Market Overview:

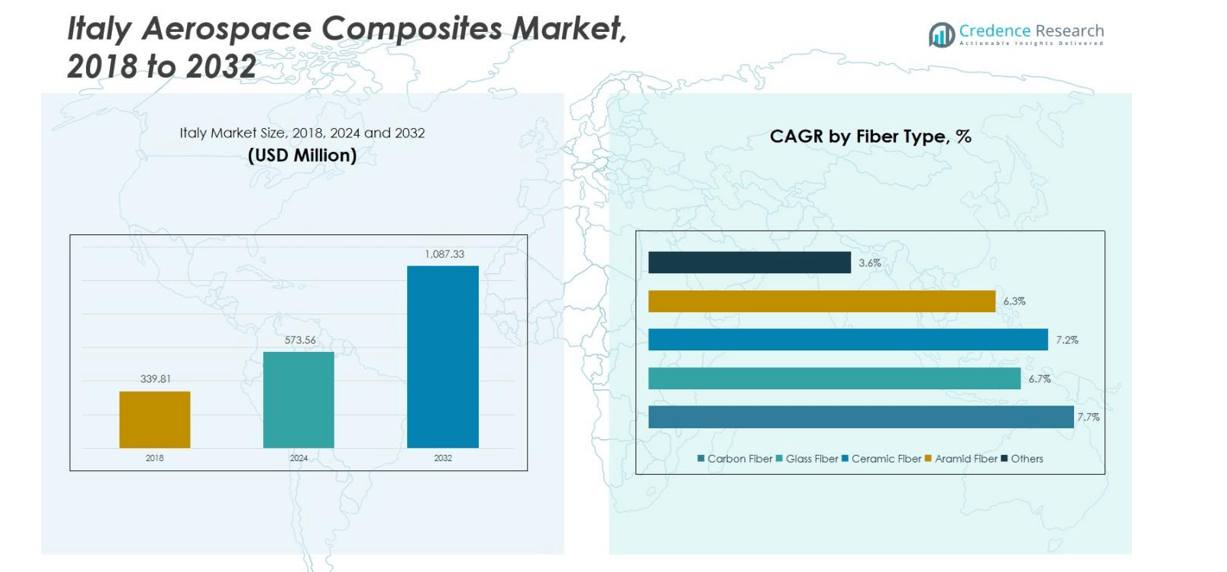

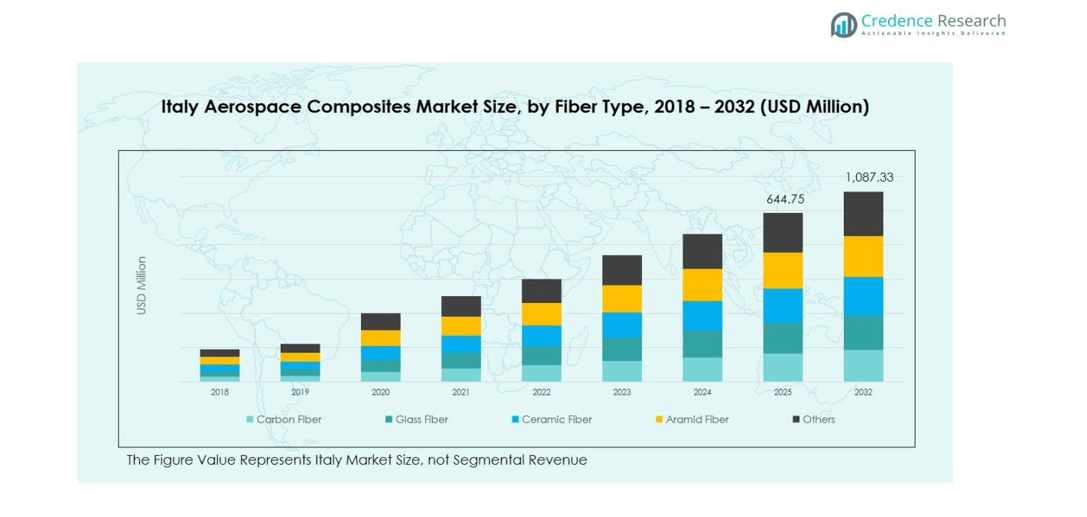

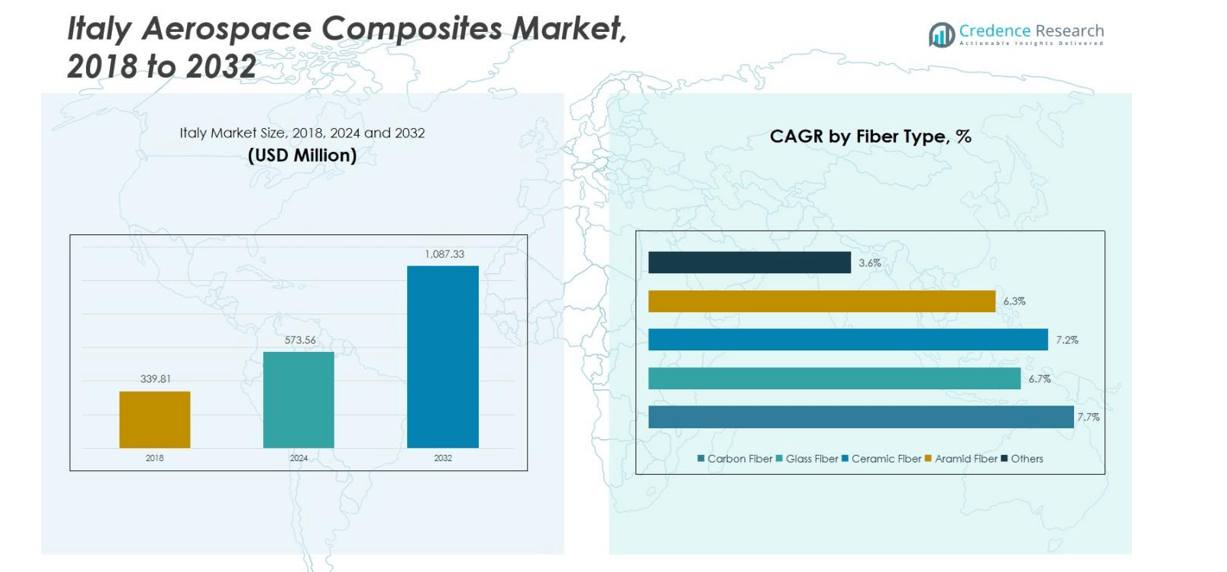

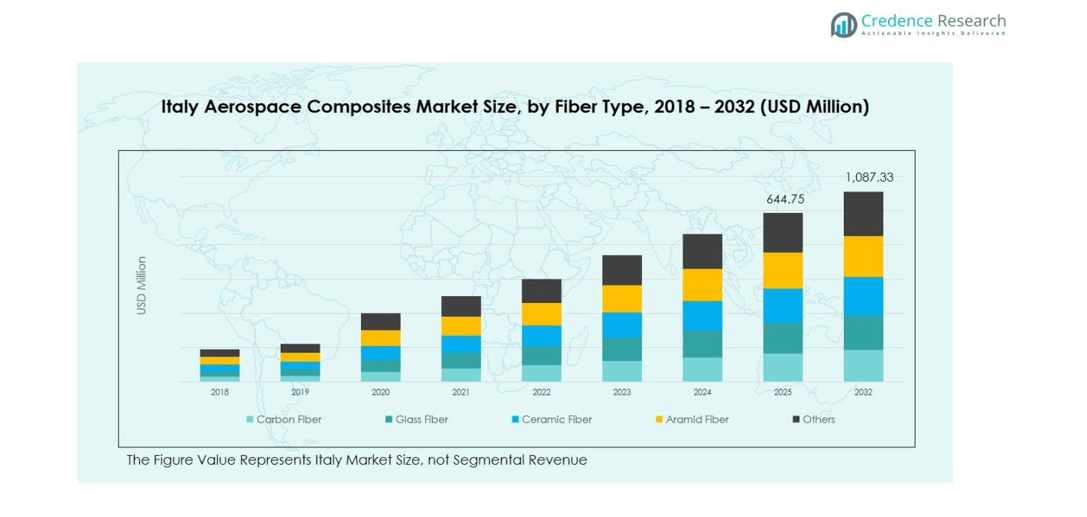

Italy Aerospace Composites Market size was valued at USD 339.81 million in 2018, reaching USD 573.56 million in 2024, and is anticipated to grow to USD 1,087.33 million by 2032, at a CAGR of 7.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Aerospace Composites Market Size 2024 |

USD 573.56 million |

| Italy Aerospace Composites Market, CAGR |

7.75% |

| Italy Aerospace Composites Market Size 2032 |

USD 1,087.33 million |

The Italy Aerospace Composites Market is highly competitive, led by key players including Aerovac LLC, Gurit Holding AG, Hexcel Corporation, Solvay SA, Arkema S.A., Huntsman Corporation, SGL Carbon SE, Owens Corning, Jowat SE, and Advanced Composites Group. These companies focus on technological innovation, high-performance carbon fiber and thermoset composites, and strategic collaborations to strengthen their market presence. Northern Italy emerges as the leading region, accounting for 45% of the market, supported by advanced manufacturing facilities, established supply chains, and a skilled workforce. The region’s strong commercial and defense aerospace activity drives demand for lightweight, durable composites, allowing top players to capitalize on growth opportunities and maintain a dominant position in Italy’s aerospace composites market.

