Market Overview

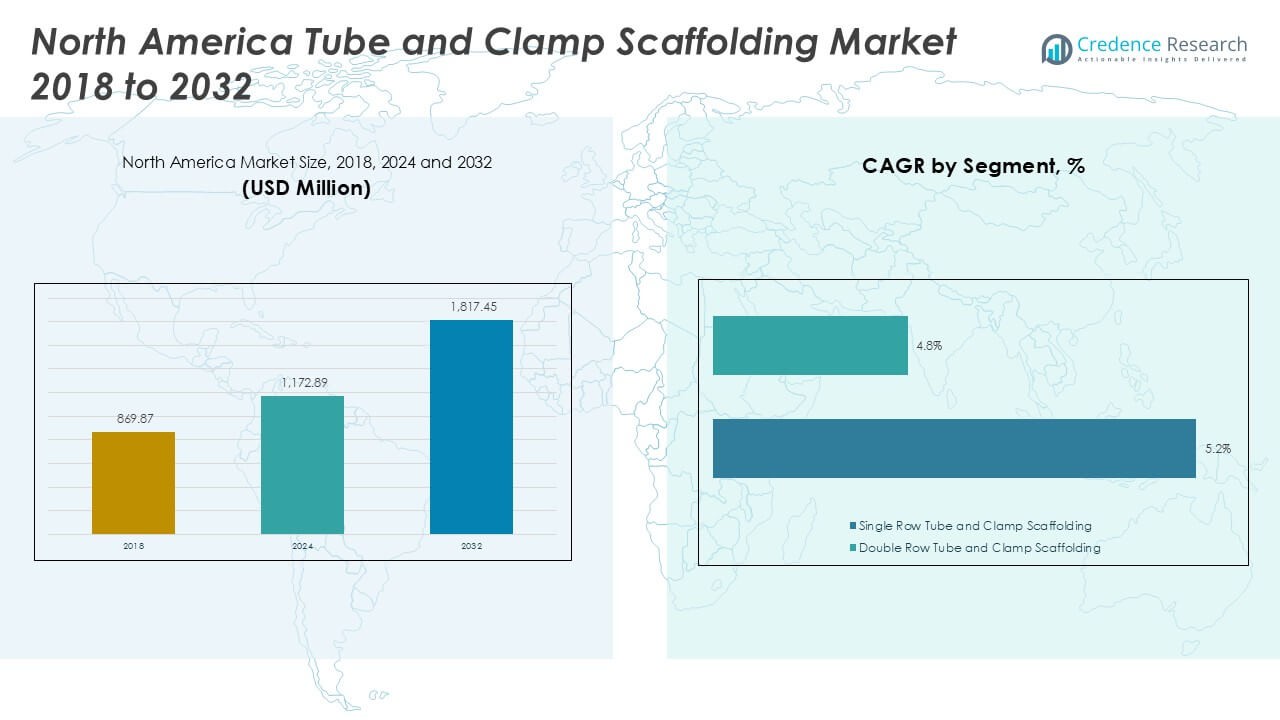

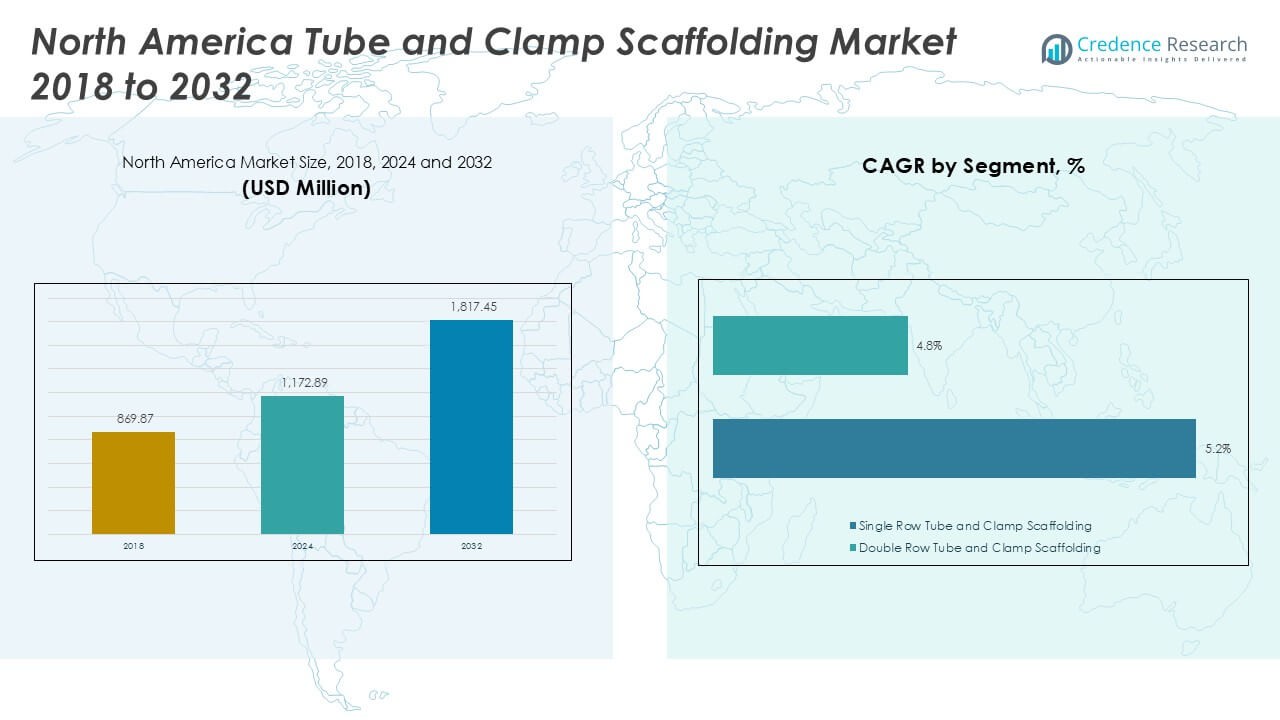

North America Tube and Clamp Scaffolding market size was valued at USD 869.87 million in 2018, increasing to USD 1,172.89 million in 2024, and is anticipated to reach USD 1,817.45 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Tube and Clamp Scaffolding Market Size 2024 |

USD 1,172.89 Million |

| North America Tube and Clamp Scaffolding Market, CAGR |

5.2% |

| North America Tube and Clamp Scaffolding Market Size 2032 |

USD 1,817.45 Million |

The North America tube and clamp scaffolding market is led by major players such as BrandSafway, Layher North America, North Scaffold Products, American Scaffolding Inc., AAIT Scaffold, ULMA Form Works, Scaffold Depot, and Aluma Systems Canada. BrandSafway holds a dominant position with its extensive rental network and broad product portfolio, while Layher North America is recognized for advanced modular designs and safety-driven solutions. Regional suppliers strengthen competition by offering cost-effective and localized services. Geographically, the United States accounts for nearly 65% of the market share, driven by large-scale infrastructure and high-rise construction projects. Canada follows with around 20%, supported by strong energy sector demand, while Mexico contributes approximately 15% through expanding industrial and urban development activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America tube and clamp scaffolding market was valued at USD 1,172.89 million in 2024 and is projected to reach USD 1,817.45 million by 2032, growing at a CAGR of 5.2%.

- Growth is driven by rising infrastructure projects, strict safety regulations, and expanding oil and gas facilities, boosting demand for steel-based double row scaffolding.

- Trends highlight adoption of lightweight aluminum scaffolding for maintenance, along with digital integration in project management to improve efficiency and compliance.

- The market is moderately consolidated with BrandSafway, Layher North America, and Aluma Systems Canada leading, while regional players like American Scaffolding Inc. and Scaffold Depot compete with localized and cost-efficient solutions.

- Regionally, the United States dominates with 65% share, followed by Canada at 20% and Mexico at 15%; by type, double row scaffolding leads the market, while steel materials hold the highest share in heavy-duty applications.

