Market Overview

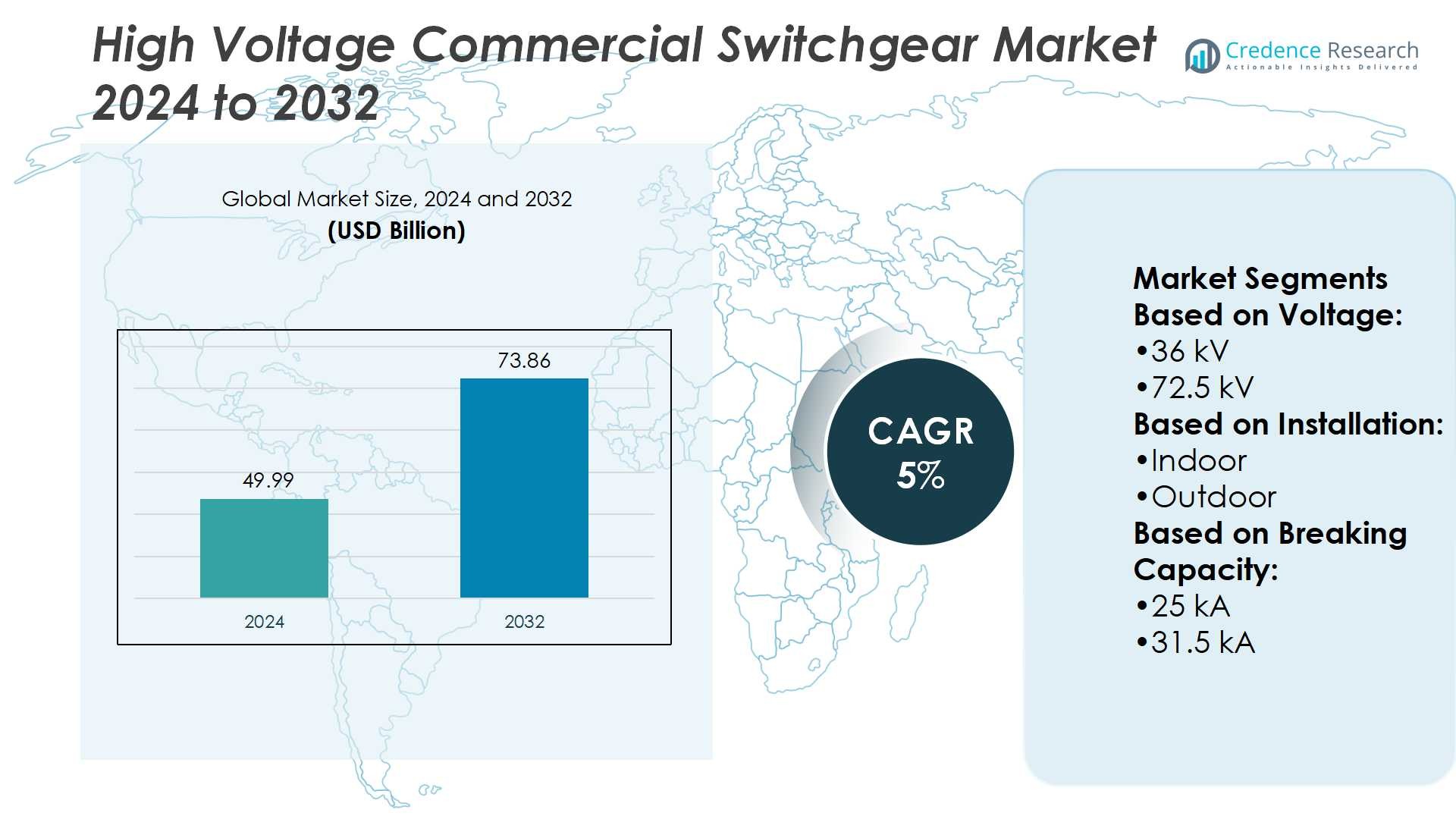

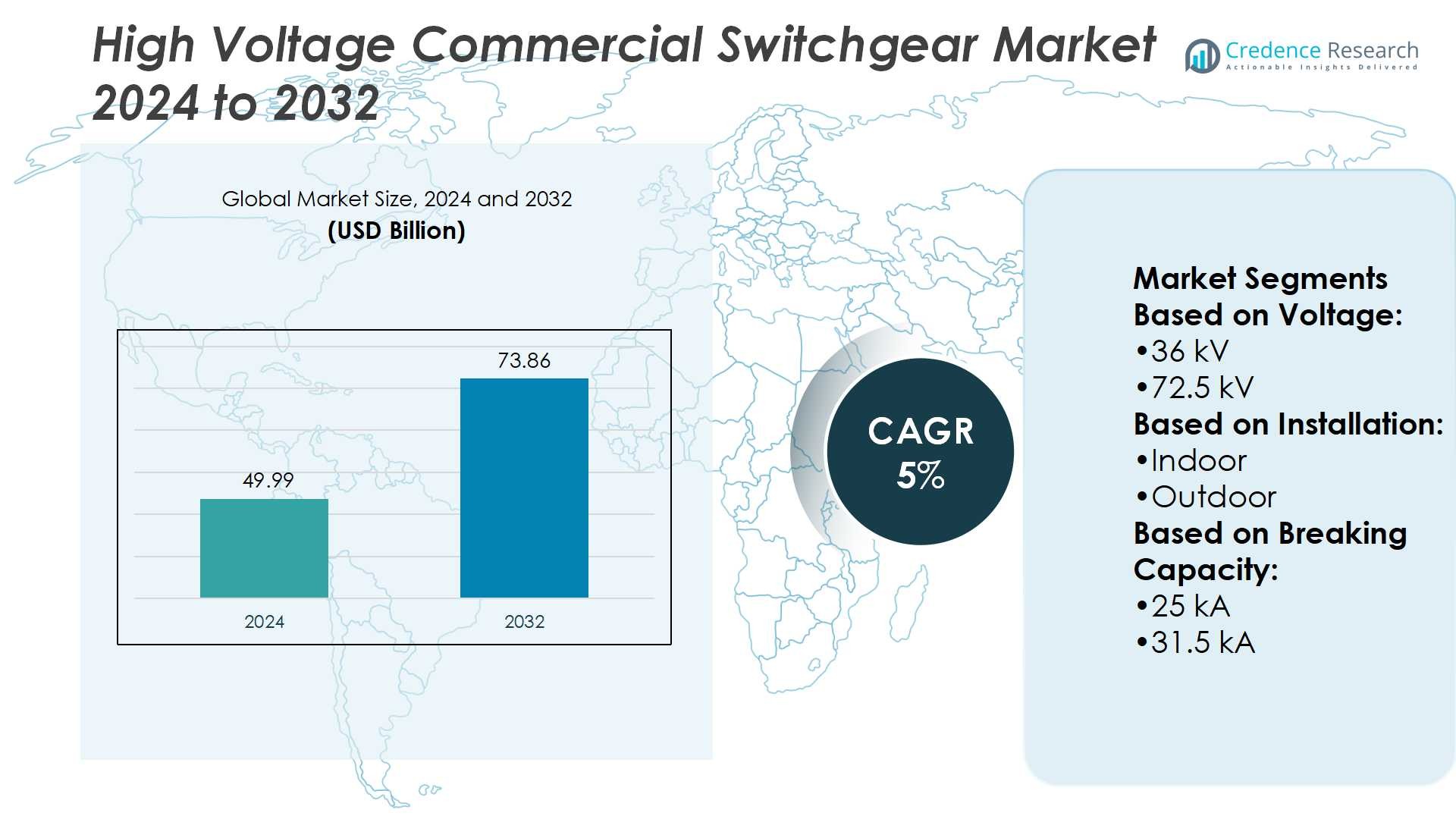

High Voltage Commercial Switchgear Market size was valued at USD 49.99 billion in 2024 and is anticipated to reach USD 73.86 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Commercial Switchgear Market Size 2024 |

USD 49.99 Billion |

| High Voltage Commercial Switchgear Market, CAGR |

5% |

| High Voltage Commercial Switchgear Market Size 2032 |

USD 73.86 Billion |

The High Voltage Commercial Switchgear Market grows through strong drivers such as rising electricity demand, grid modernization, and integration of renewable energy sources. Governments enforce strict safety and efficiency regulations, creating steady demand across industrial, commercial, and utility sectors. It benefits from increasing investments in digital infrastructure and smart grid deployment. Key trends include adoption of intelligent and IoT-enabled switchgear, expansion of modular and compact designs, and a clear shift toward eco-friendly alternatives to SF6 systems. Growing data center development and urban infrastructure projects further strengthen market potential, positioning advanced switchgear as a core element of global energy transition.

