Market Overview

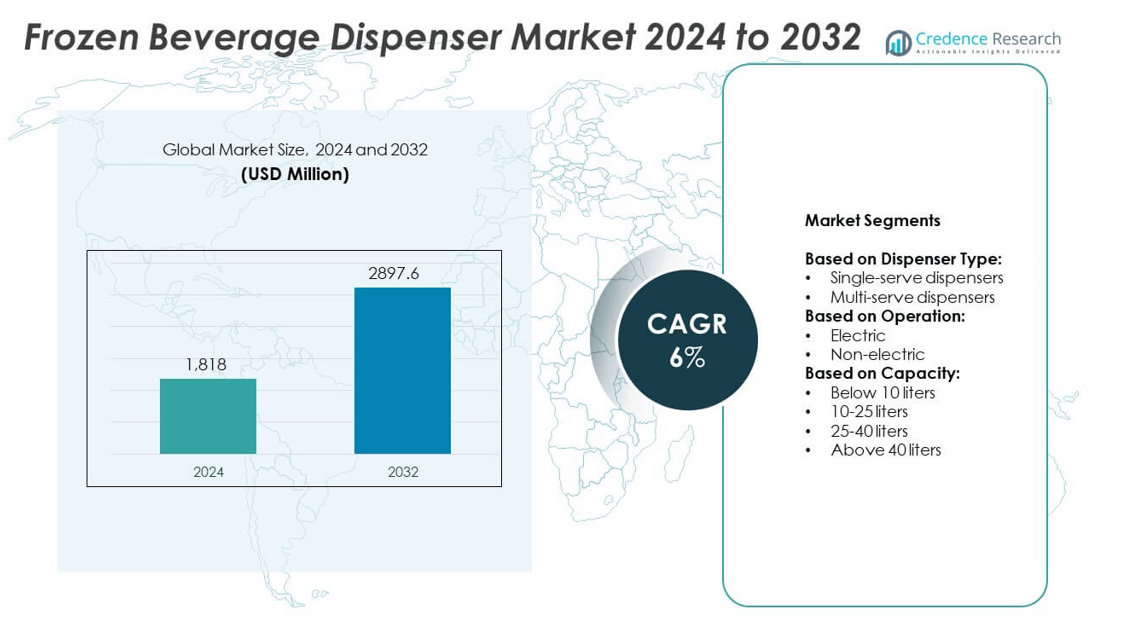

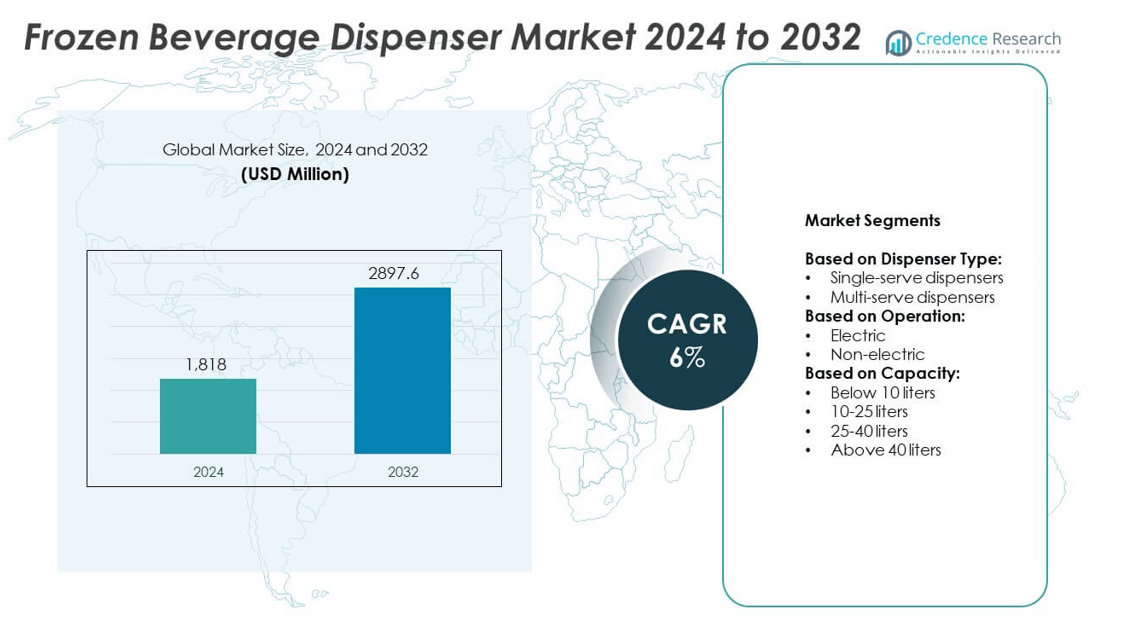

The Frozen Beverage Dispenser market size was valued at USD 1818 million in 2024 and is expected to reach USD 2897.6 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Beverage Dispenser Market Size 2024 |

