Market Overview

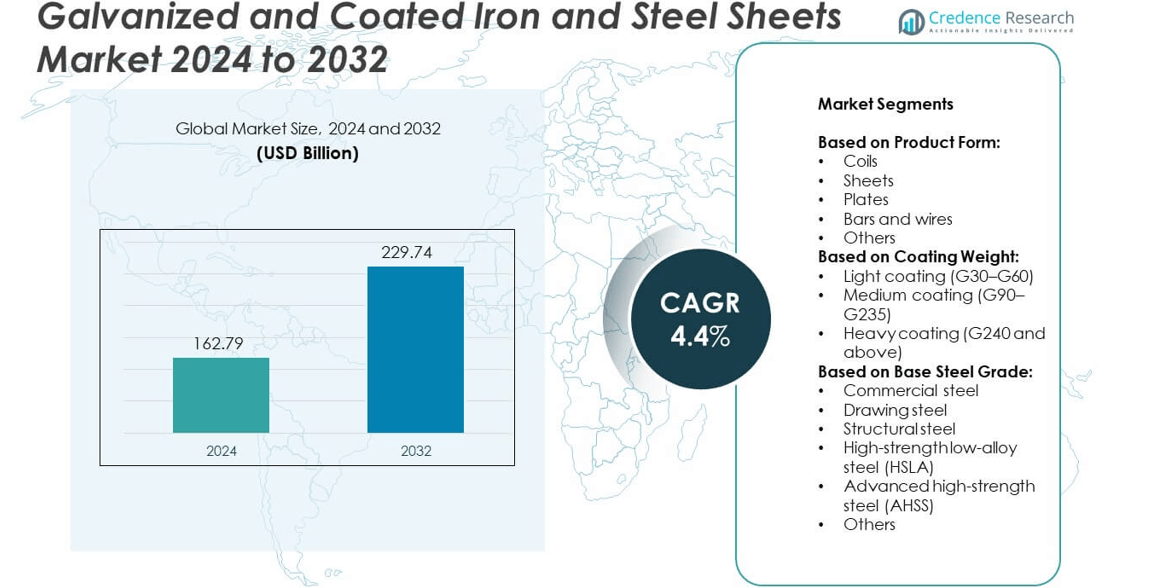

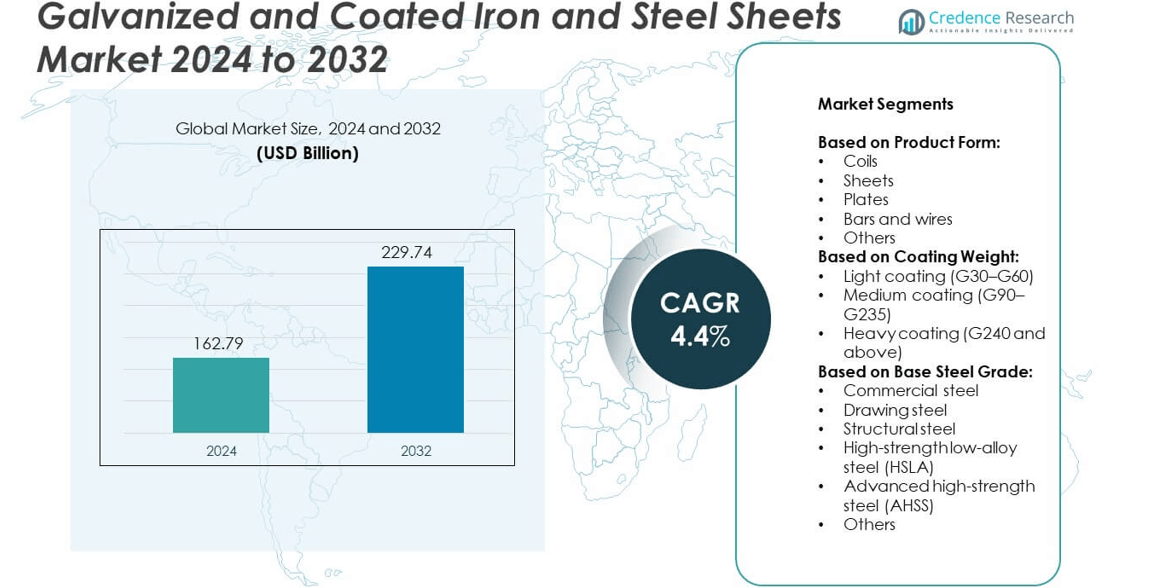

The Galvanized and Coated Iron and Steel Sheets market size was valued at USD 162.79 Billion in 2024 and is anticipated to reach USD 229.74 Billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Galvanized and Coated Iron and Steel Sheets Market Size 2024 |

