Market Overview

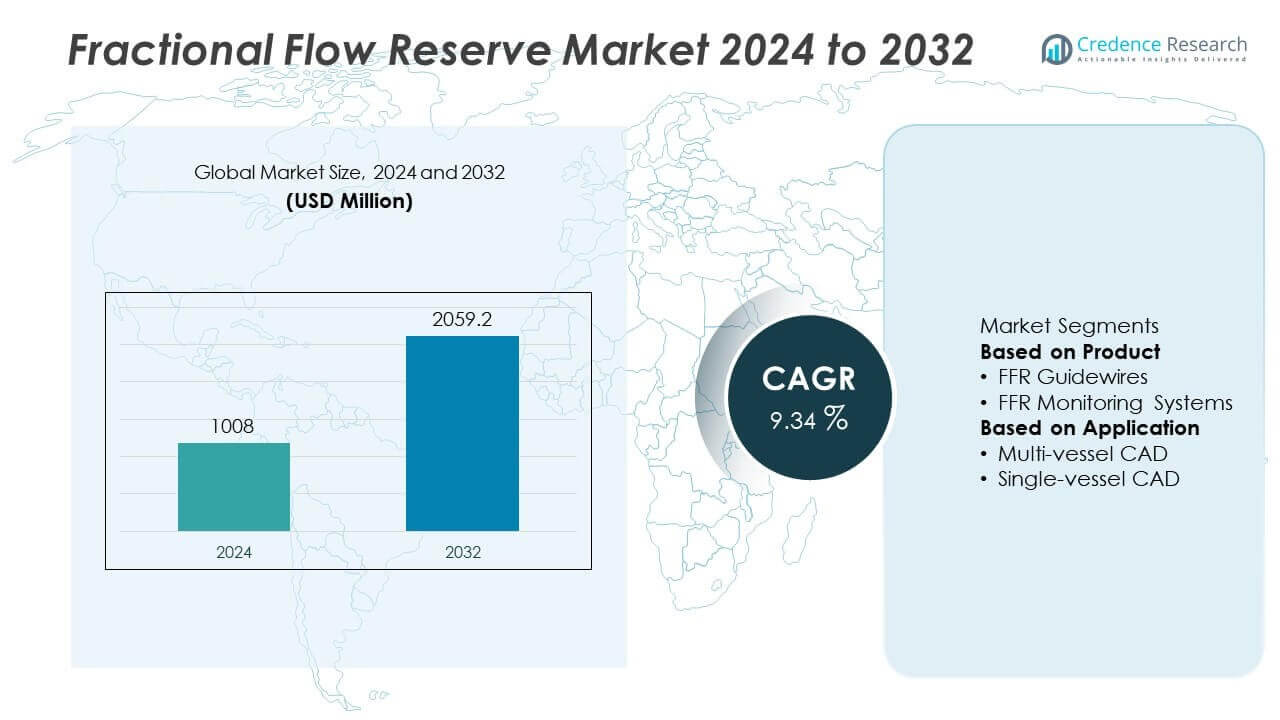

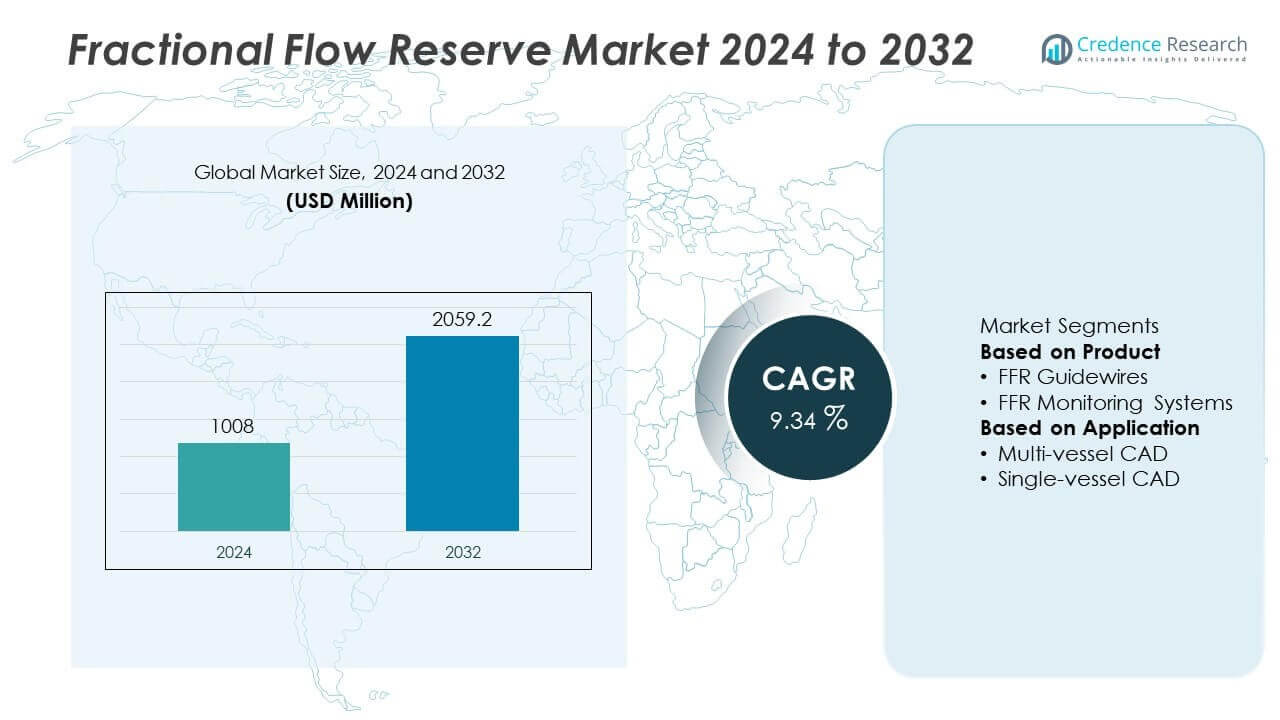

The global Fractional Flow Reserve (FFR) Market was valued at USD 1,008 million in 2024 and is projected to reach USD 2,059.2 million by 2032, growing at a CAGR of 9.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fractional Flow Reserve (FFR) Market Size 2024 |

USD 1,008 Million |

| Fractional Flow Reserve (FFR) Market, CAGR |

9.34% |

| Fractional Flow Reserve (FFR) Market Size 2032 |

USD 2,059.2 Million |

Fractional Flow Reserve Market grows with rising prevalence of coronary artery disease and increasing demand for accurate, minimally invasive diagnostics. Hospitals adopt FFR technology to guide stent placement and reduce unnecessary interventions, improving patient outcomes and lowering costs.

North America leads the Fractional Flow Reserve Market, driven by high coronary artery disease prevalence, advanced healthcare infrastructure, and strong reimbursement frameworks supporting FFR-guided interventions. Europe follows with well-established clinical guidelines from ESC and NICE encouraging routine use of FFR in percutaneous coronary interventions. Asia-Pacific is witnessing rapid growth due to rising healthcare investments, expanding catheterization labs, and increasing awareness of physiologic lesion assessment in China and India. Latin America and Middle East & Africa are gradually adopting FFR technologies as tertiary care hospitals modernize and global players expand distribution networks. Key players such as Abbott, Boston Scientific Corporation, HeartFlow, Inc., and Siemens Healthineers focus on launching advanced guidewires, image-based FFR solutions, and AI-enabled software platforms. These companies invest in physician training programs, regional partnerships, and R&D initiatives to enhance clinical outcomes and expand access to advanced diagnostic solutions worldwide.

Market Insights

- Fractional Flow Reserve Market was valued at USD 1,008 million in 2024 and is projected to reach USD 2,059.2 million by 2032, growing at a CAGR of 9.34% during the forecast period.

- Rising prevalence of coronary artery disease and demand for accurate lesion assessment drive adoption of FFR technology in catheterization labs worldwide.