USD 1818 million |

| Frozen Beverage Dispenser Market, CAGR |

6% |

| Frozen Beverage Dispenser Market Size 2032 |

USD 2897.6 million |

Frozen Beverage Dispenser market growth is driven by rising demand from quick-service restaurants, convenience stores, and entertainment venues. Consumers prefer frozen drinks like smoothies and slush, creating consistent demand year-round. Manufacturers focus on energy-efficient, compact, and IoT-enabled dispensers to improve performance and reduce costs. Premiumization trends encourage introduction of multi-flavor and customizable beverage options. Strong adoption of smart monitoring systems supports predictive maintenance and operational efficiency. Expansion into emerging markets and café culture growth further strengthen long-term market potential.

North America leads the Frozen Beverage Dispenser market, supported by a strong network of quick-service restaurants and high consumer demand for frozen beverages. Europe follows with growing café culture and adoption of energy-efficient dispensers meeting regulatory standards. Asia Pacific shows rapid growth driven by urbanization and expansion of international QSR chains. Key players include Electro Freeze, Magimix, Bunn-O-Matic Corporation, Ugolini, and Taylor Company, focusing on innovation, compact designs, and smart technologies to expand their global presence and strengthen distribution networks.

Market Insights

- The Frozen Beverage Dispenser market was valued at USD 1818 million in 2024 and is expected to reach USD 2897.6 million by 2032, growing at a CAGR of 6% during the forecast period.

- Rising demand from quick-service restaurants, cafés, and entertainment venues fuels consistent growth in frozen beverage equipment installations.

- Market trends focus on energy-efficient, compact, and IoT-enabled dispensers that improve operational efficiency and deliver consistent beverage quality.

- Leading players such as Electro Freeze, Magimix, Bunn-O-Matic Corporation, Ugolini, Jet-Ice, and Taylor Company invest in R&D to enhance technology and maintain competitive positioning.

- High initial investment and recurring maintenance costs restrain adoption for small and mid-sized outlets, slowing equipment replacement cycles.

- North America remains the largest regional market due to a mature QSR network and strong adoption of advanced equipment, while Asia Pacific shows the fastest growth supported by urbanization and rising consumer spending.

- Continuous product innovation with multi-flavor, seasonal, and customizable drink capabilities creates strong opportunities for operators to attract new customers and increase repeat sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Frozen Beverages Across Quick Service Restaurants and Cafes

Frozen Beverage Dispenser market growth is driven by higher sales of frozen drinks in QSRs and cafes. Rising urbanization and busy lifestyles push consumers toward convenient beverage options. It attracts a younger demographic seeking unique and refreshing experiences. Global chains expand product menus with frozen coffee, smoothies, and slush-based drinks. It boosts installation of multi-serve dispensers for consistent output. Seasonal demand peaks during summer months and drives higher machine utilization. Manufacturers focus on offering compact models to fit small store formats.

- For instance, FBD’s 77X Series dispenser can pour up to 5,160 oz/hr.

Technological Advancements in Beverage Dispensing Equipment

Technological upgrades in frozen beverage dispensers improve efficiency and reliability. It allows operators to deliver consistent taste and texture with less manual effort. Energy-efficient compressors and digital controls help reduce operational costs. Smart monitoring features enable predictive maintenance and lower downtime. Manufacturers integrate user-friendly interfaces that improve staff productivity. Automatic cleaning systems save time and maintain hygiene standards. This drives replacement of outdated machines with advanced models.

- For instance, Crathco’s CR2511 Barrel Freezer has a 21-qt hopper and produces 15.8 gallons/hour of frozen beverage.

Growing Adoption in Convenience Stores and Entertainment Venues

Frozen Beverage Dispenser market benefits from expanding distribution in convenience stores and cinemas. It creates impulse purchases by placing machines in high-traffic locations. Venues use dispensers to offer self-serve options, improving customer experience. Compact units support placement in limited spaces without reducing output. It drives revenue growth for retailers by encouraging repeat visits. Entertainment venues rely on dispensers to serve large crowds quickly. This trend strengthens market penetration beyond foodservice chains.

