Market Overview:

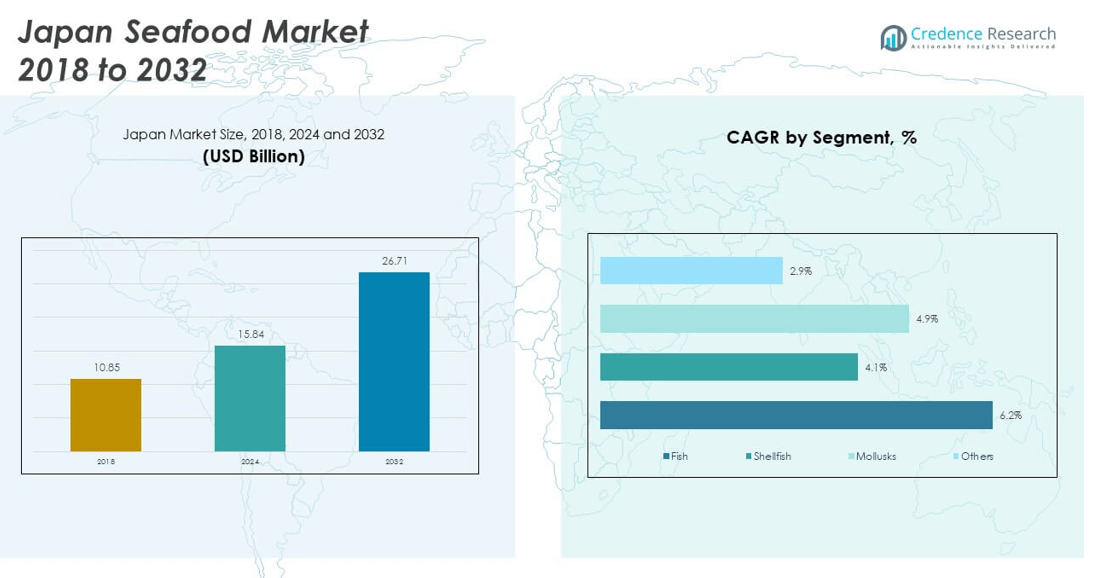

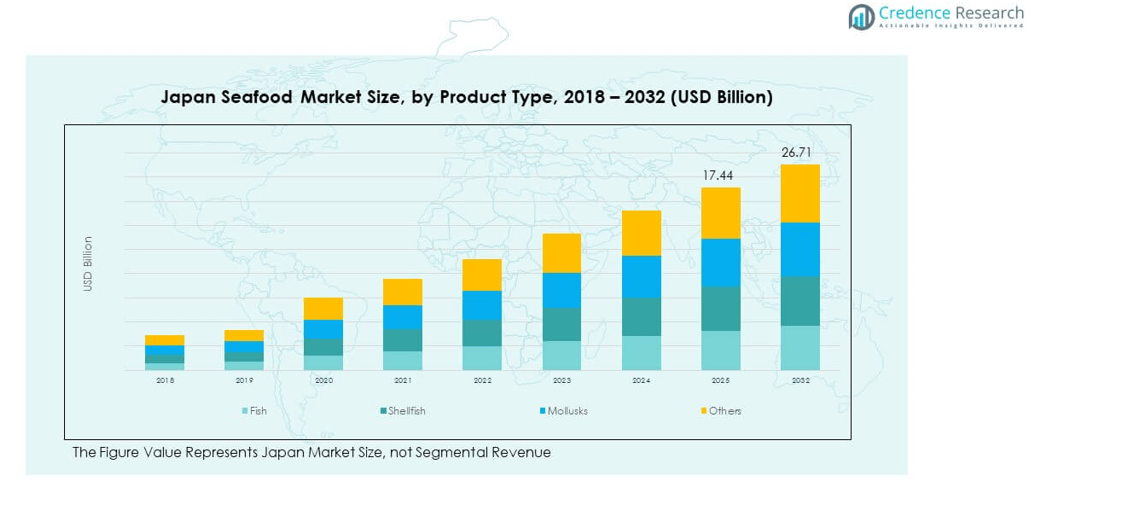

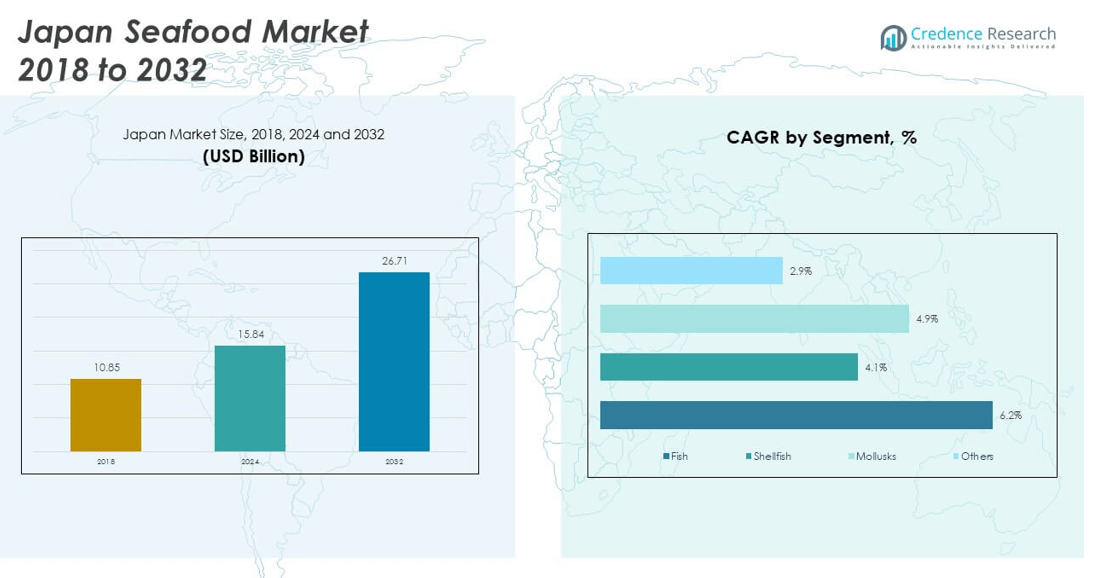

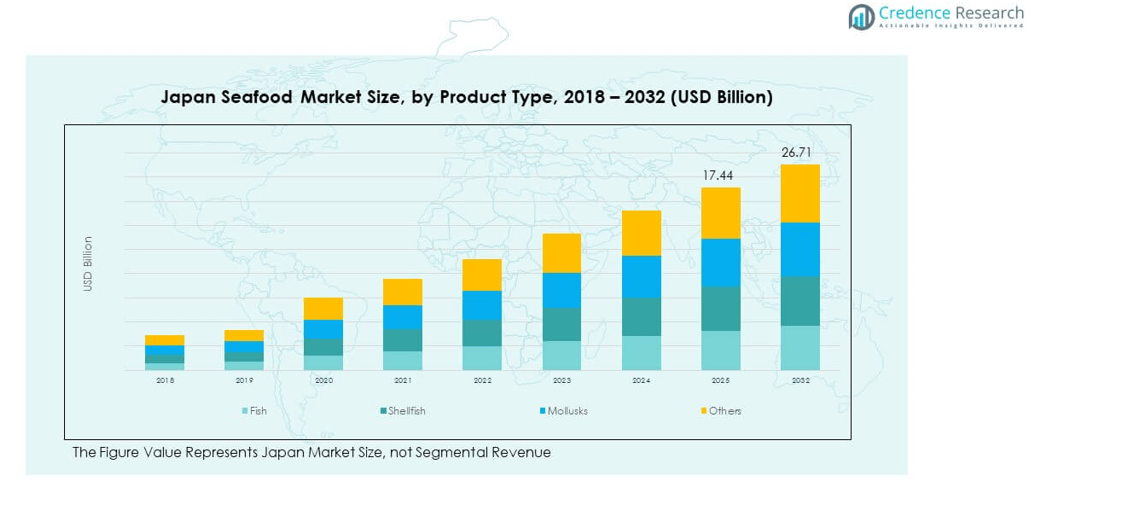

The Japan Seafood Market size was valued at USD 10.85 billion in 2018 to USD 15.84 billion in 2024 and is anticipated to reach USD 26.71 billion by 2032, at a CAGR of 6.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Seafood Market Size 2024 |

USD 15.84 billion |

| Japan Seafood Market, CAGR |

6.28% |

| Japan Seafood Market Size 2032 |

USD 26.71 billion |

The Japan Seafood Market grows through rising consumer demand for nutrient-rich food products, particularly protein and omega-3-rich fish varieties. Health awareness and lifestyle changes are influencing preferences for fresh and processed seafood options. Government policies supporting sustainable fishing and aquaculture expansion encourage stable domestic production. Advancements in cold chain logistics strengthen the reliability of distribution, while value-added products meet urban demand. Strong export potential, especially across Asia and North America, further fuels growth momentum. It continues to benefit from both cultural traditions and modern consumption trends.

