Market Overview:

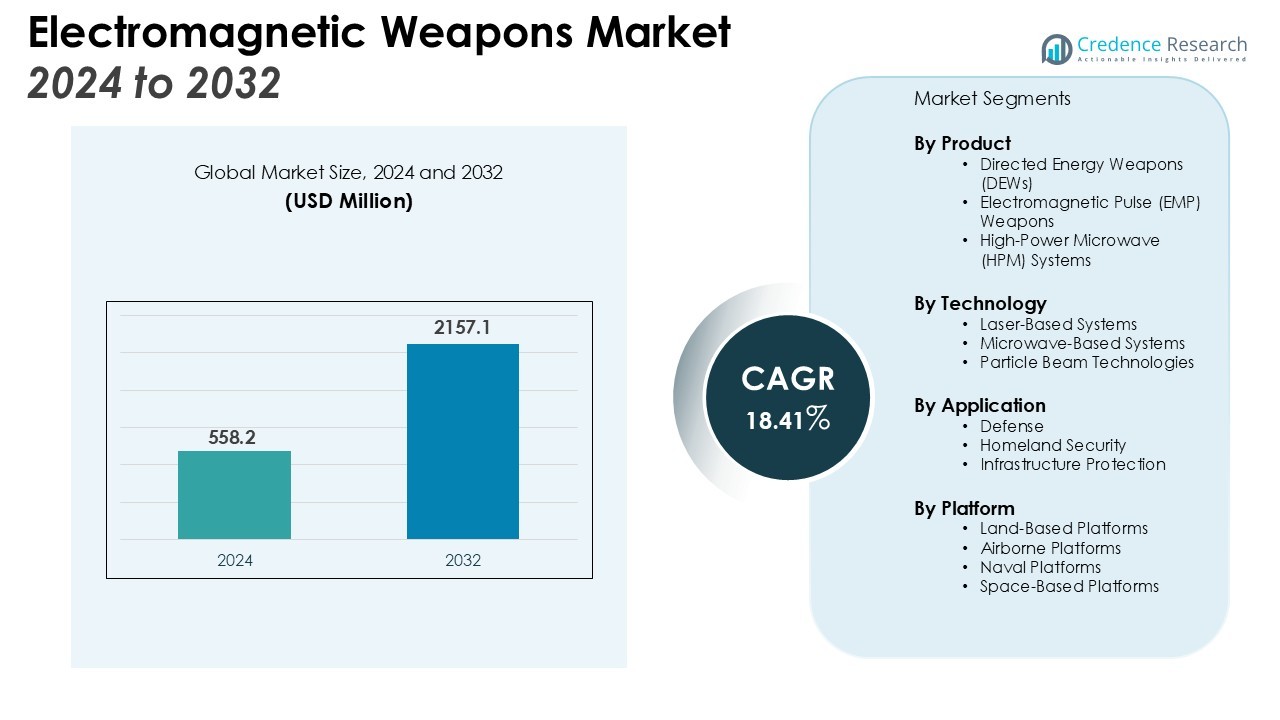

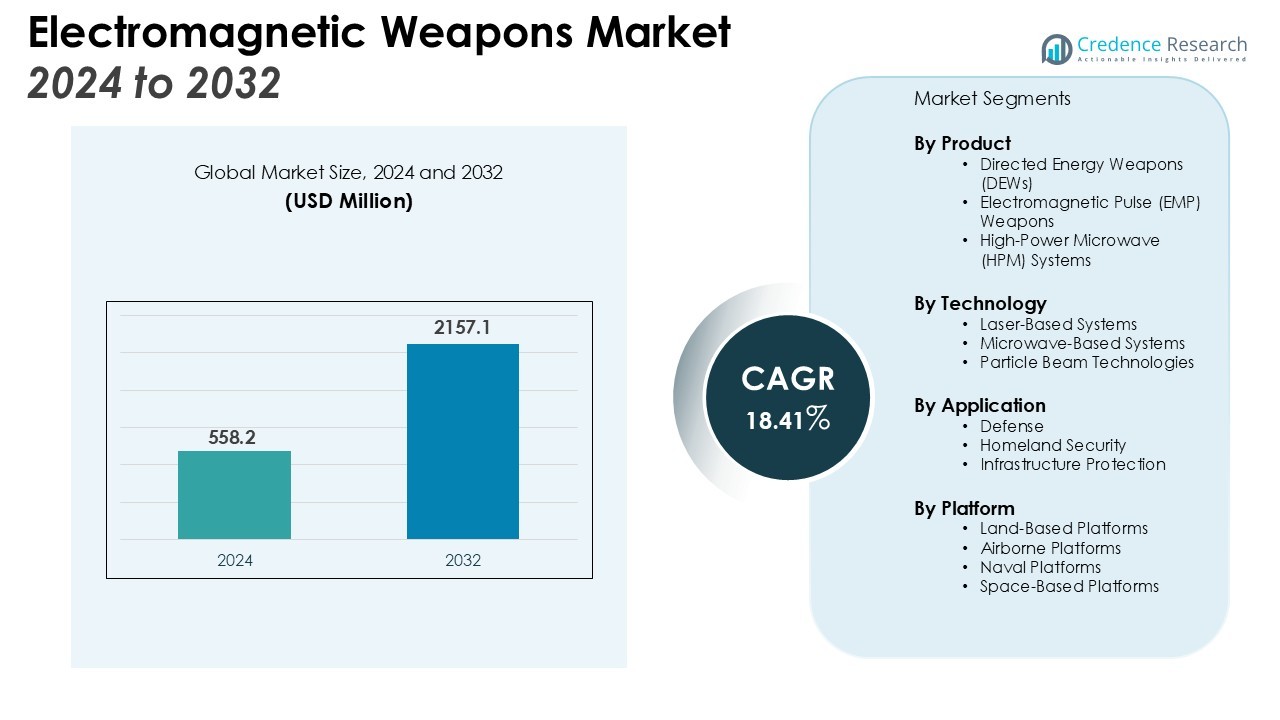

The Electromagnetic Weapons Market size was valued at USD 558.2 million in 2024 and is anticipated to reach USD 2157.1 million by 2032, at a CAGR of 18.41% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electromagnetic Weapons Market Size 2024 |

USD 558.2 Million |

| Electromagnetic Weapons Market, CAGR |

18.41% |

| Electromagnetic Weapons Market Size 2032 |

USD 2157.1 Million |

Key drivers of market growth include technological advancements in electromagnetic pulse (EMP) technology, the rising adoption of directed energy weapons, and the growing focus on enhancing defense capabilities. The increasing need for cost-effective, non-lethal weapon systems, especially in urban warfare scenarios, has led to the development of more efficient electromagnetic weapons. Additionally, governments worldwide are investing in electromagnetic weaponry to counter emerging threats and safeguard critical infrastructures from cyberattacks and EMP-related disruptions. The growing threat of electromagnetic attacks on critical infrastructure further accelerates the demand for these advanced defense systems.

Regionally, North America holds the largest market share, primarily due to strong defense spending and the presence of leading market players such as Lockheed Martin and Raytheon Technologies. Europe follows closely, with countries like the U.K. and Russia advancing their electromagnetic weapon programs. The Asia-Pacific region is expected to witness the highest growth during the forecast period, driven by military modernization efforts in China, India, and Japan, coupled with regional geopolitical tensions. Additionally, increasing defense budgets and growing concerns over security in the region are likely to boost the adoption of electromagnetic weapon systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electromagnetic Weapons Market is valued at USD 558.2 million in 2024 and is projected to reach USD 2157.1 million by 2032, growing at a CAGR of 18.41%.

- Technological advancements in EMP technology enhance the effectiveness of electromagnetic weapons, driving growth in military capabilities.

- The increasing adoption of directed energy weapons (DEWs) provides a strategic advantage by neutralizing enemy technology and drones.

- Growing cybersecurity concerns and electromagnetic threats to critical infrastructure accelerate the demand for electromagnetic weapons.

- Government investments in military modernization programs are driving the development and deployment of electromagnetic weapons globally.

- High development and maintenance costs challenge widespread adoption, requiring significant investment in research, development, and training.

- North America holds 40% of the market share, with strong defense spending, while Asia-Pacific’s rapid growth is driven by military modernization efforts.

