Market Overview:

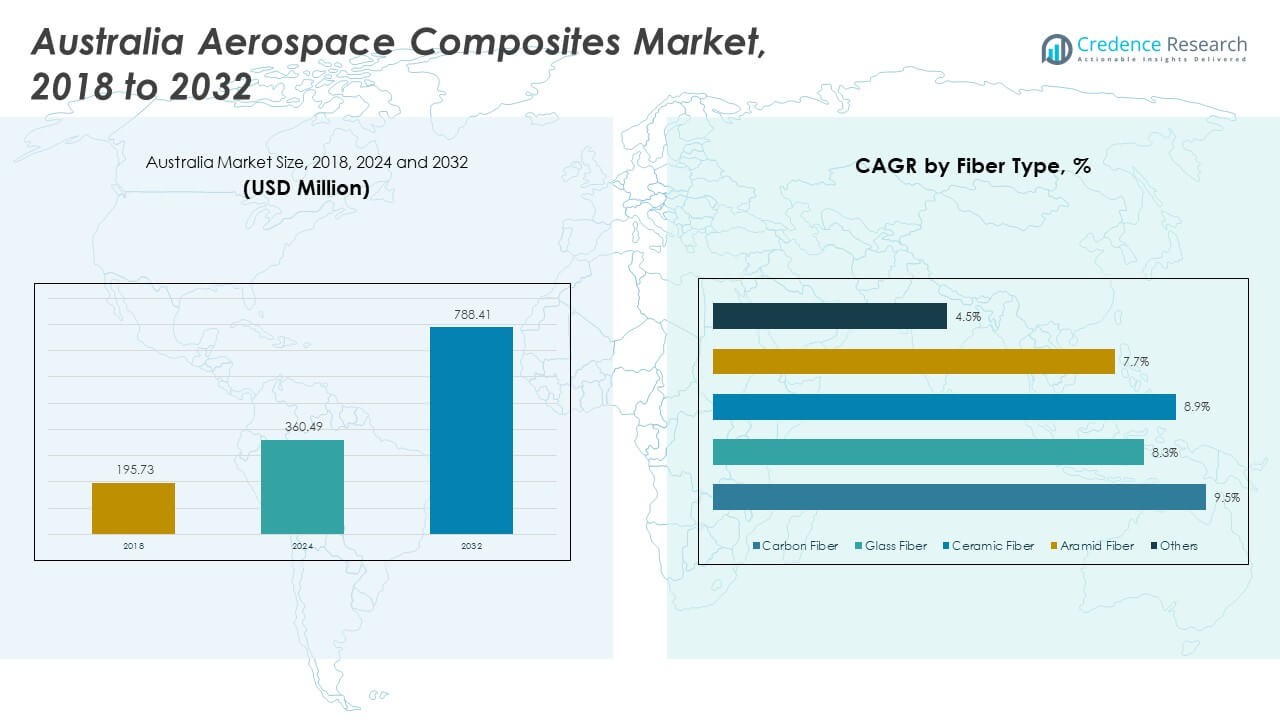

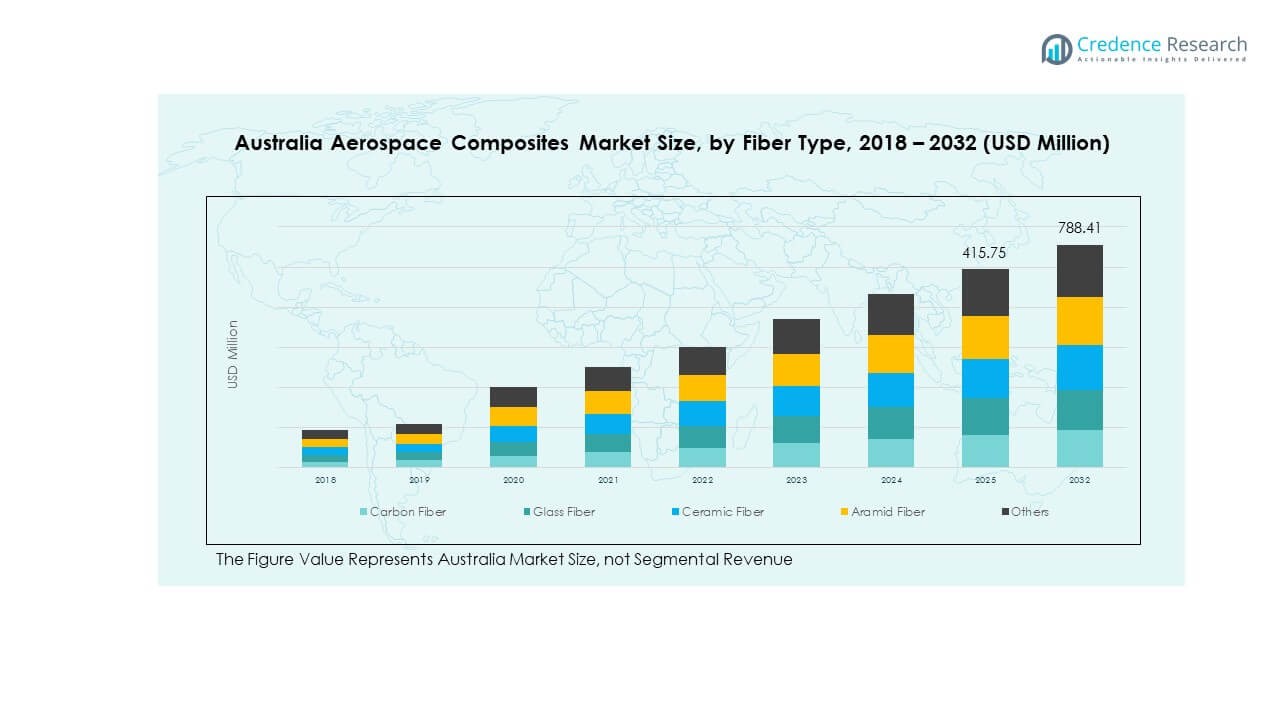

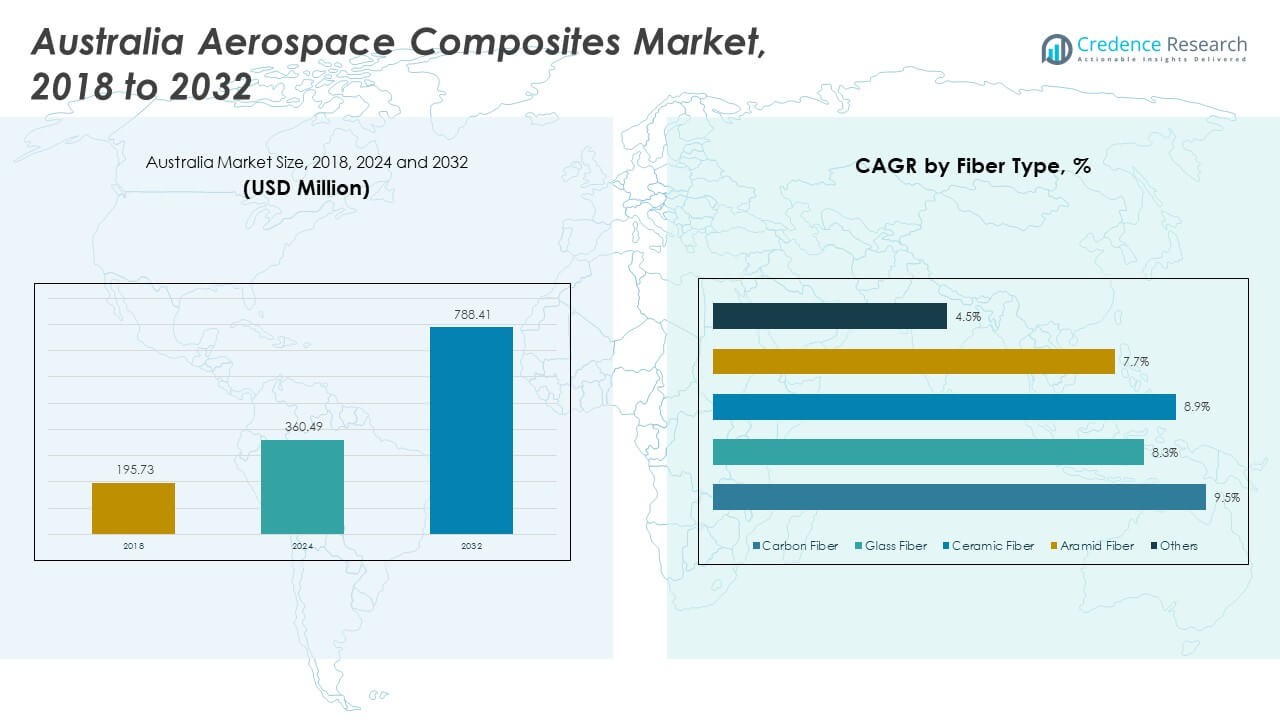

