Market Overview

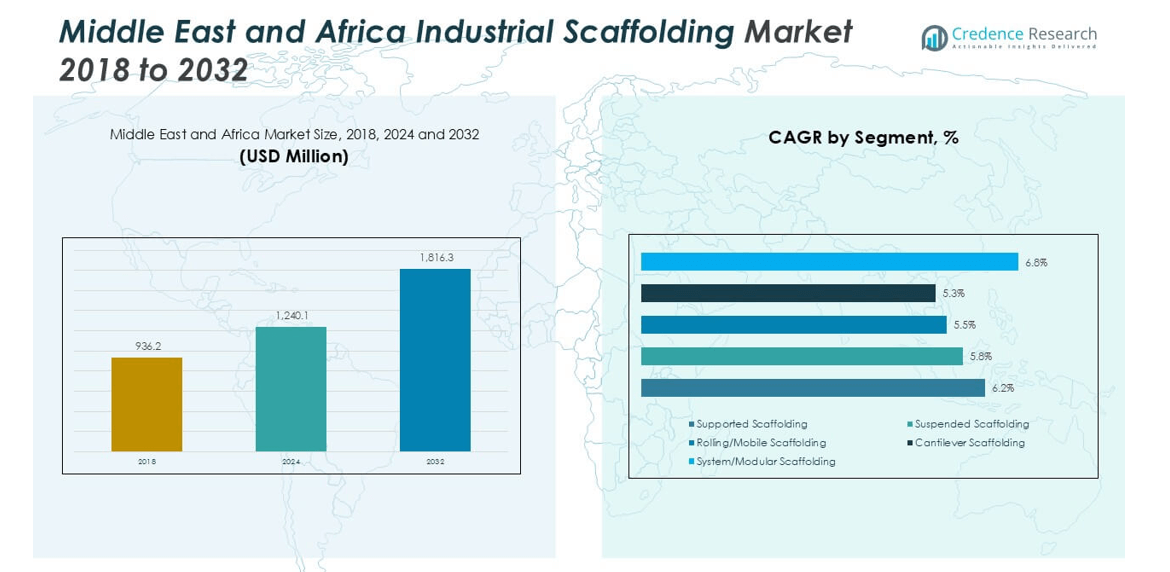

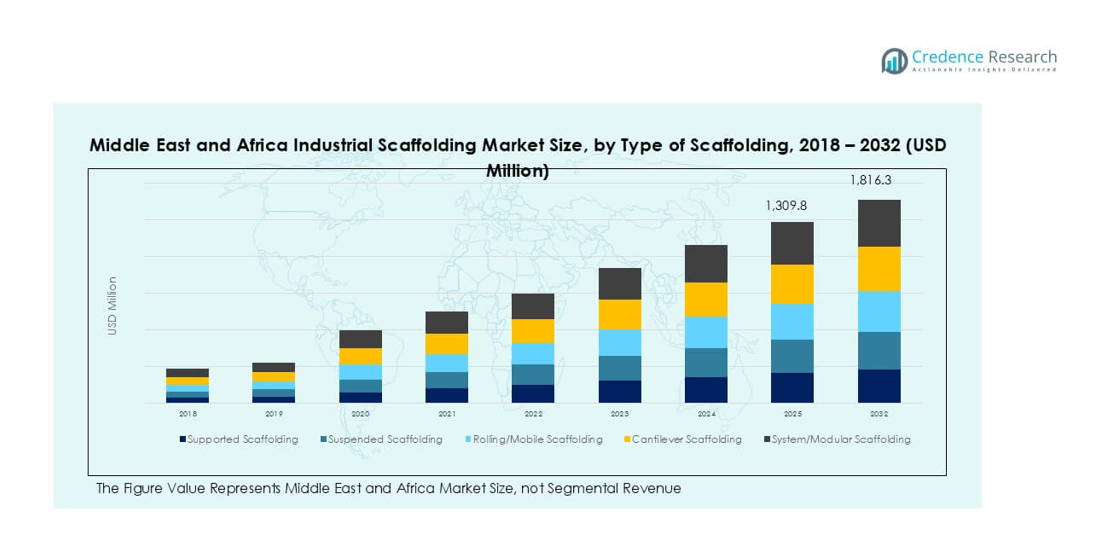

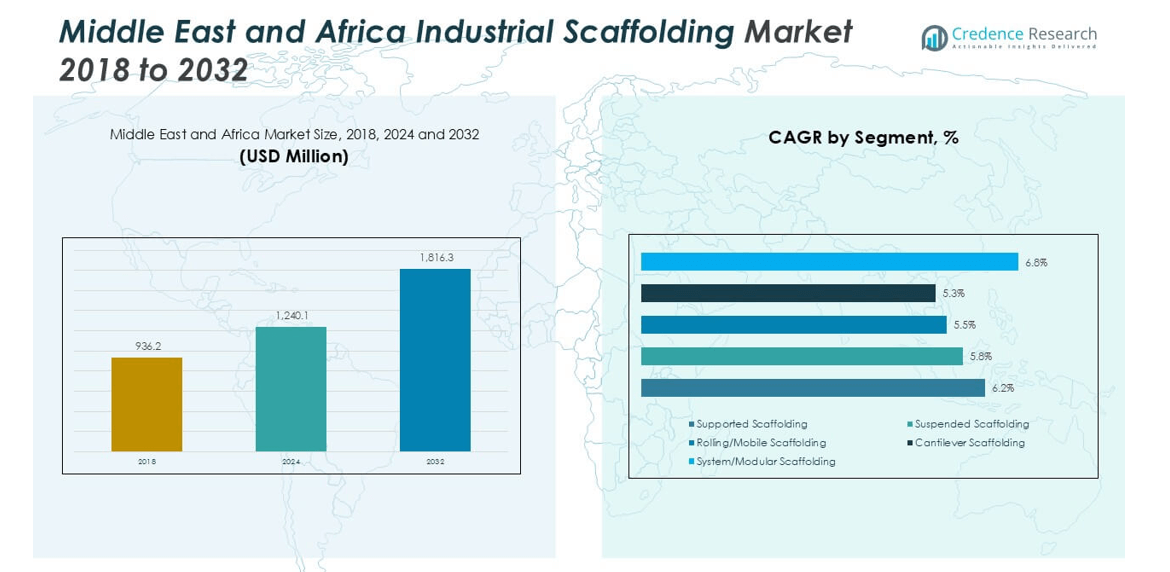

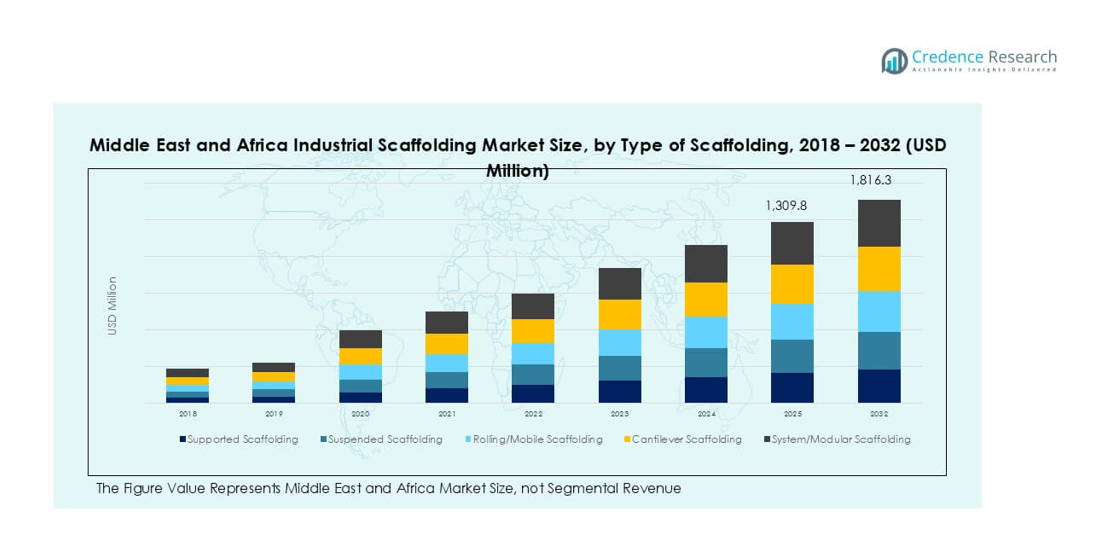

Middle East and Africa Industrial Scaffolding market size was valued at USD 936.2 million in 2018, reached USD 1,240.1 million in 2024, and is anticipated to reach USD 1,816.3 million by 2032, at a CAGR of 4.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East and Africa Industrial Scaffolding Market Size 2024 |

USD 1,240.1 million |

| Middle East and Africa Industrial Scaffolding Market, CAGR |

4.88% |

| Middle East and Africa Industrial Scaffolding Market Size 2032 |

USD 1,816.3 million |

The Middle East and Africa industrial scaffolding market is led by prominent players such as PERI GmbH, Layher Group, Altrad Group, Waco International, Tazweed