Market Overview:

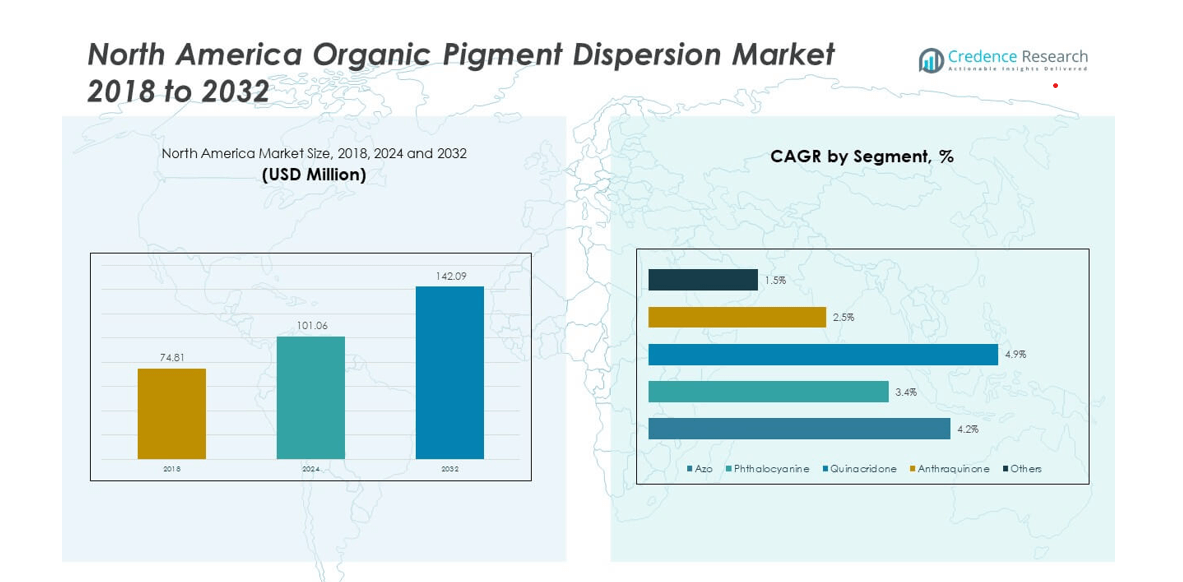

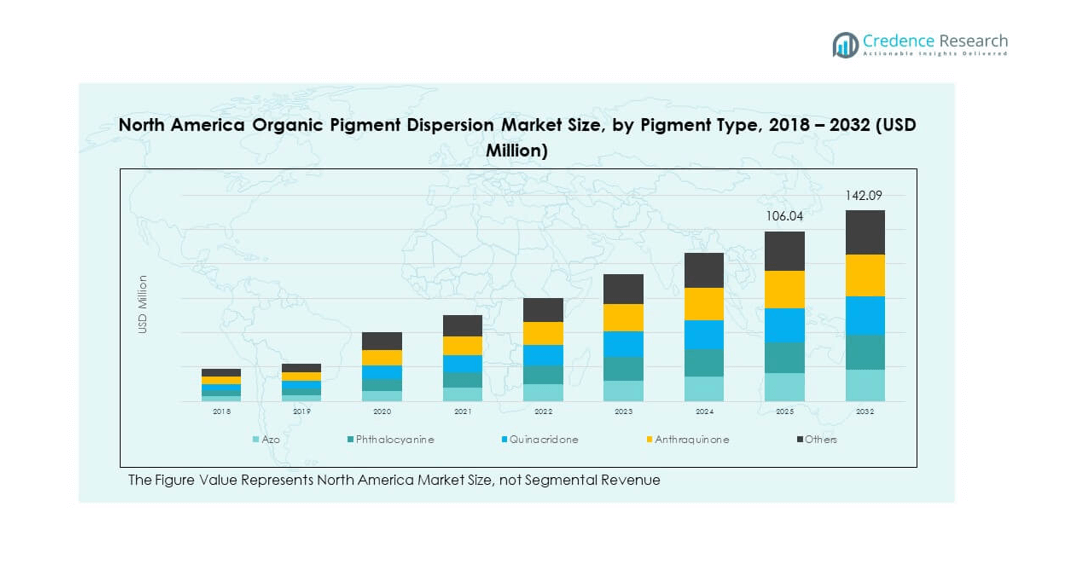

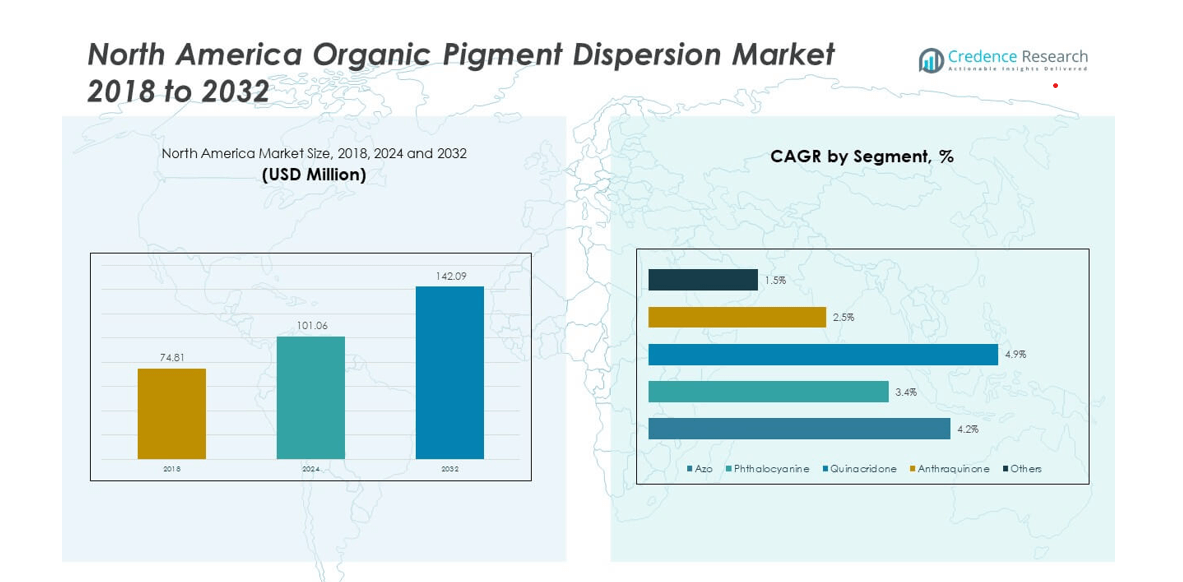

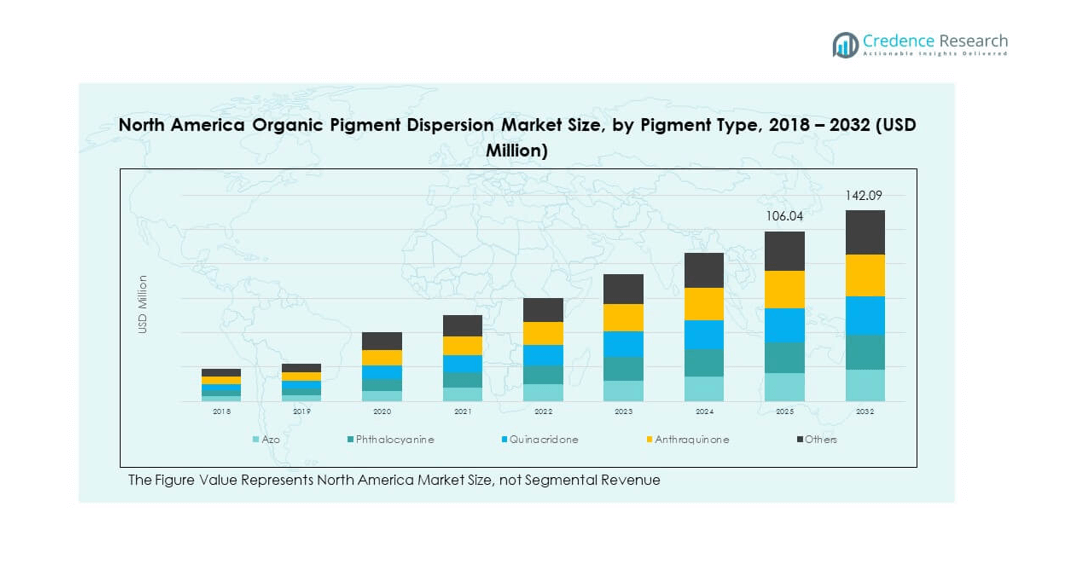

The North America Organic Pigment Dispersion Market size was valued at USD 74.81 million in 2018 to USD 101.06 million in 2024 and is anticipated to reach USD 142.09 million by 2032, at a CAGR of 4.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Organic Pigment Dispersion Market Size 2024 |