USD 162.79 Billion |

| Galvanized and Coated Iron and Steel Sheets Market, CAGR |

4.4% |

| Galvanized and Coated Iron and Steel Sheets Market Size 2032 |

USD 229.74 Billion |

The Galvanized and Coated Iron and Steel Sheets market is driven by rising infrastructure development, expanding automotive production, and increasing demand for durable consumer goods. It benefits from strong adoption in construction projects requiring corrosion-resistant materials and in vehicles where lightweight yet strong sheets improve efficiency and safety. Growing urbanization across emerging economies fuels consumption, while sustainability regulations push adoption of eco-friendly coatings. Advances in digital manufacturing and smart processes further shape market trends, enhancing product quality and operational efficiency.

Asia Pacific leads demand for the Galvanized and Coated Iron and Steel Sheets market, supported by rapid urbanization, large infrastructure projects, and high automotive production. North America follows with strong adoption in construction and advanced manufacturing, while Europe emphasizes sustainable building materials and regulatory compliance. Latin America and the Middle East & Africa show steady growth through industrial and housing expansion. Key players driving this market include ArcelorMittal, Nippon Steel, Tata Steel, Posco, and Baosteel, each focusing on innovation and global expansion.

Market Insights

- The Galvanized and Coated Iron and Steel Sheets market was valued at USD 162.79 Billion in 2024 and is projected to reach USD 229.74 Billion by 2032, growing at a CAGR of 4.4%.

- Strong demand from construction and infrastructure sectors drives adoption of coated steel sheets for durability and long service life.

- Trends highlight advanced coating technologies, lightweight high-strength steel grades, and eco-friendly manufacturing practices gaining wide acceptance.

- Competition is shaped by global leaders such as ArcelorMittal, Tata Steel, Nippon Steel, Posco, Baosteel, and JFE Steel with strategies focused on capacity expansion and product innovation.

- The market faces restraints from raw material price volatility, high production costs, and stringent regulatory compliance in coating processes.

- North America and Europe demonstrate steady demand driven by automotive and construction industries, while Latin America and the Middle East & Africa grow through housing and infrastructure development.

- Asia Pacific dominates growth, supported by rapid urbanization, rising automotive output, and strong industrial expansion in China, India, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction and Infrastructure Projects

The Galvanized and Coated Iron and Steel Sheets market benefits strongly from rapid urbanization and expanding infrastructure investments. Governments prioritize large-scale housing, road networks, and commercial projects that depend on durable coated steel products. Galvanized sheets offer corrosion resistance and long service life, making them highly suitable for bridges, roofing, and structural applications. It ensures greater adoption across both developed and developing economies where long-term resilience is valued. Major construction contractors prefer coated steel for cost efficiency and compliance with modern building codes. The growing pipeline of smart city projects further strengthens demand for these materials.

- For instance,Nippon Steel supplies galvanized steel sheets for infrastructure and construction projects, including expressways and urban development, within Japan. The company produces various galvanized steel products that conform to quality standards like JIS G 3302. This standard specifies technical requirements for hot-dip zinc-coated steel sheets with coating masses ranging from 60 to 600 grams per square meter and thicknesses from 0.25 mm to 3.2 mm

Growing Use in Automotive and Transportation Industries

Automotive manufacturers increasingly adopt galvanized and coated sheets for body panels, chassis, and underbody protection. The Galvanized and Coated Iron and Steel Sheets market supports lightweight designs while ensuring safety standards against corrosion and wear. It plays a crucial role in extending vehicle lifespans and meeting stricter durability requirements. Electric vehicle producers also rely on coated steel for battery enclosures and support structures. Rising automotive production in Asia Pacific boosts the volume of coated sheets in global supply chains. Transport infrastructure, including railways and shipping containers, also drives consistent usage of galvanized materials.

