Market Overview:

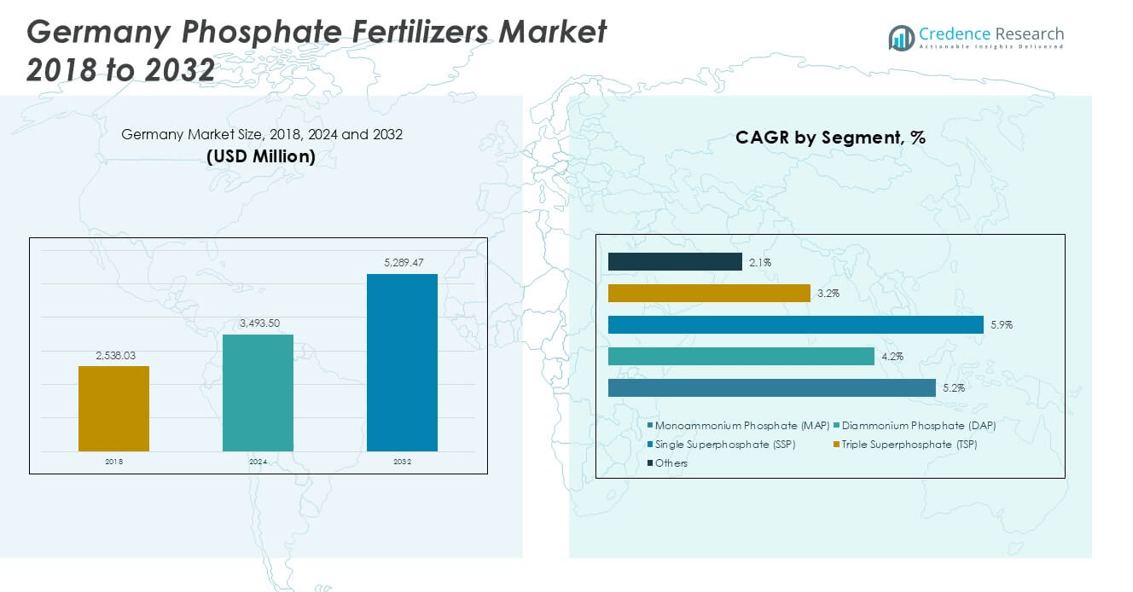

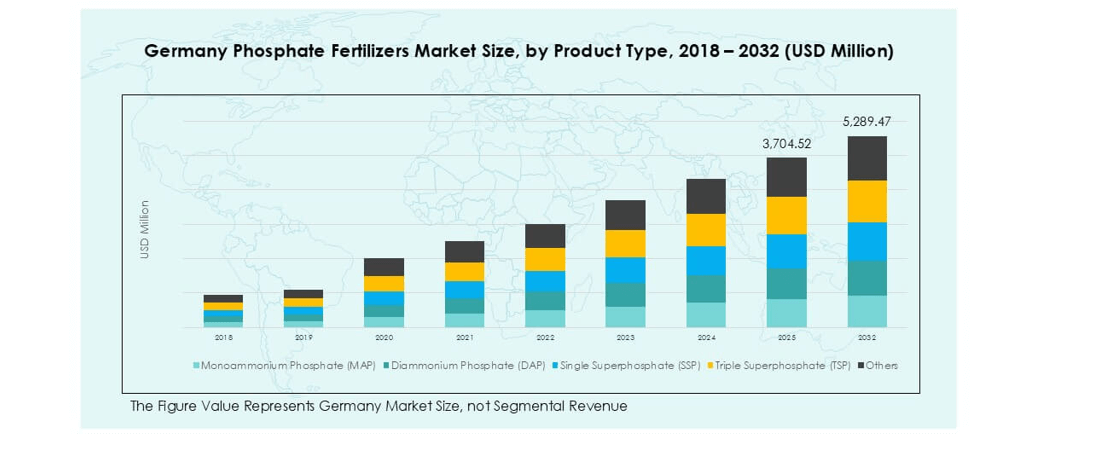

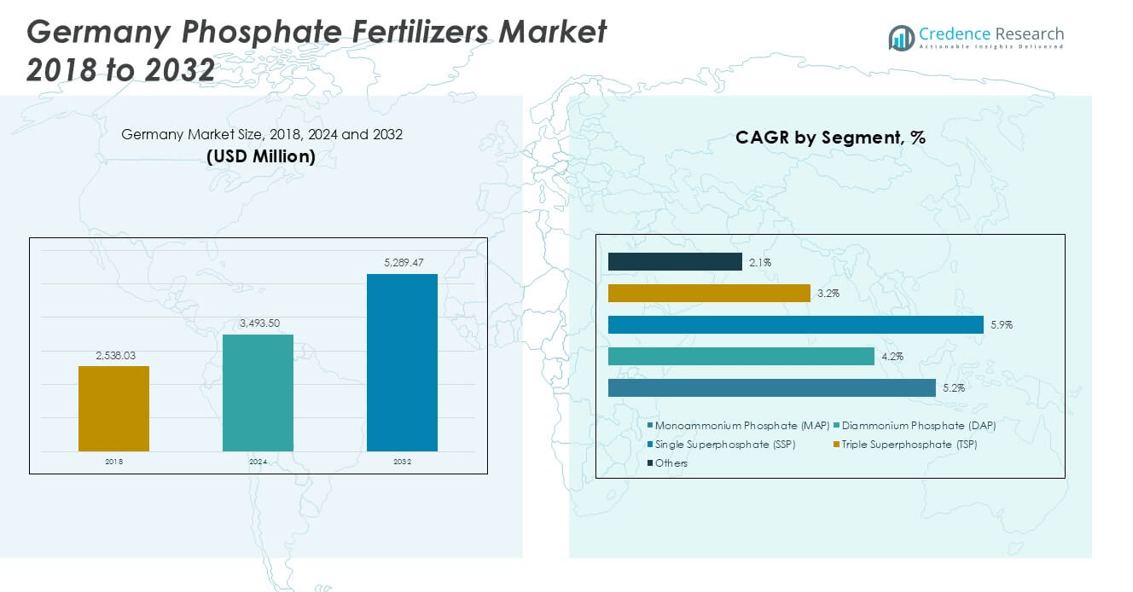

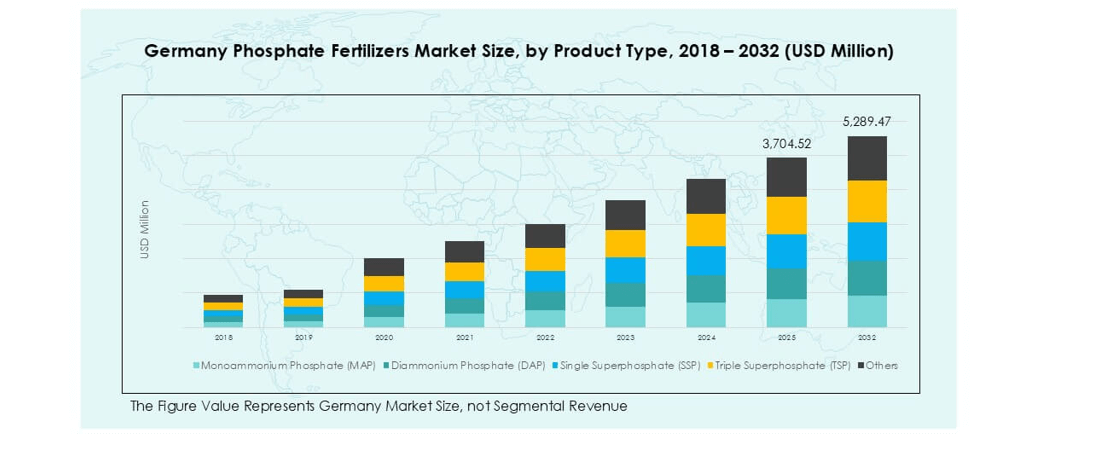

Germany Phosphate Fertilizers market size was valued at USD 2,538.03 million in 2018 and grew to USD 3,493.50 million in 2024. It is anticipated to reach USD 5,289.47 million by 2032, at a CAGR of 5.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Phosphate Fertilizers Market Size 2024 |

USD 3,493.50 million |

| Germany Phosphate Fertilizers Market, CAGR |

5.22% |

| Germany Phosphate Fertilizers Market Size 2032 |

USD 5,289.47 million |

The Germany phosphate fertilizers market is led by key players such as Yara International, EuroChem Group, BASF SE, ICL Group, Nutrien Ltd., and K+S AG, who together control a significant share through strong distribution networks and advanced product offerings. Yara International remains the market leader with a broad portfolio of MAP and DAP fertilizers, supported by precision agriculture solutions. EuroChem and ICL focus on high-efficiency phosphate blends, while BASF and COMPO Expert GmbH cater to specialty crop segments. North Germany holds the largest regional share at over 30%, driven by extensive cereal and rapeseed cultivation and early adoption of precision nutrient management practices.

