Market Overview

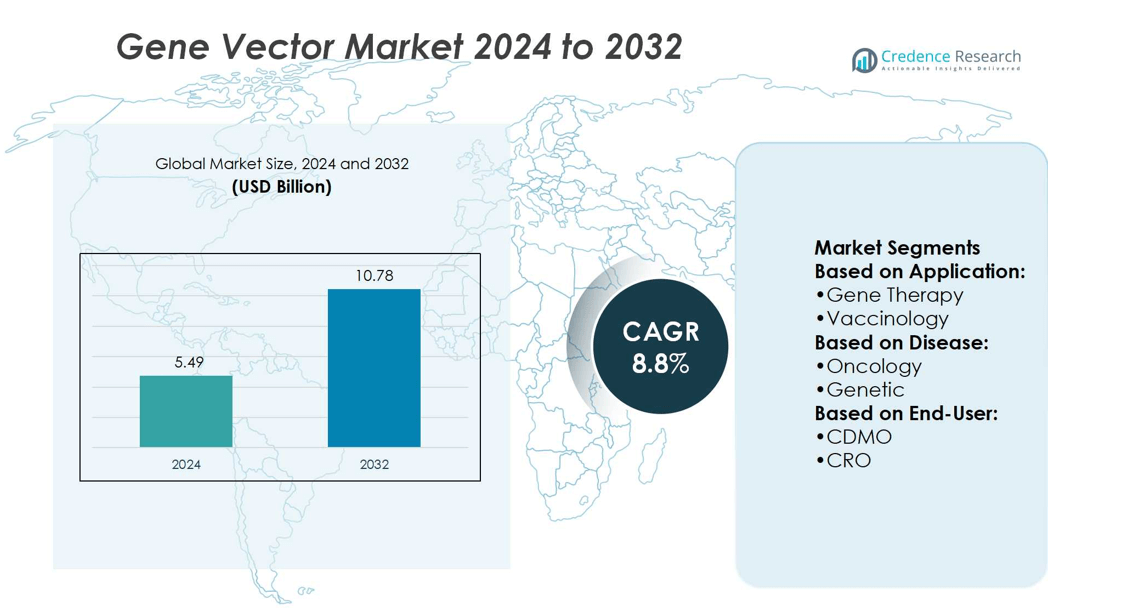

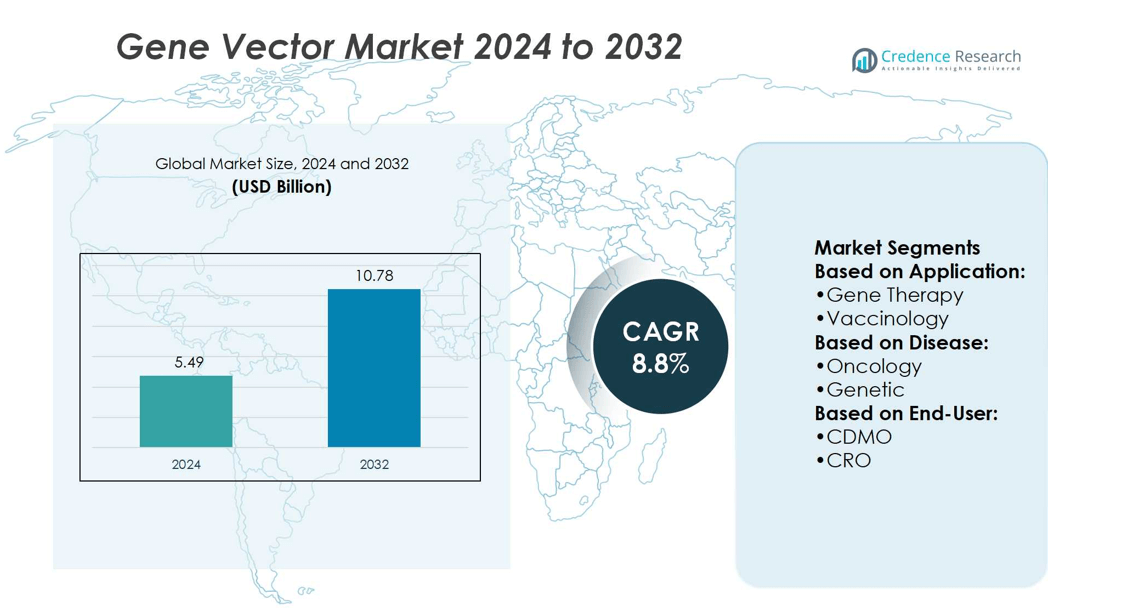

Gene Vector Market size was valued at USD 5.49 billion in 2024 and is anticipated to reach USD 10.78 billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gene Vector Market Size 2024 |