- Key trends include growth of image-based and CT-derived FFR, integration with IVUS and OCT, and AI-driven analytics to support faster and more reliable decision-making.

- The market is competitive with leading players such as Abbott, Boston Scientific Corporation, HeartFlow, Inc., Siemens Healthineers, and CathWorks focusing on product innovation, training initiatives, and expanding global distribution.

- High equipment and procedure costs, limited reimbursement in developing regions, and shortage of skilled interventional cardiologists act as restraints, slowing adoption in cost-sensitive markets.

- North America leads with strong reimbursement and widespread clinical acceptance, Europe follows with guideline-driven adoption, and Asia-Pacific shows the fastest growth with rising healthcare investment.

- Opportunities are emerging in Latin America and Middle East & Africa with modernization of cardiac care infrastructure, training programs, and introduction of affordable guidewire and software-based FFR solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Coronary Artery Disease

Fractional Flow Reserve Market grows with the increasing global burden of coronary artery disease (CAD). Rising cases of lifestyle-related disorders, hypertension, and diabetes contribute to higher rates of ischemic heart conditions. It drives demand for accurate diagnostic tools that improve treatment decisions. FFR helps interventional cardiologists determine the necessity of stenting or bypass surgery, reducing unnecessary procedures. Growing awareness among physicians about FFR-guided interventions improves adoption in catheterization labs. This trend aligns with the focus on precision medicine and patient-specific treatment strategies.

- For instance, Abbott’s PressureWire™ FFR guidewires continued to support cardiologists in improving decision-making during PCI procedures in 2024. The company’s Medical Devices segment, which includes the PressureWire, experienced strong growth in 2024, with its performance driven by several high-performing product categories, including Structural Heart and Diabetes Care.

Growing Adoption of Minimally Invasive Diagnostics

Fractional Flow Reserve Market benefits from the shift toward minimally invasive diagnostic techniques. Patients and healthcare providers prefer FFR over traditional angiography alone due to its accuracy and safety. It reduces procedure time, radiation exposure, and overall treatment costs. Increasing use of guidewire-based and image-based FFR systems enhances diagnostic confidence. Hospitals integrate FFR into routine workflows to improve clinical outcomes. This adoption is further supported by favorable clinical trial data and updated cardiology guidelines.

- For instance, Opsens Inc. reported in late 2023 that its OptoWire™ had been used in over 250,000 coronary physiology procedures cumulatively. The company’s press releases and clinical studies have indicated that the OptoWire provides reliable pressure measurements and is associated with reduced procedure time, radiation exposure, and treatment costs.

Technological Advancements in FFR Systems

Fractional Flow Reserve Market experiences growth through continuous innovation in imaging and pressure-sensing technologies. Companies develop next-generation FFR guidewires, sensors, and non-invasive software solutions. It improves measurement speed, accuracy, and ease of use during procedures. Integration with intravascular ultrasound (IVUS) and optical coherence tomography (OCT) provides comprehensive vessel assessment. AI-driven analysis enables real-time decision-making for interventional cardiologists. These advancements support higher adoption across developed and emerging healthcare markets.

Supportive Reimbursement and Healthcare Investments

Fractional Flow Reserve Market gains momentum through expanding reimbursement coverage in key regions. Government and private insurers recognize the cost-effectiveness of FFR-guided interventions in reducing major adverse cardiac events. It encourages hospitals to adopt advanced FFR systems and expand service availability. Growing investments in healthcare infrastructure, especially in emerging economies, improve access to catheterization labs. Training programs for cardiologists and technicians increase familiarity with FFR procedures. These drivers collectively support the strong growth trajectory of the market.

Market Trends

Shift Toward Image-Based and Non-Invasive FFR

Fractional Flow Reserve Market shows a strong trend toward image-based and non-invasive FFR solutions. Software-based FFR derived from CT angiography eliminates the need for pressure wires and hyperemic agents. It reduces patient discomfort and lowers procedure time while providing accurate results. Hospitals adopt these technologies to increase patient throughput and optimize resource utilization. Non-invasive FFR also supports early diagnosis in outpatient settings. This trend expands market reach beyond catheterization labs and improves overall access to care.