Market Insights

- Germany phosphate fertilizers market was valued at USD 3,493.50 million in 2024 and is projected to reach USD 5,289.47 million by 2032, growing at a CAGR of 5.22%.

- Rising demand for high-yield cereal and oilseed production drives MAP adoption, which holds over 35% share among product types due to its high phosphorus content and compatibility with precision farming.

- Market trends include adoption of precision agriculture, water-soluble phosphate fertilizers, and low-cadmium eco-friendly formulations aligned with EU nutrient regulations.

- Competitive landscape features Yara International, EuroChem, BASF SE, ICL Group, and K+S AG focusing on capacity expansion, sustainable formulations, and long-term supply partnerships to strengthen market position.

- North Germany leads with over 30% regional share, followed by South Germany at nearly 28%, driven by strong cereal, horticulture, and greenhouse production, supported by advanced nutrient management practices and strong distribution infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Monoammonium Phosphate (MAP) dominates the Germany phosphate fertilizers market, accounting for over 35% share in 2024. MAP is widely used due to its high phosphorus content and compatibility with precision farming techniques. Farmers prefer MAP for its ability to improve root development and early crop growth, particularly in cereals. Diammonium Phosphate (DAP) and Triple Superphosphate (TSP) follow, supported by use in oilseed and specialty crop production. Demand is driven by rising adoption of nutrient-efficient fertilizers, government focus on sustainable agriculture, and increasing awareness about balanced soil nutrition.

- For instance, SKW Stickstoffwerke Piesteritz is a major producer of nitrogen fertilizers in Germany, which includes supplying German agriculture with products that support cereal production in regions such as Brandenburg and Saxony-Anhalt. In 2023, the parent company of SKW Piesteritz, Agrofert, significantly expanded its presence in the European fertilizer market by acquiring Borealis’s nitrogen fertilizer business, which included production facilities in Germany.

By Application

Cereals & Grains represent the largest application segment, contributing over 40% share in 2024. Wheat, barley, and maize production in Germany rely heavily on phosphate fertilizers for higher yields and improved grain quality. This segment grows steadily with expanding use of precision application methods and soil testing practices. Oilseeds such as rapeseed also drive significant demand, followed by fruits and vegetables requiring phosphorus for better flowering and fruit setting. Rising food security concerns and adoption of integrated nutrient management practices further strengthen phosphate fertilizer consumption across all applications.

- For instance, Germany harvested 21.5 million metric tons of wheat in 2023, while the average application rate of phosphate on all agricultural land across Germany was 114.1 kg P₂O₅ per hectare.

Market Overview

Rising Demand for High-Yield Crop Production

Germany phosphate fertilizers market grows with increasing demand for higher agricultural productivity. Farmers adopt phosphorus-rich fertilizers to boost root development and grain quality in cereals, which form a major share of German crops. Growing population and export-oriented grain production further push phosphate consumption. Precision agriculture techniques, including variable-rate application, enhance fertilizer efficiency and minimize waste. This encourages steady adoption of MAP and DAP. Rising food security concerns and government focus on optimizing nutrient management practices continue to drive demand across major agricultural regions.

- For instance, in 2023, the Agravis Group reported a turnover of €8.8 billion with more than 6,800 employees and over 400 locations, primarily in Germany. As an agricultural trading and service cooperative, Agravis supports its partners and farmers with products and expertise in plant production, animal nutrition, and agricultural technology, among other sectors.

Supportive Government Policies and Subsidies

Government programs promoting sustainable farming practices boost phosphate fertilizer usage. The EU Common Agricultural Policy encourages balanced nutrient application to improve soil health and crop yields. German authorities promote site-specific phosphorus management and fertilizer efficiency programs. Farmers benefit from technical support and incentives for precision fertilizer use. Such measures increase adoption of phosphate products in cereals, oilseeds, and horticulture. Compliance with nutrient regulations drives demand for high-quality fertilizers with better solubility and controlled release properties. This creates strong opportunities for innovative phosphate-based solutions.