- For instance, In April 2025, Hyundai Motor Group and POSCO signed a comprehensive cooperation agreement on steel and battery materials, which includes an investment by POSCO in Hyundai Steel’s U.S. electric arc furnace (EAF) integrated steel mill project. The EAF plant is projected to have an annual production capacity of 2.7 million tons and is scheduled to start operations in 2029.

Expansion in Consumer Durables and Industrial Applications

The Galvanized and Coated Iron and Steel Sheets market gains traction from rising consumer durable production. Appliances such as washing machines, refrigerators, and air conditioners depend on coated steel for enhanced longevity. It provides resistance to moisture, temperature fluctuations, and daily wear, ensuring better product reliability. Industrial equipment manufacturers incorporate galvanized sheets for protective casings, storage systems, and factory components. Growing investments in manufacturing hubs across emerging economies expand opportunities for coated sheet producers. Household demand and industrial expansion create a steady growth cycle for this segment.

Support from Sustainability and Regulatory Compliance Standards

Sustainability mandates and regulatory compliance frameworks are driving innovation in coated steel production. The Galvanized and Coated Iron and Steel Sheets market aligns with eco-friendly manufacturing by reducing harmful emissions and optimizing coating technologies. It helps industries meet energy efficiency targets and green building certifications. Advanced coatings with reduced heavy metal content address global environmental concerns. International trade regulations encourage the use of standardized and compliant steel products in construction and industrial supply chains. Regulatory focus on sustainable infrastructure further accelerates adoption of galvanized and coated steel sheets worldwide.

Market Trends

Shift Toward Advanced Coating Technologies for Enhanced Performance

The Galvanized and Coated Iron and Steel Sheets market is experiencing strong demand for advanced coatings that provide improved resistance to corrosion and abrasion. Manufacturers invest in technologies that enhance surface uniformity and durability across industrial and commercial applications. It allows end-users to extend product lifecycles and reduce long-term maintenance costs. Demand for high-performance coatings is rising in construction, automotive, and heavy machinery sectors. Continuous research supports the development of eco-friendly and cost-efficient alternatives. This trend strengthens the market’s ability to adapt to global quality standards.

- For instance, JFE’s coated steel sheets, including galvanized sheets, are used for a wide range of applications such as automotive parts, construction, and containers. The company is active in the Southeast Asian market, where the total steel demand in the six major ASEAN countries (ASEAN-6) was approximately 73.5 million tonnes in 2023, representing a 1.9% decrease from the previous year.

Integration of Digitalization and Smart Manufacturing Practices

Digitalization plays an important role in reshaping production processes for galvanized and coated sheets. The Galvanized and Coated Iron and Steel Sheets market adapts to Industry 4.0 methods, including automated inspection and predictive quality control. It improves consistency, reduces defects, and ensures greater operational efficiency for manufacturers. Smart manufacturing enables traceability, helping companies meet regulatory requirements and customer expectations. Adoption of advanced monitoring systems also reduces energy consumption during the coating process. The use of connected technologies continues to grow in large-scale production facilities worldwide.

- For instance, in 2023, ArcelorMittal announced several low-carbon initiatives in Europe, including at its Ghent plant in Belgium, where its Steelanol facility achieved the first industrial-scale production of ethanol from captured steel mill gases in November 2023. This plant has a capacity to produce 80 million liters of ethanol per year

Increasing Focus on Lightweight Materials in Automotive Applications

The automotive sector is driving a trend toward lightweight yet durable coated steel products. The Galvanized and Coated Iron and Steel Sheets market supports this demand by offering thinner yet stronger sheet options. It helps automakers achieve better fuel efficiency and comply with emission reduction targets. Electric vehicle development also contributes, with coated sheets used for structural integrity and thermal protection. Rising production volumes in Asia Pacific encourage further adoption of lightweight materials. Automotive suppliers continue to expand capacity for coated steel products tailored to this segment.

