Market Overview

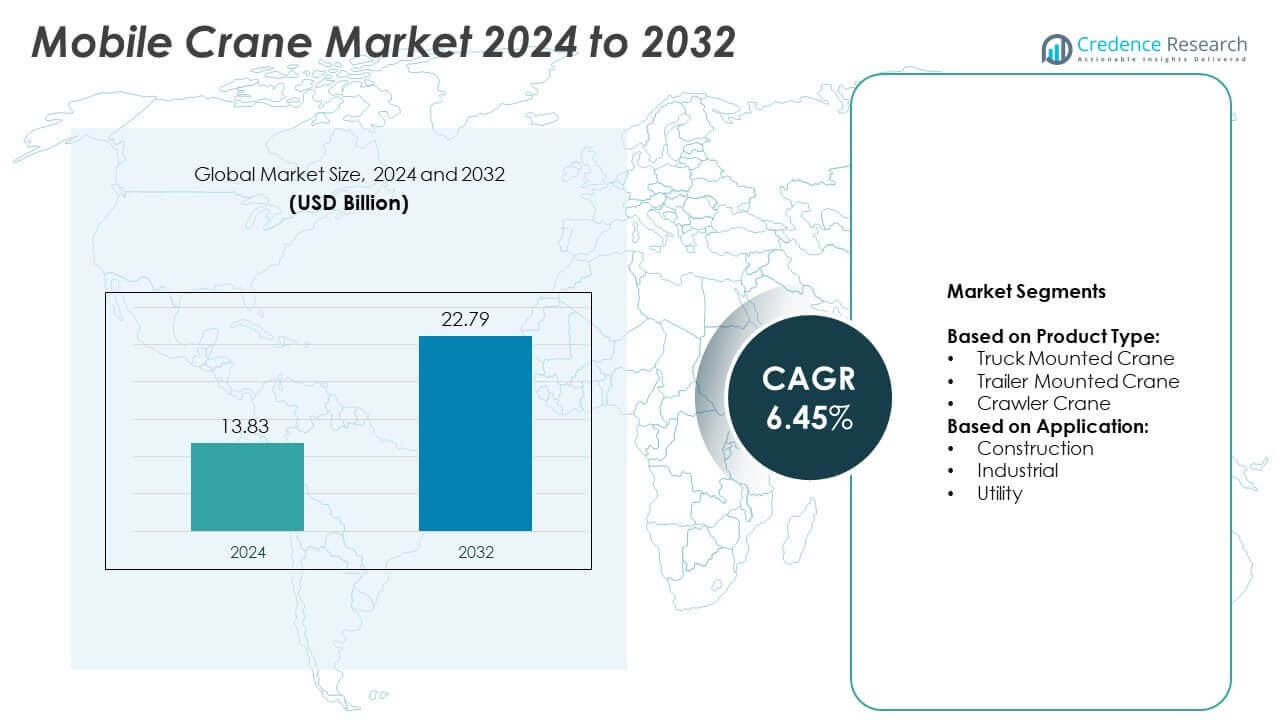

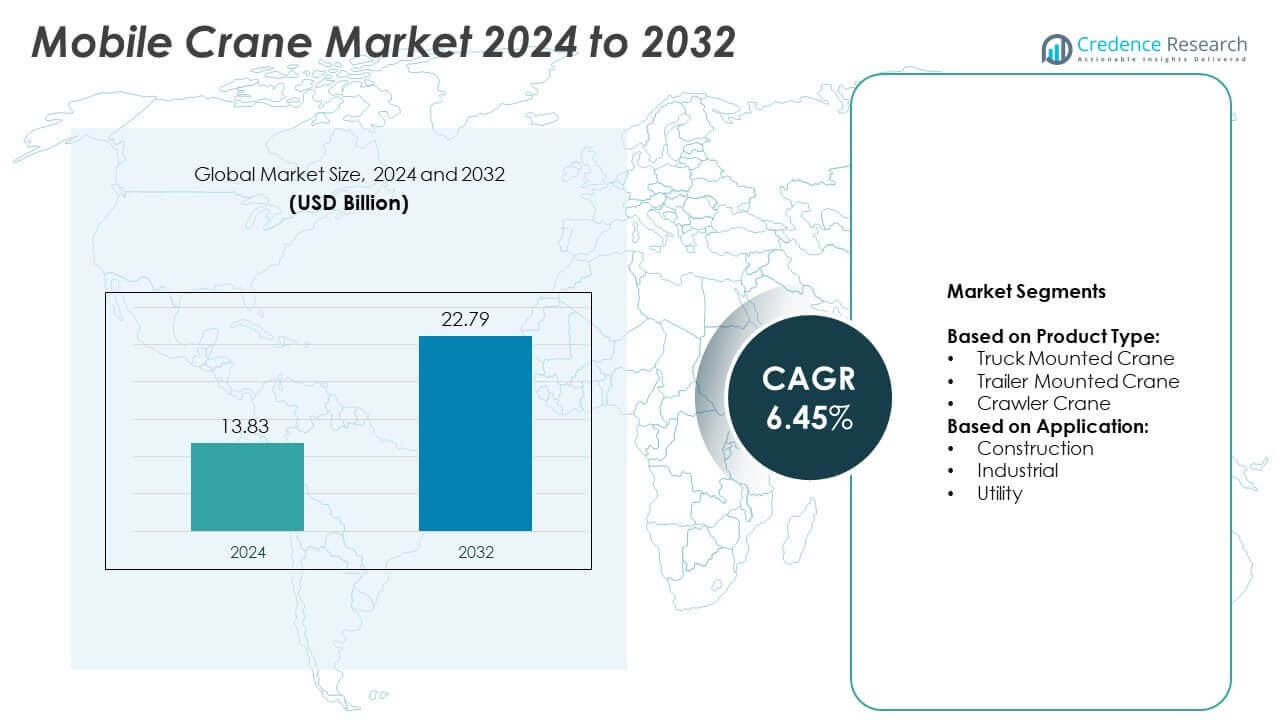

Mobile Crane Market size was valued at USD 13.83 Billion in 2024 and is anticipated to reach USD 22.79 Billion by 2032, at a CAGR of 6.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Crane Market Size 2024 |

USD 13.83 Billion |

| Mobile Crane Market, CAGR |

6.45% |

| Mobile Crane Market Size 2032 |

USD 22.79 Billion |

The Mobile Crane market grows steadily due to rising global infrastructure projects, industrial expansion, and renewable energy investments. Demand increases for versatile cranes with fast setup, higher lifting capacity, and smart features. Urbanization, smart city initiatives, and offshore wind development support long-term equipment deployment. Manufacturers adopt telematics and hybrid technologies to meet emission rules and enhance safety. Construction firms prefer mobile cranes for their flexibility, mobility, and reduced downtime, driving innovation and adoption across diverse end-use sectors.

Asia-Pacific leads the Mobile Crane market, driven by rapid infrastructure growth in China, India, and Southeast Asia. North America follows with steady demand from construction, energy, and utility sectors, while Europe shows strong adoption of hybrid cranes and smart lifting systems. Latin America and the Middle East & Africa witness gradual expansion with ongoing urban and energy projects. Key players operating across these regions include Tadano Ltd., Liebherr-International AG, Terex Corporation, and XCMG GROUP, offering region-specific solutions and support.

Market Insights

- The Mobile Crane market was valued at USD 13.83 billion in 2024 and is projected to reach USD 22.79 billion by 2032, growing at a CAGR of 6.45%.

- Rising investment in infrastructure, renewable energy, and urban construction fuels steady market expansion worldwide.

- The market sees a strong shift toward hybrid and electric cranes to meet emission standards and noise control needs.

- Key players such as Liebherr-International AG, Tadano Ltd., Terex Corporation, and XCMG GROUP focus on innovation, customization, and global service support.

- High initial investment, skilled operator shortages, and strict regulatory compliance pose challenges for small and mid-size contractors.

- Asia-Pacific leads due to rapid industrialization and large-scale public infrastructure projects, while North America and Europe maintain strong adoption driven by utility and energy sectors.

