Market Overview

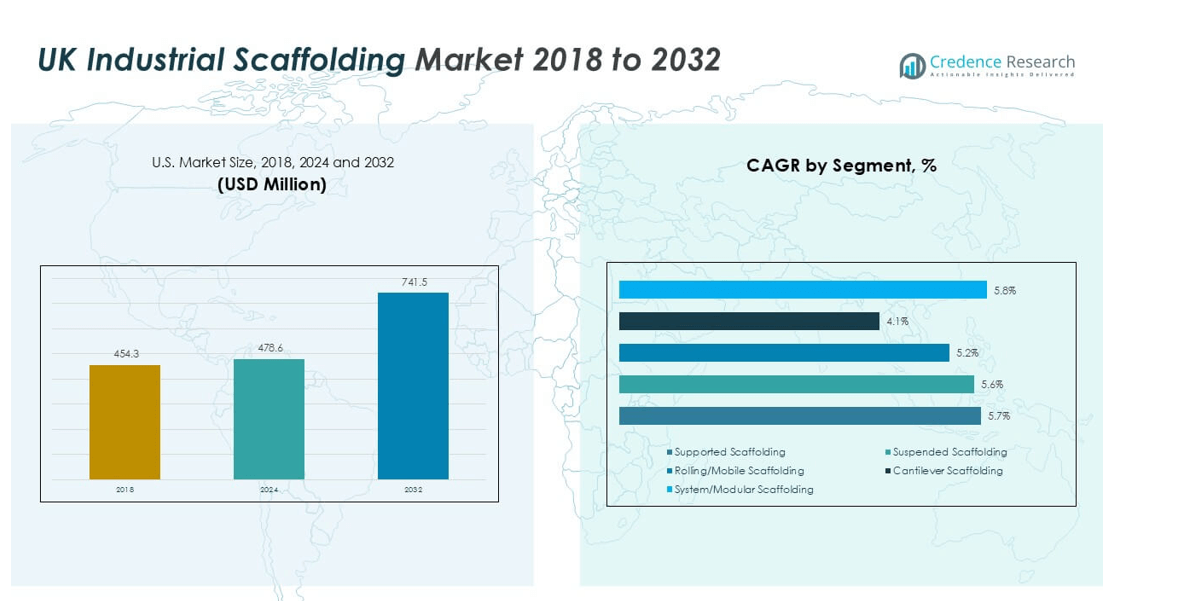

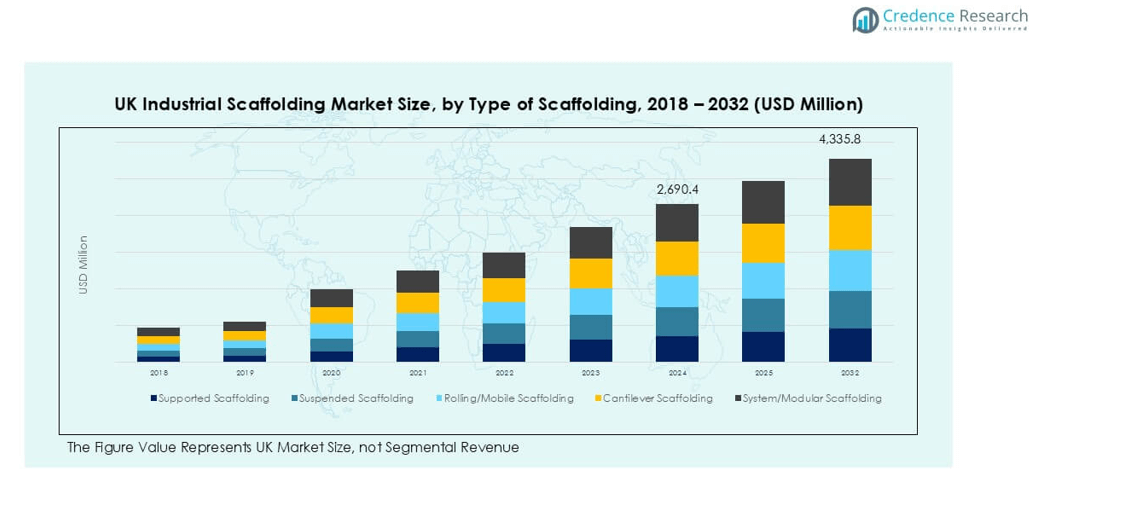

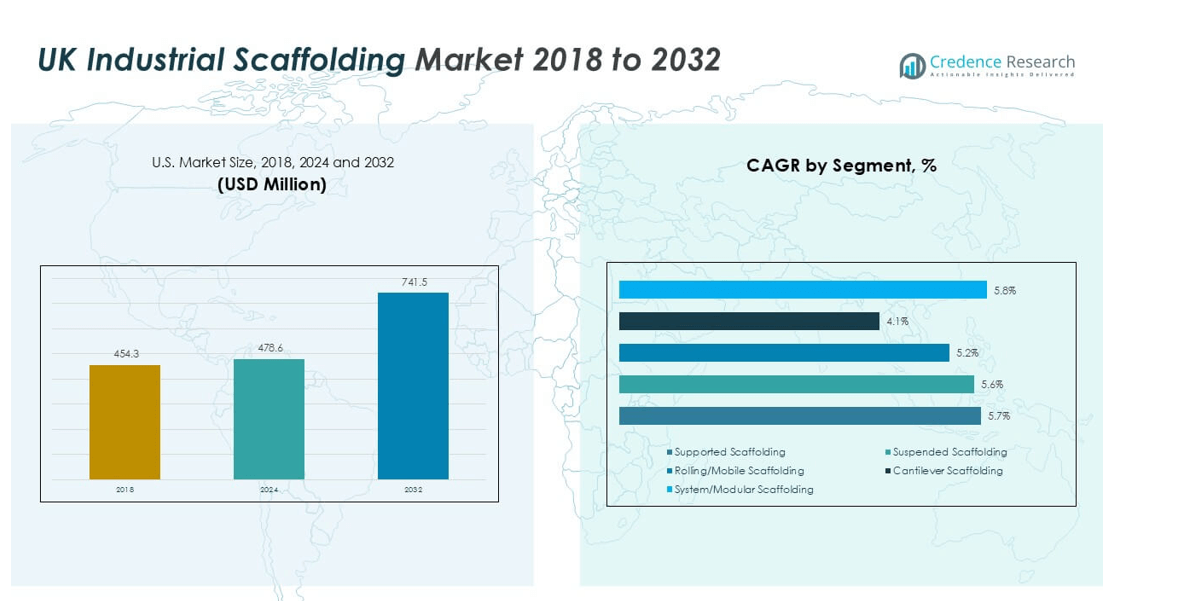

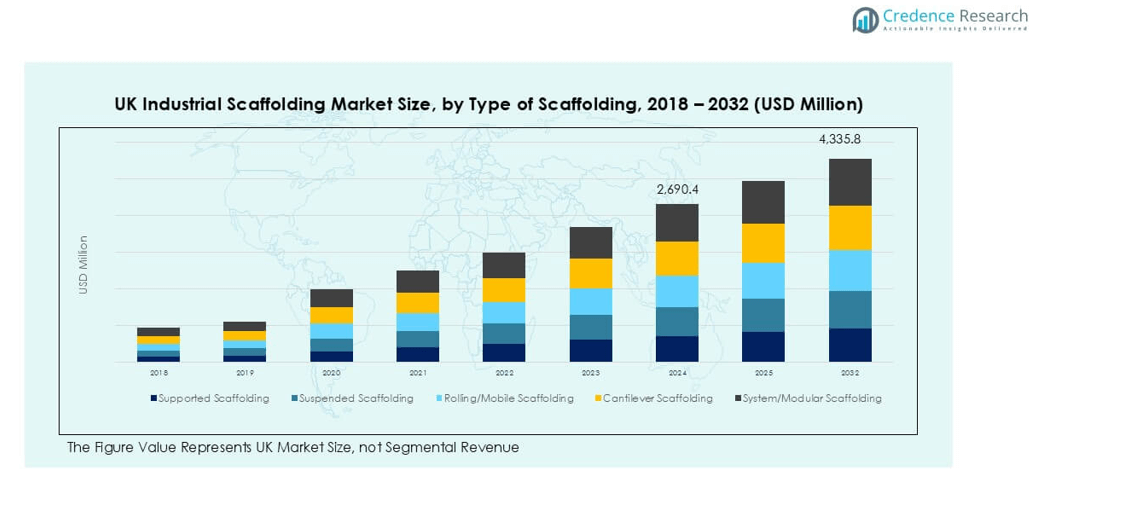

UK Industrial Scaffolding market size was valued at USD 454.31 million in 2018, reached USD 478.60 million in 2024, and is anticipated to reach USD 741.50 million by 2032, at a CAGR of 5.63% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Industrial Scaffolding Market Size 2024 |

USD 478.60 million |

| UK Industrial Scaffolding Market, CAGR |

5.63% |

| UK Industrial Scaffolding Market Size 2032 |

USD 741.50 million |

The UK industrial scaffolding market is led by key players such as BrandSafway, PERI Ltd. (UK), Layher Ltd. (UK), Altrad Services UK, Actavo (UK) Ltd., Palmers Scaffolding UK Ltd., NSG UK Ltd., KAEFER Ltd., Interserve Industrial Services, Generation UK Ltd., and Sky Scaffolding