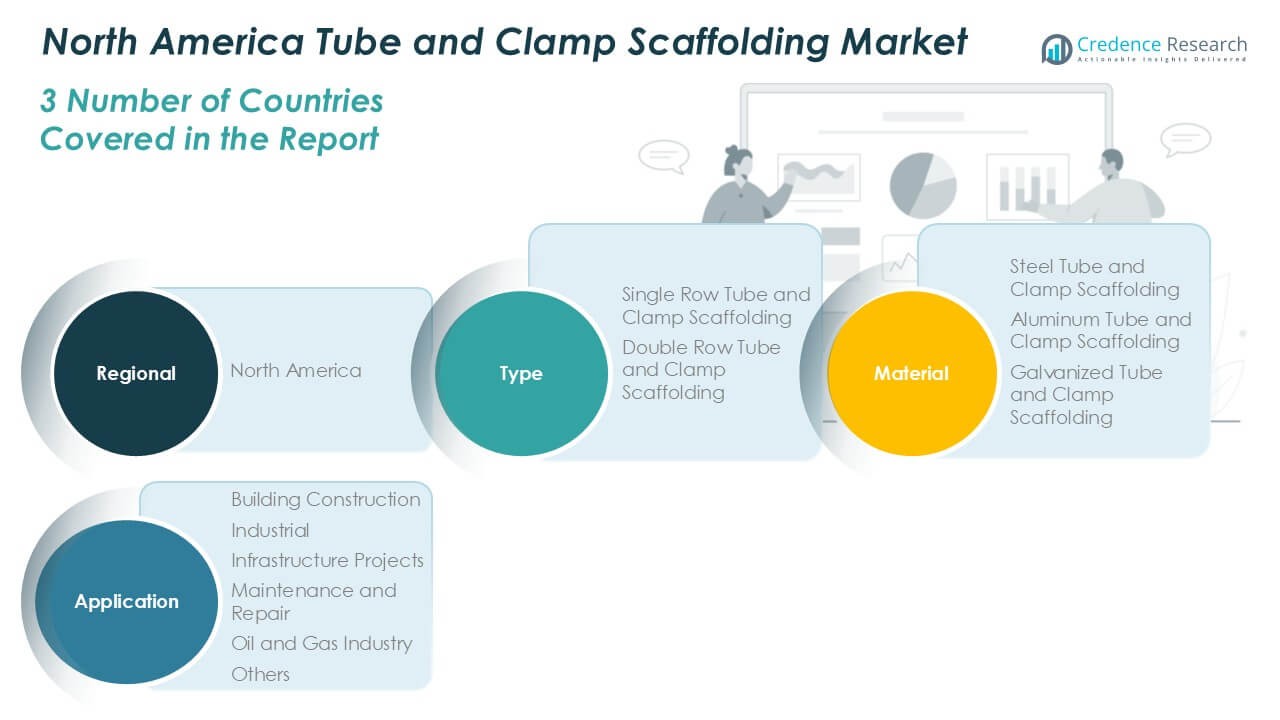

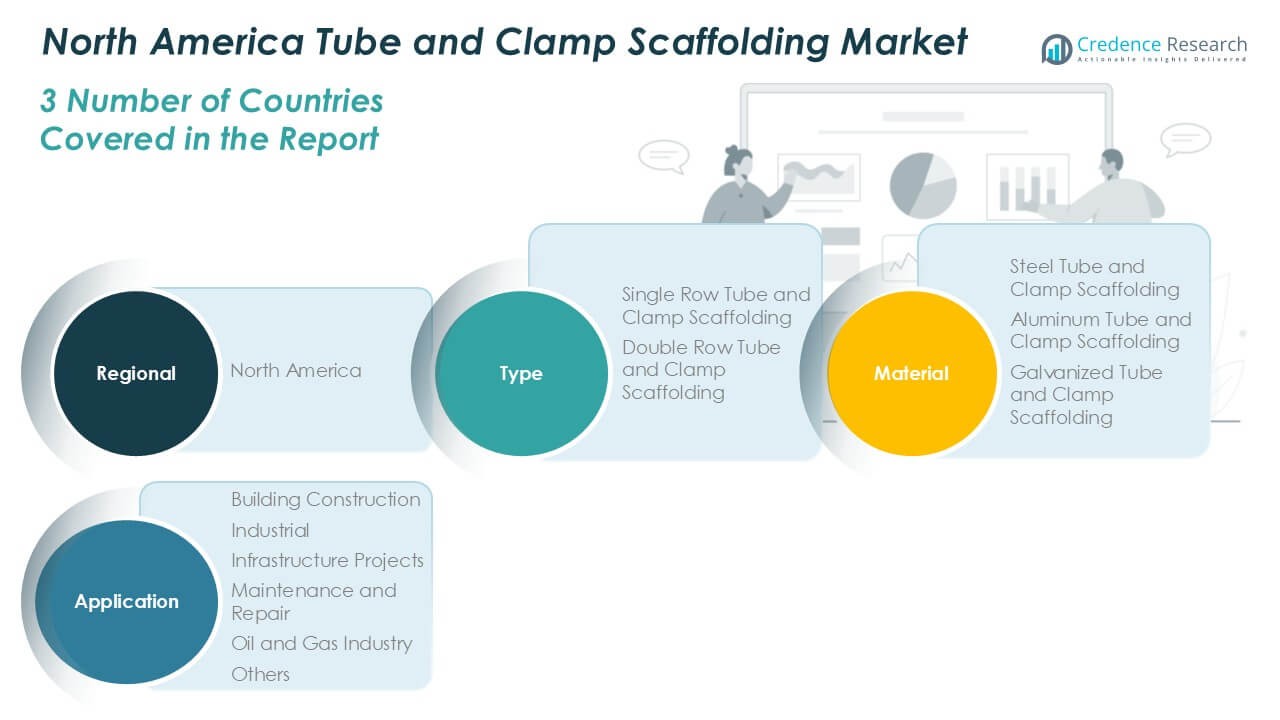

Market Segmentation Analysis:

