Market Overview

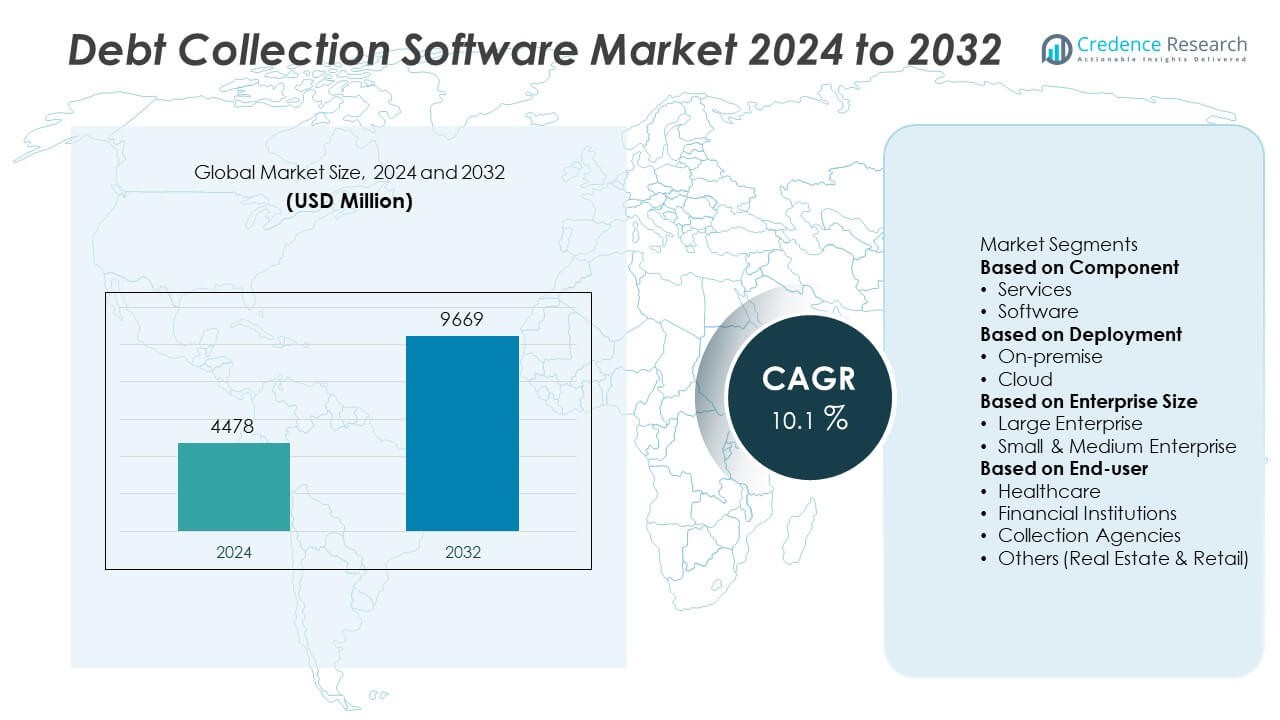

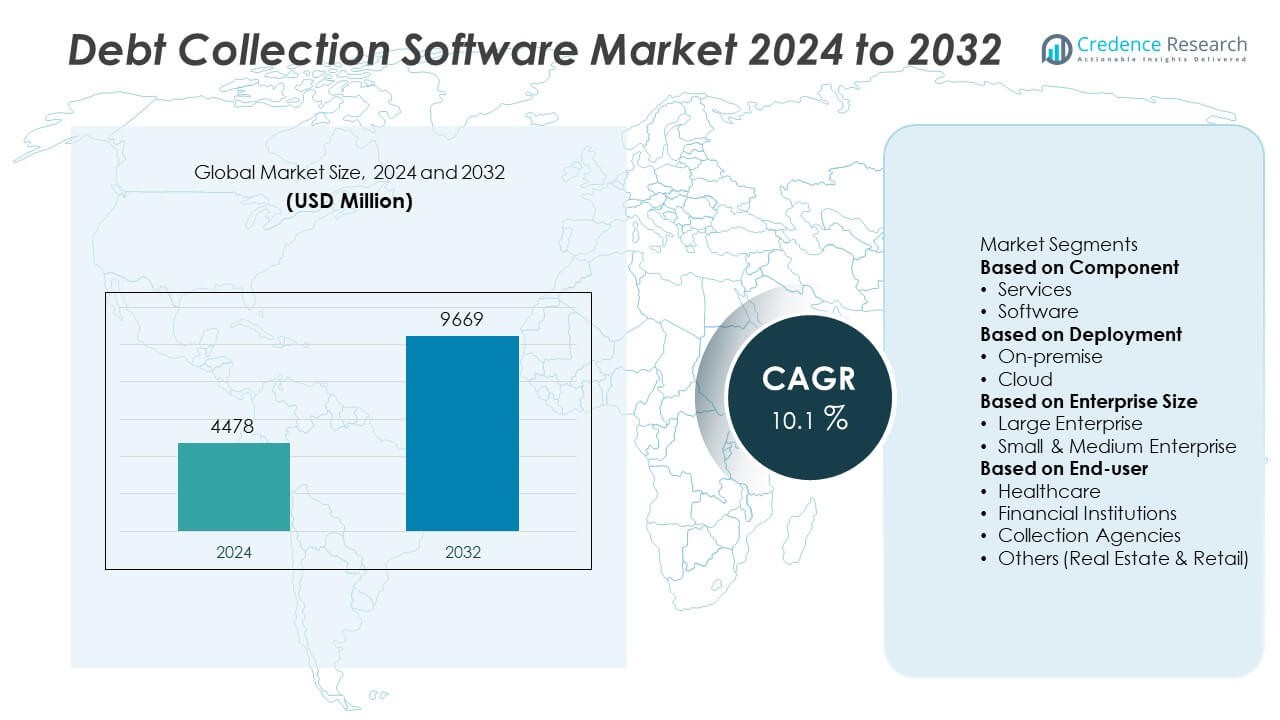

The Debt Collection Software Market was valued at USD 4,478 million in 2024 and is projected to reach USD 9,669 million by 2032, growing at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Debt Collection Software Market Size 2024 |

USD 4,478 Million |

| Debt Collection Software Market, CAGR |

10.1% |

| Debt Collection Software Market Size 2032 |

USD 9,669 Million |

Debt Collection Software Market grows with rising demand for automation, cloud deployment, and AI-driven solutions to improve recovery rates and reduce operational costs. Businesses adopt digital platforms to streamline workflows, ensure compliance with regulations, and enhance customer communication through omnichannel engagement.

Debt Collection Software Market demonstrates strong adoption across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with North America leading due to a mature financial ecosystem, high consumer credit activity, and strict compliance standards that drive demand for automated solutions. Europe follows with growing adoption of AI-driven platforms and cloud technology to meet GDPR requirements and improve recovery efficiency. Asia-Pacific is witnessing rapid growth supported by digital lending expansion, fintech innovation, and increasing use of credit among consumers. Latin America and Middle East & Africa show rising potential as financial institutions modernize operations and invest in scalable digital platforms. Key players such as Experian, TransUnion, Pegasystems Inc., and Fair Isaac Corporation focus on delivering AI-powered analytics, compliance-ready solutions, and omnichannel communication features, helping businesses improve collection rates while maintaining regulatory adherence and a positive customer experience across multiple regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Debt Collection Software Market was valued at USD 4,478 million in 2024 and is projected to reach USD 9,669 million by 2032, growing at a CAGR of 10.1%.

