Market Overview

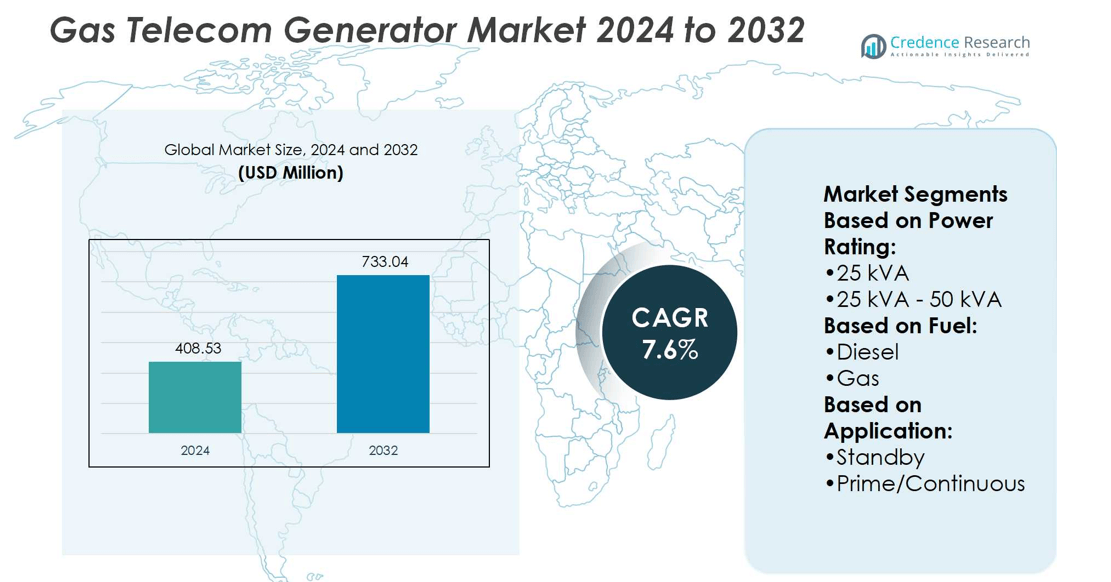

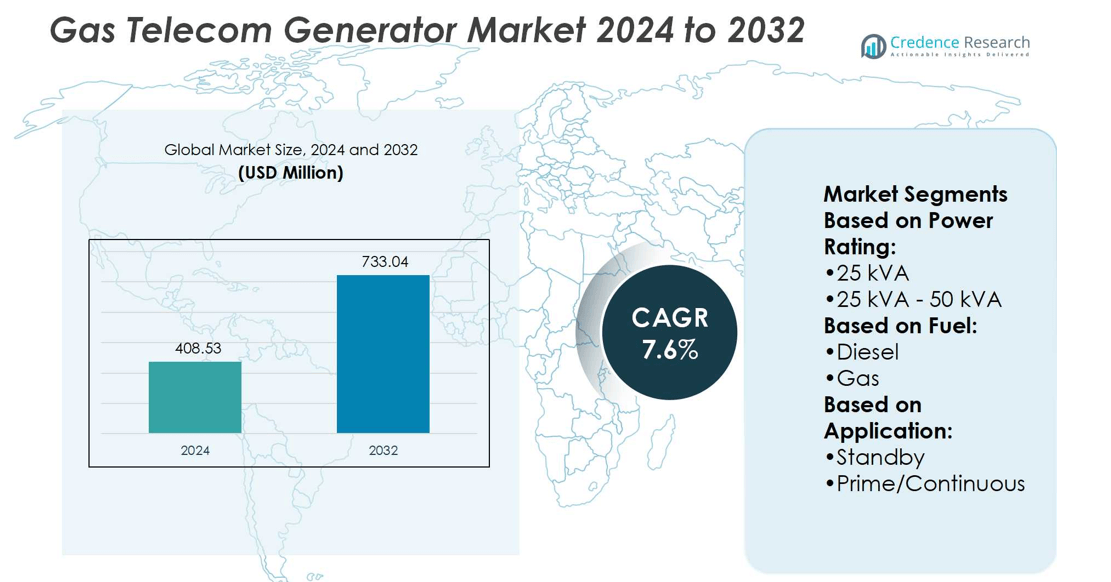

Gas Telecom Generator Market size was valued at USD 408.53 million in 2024 and is anticipated to reach USD 733.04 million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Telecom Generator Market Size 2024 |