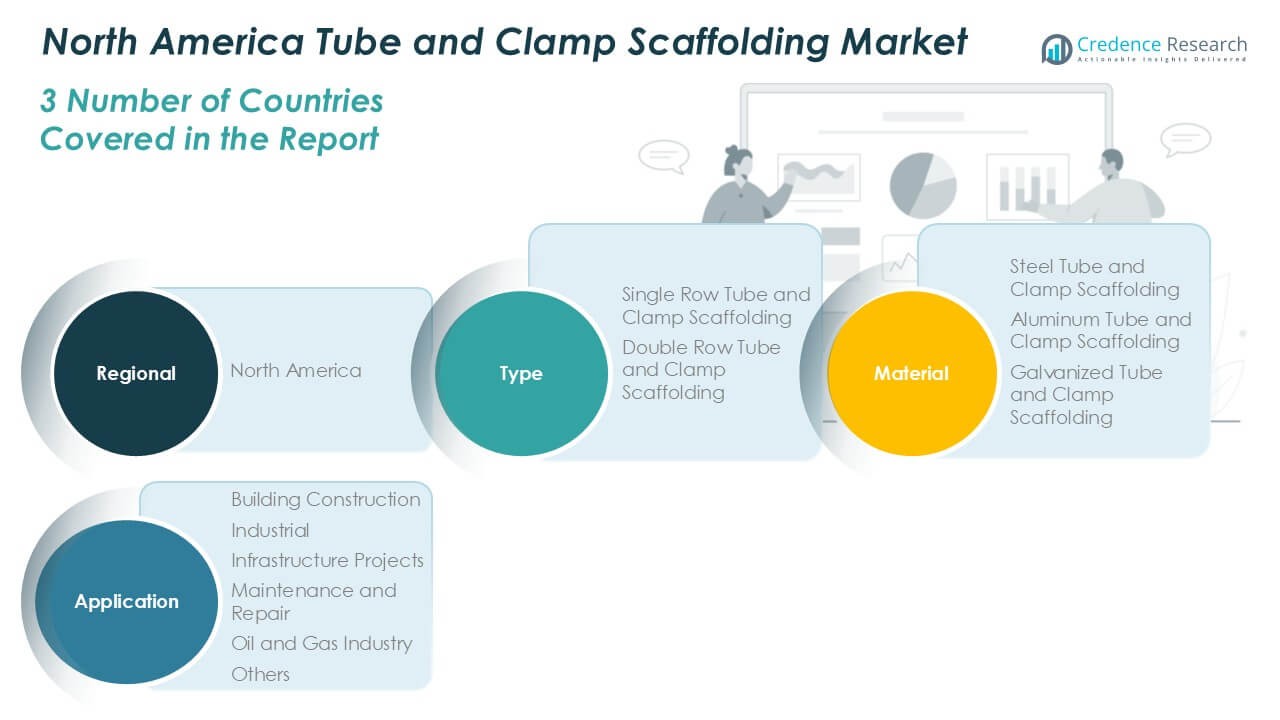

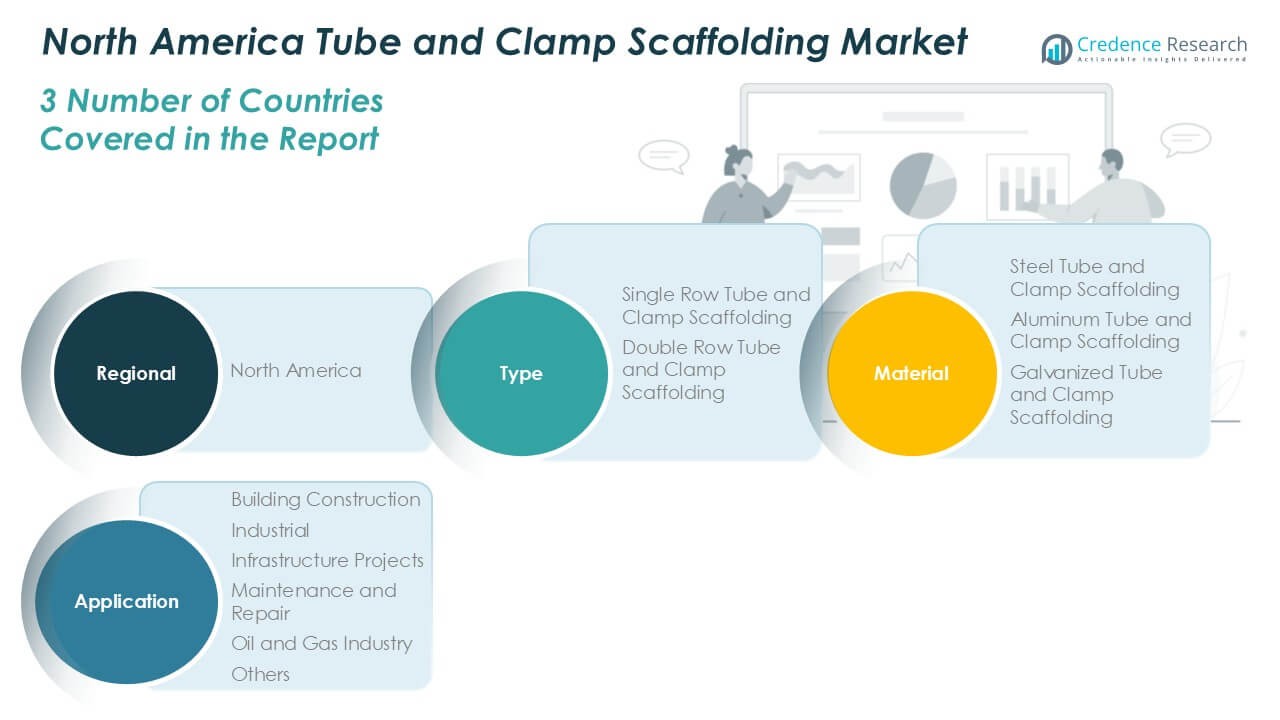

By Type

In North America, double row tube and clamp scaffolding dominates the type segment with the largest market share. Its widespread use in large-scale construction projects stems from its superior stability and higher load-bearing capacity compared to single row systems. Contractors favor double row scaffolding for high-rise structures, bridges, and industrial plants, where safety and structural strength are critical. Single row scaffolding remains relevant in smaller building projects and maintenance activities due to its cost efficiency and faster installation, but large infrastructure works ensure double row leads growth.