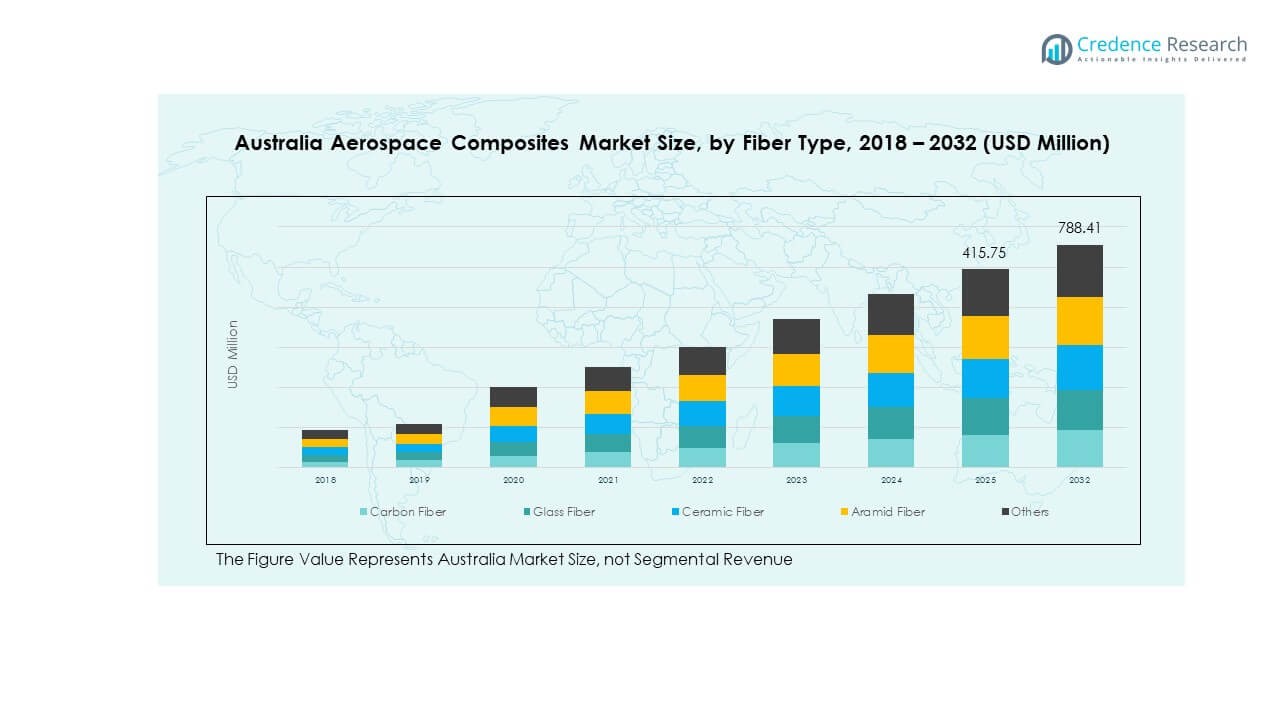

The Australia Aerospace Composites Market size was valued at USD 195.73 million in 2018 to USD 360.49 million in 2024 and is anticipated to reach USD 788.41 million by 2032, at a CAGR of 9.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Aerospace Composites Market Size 2024 |

