Market Overview

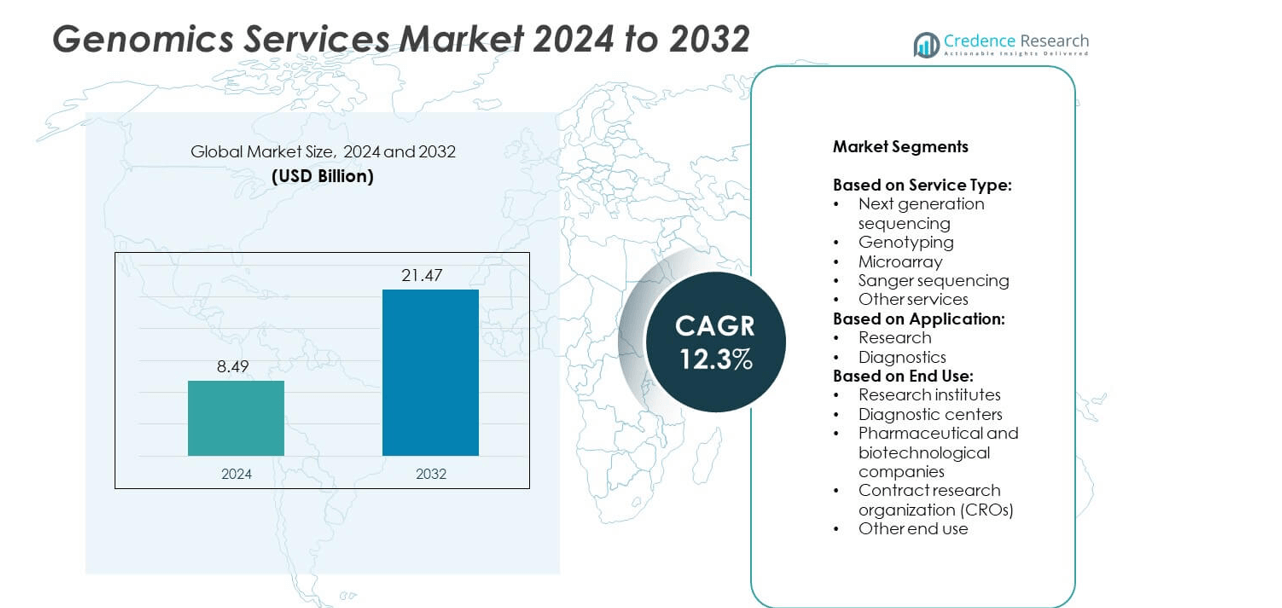

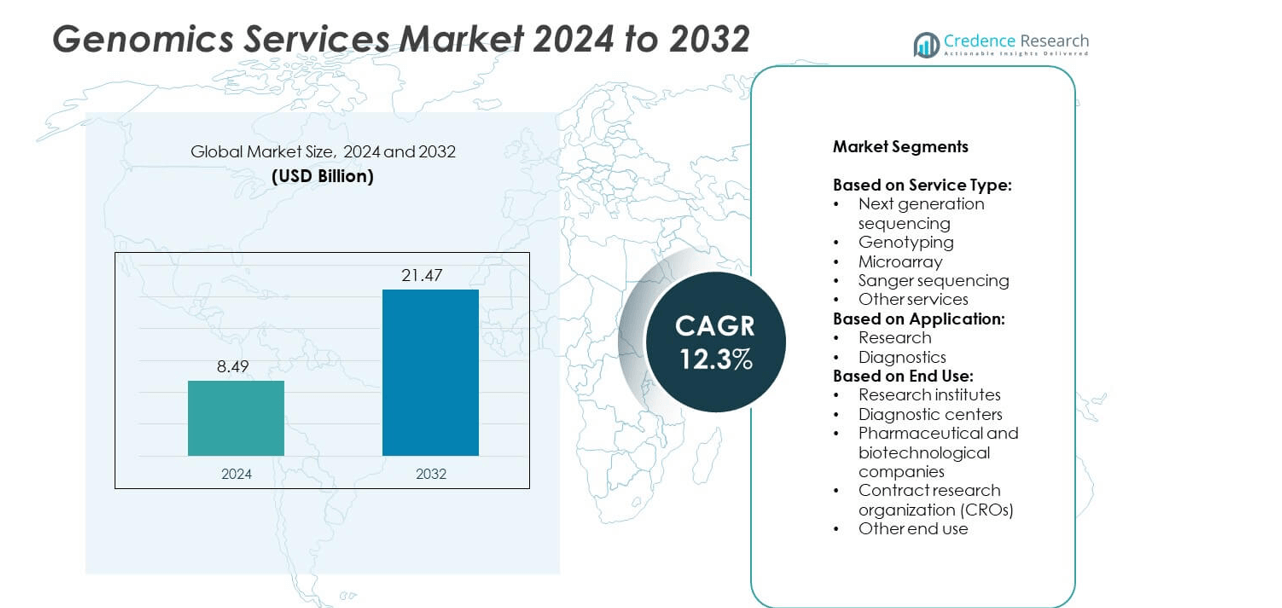

The Genomics Services Market size was valued at USD 8.49 Billion in 2024 and is expected to reach USD 21.47 Billion by 2032, growing at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Genomics Services Market Size 2024 |

USD 8.49 Billion |

| Genomics Services Market, CAGR |

12.3% |

| Genomics Services Market Size 2032 |

USD 21.47 Billion |

The Genomics Services market grows due to rising demand for precision medicine, increasing research funding, and rapid adoption of next-generation sequencing technologies. Advancements in bioinformatics and AI-driven analytics improve data accuracy and accelerate discovery. Expanding use of genomic testing in oncology, rare disease diagnosis, and preventive healthcare fuels growth. Direct-to-consumer genetic testing platforms attract wider populations. Falling sequencing costs make services more accessible. Collaborations between research institutes and industry players enhance innovation and strengthen global market presence.

North America leads the Genomics Services market due to advanced infrastructure, strong research funding, and high clinical adoption of genomic testing. Europe follows with large-scale genome projects and regulatory support for companion diagnostics. Asia Pacific shows fastest growth, driven by government-backed sequencing initiatives and rising healthcare investments. Key players such as Illumina, Eurofins Scientific, QIAGEN, and Macrogen focus on expanding service capabilities, investing in automation, and forming partnerships to strengthen presence across research and clinical genomics applications worldwide.

Market Insights

- The Genomics Services market was valued at USD 8.49 Billion in 2024 and is projected to reach USD 21.47 Billion by 2032, growing at a CAGR of 12.3%.

- Rising demand for precision medicine, targeted therapies, and population-scale genome mapping drives adoption globally.

- Advancements in next-generation sequencing, AI-powered bioinformatics, and cloud-based data analysis shape industry trends.