- Urbanization, crane rental growth, and demand for compact, telematics-enabled equipment shape future deployment and competitive strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Infrastructure Investments and Urban Development Fuel Demand Across Global Markets

Large-scale infrastructure projects in transport, energy, and urban housing drive demand for mobile cranes. Governments in Asia-Pacific, the Middle East, and Africa are increasing construction spending to modernize public assets. The Mobile Crane market benefits from the need for high-capacity lifting equipment in roads, bridges, airports, and power plants. Smart city initiatives further require cranes for utility installation and high-rise development. It supports growth in both developed and emerging economies. Strong urbanization trends and expanding metro rail and highway networks continue to boost equipment deployment.

- For instance, Liebherr-International AG’s LTM 1120-4.1 mobile crane is a 4-axle crane with a maximum lifting capacity of 120 metric tons. It features a telescopic boom extending up to 66 meters, a maximum hoist height of 91 meters, and a maximum radius of 64 meters

Expansion of Renewable Energy Projects Strengthens Equipment Utilization Rates

Wind and solar energy installations rely heavily on mobile cranes for tower erection and equipment handling. Countries with decarbonization targets are scaling up renewable energy infrastructure at record pace. The Mobile Crane market supports turbine assembly, solar panel placement, and maintenance operations. High-capacity and all-terrain cranes are deployed in remote, uneven terrains where wind farms are located. It enables safe and efficient lifting of heavy nacelles and blades. Clean energy transitions create long-term equipment rental and ownership opportunities.

- For instance, The Tadano GR-1000XLL-4 is a 100-ton class rough terrain crane with a five-section boom that extends to 51.0 meters (167.3 ft) and can be fitted with an additional jib.

Rapid Industrialization and Growth in Manufacturing Spur Crane Adoption

Growth in industrial zones, logistics hubs, and manufacturing units necessitates frequent movement of machinery and raw materials. Mobile cranes enable flexible lifting operations in confined industrial spaces and warehouses. The Mobile Crane market gains from equipment upgrades across automotive, steel, cement, and petrochemical sectors. It meets the need for high mobility, faster setup, and time-efficient material handling. Increased investment in factory automation and digitalized production further boosts demand. Cranes with real-time monitoring and safety diagnostics are now preferred.

Rising Construction Equipment Rental Services Support Accessibility and Affordability

Rental services make mobile cranes more accessible to small and mid-sized contractors. Users avoid high upfront capital expenditure and benefit from flexible, project-based equipment use. The Mobile Crane market sees growing participation from rental fleet operators in urban and industrial zones. It also promotes wider adoption among tier 2 and tier 3 city projects. Maintenance services and short delivery timelines are critical for rental success. Improved equipment availability and leasing models ensure higher fleet utilization.

Market Trends

Integration of Digital Technologies and Telematics Enhances Operational Efficiency and Safety

Manufacturers are embedding telematics, sensors, and diagnostic tools into modern mobile cranes. These features provide real-time data on crane load, engine status, and fuel consumption. The Mobile Crane market sees rising demand for digitalized equipment that supports remote monitoring and preventive maintenance. It improves uptime, reduces accidents, and helps fleet managers optimize performance. OEMs are launching mobile apps for live tracking, maintenance scheduling, and geofencing. Smart systems reduce manual intervention and enhance operator productivity across job sites.

- For instance, XCMG GROUP manufactures the XCA300U all-terrain crane, a 6-axle crane with a 300-ton lifting capacity. Some models of the crane feature an 80-meter, 7-section boom and can be used for projects in various sectors, including wind power maintenance

Shift Toward Hybrid and Electric Mobile Cranes Driven by Sustainability Goals

Companies are developing battery-electric and hybrid models to meet carbon reduction targets. Global emission regulations are pushing crane fleets toward low-emission alternatives. The Mobile Crane market benefits from early deployment of electric cranes in Europe and pilot projects in North America and Asia. It reduces noise, cuts diesel use, and supports indoor and urban construction sites with emission limits. Hybrid models offer longer runtime and better fuel savings in high-lift operations. Crane OEMs invest in R&D to improve energy storage, battery life, and charging time.

