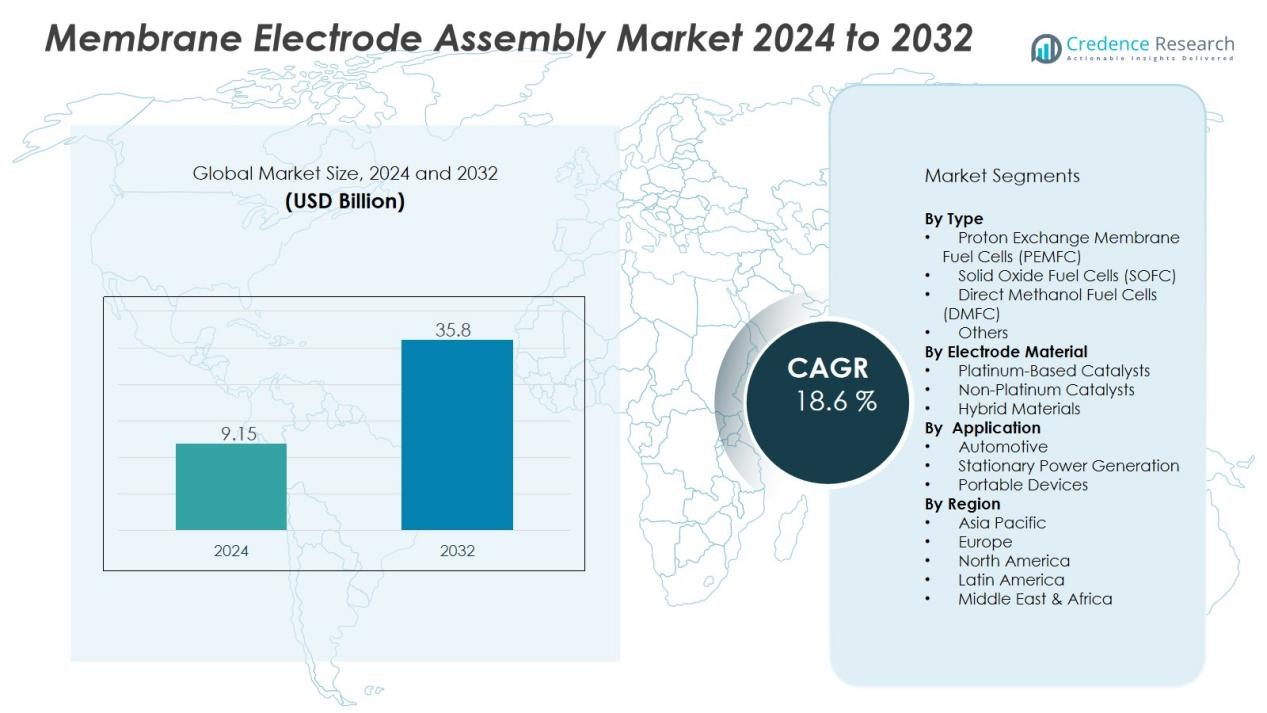

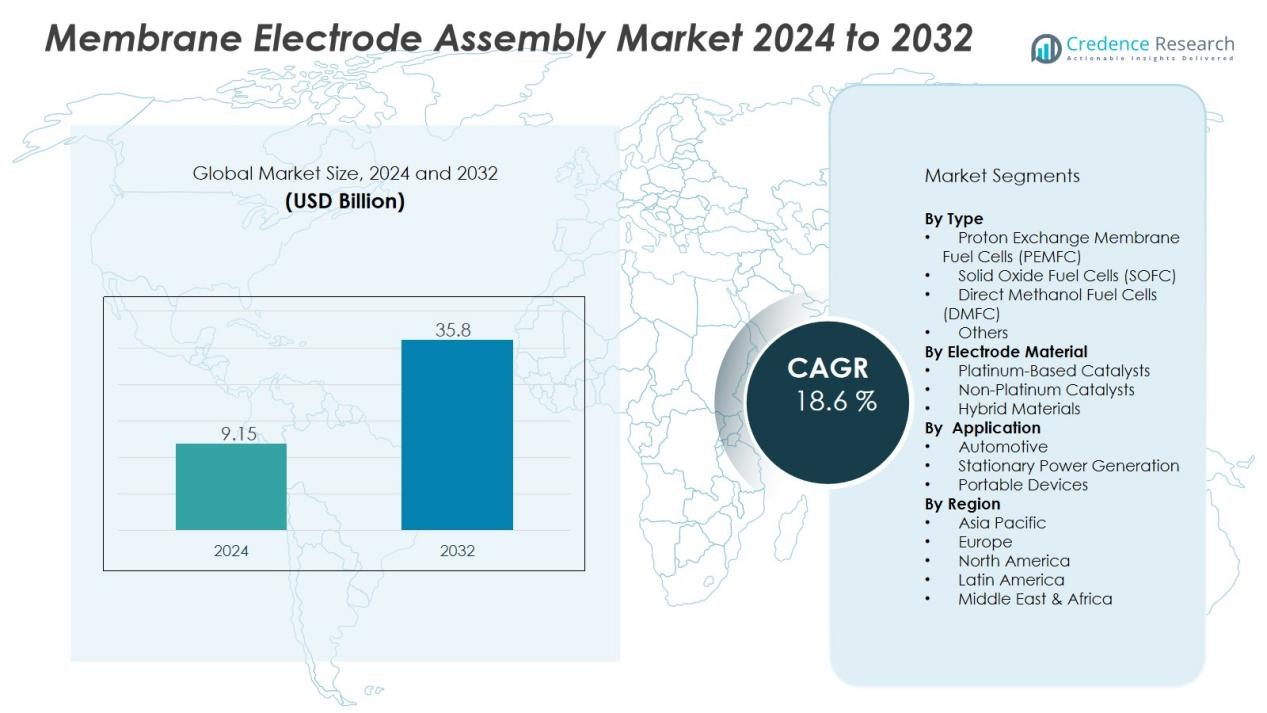

The membrane electrode assembly market size was valued at USD 9.15 billion in 2024 and is anticipated to reach USD 35.8 billion by 2032, at a CAGR of 18.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Membrane Electrode Assembly Market Size 2024 |

USD 9.15 Billion |

| Membrane Electrode Assembly Market, CAGR |

18.6 % |

| Membrane Electrode Assembly Market Size 2032 |

USD 35.8 Billion |

Market growth is fueled by several key drivers. The global shift toward decarbonization and zero-emission transportation has accelerated demand for fuel cell vehicles, directly boosting MEA adoption. Rising investments in hydrogen infrastructure, government subsidies for clean mobility, and technological improvements in durability and efficiency also support market expansion. Ongoing R&D in advanced catalyst materials and thinner membranes enhances performance while reducing costs, encouraging broader adoption across end-use industries.

Regionally, Asia-Pacific dominates the MEA market, led by strong government initiatives in Japan, China, and South Korea. Europe follows closely, driven by aggressive hydrogen strategies and clean mobility targets. North America remains a significant market, supported by investments in hydrogen refueling networks and industrial fuel cell projects. Emerging regions such as Latin America and the Middle East also show potential through pilot hydrogen initiatives and renewable energy integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The membrane electrode assembly market was valued at USD 9.15 billion in 2024 and is projected to reach USD 35.8 billion by 2032, growing at a CAGR of 18.6%.

- The global shift toward decarbonization and hydrogen adoption drives strong demand for MEAs in transport and power applications.

- Fuel cell electric vehicles are accelerating adoption due to higher energy density, faster refueling, and extended driving ranges.

- Technological advancements in catalyst materials and thinner membranes reduce costs and improve efficiency, supporting large-scale commercialization.

- High production costs and reliance on platinum remain major barriers, limiting competitiveness against alternative energy technologies.

- Limited hydrogen infrastructure and technical performance constraints hinder broader adoption, particularly in fuel cell vehicles.

- Asia-Pacific leads with 46% share, followed by Europe with 28% and North America with 19%, highlighting strong regional growth strategies.

