Market Overview:

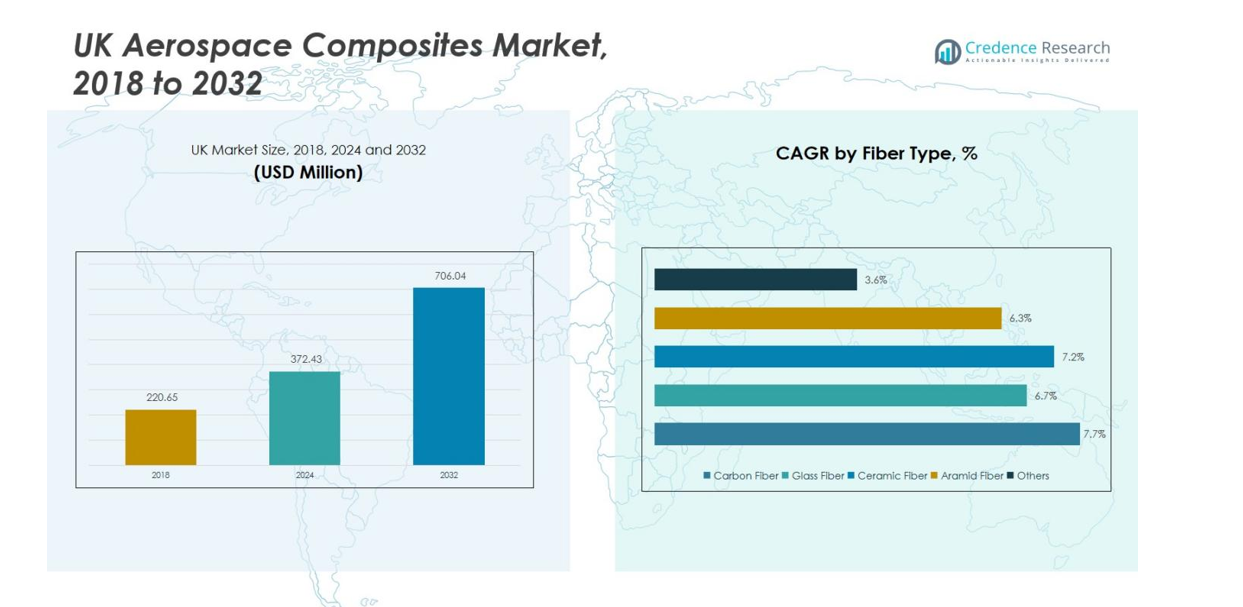

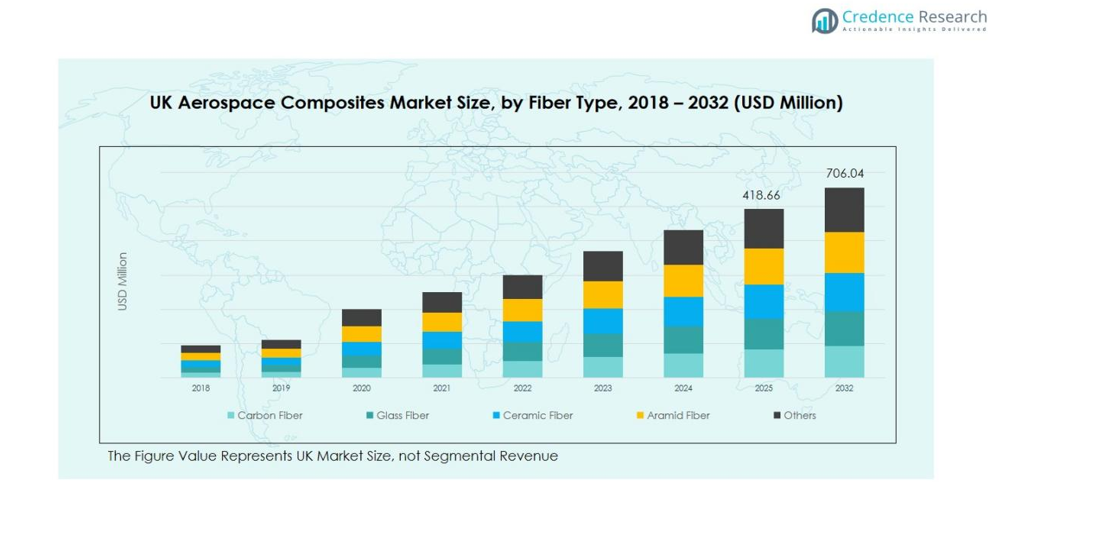

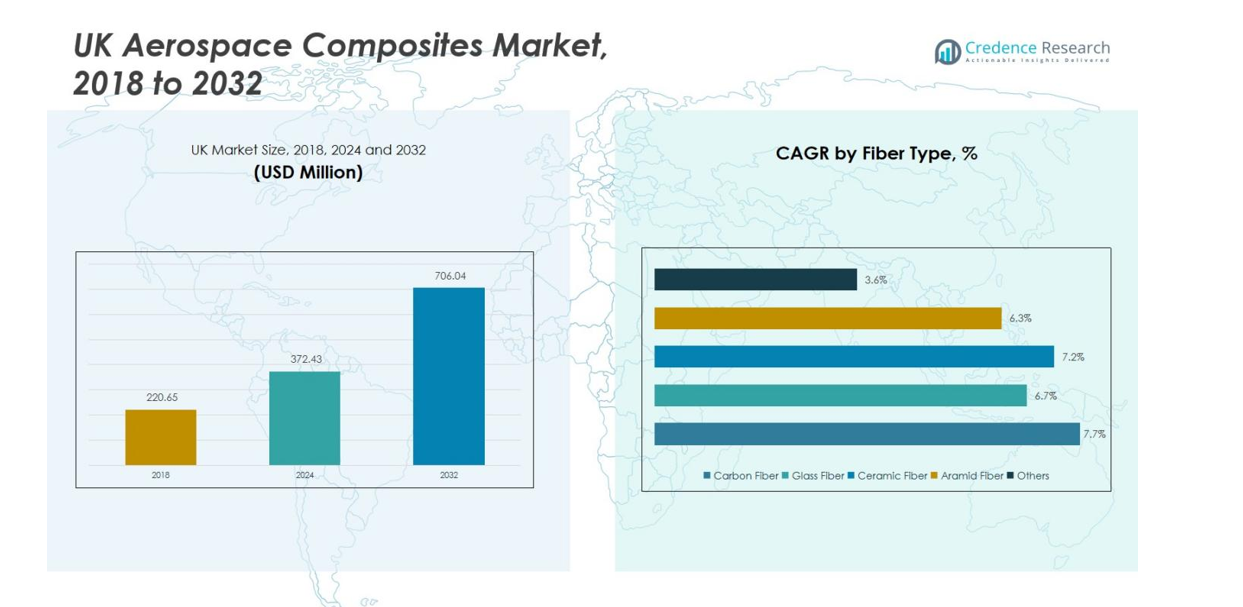

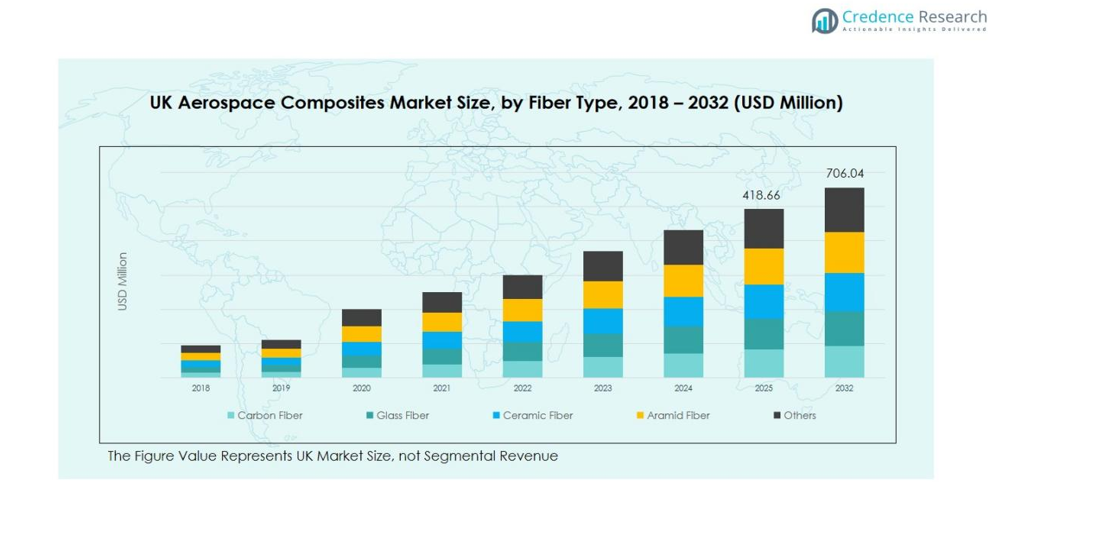

UK Aerospace Composites Market size was valued at USD 220.65 Million in 2018, rising to USD 372.43 Million in 2024, and is anticipated to reach USD 706.04 Million by 2032, at a CAGR of 7.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Aerospace Composites Market Size 2024 |

USD 372.43 Million |

| UK Aerospace Composites Market, CAGR |

7.75% |

| UK Aerospace Composites Market Size 2032 |

USD 706.04 Million |

The UK Aerospace Composites Market is highly competitive, with top players including Gurit Holding AG, Hexcel Corporation, Solvay SA, Cytec Solvay Group, Huntsman Corporation, Owens Corning, Advanced Composites Group, Rock West Composites, and Park Aerospace. These companies focus on innovation, strategic partnerships, and expanding manufacturing capabilities to strengthen their market positions. England emerges as the leading region, holding a 55% market share, supported by its concentration of aerospace manufacturing hubs, research centers, and commercial and defense aircraft programs. Scotland and Wales follow