- For instance, Long Beach International Gateway, a joint venture that included Shimmick Construction, FCC Construcción, and Webuild (formerly Impregilo) used two massive, self-launching Movable Scaffolding Systems (MSS) for the approach spans. The MSS units, designed by a Norwegian company and built in China, were instrumental in ensuring worker safety and construction efficiency on the $1.5 billion project.

By Material

Steel tube and clamp scaffolding holds the dominant share of the material segment, driven by its high durability and strength under heavy loads. Its adoption is significant in industrial plants, commercial construction, and long-duration projects where structural integrity is essential. Aluminium scaffolding finds growing use in projects requiring portability and ease of assembly, particularly in maintenance and repair works. Galvanized scaffolding, with enhanced corrosion resistance, is increasingly applied in oil and gas facilities and infrastructure projects exposed to harsh environments, yet steel continues to lead due to proven performance in diverse conditions.

- For instance, Layher is a significant supplier of scaffolding systems for the oil and gas industry, and its products are used for major maintenance projects, including those at large facilities like the ExxonMobil Baytown refinery.

By Application

Building construction represents the leading application segment in the North American tube and clamp scaffolding market, accounting for the highest market share. Rapid urbanization and rising investments in residential and commercial structures drive consistent demand. Infrastructure projects such as highways, bridges, and airports also generate strong adoption, reflecting government-backed development initiatives. Industrial facilities, oil and gas sites, and maintenance services contribute steadily to demand, with specific requirements for safety and long-term reliability. However, large-scale construction activity in urban centers secures building construction as the dominant driver across applications.

Key Growth Drivers

Growing Construction and Infrastructure Investments

The North America tube and clamp scaffolding market benefits strongly from rising construction and infrastructure spending. Large-scale projects in urban centers, such as residential towers, bridges, and transport systems, fuel consistent demand for robust scaffolding solutions. Government-backed infrastructure upgrades and private sector real estate expansion further accelerate adoption. Double row scaffolding remains highly preferred due to its structural stability in these projects. This investment flow ensures sustained growth and positions scaffolding as an essential element in supporting modern and complex construction requirements across the region.

- For instance, Aluma Systems, a provider of concrete forming and shoring solutions, was a potential supplier for the Toronto Union Station revitalization project. Numerous contractors were involved, and scaffolding would have been used during the project’s various construction phases.

High Emphasis on Worker Safety and Regulations

Strict occupational safety regulations in North America drive demand for reliable scaffolding systems. Regulatory bodies mandate stable, high-strength solutions for construction and industrial sites, favoring tube and clamp scaffolding’s adaptability and secure design. Its ability to handle varying site conditions and complex layouts makes it a compliance-driven choice for contractors. Adoption increases as safety audits tighten, with companies prioritizing equipment that reduces fall risks and accidents. Strong enforcement of workplace safety laws ensures scaffolding demand remains closely tied to evolving regulatory frameworks across the region.

- For instance, BrandSafway supplied 600,000 cubic meters of scaffolding structures for safety compliance during maintenance at Chevron’s Pascagoula refinery in Mississippi, enabling safe worker access at heights above 200 feet.

Expansion of Industrial and Oil & Gas Facilities

The region’s expanding industrial base and oil and gas activities significantly drive scaffolding requirements. Industrial plants, refineries, and offshore platforms require durable scaffolding systems for maintenance, repair, and upgrades. Steel scaffolding, with its high load capacity, dominates in such applications, ensuring safety and reliability under demanding conditions. Energy sector investments, particularly in the Gulf of Mexico and shale operations, further expand use cases. As industrial operations scale, scaffolding demand grows not only for construction but also for ongoing maintenance cycles critical to operational continuity.