USD 101.06 million |

| North America Organic Pigment Dispersion Market, CAGR |

4.30% |

| North America Organic Pigment Dispersion Market Size 2032 |

USD 142.09 million |

The market growth is driven by the rising demand for eco-friendly colorants across industries such as paints, coatings, plastics, and printing inks. Stringent environmental regulations encourage industries to shift from synthetic pigments toward sustainable organic pigment dispersions. Increasing consumer preference for products with non-toxic, durable, and vibrant coloring properties supports market expansion. Growth in packaging, automotive coatings, and textile applications also accelerates adoption. Technological advancements in dispersion techniques improve pigment performance and enable broader end-use applications. Strong investments in sustainable formulations and innovation by manufacturers further enhance market development across diverse industries.

Regionally, the United States dominates the North America Organic Pigment Dispersion Market due to strong industrial infrastructure, robust demand from packaging and coatings, and early adoption of eco-friendly technologies. Canada follows with growing investments in sustainable manufacturing and increased adoption in plastics and automotive industries. Mexico is emerging as a promising market, driven by expanding textile and construction sectors seeking cost-effective, environment-friendly colorant solutions. Differences in regulatory frameworks, industrialization levels, and technological adoption patterns shape the growth dynamics across the region, ensuring varied opportunities for manufacturers in each country.

Market Insights

- The North America Organic Pigment Dispersion Market was valued at USD 74.81 million in 2018, grew to USD 101.06 million in 2024, and is projected to reach USD 142.09 million by 2032, at a CAGR of 4.30%.

- The Global Organic Pigment Dispersion Market size was valued at USD 397.20 million in 2018 to USD 549.81 million in 2024 and is anticipated to reach USD 768.02 million by 2032, at a CAGR of 4.18% during the forecast period.

- The United States led with 62% share in 2024, supported by strong industrial demand, followed by Canada at 21% with growth in green manufacturing, and Mexico at 17% driven by expanding construction and textiles.

- Mexico represents the fastest-growing region in the market with a 17% share, benefitting from rapid urbanization, cost-efficient manufacturing, and expanding export-driven industries.

- By pigment type, azo pigments held the largest share at 34% in 2024, driven by cost efficiency and wide application across coatings and packaging.

- Phthalocyanine pigments accounted for 28% of the share in 2024, supported by their superior stability and strong demand in printing inks and plastics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly Colorants Across Industries

The North America Organic Pigment Dispersion Market is experiencing strong growth through demand for sustainable color solutions. Industries such as paints, coatings, packaging, plastics, and textiles prefer organic dispersions for their non-toxic and durable properties. Strict environmental regulations encourage manufacturers to replace heavy metal pigments with biodegradable options. Consumers also demand safer products with vivid and lasting colors, enhancing the use of organic pigments. This push aligns with sustainability goals of industries focusing on eco-conscious production. Organic pigments also improve overall product appeal by offering stable and high-performance dispersion. Industries prioritize these solutions to comply with sustainability certifications and regulations.

- For instance, in 2024, BASF launched its biomass-balanced coatings across North America under brands such as Glasurit® Eco Balance and R-M® eSense. These coatings use renewable raw materials, and BASF reported that its more than 250 biomass-balanced products helped reduce over 8 million kg of CO₂ emissions globally during 2024, with the North American expansion explicitly confirmed by sustainability managers at BASF Coatings.

Growing Adoption in Automotive and Construction Sectors

Automotive coatings and construction materials represent key applications that strengthen market adoption. The industry benefits from organic dispersions for providing vibrant, durable finishes that resist fading. Regulations limiting volatile organic compounds drive automakers to adopt sustainable coating formulations. The construction sector relies on eco-friendly pigments for paints, decorative coatings, and surface finishes. Rising urbanization in North America boosts demand for cost-efficient and safe pigment dispersions. Market players invest in developing advanced dispersions to meet technical and regulatory requirements. These pigments offer longer lifecycle performance and withstand harsh weather conditions effectively. Such benefits position organic dispersions as essential solutions for industrial coatings and protective applications.

