Market Overview

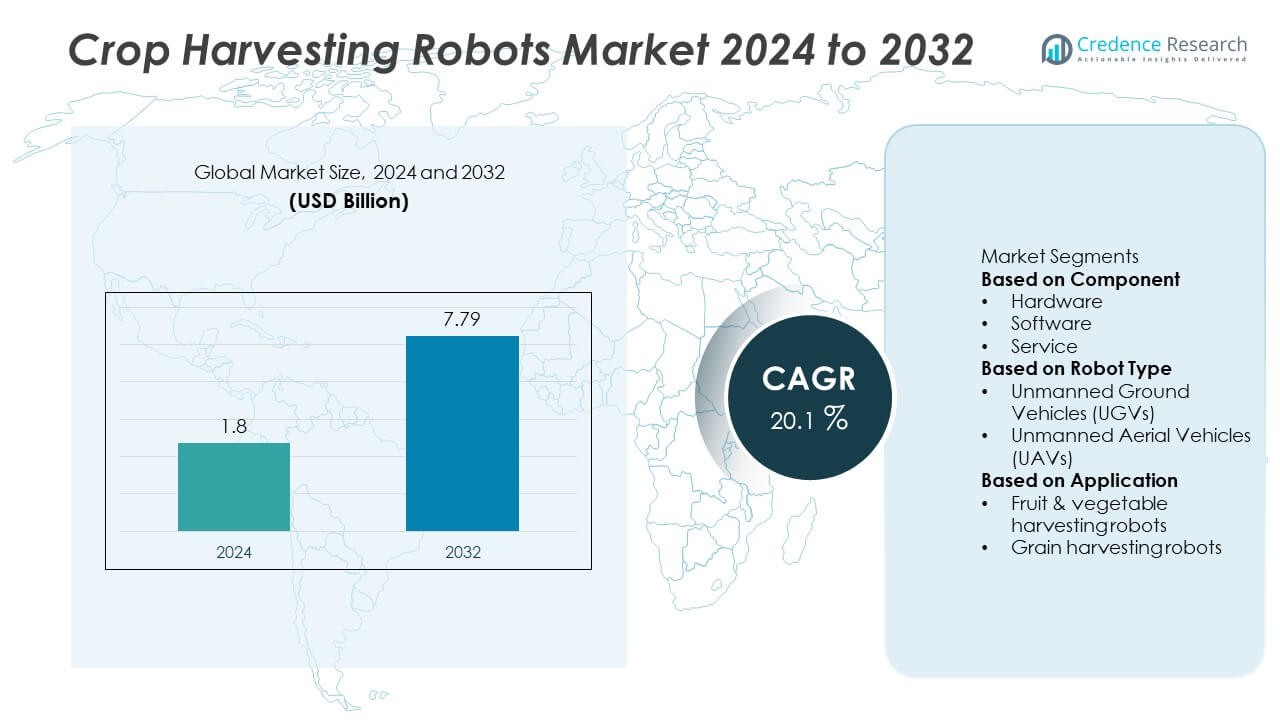

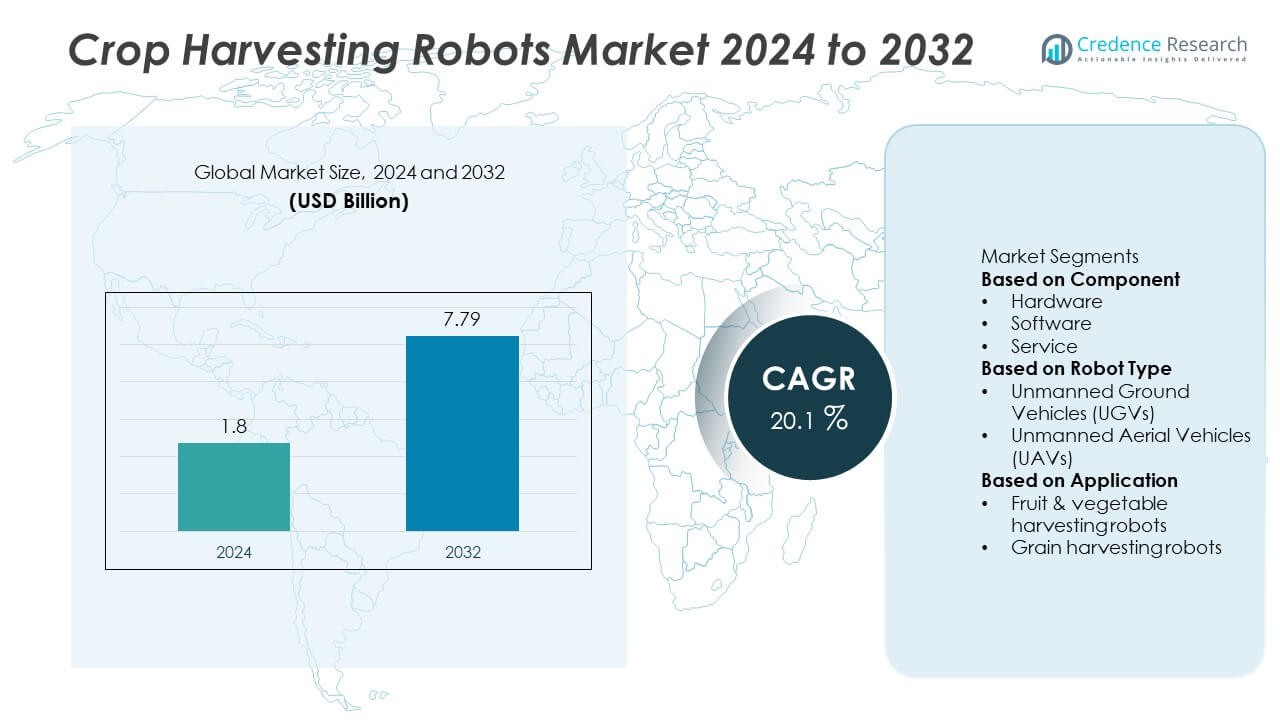

The crop harvesting robots market was valued at USD 1.8 billion in 2024 and is projected to reach USD 7.79 billion by 2032, growing at a CAGR of 20.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crop Harvesting Robots Market Size 2024 |

USD 1.8 Billion |

| Crop Harvesting Robots Market, CAGR |

20.1% |

| Crop Harvesting Robots Market Size 2032 |

USD 7.79 Billion |

The crop harvesting robots market is led by companies including Naio Technologies, Harvest CROO Robotics, Ripe Robotics, AgJunction, Octinion, Saga Robotics, Muddy Machines Ltd., Shibuya Seiki, Energid Technologies, and Agrobot. These players dominate through advanced automation platforms and AI-driven harvesting solutions designed for diverse crops and field conditions. North America emerged as the leading region, capturing 38 percent of the global market in 2024, supported by early adoption of agricultural robotics and strong R&D investments. Europe followed with 29 percent, driven by greenhouse automation and labor efficiency initiatives, while Asia Pacific showed rapid growth fueled by smart farming programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The crop harvesting robots market was valued at USD 1.8 billion in 2024 and is projected to reach USD 7.79 billion by 2032, registering a CAGR of 20.1 percent.

- Growth is driven by rising labor shortages, increasing demand for precision agriculture, and adoption of AI-based automation technologies that improve productivity and reduce manual intervention.

- Key trends include the integration of machine vision, IoT connectivity, and multi-crop robotic systems designed for fruits, vegetables, and grains, enhancing harvesting efficiency across varied environments.

- Leading players such as Naio Technologies, Harvest CROO Robotics, and Saga Robotics are expanding their presence through innovation and strategic partnerships, while high initial costs and limited crop adaptability remain key restraints.