Market Drivers:

Rising Global Shift Toward Clean Energy and Hydrogen Economy:

The membrane electrode assembly market benefits from the worldwide transition to cleaner energy sources. Governments are committing to net-zero targets, which increases demand for hydrogen-based solutions. Fuel cells, powered by MEAs, play a critical role in reducing carbon emissions across transport and power sectors. It strengthens the global movement toward sustainable energy adoption.

- For instance, BASF and ZeroAvia are collaborating to accelerate commercialization of a high-powered, lightweight MEA for aviation HT-PEM fuel cells, aiming at 3,000 W/kg specific power to support zero-emission propulsion in commercial aircraft.

Expanding Demand for Fuel Cell Electric Vehicles and Sustainable Mobility:

The growing adoption of fuel cell electric vehicles (FCEVs) is a major driver for the membrane electrode assembly market. Automakers are investing in fuel cell technology to meet stricter emission regulations. It provides higher energy density, quick refueling, and extended driving ranges compared to traditional batteries. This advantage supports its application in passenger cars, buses, and heavy-duty trucks.

- For example, the 2025 Toyota Mirai XLE FCEV offers an EPA-estimated driving range of 402 miles and can be refueled in about 5 minutes under ideal conditions. However, its practical benefits are currently limited by its exclusive availability in California, where a small and occasionally unreliable network of hydrogen fueling stations is primarily concentrated.

Technological Advancements Enhancing Efficiency and Reducing Costs:

Continuous research and innovation improve the efficiency and durability of MEAs. Developers are focusing on advanced catalyst materials, thinner membranes, and optimized designs. The membrane electrode assembly market benefits from reduced production costs, making fuel cells more commercially viable. It increases adoption across industries seeking reliable and scalable clean energy solutions.

Strong Government Policies and Infrastructure Investments:

Supportive policies and large-scale investments in hydrogen infrastructure fuel the growth of the membrane electrode assembly market. Subsidies, tax incentives, and funding programs encourage both manufacturers and end users. Expansion of hydrogen refueling stations and integration into industrial systems boost adoption. It ensures that MEAs remain central to the global clean energy strategy.

Market Trends:

Growing Focus on High-Performance Materials and Durability Enhancements:

The membrane electrode assembly market is witnessing a clear trend toward advanced material development. Manufacturers are introducing catalysts with lower platinum content to reduce costs while maintaining efficiency. It improves durability, ensuring longer operating life for fuel cells across heavy-duty transport and stationary applications. The integration of nanostructured membranes and innovative ionomers enhances conductivity and water management. Companies are also working on flexible and thinner MEAs to achieve higher power density. These advancements make MEAs more competitive compared to alternative energy storage and conversion technologies.

- For instance, Ballard Power Systems expanded its MEA production capacity sixfold in recent years to meet demand for fuel cell electric vehicles, providing MEAs with platinum loadings as low as 0.1 mg/cm², significantly reducing platinum usage while maintaining high power output and durability performance.

Increasing Commercialization of Fuel Cells Across Mobility and Stationary Power :

The membrane electrode assembly market is also shaped by rising commercialization across multiple sectors. Automakers are scaling production of fuel cell vehicles, supported by expanding hydrogen refueling infrastructure. It accelerates the adoption of MEAs in buses, trucks, and passenger vehicles. Stationary power generation, backup systems, and portable devices are also adopting MEAs to ensure reliable, zero-emission energy solutions. Governments and private players are investing heavily in pilot projects and large-scale hydrogen ecosystems. This trend strengthens the role of MEAs as a backbone for global clean energy strategies.

- For Instance, Europe had 294 hydrogen refueling stations, with Germany hosting 113 of them. This infrastructure supports the fueling of Fuel Cell Electric Vehicles (FCEVs), which use hydrogen as a power source.

Market Challenges Analysis:

High Production Costs and Dependence on Precious Metals:

The membrane electrode assembly market faces a key challenge in its reliance on high-cost materials. Platinum and other precious metals used in catalysts significantly increase overall production costs. It creates barriers for mass adoption, especially in price-sensitive regions. Manufacturers are under pressure to reduce dependency on such materials without compromising performance. Scaling production also requires advanced manufacturing processes, which further raises expenses. This limits competitiveness against other energy storage and conversion technologies.