Industrial Services, Tata Projects, RMD Kwikform Middle East, Al Laith Scaffolding, United Gulf Scaffolding & Formwork, Cape East, Waco Africa Pty Ltd, and Oman Shapoorji Company LLC. These companies dominate through advanced modular scaffolding systems, rental services, and strong partnerships with EPC contractors. GCC countries accounted for over 35% of the regional market share in 2024, driven by megaprojects in oil & gas, petrochemical, and power generation sectors. Turkey and Israel together held nearly 20% share, supported by infrastructure development and manufacturing growth, while South Africa and Egypt contributed about 19% combined, driven by mining and energy refurbishment projects.

Market Insights

- The Middle East and Africa Industrial Scaffolding market was valued at USD 1,240.1 million in 2024 and is projected to reach USD 1,816.3 million by 2032 at a CAGR of 4.88%.

- Strong demand is driven by oil & gas maintenance projects, power generation expansion, and infrastructure megaprojects in GCC countries, which together hold over 35% market share.

- Supported scaffolding leads the market with over 45% share, while modular systems are gaining traction for faster installation and enhanced safety compliance.

- The market is moderately consolidated, with key players focusing on rentals, turnkey solutions, and partnerships with EPC contractors to strengthen their position.

- Israel and Turkey collectively contribute around 20% share, while South Africa and Egypt add nearly 19%, supported by mining, metallurgy, and energy refurbishment projects that sustain recurring scaffolding demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