- North America led the market with 38 percent share in 2024, followed by Europe at 29 percent and Asia Pacific at 22 percent; hardware components held 62 percent share, dominating the segment landscape.

Market Segmentation Analysis:

By Component

The hardware segment dominated the crop harvesting robots market in 2024, capturing around 62% of total revenue. This segment’s leadership stems from the high cost and complexity of sensors, robotic arms, and navigation systems integrated into autonomous harvesting units. Precision cameras, LiDAR, and machine vision modules drive efficiency in fruit detection and picking. Continuous advancements in end-effector technology enhance grip precision and speed, reducing crop damage. The growing adoption of durable, weather-resistant robotic components across large farms further strengthens hardware demand in mechanized crop harvesting.

- For instance, Octinion’s Rubion strawberry-picking robot uses a 3D-vision system and a patented soft-touch gripper that allows it to harvest ripe berries with a delicate touch. The robot is designed for tabletop cultivation systems and is capable of harvesting at a speed of about one strawberry every five seconds.

By Robot Type

The unmanned ground vehicles (UGVs) segment accounted for the largest share of about 68% in 2024. UGVs are widely used for fruit and vegetable harvesting due to their ability to navigate uneven terrains and operate continuously in various weather conditions. These robots perform tasks such as plucking, sorting, and transporting crops with high precision. The integration of GPS guidance and computer vision improves efficiency in orchard and greenhouse environments. Increasing investments in autonomous ground robotics for field-level automation continue to reinforce this segment’s dominance.

- For instance, Saga Robotics’ Thorvald robot fleet operated over 150 autonomous UGVs across European and U.S. farms in the 2025 growing season, collectively covering thousands of acres while performing UV crop treatment, data collection, and yield prediction tasks.

By Application

The fruit and vegetable harvesting robots segment led the market in 2024, holding approximately 71% share. These robots are preferred for high-value crops such as strawberries, tomatoes, and apples, where accuracy and timing are critical. The need for gentle handling and labor-intensive picking has accelerated robotic adoption in horticulture. AI-driven recognition systems enable selective harvesting based on ripeness and quality, reducing waste. Expanding greenhouse cultivation and the rising demand for continuous fresh produce supply further support the rapid deployment of fruit and vegetable harvesting robots globally.

Key Growth Drivers

Rising Labor Shortages in Agriculture

Labor scarcity across global farms is fueling the demand for crop harvesting robots. The decline in rural workforces and the rising average age of farmers have increased the need for automation. Robotic systems maintain productivity, improve precision, and reduce dependence on seasonal labor. These machines help large-scale farms manage harvest cycles efficiently, even during peak seasons. Their ability to operate continuously and minimize human fatigue makes them vital in modernizing agricultural operations and ensuring consistent output.

- For instance, Harvest CROO Robotics developed an automated strawberry harvester capable of covering 8 acres per day and handling up to 25 berries per minute. The system uses 16 robotic arms working simultaneously, enabling one robot to replace over 30 human pickers during peak harvest periods.

Advancements in AI and Machine Vision Systems

Artificial intelligence and advanced vision systems are redefining robotic harvesting capabilities. Modern AI models enable precise fruit recognition and selective picking, reducing crop damage and waste. Enhanced imaging tools such as LiDAR and multispectral sensors improve accuracy under different light and weather conditions. These innovations help robots adapt to complex environments while ensuring faster and more reliable performance. As AI algorithms evolve, autonomous harvesters are becoming smarter, safer, and more cost-efficient for real-world farming applications.

- For instance, Ripe Robotics Eve harvester employs a deep-learning vision model trained on fruit images, enabling accurate detection and autonomous picking while aiming to minimize fruit damage.

Government Support for Agri-Automation

Global governments are promoting smart farming initiatives to address food security and sustainability goals. Subsidies, grants, and automation-friendly regulations encourage farmers to adopt robotic harvesting systems. These programs stimulate innovation and support pilot projects that demonstrate efficiency gains in various crop types. Partnerships between agricultural institutes and robotics developers are increasing. Such policy backing enhances research, reduces costs, and accelerates large-scale deployment of crop harvesting robots across developed and emerging economies.

