Market Overview:

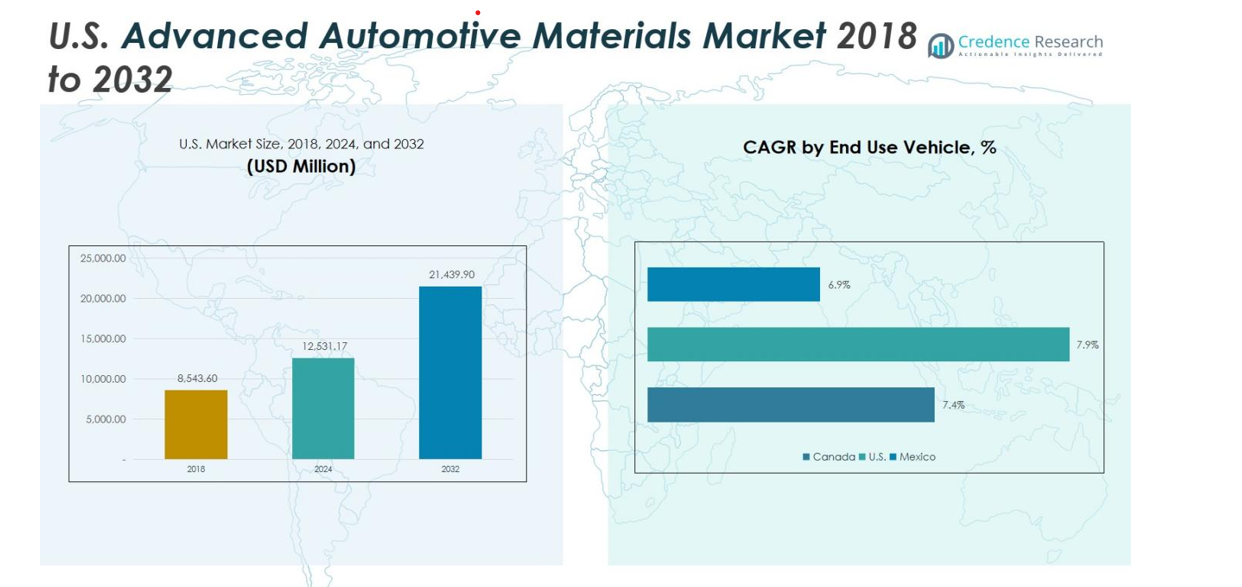

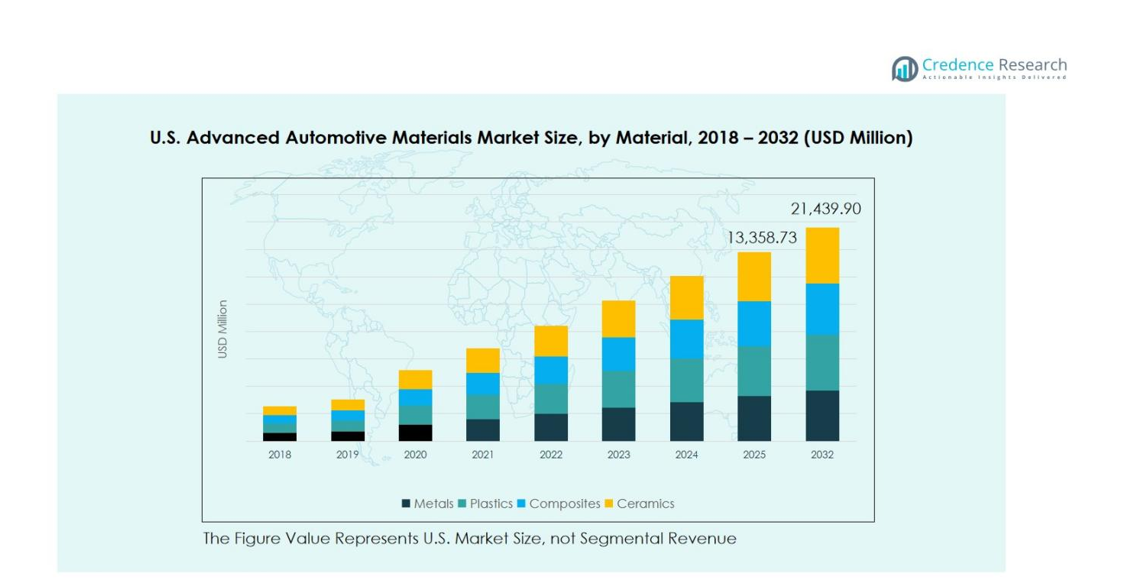

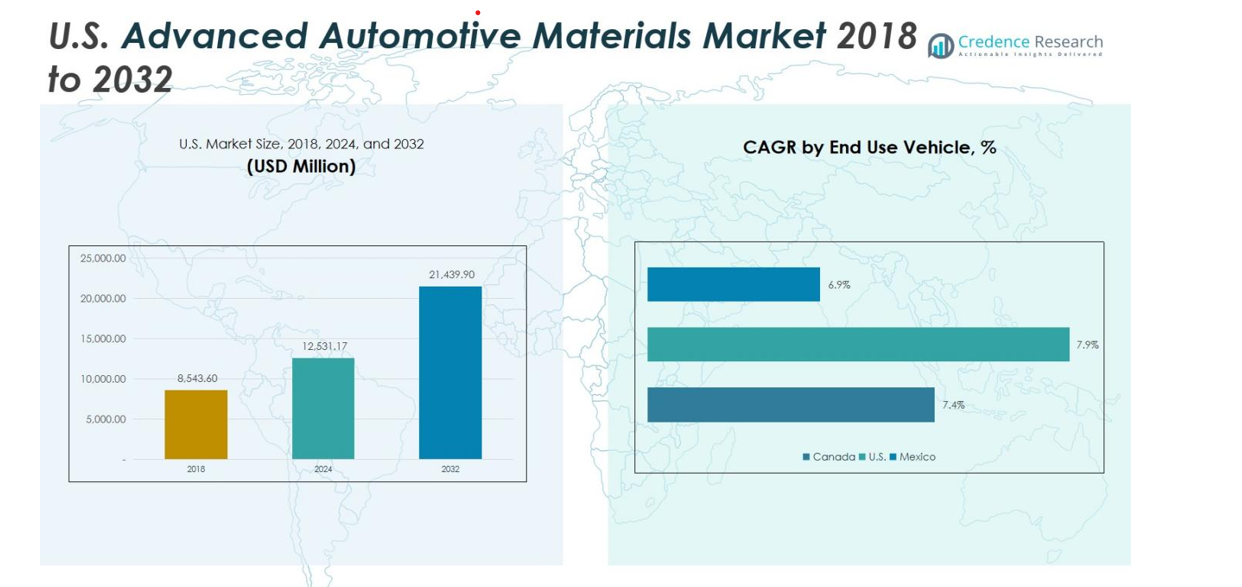

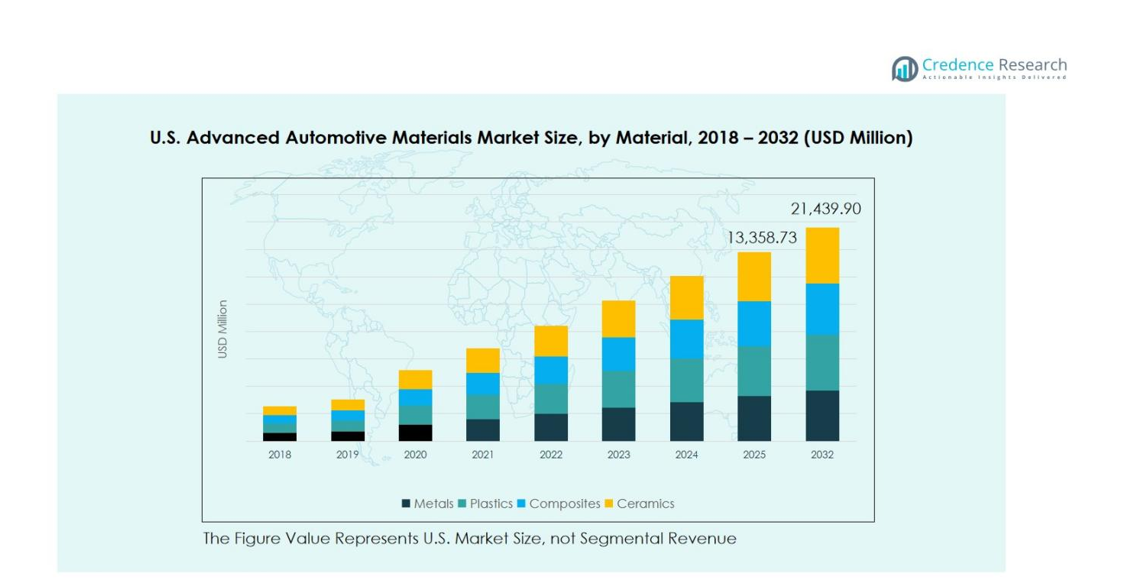

U.S. Advanced Automotive Materials Market size was valued at USD 8,543.60 million in 2018 and is projected to reach USD 12,531.17 million in 2024 and USD 21,439.90 million by 2032, growing at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Advanced Automotive Materials Market Size 2024 |

USD 12,531.17 million |

| U.S. Advanced Automotive Materials Market, CAGR |

7.5% |

| U.S. Advanced Automotive Materials Market Size 2032 |

USD 21,439.90 million |

The U.S. Advanced Automotive Materials Market is highly competitive, led by key players such as Axiom Materials, Toray Industries, DuPont de Nemours, Novelis, Wolverine Advanced Materials, Exxon Mobil, Mitsubishi Chemical, ArcelorMittal, and 3M Company. These companies focus on innovation, lightweight metals, high-performance composites, and advanced plastics to meet growing demand from passenger cars, commercial vehicles, and electric mobility segments. Strategic investments in R&D, partnerships with