Expanding Applications in Packaging and Printing Industries

The packaging sector generates strong demand for organic pigment dispersions due to growing focus on safety and sustainability. Food packaging in particular requires non-toxic pigments that comply with strict standards. Printing inks using organic dispersions enable high-quality, vibrant graphics for flexible packaging and labels. Demand increases with the expansion of e-commerce and customized packaging solutions. The market also benefits from rising awareness of recyclable and biodegradable packaging. Organic dispersions enhance print stability, ensuring sharp image reproduction in multiple formats. Printing companies value these pigments for supporting consistent performance across various substrates.

- For instance, in 2022, Heubach Group introduced Colanyl 500 Orange H5GD 500 as part of its Colanyl 500 range for packaging and coatings, offering superior light fastness, a certified 24-month shelf life, and broad compatibility in waterborne industrial and architectural paints, without DCB, label, or binder additives. All products in this range are engineered to meet food safety and regulatory standards, as confirmed by Heubach’s leadership and technical documentation.

Technological Advancements in Pigment Dispersion Techniques

Advances in dispersion technology enable manufacturers to offer pigments with higher stability and stronger performance. Companies focus on innovations that improve color strength, heat resistance, and particle uniformity. Advanced production methods allow better integration with polymers, coatings, and inks. It supports development of dispersions suitable for high-performance applications across industries. These innovations enhance production efficiency by reducing waste and energy consumption. Manufacturers also develop formulations tailored for niche sectors such as cosmetics and textiles. The market benefits from these innovations by improving pigment compatibility across diverse applications.

Market Trends

Shift Toward Bio-Based and Renewable Raw Materials

The North America Organic Pigment Dispersion Market reflects a major shift toward bio-based raw materials. Manufacturers invest in renewable feedstocks to reduce dependency on petrochemicals. Bio-derived pigments align with sustainability commitments from major industries and regulatory compliance. This shift reduces carbon footprints while ensuring non-toxic production methods. Companies highlight transparency in raw material sourcing to appeal to eco-conscious buyers. Collaboration with chemical innovators accelerates the creation of plant-based pigment dispersions. The growing consumer preference for natural and safe products drives the trend further. It ensures long-term positioning of organic pigments as part of a green supply chain.

- For example, Clariant produces high-performance quinacridone organic pigments such as Pigment Red 122 and Pigment Violet 19 using bio-succinic acid derived from renewable sugars like corn and sorghum. These pigments meet Clariant’s EcoTain® sustainability criteria, offering high tint strength and durability for automotive, plastics, and coatings.

Increasing Popularity of High-Performance Pigments in Specialized Applications

Industries demand pigments that can withstand extreme conditions, fueling high-performance pigment use. Coatings for aerospace, defense, and electronics require pigments with superior stability and resistance. Companies develop advanced dispersions offering lightfastness, chemical resistance, and thermal durability. These solutions support premium products with extended service life in demanding environments. High-performance pigments enhance design flexibility for end-users. Industries choose these dispersions to minimize replacement costs and improve efficiency. The North America Organic Pigment Dispersion Market responds with tailored formulations for industrial-grade applications. It positions advanced pigments as central to specialty and premium product segments.

Integration of Pigments with Smart and Functional Materials

Emerging technologies encourage integration of pigments with smart coatings and functional materials. Pigments now deliver more than color, providing properties like UV resistance and antimicrobial performance. Functional coatings in healthcare, electronics, and construction sectors gain prominence. The market explores dispersions supporting smart packaging and responsive surfaces. It reflects a shift toward multi-functional products enhancing durability and user value. Demand for coatings with dual benefits, such as aesthetics and protection, continues to grow. Organic pigments support these hybrid applications with adaptable dispersion properties. Such integration creates new growth opportunities across advanced material segments.

- For example, Vibrantz Technologies (formerly Chromaflo) offers “Cool Colors” functional pigment technology in North America that imparts near-infrared (NIR) reflectance to coatings. These pigments are used in roof shingles and exterior coatings to keep surfaces cooler under sunlight, reducing building energy consumption and prolonging material service life—making them especially valued in construction and industrial applications.

Rising Customization Demand in Consumer-Centric Industries

Consumer-facing industries value customized colors and finishes for unique product identities. Brands use organic pigments to achieve vibrant, distinctive designs in packaging and textiles. Fashion and lifestyle industries particularly adopt pigments for premium, personalized products. Dispersions enable brands to meet exact shade requirements without compromising quality. This customization trend extends into consumer electronics and automotive interiors. Manufacturers invest in flexible production processes to cater to varied design needs. The North America Organic Pigment Dispersion Market gains from rising interest in tailored solutions. It strengthens the market’s relevance in consumer-driven industries focusing on product differentiation.