- Rising demand for automation and predictive analytics drives adoption across banking, telecom, retail, and financial institutions.

- Trends highlight increasing use of cloud-based SaaS platforms, AI-powered chatbots, and omnichannel communication tools to improve recovery rates.

- Leading players such as Experian, TransUnion, Pegasystems Inc., Fair Isaac Corporation, and Temenos Group AG focus on enhancing compliance features, offering scalable solutions, and integrating real-time analytics.

- High implementation costs, integration complexity, and cybersecurity concerns create barriers for small and medium enterprises.

- North America leads adoption with its mature financial sector, while Asia-Pacific shows fastest growth supported by digital lending, fintech innovation, and rising consumer credit usage.

- Expanding opportunities arise from emerging markets, growing Buy Now Pay Later (BNPL) services, and demand for compliance-ready, AI-driven platforms that reduce manual efforts and improve operational efficiency.

Market Drivers

Growing Need for Automation and Efficiency in Debt Recovery

Debt Collection Software Market grows with rising demand for automation to streamline debt recovery processes. Businesses face increasing pressure to collect overdue payments faster and with fewer resources. It enables automated workflows, reminders, and payment scheduling, reducing manual efforts and errors. Lenders, financial institutions, and collection agencies use these tools to improve collection rates. Automation also helps maintain compliance with debt collection regulations while improving operational efficiency. Growing demand for scalability drives adoption across enterprises of all sizes.

- For instance, EY and Pegasystems partnered to introduce the Compassionate Collections solution, which uses an AI data-driven early warning system to identify and segment customers in default. The solution leverages the Pega Customer Decision Hub to personalize offers and repayment plans based on each customer’s situation.