- For instance, In March 2019, PALFINGER also presented a concept of the PK 18502 SH loader crane, which could be operated with a battery pack. In October 2023, the company highlighted the use of a fully electric access platform (P 280 CK) in Vienna’s city center. The company aims to offer future-proof electric and hybrid solutions that provide enhanced efficiency, safety, and a longer service life

Preference for All-Terrain and Compact Cranes in Urban and Complex Work Environments

Urban projects and congested work zones require compact cranes with high maneuverability and setup speed. All-terrain mobile cranes offer flexible movement across paved and unpaved surfaces. The Mobile Crane market aligns with demand for cranes that support tight turns, restricted site access, and varied load conditions. It meets project needs without compromising lifting capacity. Modular boom designs, shorter tail swing, and quick counterweight installation are gaining popularity. These design trends support safe lifting in space-constrained environments.

Growth of Customized Crane Solutions for Specialized Applications and End-User Needs

Customers across construction, oil and gas, and energy sectors demand cranes tailored to their job requirements. OEMs offer solutions with modular components, automated controls, and project-specific attachments. The Mobile Crane market evolves with growing demand for customization and project-specific configurations. It enables more efficient operations and reduced idle time across sectors. Operators seek cranes that support high-frequency lifting with lower operating costs. Customization helps differentiate OEM offerings and build long-term client relationships.

Market Challenges Analysis

High Initial Investment and Maintenance Costs Limit Equipment Adoption in Price-Sensitive Markets

Mobile cranes require significant upfront capital and ongoing maintenance spending. Small and mid-sized contractors often struggle to justify high acquisition costs for short-term projects. The Mobile Crane market faces challenges in expanding into regions with limited financing support and volatile construction demand. It restricts fleet modernization and delays adoption of advanced, fuel-efficient models. Maintenance of hydraulic systems, control modules, and safety components adds recurring expenses. Limited access to spare parts and trained technicians further increases operational downtime.

Skilled Labor Shortage and Regulatory Compliance Create Operational Hurdles for Crane Operators

Operating mobile cranes demands certified operators trained in load calculations, equipment handling, and safety protocols. Many regions report a shortage of skilled professionals to manage advanced crane systems. The Mobile Crane market encounters delays and cost overruns due to untrained labor and high operator turnover. It also struggles with varying safety norms, emission rules, and licensing requirements across countries. Compliance with updated standards requires regular audits, training, and system upgrades. These regulatory gaps slow down cross-border equipment deployment and rental operations.

Market Opportunities

Emerging Economies Present Strong Growth Potential Through Infrastructure Expansion and Urban Projects

Governments in Asia-Pacific, Latin America, and Africa are prioritizing roadways, rail, and housing development. These projects demand high-capacity lifting solutions for fast and efficient execution. The Mobile Crane market has significant opportunity in supporting infrastructure rollout across underserved regions. It benefits from policy-driven funding, foreign investment, and public-private partnerships. Growing urban centers need mobile cranes for vertical construction and utility setup. Local contractors seek compact and cost-effective crane models to meet tight project schedules.

Renewable Energy and Offshore Construction Drive Long-Term Equipment Demand

Wind farms, solar parks, and offshore structures require robust lifting equipment for assembly and maintenance. Many countries are expanding clean energy capacity, which directly increases crane usage. The Mobile Crane market sees long-term opportunity in hybrid and all-terrain cranes that operate in remote, uneven terrains. It enables safe equipment handling and faster project completion in energy and marine sectors. Growth in offshore wind farms and floating structures boosts demand for heavy-duty and corrosion-resistant cranes. OEMs can expand their portfolio by offering specialized cranes tailored to energy sector needs.

