Market Overview

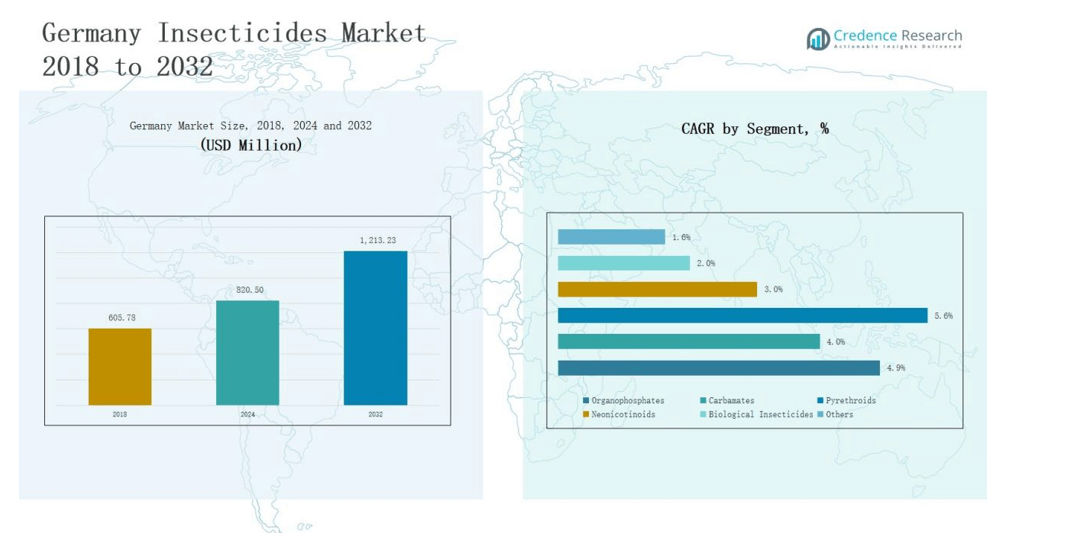

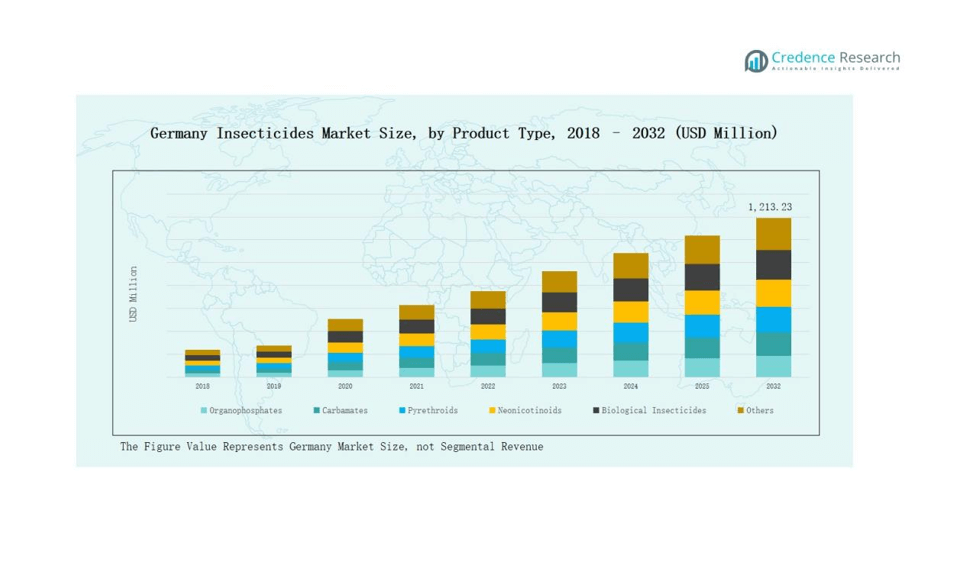

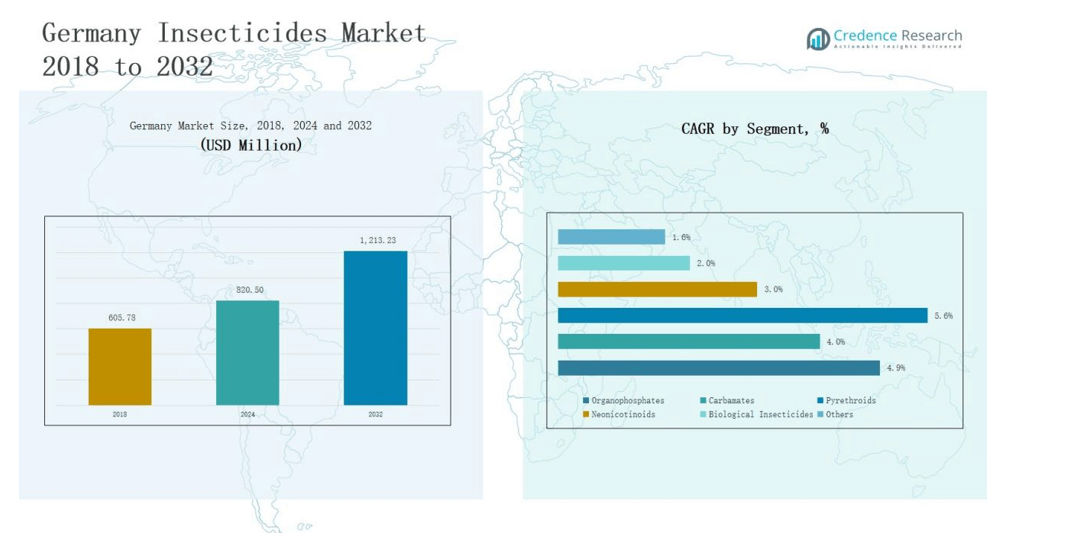

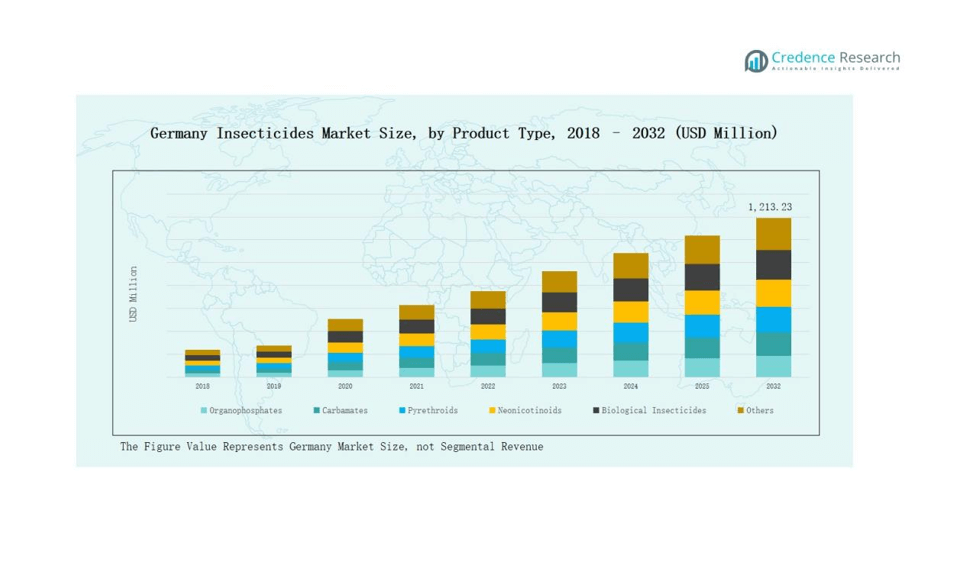

Germany Insecticides Market size was valued at USD 605.78 million in 2018 to USD 820.50 million in 2024 and is anticipated to reach USD 1,213.23 million by 2032, at a CAGR of 4.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Insecticides Market Size 2024 |

USD 820.50 million |

| Germany Insecticides Market, CAGR |

4.91% |

| Germany Insecticides Market Size 2032 |

USD 1,213.23 million |

The Germany Insecticides Market is dominated by leading players such as Bayer AG, BASF SE, Syngenta, Helm AG, ADAMA Agricultural Solutions, FMC Corporation, Nufarm, UPL Limited, Corteva Agriscience, and Cheminova Agro GmbH. These companies maintain their positions through extensive product portfolios, strong research and development investments, and compliance with strict EU regulations. They focus on expanding biological and eco-friendly formulations while supporting integrated pest management practices to meet rising sustainability demands. Among regions, West Germany led the market with 29% share in 2024, driven by intensive horticulture, greenhouse farming, and robust public health initiatives, supported by innovation hubs and strong distribution networks.