The High Voltage Commercial Switchgear Market shows strong geographical presence, with Asia Pacific holding the largest share, driven by industrialization, urban infrastructure, and renewable integration. Europe follows with 30% share, supported by strict regulatory frameworks and energy transition goals, while North America accounts for 27% through grid modernization and digital infrastructure growth. Latin America and the Middle East & Africa each hold 5%, reflecting gradual adoption. Key players shaping the market include ABB, Eaton, General Electric, Hitachi, and Fuji Electric.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Voltage Commercial Switchgear Market was valued at USD 49.99 billion in 2024 and is expected to reach USD 73.86 billion by 2032, at a CAGR of 5%.

- Rising electricity demand, grid modernization, and renewable energy integration drive consistent market growth.

- Intelligent, IoT-enabled, and modular switchgear designs represent major trends shaping future adoption.

- Competitive strategies focus on innovation, digitalization, and sustainable alternatives to SF6-based systems.

- High upfront investment, complex installation, and maintenance costs act as restraints for broader adoption.

- Asia Pacific leads with the largest share, followed by Europe at 30% and North America at 27%, while Latin America and Middle East & Africa each hold 5%.

- Key players strengthen the market landscape by addressing efficiency, automation, and regulatory compliance through advanced product portfolios.

Market Drivers

Rising Electricity Demand and Expansion of Grid Infrastructure

The High Voltage Commercial Switchgear Market benefits from surging electricity consumption across industrial and commercial facilities. Rapid urbanization and industrial expansion create strong demand for stable power distribution. It supports reliable connections in dense metropolitan areas where energy loads remain high. Utilities expand transmission and distribution networks to match rising consumption levels. Switchgear enables safe management of these networks by minimizing faults and outages. Strong investment in grid modernization reinforces the demand for advanced high-voltage systems.

- For instance, Fuji Electric’s HS series vacuum circuit breakers deliver breaking currents up to 63 kiloamperes (kA), at rated voltages between 3.6 kilovolts (kV) and 36 kV, enhancing fault interruption in high-load networks.

Government Regulations and Emphasis on Safety Standards

Stringent government policies drive consistent adoption of high-voltage commercial switchgear. Regulatory agencies enforce rules on workplace safety, energy efficiency, and fault protection. It ensures reliable operation of critical power systems in sectors such as healthcare and data centers. Manufacturers focus on compliance with international standards like IEC and ANSI to secure contracts. Governments also promote safe, sustainable infrastructure projects that need high-grade switchgear installations. These measures increase market adoption across both developed and emerging economies.

- For instance, HD Hyundai Electric’s 170 SR gas-insulated switchgear achieves a rated voltage of 170 kVrms, withstands 325 kVrms power-frequency stress, endures up to 50 kArms short-time fault current, and resists 750 kV lightning impulse voltage.

Integration of Renewable Energy into Power Networks

The High Voltage Commercial Switchgear Market gains momentum from renewable energy integration into national grids. Wind and solar projects require robust switchgear to manage variable power flows. It allows utilities to handle bidirectional electricity movement while reducing system failures. Expanding renewable capacity in Europe, Asia Pacific, and North America creates new growth opportunities. Advanced switchgear technology supports efficient connection between renewable sources and commercial demand centers. Rising focus on decarbonization accelerates the requirement for durable and intelligent solutions.

Rising Focus on Automation and Digital Technologies

Smart grid initiatives strengthen demand for modern switchgear with advanced automation features. Utilities and enterprises prioritize systems that allow real-time monitoring, fault detection, and predictive maintenance. It helps operators minimize downtime while improving operational efficiency. Integration of IoT sensors and AI-driven analytics enhances performance of high-voltage switchgear. The trend aligns with broader investments in digital infrastructure and energy efficiency. Increased adoption of intelligent switchgear solutions positions the market for sustained long-term growth.