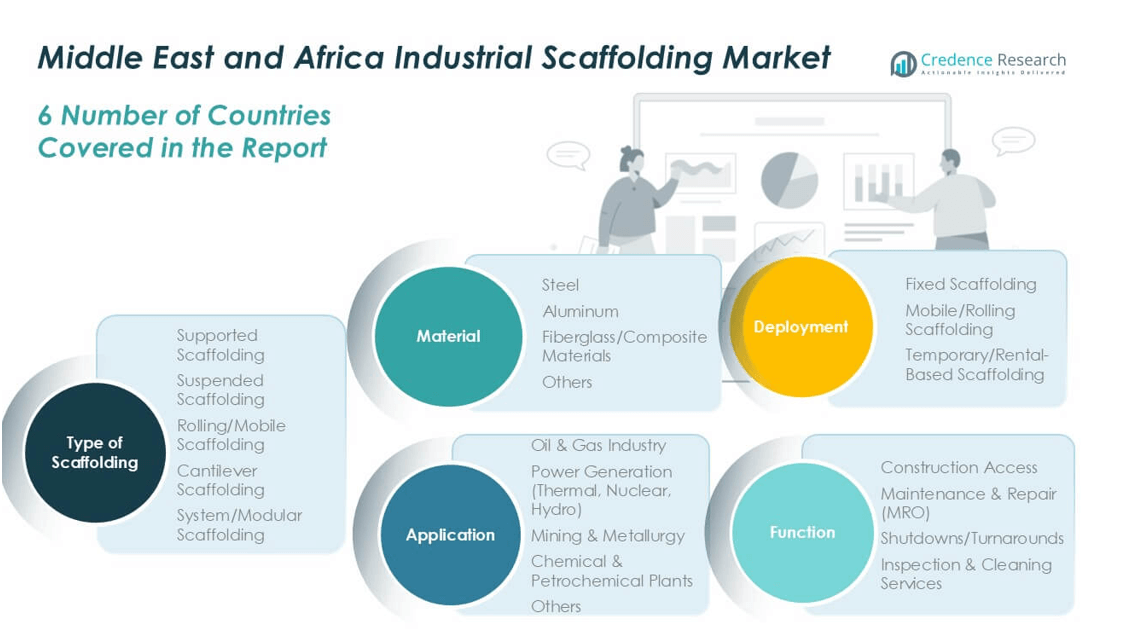

Market Segmentation Analysis:

By Type of Scaffolding

Supported scaffolding holds the dominant share in the Middle East and Africa industrial scaffolding market, accounting for over 45% of total demand in 2024. Its widespread use is driven by strength, stability, and suitability for large-scale construction and maintenance projects in oil refineries, power plants, and mining facilities. Rolling/mobile scaffolding is gaining traction due to its easy mobility and time-saving assembly features for short-duration projects. System/modular scaffolding is also witnessing rising adoption as industries favor modular solutions for complex plant structures, improving worker safety and reducing installation time.

- For instance, mobile scaffolding is a proven time-saver during maintenance shutdowns in the oil and gas industry, including in Saudi Arabia. By allowing workers to quickly and safely reposition platforms, mobile units drastically reduce the time and labor otherwise spent on repeatedly erecting and dismantling stationary scaffolding. This increased efficiency results in substantial, though case-specific, labor-hour savings.

By Application

The oil and gas industry lead the market with more than 40% share in 2024, supported by large-scale maintenance, turnaround, and expansion projects across refineries and petrochemical plants. The sector demands extensive scaffolding for inspection, repair, and shutdown operations, which require reliable access solutions. Power generation is another major application area, with growing investment in thermal and renewable energy facilities boosting scaffolding demand. Mining and metallurgy industries also contribute significantly, relying on scaffolding for structural maintenance and process plant upgrades to maintain operational efficiency.

- For instance, during a two-year contract at a major U.S. refinery, BrandSafway nearly doubled scaffold productivity, saving 60,000 labour hours over that period.

By Material

Steel scaffolding dominates the market with over 60% share in 2024, favored for its durability, load-bearing capacity, and suitability for heavy-duty industrial projects. The region’s harsh climatic conditions and long project cycles make steel the preferred choice for oil and gas and power plant applications. Aluminium scaffolding is gaining popularity due to its lightweight structure, which simplifies transport and assembly in confined spaces. Fiberglass/composite scaffolding finds niche use in chemical plants where corrosion resistance and electrical insulation are critical for worker safety.

Market Overview

Infrastructure Expansion and Industrial Projects

The Middle East and Africa region is witnessing robust infrastructure expansion and large-scale industrial projects, driving scaffolding demand. Mega projects in Saudi Arabia, UAE, and South Africa, including refineries, LNG terminals, and smart cities, require extensive scaffolding for construction and maintenance. Rapid industrialization in emerging economies supports steady demand for safe access systems. Governments continue investing in transport corridors, power plants, and manufacturing hubs, boosting the requirement for supported and modular scaffolding solutions. This factor remains a primary driver of market growth across the forecast period.

- For instance, the Saudi Arabia NEOM project spans 26,500 square kilometres, and its “The Line” component reaches 170 km in length.