- Strong competition exists with key players investing in automation, partnerships, and clinical genomics expansion.

- High testing costs, limited reimbursement policies, and regulatory complexities act as key restraints to wider adoption.

- North America leads with advanced research infrastructure, while Asia Pacific shows fastest growth due to national genome programs and rising healthcare investments.

- Expanding clinical use in oncology, rare disease diagnosis, and preventive healthcare creates sustained opportunities for service providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Precision Medicine and Targeted Therapies

The Genomics Services market gains momentum from the rising adoption of precision medicine worldwide. Healthcare providers rely on genomic insights to deliver patient-specific treatment strategies. Demand for targeted therapies grows with increasing cases of cancer and rare genetic disorders. It enables faster diagnosis and effective disease management, improving patient outcomes. Pharmaceutical companies integrate genomic data to enhance drug discovery and reduce development risks. Government initiatives supporting genetic screening programs encourage wider market adoption.

- For instance, Guardant Health’s Guardant360 test reported 206,700 clinical oncology tests in 2024 (excluding its Shield screening tests), expanding its utility in guiding treatments.

Advancements in Next-Generation Sequencing Technologies

Continuous development of next-generation sequencing (NGS) platforms supports strong market growth. The Genomics Services market benefits from faster, more cost-efficient sequencing solutions. High-throughput systems allow researchers to analyze larger sample volumes with better accuracy. It shortens turnaround times for clinical and research applications. Integration of automation and cloud-based bioinformatics further improves workflow efficiency. Lower sequencing costs make genomic services accessible to smaller labs and emerging research centers.

- For instance, Illumina’s NovaSeq X Plus platform is capable of sequencing more than 20,000 whole human genomes per year, offering high throughput for large-scale projects.