Market Trends

Growing Adoption of Smart and Digital Switchgear Solutions

The High Voltage Commercial Switchgear Market shows strong movement toward smart and digital solutions. Utilities and large enterprises prefer systems with integrated sensors and communication capabilities. It improves monitoring, fault detection, and asset management across complex networks. Cloud-enabled platforms allow operators to analyze data in real time. This trend supports predictive maintenance strategies that reduce unplanned outages. Investment in digital infrastructure accelerates the transition from conventional to intelligent switchgear.

- For instance, Eaton’s Power Xpert IGX compact switchgear operates at up to 38 kV, handles interrupting currents up to 40 kA, withstands a 200 kV Basic Impulse Level (BIL), and carries continuous currents up to 3000 A. It features a front-accessible, arc-resistant Type 2B design for enhanced personnel safety.

Rising Demand for Eco-Friendly and Sustainable Switchgear Technologies

Environmental concerns shape purchasing preferences in the switchgear industry. Manufacturers invest in eco-friendly designs that limit greenhouse gas emissions and material waste. It promotes the use of vacuum and air-insulated switchgear in place of SF6-based systems. Regulatory bodies support this trend with policies favoring sustainable technologies. Customers in Europe and Asia Pacific lead adoption of low-emission solutions. The High Voltage Commercial Switchgear Market gains long-term benefits from these green initiatives.

- For instance, CG Power’s vacuum interrupters—pioneered in India—now exceed 1,500,000 units in service worldwide, covering applications up to 72.5 kV and supporting manufacturing capacity over 150,000 units annually.

Increasing Role of Modular and Compact Switchgear Designs

Compact and modular switchgear designs gain traction across commercial and industrial applications. Space-constrained facilities prioritize solutions that optimize floor area and reduce installation costs. It simplifies maintenance through modular components that can be replaced quickly. Scalability also supports future expansion without full system replacement. Modular switchgear provides flexibility for industries requiring tailored configurations. This trend strengthens adoption in data centers, urban buildings, and transport infrastructure projects.

Expanding Integration with Renewable and Distributed Energy Systems

High-voltage switchgear plays a central role in renewable and distributed power generation. Growth of solar farms, wind parks, and microgrids raises the need for efficient interconnections. It ensures safe handling of variable loads and bidirectional energy flow. Advanced switchgear solutions enhance grid stability while supporting decarbonization goals. Utilities invest in technologies that align with clean energy policies worldwide. The High Voltage Commercial Switchgear Market evolves to meet the demands of modern renewable integration.

Market Challenges Analysis

High Initial Investment and Complex Installation Requirements

The High Voltage Commercial Switchgear Market faces challenges due to high upfront costs and technical complexity. Advanced switchgear demands substantial capital for procurement, installation, and system integration. It often requires specialized labor, which increases overall project expenses. Small and mid-sized enterprises delay adoption because of budget constraints. Complex installation procedures extend project timelines, impacting return on investment. These barriers slow market penetration in cost-sensitive regions and industries.

Maintenance Demands and Risk of Operational Failures

Ongoing maintenance remains a major challenge for operators of high-voltage switchgear. Regular inspections and part replacements are necessary to maintain safe performance. It raises operational costs and creates dependency on skilled technicians. Equipment failure risks can disrupt commercial operations, particularly in power-sensitive sectors like healthcare and data centers. Harsh environmental conditions accelerate wear and demand more frequent servicing. The High Voltage Commercial Switchgear Market must overcome these obstacles to ensure reliability and long-term adoption.

Market Opportunities

Expansion of Renewable Energy Projects and Grid Modernization

The High Voltage Commercial Switchgear Market holds strong opportunities through renewable energy expansion. Wind and solar projects require efficient switchgear for safe integration into national grids. It supports grid stability by managing fluctuating loads and bidirectional power flows. Governments worldwide increase funding for clean energy infrastructure, creating steady demand. Modernization of aging grids in North America and Europe further enhances adoption. Emerging economies also prioritize renewable integration, strengthening long-term market prospects.

Rising Demand from Data Centers and Critical Infrastructure

Data centers, healthcare facilities, and transport networks present a growing opportunity for advanced switchgear. These sectors demand uninterrupted power supply, fault protection, and real-time monitoring capabilities. It enables operators to safeguard critical infrastructure against outages and downtime. Rising digitalization and cloud expansion drive strong investment in resilient power systems. Asia Pacific leads demand with rapid data center development, followed by North America and Europe. The High Voltage Commercial Switchgear Market benefits from these high-value applications.