Regionally, Hokkaido leads due to abundant marine resources, advanced aquaculture, and strong export capacity. Kanto, including Tokyo, acts as the largest consumption hub, supported by its dense population and foodservice networks. Western Japan and Kyushu are emerging regions, benefiting from aquaculture investments and proximity to Asian trade routes. Southeast Asia and China strengthen ties as key destinations for Japanese seafood exports. It maintains a balanced growth profile, with leading regions ensuring supply strength and emerging areas creating new opportunities.

Market Insights

- The Japan Seafood Market was valued at USD 10.85 billion in 2018, reached USD 15.84 billion in 2024, and is projected to attain USD 26.71 billion by 2032, growing at a CAGR of 6.28%.

- Hokkaido holds 38% share, leading due to abundant marine resources and strong aquaculture; Kanto follows with 34% share as the largest consumption hub, while Western Japan and Kyushu account for 28% with a mix of aquaculture and export activity.

- Kyushu is the fastest-growing region with 28% share, driven by advanced aquaculture practices and proximity to Asian trade routes supporting exports.

- Fish dominates with 47% share, supported by high demand for tuna, salmon, and mackerel across domestic and export markets.

- Shellfish holds 28% share, followed by mollusks and others, reflecting diversified seafood consumption and niche demand in premium dining and international trade.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Preference for Nutrient-Rich Diets

Consumers are increasingly adopting healthier diets that include seafood due to its protein and omega-3 content. Growing lifestyle-related health issues drive more people toward nutrient-rich fish and shellfish. Public awareness campaigns further support this trend by promoting seafood as a balanced dietary choice. Younger demographics are shifting preferences toward premium and sustainable seafood products. The demand for fresh, frozen, and ready-to-cook options is also rising steadily. Convenience-focused formats such as pre-packaged sushi kits attract urban consumers. The Japan Seafood Market benefits from these evolving dietary habits. It sustains growth by meeting rising nutritional expectations with diverse offerings.

- For instance, Nissui introduced its “Air Fried” frozen seafood product line for the U.S. market, achieving a 50% reduction in lipid content compared to conventional breaded fish products; this innovation caters directly to consumers seeking healthier alternatives and is highlighted in their 2023 annual report.

Government Policies Supporting Sustainability and Supply

Japan’s government has introduced measures to promote sustainable fishing practices and aquaculture. Regulations ensure that overfishing risks are reduced and marine biodiversity is preserved. This stability in supply strengthens confidence among industry players and consumers. Investments in technology-backed aquaculture systems enhance productivity across key coastal regions. Authorities also support traceability initiatives that build consumer trust in seafood origins. Sustainable certifications increase visibility of responsibly sourced products in retail markets. The Japan Seafood Market thrives under these supportive frameworks. It aligns with global commitments to ensure responsible consumption and long-term supply security.

Advancements in Aquaculture and Cold Chain Infrastructure

Aquaculture growth addresses the rising demand for seafood in both domestic and export markets. Advanced breeding technologies ensure higher yield and disease-resistant fish stock. Cold chain systems improve storage, handling, and distribution efficiency. Reliable refrigeration allows longer preservation of freshness and quality. This infrastructure expansion reduces post-harvest losses significantly. Exporters rely on these improvements to maintain international quality standards. The Japan Seafood Market integrates these advancements to maintain its competitive edge. It positions itself as a global supplier of premium seafood products.

- For example, Nissui’s Oita Marine Biological Technology Center achieved Japan’s first full life-cycle aquaculture of Japanese amberjack in 2022 using only artificial juveniles. This breakthrough enables year-round production without dependence on wild stocks, advancing sustainable aquaculture in Japan.