Expansion of Genomic Research and Population-Scale Studies

Global investment in genomic research projects accelerates demand for comprehensive services. The Genomics Services market sees growth from population-scale sequencing programs and biobank initiatives. Governments and academic institutions use large-scale data to study disease patterns and genetic diversity. It drives innovation in diagnostics, preventive healthcare, and personalized treatment plans. Partnerships between research bodies and private companies expand service capabilities. Growing focus on rare disease studies boosts sequencing volumes and data analytics needs.

Rising Healthcare Expenditure and Supportive Policies

Increased healthcare spending worldwide supports broader adoption of genomic services. The Genomics Services market benefits from reimbursement coverage for genetic testing in several regions. Regulatory agencies promote quality standards and patient data protection, increasing trust in services. It encourages more patients and clinicians to use genetic screening options. Private players invest in expanding testing facilities and distribution networks. Supportive government programs for early disease detection create sustained market opportunities.

Market Trends

Integration of Artificial Intelligence and Bioinformatics Solutions

The Genomics Services market experiences rapid adoption of AI and bioinformatics platforms. Advanced algorithms improve accuracy of genomic data interpretation and variant detection. It streamlines workflows for researchers and clinical laboratories. Cloud-based solutions allow secure storage and real-time analysis of large datasets. AI-driven insights help identify novel biomarkers and drug targets. Integration of these tools reduces manual errors and enhances decision-making for precision medicine.

- For instance, Agendia’s FLEX Study recently reached 20,000 enrolled patients, with nearly 10,000 having 3-year follow-ups and 4,000 five-year follow-ups, to study early-stage breast cancer therapies.

Growing Use of Direct-to-Consumer Genetic Testing

Demand for direct-to-consumer (DTC) testing continues to rise, driven by consumer interest in personal health data. The Genomics Services market expands through easy-to-access home-based test kits. Companies focus on expanding test menus, including ancestry, carrier screening, and wellness insights. It encourages individuals to seek preventive care and early diagnosis. Partnerships with telehealth providers increase post-test counseling services. Digital platforms improve user engagement and result accessibility.

- For instance, Exact Sciences analyzed over 10,000 advanced solid tumor samples in a recent study and found more than 90 % had genetic alterations actionable for treatment.

Expansion of Clinical Genomics in Oncology and Rare Diseases

Clinical applications of genomics witness significant growth in oncology and rare disease research. The Genomics Services market supports tumor profiling, companion diagnostics, and hereditary cancer testing. Hospitals adopt genomic testing to guide targeted therapy decisions. It enables faster identification of actionable mutations and improves treatment outcomes. Growth of gene therapies boosts need for precise genetic analysis. Rising number of rare disease registries expands clinical testing opportunities.

Focus on Cost Efficiency and Scalability in Sequencing Platforms

Service providers invest in scalable sequencing solutions to meet growing sample volumes. The Genomics Services market benefits from falling costs of NGS platforms. High-throughput instruments improve turnaround time and efficiency. It makes genomic testing more affordable for research labs and clinical settings. Automation of sample preparation reduces labor costs and increases reproducibility. Market players compete on pricing and turnaround time to attract customers.

Market Challenges Analysis

High Cost of Genomic Testing and Limited Accessibility

The Genomics Services market faces challenges due to high costs of advanced testing solutions. Many patients in low- and middle-income regions lack access to affordable genomic services. It limits adoption despite strong awareness of precision medicine benefits. Small research labs struggle with the expense of high-throughput sequencing platforms. Limited insurance reimbursement policies further restrict routine genetic testing. Providers work to reduce costs through partnerships and technology upgrades, but affordability remains a barrier.

Data Privacy Concerns and Regulatory Complexities

Compliance with strict data protection laws adds complexity for service providers. The Genomics Services market must address patient privacy concerns and ensure secure handling of sensitive genetic data. It requires investment in advanced cybersecurity measures and encrypted storage systems. Varied regulatory requirements across regions create delays in service expansion. Ethical concerns about data sharing and misuse reduce public trust. Companies focus on transparency and regulatory alignment to improve acceptance and maintain growth momentum.

Market Opportunities

Rising Adoption of Preventive Healthcare and Early Diagnosis

The Genomics Services market gains significant opportunities from the shift toward preventive healthcare. Growing awareness about genetic risk factors drives demand for early testing. It enables proactive management of chronic and hereditary conditions. Hospitals and clinics integrate genomics into routine health checkups, creating new revenue streams. Direct-to-consumer testing platforms expand reach and attract younger demographics. Public health programs focusing on population screening further support market expansion.