Rising Consumer Debt Levels Across Industries

Debt Collection Software Market benefits from increasing consumer and corporate debt across sectors such as banking, retail, and telecom. High credit card usage and lending activity create greater need for structured debt recovery systems. It helps organizations manage large volumes of accounts and prioritize collections based on risk scoring. Predictive analytics and AI-based insights allow faster identification of delinquent accounts. Growing complexity of debt portfolios encourages firms to invest in advanced collection platforms. This trend ensures sustained demand for digital collection solutions.

- For instance, Nucleus Software’s FinnOne Neo® Collections platform incorporates AI/ML capabilities, including an AI-powered engine to predict default risk, optimize outreach, and prioritize cases based on business criteria. The platform also features a configurable, automation-ready framework that helps financial institutions manage both delinquent and pre-delinquent portfolios across various loan types.

Integration of Analytics and Artificial Intelligence

Debt Collection Software Market is driven by integration of AI, machine learning, and analytics into collection platforms. These technologies predict payment behavior, segment customers, and optimize communication strategies. It improves recovery rates by offering personalized repayment plans and reducing default risk. AI chatbots and omnichannel communication enhance customer experience while lowering operational costs. Companies gain actionable insights into performance metrics, enabling continuous process improvement. Innovation in AI-powered solutions strengthens competitive advantage for software providers.

Compliance with Regulatory Frameworks and Data Security

Debt Collection Software Market is influenced by strict regulatory requirements and data privacy laws. Businesses must comply with FDCPA, GDPR, and other country-specific debt collection regulations. It provides audit trails, documentation, and secure data handling to maintain compliance. Cloud-based solutions with encryption features reduce risk of data breaches. Organizations adopt these tools to avoid legal penalties and protect consumer information. Focus on compliance and security increases software adoption among highly regulated industries.

Market Trends

Adoption of Cloud-Based Collection Platforms

Debt Collection Software Market shows a strong shift toward cloud-based solutions for scalability and flexibility. Organizations prefer SaaS platforms to reduce infrastructure costs and improve remote accessibility. It enables real-time updates, seamless integrations, and secure data storage across multiple locations. Cloud deployment supports rapid implementation and scalability for small and large enterprises. Demand for subscription-based models grows as businesses seek predictable pricing structures. This trend supports wider adoption across diverse industries.

- For instance, Temenos Banking Cloud supports over 700 live clients and processed a record high transaction volume in 2023. Other sources mention that Temenos’ Collections solution offers clients a self-service tool for collections and uses an open API for flexible integration.

Integration of Omnichannel Communication Tools

Debt Collection Software Market benefits from rising use of omnichannel communication strategies. Collectors engage debtors through email, SMS, voice calls, and chatbots for improved outreach. It ensures higher response rates and better customer experience with consistent messaging. AI-driven personalization tailors communication timing and tone to increase repayment likelihood. Platforms offer automated reminders and digital payment links, simplifying the process. This approach improves efficiency and reduces collection cycles.

- For instance, Katabat’s omnichannel platform has enabled lenders to improve the efficiency of their debt collection processes through automated communication and self-service options. One client reported a 33% decline in payments made through agents and a 122% increase in payments via email, highlighting the platform’s effectiveness in driving customers toward digital self-service.

Growing Focus on Predictive Analytics and Automation

Debt Collection Software Market is advancing with adoption of predictive analytics and automated workflows. These tools help prioritize accounts based on repayment probability and risk level. It increases collection efficiency while reducing manual intervention. Machine learning algorithms refine models over time, improving accuracy of forecasts. Businesses leverage automation to send timely notifications and set up payment plans. This data-driven approach helps organizations recover more debt with fewer resources.

Emphasis on Compliance and Data Privacy

Debt Collection Software Market trends highlight rising importance of compliance with global regulations. Companies adopt solutions that meet GDPR, FDCPA, and other region-specific requirements. It enables secure handling of customer data and provides detailed audit trails for reporting. Platforms integrate consent management features to maintain transparency with debtors. Vendors enhance cybersecurity measures to protect sensitive financial information. Strong compliance focus builds trust and reduces risk of regulatory penalties.

Market Challenges Analysis

High Implementation Costs and Integration Complexity

Debt Collection Software Market faces challenges due to high upfront costs and complex integration requirements. Small and medium enterprises struggle to invest in advanced platforms with AI and analytics capabilities. It demands significant IT resources to integrate with existing CRM, ERP, and accounting systems. Lack of skilled staff to manage deployment and customization slows adoption. Upgrades and maintenance expenses further add to the total cost of ownership. Vendors must deliver scalable and cost-effective solutions to attract wider adoption. These challenges can delay digital transformation for many businesses.