Sustainability and Recycling Practices in Steel Supply Chains

Sustainability initiatives influence both production and consumption patterns in the coated steel industry. The Galvanized and Coated Iron and Steel Sheets market benefits from increased focus on recycling and reduced resource waste. It aligns with global climate policies encouraging green infrastructure and environmentally safe materials. Manufacturers prioritize closed-loop systems that reuse steel scrap while maintaining coating quality. New technologies also reduce reliance on harmful chemicals, improving environmental compliance. Sustainability-driven practices strengthen the competitive position of coated steel in global supply networks.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

The Galvanized and Coated Iron and Steel Sheets market faces challenges from unstable raw material prices and global supply chain issues. Fluctuations in iron ore, zinc, and energy costs directly affect production expenses and profit margins. It forces manufacturers to manage frequent pricing adjustments, which impact long-term contracts with customers. Disruptions in logistics, driven by geopolitical conflicts or port congestions, further delay material availability. Dependence on imports in certain regions increases exposure to international market instability. Companies are under pressure to maintain stable supply despite unpredictable external conditions.

Environmental Compliance Pressures and High Production Costs

Strict environmental regulations and rising sustainability expectations create significant hurdles for coated steel producers. The Galvanized and Coated Iron and Steel Sheets market must adapt to rules that restrict hazardous chemicals and reduce carbon emissions. It requires continuous investment in cleaner technologies, which often raises operational costs. Compliance with global standards such as REACH and ISO adds complexity to production processes. Smaller manufacturers struggle to keep pace with the cost of adopting advanced coating methods. Meeting environmental goals while staying competitive remains a key difficulty for the industry.

Market Opportunities

Rising Demand from Emerging Economies and Infrastructure Development

The Galvanized and Coated Iron and Steel Sheets market has strong opportunities in emerging economies investing heavily in infrastructure. Rapid urbanization in Asia Pacific, Africa, and Latin America drives demand for roofing, cladding, and structural steel. It supports new housing, commercial centers, and industrial complexes requiring durable and cost-effective materials. Governments promote large-scale projects such as smart cities, transport corridors, and renewable energy plants, all reliant on coated steel sheets. Growing middle-class populations also fuel demand for residential construction and consumer goods. Expansion in these regions offers significant growth potential for manufacturers and suppliers.

Innovation in Eco-Friendly Coatings and Advanced Manufacturing Processes

Environmental sustainability creates opportunities for companies investing in innovative coating technologies. The Galvanized and Coated Iron and Steel Sheets market benefits from advanced eco-friendly coatings that minimize environmental impact and improve durability. It opens pathways to serve industries focused on meeting green building standards and energy efficiency goals. Adoption of digital manufacturing and automation further enhances production efficiency, creating competitive advantages. Companies developing recyclable coatings and lightweight steel options can capture new customer segments. Innovation-led strategies will position producers strongly in a market shifting toward sustainability-driven demand.

Market Segmentation Analysis:

By Product Form:

The Galvanized and Coated Iron and Steel Sheets market demonstrates wide application across industries. Coils hold significant demand due to their suitability for large-scale manufacturing in construction and automotive sectors. Sheets remain dominant in roofing, cladding, and consumer durables, offering versatility and ease of fabrication. Plates are favored in heavy industries such as shipbuilding and energy infrastructure, where strength and durability are essential. Bars and wires find applications in reinforcement, electrical networks, and machinery components. Others, including specialty forms, address niche industrial requirements with customized coatings.

- For instance, In August 2025, Tata Steel dispatched the first galvanized coils from a new Continuous Galvanizing Line (CGL-1) at its Kalinganagar plant in Odisha. This line produces high-quality coated steel, including Advanced High Strength Steels, for the automotive and appliance industries. The CGL-1 is part of a larger expansion that increased the Kalinganagar plant’s total capacity from 3 million to 8 million tons per year.