OEMs, and acquisitions help strengthen their market positions. Regionally, the South dominates the market with a 32% share, followed by the Midwest at 28%, the West at 22%, and the Northeast at 18%. Strong automotive manufacturing hubs, EV production facilities, and supportive infrastructure in these regions reinforce the adoption of advanced materials, ensuring sustained growth and technological advancement across the U.S. automotive sector.

Market Insights

- The U.S. Advanced Automotive Materials Market was valued at USD 12,531.17 million in 2024 and is projected to reach USD 21,439.90 million by 2032, growing at a CAGR of 7.5%.

- Growth is driven by stringent fuel efficiency and emission regulations, along with rising demand for lightweight and electric vehicles, encouraging the adoption of metals, composites, and advanced plastics.

- Key trends include increasing use of smart and functional materials, lightweight composites, and plastics for structural, body, and interior components to improve performance, safety, and sustainability.

- The market is highly competitive, led by Axiom Materials, Toray Industries, DuPont de Nemours, Novelis, Wolverine Advanced Materials, Exxon Mobil, Mitsubishi Chemical, ArcelorMittal, and 3M Company, focusing on innovation, partnerships, and strategic expansions.

- Regionally, the South leads with a 32% share, followed by the Midwest at 28%, the West at 22%, and the Northeast at 18%, with metals dominating the material segment at 42% and passenger cars accounting for 55% of end-use consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Metals dominate the U.S. advanced automotive materials market, accounting for 42% of the material segment share. High-strength steels and aluminum alloys are increasingly preferred for reducing vehicle weight while enhancing structural integrity. The demand is driven by stringent fuel efficiency regulations and the shift toward lightweight vehicles. Plastics hold the second-largest share at around 28%, supported by growing use in interior components and body panels for cost-effective weight reduction. Composites and ceramics contribute the remaining share, benefiting from applications in high-performance parts and thermal management systems, with composites increasingly used in structural and body components.