with 15% and 11% shares, respectively, benefiting from defense contracts and rotorcraft production. Northern Ireland accounts for 8%, while other regions contribute 11%. The combined efforts of these key players, along with government support, technological advancements, and growing demand for lightweight, fuel-efficient aircraft, drive the steady growth of aerospace composites across the UK.

Market Insights

- The UK Aerospace Composites Market was valued at USD 372.43 Million in 2024 and is projected to reach USD 706.04 Million by 2032, growing at a CAGR of 7.75%. Carbon fiber dominates the market with the largest segment share, while England holds the highest regional share at 55%, followed by Scotland at 15%, Wales at 11%, Northern Ireland at 8%, and other regions at 11%.

- Rising demand for lightweight and fuel-efficient aircraft is driving the growth of the UK Aerospace Composites Market, encouraging the adoption of advanced carbon fiber and thermoset composites across commercial and military applications.

- Technological advancements, including automated fiber placement and additive manufacturing, are emerging trends, enabling faster production, improved material performance, and increased adoption of thermoplastic composites for secondary structures and interiors.

- The market is highly competitive, led by Gurit Holding AG, Hexcel Corporation, Solvay SA, Cytec Solvay Group, and Huntsman Corporation, focusing on innovation, partnerships, and portfolio expansion.

- High production costs and stringent regulatory requirements act as key restraints, while regional hubs like England and Scotland continue to lead aerospace composite manufacturing in the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type:

The UK Aerospace Composites Market by fiber type is led by carbon fiber, capturing the largest share of approximately 55%. Carbon fiber dominates due to its superior strength-to-weight ratio, excellent fatigue resistance, and efficiency in reducing overall aircraft weight, which enhances fuel efficiency. Glass fiber follows with a 25% share, favored for cost-effectiveness in non-structural applications. Ceramic and aramid fibers, with smaller shares of around 10% and 7% respectively, are primarily used in high-temperature and impact-resistant applications. The remaining 3% is occupied by other specialty fibers. Rising demand for lightweight and fuel-efficient aircraft drives carbon fiber adoption.