Export Expansion and Growing Global Demand

Global markets increasingly demand premium Japanese seafood such as tuna and shellfish. Export opportunities are supported by rising appreciation of Japanese cuisine worldwide. Countries in Asia and North America show consistent growth in imports. International trade agreements simplify logistics and reduce barriers for exporters. Branding of seafood as safe, fresh, and high quality improves its reputation abroad. Growing income levels across emerging economies create additional demand. The Japan Seafood Market capitalizes on these global opportunities. It strengthens its role as a key player in the international seafood trade.

Market Trends

Premiumization and Shift Toward High-Value Seafood Products

Japanese consumers are showing a strong preference for premium seafood varieties. Tuna, eel, and shellfish continue to dominate high-value demand. Luxury dining experiences highlight seafood as a central element of fine cuisine. Ready-to-eat premium sushi and sashimi kits attract urban professionals. Brands emphasize quality, freshness, and authenticity to secure consumer loyalty. Digital platforms enable retailers to promote premium seafood directly to households. The Japan Seafood Market adapts by investing in premium product lines. It leverages this trend to enhance domestic and export growth.

- For example, Maruha Nichiro will begin trial sales of “Sugi,” a high-fat, white-fleshed fish species, starting in May 2025. The company aims to grow production to 100,000 fish by fiscal year 2027. It also plans to obtain ASC certification for this species.

Digital Transformation in Distribution and Retail Channels

E-commerce platforms are becoming major channels for seafood distribution. Consumers prefer online purchases due to convenience and variety. Retailers use digital platforms to offer traceability and product authenticity information. Blockchain-based systems enhance transparency across supply chains. Smart logistics solutions improve delivery speed and preserve freshness. Subscription services for seafood boxes gain popularity among younger consumers. The Japan Seafood Market adopts digital tools to improve customer access and trust. It uses these innovations to secure long-term consumer engagement.

Growing Popularity of Processed and Ready-to-Eat Formats

Busy lifestyles increase the demand for ready-to-eat seafood options. Processed formats such as frozen fillets, seafood snacks, and canned fish gain traction. Urban households rely on these products for convenience and quick preparation. Companies expand product ranges to include healthier processing methods. Vacuum-sealed packaging maintains freshness and ensures longer shelf life. Ready-to-cook seafood kits also emerge as a mainstream trend. The Japan Seafood Market expands its portfolio to meet this demand. It achieves greater reach by offering diverse and convenient solutions.

Sustainability and Eco-Friendly Consumption Practices

Eco-conscious consumers prioritize seafood sourced through sustainable practices. Certifications such as MSC gain importance in retail decision-making. Companies highlight eco-friendly packaging to align with sustainability goals. Marine conservation initiatives influence brand strategies and product positioning. Consumer trust builds through visible sustainability commitments. Restaurants and retailers promote sustainably sourced menus. The Japan Seafood Market embraces these eco-driven trends. It reinforces its global standing by aligning with responsible consumption values.

- For example, in 2024, yellowtail farmed by Kyokuyo group company Kuroshio Suisan Co., Ltd. was awarded Marine Eco-Label Japan (MEL) certification. This certification underscores the company’s focus on sustainable aquaculture practices and responsible marine stewardship.

Market Challenges Analysis

Declining Fishery Resources and Overfishing Pressures

Japan’s seafood industry faces significant pressure from declining fishery resources. Overfishing and environmental changes reduce stock availability. Rising sea temperatures impact fish migration and reproduction patterns. Dependence on imports creates vulnerabilities in supply stability. This affects pricing strategies and industry competitiveness. Government-imposed quotas limit flexibility for domestic fishermen. The Japan Seafood Market must address these challenges to ensure resilience. It requires stronger collaboration between regulators, producers, and distributors.

High Operating Costs and Global Competition

Operating costs remain high due to fuel expenses, labor shortages, and advanced logistics requirements. Maintaining cold chain efficiency further adds to financial burdens. Imported seafood often competes at lower prices, challenging domestic producers. Global suppliers from regions with cheaper production costs intensify competition. Meeting international standards requires consistent investment in quality and traceability. Fluctuating currency values influence export margins and profitability. The Japan Seafood Market contends with these financial and competitive pressures. It seeks innovative strategies to maintain market position and growth momentum.