Concerns Over Data Security and Compliance Risks

Debt Collection Software Market is impacted by rising concerns over data breaches and regulatory compliance. Handling sensitive financial information makes platforms a target for cyberattacks. It forces providers to invest heavily in encryption, secure servers, and threat monitoring systems. Frequent changes in regulations such as GDPR and FDCPA increase complexity for global operations. Non-compliance can lead to legal penalties and reputational damage for businesses. Vendors must offer regular updates and compliance tools to mitigate risks. Ensuring robust security and adherence to laws remains critical for market growth.

Market Opportunities

Expansion of AI-Driven and Predictive Solutions

Debt Collection Software Market holds strong opportunities through the adoption of AI and predictive analytics. Organizations use AI models to forecast repayment behavior and improve prioritization of accounts. It enables personalized repayment plans, reducing default rates and improving customer satisfaction. Automation tools free up human agents for complex cases, increasing overall productivity. Predictive solutions also help reduce collection costs and improve recovery timelines. Vendors that offer AI-driven insights gain a competitive edge and attract enterprises looking for data-driven decision-making.

Growth in Cloud Deployment and Emerging Markets

Debt Collection Software Market gains momentum from the rise of cloud deployment and growing demand in developing economies. Cloud-based platforms allow businesses to scale easily and access systems from any location. It supports remote workforces and improves collaboration between teams and agencies. Emerging markets in Asia-Pacific, Latin America, and Africa present opportunities due to growing consumer lending and rising default rates. Digital payment adoption and fintech growth create demand for modern, automated collection tools. Vendors expanding into these regions can capture new customer segments and strengthen their global presence.

Market Segmentation Analysis:

By Component

Debt Collection Software Market is segmented by component into software and services. Software solutions dominate demand as businesses adopt platforms with automation, analytics, and omnichannel communication tools to streamline collection workflows. It helps organizations manage accounts, prioritize recovery, and track compliance efficiently. Services including implementation, integration, training, and support play a crucial role in maximizing software performance. Managed services are gaining popularity as firms outsource maintenance and monitoring to focus on core operations. This mix of software and services ensures end-to-end coverage of collection processes, improving operational outcomes.

- For instance, Credgenics works with over 100 clients globally, managing a loan book worth $60 billion, using its SaaS platform with AI-/ML-based analytics, automation of communications, and digital legal notices.

By Deployment

Debt Collection Software Market by deployment is divided into cloud-based and on-premise solutions. Cloud-based deployment leads growth due to its scalability, lower infrastructure costs, and accessibility across multiple locations. It enables faster implementation, real-time updates, and seamless integration with third-party systems. Small and mid-sized businesses prefer cloud models for predictable subscription pricing and ease of use. On-premise deployment remains relevant for organizations requiring full data control and customization. The shift toward SaaS adoption continues as remote work and digital-first operations expand globally.

- For instance, Experian migrated multiple on-premise servers to AWS, and by doing so reduced its data processing time by 60%, and shortened new product launch cycles from months to weeks.

By Enterprise Size

Debt Collection Software Market by enterprise size includes small and medium enterprises (SMEs) and large enterprises. Large enterprises contribute significant revenue due to their need to manage extensive debt portfolios and comply with strict regulations. It allows them to adopt advanced AI-powered platforms and predictive analytics for higher recovery rates. SMEs represent a rapidly growing segment, driven by the availability of affordable, cloud-based solutions. These businesses use digital tools to automate processes and reduce collection costs. The increasing demand across both segments supports market expansion and vendor innovation.

Segments:

Based on Component

Based on Deployment

Based on Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

Based on End-user

- Healthcare

- Financial Institutions

- Collection Agencies

- Others (Real Estate & Retail)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 36% market share in the Debt Collection Software Market, making it the largest regional contributor. The U.S. leads adoption with its mature financial services sector, high consumer credit penetration, and strong demand for automated recovery solutions. It benefits from early adoption of cloud-based platforms, predictive analytics, and AI-powered collection systems. Regulatory frameworks such as the Fair Debt Collection Practices Act (FDCPA) drive companies to adopt compliant and secure solutions. Canada and Mexico also contribute to growth as financial institutions modernize their debt management processes. Expansion of fintech companies and digital payment platforms strengthens demand for integrated software solutions across the region.