- For instance, in 2024, the DLG Test Center continued its process of testing and certifying various agricultural equipment, including precision spreaders, for their distribution quality and uniformity.

Expansion of Horticulture and Specialty Crops

Growing demand for fruits, vegetables, and specialty crops strengthens phosphate fertilizer consumption. Greenhouse and open-field cultivation in Germany relies on phosphorus to improve flowering, fruit set, and quality. Controlled environment agriculture expands rapidly, requiring precise nutrient formulations like MAP and TSP. Rising consumer preference for locally grown produce supports greenhouse farming growth. This shift increases adoption of water-soluble phosphate fertilizers compatible with fertigation systems. The trend aligns with Germany’s sustainability goals, encouraging use of fertilizers that enhance nutrient uptake and reduce environmental losses.

Key Trends and Opportunities

Adoption of Precision Agriculture Technologies

Precision farming drives demand for phosphate fertilizers with high efficiency and consistency. German farmers use GPS-guided machinery and digital soil mapping to optimize phosphorus application. This approach reduces wastage and improves crop performance. Growing use of smart sensors, drones, and decision-support software enhances nutrient planning. Fertilizer producers respond by developing water-soluble and coated phosphate products for targeted delivery. Precision techniques also help comply with strict nutrient regulations, offering strong growth potential for suppliers of advanced phosphate solutions.

- For instance, German agricultural machinery manufacturer Amazone reports strong performance in 2024, with its ZA-TS precision spreaders delivering highly accurate application rates for various fertilisers. The company reported a turnover of 763 million euros for the 2024 financial year and employed around 2,500 people globally during this period.

Shift Toward Sustainable and Eco-Friendly Fertilizers

Sustainability trends create opportunities for phosphate fertilizer manufacturers. Demand rises for products with lower cadmium content and improved bioavailability. Farmers prefer fertilizers that minimize runoff and protect water quality. Research into enhanced-efficiency fertilizers and organic-compatible phosphate sources gains momentum. The market also sees investment in recycling phosphorus from wastewater and animal manure. These innovations align with Germany’s circular economy goals and support long-term nutrient security. Manufacturers offering eco-friendly solutions gain a competitive edge in meeting regulatory and consumer expectations.

- For instance, SKW Piesteritz is a leading German producer of stabilized nitrogen fertilizers, which are designed to improve nitrogen use efficiency and reduce nutrient losses like ammonia, nitrous oxide, and nitrate. They have their own research and development center and work with scientific partners.

Key Challenges

Stringent Environmental Regulations

Germany enforces strict phosphorus usage limits under the EU Nitrates Directive and national nutrient regulations. These rules restrict application rates, increasing pressure on farmers to adopt more efficient fertilizers. Non-compliance risks penalties and reduced farm subsidies, which impacts consumption volumes. Fertilizer companies face challenges in formulating products that deliver required crop nutrition while meeting regulatory thresholds. Developing low-runoff and slow-release phosphate solutions becomes essential to remain competitive.

Volatility in Raw Material Supply and Pricing

Fluctuations in global phosphate rock and sulfur prices pose risks to manufacturers. Germany depends heavily on imports for phosphate raw materials, making the market sensitive to geopolitical disruptions and trade restrictions. Rising energy costs further add to production expenses. Price instability impacts farmers’ purchasing decisions and may delay fertilizer applications. Companies must secure diversified supply sources and adopt cost-efficient production technologies to maintain stable pricing and ensure steady availability.

Regional Analysis

North Germany

North Germany holds over 30% share of the country’s phosphate fertilizers market in 2024. The region has extensive cereal and rapeseed cultivation, driving strong demand for MAP and DAP. Coastal areas benefit from advanced mechanized farming and high fertilizer application rates. Precision agriculture adoption is high, supporting efficient phosphorus use and compliance with nutrient regulations. Government-backed soil fertility programs further promote balanced fertilizer use. Expanding greenhouse vegetable production in Lower Saxony also increases demand for water-soluble phosphate products. Strong logistics infrastructure ensures reliable fertilizer distribution across ports and farming hubs, strengthening the region’s market position.

South Germany

South Germany accounts for nearly 28% share of the phosphate fertilizers market, led by Bavaria and Baden-Württemberg. The region has diverse crop production, including cereals, potatoes, and fruits, requiring balanced phosphorus application. High-value horticultural crops and viticulture drive adoption of specialty fertilizers like TSP and water-soluble formulations. Farmers in South Germany actively use soil testing and precision spreading to improve yield efficiency. Demand is supported by regional agricultural cooperatives offering guidance on nutrient management. Controlled environment farming expansion in urban areas also fuels phosphate usage. This mix of traditional and intensive farming sustains steady fertilizer consumption growth.