- For instance, Boeing’s AH-64 Apache helicopter uses E-glass fiber composites in its radome, valued for minimizing electromagnetic signal distortion critical in radar applications.

By Aircraft Type:

In the UK, commercial aircraft lead the aerospace composites market with a 60% share, driven by high production rates and increasing adoption of lightweight materials for fuel efficiency and emissions reduction. Military aircraft account for roughly 25%, supported by requirements for high-strength, durable materials in defense applications. Helicopters and other aircraft types collectively hold 15%, primarily in specialized missions or smaller fleets. The shift toward more efficient and advanced commercial fleets, alongside government initiatives promoting defense modernization, fuels the growth of composite usage across aircraft types.

- For instance, the EH101 Merlin helicopter features composite main rotor blades made of carbon and glass fibers, improving aerodynamic properties and reducing weight.

By Resin Type:

Thermoset composites dominate the UK market with a 65% share, preferred for their excellent mechanical properties, dimensional stability, and cost-effective processing in aerospace applications. Thermoplastic composites, holding 35%, are gaining traction due to faster manufacturing cycles, recyclability, and improved impact resistance, particularly in secondary structures and interiors. The growing emphasis on lightweight, high-performance materials in aircraft structures drives thermoset composite adoption, while thermoplastics benefit from demand for rapid production and sustainable solutions. Both resin types play critical roles in meeting evolving aerospace performance standards.

Key Growth Drivers

Increasing Demand for Lightweight Aircraft

The UK aerospace composites market is primarily driven by the rising demand for lightweight aircraft, which enhances fuel efficiency and reduces operational costs. Airlines and manufacturers are increasingly adopting carbon fiber and advanced composite materials to lower aircraft weight while maintaining structural strength. This trend is especially prevalent in commercial aircraft, where fuel cost reduction is a critical factor. Lightweight composites also contribute to reduced carbon emissions, aligning with global sustainability regulations, further boosting the adoption of high-performance fibers and resins across the aerospace industry.

- For instance, the Airbus A350 XWB utilizes about 53% composite materials, which contributes to a lighter airframe and thus better fuel economy compared to traditional aluminum structures like the Airbus A330 that uses only about 10% composites.

Technological Advancements in Composite Materials

Advancements in composite materials and processing technologies have significantly fueled the UK aerospace composites market. Innovations in thermoset and thermoplastic resins, along with high-strength fibers, allow for more durable, heat-resistant, and corrosion-resistant components. Additive manufacturing and automated fiber placement techniques enhance production efficiency, reduce waste, and enable complex component fabrication. These technological improvements encourage manufacturers to replace traditional metals with composites, driving market growth. The continuous innovation also supports emerging applications in military aircraft and rotorcraft, expanding the demand across segments.

- For instance, Hexcel and Arkema collaboratively produced an aeronautical structure using thermoplastic composites with Arkema’s Kepstan PEKK resin and Hexcel carbon fibers, aiming to replace metals like steel and aluminum with recyclable composite parts, enhancing production rates and sustainability outside of autoclaves.

Government Initiatives and Defense Modernization

Government investments and defense modernization programs serve as strong growth drivers for the UK aerospace composites market. Initiatives aimed at upgrading military aircraft fleets, improving operational efficiency, and incorporating advanced lightweight materials encourage widespread adoption of composites. Funding for research and development in aerospace technologies further accelerates innovation and production capabilities. Additionally, stringent regulatory standards for aircraft performance, safety, and environmental compliance push manufacturers to integrate advanced composites into commercial and defense aircraft, reinforcing the market’s steady expansion over the forecast period.