Market Challenges Analysis

Regulatory and Compliance Pressures Impacting Market Expansion

The North America Organic Pigment Dispersion Market faces challenges from evolving environmental and safety regulations. Manufacturers must constantly adapt to changing compliance standards that restrict hazardous substances. These regulations increase production costs and delay time-to-market for new dispersions. Smaller producers face financial strain in upgrading equipment to meet compliance demands. The complexity of maintaining certifications also affects global supply chains. Companies must allocate resources to testing, validation, and monitoring processes. It slows innovation and increases reliance on costly third-party approvals. The challenge limits participation for small and mid-sized enterprises in the market.

High Production Costs and Raw Material Supply Issues

High production costs remain a significant barrier to market growth. Sourcing sustainable and high-quality raw materials often requires premium pricing. Supply chain disruptions also impact consistency and availability of bio-based feedstocks. Manufacturers struggle with balancing cost efficiency and product performance. Competitive pricing pressures further complicate profitability in the market. Limited raw material availability makes manufacturers dependent on international suppliers. Volatility in commodity markets adds risk to production planning. It compels companies to either pass costs onto consumers or face reduced margins in the long term.

Market Opportunities

Growing Scope in Sustainable Packaging and Consumer Goods

The North America Organic Pigment Dispersion Market shows promising opportunities in sustainable packaging and consumer goods. Growing demand for eco-friendly packaging materials drives adoption of safe pigments. Industries adopt dispersions that align with recycling and biodegradability standards. Consumer brands use these pigments to improve product appeal and meet sustainability targets. It creates new scope in food packaging, personal care, and household product applications. Companies offering compliance-ready solutions gain competitive advantage in this expanding space. Strong emphasis on corporate sustainability strengthens pigment demand across packaging and consumer segments.

Advancement in Digital Printing and Specialty Coatings

Digital printing technologies open new avenues for pigment dispersion usage. These pigments enhance high-resolution printing for packaging, textiles, and promotional products. Specialty coatings integrating pigments offer premium aesthetics and functionality. Growth in architectural coatings and smart finishes expands application areas for dispersions. The market benefits from technological integration in sectors prioritizing design and innovation. It also enables producers to offer tailored, high-value pigment solutions for niche industries. Opportunities arise from combining dispersion technologies with advanced digital platforms for flexible production. This creates strong potential for long-term growth across multiple high-value segments.

Market Segmentation Analysis

By Pigment Type, azo pigments account for a dominant share due to their cost efficiency, bright shades, and wide application across packaging and coatings. Phthalocyanine pigments follow strongly with high demand in printing inks and plastics for their superior stability and color strength. Quinacridone pigments cater to high-performance needs in automotive coatings and premium packaging, offering durability and weather resistance. Anthraquinone pigments serve specialized applications in textiles and cosmetics, providing vibrant and long-lasting shades. The others category includes niche pigments tailored for customized and specialty applications, expanding options for manufacturers across industries. The North America Organic Pigment Dispersion Market benefits from diverse pigment portfolios addressing varied performance requirements.

- For example, D&C Violet No. 2, an anthraquinone pigment, is FDA-approved for use in externally applied cosmetics in the US (21 CFR Part 74.3602); every batch undergoes FDA batch certification before acceptance for US cosmetics manufacturing.

By Application, paints and coatings dominate usage, supported by construction, automotive, and industrial demand for durable and eco-friendly finishes. Printing inks represent a strong segment, driven by packaging growth and the rising use of flexible, vibrant graphics in e-commerce and retail. Plastics and polymers adopt dispersions for coloring household goods, packaging materials, and industrial products, ensuring consistent performance. Textiles use pigments for bright, durable coloration, while cosmetics utilize dispersions for safe, non-toxic formulations in personal care products. The others segment includes specialty applications across electronics and niche consumer goods. It highlights the broad versatility and adaptability of pigment dispersions across regional industries.

- For example, Sun Chemical is a leading supplier of pigment dispersions to the North American market, as publicly documented in company releases and its North American page. Flint Group is also confirmed as a significant supplier of packaging inks and dispersions, serving the flexible packaging sector across the region.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

By Region

Regional Analysis

United States

The United States holds the dominant share of the North America Organic Pigment Dispersion Market, accounting for 62% of total revenue. Strong industrial infrastructure and advanced manufacturing capabilities drive large-scale adoption. High demand from packaging, automotive coatings, and textiles contributes significantly to market expansion. The U.S. also benefits from strict environmental policies that accelerate the shift toward eco-friendly pigments. Investments in R&D and technological advancements strengthen product quality and diversify applications. Leading players operate major facilities in the country, consolidating its position as the largest regional contributor. It remains the primary hub for innovation and regulatory-driven growth in pigment dispersions.