Market Drivers:

Technological Advancements in Electromagnetic Pulse (EMP) Technology

The continuous evolution of electromagnetic pulse (EMP) technology significantly drives the growth of the Electromagnetic Weapons Market. Breakthroughs in EMP weaponry have enhanced its effectiveness, making it a critical tool for both offensive and defensive strategies. Military agencies are prioritizing EMP technology for its ability to disable electronic systems without causing physical harm to personnel or infrastructure. The growing need for precise and controlled non-lethal weapons further pushes the development of EMP-based systems in defense applications.

- For Instance, In 2012, Boeing successfully tested its CHAMP (Counter-electronics High-powered Microwave Advanced Missile Project) missile, which achieved non-destructive immobilization of seven mock targets in the Utah desert.

Increased Adoption of Directed Energy Weapons

Directed energy weapons (DEWs) are increasingly adopted across military forces, contributing to the market’s expansion. These weapons use focused energy, such as electromagnetic waves, to damage or destroy targets. DEWs offer a strategic advantage in various combat scenarios, offering precise control over attacks. Their potential to neutralize enemy technology, disable drones, and counter cyberattacks makes them essential in modern warfare, driving demand within the Electromagnetic Weapons Market.

- For Instance, In August 2022, Lockheed Martin delivered a 300-kilowatt high-energy laser system to the U.S. Army for integration on a military vehicle for field testing. At the time, it was the most powerful solid-state laser the company had delivered to the Department of Defense.

Emerging Threats and Cybersecurity Concerns

Growing concerns about electromagnetic attacks on critical infrastructure fuel the demand for electromagnetic weapons. The increasing frequency of cyberattacks targeting power grids, communication networks, and military assets highlights vulnerabilities that these weapons can address. With cyber threats becoming more sophisticated, governments are investing heavily in electromagnetic weaponry to protect against such attacks, reinforcing the need for advanced defense systems. This drive for enhanced cybersecurity capabilities continues to support the market’s growth.

Government Investments and Military Modernization

Governments worldwide are investing in cutting-edge electromagnetic weapons to strengthen national defense. Military modernization programs focus on adopting new technologies to maintain strategic advantages, particularly in countering unconventional threats. This focus on defense innovation encourages the development and deployment of electromagnetic weapons, with countries like the United States and China leading the charge. The increased defense budgets in many nations further propel market demand, especially as geopolitical tensions continue to rise globally.

Market Trends:

Growing Integration of Electromagnetic Weapons with Advanced Defense Systems

A significant trend in the Electromagnetic Weapons Market is the growing integration of these weapons with advanced defense systems, particularly within military and naval forces. Electromagnetic weapons are being combined with existing technologies, such as radar systems and drones, to create multi-layered defense mechanisms capable of targeting both physical and electronic threats. This integration enables a higher level of operational efficiency and adaptability in complex combat environments. By complementing traditional weapons with electromagnetic capabilities, militaries can enhance their deterrence and protection strategies. As defense forces adopt more advanced technologies, the use of electromagnetic weapons is becoming central to achieving superior tactical advantages in modern warfare scenarios.

- For Instance, U.S. Navy test, likely involving a BAE Systems launcher, fired a projectile at a muzzle velocity of 2,520 m/s (8,268 ft/s) using a 10.64 MJ energy pulse. BAE Systems delivered a more powerful 32 MJ prototype demonstrator to the Naval Surface Warfare Center in Dahlgren, Virginia, in January 2012.

Development of Compact and Mobile Electromagnetic Weapons

The demand for compact and mobile electromagnetic weapons is rising in response to the need for more flexible and deployable defense solutions. Smaller, more portable systems are gaining traction, particularly for use in tactical military operations and on-the-go defense applications. These compact systems provide an advantage in scenarios where space and weight limitations exist, such as on vehicles or naval vessels. The shift toward mobility is also seen in the increasing development of electromagnetic weapons that can be quickly deployed and operated by smaller units in conflict zones. This trend reflects a broader move towards more agile, responsive, and versatile defense technologies that can be easily adapted to meet the needs of modern security challenges.

- For instance, Lockheed Martin’s HELIOS system delivered 60 kW output in a field test.