Market Segmentation Analysis:

By Voltage

The High Voltage Commercial Switchgear Market shows clear differentiation across voltage ranges. Switchgear rated at 36 kV serves medium-scale commercial facilities and localized distribution systems. It supports cost-efficient solutions for small industries and urban infrastructure. The 72.5 kV and 123 kV categories dominate in industrial parks, transport hubs, and data centers. These voltage levels provide reliable protection against overloads in high-demand environments. Switchgear rated at 145 kV finds use in heavy industries and large utilities, where strong fault handling is essential. Each segment addresses unique power distribution needs and strengthens market diversity.

- For instance, GE Vernova manufactures live tank circuit breakers covering voltage classes from 36 kV up to 1,100 kV, delivering solutions for applications ranging from small distribution feeders to the world’s highest-voltage transmission grids.

By Installation

The market divides between indoor and outdoor installations, both meeting specific operational demands. Indoor switchgear suits commercial complexes, manufacturing plants, and data centers where controlled environments enhance safety. It reduces exposure to dust, humidity, and environmental stress. Outdoor switchgear supports utility grids, renewable projects, and large industrial units. It withstands harsh weather while maintaining reliable performance across distributed power networks. Growing infrastructure development projects expand the adoption of both categories. The balance between indoor and outdoor applications highlights flexibility in market deployment.

- For instance, ABB’s VHE 12S cubicle with HCA vacuum circuit breaker (indoor) handles 12 kV rated voltage, busbar currents of 1,250 A, 2,000 A, and 3,000 A, and has a short-time withstand current of 40 kA and making capacity of 100 kAp.

By Breaking Capacity

Breaking capacity remains a critical parameter for market segmentation. The 25 kA and 31.5 kA categories address small and mid-sized facilities with moderate fault risks. It offers reliable protection while balancing cost efficiency. Switchgear with 40 kA capacity supports industries with heavier loads such as mining and petrochemicals. The 50 kA category dominates in high-risk environments like utilities, transportation corridors, and large manufacturing plants. Strong demand for advanced safety standards drives preference for higher breaking capacities. The High Voltage Commercial Switchgear Market gains resilience by addressing fault scenarios across diverse power infrastructures.

Segments:

Based on Voltage:

Based on Installation:

Based on Breaking Capacity:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounted for 27% share of the High Voltage Commercial Switchgear Market in 2024, driven by strong investment in grid modernization and renewable integration. The United States leads the region with widespread adoption of high-voltage systems across utilities, data centers, and manufacturing facilities. Canada supports the growth through energy transition programs and cross-border transmission upgrades. It benefits from stringent regulatory requirements that emphasize energy efficiency and safety standards. Rapid expansion of digital infrastructure and cloud-based operations creates higher demand for reliable switchgear in commercial environments. The presence of major industry players and advanced R&D centers reinforces innovation in automation and sustainable designs. Long-term opportunities emerge from government-led initiatives supporting renewable energy integration and large-scale smart grid deployment.

Europe

Europe represented 30% share of the High Voltage Commercial Switchgear Market in 2024, supported by advanced energy transition policies and stringent regulatory frameworks. Germany, France, and the United Kingdom dominate due to strong renewable energy deployment and industrial expansion. It thrives under the European Union’s push for decarbonization and the replacement of aging SF6-based systems with eco-friendly alternatives. Investments in offshore wind and interconnection projects further drive adoption of high-voltage switchgear solutions. Smart city initiatives across Western Europe increase demand for compact, modular, and intelligent switchgear. Eastern Europe shows rising adoption fueled by infrastructure modernization and foreign investments in industrial facilities. Sustainability-focused policies and grid enhancement programs ensure long-term growth across the region.

Asia Pacific

Asia Pacific held the largest share at 33% of the High Voltage Commercial Switchgear Market in 2024, reflecting rapid industrialization and urban infrastructure development. China leads the region with significant investments in ultra-high-voltage transmission and commercial power systems. India expands adoption through government-led electrification projects, renewable integration, and rapid data center growth. It also benefits from strong development across Southeast Asia, where countries such as Vietnam and Indonesia upgrade power distribution systems. Japan and South Korea reinforce market growth with advanced automation and smart grid deployment. Expanding renewable energy targets across the region further increase demand for high-capacity switchgear. The region’s dominance is supported by strong manufacturing bases and competitive pricing structures.