Limited Infrastructure and Technical Performance Constraints:

The membrane electrode assembly market is also constrained by the slow pace of hydrogen infrastructure development. Lack of widespread refueling stations restricts fuel cell vehicle deployment, which directly affects MEA demand. It also faces challenges in durability under extreme operating conditions, including high temperatures and fluctuating loads. Water management, mechanical stability, and consistent conductivity remain technical hurdles. Without improvements in these areas, long-term reliability and large-scale adoption remain limited. Addressing infrastructure and performance gaps is critical for sustained market growth.

Market Opportunities:

Expanding Role in Zero-Emission Mobility and Heavy-Duty Transport:

The membrane electrode assembly market presents strong opportunities in the global push for zero-emission vehicles. Governments and automakers are prioritizing fuel cell buses, trucks, and commercial fleets to meet sustainability targets. It enables longer driving ranges and faster refueling compared to battery-electric vehicles, making MEAs ideal for heavy-duty applications. Hydrogen-powered trains, ships, and aviation also open new avenues for adoption. The scalability of MEAs across diverse mobility platforms strengthens their market potential. Growing investment in hydrogen corridors and green mobility ecosystems further supports this expansion.

Rising Adoption in Stationary Power, Backup Systems, and Industrial Applications:

The membrane electrode assembly market is also set to benefit from wider use in stationary and industrial energy systems. Fuel cells powered by MEAs provide reliable, clean backup power for data centers, hospitals, and telecom networks. It also supports integration with renewable energy, ensuring stable supply during fluctuations in solar or wind generation. Industrial users are adopting MEAs to reduce carbon emissions and enhance energy security. Emerging projects in microgrids and distributed power generation increase demand further. These opportunities highlight MEAs as a critical enabler of global clean energy transition.

Market Segmentation Analysis:

By Type:

The membrane electrode assembly market is segmented into proton exchange membrane fuel cells (PEMFC), solid oxide fuel cells (SOFC), and others. PEMFC dominates the segment due to its widespread use in automotive, portable, and stationary applications. It offers high power density, low operating temperature, and quick start-up capabilities. SOFC is gaining traction in stationary power systems due to high efficiency and fuel flexibility. Other types, including direct methanol fuel cells, cater to niche portable applications. The balance between performance and cost drives adoption across these segments.

- For instance, Toyota’s first-generation Mirai employs a PEMFC stack delivering 114 kW of maximum output and a volumetric power density of 3.1 kW/L.

By Electrode Material:

Electrode material plays a critical role in MEA performance. The segment includes platinum-based catalysts, non-platinum catalysts, and hybrid materials. The membrane electrode assembly market relies heavily on platinum-based electrodes for high efficiency, despite cost concerns. Non-platinum catalysts are emerging as cost-effective alternatives through research and development efforts. Hybrid materials combine multiple catalysts to improve durability and reduce reliance on precious metals. It continues to evolve with growing emphasis on affordability and scalability.

- For instance, Johnson Matthey’s PtCo@Pt–Co–GNF hybrid electrocatalyst delivered a current density of 438 mA/cm² at 0.8 V—over four times higher than conventional Pt₃Co/C catalysts—while maintaining stability over extended cycling.

By Application:

MEA applications span automotive, stationary power generation, and portable devices. The automotive sector dominates with rising adoption of fuel cell electric vehicles. It benefits from government incentives and expanding hydrogen infrastructure. Stationary power systems are also witnessing growth, supported by demand for reliable, zero-emission backup power. Portable applications, including consumer electronics and small-scale energy devices, add further potential. The wide application scope reinforces MEAs as a critical enabler of clean energy solutions.