USD 5.49 billion |

| Gene Vector Market, CAGR |

8.8% |

| Gene Vector Market Size 2032 |

USD 10.78 billion |

The Gene Vector Market grows through strong demand for advanced therapies addressing oncology, rare genetic disorders, and infectious diseases. Key drivers include rising clinical approvals, increasing investments in biotechnology, and expanding use of contract development and manufacturing services. Advancements in vector engineering, regulatory support, and growing patient awareness further accelerate adoption. Trends highlight the shift toward non-viral vectors for safety and cost advantages, expansion of global manufacturing capacity, and integration of digital technologies for process efficiency. Emerging partnerships between research institutions and biopharma companies strengthen pipelines, while personalized medicine continues to shape innovation and long-term growth opportunities.

North America dominates the Gene Vector Market with the largest share, supported by advanced healthcare infrastructure and strong R&D investments, while Europe follows with robust regulatory frameworks and established biotech hubs. Asia Pacific emerges as the fastest-growing region, driven by rising clinical trials and healthcare spending. Latin America and the Middle East & Africa hold smaller shares but show gradual growth through improving healthcare systems. Key players include Lonza, Thermo Fisher Scientific, Oxford Biomedica, Fujifilm Diosynth Biotechnologies, and Spark Therapeutics.

Market Insights

- Gene Vector Market size reached USD 5.49 billion in 2024 and will grow at 8.8% CAGR to 2032, achieving USD 10.78 billion.

- Rising demand for therapies targeting oncology, rare genetic disorders, and infectious diseases drives strong adoption.

- Advancements in vector engineering, regulatory backing, and digital integration shape efficiency and innovation trends.

- Competition intensifies with companies focusing on capacity expansion, strategic partnerships, and scalable manufacturing solutions.

- High production costs, complex regulatory approvals, and infrastructure limitations act as key restraints to growth.

- North America leads the market, Europe holds significant share, and Asia Pacific records the fastest expansion.

- Latin America and Middle East & Africa show gradual growth, supported by improving healthcare systems and investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Gene Therapy and Targeted Treatments

The Gene Vector Market gains momentum from the increasing adoption of gene therapy for rare and chronic diseases. Growing demand for targeted treatments drives investment in vector-based delivery systems. Healthcare providers rely on advanced vectors to improve patient outcomes. It supports personalized medicine initiatives by enabling precise genetic modifications. Strong clinical trial pipelines highlight its expanding use across oncology, hematology, and neurology. Rising prevalence of genetic disorders further strengthens the market’s role in modern healthcare.

- For instance, Spark-Roche recently dosed the first patient in a Huntington’s disease (HD) gene therapy trial (RG6662/SPK-10001), targeting both mutant and wild-type huntingtin via AAV vector, delivered through intracranial infusion in 8 planned participants.

Advancements in Vector Engineering and Manufacturing Technologies

Continuous progress in vector design and manufacturing efficiency supports steady market expansion. Innovations in viral and non-viral vectors enhance safety, stability, and delivery effectiveness. It benefits from scalable bioprocessing techniques that lower production costs. Automation and digital monitoring systems improve quality control during vector manufacturing. Contract development and manufacturing organizations adopt these technologies to meet rising demand. Regulatory agencies also encourage safe production practices, reinforcing industry confidence in advanced solutions.

- For instance, Novasep’s viral-vector business (Henogen), with two locations in Seneffe and Gosselies, Belgium, built out a GMP clinical & commercial manufacturing capacity of over 7,000 m² before its acquisition by Thermo Fisher.

Expanding Investments in Biotechnology Research and Development

The Gene Vector Market advances with significant funding from public and private organizations. Governments support gene therapy programs through grants and strategic collaborations. Biotech firms invest heavily in developing next-generation vectors with higher transduction efficiency. It creates opportunities for startups specializing in innovative delivery platforms. Rising venture capital inflows further accelerate product pipelines. Partnerships between academia and industry foster rapid progress, strengthening the commercial viability of advanced gene vector platforms.