Market Opportunities

Expanding Role of Functional and Health-Focused Seafood Products

Growing consumer focus on health fuels opportunities for seafood enriched with added nutrients. Functional seafood categories such as fortified fish and omega-3 enhanced products gain popularity. Foodservice outlets also demand healthier menu options. Companies explore opportunities in nutraceutical-based seafood innovations. Rising lifestyle diseases increase demand for preventive health foods. The Japan Seafood Market addresses this gap with new product development. It aligns seafood offerings with wellness-oriented consumption. This creates fresh growth prospects across retail and foodservice sectors.

Global Expansion and Brand Strengthening Through Exports

Export potential offers major growth opportunities across international markets. Japanese seafood holds a strong global reputation for quality and authenticity. Branding strategies highlight cultural value and culinary heritage. Growing appreciation of Japanese cuisine strengthens seafood demand abroad. Trade partnerships open access to emerging economies with rising purchasing power. Logistics innovations support faster delivery to distant markets. The Japan Seafood Market leverages these prospects to expand its global footprint. It secures new revenue streams while reinforcing its leadership in premium seafood exports.

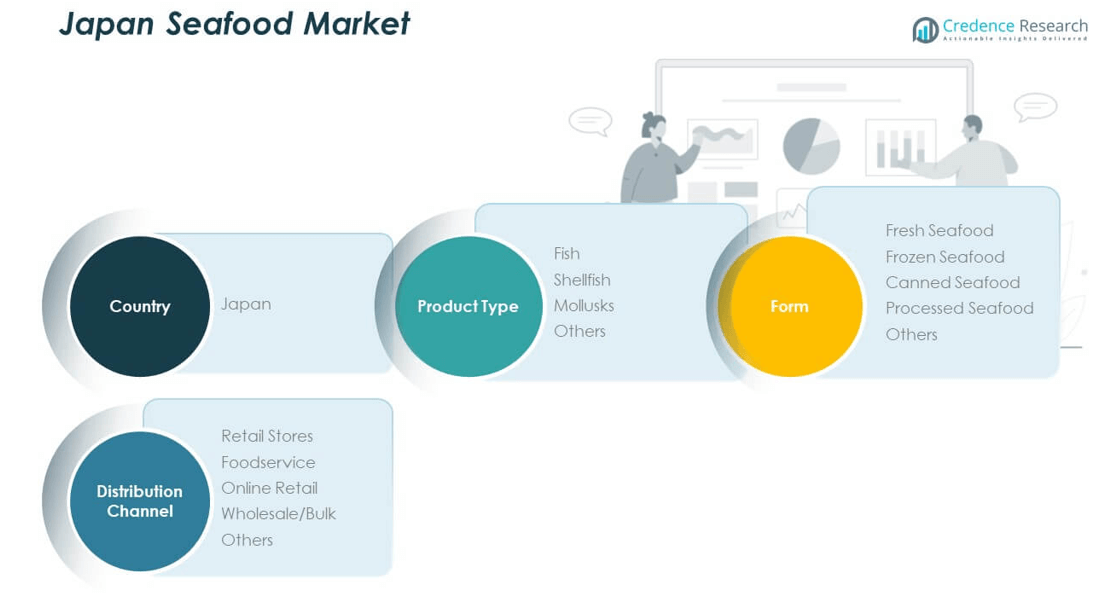

Market Segmentation Analysis

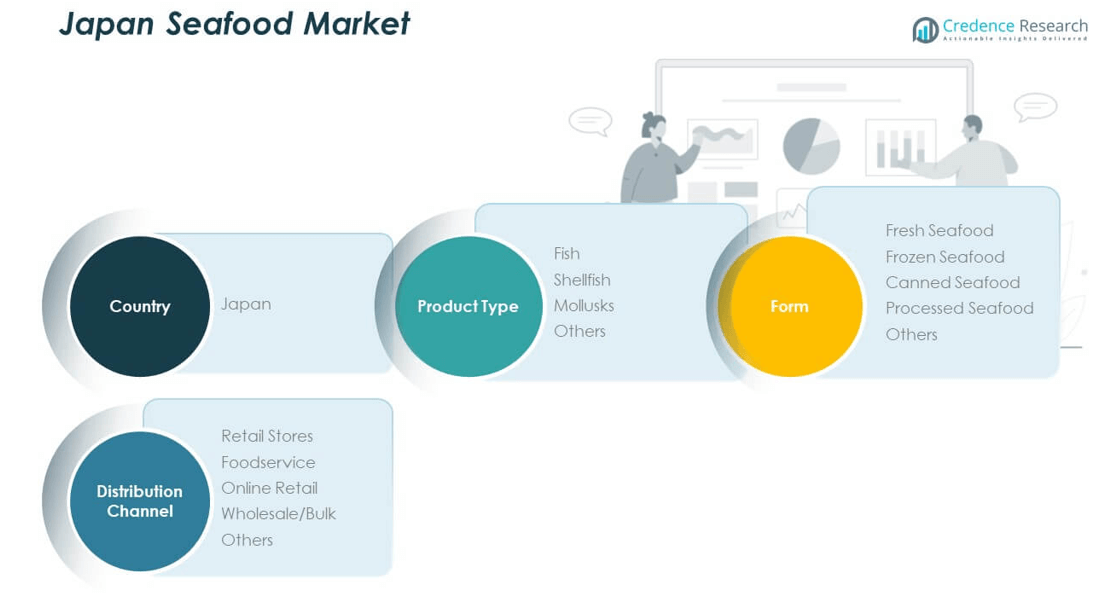

By product type, fish dominates the Japan Seafood Market, supported by high consumption of tuna, salmon, and mackerel. Shellfish, including crabs and shrimps, hold strong demand in both domestic and export markets. Mollusks such as squid and octopus maintain steady growth due to culinary traditions. Other categories including specialty species capture niche demand in premium foodservice channels. It continues to diversify across these product segments to balance traditional and modern consumer needs.

- For instance, in July 2025, Pure Salmon Japan (Soul of Japan Ltd.) secured USD 460 million to build a 10,000-tonne land-based Atlantic salmon RAS facility in Tsu City, Mie Prefecture, with first harvest planned for mid-2027.

By form, fresh seafood leads consumption, reflecting Japanese preference for raw and high-quality products. Frozen seafood follows closely, supported by technological advances in preservation and storage. Canned seafood records stable sales, driven by long shelf life and convenience. Processed seafood, including ready-to-eat and value-added items, grows in popularity among urban households. Other forms serve specific market niches and support product innovation. It strengthens its position through continuous development in product formats that suit changing lifestyles.