Market Challenges Analysis:

High Development and Maintenance Costs

One of the key challenges facing the Electromagnetic Weapons Market is the high cost of developing and maintaining these advanced systems. The complex technology behind electromagnetic weapons requires significant investment in research, development, and testing. Manufacturing these weapons involves specialized components and materials that can drive up costs, making them expensive to deploy on a large scale. Many defense organizations face budget constraints, limiting their ability to invest in these cutting-edge systems. Continuous maintenance, technical upgrades, and operational training further add to the financial burden, making it a major challenge for widespread adoption across all defense sectors.

Regulatory and Ethical Concerns

The deployment of electromagnetic weapons also faces significant regulatory and ethical challenges. Various international treaties and regulations limit the use of certain types of electromagnetic technology, especially concerning non-lethal and non-traditional weaponry. Governments and defense organizations must navigate these legal frameworks while ensuring compliance with global standards. Ethical concerns over the potential misuse of electromagnetic weapons, especially in civilian areas or conflict zones, add another layer of complexity. As such, ensuring these weapons are used appropriately and responsibly remains a critical challenge for the market.

Market Opportunities:

Expansion of Civilian and Critical Infrastructure Protection Applications

The Electromagnetic Weapons Market holds significant opportunities in the protection of civilian infrastructure and critical assets. As global reliance on electronic systems grows, the vulnerability to cyberattacks and electromagnetic disruptions increases. Electromagnetic weapons offer an effective solution to safeguard power grids, communication networks, and other vital sectors from electromagnetic interference or attacks. Governments and private organizations are investing in these technologies to ensure the resilience of critical infrastructure against potential threats. This growing focus on cybersecurity and infrastructure protection creates new avenues for the market to expand.

Adoption of Non-Lethal Technologies in Modern Military Operations

Non-lethal technologies, including electromagnetic weapons, present a unique opportunity for the Electromagnetic Weapons Market. These systems allow military forces to incapacitate targets without causing permanent harm, making them highly suitable for conflict scenarios where minimizing casualties is crucial. The increasing demand for non-lethal force in urban warfare and peacekeeping missions drives market growth. Electromagnetic weapons, with their ability to disable electronic systems, provide a strategic advantage in such operations. Their ability to neutralize drones, communication systems, and other critical technologies further enhances their appeal within modern military strategies.

Market Segmentation Analysis:

By Product

The Electromagnetic Weapons Market is segmented by product into directed energy weapons (DEWs), electromagnetic pulse (EMP) weapons, and high-power microwave (HPM) systems. Directed energy weapons are gaining significant traction due to their precision and non-lethal capabilities. EMP weapons are crucial for disabling enemy electronics, while HPM systems are increasingly used for their ability to damage or disrupt electronic equipment. These products are essential for modern military operations, providing a strategic advantage in combat scenarios.

- For instance, Lockheed Martin’s Advanced Test High Energy Asset (ATHENA) laser weapon system successfully disabled the engine of a truck at a distance of more than 1 mile during tests in 2023, demonstrating precise targeting capabilities.

By Technology

The market is divided by technology into laser-based, microwave-based, and particle beam technologies. Laser-based systems are widely adopted for their high precision and minimal collateral damage. Microwave-based technologies, particularly HPM systems, are advancing rapidly for their ability to disable enemy electronics. Particle beam systems are still in early stages but are expected to play a significant role in future defense strategies due to their potential to deliver powerful and focused energy.

- For instance, Lockheed Martin’s Advanced Test High Energy Asset (ATHENA) deployed a 30 kW fiber-laser beam to burn through the engine manifold of a moving truck at 1.5 km distance in under 5 seconds.

By Application

The Electromagnetic Weapons Market is applied in defense, homeland security, and infrastructure protection. In defense, these weapons are used for countering electronic warfare, disabling drones, and protecting critical military assets. Homeland security applications focus on protecting communication networks and transportation systems from electromagnetic attacks. Infrastructure protection involves safeguarding power grids, satellites, and other vital systems from EMP-related disruptions. The increasing importance of cybersecurity and defense capabilities in these areas continues to drive the market’s growth.