Market Insights

- The Germany Insecticides Market grew from USD 605.78 million in 2018 to USD 820.50 million in 2024 and is forecasted to reach USD 1,213.23 million by 2032 at a CAGR of 91%.

- Organophosphates led with 32% share in 2024, followed by pyrethroids at 22%, carbamates at 18%, neonicotinoids at 15%, biological insecticides at 9%, and others at 4%.

- By application, agriculture dominated with 61% share, followed by public health at 14%, forestry at 11%, turf and landscape at 9%, and others at 5%.

- West Germany led with 29% share in 2024, followed by North Germany with 28%, South Germany with 24%, and East Germany with 19%.

- Key players include Bayer AG, BASF SE, Syngenta, Helm AG, ADAMA Agricultural Solutions, FMC Corporation, Nufarm, UPL Limited, Corteva Agriscience, and Cheminova Agro GmbH.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

In the Germany insecticides market, organophosphates led with 32% share in 2024, supported by their broad-spectrum efficacy in cereal and vegetable crops. Pyrethroids followed with 22% share, valued for affordability and fast action across agricultural and non-agricultural settings. Carbamates accounted for 18%, mainly in horticulture and greenhouse farming, though regulatory pressure is limiting growth. Neonicotinoids held 15% share, used for systemic crop protection against sap-feeding insects, but partial EU restrictions are curbing usage. Biological insecticides, with 9% share, are growing fastest, fueled by demand for eco-friendly and residue-free solutions. The remaining 4% came from newer chemistries and niche formulations grouped under “Others.”

- For instance, BASF’s newer insecticides, like Exponus (Broflanilide), are designed with a novel mode of action to combat pests resistant to older chemistries, providing broad-spectrum control for crops.

By Application

By application, agriculture dominated with 61% share in 2024, reflecting Germany’s intensive farming and need for crop protection in grains, fruits, and vegetables. Public health applications ranked second with 14% share, driven by insecticide use in vector control against mosquitoes and ticks. Forestry captured 11%, supported by bark beetle management in conifer plantations, a growing concern under climate change. Turf and landscape management represented 9%, covering parks, sports fields, and ornamental greenery, where safer formulations are preferred. The remaining 5% share came from other uses such as storage protection and household applications, sustained by rising consumer demand for ready-to-use, low-toxicity products.

- For instance, Bayer AG expanded its K-Othrine Partix insecticide for public health programs in Europe, supporting mosquito and tick control initiatives with longer-lasting residual efficacy.

Market Overview

Rising Demand for Crop Protection

Germany’s intensive agriculture sector continues to rely heavily on insecticides to safeguard high-value crops, including cereals, fruits, and vegetables. Farmers face increasing pest pressures due to climate change, which accelerates pest cycles and infestation rates. The need to ensure consistent yields for both domestic consumption and export markets drives demand. Strong adoption of advanced formulations, particularly in greenhouse farming, reinforces market expansion. This reliance on chemical and biological solutions makes crop protection a key growth driver.

- For instance, Syngenta’s Minecto Alpha is a dual-action insecticide used in some European countries on crops like tomatoes, peppers, and lettuce to control pests and manage resistance.

Shift Toward Biological and Eco-Friendly Solutions

Growing regulatory restrictions on chemical residues and EU policies promoting sustainable farming practices are encouraging the adoption of biological insecticides. Consumers increasingly prefer organic and residue-free produce, reinforcing demand for eco-friendly formulations. This shift is supported by government subsidies and farmer training programs aimed at promoting integrated pest management (IPM). As awareness of environmental impact rises, biological products are expanding faster than conventional chemistries, positioning them as a central driver in the German market.