By Coating Weight:

Medium coating (G90–G235) maintains a strong position due to balanced performance and cost efficiency. It provides reliable corrosion resistance suitable for automotive, construction, and industrial applications. Light coating (G30–G60) is widely used in interior applications or environments with lower exposure risks, offering cost-effective solutions. Heavy coating (G240 and above) caters to marine, infrastructure, and outdoor utility projects, where durability against harsh conditions is critical. It enables long service life and reduces maintenance cycles, making it attractive for infrastructure investments. Manufacturers strategically supply coating weight options to align with regional climate and regulatory requirements.

- For instance, Jiangsu Shagang, one of the world’s largest steel manufacturers, had an annual crude steel production of approximately 40.54 million tonnes in 2023, ranking it as the sixth largest producer globally. The company supplies a variety of steel products, including galvanized sheets.

By Base Steel Grade:

Commercial steel dominates everyday construction and consumer goods due to affordability and versatility. Drawing steel plays a vital role in manufacturing appliances and automotive parts requiring high formability. Structural steel supports bridges, buildings, and industrial frameworks, offering superior load-bearing capacity. High-strength low-alloy steel (HSLA) gains traction in transport and energy projects where performance under stress is required. Advanced high-strength steel (AHSS) is increasingly used in automotive safety structures, combining lightweight properties with durability. Others, including specialized alloys, serve industries requiring tailored strength and resistance. It enables diversification and strengthens the adaptability of coated steel across sectors.

Segments:

Based on Product Form:

- Coils

- Sheets

- Plates

- Bars and wires

- Others

Based on Coating Weight:

- Light coating (G30–G60)

- Medium coating (G90–G235)

- Heavy coating (G240 and above)

Based on Base Steel Grade:

- Commercial steel

- Drawing steel

- Structural steel

- High-strength low-alloy steel (HSLA)

- Advanced high-strength steel (AHSS)

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 28% in the Galvanized and Coated Iron and Steel Sheets market, supported by strong construction and automotive industries. The region benefits from rising investments in commercial infrastructure, smart city projects, and the renovation of aging structures. It remains a hub for advanced automotive manufacturing, with galvanized sheets widely used for body panels, structural components, and underbody protection. The United States leads consumption, supported by large-scale infrastructure funding and regulatory frameworks that emphasize durability and safety. Canada contributes significantly through its expanding residential construction sector and energy infrastructure investments. Demand is further driven by the presence of advanced production facilities, which adopt eco-friendly coating technologies and automated systems to meet sustainability targets. Manufacturers also focus on supplying customized coated steel products tailored for North American weather conditions, enhancing durability in diverse climates.

Europe

Europe accounts for a market share of 25%, driven by robust industrial activity, high regulatory standards, and strong adoption of sustainable building practices. The region shows significant demand in construction, automotive, and renewable energy projects. It supports infrastructure upgrades, including bridges, railways, and wind turbine projects that rely on galvanized steel for durability. The European Union’s stringent environmental regulations push manufacturers toward greener coating technologies, enhancing long-term adoption. Germany, France, and Italy lead consumption, particularly in automotive production and heavy machinery. It benefits from advanced research and development activities, with companies innovating lightweight coated steel solutions to meet energy efficiency targets. Demand for consumer appliances such as washing machines and refrigerators also adds to regional growth. Growing investment in solar and offshore wind projects strengthens further opportunities for coated sheet suppliers.

Asia Pacific

Asia Pacific leads with the largest market share of 32%, reflecting rapid urbanization, infrastructure growth, and industrial expansion. The region sees strong demand in China, India, Japan, and South Korea, where construction and automotive sectors dominate. It supports mega infrastructure projects such as highways, airports, and energy facilities that require coated steel sheets. Growing residential housing demand, driven by rising middle-class populations, adds to consistent consumption. It also benefits from large automotive production hubs in China, Japan, and South Korea, where galvanized steel is critical for vehicle safety and durability. Emerging economies across Southeast Asia contribute additional growth, supported by government-led investments in industrial and transport infrastructure. Regional manufacturers expand production capacity to cater to rising exports, while digitalization and automation improve cost efficiency. Innovation in eco-friendly coatings helps align with global sustainability standards, further strengthening Asia Pacific’s dominance.