Strong Regulatory Approvals and Commercialization Pathways

Clearer regulatory guidelines support faster approvals of gene therapy products, boosting confidence in vector use. Agencies streamline review processes for innovative therapies targeting rare diseases. It enables biotechnology firms to accelerate product launches and expand treatment availability. Growing number of approved gene therapies drives higher demand for vectors. Standardized regulatory frameworks also encourage investment in large-scale facilities. Strong commercialization pathways position the market for sustained adoption across global healthcare systems.

Market Trends

Growing Adoption of Non-Viral Vectors for Safer and Flexible Applications

The Gene Vector Market shows a clear trend toward increased use of non-viral vectors. Demand rises due to safety concerns with viral vectors in certain therapies. It supports applications in mRNA delivery, plasmid DNA, and CRISPR-based systems. Researchers prefer non-viral approaches for cost efficiency and scalability. Flexible design and lower immune responses further strengthen adoption. This trend highlights a broader shift toward safer, patient-friendly delivery technologies.

- For instance, Oxford Biomedica’s Upstream Process Enhancement work for AAV9 at 2 L bioreactor scale recorded a 3.2× titer improvement from optimized transfection and process parameters.

Expansion of CRISPR and Gene Editing Technologies in Clinical Research

Rapid integration of CRISPR technology into clinical pipelines drives strong demand for advanced vectors. The Gene Vector Market benefits from CRISPR’s precision and versatility across therapeutic areas. It requires vectors with improved accuracy, efficiency, and reduced off-target effects. Clinical studies increasingly rely on vectors to deliver CRISPR components into target cells. Collaborations between biotech firms and academic institutions accelerate this trend. Regulatory approvals of CRISPR-based therapies highlight the importance of reliable vector systems.

- For instance, Eurogentec’s single-step chromatography purification enables plasmid DNA with impurity levels below 0.1 EU/µg endotoxin, ensuring compliance with clinical-grade vector standards.

Increased Outsourcing to Contract Development and Manufacturing Organizations

Growing reliance on CDMOs reflects a significant trend in the gene therapy value chain. Companies outsource vector development to reduce costs and scale production efficiently. It enables biotech firms to focus on R&D while ensuring quality manufacturing. CDMOs expand capacity to meet rising demand from clinical and commercial stages. Advanced automation and digital tools strengthen their role in the ecosystem. This trend enhances global supply chains and improves access to specialized expertise.

Rising Focus on Personalized and Rare Disease Treatments

The Gene Vector Market aligns with the trend toward personalized medicine and rare disease therapies. It plays a central role in enabling targeted gene delivery solutions. Rising diagnosis rates of genetic disorders highlight the need for specialized vectors. Companies design vectors tailored to patient-specific requirements. Regulatory incentives for orphan drugs accelerate this momentum. This trend underscores the market’s transition toward highly specialized, precision-driven treatment models.

Market Challenges Analysis

Complex Manufacturing Processes and High Production Costs

The Gene Vector Market faces significant challenges linked to complex production and high costs. Manufacturing viral and non-viral vectors requires advanced bioprocessing systems and strict quality controls. It creates hurdles for companies trying to scale production while maintaining consistency. Limited availability of raw materials and skilled professionals further complicates operations. High development expenses often restrict smaller biotech firms from competing effectively. These challenges slow down commercialization timelines and limit widespread adoption in healthcare systems.

Stringent Regulatory Frameworks and Safety Concerns in Clinical Applications

Strict regulatory requirements create another barrier to rapid market growth. Authorities demand extensive testing to ensure safety, efficacy, and long-term stability of vectors. It increases approval timelines and raises compliance costs for companies. Concerns over immune reactions, toxicity, and off-target effects remain difficult to address fully. Developers must balance innovation with adherence to evolving safety standards. These obstacles reduce the pace of new therapy introductions and challenge market expansion efforts.

Market Opportunities

Expanding Scope in Emerging Therapies and Precision Medicine

The Gene Vector Market offers strong opportunities through its role in advancing precision medicine. It enables targeted delivery for gene therapy, cell therapy, and regenerative medicine. Growing acceptance of CRISPR-based and RNA-based treatments broadens application areas. Rising investment in oncology, rare genetic disorders, and neurology creates new growth avenues. Strategic collaborations between biotech firms and research institutes strengthen innovation pipelines. These factors highlight the potential for vectors to become integral tools in next-generation therapies.