Oil & Gas Turnaround and Maintenance Activities

Frequent maintenance shutdowns in oil and gas facilities remain a critical growth driver. The region’s significant share in global oil production necessitates regular inspection, repair, and plant overhauls, which require large scaffolding setups. Refineries and petrochemical plants schedule turnarounds every few years, creating consistent demand for reliable and reusable scaffolding systems. Specialized scaffolding for high-temperature, hazardous environments is in high demand. This ensures worker safety, reduces downtime, and supports operational continuity, sustaining market growth even during construction slowdowns.

- For example, Saudi Aramco’s General Instruction (GI-8.001) requires scaffolds over 12.2 metres to follow strict erection and inspection procedures.

Regulatory Focus on Worker Safety

Stringent safety regulations and compliance standards across industrial sectors are accelerating scaffolding adoption. Authorities in the Middle East and Africa are enforcing stricter Occupational Health and Safety (OHS) norms, mandating safe work platforms and fall protection systems. Companies prioritize scaffolding solutions that meet international standards, such as OSHA and BS EN regulations. This drives investment in advanced modular and system scaffolding that enhances worker safety and reduces assembly time. Safety-driven adoption also encourages training programs and skilled labor deployment, positively impacting market dynamics.

Key Trends and Opportunities

Adoption of Modular and Prefabricated Scaffolding

Industries are rapidly shifting toward modular and prefabricated scaffolding systems to improve efficiency. These systems allow faster assembly, dismantling, and reconfiguration, reducing project timelines and labor costs. The trend supports higher productivity in time-sensitive projects such as plant shutdowns and offshore maintenance. Digital planning tools, such as 3D modeling, further enhance scaffold design accuracy. Market players have an opportunity to expand product portfolios with lightweight, easy-to-install modular systems that comply with international safety standards, tapping into rising demand for cost-efficient and safe access solutions.

- For instance, Marr Scaffolding installed system scaffold platforms and other access equipment for assembling the onshore components of the Vineyard Wind project. The Vineyard Wind project is the first utility-scale offshore wind farm in the U.S. and consists of a total of 62 turbines.

Growing Demand from Renewable Energy Sector

The region’s energy transition initiatives are opening new opportunities for scaffolding suppliers. Investments in solar power plants, wind farms, and hydrogen facilities are increasing, driving demand for specialized scaffolding during construction and maintenance phases. Renewable projects require scaffolding that is quick to deploy and adaptable to complex structures like wind towers. This shift diversifies revenue sources for scaffolding manufacturers and service providers, reducing dependence on the oil and gas sector. Companies that offer tailored solutions for green energy projects can secure a strong competitive advantage.

- For instance, Marr Scaffolding’s work on the Vineyard Wind project included providing access equipment, such as work platforms, rolling towers, and guardrail systems, for the assembly of wind turbine components onshore at the Port of Providence. Their equipment supported the primary contractor, Riggs Distler, in preparing the components for later offshore installation.

Key Challenges

High Labor Dependency and Skill Shortages

The scaffolding market is labor-intensive, and shortages of skilled scaffolders pose operational challenges. Many projects face delays due to inadequate trained personnel, which impacts safety and project timelines. High labor dependency increases project costs and limits scalability for service providers. The industry is gradually adopting mechanized and modular systems to reduce labor requirements, but the transition is slow. Companies must invest in workforce training and certification programs to overcome this challenge and maintain compliance with stringent safety standards.

Volatility in Raw Material Prices

Fluctuations in steel and aluminum prices significantly impact scaffolding production costs. Rising raw material costs reduce profit margins for manufacturers and contractors, especially in competitive bidding scenarios. The situation is further complicated by supply chain disruptions and import dependencies in certain regions. Companies are exploring alternative materials and long-term procurement contracts to manage price volatility. However, persistent cost fluctuations remain a key challenge, potentially affecting adoption rates of high-quality scaffolding systems in price-sensitive projects.