- For instance, Bayer introduced Vynyty Citrus, a biological pheromone- and kairomone-based product in Spain and southern Europe to reduce chemical insecticide use and comply with EU residue reduction goals.

Expansion of Public Health Initiatives

Public health applications are gaining momentum due to rising concerns about vector-borne diseases, including mosquito- and tick-related illnesses. Authorities and municipalities are intensifying vector control programs, leading to greater insecticide use in urban and semi-urban areas. Climate shifts that extend mosquito breeding seasons further increase demand. The focus on protecting public health and maintaining sanitary environments makes this segment a strong contributor to overall market growth, complementing agricultural demand.

Key Trends & Opportunities

Adoption of Integrated Pest Management (IPM)

Integrated pest management is emerging as a critical trend, balancing effective pest control with reduced reliance on chemical insecticides. German farmers are increasingly adopting IPM practices that combine biological control, crop rotation, and targeted chemical use. This approach addresses regulatory compliance while ensuring sustainable farming. It creates opportunities for companies to offer integrated product portfolios that include both conventional and biological solutions, strengthening their market positioning in a compliance-driven landscape.

- For instance, BASF launched Attraxor®, a plant growth regulator designed to enhance turf health as part of broader IPM programs, while expanding its biologicals portfolio to meet EU pesticide reduction goals.

Technological Innovation in Formulations

Advancements in nano-formulations, controlled-release technologies, and seed treatments are creating opportunities for enhanced insecticide performance. These innovations improve pest control efficiency while minimizing environmental impact. Companies investing in R&D are launching products that address resistance challenges and deliver longer-lasting effects. Germany’s strong focus on precision agriculture further supports the adoption of technologically advanced insecticides. This trend provides opportunities for global and regional players to differentiate through innovation and sustainability-driven solutions.

- For instance, Corteva Agriscience expanded its Lumivia™ CPL insecticide seed treatment across key cereal markets, offering improved protection against early-season insect pests with a reduced environmental footprint.

Key Challenges

Stringent Regulatory Environment

The Germany insecticides market operates under strict EU regulations that limit the use of certain active ingredients, including neonicotinoids. Compliance costs for manufacturers are high, and frequent updates to safety standards create uncertainty. These restrictions constrain market growth for conventional insecticides and push companies to accelerate innovation. For smaller players, navigating these regulations presents significant barriers to entry, reducing competitiveness in the long term.

Rising Pest Resistance

Prolonged reliance on chemical insecticides has led to increasing cases of pest resistance, particularly with pyrethroids and organophosphates. Resistance reduces product effectiveness, forcing farmers to apply higher doses or switch to costly alternatives. This challenge raises production costs and undermines sustainable farming practices. The market must invest in resistance-management strategies, including rotation of active ingredients and integration of biological solutions, to mitigate this growing threat.

High Cost of Biological Alternatives

Although biological insecticides are growing rapidly, their higher cost compared to conventional chemicals limits adoption among small and medium-scale farmers. Price sensitivity remains high in the German market, especially for crops with tight profit margins. Without subsidies or stronger government support, many farmers struggle to justify the transition. The price gap between biological and synthetic solutions remains a critical barrier, slowing the pace of sustainable transformation in the insecticides market.

Regional Analysis

North Germany

North Germany held 28% share of the Germany Insecticides Market in 2024. The region’s dominance comes from extensive cereal and rapeseed cultivation requiring consistent pest control. Farmers in Schleswig-Holstein and Lower Saxony rely on both chemical and biological insecticides to secure yields. The rising adoption of eco-friendly formulations reflects regulatory compliance and consumer demand for residue-free food. Public health applications, especially mosquito control near coastal and river areas, add to demand. It maintains a balanced presence of global and regional suppliers, ensuring competitive growth.