Midlands Ltd. These companies maintain strong competitive positions through nationwide service networks, modular system offerings, and long-term industrial contracts. London & South East accounts for 32% of the market, driven by major infrastructure projects, refineries, and transport upgrades. The Midlands holds 22%, supported by manufacturing and power plant activity. Northern regions, including Scotland, contribute significantly through oil, gas, and offshore wind projects. Leading players continue to focus on digital planning, training initiatives, and safety compliance to strengthen market share and meet rising demand for efficient and high-quality scaffolding solutions across diverse UK industries.

Market Insights

- The UK Industrial Scaffolding market was valued at USD 478.60 million in 2024 and is expected to reach USD 741.50 million by 2032, growing at a CAGR of 5.63%.

- Demand is driven by infrastructure expansion, refinery turnarounds, and power plant maintenance, supported by strict HSE safety regulations and growing adoption of modular scaffolding systems.

- Trends include rising use of BIM planning, digital inspections, and IoT-enabled monitoring to improve project efficiency, along with increasing adoption of aluminum and composite scaffolding for lightweight and corrosion-resistant applications.

- The market is competitive with key players such as BrandSafway, PERI Ltd. (UK), Layher Ltd. (UK), and Altrad Services UK focusing on technology upgrades, rental fleet expansion, and training initiatives to gain share.

- London & South East leads with 32% share, followed by Midlands at 22% and North of England at 18%, while supported scaffolding dominates with over 40% share by type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

