Stringent Emissions Regulations and Urban Clean Air Policies Drive Market Growth

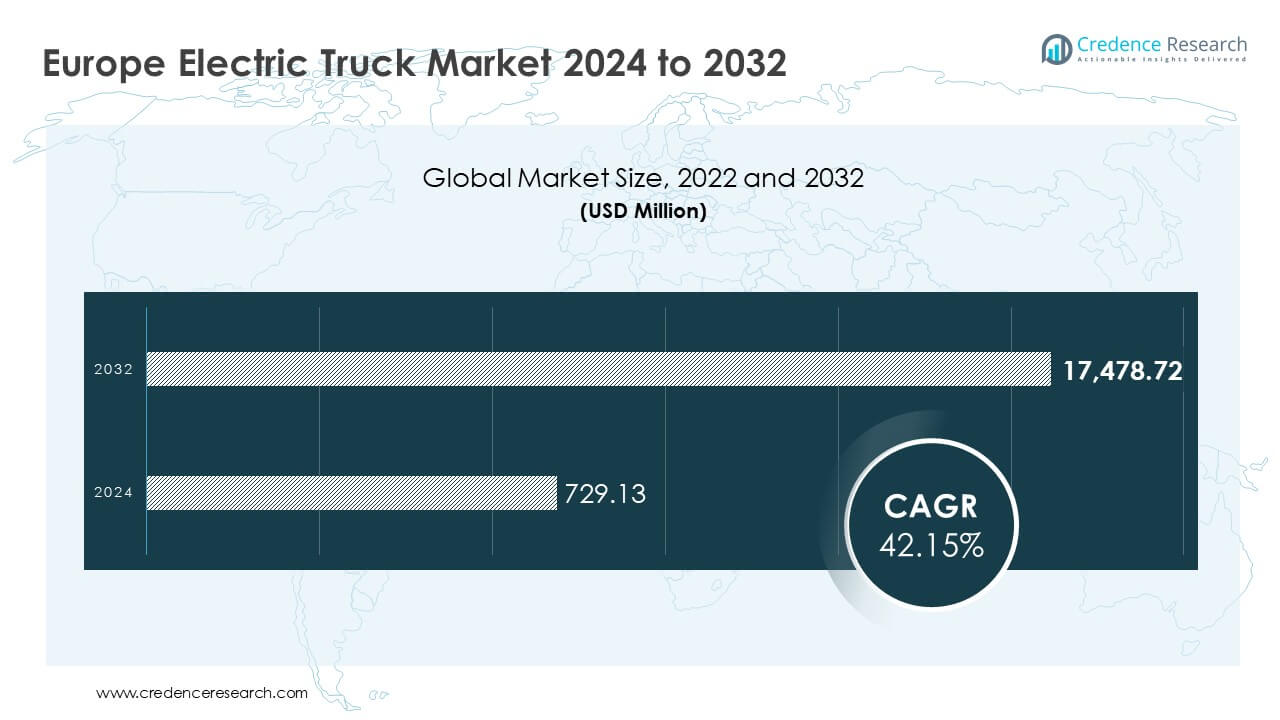

According to a new market report published by Credence Research, “Europe Electric Truck Market By Propulsion Type (BEV, PHEV, FCEV); By Truck Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks); By End User (Last-Mile Delivery, Long Haul Transportation, Refuse Services, Field Services, Distribution Services); By Range (Up to 200 Miles, Above 200 Miles); By Battery Capacity (Less Than 50 kWh, 50–250 kWh, Above 250 kWh); By Region – Growth, Share, Opportunities & Competitive Analysis, 2024 – 2032”, the Europe electric truck market was valued at USD 729.13 million in 2023 and is expected to reach USD 17,478.72 million by 2032, growing at a CAGR of 42.15% during the forecast period.

Market Overview

The European electric truck market is undergoing a transformative shift, driven by regulatory mandates, operational efficiency, and advancing vehicle technology. Adoption is accelerating among both public and private fleet operators as electric trucks offer a practical route to reducing transportation-related emissions while supporting total cost of ownership advantages.

Western Europe accounts for approximately 70% of the market share, with countries like the Netherlands, Sweden, and Norway leading in early adoption. The presence of established OEMs and charging infrastructure further strengthens market penetration in this sub-region.

Browse market data figures spread through 220+ pages and an in-depth TOC on “Europe Electric Truck Market”

EU CO₂ Emission Standards Fuel Electrification

Strict EU-wide CO₂ emission regulations remain the central growth driver in the Europe electric truck market. Fleet operators and OEMs are under increasing pressure to reduce emissions in line with 2030 and 2035 climate targets. The European Commission mandates a 45% reduction in truck CO₂ emissions by 2030 compared to 2019 levels.

To comply, manufacturers are expanding their zero-emission truck portfolios, with several models entering the market across light, medium, and heavy-duty segments. Electric trucks, offering zero tailpipe emissions, provide a direct path for compliance. As regulatory enforcement intensifies, fleet operators are aligning capital investments toward electric vehicle procurement.