USD 360.49 Million |

| Australia Aerospace Composites Market, CAGR |

9.57% |

| Australia Aerospace Composites Market Size 2032 |

USD 788.41 Million |

Growing investments in advanced composite technologies are driving the Australia Aerospace Composites Market. The demand for lightweight, fuel-efficient aircraft is pushing manufacturers to adopt carbon fiber and high-strength resin systems. Increased defense modernization, strong domestic production capacity, and research-led innovation contribute to market expansion. Composite structures improve durability, reduce maintenance costs, and enhance aircraft performance. Government-backed programs and private sector investments accelerate technology adoption.

Victoria leads the Australia Aerospace Composites Market due to its strong aerospace manufacturing base and well-developed infrastructure. Queensland is rapidly emerging as a key hub, supported by strategic defense investments and growing MRO capabilities. New South Wales is strengthening its position through R&D initiatives and increased private sector involvement. Regional collaborations with global OEMs are enhancing technology transfer and boosting production. These state-level developments are shaping a competitive ecosystem that supports innovation, efficiency, and export potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Aerospace Composites Market was valued at USD 195.73 million in 2018, reached USD 360.49 million in 2024, and is projected to reach USD 788.41 million by 2032, growing at a CAGR of 9.57%.

- Victoria leads with 38% of the market share, supported by advanced infrastructure and strong defense programs. Queensland follows with 33% share, benefiting from growing MRO capabilities, while New South Wales holds 29%, driven by R&D and private investments.

- Queensland represents the fastest-growing region with a 33% share, supported by strategic defense contracts, expanding aerospace clusters, and export-oriented manufacturing capacity.

- Carbon fiber dominates the segment distribution, holding roughly 40% of the total fiber share, reflecting its strong use in structural components for weight reduction.

- Glass fiber ranks second with nearly 25% of the share, used mainly in secondary structures and cost-efficient applications in commercial aerospace programs.

Market Drivers

Rising Demand for Lightweight and High-Performance Materials in Aircraft Manufacturing

The Australia Aerospace Composites Market benefits from increasing use of advanced lightweight materials in aircraft production. Composite materials lower the overall aircraft weight and improve fuel efficiency. Growing carbon emission regulations encourage manufacturers to adopt sustainable solutions. Rising demand for longer aircraft range and higher payload capacity further drives the need for composites. The defense sector is also increasing its investments in lightweight materials for better agility and durability. Composite parts help improve structural integrity and reduce maintenance costs. High stiffness-to-weight ratios make these materials suitable for critical components. It is strengthening its role as a core enabler of aerospace innovation.

Expanding Domestic Aerospace Production Capabilities Across Key States

Local aerospace manufacturers are expanding composite production facilities to meet rising demand. Strategic investments by government and private players boost R&D capabilities. Victoria, Queensland, and New South Wales are emerging as strong manufacturing hubs. Partnerships with global aerospace OEMs increase technology transfer and adoption of advanced materials. This expansion supports local job creation and strengthens the supply chain network. Strong defense procurement programs further accelerate domestic production. Rising collaboration with research institutions enhances technical capabilities. It is shaping a resilient and competitive national aerospace ecosystem.

Increased Defense Spending and Upgradation of Military Fleets

Strong defense budgets fuel composite demand across military aircraft, helicopters, and UAV platforms. Advanced composites improve stealth features, reduce weight, and increase operational performance. Fleet modernization programs encourage the use of lighter and stronger components. Australian defense contracts increasingly require high-performance composite structures. The push for enhanced mobility and endurance in defense aircraft drives this demand. Composites also lower maintenance costs and enhance durability in extreme conditions. Local suppliers benefit from growing government support. It is reinforcing the country’s defense modernization goals.

- For instance, in August 2025, the U.S. Defense Security Cooperation Agency approved a USD 404 million Baseline 2 upgrade for Australia’s MC-55A Peregrine fleet. L3Harris Technologies was named the principal contractor under this ISR/EW program supporting the Royal Australian Air Force. The deal strengthens bilateral defense cooperation and enhances airborne intelligence capabilities.