Canada

Canada represents 21% of the market share, supported by sustainable manufacturing and a rising focus on green building materials. The construction sector actively integrates eco-friendly paints and coatings using organic dispersions. Growth in the Canadian packaging industry further expands pigment demand. Regulatory frameworks promoting low-VOC products foster a favorable market environment. Local manufacturers and distributors strengthen partnerships to expand availability across industries. The country shows strong adoption in plastics and specialty coatings where safety and compliance standards are critical. It plays a growing role in expanding environmentally conscious pigment solutions across North America.

Mexico

Mexico accounts for 17% of the North America Organic Pigment Dispersion Market and continues to emerge as a fast-growing segment. Expansion in textiles, plastics, and consumer goods industries drives pigment adoption. Cost-efficient manufacturing and supportive trade policies attract foreign investments. Rising urbanization and industrialization contribute to steady growth in construction and packaging applications. Local industries emphasize affordable eco-friendly solutions to align with export market standards. Mexico’s role is strengthened by its growing integration into North American supply chains. It is evolving as a key contributor with high potential for future market share growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DCL Corporation

- Palmer Holland, Inc.

- Barentz

- First Source Worldwide, LLC

- Chromaflo: A Vibrantz Technologies

- Ravago Chemicals North America

- Neelikon Colors Global USA Inc.

- ColorChem International Corp.

- Plastiques St-Paul Inc.

- Liberty Specialty Chemicals

Competitive Analysis

The North America Organic Pigment Dispersion Market features a moderately consolidated structure, with a mix of global corporations and regional suppliers. Key players such as DCL Corporation, Palmer Holland, and Chromaflo (Vibrantz Technologies) dominate with extensive product portfolios and strong distribution networks. Barentz, Ravago Chemicals North America, and First Source Worldwide expand presence through acquisitions, partnerships, and regional collaborations. Companies focus on innovation in dispersion technology, compliance with stringent environmental standards, and development of bio-based formulations to gain a competitive edge. Smaller firms like Neelikon Colors Global USA Inc. and ColorChem International Corp. compete by offering niche products and specialized customer solutions. Plastiques St-Paul Inc. and Liberty Specialty Chemicals strengthen regional markets through tailored product offerings. Competitive intensity remains high due to demand for sustainable pigments across diverse applications. It pushes companies to invest in R&D, expand geographic reach, and align with end-user sustainability goals. The competition fosters innovation, product differentiation, and long-term market resilience.

Recent Developments

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

- In May 2023, Palmer Holland, Inc., a specialty chemical distributor headquartered in Cleveland, Ohio, restructured its executive team to strengthen its focus on people, growth, and customer service. New appointments included leadership roles in industrial specialties and consumer & life sciences segments to support market transformation and sustained growth

- In February 2023, The Heubach Group entered an exclusive distribution partnership with Lintech International LLC. The agreement brings Heubach’s full set of organic, inorganic, and anti-corrosive pigment dispersions to U.S. markets, supporting powerful outreach across coatings, plastics, and printing sectors.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America Organic Pigment Dispersion Market will expand through rising demand for eco-friendly pigments across packaging and coatings.

- Advancements in dispersion technologies will improve pigment stability, color strength, and compatibility with multiple applications.

- Regulatory frameworks encouraging low-VOC and sustainable materials will continue to shape industry strategies and investments.

- Demand from the automotive and construction sectors will drive consistent growth in protective and decorative coatings.

- Digital printing advancements will strengthen adoption in flexible packaging, textiles, and high-quality graphic applications.

- Expansion of bio-based pigment production will enhance sustainability and reduce reliance on petrochemical feedstocks.

- Canada and Mexico will emerge as growth hotspots, complementing the United States’ dominant share in the region.

- Companies will prioritize product customization to meet brand-specific needs in consumer-centric industries.

- Strategic mergers, acquisitions, and partnerships will help firms consolidate presence and expand product portfolios.

- Long-term market opportunities will be shaped by integration of pigments into smart, functional, and specialty materials.