USD 408.53 million |

| Gas Telecom Generator Market, CAGR |

7.6% |

| Gas Telecom Generator Market Size 2032 |

USD 733.04 million |

The Gas Telecom Generator Market grows through rising demand for reliable backup power across expanding telecom networks and 5G infrastructure. Drivers include increasing data traffic, stricter emission regulations, and the need for sustainable energy alternatives to diesel systems. Telecom operators adopt gas-based units for cost efficiency, lower emissions, and long-term operational stability. Trends highlight the integration of hybrid systems with renewable energy, deployment of IoT-enabled monitoring solutions, and greater adoption in rural and off-grid areas. The market also reflects a strong shift toward natural gas and biogas generators, aligning with global sustainability and energy diversification goals.

The Gas Telecom Generator Market shows strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific emerging as the fastest-growing region due to rapid telecom expansion and 5G deployment. North America and Europe maintain significant shares supported by advanced infrastructure and strict emission policies. Key players include AGG POWER TECHNOLOGY (UK) CO., LTD, Aggreko, Atlas Copco AB, Caterpillar, Cummins, Generac Power Systems, HIMOINSA, Green Power Systems, Cshpower, and Chroma Power Systems India.

Market Insights

- The Gas Telecom Generator Market size was valued at USD 408.53 million in 2024 and is projected to reach USD 733.04 million by 2032, at a CAGR of 7.6%.

- Rising demand for reliable backup power and 5G infrastructure expansion drives strong market growth.

- The market trends show hybrid integration with renewable energy and IoT-enabled monitoring adoption.

- Competitive analysis highlights focus on sustainability, emission reduction, and advanced service networks.

- Market restraints include high installation costs, fuel supply limitations, and regulatory challenges in certain regions.

- Regional analysis shows Asia Pacific as the fastest-growing region, with North America and Europe holding significant shares.

- Key players such as Caterpillar, Cummins, Aggreko, Atlas Copco, and Generac strengthen positions through product innovation and global distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Reliable Telecom Power Solutions

The Gas Telecom Generator Market expands with rising demand for reliable backup power across telecom sites. Increasing mobile data traffic and higher network penetration require uninterrupted energy to maintain seamless connectivity. Telecom towers in urban and rural areas depend on continuous power supply, which often faces disruptions due to unstable grids. Gas-based generators provide cost-efficient and cleaner alternatives compared to diesel units, strengthening adoption. Their ability to support long runtimes makes them highly relevant for telecom infrastructure resilience. It ensures that operators maintain service quality while reducing downtime risks.

- For instance, Chroma Power Systems India Private Limited has deployed advanced gas generator solutions tailored for telecom applications, with units delivering continuous output capacities ranging from 4 kW to 20 MW. The company’s production facility manufactures more than 5,000 gensets annually, ensuring large-scale availability for operators across India and neighboring markets.

Regulatory Support and Environmental Compliance

Stringent emission regulations drive the adoption of gas-powered systems in the telecom sector. Governments worldwide impose restrictions on diesel generator usage due to high emissions and environmental concerns. Gas generators meet compliance requirements by offering lower carbon and particulate emissions. The market benefits from these policies as telecom companies prioritize greener alternatives. It positions gas generators as a sustainable option for long-term infrastructure expansion. Increasing preference for eco-friendly energy solutions reinforces demand across developed and emerging economies.

- For instance, Cummins has developed a gas generator series such as the HSK78G, which delivers NOₓ emissions as low as 250 mg per Nm³ (0.5 g/hp-hr) without exhaust aftertreatment.

Cost Efficiency and Operational Benefits

Cost advantages play a key role in driving gas generator deployment across telecom networks. Lower fuel costs compared to diesel make them attractive for operators seeking long-term savings. These systems deliver high efficiency, reducing maintenance frequency and operational expenditure. The Gas Telecom Generator Market benefits from technological improvements that enhance reliability and fuel flexibility. Distributed power generation also supports telecom firms operating in remote or off-grid areas. It ensures that operators achieve both financial and operational stability through sustainable investments.

Technological Advancements and Industry Modernization

Innovations in generator technology significantly accelerate adoption within the telecom industry. Modern gas generators integrate smart monitoring systems, enabling predictive maintenance and performance optimization. Hybrid configurations with renewable energy sources further enhance efficiency and reduce reliance on fossil fuels. Companies invest in advanced engine designs to improve durability and fuel adaptability. The integration of digital controls also strengthens monitoring and remote management for telecom operators. It highlights how technology advancements align with industry modernization and long-term energy security.