Segmentations:

- By Product:

- Directed Energy Weapons (DEWs)

- Electromagnetic Pulse (EMP) Weapons

- High-Power Microwave (HPM) Systems

- By Technology:

- Laser-Based Systems

- Microwave-Based Systems

- Particle Beam Technologies

- By Application:

- Defense

- Homeland Security

- Infrastructure Protection

- By Platform:

- Land-Based Platforms

- Airborne Platforms

- Naval Platforms

- Space-Based Platforms

- By Region:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

Regional Analysis:

North America

North America holds the largest share of the Electromagnetic Weapons Market, capturing 40% of global demand. The region benefits from robust defense spending and advanced technological infrastructure, with the U.S. leading in the development and integration of electromagnetic weapon systems. The U.S. Department of Defense is prioritizing high-energy lasers and high-power microwave technologies to enhance its defense capabilities. This focus on technological innovation and modernization is expected to continue driving the market’s growth in the region.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, contributing 30% of the global Electromagnetic Weapons Market. The increasing defense budgets and strategic focus on modernizing military capabilities are key drivers in countries like China, India, Japan, and South Korea. China’s advancements in railgun technology and India’s successful testing of electromagnetic railguns highlight the region’s commitment to strengthening defense capabilities. The growing security concerns and regional geopolitical tensions further enhance the demand for electromagnetic weapons in Asia-Pacific.

Europe

Europe holds a significant portion of the Electromagnetic Weapons Market, accounting for 20% of the total market share. Nations like the UK, France, and Germany are actively investing in electromagnetic weaponry to enhance their military capabilities. The region’s increasing defense budgets, along with the growing need to protect critical infrastructure from electronic attacks, are key factors driving market expansion. Europe’s defense initiatives aim to integrate electromagnetic weapons into existing systems to maintain strategic advantages in an evolving security landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Honeywell

- BAE Systems

- Boeing

- QinetiQ

- Rheinmetall

- Elbit Systems

- General Atomics

- L3Harris Technologies

- Northrop Grumman

- Raytheon Technologies

- Lockheed Martin

- Rafael Advanced Defense Systems

Competitive Analysis:

The Electromagnetic Weapons Market is competitive, with key players such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman leading in the development of high-power microwave systems and directed energy weapons. These companies focus on technological advancements and substantial investments in research and development to enhance product capabilities. Smaller firms like BAE Systems and Boeing also play a role by offering specialized electromagnetic weapon systems, often through government collaborations. Geopolitical tensions and increased defense spending worldwide intensify competition, driving companies to innovate and expand their product offerings. The growing demand for advanced defense solutions further strengthens the market’s competitive landscape, encouraging both established players and new entrants to innovate and enhance their portfolios.

Recent Developments:

- In August 2025, BAE Systems announced it had delivered its 1,000th infrared seeker to Lockheed Martin for integration into the Terminal High Altitude Area Defense (THAAD) weapon system.

- In May 2025, Boeing and Qatar Airways announced a historic order for up to 210 widebody aircraft, which stands as the largest widebody order for Boeing and the largest-ever order for the airline.

- In April 2025, Boeing entered into an agreement to sell parts of its Digital Aviation Solutions business, including Jeppesen and ForeFlight, to the software investment firm Thoma Bravo for a sum of $10.55 billion.

Report Coverage:

The research report offers an in-depth analysis based on product, Technology, Application, Platform and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for non-lethal, cost-effective defense solutions will continue to drive the growth of electromagnetic weapons.

- Increasing global military modernization efforts will propel the development of advanced directed energy weapons and EMP systems.

- The adoption of electromagnetic weapons for infrastructure protection will expand as concerns over cybersecurity and electromagnetic attacks grow.

- Geopolitical tensions, especially in Asia-Pacific, will result in heightened investments in electromagnetic weapon systems.

- Governments will focus on enhancing homeland security by incorporating electromagnetic technologies into defense and civilian protection strategies.

- Innovations in high-power microwave (HPM) and laser-based systems will lead to improved weapon efficiency and reduced operational costs.

- The growing need to counter emerging threats such as drones and electronic warfare will stimulate market growth.

- Integration of electromagnetic weaponry into space and naval platforms will open new applications and boost defense capabilities.

- Strategic defense partnerships between countries will enhance the research and development of next-generation electromagnetic weapons.

- Ethical and regulatory concerns around the use of electromagnetic weapons will lead to more stringent international agreements and compliance standards.