Market Insights

- The Italy Aerospace Composites Market was valued at USD 573.56 million in 2024 and is projected to reach USD 1,087.33 million by 2032, growing at a CAGR of 7.75%.

- Growth is driven by rising demand for lightweight and fuel-efficient aircraft, technological advancements in carbon fiber and thermoset composites, and expansion of commercial and defense aircraft programs across Italy.

- Key trends include increased adoption of thermoplastic composites for secondary structures and interiors, and the integration of advanced manufacturing techniques such as automated fiber placement and 3D printing to improve efficiency and component precision.

- The market is highly competitive with top players including Aerovac LLC, Gurit Holding AG, Hexcel Corporation, Solvay SA, Arkema S.A., and Huntsman Corporation, focusing on product innovation, strategic partnerships, and regional expansion.

- Northern Italy dominates with a 45% market share, followed by Central Italy at 30%, Southern Italy at 15%, and Insular Italy at 10%, while carbon fiber leads the fiber type segment with 52% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type

Carbon fiber dominates the Italy Aerospace Composites Market, accounting for 52% of the total market share. Its high strength-to-weight ratio, excellent fatigue resistance, and corrosion resistance make it the preferred choice for critical aerospace components. Glass fiber follows with a significant share of 25%, used primarily in non-structural applications due to its cost-effectiveness. Ceramic and aramid fibers contribute 12% and 8%, respectively, while other fibers account for 3%. Growing demand for lightweight and fuel-efficient aircraft is driving increased adoption of carbon fiber in aerostructures and engine components.

- For instance, Fibra Italia specializes in producing carbon fiber fuselage components such as covers, skins, and fairings for ultralight and transport aircraft, using advanced prepreg and autoclave technologies certified to UNI EN ISO 9100 standards.

By Aircraft Type

Commercial aircraft lead the Italy Aerospace Composites Market, capturing around 60% of the market share, driven by rising air travel and fleet modernization programs. Military aircraft hold 25%, supported by defense upgrades and enhanced performance requirements. Helicopters account for 10%, benefiting from lightweight composites for rotor blades and fuselage panels. The remaining 5% comprises other aircraft types, including drones and regional jets. Increasing focus on fuel efficiency, payload optimization, and reduced maintenance costs continues to boost the adoption of composites in commercial and defense aviation sectors.

- For instance, Leonardo, a major Italian company, supplies 14% of the composite components for Boeing’s 787 Dreamliner commercial aircraft, showcasing extensive use of carbon fiber reinforced composites in critical parts like fuselage and wings.

By Resin Type

Thermoset composites dominate with a 70% share of the Italy Aerospace Composites Market due to their excellent dimensional stability, high-temperature resistance, and superior mechanical performance in critical aerospace applications. Thermoplastic composites account for 30%, gaining traction due to recyclability, faster manufacturing cycles, and design flexibility. The preference for thermoset resins in aerostructures and propulsion components is driven by stringent safety standards and the need for long-term durability. Meanwhile, the adoption of thermoplastics is accelerating in secondary and interior components where lightweight and process efficiency are prioritized.

Key Growth Drivers

Rising Demand for Lightweight Aircraft

The growing need for fuel-efficient and environmentally friendly aircraft is driving the adoption of aerospace composites in Italy. Lightweight materials such as carbon fiber and thermoset composites reduce overall aircraft weight, improving fuel economy and lowering emissions. Airlines and manufacturers are increasingly integrating composites in aerostructures, propulsion components, and interiors to enhance operational efficiency. Government regulations promoting sustainable aviation and rising oil prices further encourage manufacturers to adopt high-performance composites, fueling growth in both commercial and military aerospace sectors.

- For instance, Leonardo’s Aerostructures Division is advancing the recovery and reuse of carbon fiber composites in aerostructures, promoting sustainability and cost efficiency in aircraft manufacturing.