Market Trends

Growing Shift Toward Cleaner Power Alternatives

The Gas Telecom Generator Market reflects a clear transition toward eco-friendly energy solutions. Telecom operators increasingly replace diesel systems with gas-powered units to reduce emissions and comply with regulations. The shift aligns with sustainability goals and helps companies lower their carbon footprint. It highlights the industry’s focus on balancing energy reliability with environmental responsibility. Operators adopt natural gas and biogas solutions to support greener telecom infrastructure. This trend is most evident in regions enforcing strict air quality standards.

- For instance, HIMOINSA offers biogas generator sets such as the HGM-1895 T5 BIO model, which delivers 2000 kW power output and includes a 95.3 L / 170 mm bore × 210 mm stroke 20-V engine (MTU 20V4000L32).

Integration of Hybrid and Renewable Systems

Hybrid energy systems combining gas generators with solar or wind sources gain significant traction. Telecom companies use these setups to reduce fuel dependency and improve operational cost efficiency. The integration supports energy diversification while ensuring uninterrupted network performance in off-grid sites. It enables telecom operators to achieve both sustainability and resilience objectives. The Gas Telecom Generator Market benefits from hybrid adoption as companies strengthen energy portfolios. It reinforces the importance of multi-source energy strategies in the telecom sector.

- For instance, QES 380 model delivers 304 kW prime power at 400 V, with a standard fuel tank of 520 L and an optional 900 L tank. Under full-load, that machine consumes 76.3 L/h of fuel.

Adoption of Smart Monitoring and IoT Technologies

Digitalization drives strong uptake of smart control systems in gas generators. IoT-enabled platforms provide real-time monitoring, predictive maintenance, and fuel optimization features. Telecom operators value these capabilities for reducing downtime and extending equipment life. It enhances transparency, improves efficiency, and ensures operational stability across distributed networks. Remote management becomes essential for operators managing thousands of telecom towers. The trend marks a decisive move toward intelligent and connected power systems.

Expansion in Emerging and Rural Telecom Infrastructure

Rural and semi-urban network expansion creates strong demand for gas-powered generators. Regions with limited grid access rely on them to secure consistent telecom operations. The Gas Telecom Generator Market grows as developing countries prioritize digital connectivity and 5G readiness. It supports telecom providers in bridging the digital divide across underserved regions. Cost-effective and durable gas generators ensure reliable services for expanding subscriber bases. This trend underscores their role in enabling infrastructure growth in developing economies.

Market Challenges Analysis

High Installation and Operational Constraints

The Gas Telecom Generator Market faces barriers due to high upfront installation costs and complex infrastructure requirements. Telecom operators often struggle with gas pipeline availability, especially in remote areas with weak energy networks. Limited access to fuel supply chains restricts large-scale deployment and raises logistical challenges. It also demands specialized installation expertise, which adds to operational complexity and expenses. In regions with unstable gas distribution networks, telecom companies encounter delays in securing reliable power sources. These constraints slow adoption and affect long-term scalability for operators seeking efficient backup solutions.

Regulatory, Environmental, and Technical Limitations

Strict government policies on emissions and fuel use present regulatory hurdles for gas generators. While cleaner than diesel, gas units still emit greenhouse gases, raising concerns among environmental groups. The Gas Telecom Generator Market also contends with technical limitations such as lower power density compared to diesel systems. It requires continuous innovation to improve performance and adapt to high-demand telecom operations. Telecom operators remain cautious due to uncertainties in compliance standards and evolving environmental frameworks. These challenges emphasize the need for improved fuel technologies, reliable supply chains, and supportive regulatory alignment.

Market Opportunities

Expansion of Telecom Infrastructure and 5G Deployment

The Gas Telecom Generator Market holds strong opportunities from expanding telecom networks and 5G deployment worldwide. Rapid subscriber growth and rising mobile data usage push operators to enhance network reliability with stable power sources. Gas generators present an attractive alternative to diesel units by combining cost efficiency with cleaner operations. It creates scope for widespread adoption in both urban towers and rural installations where grid access is weak. The transition toward advanced networks requires backup systems capable of meeting high energy demands. This opportunity positions gas generators as critical enablers of telecom modernization.