Latin America

Latin America secures a market share of 9%, reflecting steady growth supported by construction, automotive, and industrial development. Brazil and Mexico remain the leading consumers, with significant investments in infrastructure and automotive assembly plants. The region relies heavily on galvanized sheets for housing projects, bridges, and commercial centers. It shows rising demand for coated steel in consumer appliances, including refrigerators and washing machines, driven by growing urban populations. It also benefits from expanding mining and energy industries that require durable and corrosion-resistant steel products. Import dependence for advanced coated steel types creates opportunities for global suppliers to strengthen regional presence. Rising government initiatives to modernize infrastructure further support demand, while increasing partnerships with international manufacturers enhance supply chain resilience.

Middle East and Africa

The Middle East and Africa represent a market share of 6%, with growth driven by construction, energy, and infrastructure projects. The Gulf countries, led by Saudi Arabia and the United Arab Emirates, prioritize large-scale construction projects, including smart cities, transport hubs, and renewable energy plants. It benefits from high demand for galvanized steel sheets in harsh desert conditions where corrosion resistance is essential. Africa shows emerging demand through infrastructure modernization programs and rising housing needs. The region’s growing industrial base, particularly in South Africa and Nigeria, supports consistent usage of coated steel in machinery and utilities. Strong government funding in energy and oil projects further strengthens demand. International suppliers target the region with advanced coated steel products, offering long-term durability tailored to extreme weather conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rizhao Steel

- Wuhan Iron and Steel

- Posco

- Shougang Group

- Baosteel

- HBIS Group

- ArcelorMittal

- JFE Steel

- Valin Iron and Steel

- Shandong Iron and Steel

- Nippon Steel

- Jiangsu Shagang

- Hyundai Steel

- Tata Steel

- Taiyuan Iron and Steel

Competitive Analysis

The leading players in the Galvanized and Coated Iron and Steel Sheets market include Rizhao Steel, Wuhan Iron and Steel, Posco, Shougang Group, Baosteel, HBIS Group, ArcelorMittal, JFE Steel, Valin Iron and Steel, Shandong Iron and Steel, Nippon Steel, Jiangsu Shagang, Hyundai Steel, Tata Steel, and Taiyuan Iron and Steel. These companies maintain a competitive edge through large-scale production capabilities, advanced coating technologies, and strong global distribution networks. Their operations are closely aligned with growing demand from construction, automotive, and industrial sectors. It is marked by strategic investments in eco-friendly production processes that meet global sustainability standards. Market leaders also emphasize product diversification, offering solutions across light, medium, and heavy coatings to serve multiple industries. Regional dominance plays a major role, with Asian producers securing strong shares due to rapid urbanization and infrastructure expansion. European and global leaders focus on innovation in lightweight and high-strength steel grades to meet stricter regulatory standards. It reflects an industry structure where global capacity expansion, digitalization in manufacturing, and long-term supply agreements with automotive and construction sectors remain critical. The market’s competitive landscape is defined by scale, technological advancement, and the ability to adapt to sustainability-driven demand.

Recent Developments

- In March 2025, Hyundai Steel announced plans to build an Electric Arc Furnace (EAF) flat steel mill in Ascension Parish, Louisiana, with construction scheduled to start in Q3 2026.

- In September 2023, Rizhao Steel planned to launch two new coated steel lines targeting sectors like automotive and construction. Its earlier pickling and galvanizing line has been operational since 2016

- In 2023, Jiangsu Shagang publicly announced plans to integrate AI for monitoring production efficiency and also confirmed the expansion of its galvanizing capacity.

Report Coverage

The research report offers an in-depth analysis based on Product Form, Coating Weight, Base Steel Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising infrastructure investments worldwide.

- Demand from automotive manufacturing will strengthen with expansion of electric vehicles.

- Construction projects will continue to drive coated steel adoption in urban areas.

- Manufacturers will focus on advanced coatings with higher corrosion resistance.

- Digital technologies will support efficient production and quality control.

- Sustainability goals will push adoption of eco-friendly coating processes.

- Emerging economies will provide strong opportunities through housing and industrial growth.

- Supply chain diversification will reduce risks from raw material fluctuations.

- Lightweight steel grades will gain traction in transportation and renewable energy sectors.

- Global players will expand capacity to meet rising regional and export demand.