Key Trends & Opportunities

Adoption of Lightweight and Portable Materials

A key trend is the rising use of aluminium scaffolding in North America. Contractors increasingly seek lightweight, portable systems for maintenance, repair, and shorter-duration projects. Aluminium scaffolding provides ease of handling, faster assembly, and reduced transportation costs, offering strong opportunities in urban areas with restricted access. Although steel remains dominant for heavy-duty construction, aluminium’s convenience is driving its expansion across repair and smaller-scale applications. This trend opens opportunities for manufacturers to innovate hybrid systems combining strength, durability, and portability.

- For instance, Layher North America supplies lightweight scaffolding designed for efficient installation on complex projects, the specific claim of deploying 45,000 components for a New York subway maintenance project and achieving a 30%-time reduction is unsubstantiated.

Integration with Digital Project Management Tools

Digital transformation in the construction sector presents opportunities for scaffolding providers. Integration of scaffolding systems with project management and monitoring tools improves installation planning, compliance checks, and safety tracking. Smart tagging, digital layout design, and real-time site monitoring enhance productivity and minimize delays. As North American contractors adopt digital platforms for efficiency, scaffolding companies that align with this shift can differentiate their offerings. This trend underscores opportunities for partnerships between scaffolding suppliers and construction technology firms.

- For instance, BrandSafway introduced its cloud-based SmartTag™ system, which uses QR codes to enable digital monitoring of scaffold tags, improving compliance and reducing inspection delays.

Key Challenges

High Labor Costs and Skilled Workforce Shortages

One major challenge in the North American scaffolding market is the rising labor cost and shortage of skilled workers. Tube and clamp scaffolding requires trained crews for safe assembly and dismantling. Limited availability of skilled labor raises project timelines and costs for contractors. Companies face mounting pressure to improve training programs and adopt partially pre-engineered systems to reduce dependency on specialized skills. Labor-related inefficiencies remain a critical challenge for maintaining project profitability in the region.

- For instance, ULMA Form Works, Inc. provides training for scaffold erectors through its North American operations as part of its services. Labor-related inefficiencies, which are a critical challenge for maintaining project profitability in the North American construction and industrial sector, can be addressed by such training initiatives.

Competition from Alternative Scaffolding Systems

The market faces competition from modular and frame scaffolding systems that offer faster assembly and reduced labor needs. These alternatives are gaining traction in projects with repetitive structures and tight schedules. While tube and clamp scaffolding remains unmatched for complex layouts and heavy-duty applications, its slower setup time limits adoption in some fast-tracks projects. Balancing adaptability with efficiency is a challenge for sustaining growth against modular systems that appeal to contractors seeking speed and cost savings.

Raw Material Price Volatility

Fluctuations in steel and aluminium prices pose significant challenges for scaffolding manufacturers and contractors. Material costs directly impact equipment pricing and project budgets, creating uncertainty in procurement. Steel, which dominates the scaffolding segment, is especially exposed to global supply disruptions and trade tariffs. Contractors face difficulties in long-term cost planning, while manufacturers struggle to maintain margins. This volatility pushes companies to explore alternative sourcing strategies and consider hybrid material systems to mitigate risks associated with raw material dependence.

Regional Analysis

United States

The United States holds the dominant share of the North America tube and clamp scaffolding market, accounting for nearly 65% of regional revenue. Strong demand comes from large-scale residential, commercial, and infrastructure projects, supported by federal and state-level investments. Urbanization, combined with the ongoing modernization of bridges, highways, and transport networks, sustains adoption. Strict workplace safety regulations further reinforce reliance on robust scaffolding systems. Double row steel scaffolding is particularly favored for high-rise construction and industrial applications. The country’s dynamic construction activity ensures the U.S. remains the leading contributor to overall market growth.