Expansion into Emerging Economies and Untapped Markets

Emerging economies present strong potential for growth due to rising healthcare investments. The Genomics Services market benefits from government funding for research infrastructure. It creates opportunities for local partnerships and establishment of regional sequencing facilities. Pharmaceutical companies expand clinical trial networks in Asia-Pacific and Latin America. Falling sequencing costs make advanced services accessible to a broader customer base. Growing collaborations with academic institutions strengthen innovation and service adoption.

Market Segmentation Analysis:

By Service Type:

Next-generation sequencing (NGS) due to its high accuracy and ability to process large volumes of data quickly. NGS dominates research and clinical applications, enabling whole-genome and targeted sequencing projects. Genotyping follows as a major contributor, supporting large-scale studies such as genome-wide association studies (GWAS). Microarray technology remains relevant for expression profiling and copy number variation studies. Sanger sequencing continues to serve as a gold standard for small-scale validation and low-throughput applications. Other services, including epigenomics and transcriptomics, gain traction as researchers seek multi-omics approaches for disease understanding. It creates opportunities for integrated service providers offering end-to-end solutions.

- For instance, Labcorp processes more than 700 million tests annually for patients globally across its comprehensive diagnostic and drug development laboratory services. This number includes genomic and molecular diagnostics along with other services.

By Application:

Research holds the largest share, driven by public and private funding for genomics programs. The Genomics Services market supports initiatives such as population-scale genome mapping and functional genomics studies. Diagnostics is the fastest-growing application due to increasing use of genomic testing in oncology, infectious disease detection, and rare disease diagnosis. It enables precision medicine adoption and better clinical decision-making. Expanding coverage for genetic testing in developed markets accelerates this segment’s growth.

- For instance, GeneDx reported that its exome and genome test results volume grew to 23,102 in Q2 2025, up 28% year-over-year.

By End-Use:

Research institutes represent the dominant segment, using genomics services for academic studies, disease modeling, and biomarker discovery. Pharmaceutical and biotechnological companies leverage these services for drug discovery and companion diagnostics development. Diagnostic centers rapidly expand capabilities to offer clinical genetic testing. Contract research organizations (CROs) support outsourcing demand for sequencing and bioinformatics. Other end users, including government agencies and non-profit organizations, contribute to market demand through funding and public health initiatives. It drives continuous innovation and market expansion across regions.

Segments:

Based on Service Type:

- Next generation sequencing

- Genotyping

- Microarray

- Sanger sequencing

- Other services

Based on Application:

Based on End Use:

- Research institutes

- Diagnostic centers

- Pharmaceutical and biotechnological companies

- Contract research organization (CROs)

- Other end use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Genomics Services market with 38% share in 2024, supported by strong infrastructure for genomic research and healthcare innovation. The region benefits from high adoption of next-generation sequencing (NGS) platforms across academic institutes, diagnostic laboratories, and pharmaceutical companies. It leads in precision medicine initiatives, with several government programs funding genomics research and population health studies. Clinical adoption is accelerated by favorable reimbursement policies for genetic testing, particularly in oncology and rare disease diagnostics. The presence of key players, including Illumina, Thermo Fisher Scientific, and Agilent Technologies, strengthens the competitive environment. Collaborations between biopharma companies and research institutes further increase the demand for sequencing, genotyping, and bioinformatics services. It continues to dominate market growth due to its advanced technology adoption and strong regulatory support.

Europe

Europe accounts for 27% of the Genomics Services market, driven by strong government-backed genomics initiatives and research funding. Leading countries such as the United Kingdom, Germany, and France invest heavily in precision medicine programs and population-scale sequencing projects. Widespread adoption of genomics services supports clinical trials, personalized therapies, and rare disease diagnosis. The European Medicines Agency’s support for companion diagnostics accelerates the integration of genomics in drug development. Growing collaborations between academic research centers and biotech firms strengthen the regional ecosystem. The region also benefits from harmonized data-sharing frameworks under GDPR, improving research efficiency and patient trust. It maintains robust growth with increasing investments in bioinformatics and genomics infrastructure.