- For instance, the Medis QFR solution, which is created by Medis Medical Imaging and not distributed by Pie Medical Imaging, enables per-vessel analysis in under 30 seconds for its QFR 3.0 version. This quick, software-based assessment, backed by extensive clinical evidence, streamlines workflow in the cath lab and supports market reach by reducing procedure time and cost. Pie Medical Imaging offers a separate, distinct technology called vFFR.

Integration with Advanced Imaging Modalities

Fractional Flow Reserve Market benefits from integration with intravascular ultrasound (IVUS) and optical coherence tomography (OCT). Combined use of FFR with imaging techniques provides detailed anatomical and physiological assessment of coronary lesions. It enables precise decision-making for stent placement and treatment planning. Physicians value the ability to visualize plaque morphology along with pressure gradients. Hybrid imaging and physiology platforms improve workflow efficiency in catheterization labs. This integration supports adoption in complex and multivessel disease cases.

- For instance, Philips’ IntraSight interventional applications platform, which integrates iFR/FFR and IVUS technologies, supports clinicians in achieving precise stent optimization and decision-making during complex coronary and peripheral interventions. This platform, which evolved from the Philips Volcano Core technology, incorporates these clinically recommended modalities to aid in treatment planning.

Adoption of AI and Real-Time Data Analytics

Fractional Flow Reserve Market experiences rising use of AI-driven software and real-time analytics. Machine learning algorithms enhance accuracy by automatically interpreting pressure readings and detecting artifacts. It supports faster and more consistent clinical decision-making. Cloud-based platforms allow secure data sharing and remote consultation between specialists. Hospitals leverage predictive analytics to improve patient outcomes and reduce readmission rates. AI adoption strengthens confidence in FFR-guided interventions among clinicians.

Growing Preference for Outpatient and Ambulatory Settings

Fractional Flow Reserve Market is witnessing higher adoption in ambulatory surgical centers and outpatient cardiac clinics. Miniaturized systems and simplified workflows make FFR procedures suitable for these settings. It lowers hospital stay duration and reduces overall healthcare costs. This trend aligns with the broader movement toward value-based care and patient convenience. Ambulatory adoption increases capacity for early intervention and preventive cardiology programs. The shift supports market growth in both developed and emerging economies.

Market Challenges Analysis

High Procedure Cost and Limited Reimbursement in Developing Regions

Fractional Flow Reserve Market faces challenges due to the high cost of FFR guidewires, sensors, and supporting equipment. Many hospitals in emerging economies struggle to justify investment without strong reimbursement coverage. It limits access to advanced diagnostics for a large patient base. Out-of-pocket expenses deter patients from opting for FFR-guided interventions, even when clinically recommended. Limited government funding for cardiology infrastructure further slows adoption. These economic barriers restrict market penetration in cost-sensitive regions.

Need for Skilled Personnel and Workflow Integration Issues

Fractional Flow Reserve Market is impacted by the requirement for trained interventional cardiologists and technicians. Lack of skilled operators leads to inconsistent measurement quality and poor clinical outcomes. It creates hesitation among hospitals to adopt FFR systems widely. Integrating FFR into existing catheterization workflows can be challenging, leading to longer procedure times during early adoption. Resistance to change from conventional angiography-based decision-making also slows uptake. Overcoming these training and integration hurdles remains essential for market expansion.

Market Opportunities

Expansion of Non-Invasive and Image-Based FFR Solutions

Fractional Flow Reserve Market holds strong opportunities with the rapid development of CT-derived and non-invasive FFR technologies. Hospitals are adopting these solutions to reduce procedure time and avoid the need for hyperemic agents. It enables cardiologists to assess coronary physiology without invasive catheterization, improving patient experience. Non-invasive FFR also supports screening programs for high-risk populations, expanding its clinical use. Growing preference for outpatient diagnostics creates demand for software-based solutions. These advancements open new revenue streams for technology providers and widen access to early diagnosis.