Focus on Customization and Premiumization of Beverages

Customization trends reshape beverage offerings, pushing demand for versatile dispensers. It enables operators to serve multiple flavors and mix combinations on demand. Consumers prefer premium frozen beverages with natural ingredients and unique flavors. Dispensers with modular systems support quick flavor changeovers. Operators use this flexibility to introduce seasonal and limited-edition drinks. Product innovation drives differentiation in competitive foodservice markets. This creates a positive cycle of higher sales and recurring equipment investments.

Market Trends

Integration of Smart and IoT-Enabled Dispensers

Frozen Beverage Dispenser market sees a shift toward smart and IoT-enabled systems. It allows operators to monitor performance remotely and schedule timely maintenance. Real-time data tracking supports inventory planning and reduces wastage. Smart features help maintain consistent drink quality across multiple outlets. Operators benefit from reduced downtime through predictive alerts. Energy management systems lower operating costs and support sustainability goals. This trend strengthens adoption among large foodservice chains and franchise networks.

- For instance, The ICEE Company serves over 500 million frozen beverages annually across more than 400,000 retail locations. These figures apply to its business both within and outside the USA.

Rising Preference for Energy-Efficient and Eco-Friendly Solutions

Manufacturers focus on developing energy-efficient dispensers to meet sustainability standards. It helps operators lower power consumption and reduce carbon footprints. Use of natural refrigerants gains traction to comply with environmental regulations. Compact and efficient designs optimize space in small outlets. Operators choose models with lower lifecycle costs for better ROI. This trend aligns with global sustainability targets and corporate commitments. Growing environmental awareness supports demand for eco-friendly beverage equipment.

- For instance, Stoelting Foodservice model D118-38-L-AF has a hopper capacity of 5 gallons (≈ 18.93 L) and freezing cylinder capacity of 2 gallons (≈ 7.57 L).

Expansion of Self-Serve Beverage Stations in Retail and Hospitality

Frozen Beverage Dispenser market benefits from self-serve models in retail stores and hotels. It improves customer experience by offering quick and interactive service. Retailers use self-serve stations to attract foot traffic and boost impulse sales. Modular machines allow multiple flavors to be dispensed simultaneously. Hotels and resorts install units to enhance guest amenities and convenience. Automated systems minimize staff involvement and improve service speed. This trend encourages investment in user-friendly and durable machines.

Product Innovation with Multi-Flavor and Multi-Serve Capabilities

Manufacturers introduce multi-flavor dispensers to meet consumer demand for variety. It enables rapid switch between flavors without cross-contamination issues. Advanced models offer frozen cocktails, smoothies, and slush in one machine. Operators gain flexibility to expand menus without major investment. Product innovation supports differentiation in competitive beverage markets. Seasonal flavors create repeat purchases and build customer loyalty. Continuous upgrades in dispenser technology stimulate market growth and replacement demand.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

Frozen Beverage Dispenser market faces a challenge due to high upfront costs of machines. It requires significant capital for installation and setup, limiting adoption for small outlets. Regular maintenance adds recurring expenses for operators. Complex parts and specialized servicing increase downtime when machines fail. Smaller businesses struggle to justify investments without guaranteed sales volume. Price-sensitive markets delay equipment upgrades due to cost concerns. This slows replacement cycles and restricts overall market expansion.

Operational Complexities and Technical Issues

Operators face operational hurdles when managing frozen beverage dispensers across multiple locations. It demands trained staff to handle cleaning and maintain hygiene standards. Technical breakdowns during peak hours cause revenue losses and customer dissatisfaction. Frequent temperature fluctuations affect product quality and consistency. Supply chain delays for spare parts can extend machine downtime. Businesses must invest in staff training to ensure efficient operation. These challenges limit smooth operations and create hesitancy for large-scale deployment.

Market Opportunities

Expansion into Emerging Markets and Untapped Regions

Frozen Beverage Dispenser market holds strong potential in developing economies with rising disposable incomes. It benefits from rapid growth of quick-service restaurants and convenience stores in these regions. Urbanization fuels demand for ready-to-drink beverages and frozen refreshments. Retailers seek affordable dispenser solutions to attract young and urban consumers. Growth in tourism drives installation of machines in resorts, airports, and entertainment zones. This opens opportunities for global manufacturers to expand distribution networks. Local partnerships help increase market penetration and brand visibility.