Growing R&D Investments and Technological Innovation in Composite Processing

Rising investments in R&D programs drive technological progress in composite manufacturing. Advanced processing technologies, such as automated fiber placement and out-of-autoclave methods, enable cost-effective production. These innovations reduce manufacturing cycle times and improve product quality. Industry-academic collaborations strengthen technical knowledge and workforce development. Government initiatives support innovation in sustainable aerospace materials. Improved heat resistance and impact strength make composites ideal for critical aircraft systems. Advanced automation also improves production accuracy and scalability. It is supporting continuous modernization of the aerospace materials sector.

- For instance, UNSW’s Automated Composites Laboratory hosts Australia’s most advanced Automated Fibre Placement (AFP) robotic system—featuring a 6-axis platform, high-temperature thermoplastic layup capability, and the ability to produce aerospace components up to 4 meters. The lab, working with industry partners under the ARC Training Centre for Automated Manufacture, has positioned UNSW as a core R&D hub for next-gen aerospace material automation.

Market Trends

Integration of Advanced Manufacturing Technologies to Enhance Efficiency and Precision

The Australia Aerospace Composites Market is witnessing rising adoption of advanced manufacturing methods. Automation in composite production reduces labor dependency and increases consistency. Digital twins and AI-driven systems improve quality control and operational efficiency. Lightweight structures with high mechanical performance are becoming standard. OEMs use additive manufacturing to produce complex shapes with less waste. This shift enables faster development cycles and reduced production costs. Real-time monitoring also ensures greater precision in assembly lines. It is driving transformation across the aerospace materials value chain.

Emergence of Sustainable Composite Materials for Green Aviation Goals

Sustainability trends are influencing composite production strategies in the aerospace sector. Manufacturers are adopting bio-based and recyclable composites to meet environmental standards. Lower lifecycle emissions and improved end-of-life recyclability strengthen their adoption. Sustainable manufacturing methods align with net-zero emission targets. OEMs are introducing greener aircraft models with reduced environmental impact. Material suppliers are focusing on lower resin toxicity and energy-efficient processing. This trend also attracts investors interested in climate-focused innovation. It is supporting a more sustainable aerospace manufacturing ecosystem.

- For instance, in September 2024, Change Climate Pty Ltd, in partnership with the University of Southern Queensland, the Australian National University, and the University of South Australia, developed the BYOXY Bio-Epoxy Resin—the world’s first epoxy resin made entirely from 100% renewable resources. Supported by the iLAuNCH Trailblazer program, the resin is UV-resistant and recyclable, specifically formulated for aerospace and space composite applications.

Increased Use of Multifunctional Composites for Performance Optimization

The industry is shifting toward multifunctional composite materials with integrated capabilities. These composites combine structural strength with advanced properties such as thermal resistance or lightning protection. Their multifunctionality reduces component count and simplifies aircraft design. OEMs benefit from lower weight and reduced maintenance costs. Integration of sensors into composites also enhances predictive maintenance. Multifunctional designs support faster assembly and better operational efficiency. They also improve aircraft safety and durability during harsh operations. It is enabling new performance standards in next-generation aircraft.

Strategic Collaborations and Supply Chain Strengthening Among Key Players

Rising collaborations between global aerospace OEMs and Australian suppliers enhance technology transfer. Strong alliances support local production capacity and capability development. Joint ventures enable faster adoption of advanced composite solutions. Supply chain diversification strategies mitigate risks and increase resilience. Investments in logistics infrastructure support timely deliveries and quality assurance. Partnerships with research bodies strengthen knowledge sharing and innovation. International cooperation enhances export competitiveness. It is strengthening the country’s position in the global aerospace ecosystem.