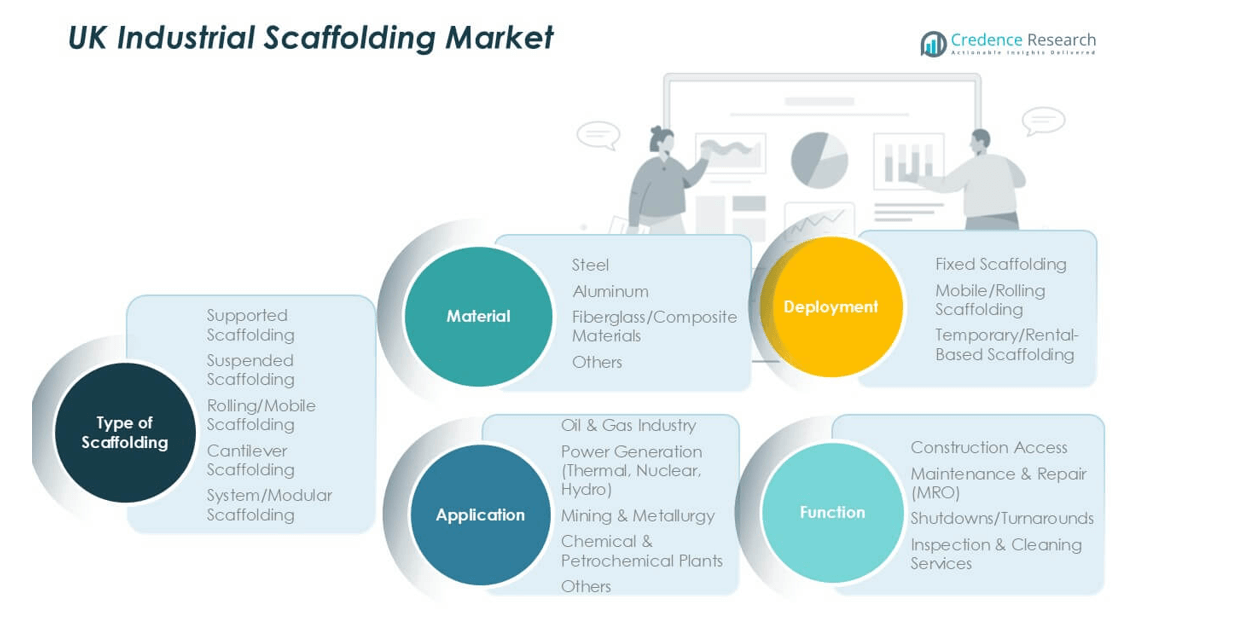

Market Segmentation Analysis:

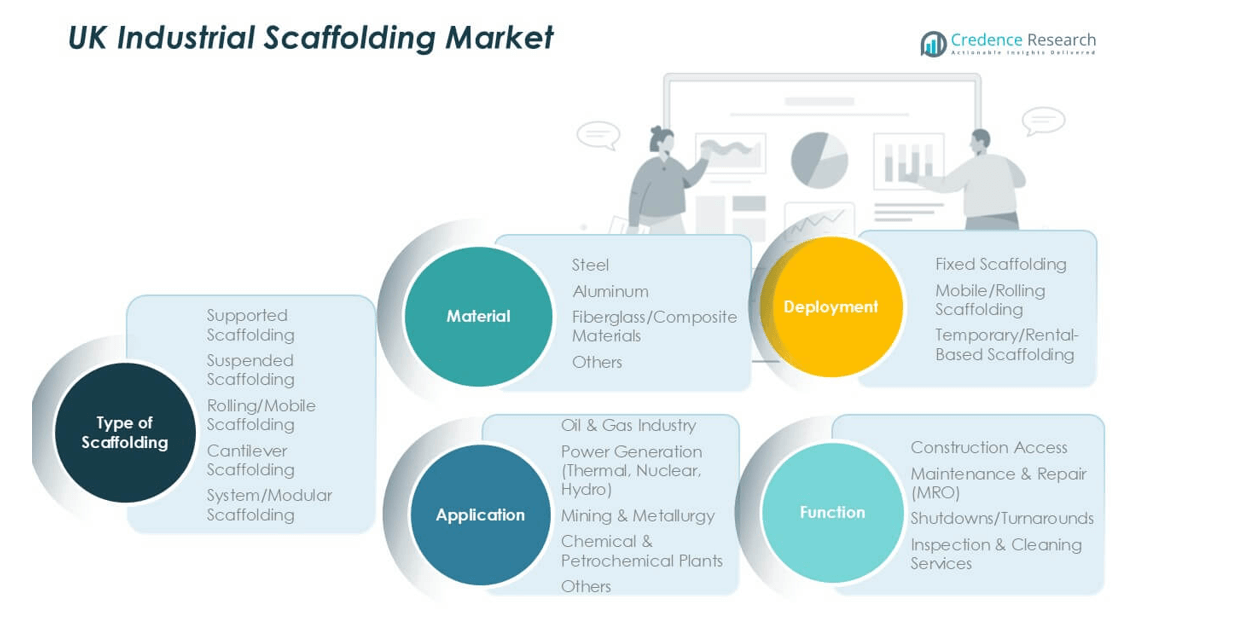

By Type of Scaffolding

Supported scaffolding dominated the UK industrial scaffolding market in 2024, accounting for over 40% market share. Its widespread adoption is driven by ease of installation, cost-effectiveness, and high load-bearing capacity, making it suitable for large-scale industrial projects. System/modular scaffolding is gaining traction due to its flexibility and enhanced safety features, supporting complex plant maintenance and construction tasks. Rolling scaffolding is preferred for quick, mobile applications in confined industrial sites. Demand for cantilever and suspended scaffolding remains niche, mainly used where ground support is limited, such as bridge repairs and offshore platforms.