Government-led low-emission vehicle (LEV) incentive schemes in key countries, including Germany, France, and the Netherlands, further support electric truck purchases through subsidies and tax benefits. These initiatives reduce the upfront cost burden and promote large-scale fleet transitions.

Advancements in Charging and Battery Technology

Technology innovation remains a key trend shaping adoption. Higher battery energy densities now support longer driving ranges, enabling electric trucks to serve not only urban delivery routes but also regional logistics operations.

Charging times are also improving. Fast-charging and ultra-fast-charging technologies reduce fleet downtime, which is critical for logistics operators. Battery-swapping pilots are in early deployment across several European markets, aiming to optimize turnaround time for freight carriers operating on tight schedules.

OEMs are embedding telematics and digital fleet management systems to track vehicle health, charging status, and route optimization in real time. This digital integration helps fleets manage power consumption, maintenance, and delivery efficiency.

Charging infrastructure is expanding through multi-stakeholder partnerships. Automakers, energy utilities, and national governments are jointly investing in corridor-based charging hubs, particularly on major freight routes such as the TEN-T network. These investments improve charging availability and reduce range-related uncertainty.

Hydrogen fuel cell electric trucks are emerging in parallel as a viable solution for long-haul routes, supported by ongoing infrastructure planning and fuel cell system integration by key players.

Charging Infrastructure and Range Limitations

Despite progress, infrastructure development remains insufficient for large-scale heavy-duty fleet deployment. Long-haul operations require high-capacity chargers located along inter-urban highways. Current availability of such infrastructure is limited, contributing to range anxiety among potential buyers.

This is particularly challenging for freight companies operating across borders where charging standards, access rights, and network coverage vary. Lack of infrastructure standardization limits operational flexibility for fleet operators and delays regional deployment.

High upfront vehicle costs also present a challenge. Battery electric trucks require significant capital investment, especially in models with high-capacity battery packs suitable for regional and long-haul use. While operating costs are lower over time, initial procurement remains a barrier for small and mid-sized fleets.

Battery replacement costs over the vehicle lifecycle further contribute to total cost of ownership considerations. Without predictable residual value or second-life battery applications, fleet managers remain cautious in large-scale investments.

Market Segmentation

By Propulsion Type

- BEV (Battery Electric Vehicle)

- PHEV (Plug-in Hybrid Electric Vehicle)

- FCEV (Fuel Cell Electric Vehicle)

By Truck Type

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

By End User

- Last-Mile Delivery

- Long Haul Transportation

- Refuse Services

- Field Services

- Distribution Services

By Range

- Up to 200 Miles

- Above 200 Miles

By Battery Capacity

- Less Than 50 kWh

- 50–250 kWh

- Above 250 kWh

By Country

- Germany

- United Kingdom

- Italy

- France

- Spain

- Belgium

- Russia

- The Netherlands

- Rest of Europe

Competitive Landscape

The European electric truck market is highly consolidated with key players expanding their regional presence and product lines. Partnerships, fleet trials, and technological innovation remain core strategies.

Key players:

- AB Volvo

- Volta Trucks

- Daimler Trucks (Mercedes Benz Group AG)

- DAF Trucks NV (PACCAR Inc.)

- E-Trucks Europe BE

- Renault Trucks

- Tesla Motors Inc.

- Einride AB

- Tevva Motors Limited

- BYD Co. Ltd

- Scania AG

- MAN SE (Volkswagen AG)

- IVECO SpA

- E-Force One AG

AB Volvo and Daimler Trucks are early leaders in medium and heavy-duty electric truck deployment. Tesla and BYD are entering the market with competitive long-range offerings. Tevva, Einride, and Volta Trucks provide modular and purpose-built designs tailored to urban logistics.

OEMs are investing in local assembly and component partnerships to comply with regional sourcing rules and reduce manufacturing lead times. Collaborations with logistics operators and government agencies are expanding deployment in pilot zones and low-emission urban areas.

Regional Insights

Western Europe dominates the market with mature infrastructure and supportive national policies. The region benefits from established OEM headquarters and early deployment programs.

Volvo Trucks held a 42% market share in 2021 across Sweden and Norway, signaling strong OEM-fleet collaboration and alignment with national decarbonization targets.

Countries including the Netherlands and Germany are investing in heavy-duty truck charging infrastructure through national road freight electrification programs. United Kingdom’s zero-emission vehicle mandates for new trucks after 2035 will further accelerate deployment.

Eastern and Southern Europe will see delayed but steady adoption as infrastructure and financial incentives scale up.

Future Outlook

Europe’s electric truck market is positioned for sustained high growth driven by regulatory enforcement, cost efficiency, and maturing technology. Government support, especially through green transport subsidies and infrastructure development, will be essential in overcoming deployment challenges.

Innovations in solid-state batteries, modular charging systems, and fleet-as-a-service (FaaS) models will broaden market participation. As OEMs expand their offerings and fleet managers prioritize compliance and cost optimization, Europe is set to become a global benchmark for electric freight transportation.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com