- For instance, in 2024 DayBreak Co., Ltd. showcased its ARTLOCK Freezer technology in collaboration with fishery experts from Toyama Prefecture. The system preserves the flavor, texture, and freshness of locally caught fish by preventing drying, oxidation, and color change.

By distribution channel, retail stores remain the largest segment, ensuring strong consumer access to seafood. Foodservice, including restaurants and catering, generates consistent demand with focus on freshness and variety. Online retail grows rapidly, supported by digital platforms and efficient logistics. Wholesale and bulk supply serve institutional buyers and international trade flows. Other channels contribute by addressing regional and specialty markets. It maintains growth by integrating traditional retail networks with emerging digital and wholesale platforms to meet broad demand.

Segmentation

By Product Type

- Fish

- Shellfish

- Mollusks

- Others

By Form

- Fresh Seafood

- Frozen Seafood

- Canned Seafood

- Processed Seafood

- Others

By Distribution Channel

- Retail Stores

- Foodservice

- Online Retail

- Wholesale/Bulk

- Others

Regional Analysis

Hokkaido and Northern Japan

Hokkaido dominates the Japan Seafood Market with a 38% share, driven by its rich marine resources and large-scale aquaculture activities. The region is known for high-quality salmon, crab, and scallops, which enjoy strong domestic and export demand. Cold water conditions support sustainable harvest and enhance seafood quality. Infrastructure investments in fishing ports and cold storage facilities strengthen the region’s supply chain. Hokkaido also benefits from government support promoting regional fisheries. Strong branding of seafood products enhances consumer trust in both local and international markets. It continues to lead the industry with consistent supply and premium product positioning.

Kanto and Central Japan

Kanto and Central Japan hold a 34% share, reflecting their role as the largest consumption hub. Tokyo and surrounding areas create steady demand through retail, foodservice, and premium dining outlets. Distribution networks are highly advanced, enabling efficient seafood trade across the country. Large seafood markets such as Toyosu in Tokyo serve as national distribution centers. The region’s economic strength ensures stable demand for fresh and processed seafood products. Imports entering through major ports support variety and supply balance. It plays a vital role in shaping consumer trends and maintaining price competitiveness in the market.