- For instance, at the Lindsey Oil Refinery hydrodesulphurisation plant, over 10,000 individual scaffold structures were deployed, many supported scaffold bays exceeding 6 m in height.

By Application

The oil & gas industry held the largest share, contributing more than 35% of overall demand in 2024. Frequent maintenance shutdowns, refinery expansions, and offshore platform upgrades drive high scaffolding consumption in this sector. Power generation facilities, including thermal and nuclear plants, represent the second-largest application segment due to ongoing infrastructure refurbishment and compliance with safety regulations. Chemical and petrochemical plants continue to invest in scaffolding solutions for plant turnarounds and upgrades. Mining and metallurgy applications are expanding steadily, supported by investments in extraction and smelting capacity across the UK industrial base.

- For example, Valero’s Pembroke refinery substituted traditional tube-and-fitting scaffolding with LOBO System platforms for all maintenance tasks at heights up to 6 m, saving US$1,500,000 in scaffold costs over a three-year period.

By Material

Steel accounted for over 60% of the UK scaffolding market in 2024, driven by its superior strength, durability, and ability to handle heavy industrial loads. It remains the material of choice for high-rise and large-scale industrial structures. Aluminum scaffolding is growing steadily due to its lightweight, corrosion-resistant properties, which improve assembly efficiency and reduce labor costs. Fiberglass and composite scaffolding, though a smaller segment, are increasingly used in chemical plants where electrical insulation and non-conductive materials are critical for worker safety. This trend supports niche but rising demand for composite solutions.

Market Overview

Infrastructure Expansion and Industrial Upgrades

The UK industrial scaffolding market is driven by growing infrastructure investments and plant modernization projects. Expansion of oil refineries, power generation facilities, and manufacturing units fuels demand for safe and durable scaffolding solutions. Government-backed infrastructure programs and increased spending on industrial maintenance further strengthen the market. Frequent shutdowns and repair activities in oil & gas, chemical, and power sectors ensure consistent demand. The rising emphasis on workplace safety and compliance with OSHA and HSE standards boosts adoption of advanced scaffolding systems across industries.

- For instance, TRAD Group’s Plettac Metrix system was used for a 150 m long access gantry in Southampton docklands, 6 m high with two intermediate structural lifts, erected by five operatives in four days.

Shift Toward Modular and System Scaffolding

Rising preference for modular scaffolding systems is a key driver shaping the market. Modular solutions offer faster installation, reduced labor costs, and superior adaptability for complex plant layouts. Industrial operators increasingly select system scaffolding to minimize downtime during maintenance and turnaround projects. This trend is supported by digital design tools that improve planning and enhance on-site safety. Contractors also benefit from reusability and lower material wastage, strengthening overall project cost efficiency. This shift positions modular scaffolding as a preferred choice across power plants, refineries, and large industrial facilities.

- For instance, in the same Plettac Metrix project in Southampton, using system scaffold sections reduced erection time by one full week compared to traditional tube & fitting scaffolding for a comparable access structure.

Regulatory Focus on Safety and Compliance

Stringent workplace safety regulations in the UK drive increased adoption of high-quality scaffolding solutions. The Health and Safety Executive (HSE) mandates strict scaffolding safety standards, pushing industries to upgrade to certified systems. Regular inspections and audits encourage companies to invest in durable and tested scaffolding structures to prevent accidents. Compliance with BS EN 12811 standards is becoming a priority for contractors and plant operators. These regulations not only ensure worker safety but also reduce downtime, enhancing productivity and promoting wider use of engineered scaffolding systems across industrial projects.

Key Trends & Opportunities

Rising Adoption of Digital and Smart Scaffolding Solutions

Integration of digital tools in scaffolding design and monitoring is an emerging trend. 3D modeling and BIM-based planning improve project efficiency, reduce rework, and optimize material usage. IoT-enabled sensors for structural stability monitoring enhance on-site safety and provide real-time alerts. These innovations appeal to contractors seeking cost savings and faster project execution. As digitalization expands across UK construction and industrial sectors, adoption of smart scaffolding solutions is expected to grow, offering manufacturers opportunities to differentiate with technology-driven offerings and enhance value for end-users.