- For instance, in May 2025, Lockheed Martinpartnered with the Royal Australian Air Force (RAAF) to link F-35 flight simulators across the Williamtown and Tindal bases under a Distributed Mission Training (DMT) This marked Australia’s first international F-35 simulator connection, improving pilot readiness, networked training, and system resilience within Lockheed Martin’s global aerospace ecosystem.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limiting Scalability

The Australia Aerospace Composites Market faces challenges from high production costs and complex processing steps. Composite manufacturing requires specialized equipment, cleanrooms, and skilled labor. These factors increase capital expenditure and limit small-scale entry. Autoclave processes demand high precision and long cycle times. Achieving uniform quality across large structures remains difficult. Limited standardization raises production variability and cost uncertainty. This complexity impacts pricing strategies for OEMs and suppliers. It is restraining rapid scaling of composite adoption in aerospace applications.

Supply Chain Disruptions and Limited Raw Material Availability

Volatility in global supply chains creates procurement challenges for composite manufacturers. Dependence on imported raw materials increases lead times and costs. Geopolitical factors and shipping delays disrupt consistent availability of carbon fibers and resins. Lack of domestic large-scale suppliers limits flexibility in responding to demand spikes. These constraints affect production timelines and project deliveries. Inventory management becomes more difficult during market fluctuations. Rising transportation costs further pressure profit margins. It is adding operational risks to the composite manufacturing value chain.

Market Opportunities

Expansion of Domestic Composite Manufacturing Capacity Through Strategic Investments

The Australia Aerospace Composites Market holds strong potential through strategic capacity expansion. Local players are increasing their production footprint to meet aerospace and defense demand. Government-backed programs support infrastructure and advanced technology integration. Collaborations with international firms help scale capabilities faster. Investments in automated production lines improve quality and throughput. Localizing key stages of the supply chain also reduces dependency on imports. Regional economic zones are fostering industrial growth. It is creating a favorable environment for aerospace material innovation.

Growth in Exports and Integration with Global Aerospace Supply Chains

Expanding global collaborations provide opportunities for Australian suppliers to access new markets. Partnerships with international OEMs increase export potential of advanced composite components. Certification and quality standard alignment enable entry into established aerospace programs. Strengthened logistics and port infrastructure support competitive delivery timelines. Rising demand for lightweight materials globally expands trade prospects. Integration with global supply chains also improves technology access. It is reinforcing Australia’s position in the international aerospace ecosystem.

Market Segmentation Analysis

The Australia Aerospace Composites Market is segmented by fiber type, aircraft type, resin type, and application.

By fiber type, carbon fiber dominates due to its high strength-to-weight ratio and durability. Glass fiber is used in secondary structures, while ceramic and aramid fibers support high-performance applications.

- For instance, Toray Carbon Fibers Europe expanded production capacity at its Abidos facility in France from 5,000 to 6,000 metric tons of medium and high modulus carbon fiber tows to meet growing aerospace demand. The expansion aims to strengthen the company’s supply capabilities for advanced aerospace applications.

By aircraft type, commercial aircraft hold a major share, with military aircraft and helicopters contributing to specialized demand.

By resin type, thermoset composites lead for their superior performance in structural components, while thermoplastic composites gain traction for repairability and recyclability.

By application, aerostructures form the largest segment, followed by engine components, interiors, propulsion components, and radomes. It is diversifying applications across both civil and defense aerospace programs.

- For instance, Spirit AeroSystems manufactures composite fuselage sections and nacelles for Airbus A350, Boeing 787, and Sikorsky CH-53K aircraft using resin transfer infusion and automated fiber placement, optimizing weight efficiency in major aerostructures.

Segmentation

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Ceramic Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Helicopter

- Others

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By Application

- Aerostructures

- Engine Components

- Interiors

- Propulsion Components

- Radomes

- Others

Regional Analysis

Victoria leads the Australia Aerospace Composites Market with a 38% share, supported by advanced manufacturing infrastructure and defense-focused programs. The state hosts key aerospace suppliers, research institutions, and government-backed innovation hubs. Strong partnerships with global OEMs enhance local composite production capabilities. Major aircraft assembly and component manufacturing facilities drive industrial growth. Skilled workforce availability strengthens its competitive position. The region also benefits from targeted investment in R&D and digital production technologies. It is driving large-scale composite adoption in both civil and defense segments.