Market Segmentation Analysis:

By Product Type:

Truck mounted cranes lead the market due to their mobility, setup speed, and on-road travel capability. These cranes offer strong lifting performance and quick deployment, which suits short-duration projects. The Mobile Crane market benefits from truck mounted units in urban construction and utility maintenance where frequent relocation is needed. It supports crane rental companies that serve multiple sites with limited setup space. Trailer mounted cranes hold a smaller share, often used in temporary or emergency lifting tasks. Their detachable design and lower cost attract small contractors in utility or event infrastructure services. Crawler cranes dominate heavy-duty construction, oil and gas, and offshore wind projects. Their stability, high lifting capacity, and ability to work on rough terrain make them ideal for long-duration and critical infrastructure jobs.

- For instance, Zoomlion Heavy Industry Science & Technology Co., Ltd. manufactures the ZAT24000H, a 2,400-tonne all-terrain crane primarily designed for wind power construction.

By Application:

Construction holds the largest share in mobile crane usage, driven by growing demand for residential towers, commercial complexes, roads, and bridges. The Mobile Crane market aligns with rising investment in global construction and smart city developments. It supports lifting structural components, steel frames, and pre-cast elements on congested job sites. Industrial applications include equipment installation, plant maintenance, and logistics within sectors like cement, steel, petrochemicals, and warehousing. Crane operations in this segment require compact size, precision, and indoor lifting capacity. Utility applications such as power grid maintenance, telecom infrastructure, and water treatment plants also rely on mobile cranes. These projects often need cranes with extended reach, all-terrain support, and fast setup to minimize service disruption.

- For instance, Manitex International manufactures a range of boom truck cranes, including models with capacities up to 65 or 70 tons in its TC Series

Segments:

Based on Product Type:

- Truck Mounted Crane

- Trailer Mounted Crane

- Crawler Crane

Based on Application:

- Construction

- Industrial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 28.4% of the global Mobile Crane market in 2024, supported by strong infrastructure spending, energy sector investments, and fleet modernization. The United States dominates this regional share, with major deployments across highway construction, commercial real estate, and utility grid upgrades. Mobile cranes are in high demand across metropolitan areas for lifting HVAC systems, structural steel, and modular components. It also benefits from the rapid expansion of wind and solar energy projects, especially in Texas, California, and the Midwest. Canada contributes through urban development and mining operations, where crawler and truck-mounted cranes remain essential. The presence of leading crane rental operators and OEMs strengthens after-sales service networks across the region. Local government funding for bridge repair, public transit, and telecom infrastructure continues to support long-term fleet demand.

Europe

Europe held a market share of 24.7% in 2024, driven by emission regulations, green construction initiatives, and large infrastructure projects. Germany, France, and the UK lead in mobile crane adoption for residential, transport, and renewable energy projects. The Mobile Crane market benefits from EU-supported funding for wind farms, EV battery plants, and urban rail expansion. It supports demand for all-terrain and hybrid cranes that meet strict emission and noise standards. Italy and Spain are investing in road and metro upgrades, driving equipment usage in congested cities. Europe is also a key hub for crane manufacturing, with strong OEM presence and export capability. Fleet operators in this region focus on compact and modular cranes that allow quick deployment and precise lifting under tight spatial constraints.

Asia-Pacific

Asia-Pacific led the global market with the highest share of 34.2% in 2024, supported by massive infrastructure and industrial expansion. China, India, Japan, and Southeast Asian nations continue to invest in high-speed rail, airports, urban housing, and logistics corridors. The Mobile Crane market sees strong growth from both public and private sector megaprojects across the region. China remains the largest contributor with widespread deployment in steel plants, ports, and new energy construction. India accelerates mobile crane adoption across expressways, smart cities, and renewable parks. Japan emphasizes earthquake-resilient infrastructure and efficient lifting technologies. Southeast Asia expands usage in bridges, tunnels, and manufacturing clusters. Regional players often offer cost-effective crane models tailored to dense urban zones and remote terrains.

Latin America

Latin America represented 6.8% of the global Mobile Crane market in 2024, with moderate but growing demand. Brazil and Mexico are key contributors, investing in oil and gas, mining, and industrial infrastructure. Mobile cranes are used for refinery upgrades, heavy plant installations, and steel structure assembly. It supports long-term projects in electric utilities and transportation corridors backed by international funding. Construction growth in Chile, Peru, and Colombia also creates new crane rental opportunities. Market growth is challenged by fluctuating economic conditions and limited local production. OEMs and rental firms continue to expand operations through joint ventures and service hubs.