Segmentations:

By Type:

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Direct Methanol Fuel Cells (DMFC)

- Others

By Electrode Material:

- Platinum-Based Catalysts

- Non-Platinum Catalysts

- Hybrid Materials

By Application:

- Automotive

- Stationary Power Generation

- Portable Devices

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 46% market share in 2024, leading the global membrane electrode assembly market. It benefits from strong government policies in Japan, China, and South Korea that prioritize hydrogen fuel cell deployment. Expanding adoption of fuel cell electric vehicles and investment in hydrogen refueling networks drive growth. It also gains momentum from large-scale projects in public transportation, power generation, and industrial applications. Domestic automakers and energy companies accelerate commercialization with joint ventures and technology partnerships. This region continues to dominate due to aggressive clean energy strategies and established manufacturing bases.

Europe:

Europe accounted for 28% market share in 2024, supported by robust hydrogen policies and net-zero targets. The European Union has committed significant funding toward hydrogen infrastructure and clean mobility projects. It benefits from strong adoption of fuel cells in public transport, heavy-duty vehicles, and industrial energy systems. Countries such as Germany, France, and the U.K. lead regional investments, with pilot projects expanding into large-scale operations. The region also focuses on localizing production of MEAs and catalysts to reduce dependency on imports. Continuous policy alignment with climate goals positions Europe as a major growth hub.

North America:

North America held 19% market share in 2024, with the United States leading regional adoption. Federal incentives, state-level funding, and public-private partnerships drive investments in hydrogen and fuel cell technologies. It benefits from strong demand in heavy-duty vehicles, backup power systems, and industrial energy applications. Canada also supports the market with its national hydrogen strategy and clean energy investments. Ongoing collaborations between automakers, energy providers, and technology developers accelerate commercialization. North America’s focus on innovation and large-scale industrial projects enhances its role in global MEA adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hyundai Motors

- NEL Hydrogen

- Ballard Power Systems

- ITM Power

- DKSH

- SFC Energy

- PowerCell Sweden

- Plug Power

- Toyota Motors

- Honda Motors

- eGo Energy

- Bloom Energy

- Elogen

Competitive Analysis:

The membrane electrode assembly market is highly competitive, shaped by both established players and emerging innovators. Key companies include Hyundai Motors, NEL Hydrogen, Ballard Power Systems, ITM Power, DKSH, SFC Energy, PowerCell Sweden, Plug Power, Toyota Motors, and Honda Motors. It is defined by strong investments in research, commercialization, and partnerships to enhance efficiency and scalability of fuel cell systems. Companies focus on lowering platinum content, extending durability, and improving mass production capabilities. Strategic alliances with automakers and energy providers expand market reach, while government-backed projects accelerate deployment. It remains influenced by technological advancements and global clean energy policies that drive competition among leading firms.

Recent Developments:

- In April 2025, Hyundai Motors launched the all-new NEXO fuel cell electric vehicle (FCEV) at the Seoul Mobility Show 2025, featuring over 700 km range from a five-minute charge and advanced safety and comfort features.

- In January 2025, Nel ASA acquired an equity stake in Cavendish Hydrogen, marking a strategic investment to expand green hydrogen solutions.

- In March 2025, Samsung E&A acquired a 9.1% equity stake in Nel ASA for approximately $33 million and signed a strategic collaboration agreement to develop green hydrogen plant solutions worldwide.

Report Coverage:

The research report offers an in-depth analysis based on Type, Electrode Material, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The membrane electrode assembly market will gain momentum from accelerating global hydrogen adoption across transport and power sectors.

- It will see stronger demand from heavy-duty applications such as trucks, buses, trains, and marine transport.

- Technological innovations will reduce platinum content and improve durability, making MEAs more cost-effective.

- Integration with renewable energy projects will expand stationary fuel cell use in microgrids and backup systems.

- Governments will continue to strengthen hydrogen policies, creating favorable conditions for large-scale MEA deployment.

- Collaborations among automakers, energy firms, and research institutions will enhance commercialization.

- Asia-Pacific will remain the leading hub, while Europe and North America will grow with policy-driven investments.

- Industrial applications such as chemical processing and distributed power will open new revenue streams.

- Advanced manufacturing techniques will scale production while improving consistency and performance.

- The market will emerge as a cornerstone of the clean energy transition, enabling wider adoption of hydrogen solutions.