- For instance, an academic study in the UK connected real-time IoT sensor streams with high-fidelity BIM models to detect structural deviation; the system used over 50 sensors and captured data every 2 seconds, reducing model-rework by 30 minutes per scaffold layout.

Growth in Green Energy and Sustainable Projects

The UK’s commitment to renewable energy transition is creating new opportunities for scaffolding providers. Construction of offshore wind farms, battery plants, and hydrogen production facilities requires large-scale scaffolding systems. Eco-friendly scaffolding materials, including recyclable aluminum and low-carbon steel, are gaining popularity. This trend supports sustainability targets while reducing environmental impact. Companies that offer energy-efficient production methods and reusable scaffolding systems stand to benefit as industrial clients increasingly prioritize ESG compliance. The shift toward green infrastructure projects will continue to boost scaffolding demand through 2032.

- For instance, the Green Volt offshore wind farm (planned for commissioning in 2029) will use up to 35 floating turbines, each with a capacity of up to 16 MW. Construction is expected to begin in 2025.

Key Challenges

High Labor and Installation Costs

Labor shortages and rising wages in the UK construction sector increase project costs for scaffolding installation. Skilled labor is essential for assembling complex scaffolding structures safely and efficiently, but availability remains limited. Longer project timelines and training requirements further add to costs. These factors can deter smaller contractors from investing in advanced scaffolding systems. Companies are focusing on modular designs and prefabricated solutions to reduce labor dependency, but cost management remains a key challenge for the industry in maintaining profitability.

Fluctuating Raw Material Prices

Volatility in steel and aluminum prices poses a significant challenge for scaffolding manufacturers and rental providers. Fluctuations in raw material costs directly impact production expenses and profit margins. Price instability can lead to delayed procurement and project cost overruns, especially for long-term contracts. Import dependence for certain raw materials adds to pricing risk in the UK market. Companies are adopting inventory optimization strategies and exploring alternative materials such as composites to mitigate these fluctuations, but margin pressures continue to influence overall market growth.

Regional Analysis

London & South East

This region leads demand with dense industrial estates and mega projects. Refineries, power assets, and ports require frequent shutdown scaffolding. Data centers and logistics hubs add recurring maintenance needs. London’s transport upgrades sustain complex access solutions. Modular systems speed turnarounds and reduce labor exposure. Contractors prioritize engineered designs for constrained urban sites. Offshore wind components stage through Thames and Solent ports. Strict HSE compliance drives premium system adoption. Aluminum towers support rapid fit-outs and FM work. Large rental fleets keep utilization high year-round. Supply chains remain resilient through established depots. Framework agreements lock multi-site industrial coverage.

Midlands

The Midlands benefits from diversified manufacturing and energy assets. Steelworks, automotive plants, and food processing sites anchor volumes. Thermal power stations and waste-to-energy units add periodic outages. System scaffolding supports complex conveyor and vessel access. Contractors deploy BIM layouts to compress shutdown durations. Rail electrification and depot upgrades sustain steady orders. Modular platforms cut erection hours on repetitive bays. Chemical clusters around Nottingham and Staffordshire require non-conductive options. Composite solutions gain share in sensitive zones. Regional depots shorten response times for call-outs. Rental providers expand training to address skills gaps. Utilization improves through multi-industry contracts.

North of England

Heavy industry and ports underpin northern demand. Petrochemical sites on Teesside and Humberside schedule regular turnarounds. Offshore supply bases require suspended and cantilever solutions. Hydrogen pilots and carbon capture projects need engineered access. Rolling scaffolds support repetitive maintenance in manufacturing halls. Steel dominates for heavy loads and exposed conditions. Aluminum assists rapid interior reconfiguration and MRO tasks. Contractors deploy digital inspections to verify anchor integrity. Harsh weather elevates design factors and bracing density. Frameworks with Tier-1 EPCs stabilize pipeline visibility. Training centers upskill crews for advanced system standards. Logistics corridors enable fast redeployment between clusters.