Rising Penetration in Emerging Healthcare Markets

Fractional Flow Reserve Market can grow significantly in emerging economies with increasing investment in cardiac care infrastructure. Governments and private hospitals expand catheterization labs and adopt modern diagnostic tools. It allows wider use of FFR-guided interventions in regions with high prevalence of coronary artery disease. Availability of affordable guidewires and training programs improves adoption among cost-sensitive healthcare providers. Partnerships with local distributors and telehealth platforms help penetrate underserved markets. This opportunity strengthens the global reach of leading FFR solution providers.

Market Segmentation Analysis:

By Product

Fractional Flow Reserve Market is segmented by product into FFR guidewires, FFR monitoring systems, and image-based FFR software solutions. FFR guidewires dominate the market due to their widespread adoption in catheterization labs for real-time pressure measurement. It provides accurate physiological assessment and supports stent placement decisions during percutaneous coronary interventions (PCI). FFR monitoring systems are essential for capturing pressure gradients and integrating data with angiographic images, enhancing procedural efficiency. Image-based FFR solutions are gaining traction as they eliminate the need for invasive wires and hyperemic agents. These non-invasive tools enable cardiologists to evaluate coronary flow using CT imaging, improving patient comfort and reducing procedural risks. Growing preference for less invasive options is expected to accelerate the share of software-based FFR solutions in the coming years.

- For instance, Abbott’s PressureWire™ X was used in many percutaneous coronary intervention (PCI) procedures globally in 2024 to support physiology-guided stenting decisions.

By Application

Fractional Flow Reserve Market by application includes single-vessel disease, multi-vessel disease, and others. Multi-vessel disease accounts for the largest share due to the complexity of diagnosis and need for precise treatment planning. It helps clinicians identify functionally significant lesions, reducing the likelihood of unnecessary stent placement. Single-vessel disease applications are also significant as they allow accurate evaluation of borderline lesions where angiography alone is inconclusive. Use of FFR in intermediate lesions improves patient outcomes and lowers adverse event rates. Adoption is rising in academic hospitals and specialized cardiac centers where comprehensive evaluation of coronary physiology is a priority. This application-based growth highlights the importance of FFR in guiding evidence-based treatment decisions across diverse patient groups.

- For instance, HeartFlow partnered with NHS England, which began integrating FFRCT into routine care through the Innovation and Technology Payment (ITP) program in 2018, and followed with funding through the MedTech Funding Mandate starting in April 2021.

Segments:

Based on Product

- FFR Guidewires

- FFR Monitoring Systems

Based on Application

- Multi-vessel CAD

- Single-vessel CAD

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 39% of the Fractional Flow Reserve Market, making it the largest regional segment. The United States leads with strong adoption of FFR technology in catheterization labs due to a well-established healthcare infrastructure and high prevalence of coronary artery disease. It benefits from favorable reimbursement policies that support the use of FFR-guided interventions in percutaneous coronary interventions (PCI). The presence of key players and continuous technological advancements, including CT-derived FFR solutions, drive market growth. Canada also contributes with rising investments in cardiac care centers and a growing emphasis on minimally invasive diagnostics. High awareness among cardiologists and training programs further enhance adoption rates across the region.

Europe

Europe accounts for 30% of the Fractional Flow Reserve Market, supported by strong clinical guideline recommendations from ESC and NICE that promote FFR use in diagnostic workflows. Germany, France, and the UK lead in procedure volumes due to advanced interventional cardiology networks. It benefits from robust research activity and availability of state-of-the-art catheterization facilities. European healthcare systems encourage evidence-based treatment planning, increasing FFR integration into routine practice. Reimbursement frameworks are well-defined in major countries, making FFR adoption cost-effective. Focus on reducing unnecessary stenting procedures supports the growth of image-based and guidewire-based FFR solutions.

Asia-Pacific

Asia-Pacific represents 21% of the Fractional Flow Reserve Market and is the fastest-growing regional segment. Rapid growth is driven by rising incidence of coronary artery disease in China, India, and Southeast Asia. It benefits from increasing healthcare expenditure, expanding hospital infrastructure, and government initiatives to modernize cardiac care. Local and international manufacturers introduce affordable FFR systems tailored for cost-sensitive markets. Training programs for interventional cardiologists are expanding, improving clinical competence and driving procedure volumes. The adoption of non-invasive FFR technologies is gaining momentum in urban centers with advanced imaging facilities.