- For instance, advanced high-strength steel (AHSS) can reduce component weight by up to 25%, improving crash performance while maintaining manufacturing compatibility, as supported by collaborations between the U.S. Department of Energy, Pacific Northwest National Laboratory, and automakers like Ford and General Motors.

By Application

Structural components lead the application segment with a market share of 40%, driven by the need for lightweight yet durable frames and chassis structures to comply with fuel economy standards. Body panels follow at 30%, supported by aluminum and composite integration for weight reduction and corrosion resistance. Interior components represent about 20%, with plastics and composites used for dashboards, consoles, and seating structures, enhancing aesthetics and durability. Electrical components hold the remaining 10%, boosted by the adoption of lightweight materials for battery housings, connectors, and EV-specific electrical modules, driven by electrification trends.

- For instance, Tesla utilizes large aluminum die castings for its Model Y rear underbody, replacing multiple parts with a single lightweight, stiff component to reduce weight and complexity.

By End Use Vehicles

Passenger cars represent the largest end-use segment, accounting for 55% of the market share, fueled by rising consumer demand for lightweight, fuel-efficient vehicles. Commercial vehicles hold a 30% share, driven by regulatory pressures to reduce emissions and operational costs through weight reduction. Two-wheelers account for the remaining 15%, with advanced plastics and composites increasingly used to improve durability, safety, and fuel efficiency. Growth in all segments is underpinned by regulatory mandates, consumer preferences for performance, and ongoing innovations in materials technology across the automotive sector.

Key Growth Drivers

Stringent Fuel Efficiency and Emission Regulations

Regulatory mandates for fuel efficiency and reduced vehicular emissions are a major growth driver in the U.S. advanced automotive materials market. Automakers increasingly adopt lightweight metals, composites, and plastics to meet Corporate Average Fuel Economy (CAFE) standards and emission targets. These materials enable reduced vehicle weight without compromising safety, improving overall fuel performance. Government incentives for electric and hybrid vehicles further accelerate material adoption, creating a favorable environment for manufacturers to innovate and integrate advanced materials across structural, body, and interior components.

- For instance, BMW has extensively used carbon fiber-reinforced plastic (CFRP) in the passenger cell of its i3 and i8 models, reducing overall vehicle weight by approximately 250–350 pounds compared to traditional steel structures, which directly enhances energy efficiency and extends electric range.

Rising Demand for Electric and Hybrid Vehicles

The growing popularity of electric and hybrid vehicles is propelling the demand for advanced automotive materials. Lightweight metals, high-strength composites, and specialized plastics are critical in battery enclosures, chassis, and structural components to maximize range and efficiency. The market benefits from OEM investments in EV platforms and new vehicle launches, which require advanced materials to offset battery weight. Increasing consumer preference for sustainable and energy-efficient mobility solutions reinforces material adoption, driving innovation in composites, ceramics, and plastics for enhanced performance, durability, and safety.

- For instance, the Toyota Mirai utilizes high-pressure hydrogen tanks constructed with a three-layer structure of carbon fiber-reinforced plastic, developed in collaboration with Toyoda Gosei, to store hydrogen at 70 MPa (10,000 psi).

Focus on Vehicle Lightweighting and Performance

Automakers’ emphasis on vehicle lightweighting and performance is fueling the adoption of advanced materials. Reducing overall weight enhances fuel efficiency, driving dynamics, and payload capacity while maintaining safety standards. Materials such as aluminum alloys, high-strength steels, and carbon fiber composites are increasingly incorporated into body panels, structural components, and interiors. Innovations in material processing and manufacturing techniques further support cost-effective integration. This focus creates a continuous demand pipeline for lightweight metals, composites, and plastics, benefiting both OEMs and material suppliers with long-term growth opportunities.