Scotland

Energy projects drive most Scottish demand. Onshore terminals and offshore support yards require specialized access. Fabrication shops near Aberdeen adopt modular systems. Offshore wind construction boosts large, engineered platforms. Harsh coastal conditions favor galvanized steel and robust couplers. Refineries and gas plants plan cyclical shutdowns with strict windows. Rope access integrates with suspended modules for flare stacks. Composite decks appear in high-voltage areas. Digital twin planning reduces offshore time-on-task. Contractors stage materials through North Sea ports. Weather delays push contingency scaffolding capacity. Safety culture and HSE audits sustain premium product uptake.

Wales

Wales records steady demand from power, metals, and ports. Combined-cycle plants and biomass units schedule planned outages. Steelworks and smelters require high-load supported scaffolds. Coastal infrastructure maintenance favors corrosion-resistant systems. Aluminum frames accelerate interiors and FM programs. Modular designs reduce downtime in repetitive bays. Contractors leverage local depots for rapid mobilization. Non-conductive platforms serve electrical substations and chemical zones. BIM-assisted layouts improve clash detection. Training partnerships strengthen competency pipelines. Framework agreements with utilities stabilize annual volumes. Safety KPIs drive continuous product upgrades and inspections.

Northern Ireland

Industrial estates, agri-processing, and power assets sustain demand. Ports and ship repair yards require suspended and cantilever options. Modular scaffolding supports rapid shutdowns and fit-outs. Steel remains prevalent for exterior heavy-duty works. Aluminum assists interior maintenance with limited lift capacity. Cross-channel suppliers provide specialized components quickly. Digital inspections enhance traceability and compliance. Contractors emphasize multi-skilled crews for flexible deployment. Composite platforms appear in high-risk electrical areas. Public infrastructure upgrades create periodic surges. Rental fleets balance seasonal variability with framework commitments. HSE alignment and client audits promote standardized, engineered solutions.

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- London & South East

- Midlands

- North of England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK industrial scaffolding market is highly competitive, with several established players offering rental, sales, and turnkey access solutions. Major companies such as BrandSafway, PERI Ltd. (UK), Layher Ltd. (UK), Altrad Services UK, Actavo (UK) Ltd., Palmers Scaffolding UK Ltd., NSG UK Ltd., KAEFER Ltd., Interserve Industrial Services, Generation UK Ltd., and Sky Scaffolding Midlands Ltd. collectively dominate market share through strong regional presence and long-term contracts with key industrial clients. These firms invest in modular and system scaffolding technologies to reduce project time and improve safety compliance. Partnerships with EPC contractors, refineries, and power plants strengthen recurring revenue streams. Many providers expand training programs to address skilled labor shortages and enhance service quality. Continuous innovation, such as digital design tools, BIM integration, and IoT-enabled safety monitoring, helps leading companies differentiate and secure competitive advantage in a market driven by safety, efficiency, and regulatory compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BrandSafway

- PERI Ltd. (UK)

- Layher Ltd. (UK)

- Altrad Services UK

- Actavo (UK) Ltd.

- Palmers Scaffolding UK Ltd.

- NSG UK Ltd. (Northern Scaffolding Group)

- KAEFER Ltd.

- Interserve Industrial Services

- Generation UK Ltd.

- Sky Scaffolding Midlands Ltd.

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continuous infrastructure upgrades and industrial maintenance projects.

- Modular and system scaffolding adoption will expand to reduce project downtime.

- Digital tools like BIM and IoT monitoring will become standard in scaffolding planning.

- Aluminum and composite scaffolding usage will grow for lightweight and corrosion-resistant needs.

- Safety regulations will push companies toward certified, engineered scaffolding solutions.

- Rental fleet providers will invest in training programs to close skill gaps.

- Offshore wind and green energy projects will create new scaffolding opportunities.

- Competitive intensity will increase with focus on technology-led differentiation.

- Regional demand will stay highest in London & South East, driven by urban projects.

- Partnerships with EPC contractors and industrial operators will secure long-term service contracts.