Key Trends & Opportunities

Integration of IoT and Data Analytics

The combination of IoT sensors and data analytics is transforming crop management. Connected robots gather and analyze real-time information on soil, weather, and crop maturity. This integration supports predictive maintenance, optimized harvesting schedules, and yield forecasting. Data-driven insights help farmers make accurate decisions that enhance sustainability and reduce losses. As smart farming infrastructure expands, the use of IoT-based robotic systems will continue to improve efficiency and traceability in agricultural operations.

- For instance, Naïo Technologies uses a guidance system that combines RTK GPS and other sensors on its weeding robots like the Orio and Dino, enabling autonomous field navigation and high-precision weeding.

Expansion of Multi-Crop Harvesting Robots

Manufacturers are designing flexible robots capable of handling multiple crop types. These adaptable machines reduce equipment downtime and operational costs for farms cultivating diverse produce. Interchangeable tools and intelligent gripping systems allow smooth transitions between fruits, grains, and vegetables. This flexibility supports year-round utilization and expands the commercial potential of robotic platforms. The growing emphasis on versatility and modularity in design opens new opportunities for technology providers in precision agriculture.

- For instance, the joint robotics activities of Octinion and Priva were merged under the Kompano brand in 2021 before being rebranded as Octiva in 2022. The initial focus was on crop-specific tasks, such as Priva’s tomato de-leafing robot and Octinion’s strawberry picker, using a patented “soft touch gripper” to handle fruit without damage.

Key Challenges

High Initial Cost and ROI Concerns

The cost of purchasing and maintaining robotic harvesting systems remains a critical challenge. Sophisticated sensors, navigation modules, and AI hardware make these systems expensive for smaller farms. Many producers struggle to achieve profitability without financial support or shared ownership models. Maintenance requirements and technical expertise add to the financial burden. Reducing costs through mass production, leasing programs, and modular designs will be essential for broader market adoption.

Limited Adaptability to Crop Diversity

Crop variability presents operational challenges for robotic harvesters. Differences in shape, size, and ripeness levels require specialized programming and mechanical adjustments. Robots often struggle to perform efficiently across various agricultural conditions such as dense foliage or uneven terrain. Limited flexibility reduces productivity when switching between crop types. Continuous advancements in AI learning, sensor calibration, and end-effector technology are necessary to enhance adaptability and ensure consistent harvesting performance.

Regional Analysis

North America

North America held the largest share of 38 percent in the crop harvesting robots market in 2024. The region’s dominance is driven by advanced farm mechanization, strong research infrastructure, and rapid adoption of precision agriculture technologies. The United States leads with extensive deployment of autonomous harvesters for high-value crops such as strawberries, apples, and tomatoes. Supportive government programs promoting agricultural robotics and partnerships between technology providers and large farms further accelerate regional growth. Canada is also expanding its smart farming initiatives, emphasizing labor efficiency and sustainability in large-scale horticulture and greenhouse operations.

Europe

Europe accounted for 29 percent of the global market in 2024, supported by high agricultural automation levels and strict labor regulations. Countries such as the Netherlands, Spain, and Germany are early adopters of robotic harvesting systems for fruit and vegetable production. The region’s focus on sustainable farming and food security drives investments in intelligent machinery. EU-funded projects and university-led research programs strengthen innovation in autonomous and semi-automated harvesters. Growing greenhouse cultivation and labor shortages in southern Europe further boost the use of advanced robotic systems for continuous crop collection.

Asia Pacific

Asia Pacific captured 22 percent of the market in 2024, fueled by population growth and the rising need for efficient food production. Japan and South Korea lead regional adoption with highly automated horticultural systems and strong robotics manufacturing capabilities. China’s push toward smart agriculture and government support for AI-based farming technologies also contribute to rapid expansion. The region’s diverse climatic conditions and fragmented farm structures encourage localized robotic solutions. Increasing investment from agritech startups and multinational companies is expected to strengthen market penetration across India, Australia, and Southeast Asia.