Technological Advancements in Composite Materials

Continuous innovation in composite materials and manufacturing processes is fueling market growth. Advanced carbon fibers, hybrid composites, and improved resin systems offer superior strength, durability, and resistance to extreme temperatures. Automated manufacturing techniques such as resin transfer molding and additive manufacturing reduce production costs and improve efficiency. These technological improvements enable aerospace manufacturers in Italy to develop complex components with higher performance standards, driving the integration of composites across new aircraft programs and expanding the market for high-value applications.

- For instance, the CARBOWAVE project led by the University of Limerick introduced a new plasma and microwave heating method that reduces energy consumption in carbon fiber production by up to 70%, making the material greener and more cost-effective.

Expansion of Commercial and Defense Aircraft Programs

The expansion of commercial aircraft fleets and modernization of military aviation programs are significant growth drivers. Italy’s aerospace sector is witnessing investments in next-generation commercial airliners, regional jets, and military fighter and transport aircraft, which heavily rely on composite materials. Rising passenger traffic and strategic defense requirements create demand for lightweight, high-strength materials. Manufacturers are adopting composites to meet performance, safety, and durability standards, leading to increased production volumes and market growth, especially in carbon fiber-dominant applications.

Key Trends & Opportunities

Integration of Thermoplastic Composites

Thermoplastic composites are gaining traction in the Italian aerospace sector due to their recyclability, faster production cycles, and design flexibility. These materials offer opportunities in secondary structures, interior components, and non-critical applications. Manufacturers are exploring hybrid solutions combining thermoset and thermoplastic properties to enhance performance while reducing lifecycle costs. The growing focus on sustainable materials and efficiency-driven production processes presents an opportunity for companies to innovate and expand their market share in thermoplastic composites, complementing the dominant thermoset segment.

- For instance, Leonardo Helicopters in Italy uses carbon/PPS thermoplastic composites on the AW169 helicopter’s horizontal tail, improving toughness and enabling ultra-thin structural designs.

Increasing Use of Advanced Manufacturing Techniques

Adoption of advanced manufacturing techniques such as automated fiber placement, 3D printing, and resin transfer molding is a key market trend. These technologies enable precise, lightweight, and high-strength composite components, reducing waste and production time. Italian aerospace manufacturers are leveraging these methods to enhance performance and meet stringent regulatory standards. The integration of Industry 4.0 practices and digital twins provides opportunities for process optimization, cost reduction, and scalability, encouraging broader adoption of composites across aerostructures, engine components, and complex aircraft parts.

- For instance, Airbus uses automated fiber placement (AFP) to manufacture fuselage skins and wing components for the A350, achieving high structural integrity and weight reduction through precise layering of carbon fiber composites.

Key Challenges

High Production and Raw Material Costs

The high cost of carbon fibers, specialty resins, and advanced manufacturing equipment presents a major challenge. Small and medium-sized enterprises in Italy face barriers in adopting high-value composites due to capital-intensive processes. Price volatility in raw materials can impact project budgets, limiting large-scale adoption. Despite long-term efficiency gains, the initial investment and production expenses remain significant hurdles, particularly for defense and regional aircraft manufacturers seeking cost-effective solutions without compromising performance or safety standards.

Complex Manufacturing and Regulatory Compliance

The aerospace composites market in Italy faces challenges related to complex manufacturing processes and stringent certification requirements. Producing high-performance components requires specialized expertise, quality control, and precise process management. Regulatory compliance with European Aviation Safety Agency (EASA) standards and testing protocols adds time and cost to development cycles. These complexities limit the speed of adoption for new materials and technologies, making it challenging for smaller players to compete and for manufacturers to scale operations while maintaining safety and reliability standards.

Regional Analysis

Northern Italy

Northern Italy dominates the aerospace composites market with a market share of 45%, driven by the concentration of major aerospace manufacturers and advanced production facilities. Regions such as Lombardy, Piedmont, and Veneto host key aerostructure and engine component manufacturers, fostering innovation in carbon fiber and thermoset composites. The presence of established supply chains, skilled labor, and research institutions supports the development of high-performance composites. Strong demand for commercial aircraft, combined with investments in defense programs, further boosts growth in this region, making Northern Italy the primary contributor to the country’s aerospace composites market.

Central Italy

Central Italy holds a market share of 30% in the aerospace composites sector, supported by clusters in Tuscany and Lazio focusing on aerospace component production and R&D activities. The region benefits from a skilled workforce, proximity to universities, and collaboration between manufacturers and research centers for advanced fiber and resin technologies. Central Italy primarily serves mid-sized commercial aircraft projects and specialized military aircraft components. Investment in lightweight thermoset composites and innovative manufacturing techniques drives growth, enabling local manufacturers to compete in high-performance aerospace applications while contributing significantly to Italy’s overall aerospace composites market.