Growing Demand for Sustainable and Hybrid Energy Solutions

Sustainability goals open pathways for hybrid energy solutions that integrate gas generators with renewables. Telecom operators actively seek to reduce carbon footprints while maintaining service continuity across expanding infrastructures. The Gas Telecom Generator Market benefits from these initiatives by aligning with environmental compliance and corporate ESG commitments. It enables providers to adopt biogas and natural gas units that lower emissions and improve operational efficiency. Smart hybrid setups offer long-term savings while meeting green energy targets. These opportunities highlight gas generators’ role in future-ready, sustainable telecom energy strategies.

Market Segmentation Analysis:

By Power Rating

The Gas Telecom Generator Market demonstrates varied demand across different power ratings, reflecting the diverse energy needs of telecom operators. Units rated ≤ 25 kVA hold steady adoption in small-scale telecom sites and rural towers where energy requirements remain modest. Generators in the > 25 kVA – 50 kVA range see stronger demand in suburban deployments, supporting medium-capacity network equipment. Systems in the > 50 kVA – 125 kVA category gain traction in growing urban infrastructures, ensuring reliable performance for multiple tower installations. The > 125 kVA – 200 kVA segment is preferred for larger facilities, handling higher loads and ensuring resilience in critical network hubs. Generators rated > 200 kVA – 330 kVA dominate high-capacity installations where reliability is paramount, while units above 330 kVA cater to extensive telecom data centers and centralized facilities. It underscores the market’s ability to serve diverse operational scales, from rural deployments to advanced network infrastructures.

- For instance, Generac’s MG250 model is a gaseous-fuel generator set with rated standby power of 250 kW / 313 kVA, prime power of 225 kW / 281 kVA, supplied by a 14.2 L inline engine.

By Fuel

By fuel type, the market segments into diesel and gas generators, with gas gaining traction due to environmental compliance and lower fuel costs. Telecom operators prefer gas units for long-term sustainability and reduced emissions compared to traditional diesel systems. While diesel remains common in areas with limited gas supply, growing investment in natural gas and biogas infrastructure supports the shift toward cleaner options. The Gas Telecom Generator Market benefits from policies promoting reduced carbon emissions, encouraging telecom providers to adopt gas-based systems. It reflects the industry’s broader move toward sustainable and cost-efficient energy strategies.

- For instance, Aggreko offers a 1,500 kW PowerFlex gas generator that operates on natural gas, propane HD-5, biogas, or landfill gas, delivering 1,489 kWe continuous power output. Its exhaust emissions are calibrated at 400 mg NOₓ per m³ and 1,000 mg CO per m³.

By Application

Application-based segmentation shows strong use of standby generators in telecom towers, ensuring uninterrupted services during grid outages. These systems dominate in regions with unstable power infrastructure, where reliability remains a priority. Prime and continuous generators, on the other hand, support telecom networks in off-grid or rural areas, ensuring seamless operations where grid access is limited. Their relevance grows with telecom expansion in emerging economies, where permanent off-grid power remains essential. It highlights how the market adapts to both short-term backup requirements and long-term continuous supply demands across varied geographies.

Segments:

Based on Power Rating:

Based on Fuel:

Based on Application:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 32% share of the Gas Telecom Generator Market, supported by advanced telecom infrastructure and extensive data center networks. The region benefits from a reliable natural gas supply chain and strict emission regulations that accelerate adoption of gas-based systems. Operators in the United States and Canada increasingly replace diesel units with cleaner alternatives to meet sustainability targets. It maintains a steady growth outlook as telecom companies expand 5G coverage and reinforce network reliability. The high density of telecom towers and strong investment in backup power keep North America a leading region.

Europe

Europe accounts for 27% share of the market, with growth anchored in regulatory policies that limit diesel generator use. Countries such as Germany, the UK, and France promote low-emission energy solutions, creating strong demand for gas generators. Telecom operators adopt these systems to ensure compliance and support broader climate goals. The market also benefits from well-developed gas infrastructure that enables large-scale deployment. It continues to record steady expansion as networks modernize and energy efficiency becomes a priority.

Asia Pacific

Asia Pacific captures 28% share and emerges as the fastest-growing regional market. Rapid urbanization, rural connectivity programs, and large-scale 5G rollout drive significant demand for reliable power backup. Countries like China, India, and Japan invest heavily in telecom expansion, making gas generators essential in areas with unstable grids. It also benefits from supportive government initiatives promoting energy diversification. With rising telecom tower installations, Asia Pacific is expected to challenge North America’s leading position in the coming years.