Key Trends and Opportunities

Integration of Smart and Functional Materials

Smart and functional materials are emerging as a key trend and opportunity in the U.S. automotive sector. Advanced composites, self-healing plastics, and high-performance ceramics are integrated into components to enhance thermal management, vibration damping, and structural integrity. Electrification and autonomous driving systems also demand materials with embedded sensors and conductive properties. This trend opens new avenues for innovation and premium vehicle differentiation. Manufacturers leveraging these materials can achieve better energy efficiency, safety, and user experience, positioning themselves advantageously in a competitive automotive landscape.

- For instance, General Motors developed shape memory alloys that adjust airflow via louver systems for better engine efficiency and incorporated conducting polymer sensors in smart seats to enhance comfort.

Expansion of Lightweight Composites and Plastics

The increasing use of lightweight composites and plastics represents a significant growth opportunity. These materials reduce vehicle weight while offering design flexibility, corrosion resistance, and cost efficiency. OEMs are exploring carbon fiber-reinforced composites, thermoplastics, and hybrid materials for structural and interior applications. Advancements in manufacturing techniques, such as injection molding and additive manufacturing, enable wider adoption in passenger cars, commercial vehicles, and two-wheelers. This trend aligns with consumer demand for fuel efficiency, sustainable materials, and high-performance designs, driving consistent growth across multiple automotive segments.

- For instance, BMW incorporates carbon fiber reinforced polymer (CFRP) in key vehicle components like the passenger cell of the BMW i3 and roofs of its M models, enhancing lightweight construction and fuel efficiency.

Key Challenges

High Costs of Advanced Materials

The high cost of advanced automotive materials poses a key challenge for widespread adoption. Metals like aluminum and titanium, along with carbon-fiber composites and specialized ceramics, remain expensive compared to conventional materials, impacting production budgets. OEMs face a trade-off between material performance and cost-effectiveness, particularly in price-sensitive vehicle segments. While technological innovations reduce some costs over time, the initial investment remains a barrier for small-scale manufacturers and aftermarket applications, potentially slowing adoption rates despite strong regulatory and consumer-driven demand.

Complex Manufacturing and Supply Chain Requirements

Advanced materials often require specialized processing techniques, equipment, and supply chain integration, creating a significant market challenge. Composites, high-strength alloys, and ceramics demand precise manufacturing controls, skilled labor, and extended lead times. Delays or disruptions in raw material supply, particularly for carbon fiber or rare metals, can impact production schedules and increase costs. Automakers must invest in R&D, certification, and process optimization to ensure consistent quality. These complexities hinder rapid deployment, especially for new entrants and smaller players, limiting short-term market expansion despite growing demand.

Regional Analysis

Northeast

The Northeast region holds a market share of 18% in the U.S. advanced automotive materials market, driven by the presence of several automotive manufacturing hubs and R&D centers. Demand is primarily fueled by passenger cars and commercial vehicles, with OEMs increasingly adopting lightweight metals, plastics, and composites to meet fuel efficiency and emission standards. High investments in EV production and advanced manufacturing technologies contribute to regional growth. Additionally, collaborations between material suppliers and automakers on innovative composites and high-performance plastics further strengthen the Northeast’s position, making it a key contributor to the overall market expansion.

Midwest

The Midwest commands a market share of 28%, supported by a strong automotive manufacturing base, including major OEM plants and tier-1 suppliers. Structural components and body panels manufactured with high-strength steels, aluminum, and composites dominate material consumption. The region benefits from continuous investments in advanced material adoption for lightweighting and performance improvement. Growing demand for electric and hybrid commercial vehicles further drives market expansion. Midwest manufacturers leverage proximity to raw material suppliers and advanced logistics networks to optimize production efficiency, solidifying the region’s role as a major hub in the U.S. advanced automotive materials market.