Europe

Europe accounts for 28% market share, supported by strict regulatory compliance requirements and digital transformation initiatives across the financial industry. Countries such as the U.K., Germany, and France lead demand due to large-scale consumer lending markets and growing adoption of cloud technology. It benefits from GDPR regulations, which push vendors to enhance data security and transparency features. European businesses adopt AI-driven collection tools to optimize customer communication and improve repayment rates. Increasing focus on sustainability and ethical debt recovery practices also influences software design. Growth is further supported by rising collaboration between traditional banks and technology providers to streamline operations.

Asia-Pacific

Asia-Pacific holds 22% market share and is the fastest-growing region in the Debt Collection Software Market. Rapid urbanization, rising credit card usage, and growing consumer lending drive demand across China, India, Japan, and Southeast Asia. It benefits from government initiatives supporting digitalization and fintech innovation, encouraging enterprises to adopt automated solutions. Cloud-based platforms see strong growth as they provide cost-effective scalability for SMEs. Regional banks and microfinance institutions use digital tools to handle large debt portfolios efficiently. Expansion of e-commerce and BNPL (Buy Now, Pay Later) services further creates opportunities for debt management platforms.

Latin America

Latin America captures 8% market share, with Brazil and Mexico dominating adoption due to high levels of consumer credit activity. It experiences rising demand for modern, automated solutions to replace legacy manual collection processes. Economic volatility and rising delinquency rates encourage financial institutions to invest in predictive analytics and risk assessment tools. Cloud-based platforms gain traction as they offer affordable deployment and scalability for regional banks and credit unions. Growth of digital payment systems also fuels integration of advanced collection software in the market.

Middle East & Africa

Middle East & Africa represent 6% market share, with adoption gradually increasing due to expanding banking and telecom sectors. GCC countries such as UAE and Saudi Arabia lead demand with their investments in financial technology and automation. It benefits from rising consumer lending and government efforts to strengthen credit infrastructure. South Africa and Nigeria contribute through increased adoption of cloud solutions among microfinance institutions. Vendors focus on providing localized solutions that meet regional compliance and language requirements. Growing interest in data security and regulatory alignment is expected to accelerate future adoption in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chetu Inc.

- Constellation Software Inc.

- Pegasystems Inc.

- Nucleus Software Exports Ltd.

- TransUnion

- Experian

- Temenos Group AG

- CGI Group Inc.

- CDS Software

- Fair Isaac Corporation

Competitive Analysis

Competitive landscape of the Debt Collection Software Market is shaped by leading players such as Experian, TransUnion, Fair Isaac Corporation, Pegasystems Inc., Temenos Group AG, Constellation Software Inc., CGI Group Inc., Nucleus Software Exports Ltd., Chetu Inc., and CDS Software. These companies compete by offering AI-powered analytics, machine learning algorithms, and predictive modeling to improve recovery rates and customer segmentation. They focus on developing cloud-based platforms with omnichannel communication, automated workflows, and compliance management features to meet global regulatory requirements. Strategic partnerships with financial institutions, telecom operators, and fintech firms strengthen their market presence and ensure seamless integration with existing enterprise systems. Continuous investment in R&D allows these players to innovate with features like real-time dashboards, customizable workflows, and secure data management. Expansion into emerging markets, coupled with scalable SaaS models, enables them to serve SMEs and large enterprises effectively. This competitive focus ensures steady growth and technological advancement across the industry.

Recent Developments

- In September 2025, Experian did announce a new solution called Financial Crime Compliance Perpetual Monitoring to help banks and lenders combat financial crime, including fraud, by continuously monitoring customer data to flag potential risks and reduce manual efforts.

- In July 2025, Pega enters a five-year strategic collaboration with AWS to “reimagine legacy transformation” via agentic automation.

- In June 2025, FICO launched FICO® Score 10 BNPL and FICO® Score 10 T BNPL. These include Buy-Now-Pay-Later data in credit scoring, giving lenders better insight into consumer repayment behaviour.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Enterprise Size, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-powered and predictive debt collection tools will continue to rise.

- Cloud-based and SaaS models will dominate new deployments across industries.

- Omnichannel communication will become standard for improving customer engagement and recovery rates.

- Integration with digital payment platforms will streamline repayment processes.

- Regulatory compliance features will be enhanced to meet evolving global standards.

- SMEs will adopt affordable, scalable solutions to reduce manual collection efforts.

- Data security and encryption technologies will gain priority to protect sensitive information.

- Emerging markets will drive growth with rising consumer lending and credit activity.

- Automation and chatbots will handle routine interactions, reducing collection costs.

- Collaboration between fintechs and software providers will accelerate innovation and market expansion.