Queensland holds a 33% market share, driven by its growing aerospace manufacturing ecosystem and strategic defense contracts. The state focuses on integrating composite technologies into maintenance, repair, and overhaul operations. Government incentives encourage private investments in advanced production facilities. Aerospace clusters in Brisbane and surrounding areas support high-volume component production. Rising exports to Asia-Pacific markets enhance the region’s economic contribution. Its growing presence in UAV and rotary-wing programs accelerates demand. It is becoming a key production and innovation hub for next-generation aerospace materials.

New South Wales accounts for 29% of the market, supported by strong R&D activity and university-industry collaborations. The region invests in composite testing, design, and prototyping capabilities. Local aerospace companies are expanding production capacity to support both domestic and export programs. Strategic proximity to major transport hubs supports supply chain efficiency. High investment in digital engineering strengthens material performance research. Its focus on sustainability and smart manufacturing enhances industry competitiveness. It is building a strong foundation for future composite technology leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gurit Holding AG

- Hexcel Corporation

- Solvay SA

- Owens Corning

- Huntsman Corporation

- Aerovac LLC

- SGL Carbon SE

- Advanced Composites Group

- Rock West Composites

- Cytec Solvay Group

- Quickstep Holdings Ltd (Australia)

- Boeing Australia

- Airbus Australia Pacific

- Lockheed Martin Australia

- Northrop Grumman Australia

- GE Aviation

Competitive Analysis

The Australia Aerospace Composites Market is defined by strong collaboration between local manufacturers and global OEMs. Key players include Quickstep Holdings, Boeing Australia, Airbus Australia Pacific, Lockheed Martin Australia, Northrop Grumman, and GE Aviation. These companies invest heavily in R&D and advanced composite processing technologies. Strategic partnerships with research institutes support innovation and workforce training. The competitive landscape is shaped by vertical integration and localization of supply chains. Focus on carbon fiber innovation and lightweight structural solutions drives product differentiation. Increasing investment in automation and digital manufacturing boosts cost efficiency. It is positioning Australia as a competitive player in the global aerospace composites value chain.

Recent Developments

- In June 2025, Owens Corning established a partnership with Switzerland-based Composite Recycling to develop industrial-scale recycling technologies for glass fiber reinforcement products. The initiative centers on integrating reclaimed glass fibers into Owens Corning’s production streams, thereby supporting circular economy efforts within aerospace and related industries.

- In May 2025, Hexcel Corporation entered a major partnership with U.S.-based aerospace startup JetZero to develop and qualify next-generation carbon fiber composites for JetZero’s blended wing body (BWB) aircraft platform under the FAA’s Fueling Aviation’s Sustainable Transition (FAST) program.

- In March 2025, Gurit Holding AG reaffirmed its commitment to the defense composites sector by re-signing a long-term supply contract with USMI for the delivery of advanced composite materials used in government and marine applications. The renewed agreement strengthens Gurit’s global position in high-performance composite manufacturing and supports innovations in structural materials applicable to aerospace and defense environments.

- In March 2025, Huntsman Corporation announced a strategic collaboration with Advanced Material Development Ltd. (AMD) to co-develop carbon nanotube-integrated resin systems for aerospace and defense composites. The partnership leverages Huntsman’s resin expertise and AMD’s nanotechnology research capabilities to create electrically enhanced materials offering improved strength and conductivity.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Aircraft Type, Resin Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Aerospace Composites Market will expand through stronger domestic manufacturing capacity and strategic investments.

- Advancements in lightweight material technologies will support the next generation of aircraft designs.

- Increased defense modernization programs will drive steady composite demand across military platforms.

- Automation and digitalization in production will enhance cost efficiency and precision.

- Growing collaborations with global OEMs will integrate local suppliers into international supply chains.

- Sustainability goals will accelerate the adoption of recyclable and eco-friendly composite materials.

- Multifunctional composites will gain traction due to their superior performance characteristics.

- Expansion of aerospace clusters in Victoria, Queensland, and New South Wales will strengthen the supply base.

- R&D investments will boost innovation in resin systems, fiber technologies, and manufacturing methods.

- Export growth and international certifications will position Australia as a competitive global composite supplier.