Asia Pacific

Asia Pacific holds 22% market share and is the fastest-growing region in the Genomics Services market. Rising healthcare spending, expanding biotechnology sectors, and government-backed genomics projects contribute to rapid adoption. Countries like China, Japan, and India launch national genome sequencing programs, creating demand for large-scale data analysis and service providers. Pharmaceutical and biopharmaceutical companies expand clinical research networks, boosting outsourcing opportunities. It benefits from falling sequencing costs, making advanced testing more affordable and accessible. Academic research institutes and hospitals collaborate with global players to establish local sequencing centers. Strong growth is expected as awareness of precision medicine and genetic screening continues to rise.

Latin America

Latin America represents 7% of the Genomics Services market, with Brazil and Mexico leading adoption. The region invests in expanding diagnostic capabilities, particularly in oncology and infectious disease genomics. Research collaborations with international institutions strengthen local genomic research. Limited reimbursement coverage and lower awareness slow adoption in some areas, but increasing private investments improve accessibility. It shows potential for growth as infrastructure develops and genetic testing becomes more affordable. Public health initiatives targeting rare disease screening and newborn screening support long-term market expansion.

Middle East and Africa

The Middle East and Africa hold 6% share of the Genomics Services market, characterized by gradual adoption of genomic testing services. The Gulf countries, including Saudi Arabia and the UAE, invest in precision medicine programs and research infrastructure. Africa sees rising interest in genomics to address region-specific diseases and genetic diversity. Limited infrastructure and shortage of skilled professionals remain challenges for wide-scale adoption. It gains momentum through international collaborations and funding programs focused on rare disease diagnosis and infectious disease research. Growing investments in healthcare modernization are expected to create new opportunities for genomics service providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Macrogen

- Illumina

- Bio Rad Laboratories

- GENEWIZ (Azenta)

- Eurofins Scientific

- QIAGEN

- Color Genomics

- BGI Genomics

- GE Healthcare

- IQVIA

- Danaher

- 23andMe

- LGC

- Hoffmann-La Roche

- Agilent Technologies

Competitive Analysis

The Genomics Services market features strong competition with leading players such as Macrogen, Illumina, Bio Rad Laboratories, GENEWIZ (Azenta), Eurofins Scientific, QIAGEN, Color Genomics, BGI Genomics, GE Healthcare, IQVIA, Danaher, 23andMe, LGC, F. Hoffmann-La Roche, and Agilent Technologies. These companies focus on expanding service portfolios, improving sequencing efficiency, and strengthening global presence through partnerships and acquisitions. Innovation in next-generation sequencing platforms and bioinformatics tools drives competitive differentiation. Companies invest in automation, AI-driven analytics, and cloud-based solutions to enhance data accuracy and reduce turnaround times. Strategic collaborations with research institutes and pharmaceutical firms expand their customer base and support drug discovery programs. Several players target population genomics and large-scale sequencing projects to increase market penetration. Continuous development of clinical genomics applications, including oncology testing and rare disease diagnostics, fuels growth. Regional expansion in Asia Pacific and Latin America remains a focus to capture rising demand in emerging markets. Competition encourages price optimization and wider accessibility of services, making genomics more affordable for smaller labs and clinics. The market remains highly dynamic with players competing on technology, quality, and scalability, positioning themselves to serve both research and clinical segments effectively.

Recent Developments

- In 2024, Illumina completed integration of its new XLEAP-SBS sequencing chemistry into all reagents for its NextSeq 1000 and NextSeq 2000 instruments, improving speed (~20% faster turnaround), quality, and output.

- In 2024, QIAGEN launched Biomedical KB-AI, a generative AI-driven knowledge base containing over 640 million biomedical relationships to aid drug discovery and biomarker identification.

- In 2024, Azenta launched a long-read Whole Genome Sequencing (WGS) test for clinical applications, becoming the first commercial provider in the US to offer this test.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Genomics Services market will see strong demand from precision medicine and personalized therapies.

- Adoption of next-generation sequencing platforms will expand across research and clinical laboratories.

- AI-powered bioinformatics tools will improve data interpretation and speed of genomic analysis.

- Direct-to-consumer genetic testing will attract younger demographics and boost preventive healthcare usage.

- Population-scale genome mapping programs will generate higher service volumes for providers.

- Pharmaceutical companies will increase outsourcing of sequencing and genotyping for drug discovery.

- Falling sequencing costs will make advanced testing more accessible in emerging economies.

- Regulatory frameworks will strengthen focus on data privacy and secure genomic data sharing.

- Collaborations between academic institutes and industry players will accelerate innovation.

- Growth in rare disease research and companion diagnostics will create new market opportunities.