Latin America

Latin America holds 6% of the Fractional Flow Reserve Market, with Brazil and Mexico leading in adoption. Growth is supported by rising demand for advanced diagnostic tools in tertiary care hospitals and specialized heart institutes. It faces challenges due to limited reimbursement and uneven access to cardiac catheterization labs, but private healthcare investments are improving availability. Awareness campaigns by medical societies are encouraging cardiologists to adopt FFR-guided PCI. Increasing partnerships with global FFR device manufacturers strengthen distribution networks in the region.

Middle East & Africa

Middle East & Africa capture 4% of the Fractional Flow Reserve Market, representing an emerging growth area. Gulf countries invest heavily in advanced cardiac care facilities, boosting adoption of FFR technology. It benefits from rising prevalence of cardiovascular diseases linked to diabetes and obesity in the region. Africa shows gradual uptake with donor-funded programs supporting infrastructure development. Collaborations with international healthcare providers help introduce modern diagnostics and training for local cardiologists. Growing private sector participation is expected to further expand the market during the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CathWorks

- Siemens Healthineers

- Opsens, Inc.

- Pie Medical Imaging

- Abbott

- ACIST Medical Systems

- HeartFlow, Inc.

- Boston Scientific Corporation

- OpSens Medical

- Koninklijke Philips N.V.

Competitive Analysis

Competitive landscape of the Fractional Flow Reserve Market is shaped by leading players such as Abbott, Boston Scientific Corporation, HeartFlow, Inc., Siemens Healthineers, OpSens Medical, ACIST Medical Systems, Koninklijke Philips N.V., Pie Medical Imaging, CathWorks, and Opsens, Inc. These companies focus on developing advanced FFR guidewires, pressure monitoring systems, and image-based FFR solutions to improve diagnostic accuracy and streamline procedures. They invest heavily in R&D to launch next-generation technologies, including CT-derived FFR and AI-enabled software platforms, which reduce procedure time and enhance clinical decision-making. Strategic collaborations with hospitals and academic centers help in conducting clinical trials that strengthen evidence supporting FFR use. Global players also expand their presence in emerging markets by offering cost-effective solutions and comprehensive training programs for interventional cardiologists. Continuous innovation, physician education initiatives, and integration with intravascular imaging tools maintain their competitive edge and drive broader adoption across global healthcare systems.

Recent Developments

- In May 2025, CathWorks announced that the PROVISION study met its primary endpoint, showing similar one-year clinical outcomes for FFRangio compared to wire-based FFR.

- In May 2025, HeartFlow released two-year results from the FISH&CHIPS study (UK NHS) showing combining CCTA + FFRCT improved care efficiency vs CCTA alone.

- In April 2025, Medis Medical Imaging got U.S. FDA clearance for Medis QFR version 3.0, a wire-free angiography-derived physiology assessment tool.

- In October 2024, Boston Scientific launched the AVVIGO+ Multi-Modality Guidance System in India, integrating IVUS + FFR technologies.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of FFR-guided interventions will grow with rising coronary artery disease prevalence worldwide.

- Image-based and CT-derived FFR solutions will gain popularity for non-invasive diagnostics.

- AI and machine learning integration will improve accuracy and speed of FFR interpretation.

- Hospitals will expand FFR use to optimize stent placement and reduce unnecessary procedures.

- Emerging markets will see higher adoption with improved access to catheterization labs and training.

- Reimbursement coverage will expand, encouraging wider use of FFR in routine PCI.

- Integration with IVUS and OCT will provide comprehensive lesion assessment in complex cases.

- Portable and cost-efficient FFR systems will increase penetration in outpatient settings.

- Strategic collaborations between device makers and healthcare systems will enhance clinical adoption.

- Competition among global players will drive continuous innovation and improved product affordability.