Key Trends & Opportunities

Rising Adoption of Thermoplastic Composites

The growing focus on sustainability and rapid manufacturing is driving the adoption of thermoplastic composites in the UK aerospace market. Thermoplastics offer recyclability, high impact resistance, and faster production cycles compared to traditional thermosets. Manufacturers are increasingly incorporating thermoplastic composites in secondary structures, interiors, and non-critical components, providing opportunities for cost reduction and improved operational efficiency. The trend also aligns with environmental regulations encouraging recyclable materials, creating new avenues for market growth while supporting lightweight, high-performance aircraft designs

- For instance, Airbus’s Clean Sky 2 OUTCOME project has validated a sustainable manufacturing process for a thermoplastic composite upper skin on the external wing box of the C-295 aircraft, highlighting cost-effective, lightweight, and recyclable design advances.

Expansion in Commercial Aircraft Production

The expansion of commercial aircraft production in the UK and Europe presents significant opportunities for aerospace composites manufacturers. Airlines are upgrading fleets to meet increasing passenger demand while focusing on fuel efficiency and emission reduction. This drives the demand for advanced composites such as carbon fiber and thermoset materials. Emerging technologies, including hybrid and electric aircraft, further fuel market growth by requiring innovative lightweight components. Companies that invest in R&D and strategic partnerships can capitalize on these opportunities, positioning themselves at the forefront of the evolving aerospace landscape.\

- For instance, Airbus, ATR, and Daher are collaborating on the LIME project to develop hybrid-electric aircraft battery systems with composite casings, which emphasizes the need for lightweight, advanced composites to enable hybrid and electric aircraft technologies.

Key Challenges

High Production Costs of Advanced Composites

Despite strong growth prospects, high production costs of advanced composites remain a key challenge in the UK market. Manufacturing processes for carbon fiber and high-performance resins require significant investment in machinery, skilled labor, and quality control. These costs can limit adoption in price-sensitive applications or smaller manufacturers. Additionally, the complexity of integrating composites into existing aircraft designs may increase production timelines and expenses. Overcoming these financial and technical barriers is essential for broader market penetration and achieving economies of scale.

Regulatory and Certification Hurdles

Stringent regulatory requirements and certification processes pose challenges for the UK aerospace composites market. Aerospace components must comply with rigorous safety, performance, and environmental standards, which can delay product launches and increase development costs. Certification for new materials, especially for military and commercial aircraft, often involves extensive testing and validation. These regulatory hurdles can limit the speed of adoption of innovative composite technologies, requiring manufacturers to invest substantial time and resources to meet compliance, thereby impacting market growth and operational efficiency.

Regional Analysis

England

England dominates the UK Aerospace Composites Market, holding a 55% market share, driven by its strong concentration of aerospace manufacturing hubs and research centers. The region hosts major commercial and defense aircraft manufacturers that extensively use carbon fiber and thermoset composites. Rising investment in advanced composite materials and automated manufacturing technologies further propels market growth. England’s strategic infrastructure, skilled workforce, and government support for aerospace innovation strengthen its position. Increasing demand for lightweight and fuel-efficient aircraft, coupled with expansion in commercial aircraft production, continues to drive the adoption of aerospace composites across both industrial and defense applications.

Scotland

Scotland accounts for 15% of the UK aerospace composites market, supported by its growing aerospace manufacturing sector and focus on defense aircraft programs. Key players in Scotland are investing in high-performance materials such as carbon fiber and aramid fiber for military applications. The region benefits from research collaborations between universities and aerospace manufacturers, promoting innovation in composite materials and processes. Expansion of helicopter and rotorcraft production, along with government defense contracts, boosts demand for aerospace composites. Scotland’s strategic initiatives and investment in advanced manufacturing technologies enhance production efficiency and contribute to steady market growth.

Wales

Wales holds an 11% share of the UK aerospace composites market, largely fueled by its specialization in helicopter and small aircraft manufacturing. The region emphasizes lightweight composite structures, particularly thermoset and thermoplastic composites, for improved performance and fuel efficiency. Collaboration between local aerospace clusters and universities supports R&D in advanced materials. Rising demand for defense helicopters and commercial rotorcraft creates growth opportunities for aerospace composites in Wales. Government incentives for aerospace innovation, along with investments in automated production technologies, further strengthen the region’s market presence and encourage adoption of advanced fiber and resin technologies across applications.