Innovation in Product Offerings and Customization Features

Manufacturers can leverage opportunities by introducing versatile dispensers with multi-flavor and premium beverage options. It supports operators in launching unique and healthier frozen drinks to attract health-conscious consumers. Integration of smart technology allows remote monitoring and predictive maintenance. Compact, energy-efficient designs meet demand for space-saving solutions in small outlets. Seasonal and limited-edition flavors boost consumer engagement and repeat purchases. Strong focus on R&D helps companies stay competitive and capture niche segments. These opportunities encourage long-term growth and higher replacement demand.

Market Segmentation Analysis:

By Dispenser Type:

Single-serve dispensers hold a notable share due to demand from cafes and small retail outlets. Frozen Beverage Dispenser market benefits from rising consumer preference for portion-controlled and customizable drinks. It allows operators to serve fresh beverages quickly with minimal waste. Multi-serve dispensers dominate in quick-service restaurants and entertainment venues where high-volume output is essential. Their ability to produce multiple servings in less time improves service speed during peak hours. Manufacturers focus on compact multi-serve units to support space-limited counters while maintaining capacity. This balance of efficiency and convenience sustains strong demand across both segments.

- For instance, The Spaceman USA model 6695-C is a countertop frozen beverage and shake machine featuring two 7.3-quart (approx. 6.9 L) freezing cylinders and two 12.7-quart (approx. 12 L) mix hoppers.

By Operation:

Electric dispensers lead the market due to their ability to maintain consistent temperature and quality. It reduces manual effort and ensures uniformity in taste across multiple servings. Electric units are widely adopted in commercial spaces that prioritize speed and hygiene. Non-electric dispensers find use in remote or low-power locations, but adoption remains limited. They serve niche applications such as temporary stalls and outdoor events. Manufacturers explore solar-assisted systems to expand adoption in off-grid areas. Growing awareness of energy-efficient electric models continues to strengthen this segment’s dominance.

- For instance, Taylor’s Model 0340 Frozen Uncarbonated Beverage Freezer has a 7-quart (≈ 6.6 L) freezing cylinder and a 20-quart (≈ 18.9 L) mix hopper.

By Capacity:

Below 10-liter dispensers cater to small outlets and kiosks with low daily sales. It allows businesses to offer frozen drinks without overstocking or wastage. The 10–25 liter range is popular among cafes and convenience stores due to balanced size and output. The 25–40 liter category serves mid-sized restaurants that handle moderate customer volumes. Above 40-liter dispensers dominate in cinemas, stadiums, and amusement parks where high demand is frequent. Operators prefer large-capacity units to minimize refills during peak hours. Manufacturers focus on designing durable and energy-efficient large units to improve profitability for high-traffic locations.

Segments:

Based on Dispenser Type:

- Single-serve dispensers

- Multi-serve dispensers

Based on Operation:

Based on Capacity:

- Below 10 liters

- 10-25 liters

- 25-40 liters

- Above 40 liters

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Frozen Beverage Dispenser market at 36%. Strong presence of quick-service restaurant chains and convenience store networks drives demand. It benefits from high consumer spending on frozen beverages like slush, smoothies, and frozen coffee. Technological adoption is strong, with operators favoring IoT-enabled and energy-efficient dispensers. Manufacturers introduce innovative multi-serve models to meet the needs of large venues and drive-through formats. Seasonal peaks during summer months further boost utilization rates and sales. Continuous investment in upgrading equipment to meet hygiene and sustainability standards strengthens regional market leadership.

Europe

Europe accounts for 28% of the Frozen Beverage Dispenser market, supported by growing café culture and foodservice expansion. It benefits from rising demand for premium frozen beverages and sustainable equipment. European operators prefer energy-efficient and eco-friendly models that meet strict environmental regulations. Strong adoption in countries like the UK, Germany, and France supports regional growth. Multi-serve dispensers dominate in cinemas and retail chains that experience high footfall. Consumers show interest in natural and low-sugar frozen drinks, encouraging menu diversification. Replacement of outdated machines with advanced, automated systems continues to drive sales.