Western Japan and Kyushu

Western Japan and Kyushu account for a 28% share, supported by strong fisheries and export-oriented activities. Kyushu specializes in aquaculture of yellowtail, sea bream, and mackerel, supplying both domestic and overseas markets. The region benefits from proximity to Asian trade routes, making exports efficient and competitive. Seafood industries here focus on innovation in farming techniques and sustainable practices. Local governments encourage diversification into value-added seafood processing. Regional demand is sustained by vibrant culinary traditions and strong retail presence. It strengthens the overall Japan Seafood Market by combining export opportunities with dynamic local consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha (Nissui)

- Kyokuyo Co., Ltd.

- Daisui Co., Ltd.

- Proximar Seafood (Fuji Atlantic Salmon)

- Nissin Food Products

- Hayashikane Sangyo Co., Ltd.

- Nihon Suisan Katei Co., Ltd.

- Hachikan Co., Ltd.

- Kato Gyogyo

Competitive Analysis

The Japan Seafood Market features a concentrated competitive landscape led by established domestic players with strong supply chain integration. Companies such as Maruha Nichiro, Nippon Suisan Kaisha (Nissui), and Kyokuyo Co., Ltd. dominate production, processing, and distribution. Their broad product portfolios and global presence give them a distinct advantage in exports. These players invest heavily in sustainable fishing, advanced aquaculture, and cold chain technologies to maintain quality and efficiency. Mid-sized firms like Daisui and Hayashikane Sangyo strengthen regional supply with niche products and value-added processing. It also benefits from partnerships with international firms that bring advanced farming and packaging innovations. Competitive strategies focus on sustainability certifications, digital traceability systems, and premium branding to appeal to both domestic and global consumers. Market leaders consistently expand through mergers, product launches, and geographic diversification to secure long-term growth. Smaller players strengthen market presence by targeting specialty seafood categories such as eel, shellfish, and regional delicacies. Export-driven firms in Kyushu and Hokkaido capitalize on rising global demand for Japanese seafood, especially in Asia and North America.

Recent Developments

- In September 2025, Japanese seafood giant Kyokuyo Co., Ltd. announced a major acquisition, reaching a basic agreement to acquire a majority stake in the Engelsviken Group, including Engelsviken Canning Denmark (ECD) and Engelsviken Norway (EN). This move is a key part of Kyokuyo’s broader strategy to expand its overseas footprint and strengthen synergies within its European operations, enabling increased sales of processed salmon, trout, and fried seafood through its subsidiaries in the Netherlands and Turkey.

- July 2025, two Japanese companies, ShrimpTech JIRCAS and IMT Engineering, signed a letter of intent to pursue a strategic partnership for the development and expansion of land-based shrimp farming in Japan. This collaboration aims to advance innovation and sustainability in the domestic shrimp production sector by leveraging the strengths of both companies.

- In July 2025, Maruha Nichiro, a leading Japanese seafood company, announced a partnership with South Korea’s Dongwon Industries to tap into the Korean food boom in Japan, including the launch of new seafood-based products specifically developed for the fall season. This alliance highlights ongoing cross-border collaboration and product innovation in the Japanese seafood market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and high-value seafood varieties will expand, strengthening domestic and export opportunities.

- Aquaculture innovation with disease-resistant species will enhance production capacity and reduce supply volatility.

- Cold chain infrastructure upgrades will improve freshness, efficiency, and distribution reliability across the market.

- Digital platforms will transform seafood sales, with e-commerce becoming a primary retail channel.

- Sustainability certifications and eco-friendly sourcing will remain central to brand positioning and consumer trust.

- Processed and ready-to-eat seafood will capture rising demand from urban and younger demographics.

- Global appreciation of Japanese cuisine will boost seafood exports to Asia, North America, and Europe.

- Strategic partnerships and mergers will intensify, enabling firms to expand geographic presence and portfolios.

- Government support for sustainable fishing and traceability systems will strengthen industry resilience.

- Regional producers in Hokkaido and Kyushu will expand roles, balancing export growth with local consumption.