Middle East & Africa

Middle East & Africa accounted for 5.9% of the Mobile Crane market in 2024, with demand led by energy, urban construction, and infrastructure renewal. Gulf countries invest in smart cities, stadiums, tourism infrastructure, and solar power plants. The Mobile Crane market benefits from high-rise projects in Saudi Arabia and UAE, including NEOM and Expo-linked developments. Africa sees crane adoption across dam construction, road networks, and energy access programs. South Africa, Nigeria, and Egypt remain the largest crane markets on the continent. Growth is supported by foreign investment and government-led modernization plans. The region continues to shift toward mobile equipment that meets harsh climate and terrain conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sarens NV

- Manitex International

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Sumitomo Heavy Industries, Ltd.

- KOBELCO Construction Machinery Co., Ltd.

- XCMG GROUP

- PALFINGER AG

- Bauer AG

- Tadano Ltd.

- SANY HEAVY INDUSTRY INDIA PRIVATE LIMITED

- Terex Corporation

- KATO WORKS CO., LTD.

- LiuGong Machinery Co., Ltd.

- Liebherr-International AG

Competitive Analysis

The Mobile Crane market remains highly competitive, with key players including Sarens NV, Tadano Ltd., Liebherr-International AG, Terex Corporation, XCMG GROUP, Manitex International, Zoomlion Heavy Industry Science & Technology Co., Ltd., and PALFINGER AG. These companies maintain strong global presence through continuous innovation, diversified product lines, and strategic distribution networks. They invest heavily in R&D to develop cranes with higher lifting capacities, improved fuel efficiency, and digital control systems. Several players focus on electric and hybrid models to meet evolving emission standards and urban project needs. Manufacturers actively expand production capacity and enhance service networks across Asia-Pacific, Europe, and North America to meet rising regional demand. OEMs offer telematics, remote diagnostics, and modular configurations to support varied end-user requirements. Strategic collaborations with rental companies and construction firms improve product access and fleet visibility. Players differentiate by providing tailored crane solutions for energy, construction, and industrial sectors. Aftermarket services, financing options, and operator training programs further strengthen brand loyalty. The competitive landscape continues to evolve as companies shift toward sustainable lifting solutions, digital integration, and market-specific customization. This focus on adaptability, performance, and regulatory compliance positions leading firms to maintain strong market share across high-growth regions.

Recent Developments

- In 2025, PALFINGER unveiled the Generation 3 Urban Range recycling cranes prototype with HT 18 TEC hookloader, new TEC aerial work platforms, and the PK 880 TEC loader crane with smart assistance systems. The company aims for strong revenue growth in 2025 with new product launches planned

- In 2025, Sarens introduced the fully electric, zero-emissions SGC-170 super-heavy lift crane and supported key NASA projects such as Mobile Launcher 2 at Kennedy Space Center. Sarens also planned a mobile field service app launch in 2025

- In 2023, Liebherr introduced several innovations including the LTC1050-3.1E hybrid compact crane and LR1700-1.0W narrow track crawler crane, expanded digital solutions (MyLiebherr), and focused on sustainability with battery electric prototypes and carbon emission reductions at its Ehingen site.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mobile crane demand will grow with rising infrastructure, energy, and urban development projects worldwide.

- Rental services will expand across emerging markets, supporting small and mid-sized contractor access.

- Electric and hybrid cranes will gain traction due to emission regulations and noise restrictions.

- Asia-Pacific will continue to lead in volume, driven by large-scale construction and manufacturing expansion.

- Telematics and digital monitoring features will become standard for fleet management and safety.

- OEMs will focus on compact, all-terrain, and modular cranes to support urban and industrial use.

- Customization for specific applications in wind energy, petrochemical, and utility sectors will increase.

- Labor shortage will drive demand for automated features and remote operation systems in crane fleets.

- Public-private partnerships will play a key role in boosting crane deployment across large infrastructure projects.

- Regulatory compliance and operator training will remain central to safe crane operation and global trade.