Global Expansion and Rising Demand in Developing Healthcare Markets

Opportunities also arise from expanding healthcare infrastructure across emerging economies. The Gene Vector Market benefits from growing adoption of advanced therapies in Asia Pacific, Latin America, and the Middle East. It aligns with rising healthcare spending and patient access to innovative treatments. Governments support initiatives that encourage local biomanufacturing and technology transfer. Global partnerships foster wider availability of safe and cost-effective vectors. This creates long-term opportunities for industry players to expand their footprint across underserved regions.

Market Segmentation Analysis:

By Application

The Gene Vector Market demonstrates strong adoption across gene therapy and vaccinology. Gene therapy leads growth, supported by expanding pipelines targeting rare and chronic conditions. It enables precise delivery of genetic material to restore or modify cellular functions. Vaccinology also represents a vital segment, with viral and non-viral vectors driving next-generation vaccine development. Rising focus on pandemic preparedness and personalized vaccines strengthens this segment further. Both applications highlight the critical role of vectors in advancing medical innovation.

- For instance, Lonza’s viral vector CDMO service supports suspension-based upstream production in cGMP for AAV, lentivirus, adenovirus, or oncolytic virus using bioreactors ranging from 50 L up to 2,000 L, enabling both early-stage and commercial-scale manufacturing.

By Disease

Oncology represents the largest disease segment due to rising demand for targeted cancer therapies. The Gene Vector Market leverages vectors to deliver genes that suppress tumors or enhance immune response. It also shows strong momentum in genetic diseases, where therapies aim to correct inherited mutations. Infectious diseases remain a promising segment, as vectors support vaccine development for viral outbreaks and global health challenges. Research efforts in these areas strengthen the long-term role of gene vectors in clinical practice. The broad coverage of diseases highlights the market’s capacity to support multiple therapeutic areas.

- For instance, Fujifilm Diosynth Biotechnologies (FDB) feasibility study for a client’s AAV9 oncology candidate, using 10 L bioreactors, achieved a harvest titer greater than 1 x 10¹¹ vector genomes per milliliter (vg/mL).

By End-User

Pharma and biotech companies dominate demand, leading the adoption of advanced vector technologies. These organizations invest heavily in clinical programs and commercial production. It creates steady opportunities for contract development and manufacturing organizations (CDMOs), which provide scalable vector manufacturing capabilities. Contract research organizations (CROs) play a growing role in supporting clinical trials, offering specialized expertise in vector evaluation and regulatory compliance. Collaborations among these end-users strengthen the supply chain and accelerate therapeutic development. This ecosystem underscores the importance of shared capabilities to meet rising demand across healthcare applications.

Segments:

Based on Application:

Based on Disease:

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Gene Vector Market with 38.5% share in 2024. The United States drives this dominance due to its advanced healthcare infrastructure, large patient pool, and extensive biotechnology research. The country has a strong base of pharmaceutical companies, academic institutions, and contract development and manufacturing organizations (CDMOs) focusing on viral and non-viral vectors. Canada also contributes with supportive healthcare policies and investments in rare disease therapies. High adoption of oncology and genetic disorder therapies strengthens demand, while the FDA’s clear regulatory frameworks accelerate approvals. The region continues to witness strong funding for clinical trials and vector manufacturing expansion, making it a hub for innovation and early adoption.

Europe

Europe accounts for 22% of the Gene Vector Market. Germany, the United Kingdom, and France are the key markets driving growth across the region. Supportive funding from both government and private sources fuels research in gene therapy and vector development. The European Medicines Agency (EMA) has established structured guidelines for gene-based therapies, encouraging more clinical trials and commercialization. Germany leads vector production, while the UK invests heavily in genetic research and therapy pipelines. France contributes with advancements in vaccine applications. The region benefits from strong collaborations between universities, biotech firms, and CDMOs, although regulatory costs and complexity sometimes slow wider adoption compared to North America.

Asia Pacific

Asia Pacific holds a 31% share and records the fastest growth in the Gene Vector Market. China dominates with a rapidly expanding biotechnology sector and heavy investments in gene therapy research. Japan contributes with advanced R&D facilities and a strong focus on oncology treatments, while South Korea is investing in viral vector production and clinical trials. India is emerging as a key market with a growing patient base and rising biotech capabilities. Governments across the region are reforming regulatory frameworks to accelerate approvals and attract investments. Rising healthcare expenditure, a growing incidence of genetic disorders, and active participation in international collaborations position Asia Pacific as a critical growth engine for the market.