Regional Analysis

GCC Countries

GCC countries accounted for over 35% of the Middle East and Africa industrial scaffolding market in 2024, driven by large-scale infrastructure projects and oil & gas investments. Saudi Arabia’s Vision 2030, UAE’s refinery expansions, and Qatar’s LNG capacity growth continue to boost demand. These projects require extensive supported and modular scaffolding for construction, maintenance, and turnaround activities. The presence of global contractors and adherence to strict safety standards fuel adoption of advanced scaffolding systems. Strong government spending and mega-project pipelines make GCC countries the most lucrative market for scaffolding suppliers in the forecast period.

Israel

Israel represented around 8% of the market share in 2024, supported by growth in high-tech industrial facilities, energy infrastructure, and manufacturing expansion. Ongoing investments in gas field development, power plants, and chemical production facilities drive consistent scaffolding demand. Israel’s focus on innovation encourages the adoption of modular scaffolding systems that improve efficiency and worker safety. Additionally, increased construction of commercial buildings and data centers adds to market potential. The emphasis on complying with stringent safety regulations creates opportunities for suppliers offering certified scaffolding solutions tailored for complex, technology-intensive projects.

Turkey

Turkey held approximately 12% of the market share in 2024, supported by strong construction activity and industrial development. Large-scale projects in transportation infrastructure, petrochemical complexes, and renewable energy facilities require substantial scaffolding deployment. The country’s manufacturing sector also drives demand for scaffolding in plant maintenance and upgrades. Turkish contractors increasingly adopt lightweight, modular systems to reduce costs and speed up project execution. The government’s focus on infrastructure modernization and energy diversification supports stable market growth, positioning Turkey as a key hub for scaffolding suppliers targeting both domestic and export opportunities.

South Africa

South Africa captured nearly 10% of the market share in 2024, with demand driven by mining, metallurgy, and power generation sectors. Extensive use of scaffolding is required for smelter maintenance, shaft deepening, and power plant refurbishment projects. Ongoing efforts to modernize Eskom’s aging infrastructure further support demand for system scaffolding. The construction of commercial and residential projects in urban centers adds to market growth. Despite economic challenges, the government’s commitment to infrastructure spending sustains market activity. Local manufacturers and rental companies benefit from long-term service contracts and recurring industrial maintenance requirements.

Egypt

Egypt accounted for around 9% of the regional scaffolding market in 2024, driven by mega infrastructure projects and energy sector development. The country’s large-scale refinery upgrades, natural gas projects, and new industrial zones boost scaffolding demand. Construction of the New Administrative Capital and expansion of transport networks further fuel market growth. Steel scaffolding remains the preferred material due to its durability and ability to handle heavy loads. International contractors partnering with local players ensure compliance with global safety standards, creating opportunities for suppliers offering high-quality, modular scaffolding solutions.

Rest of Middle East & Africa

The rest of the Middle East and Africa represented about 26% of the market share in 2024, covering countries such as Nigeria, Kenya, and Algeria. Demand is largely driven by oil & gas infrastructure, mining operations, and emerging power generation projects. These markets show strong potential as governments prioritize industrial development and energy capacity expansion. However, challenges such as limited skilled labor and inconsistent safety enforcement restrain faster growth. Market players focusing on rental services and training programs can capture opportunities, as these regions are expected to witness rising demand for cost-effective scaffolding solutions in the coming years.