Asia Pacific

Asia Pacific holds 22% share and represents the fastest-growing regional market. Rising disposable incomes and rapid urbanization create strong demand for frozen beverage dispensers. It gains from the expansion of international QSR brands and domestic foodservice outlets. Operators invest in electric and compact dispensers to maximize efficiency in small spaces. Growing youth population favors frozen drinks, driving impulse purchases in convenience stores and malls. Manufacturers collaborate with local distributors to improve market reach and after-sales support. Increasing tourism across countries like Thailand and Indonesia boosts installation in hotels and resorts.

Latin America

Latin America contributes 8% share, driven by rising foodservice infrastructure and café chains. It experiences growing popularity of frozen beverages in Brazil, Mexico, and Chile. Retailers and entertainment venues install multi-serve dispensers to cater to young, urban consumers. Operators demand durable and cost-efficient equipment due to price-sensitive nature of the market. Manufacturers introduce affordable models to attract small and mid-sized businesses. Seasonal demand peaks in warmer months, supporting higher machine utilization. Local partnerships help expand service networks and improve maintenance support.

Middle East and Africa

Middle East and Africa hold 6% share, supported by growth in tourism and hospitality projects. It sees strong installation of dispensers in resorts, hotels, and airports. Expanding quick-service restaurants in the UAE and Saudi Arabia fuel regional growth. Electric dispensers dominate due to hot climate conditions requiring consistent cooling performance. Operators seek energy-efficient models to lower operational costs. International brands enter the market through partnerships with local distributors. Growing urban population and rising disposable income contribute to higher adoption in emerging cities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Electro Freeze

- Magimix

- Bunn-O-Matic Corporation

- Ugolini

- Jet-Ice

- SPM Drink Systems

- Donper America

- Zoku

- Elmeco

- Grindmaster-Cecilware

- Carpigiani Group

- Taylor Company

- Stoelting Foodservice Equipment

- Cofrimell

- Sencotel

Competitive Analysis

The leading players in the Frozen Beverage Dispenser market include Electro Freeze, Magimix, Bunn-O-Matic Corporation, Ugolini, Jet-Ice, SPM Drink Systems, Donper America, Zoku, Elmeco, Grindmaster-Cecilware, Carpigiani Group, Taylor Company, Stoelting Foodservice Equipment, Cofrimell, and Sencotel. These companies compete through innovation, product reliability, and global distribution networks. They focus on designing dispensers that deliver consistent beverage quality and reduce operational costs for foodservice operators. Strong emphasis is placed on energy-efficient models and compact solutions to cater to small retail formats. Many players invest in R&D to integrate IoT-enabled controls and predictive maintenance features, which attract quick-service restaurants and large entertainment venues. Competitive pricing strategies and after-sales service support help strengthen customer loyalty and repeat purchases. Expansion into emerging markets remains a priority, with several companies forming partnerships with local distributors to boost market penetration. Customization options, including multi-flavor and seasonal beverage capabilities, create differentiation and enhance brand value. The competitive landscape is expected to intensify with growing demand from Asia Pacific and Latin America. Players who can combine affordability, technology, and service quality will secure long-term growth and defend market share against new entrants.

Recent Developments

- In 2025, Electro Freeze showcased at the National Restaurant Association Show how their machines are designed for fast, intuitive disassembly and cleaning, minimizing labor while maximizing uptime, with a focus on durable and user-friendly equipment.

- In 2024, Taylor Company launched the C393 Frozen Carbonated Beverage Machine featuring three 7-quart freezing cylinders and improved freeze time & recovery.

- In 2024, Carpigiani unveiled the new “SyNthesis 1” modular freezing system at Sigep 2024, designed to produce, store, and serve gelato in front-of-customer settings.

Report Coverage

The research report offers an in-depth analysis based on Dispenser Type, Operation, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market demand will grow with expansion of quick-service restaurants and convenience store chains.

- Technological upgrades will focus on smart, IoT-enabled dispensers for remote monitoring.

- Energy-efficient and eco-friendly models will gain preference to meet sustainability goals.

- Multi-flavor and modular machines will dominate due to rising customization trends.

- Growth in tourism and entertainment sectors will boost installations in resorts and cinemas.

- Manufacturers will invest in compact designs to support space-limited retail outlets.

- Replacement demand will rise as operators upgrade outdated equipment with advanced models.

- Emerging markets in Asia Pacific and Latin America will see rapid adoption.

- Product innovation will introduce healthier and natural frozen drink options.

- Partnerships between global brands and local distributors will expand after-sales support networks.