Southern Italy

Southern Italy accounts for 15% of the country’s aerospace composites market, with growth driven by emerging aerospace clusters in Campania and Apulia. While less industrialized than Northern and Central Italy, the region is witnessing rising investment in aerospace infrastructure, composites manufacturing, and maintenance, repair, and overhaul (MRO) facilities. Focus on lower-cost production, training programs, and government incentives encourages adoption of carbon fiber and thermoplastic composites. Southern Italy’s market primarily serves regional commercial aircraft, helicopters, and defense projects, providing opportunities for smaller manufacturers to establish a foothold while gradually increasing their contribution to the national aerospace composites market.

Insular Italy (Sicily & Sardinia)

Insular Italy contributes 10% to the aerospace composites market, driven by niche applications and maintenance facilities supporting helicopters, regional aircraft, and specialized defense projects. Limited industrial infrastructure restricts large-scale manufacturing, but targeted investments in composites and partnerships with mainland manufacturers enhance capabilities. The region focuses on advanced thermoset and thermoplastic components for lightweight structures, interiors, and aerostructures. Proximity to Mediterranean shipping routes facilitates supply chain efficiency. Increasing demand for lightweight, durable materials and government-backed aerospace initiatives provides growth opportunities, positioning Insular Italy as a strategic, though smaller, contributor to the overall aerospace composites market in the country.

Market Segmentations:

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Insular Italy

Competitive Landscape

The competitive landscape of the Italy Aerospace Composites Market features key players including Aerovac LLC, Gurit Holding AG, Hexcel Corporation, Solvay SA, Arkema S.A., Huntsman Corporation, SGL Carbon SE, Owens Corning, Jowat SE, and Advanced Composites Group. Market competition is primarily driven by technological innovation, product differentiation, and strategic collaborations. Companies are focusing on developing high-performance carbon fiber, thermoset, and thermoplastic composites to meet the growing demand for lightweight, fuel-efficient aircraft. Investments in advanced manufacturing processes such as automated fiber placement, additive manufacturing, and resin transfer molding enhance production efficiency and quality. Additionally, strategic partnerships, mergers, and acquisitions enable players to expand their portfolios and strengthen regional presence. The competitive intensity compels continuous R&D efforts, enabling companies to deliver innovative solutions while capturing significant market share in Italy’s aerospace composites sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aerovac LLC

- Gurit Holding AG

- Hexcel Corporation

- Solvay SA

- Arkema S.A.

- Huntsman Corporation

- SGL Carbon SE

- Owens Corning

- Jowat SE

- Advanced Composites Group

Recent Developments

- In February 2025, AOC Ltd inaugurated a new pilot plant in Filago, Italy, focused on developing advanced resin formulations for aerospace composite materials to accelerate innovation and production efficiency.

- In November 2023, Leonardo S.p.A. partnered with Herambiente S.p.A. to launch full-scale testing of an industrial facility in Emilia-Romagna dedicated to recycling carbon fibers from polymer-matrix composites used in aircraft components, promoting sustainability in aerospace manufacturing.

- In November 2023, Vega Composites S.r.l. entered a joint venture with Merlinhawk Aerospace Pvt Ltd of India to establish a composites design and manufacturing unit, strengthening Italy’s role in the global aerospace supply chain.

- In June 2025, Baykar Technologies completed the acquisition of Piaggio Aerospace S.p.A., enhancing its technological capabilities and expanding Italy’s aerospace composites and aerostructures expertise through strategic integration.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Aircraft Type, Resin Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing demand for lightweight and fuel-efficient aircraft.

- Adoption of carbon fiber composites will continue to dominate across aerostructures and engine components.

- Advanced thermoplastic composites will gain traction in secondary structures and interiors.

- Expansion of commercial aircraft fleets in Italy will drive increased use of high-performance composites.

- Military modernization programs will support growth in defense-related aerospace composites.

- Investments in automated manufacturing and 3D printing will enhance production efficiency and reduce costs.

- Sustainability initiatives will encourage development and use of recyclable composite materials.

- Strategic collaborations and partnerships among manufacturers will strengthen market presence.

- Research and innovation in hybrid composites will create new application opportunities.

- Regulatory compliance and performance standards will guide the adoption of advanced composite technologies.