Northern Ireland

Northern Ireland captures 8% of the UK aerospace composites market, driven by niche manufacturing of specialized aircraft components and defense applications. The region leverages high-performance carbon fiber and thermoset composites to deliver lightweight, durable structures. Strong government support for aerospace innovation, coupled with partnerships between local manufacturers and international players, enhances capabilities in composite fabrication. Northern Ireland’s focus on research, defense contracts, and helicopter production fuels market growth. Investments in advanced manufacturing techniques, including automated fiber placement and additive manufacturing, improve production efficiency and support the expanding use of aerospace composites in commercial, military, and rotorcraft applications.

Other Regions

The remaining UK regions contribute 11% to the aerospace composites market, primarily through small-scale manufacturing units and specialized component production. These regions focus on supplying high-performance fiber and resin components to larger aerospace hubs. The adoption of carbon fiber and thermoset composites in commercial aircraft, rotorcraft, and defense applications is increasing steadily. Regional collaborations and government incentives encourage innovation and investment in advanced composite technologies. Growth in specialized applications, such as propulsion components and interiors, supports market expansion. These areas play a complementary role by supplying critical composite materials and components to the broader UK aerospace ecosystem.

Market Segmentations:

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

- Others

Competitive Landscape

The competitive landscape of the UK Aerospace Composites Market features key players such as Gurit Holding AG, Hexcel Corporation, Solvay SA, Cytec Solvay Group, JEC Composites, Huntsman Corporation, Owens Corning, Advanced Composites Group, Rock West Composites, and Park Aerospace. These companies focus on innovation, strategic partnerships, and expansion of manufacturing capabilities to strengthen their market presence. They invest heavily in research and development to introduce lightweight, high-strength carbon fiber and thermoset composites for commercial and military aircraft. Companies are also adopting automated fiber placement and advanced thermoplastic processing technologies to improve efficiency and reduce costs. Strategic mergers, acquisitions, and collaborations further enhance product portfolios and geographic reach. The market remains highly competitive due to continuous technological advancements, increasing demand for fuel-efficient aircraft, and the growing adoption of composites across aerostructures, interiors, and propulsion components.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gurit Holding AG

- Hexcel Corporation

- Solvay SA

- Cytec Solvay Group

- JEC Composites

- Huntsman Corporation

- Owens Corning

- Advanced Composites Group

- Rock West Composites, Inc.

- Park Aerospace

Recent Developments

- On October 14, 2025, iCOMAT inaugurated a state-of-the-art automated space manufacturing facility in Gloucestershire. The £4.8 million investment, supported by the UK Space Agency, aims to revolutionize lightweight space structures using advanced composite technologies.

- On September 8, 2025, GTR Composites Group partnered with NP Aerospace to deliver a new UK-based defense composites offering. This collaboration aims to meet the growing composite demands from defense prime contractors and high-technology unmanned systems suppliers.

- On June 18, 2025, GKN Aerospace launched the ASPIRE program, a £12 million UK R&D initiative aimed at developing and demonstrating next-generation composite wing and flap structures.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Aircraft Type, Resin Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by rising demand for lightweight and fuel-efficient aircraft.

- Carbon fiber composites will continue to dominate due to superior strength-to-weight ratio and durability.

- Thermoset composites will maintain a larger share, while thermoplastic composites will see increasing adoption for rapid manufacturing.

- Commercial aircraft production expansion will remain a key growth engine for aerospace composites.

- Defense modernization programs and military aircraft upgrades will boost demand for high-performance materials.

- Advanced manufacturing technologies, including automated fiber placement and additive manufacturing, will enhance production efficiency.

- R&D investments will drive innovation in high-strength and heat-resistant composite materials.

- Sustainability and recyclable materials will influence future composite material choices.

- Strategic collaborations, mergers, and acquisitions will strengthen market presence and technological capabilities.

- Emerging applications in rotorcraft, propulsion components, and interiors will provide additional growth opportunities.