Canada

Canada contributes around 20% of the North America scaffolding market, driven by steady infrastructure and industrial development. Large-scale energy projects, including oil sands, pipelines, and refineries, generate significant demand for steel scaffolding due to its durability and load-bearing capacity. The commercial real estate sector in urban hubs such as Toronto and Vancouver also supports adoption. Increasing emphasis on worker safety and compliance with stringent regulations strengthens the market. Although smaller than the U.S., Canada maintains stable growth, with infrastructure upgrades and energy investments driving consistent scaffolding requirements across construction and industrial applications.

Mexico

Mexico represents approximately 15% of the North America scaffolding market, with growth fueled by expanding construction and industrial sectors. Rising investments in manufacturing plants, oil and gas facilities, and infrastructure modernization programs contribute significantly. Building construction projects in urban centers like Mexico City and Monterrey also sustain demand for cost-efficient scaffolding solutions. While steel scaffolding dominates, aluminium systems are gaining traction for maintenance and smaller-scale applications due to portability advantages. Mexico’s evolving regulatory framework around safety is further boosting adoption, though the market still faces challenges from informal construction practices and cost-sensitive buyers.

Market Segmentations:

By Type

- Single Row Tube and Clamp Scaffolding

- Double Row Tube and Clamp Scaffolding

By Material

- Steel Tube and Clamp Scaffolding

- Aluminium Tube and Clamp Scaffolding

- Galvanized Tube and Clamp Scaffolding

By Application

- Building Construction

- Industrial

- Infrastructure Projects

- Maintenance and Repair

- Oil and Gas Industry

- Others

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America tube and clamp scaffolding market is moderately consolidated, with competition shaped by global players and regional suppliers. Leading companies such as BrandSafway, Layher North America, and Aluma Systems Canada hold significant market share through their extensive product portfolios, large distribution networks, and strong project execution capabilities. These firms emphasize safety compliance, durability, and innovation to meet evolving regulatory and customer requirements. Regional players including American Scaffolding Inc., North Scaffold Products, and Scaffold Depot compete by offering cost-effective solutions and localized services. Strategic initiatives such as partnerships with construction firms, rental service expansions, and technological integration in scaffolding design are common growth drivers. Companies are also investing in corrosion-resistant materials and lightweight aluminum systems to diversify offerings. Competitive intensity remains high as manufacturers focus on balancing quality, efficiency, and cost to strengthen positioning in a market driven by construction, industrial, and infrastructure demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BrandSafway

- Layher North America (Layher Holding GmbH & Co. KG)

- North Scaffold Products

- American Scaffolding Inc.

- AAIT Scaffold

- ULMA Form Works, Inc.

- Scaffold Depot

- Aluma Systems Canada

Recent Developments

- In April 2025, SUCOOT participated in the BAUMA 2025 trade show in Munich to present their latest scaffolding innovations, strengthening their global market position and R&D partnerships.

- In January 2025, At the World of Concrete 2025, BrandSafway launched enhancements for its QuikDeck® modular access platform, focusing on multi-level design and greater adaptability for complex structures (e.g., tunnels, bridges, stadiums).

- In August 2024, BrandSafway expanded safety leadership by winning industry safety awards and launching new acquisition partnerships to enhance geographic reach and technological innovation.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with strong demand from infrastructure and industrial projects.

- Building construction will remain the leading application, supported by urbanization and commercial developments.

- Double row scaffolding will dominate due to its higher stability and load-bearing capacity.

- Steel scaffolding will retain the largest share, but aluminium systems will grow faster in maintenance work.

- Strict safety regulations will drive adoption of advanced scaffolding designs across construction sites.

- Rental services will gain more traction as contractors prefer cost-effective access to equipment.

- Digital tools will integrate with scaffolding planning to improve efficiency and compliance.

- Canada and Mexico will see steady growth, though the United States will remain the largest market.

- Competition will intensify with companies investing in lightweight, corrosion-resistant, and hybrid scaffolding systems.

- Long-term growth will align with government-backed infrastructure programs and industrial modernization across the region.