South Germany

South Germany accounted for 24% share in 2024, driven by vineyards, fruit orchards, and vegetable farming in Bavaria and Baden-Württemberg. The region favors specialty insecticides tailored for high-value crops, including biological solutions supported by EU sustainability programs. Agricultural cooperatives and strong farmer associations promote integrated pest management practices, expanding eco-friendly usage. Climate-driven pest outbreaks, particularly in vineyards, sustain demand for innovative products. Forestry also plays a significant role, with control measures targeting bark beetles. It remains a focal point for both research trials and advanced formulations.

East Germany

East Germany captured 19% share of the market in 2024. The region emphasizes large-scale grain and maize farming, which drives demand for broad-spectrum insecticides such as organophosphates and pyrethroids. Government-backed projects encourage biological alternatives, but adoption remains gradual due to cost sensitivity. Pest outbreaks in forestry, especially affecting spruce plantations, further support insecticide demand. The concentration of industrial agriculture in Saxony and Brandenburg ensures steady market expansion. It is increasingly attracting investment from major agrochemical companies to strengthen distribution networks.

West Germany

West Germany represented 29% share in 2024, making it the leading regional market. Intensive horticulture, greenhouse farming, and vegetable production drive insecticide demand in North Rhine-Westphalia and Hesse. Public health applications also contribute strongly, with vector control programs targeting ticks and mosquitoes in densely populated urban areas. Biological insecticides are rapidly gaining traction in the region, supported by innovation hubs and partnerships with universities. The region’s diversified farming landscape supports both conventional and eco-friendly solutions. It remains a critical hub for global players with strong distribution and R&D presence.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The Germany Insecticides Market is characterized by the presence of global leaders and strong regional players competing through innovation, regulatory compliance, and distribution strength. Bayer AG, BASF SE, and Syngenta dominate the market with broad product portfolios, advanced R&D capabilities, and established farmer networks. These companies focus on developing sustainable formulations, including biological insecticides, to align with strict EU regulations and consumer demand for eco-friendly solutions. Regional players such as Helm AG and Cheminova Agro GmbH strengthen competition by offering localized products tailored to specific crops and cost-sensitive farmers. Strategic partnerships, product launches, and expansion into digital farming solutions are common competitive strategies. Companies also invest in integrated pest management programs, reinforcing their role in supporting sustainable agriculture. The competitive environment is further shaped by regulatory challenges that drive constant innovation and product reformulation, ensuring the market remains dynamic and highly innovation-driven.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Bayer AG

- BASF SE

- Syngenta

- Helm AG

- ADAMA Agricultural Solutions

- FMC Corporation

- Nufarm

- UPL Limited

- Corteva Agriscience

- Cheminova Agro GmbH

Recent Developments

- In January 2025, BASF SE announced the launch of Ridesco WG Insecticide, a dual-active formulation combining alpha-cypermethrin and dinotefuran for fast-action pest control in integrated management systems.

- In March 2025, Bayer AG introduced Plenexos, a ketoenol insecticide providing flexible application options and effective protection against sucking pests while supporting sustainability in German agriculture.

- In July 2024, Corteva Agriscience Germany GmbH launched ProClova® (florpyrauxifen-benzyl + amidosulfuron WG), a clover-friendly herbicide available in Germany from July. It improves grassland weed control while preserving valuable clover species

- In January 2025, Crystal Crop Protection acquired the herbicide active ingredient Ethoxysulfuron from Bayer AG, underscoring ongoing M&A activity involving German insecticide assets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will continue to expand with stronger regulatory support.

- Integrated pest management adoption will rise as farmers seek sustainable crop protection.

- Precision agriculture technologies will boost demand for targeted insecticide applications.

- Public health programs will expand vector control measures, supporting insecticide consumption.

- Resistance management strategies will gain importance in product development and usage.

- Greenhouse and horticulture farming will drive innovation in specialized insecticide formulations.

- Partnerships between global leaders and regional players will strengthen distribution networks.

- Consumer preference for residue-free produce will accelerate the shift to eco-friendly solutions.

- Forestry insecticide demand will grow with increasing bark beetle infestations from climate change.

- Regulatory-driven reformulation of existing products will create opportunities for advanced chemistries.