Latin America

Latin America accounted for 5% share of the High Voltage Commercial Switchgear Market in 2024, with growth led by Brazil and Mexico. The region benefits from expanding renewable projects, especially solar and wind farms, which require advanced switchgear for grid integration. It also sees rising adoption in urban centers, where commercial facilities demand uninterrupted power distribution. Chile and Argentina contribute through grid upgrades and infrastructure projects supported by foreign investment. Market growth faces challenges from high initial costs and slower regulatory alignment with global standards. However, opportunities remain strong due to ongoing industrialization and digital infrastructure development. It continues to position itself as a gradually emerging market with steady long-term potential.

Middle East & Africa

The Middle East & Africa captured 5% share of the High Voltage Commercial Switchgear Market in 2024, supported by large-scale infrastructure and energy diversification programs. The Gulf states lead with investments in commercial facilities, transport infrastructure, and renewable energy projects. It gains traction through mega projects in Saudi Arabia, the UAE, and Qatar, where reliable high-voltage systems are essential. Africa shows potential growth driven by electrification programs in South Africa, Nigeria, and Kenya. Harsh climatic conditions in several regions drive demand for durable outdoor switchgear solutions. Expansion of oil, gas, and mining industries also supports increased adoption of high-capacity systems. Long-term opportunities arise from government commitments to diversify energy sources and strengthen commercial infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric

- HD Hyundai Electric

- Eaton

- CG Power and Industrial Solutions

- Hyosung Heavy Industries

- General Electric

- ABB

- E + I Engineering

- Bharat Heavy Electricals

- Hitachi

Competitive Analysis

The High Voltage Commercial Switchgear Market leaders including ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, and Hyosung Heavy Industries. The High Voltage Commercial Switchgear Market demonstrates intense competition, driven by technological advancement, sustainability goals, and growing demand for intelligent power systems. Companies emphasize research and development to introduce eco-efficient and digital solutions that align with global energy transition efforts. Strategic partnerships, infrastructure investments, and expansion into emerging economies remain central to capturing market share. Market players also focus on modular and compact switchgear designs to meet rising demand from data centers, renewable energy projects, and urban infrastructure. Increasing regulatory pressure for safer and more sustainable systems further accelerates innovation. The competitive environment highlights continuous product differentiation and strong alignment with smart grid and renewable integration initiatives.

Recent Developments

- In May 2025, Hitachi Energy Ltd. introduced a switchgear technology aimed at reducing sulfur hexafluoride (SF₆) emissions, which account for 80% of such emissions in the power sector. In response, the company has unveiled the world’s highest-voltage SF₆-free solutions.

- In March 2025, nVent Electric plc announced to enter into a definitive agreement to acquire the enclosures, switchgear, and bus systems businesses of Avail Infrastructure Solutions for an acquisition price of subject to customary adjustments.

- In December 2024, Hitachi Energy is investing approximately to expand its High Voltage Products factory in Brno, Czech Republic, marking a significant step in its global strategy to support the clean energy transition.

- In May 2024, L&T Switchgear, one of India’s leading electrical and automation brands and a pioneer in energy management, unveiled its new brand identity, ‘Lauritz Knudsen Electrical and Automation’. Announces plans to invest Rs 850 cr. over the next 3 years.

- In April 2024, Schneider Electric and Digital Realty launched a circular economy initiative at the Paris 5 (PAR5) data center. This partnership aims to extend the lifespan of critical systems at PAR5, including Schneider Electric’s high-voltage (LV) and high-voltage (MV) electrical equipment, switchgear, and UPS units.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Installation, Breaking Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for smart grid infrastructure.

- Renewable energy integration will strengthen the need for advanced switchgear solutions.

- Eco-friendly technologies will replace SF6-based systems at a faster pace.

- Modular and compact switchgear designs will gain preference in urban facilities.

- Digital monitoring and IoT-enabled systems will drive adoption across industries.

- Data center expansion will create steady demand for high-voltage switchgear.

- Grid modernization projects will boost investments in advanced fault management systems.

- Emerging economies will expand adoption through electrification and industrialization programs.

- Regulatory pressure will push manufacturers toward sustainable and efficient product designs.

- Long-term opportunities will emerge from automation and AI-driven predictive maintenance solutions.