East Germany

East Germany represents around 22% share of the phosphate fertilizers market, with large-scale farms focusing on cereals, oilseeds, and fodder crops. The region benefits from consolidated farming structures, enabling bulk procurement and efficient fertilizer distribution. MAP dominates due to its high nutrient content and compatibility with large-scale application methods. Rising investment in modern irrigation systems increases the use of water-soluble phosphate fertilizers. EU-funded projects supporting soil fertility restoration encourage adoption of balanced fertilization practices. Growing livestock production also boosts demand for phosphorus for fodder crop cultivation, maintaining stable fertilizer usage across the region’s agricultural landscape.

West Germany

West Germany captures nearly 20% share of the phosphate fertilizers market, driven by mixed farming practices and strong horticulture production. North Rhine-Westphalia leads with high demand for fertilizers in vegetable, fruit, and ornamental plant cultivation. Urban farming initiatives and greenhouse production increase adoption of soluble phosphate fertilizers. The region also has a high density of livestock farms, requiring phosphorus for forage crop production. Strong research and innovation hubs in West Germany support development of advanced fertilizer solutions. Distribution networks and agri-cooperatives ensure timely availability, sustaining consistent demand despite smaller farm sizes compared to eastern regions.

Market Segmentations:

By Product Type:

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Others

By Application:

- Cereals & Grains

- Oilseeds

- Fruits & Vegetables

- Others

By Geography:

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The Germany phosphate fertilizers market is moderately consolidated, with key players including Yara International, EuroChem Group, BASF SE, ICL Group, and K+S AG holding significant market presence. These companies focus on expanding production capacities, improving product quality, and developing sustainable phosphate solutions to meet regulatory requirements. Yara International leads with its strong distribution network and advanced precision agriculture offerings, while EuroChem and ICL invest in innovative phosphate blends with higher solubility and efficiency. BASF SE leverages its R&D capabilities to develop enhanced fertilizers compatible with environmental compliance goals. Local players such as COMPO Expert GmbH and Helm AG support regional demand with specialized formulations for horticulture and greenhouse cultivation. Strategic collaborations, mergers, and long-term supply agreements are common to strengthen market share. Growing focus on recycled phosphorus and circular economy initiatives drives innovation, encouraging companies to introduce eco-friendly and nutrient-efficient solutions for German farmers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2023, Yara announced that it is acquiring the organic-based fertilizer business of Agribios, a company in Italy. The acquisition includes a production facility in Ronco all’Adige, focused on sustainable farming solutions through organic-based and organo-mineral fertilizers. This deal aligns with Yara’s strategy to expand its offerings in regenerative agriculture, complementing its current mineral fertilizer portfolio.

- In May 2022, Coromandel International, a fertilizer manufacturer, plans to buy a 45% stake in Baobab Mining and Chemicals Corporation (BMCC), a rock phosphate mining firm based in Senegal Africa, for $19.6 million (approximately $150 crore).

- In May 2022, Indian Potash Ltd signed a five-year agreement with Israel Chemical Ltd to import 0.6-0.65 million tonnes of potash muriate annually.

- In February 2022, EuroChem Group (hereafter referred to as “EuroChem” or “the Group”), a leading global producer of fertilizer, recently announced that it had completed the acquisition of the Serra do Salitre phosphate project in Brazi

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for phosphate fertilizers will rise with growing cereal and oilseed cultivation in Germany.

- Adoption of precision farming will increase usage efficiency and optimize application rates.

- Water-soluble and specialty phosphate products will gain traction in greenhouse and horticulture farming.

- Eco-friendly fertilizers with low heavy metal content will see higher acceptance under EU regulations.

- Digital tools for nutrient monitoring will boost demand for customized phosphate solutions.

- Investment in recycled phosphorus technologies will strengthen circular economy initiatives.

- Leading players will expand production and distribution networks to meet rising demand.

- Government support for balanced fertilization will encourage use of MAP and DAP.

- Volatility in raw material prices will drive focus on cost-efficient sourcing strategies.

- Regional demand growth will be led by North Germany with increasing precision agriculture adoption.