Latin America

Latin America represents 7% share, with Brazil and Mexico leading adoption. The region shows rising demand for reliable power supply as telecom operators expand networks into underserved areas. However, limited infrastructure and supply chain constraints slow wider adoption of gas generators. It still presents growth opportunities as operators seek alternatives to diesel for long-term sustainability. The market outlook remains positive as investments in telecom infrastructure increase.

Middle East & Africa

The Middle East & Africa holds 6% share, supported by infrastructure development and growing telecom penetration. Countries in the Gulf Cooperation Council invest in expanding 5G networks, which drives backup power demand. Africa’s rural network expansion also creates opportunities for gas generator deployment where grid access is weak. The region faces challenges in fuel availability and distribution, but long-term prospects remain promising. It highlights the importance of gas-based systems in supporting connectivity across diverse terrains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chroma Power Systems India Private Limited

- Cummins, Inc.

- HIMOINSA

- Green Power Systems s.r.l.

- Atlas Copco AB

- Generac Power Systems, Inc.

- Aggreko

- Caterpillar

- Cshpower

- AGG POWER TECHNOLOGY (UK) CO., LTD

Competitive Analysis

The Gas Telecom Generator Market Key players such as AGG POWER TECHNOLOGY (UK) CO., LTD, Aggreko, Atlas Copco AB, Caterpillar, Chroma Power Systems India Pvt. Ltd., Cshpower, Cummins, Inc., Generac Power Systems, Inc., Green Power Systems s.r.l., HIMOINSA). The Gas Telecom Generator Market remains highly competitive, with companies focusing on innovation, sustainability, and cost efficiency to strengthen their positions. Competition centers on developing generators that deliver lower emissions, higher fuel efficiency, and improved reliability under diverse telecom site conditions. Firms invest in hybrid and digital monitoring technologies to meet rising demand for intelligent power management. Global players leverage extensive service networks and established brand reputation, while regional companies compete by offering cost-effective solutions tailored to local fuel availability and regulatory environments. The market also reflects a growing emphasis on sustainability, pushing manufacturers to adopt natural gas and biogas options that align with environmental goals. Competitive advantage increasingly depends on balancing performance with long-term operational savings and ensuring compliance across multiple regulatory frameworks. This dynamic landscape ensures continuous innovation and strategic differentiation across product portfolios.

Recent Developments

- In October, 2024, HIMOINSA launched its HGY Series of natural gas generators in Madrid, Spain, showcasing a new power solution for critical applications. Developed in collaboration with Yanmar Power Technology, these generators range from 1250kVA to 3500kVA and are designed for efficiency and low emissions.

- In June 2024, Caterpillar has expanded its portfolio of commercial power solutions by adding the Cat CG260 gas gensets, operating on hydrogen fuel. The 12- and 16-cylinder models of the CG260 are approved for use with up to 25% hydrogen gas by volume.

- In April 2024, Cummins Power Generation has introduced 2 new gensets powered by the Cummins’s QSK78 engine. These 2 new models including C3000D6EB and C2750D6E offers power outputs of 3,000 kW and 2,750 kW respectively, are designed for critical applications including wastewater treatment plants, healthcare facilities, and data centers.

- In April 2024, Mitsubishi Electric Corporation and Mitsubishi Heavy Industries announced today the completion of their power-generator systems businesses merger under the newly formed Mitsubishi Generator Co. This joint venture combines the technologies and resources of both companies, enhancing market competitiveness and leveraging strong synergies.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Gas Telecom Generator Market will expand with rising telecom tower installations worldwide.

- It will gain momentum from 5G network rollouts requiring reliable backup power.

- Operators will adopt gas-based systems to reduce emissions and meet regulatory targets.

- Hybrid setups combining gas generators with renewable energy will increase adoption.

- Digital monitoring and IoT integration will enhance predictive maintenance and efficiency.

- Natural gas and biogas generators will see higher demand for sustainability goals.

- Rural and remote network expansion will drive reliance on continuous power solutions.

- Companies will invest in compact, modular units for easier deployment and transport.

- Service networks and after-sales support will remain critical for competitive positioning.

- The market will focus on lowering lifecycle costs while improving fuel flexibility.