Latin America

Latin America represents 4% of the Gene Vector Market. Brazil is the largest contributor, followed by Mexico, both showing growing investments in healthcare infrastructure and biotechnology. While the region still depends heavily on imports and global partnerships for advanced therapies, increasing awareness of genetic disorders and oncology treatments is creating demand for gene vector applications. Government programs to expand healthcare access and private sector investments in research labs support gradual adoption. Despite challenges such as high costs and limited R&D facilities, Latin America shows steady growth potential, with Brazil positioning itself as a regional hub for clinical research and therapy adoption.

Middle East & Africa

The Middle East & Africa account for 3.5% of the Gene Vector Market. The Gulf countries, including the UAE and Saudi Arabia, are driving regional progress by investing in biotechnology research hubs and healthcare modernization projects. South Africa also plays a notable role, with its established research facilities and focus on infectious disease treatment. However, the region overall faces challenges such as limited R&D infrastructure, high costs, and regulatory barriers. Collaborations with North American and European firms are helping to bridge gaps, while government initiatives continue to encourage medical innovation. Gradual adoption of gene therapy and increased partnerships signal slow but steady growth for the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Spark Therapeutics

- Novasep

- Cobra Biologics

- Oxford Biomedica

- Kaneka Eurogentec

- Lonza

- Fujifilm Diosynth Biotechnologies

- Thermo Fisher Scientific

- Merck KGaA Inc.

- SIRION Biotech

Competitive Analysis

The Gene Vector Market companies such as Cobra Biologics, Fujifilm Diosynth Biotechnologies, SIRION Biotech, Merck KGaA Inc., Thermo Fisher Scientific, Lonza, Oxford Biomedica, Novasep, Spark Therapeutics, and Kaneka Eurogentec. The Gene Vector Market is defined by strong competition, where companies prioritize advanced manufacturing capabilities, regulatory compliance, and scalability to meet rising demand. Firms are expanding production facilities, investing in viral and non-viral vector platforms, and forming strategic collaborations to accelerate clinical and commercial supply. The competitive landscape is also shaped by contract development services that support biotechnology and pharmaceutical companies in reducing time-to-market. Innovation in vector design, efficiency improvements in transfection methods, and integration of digital technologies for process control have become central to differentiation. Partnerships with research institutions and global biopharma firms highlight the emphasis on innovation pipelines, while mergers and acquisitions strengthen portfolios and broaden geographic reach. The market competition continues to intensify as demand for gene therapy grows across oncology, rare diseases, and vaccine development.

Recent Developments

- In June 2025, Probio opened its flagship U.S. plasmid DNA and viral vector GMP manufacturing facility. At 96,000 square feet, the site was designed to help gene and cell therapy developers with complete end-to-end services. This facility strengthened Probio’s global presence as a CDMO and provided enhanced scalability and speed of production.

- In May 2025, 3P Biovian introduced two new platforms to allow capacity to enhance AAV and plasmid DNA (pDNA) manufacturing. Their AAV platform focused on preclinical to early clinical, and the pDNA platform supported DNA vaccines and viral vector manufacturing.

- In October 2023, AGC Biologics announced that they will be expanding their pDNA manufacturing facility in Germany. This is expected to help the company to reduce the time required for manufacturing.

- In February 2023, BioNTech SE announced that they have completed the setup of first plasmid DNA manufacturing plant of theirs in Germany. This has enabled the company to manufacture pDNA independently for clinical and commercial applications.

Report Coverage

The research report offers an in-depth analysis based on Application, Disease, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising approvals of gene therapies across oncology and rare diseases.

- Non-viral vectors will gain traction as safer and cost-effective alternatives to viral platforms.

- Increased investment in contract development and manufacturing organizations will accelerate production capacity.

- Regulatory frameworks will evolve to streamline approvals while ensuring safety and efficacy.

- Asia Pacific will record the fastest growth due to expanding biotech hubs and supportive policies.

- Advanced technologies in vector engineering will improve efficiency, targeting accuracy, and scalability.

- Partnerships between biopharma firms and academic institutions will drive innovation pipelines.

- Manufacturing automation and digital integration will enhance quality and reduce production costs.

- Personalized medicine initiatives will expand demand for customized vector solutions.

- Mergers, acquisitions, and strategic alliances will reshape the competitive landscape globally.