South

The Southern region accounts for a market share of 32%, making it the largest contributor to the U.S. advanced automotive materials market. Rapid industrialization, favorable manufacturing policies, and a concentration of automotive assembly plants drive strong demand for metals, plastics, and composites. Passenger cars and commercial vehicles dominate consumption, with a growing focus on lightweight structural components and interior applications. The region benefits from investments in EV production facilities and collaborations with material suppliers to integrate advanced ceramics and composites. Strong infrastructure and logistics support enable efficient supply chain management, sustaining long-term market growth in the South.

West

The Western region holds a market share of 22%, driven by the increasing presence of electric vehicle manufacturers, technology-driven automotive startups, and innovation centers. Advanced composites, lightweight metals, and functional plastics see high adoption in structural, body, and electrical components. Regulatory pressure for emission reduction and fuel efficiency, combined with consumer demand for sustainable and high-performance vehicles, supports material utilization. The region also emphasizes R&D for smart and functional materials integration, providing opportunities for market expansion. Strong collaborations between OEMs and material technology providers make the West a crucial region for innovation-driven growth in advanced automotive materials.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End Use Vehicles

- Passenger Cars

- Commercial Vehicles

- Two-wheelers

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. advanced automotive materials market includes key players such as Axiom Materials, Toray Industries, DuPont de Nemours, Novelis, Wolverine Advanced Materials, Exxon Mobil, Mitsubishi Chemical, ArcelorMittal, and 3M Company. The market is highly competitive, driven by innovation, product diversification, and strategic partnerships. Companies focus on developing lightweight metals, high-performance composites, and advanced plastics to meet growing demand from passenger cars, commercial vehicles, and electric mobility segments. Investment in R&D, collaborations with OEMs, and acquisitions are common strategies to enhance product portfolios and expand market presence. Additionally, firms are exploring sustainable materials and smart components to comply with stringent emission regulations and fuel efficiency standards. Regional manufacturing capabilities, supply chain efficiency, and advanced technological adoption further differentiate competitive positioning, making innovation and strategic alliances critical for long-term success in the U.S. market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2023, Universal Matter Inc. completed the acquisition of Applied Graphene Materials’ main operating businesses in the UK and U.S. for $1.3 million.

- In August 2023, four leading automotive companies Collision Services, Auto Body Toolmart, I/D/E/A, and Sid Savage merged to form US Auto Supply. This consolidation aims to streamline operations and strengthen their position in the automotive supply market, reflecting the industry’s trend toward strategic partnerships and collaborative growth.

- In November 2024, American Industrial Acquisition Corporation (AIAC) acquired KI USA Corporation, a manufacturer of medium-sized metal stamped and welded assemblies with electrodeposition coating.

- In November 2024, Pangea launched two new advanced leather materials designed for the automotive industry. These materials are nearly 90% bio-based and help divert waste from landfills, significantly reducing environmental impact.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicles and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing as automakers prioritize lightweight materials for fuel efficiency and emission compliance.

- Demand for high-strength metals and aluminum alloys will increase across passenger cars and commercial vehicles.

- Composites and advanced plastics will see rising adoption in structural and interior components.

- Electrification of vehicles will drive growth in materials for battery enclosures, electrical components, and thermal management systems.

- Regulations on emissions and corporate fuel economy standards will remain a key growth driver.

- Smart and functional materials will gain traction, enabling enhanced safety, performance, and vehicle connectivity.

- Expansion of EV manufacturing hubs will create regional growth opportunities, especially in the West and South.

- Lightweighting initiatives will drive innovation in body panels and chassis components.

- OEMs will increasingly collaborate with material suppliers to optimize costs and production efficiency.

- Sustainable and recyclable materials will become a focus, aligning with environmental goals and consumer preferences.