Latin America

Latin America represented 7 percent of the global market in 2024, driven by expanding agribusiness investments and growing interest in automation to counter labor shortages. Brazil and Mexico are leading adopters of robotic harvesters in fruit, coffee, and sugarcane plantations. Regional governments are promoting mechanization to improve export competitiveness and crop quality. Collaborations with European and U.S. technology firms are enhancing accessibility to precision agriculture tools. As agricultural exports rise, farmers are increasingly integrating robotic systems to enhance productivity, reduce waste, and improve yield consistency across large commercial farms.

Middle East & Africa

The Middle East and Africa held a market share of 4 percent in 2024, showing early-stage adoption of crop harvesting robots. The region’s growth is supported by food security initiatives, desert farming innovations, and the development of controlled-environment agriculture. Countries such as Israel and the United Arab Emirates are leading in adopting AI-powered harvesting systems for greenhouse crops. In Africa, the focus remains on pilot projects introducing affordable automation for smallholder farmers. Increasing awareness of smart farming technologies and partnerships with international robotics firms are expected to drive gradual market expansion.

Market Segmentations:

By Component

- Hardware

- Software

- Service

By Robot Type

- Unmanned Ground Vehicles (UGVs)

- Unmanned Aerial Vehicles (UAVs)

By Application

- Fruit & vegetable harvesting robots

- Grain harvesting robots

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the crop harvesting robots market is characterized by technological innovation, strategic collaborations, and expanding automation in global agriculture. Key players such as Naio Technologies, Harvest CROO Robotics, Ripe Robotics, AgJunction, Octinion, Saga Robotics, Muddy Machines Ltd., Shibuya Seiki, Energid Technologies, and Agrobot are actively shaping market development through advanced product portfolios and regional expansion. These companies focus on integrating artificial intelligence, computer vision, and machine learning for improved accuracy in fruit and vegetable harvesting. Partnerships with agricultural producers and research institutes help accelerate pilot deployments and commercial scaling. Manufacturers emphasize modular design, autonomous navigation, and real-time data analytics to enhance performance in varied crop environments. Continuous investment in R&D supports innovation in end-effector technology and multi-crop adaptability. As competition intensifies, firms are prioritizing cost efficiency, durability, and precision to gain an edge in both developed and emerging agricultural economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Naio Technologies

- Harvest CROO Robotics

- Ripe Robotics

- AgJunction

- Octinion

- Saga Robotics

- Muddy Machines Ltd.

- Shibuya Seiki

- Energid Technologies

- Agrobot

Recent Developments

- In August 2025, Saga Robotics raised funding to triple its robot deployment in US vineyards; more than 150 Thorvald units are active in the 2025 season.

- In April 2025, Harvest CROO Robotics announced its field trials hit human-level harvesting performance, and the new system’s vision processing is now 200× more powerful than earlier versions.

- In May 2023, Ripe Robotics had its prototype robot Eve pick full commercial bins of apples autonomously in an orchard trial.

Report Coverage

The research report offers an in-depth analysis based on Component, Robot Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of autonomous harvesting robots will expand across large and medium-sized farms.

- Integration of AI and deep learning will enhance fruit recognition and picking precision.

- Multi-crop robotic systems will gain traction for flexible and year-round operations.

- Advancements in end-effector design will improve handling of delicate produce.

- Cloud-based data analytics will support predictive maintenance and yield optimization.

- Collaboration between agritech startups and traditional equipment manufacturers will intensify.

- Government initiatives will promote smart farming and sustainable automation practices.

- Compact and affordable models will increase accessibility for small-scale farmers.

- Use of renewable energy and battery-efficient systems will strengthen eco-friendly operations.

- Global R&D investments will accelerate innovation in navigation, sensing, and harvesting efficiency.