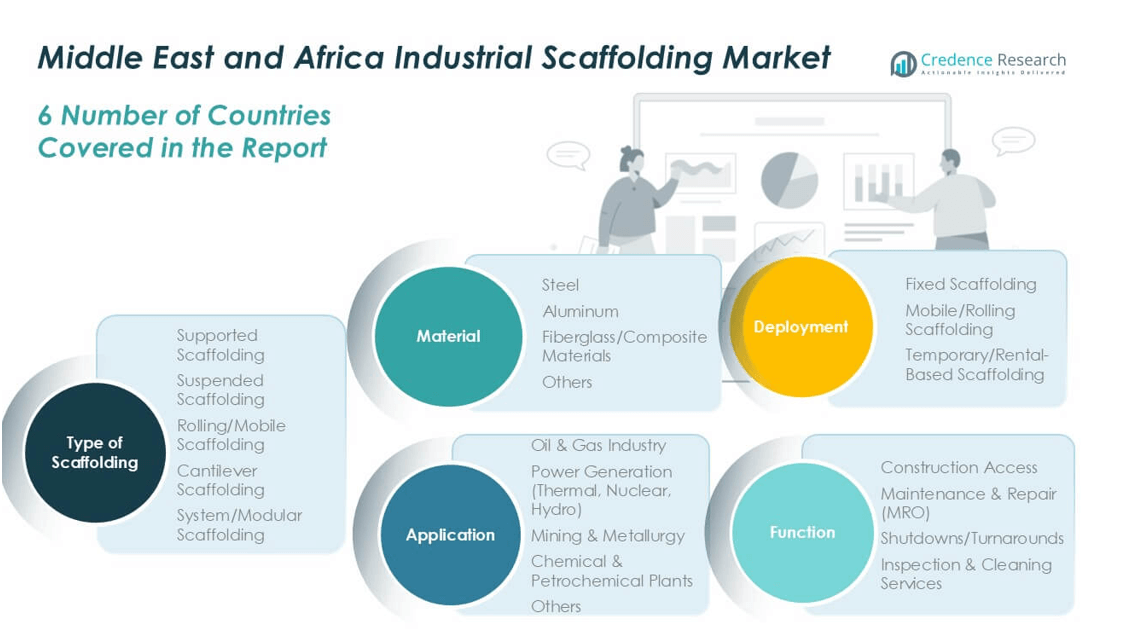

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- GCC Countries

- Israel

- Turkey

- South Africa

- Egypt

- Rest of Middle East & Africa

Competitie Landscape

The Middle East and Africa industrial scaffolding market is moderately consolidated, with global and regional players competing through product innovation, rental services, and turnkey project support. Leading companies such as PERI GmbH, Layher Group, Altrad Group, Waco International, Tazweed Industrial Services, Tata Projects, RMD Kwikform Middle East, Al Laith Scaffolding, United Gulf Scaffolding & Formwork, Cape East, Waco Africa Pty Ltd, and Oman Shapoorji Company LLC dominate market activity. These firms focus on supplying advanced modular scaffolding systems, enhancing safety compliance, and reducing assembly time. Strategic partnerships with EPC contractors and oil & gas operators strengthen their market position. Rental services remain a major growth avenue, supported by recurring maintenance and turnaround projects in refineries, power plants, and mining facilities. Regional players leverage competitive pricing and localized services, while international companies invest in training programs, digital scaffold management tools, and expansion into high-growth markets like GCC and North Africa.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PERI GmbH

- Layher Group

- Altrad Group

- Waco International

- Tazweed Industrial Services (KSA)

- Tata Projects (UAE & ME presence)

- RMD Kwikform Middle East

- Al Laith Scaffolding (UAE)

- United Gulf Scaffolding & Formwork (UAE)

- Cape East (UAE/Saudi Arabia)

- Waco Africa Pty Ltd (South Africa)

- Oman Shapoorji Company LLC (Oman)

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by large-scale industrial and infrastructure projects.

- GCC countries will remain the dominant regional market due to ongoing megaprojects and refinery expansions.

- Supported scaffolding will continue leading demand, with modular systems gaining rapid adoption.

- Rental-based scaffolding services will expand as companies prioritize cost-effective project execution.

- Renewable energy projects such as solar and wind farms will create new opportunities for suppliers.

- Digital tools for scaffold design and planning will improve operational efficiency and safety compliance.

- Investment in workforce training and safety programs will increase to meet regulatory standards.

- Regional players will expand their presence through competitive pricing and local partnerships.

- Turnaround and maintenance activities in oil & gas and power sectors will generate recurring demand.

- Adoption of lightweight aluminum and composite scaffolding will grow for specialized applications.