Market Overview

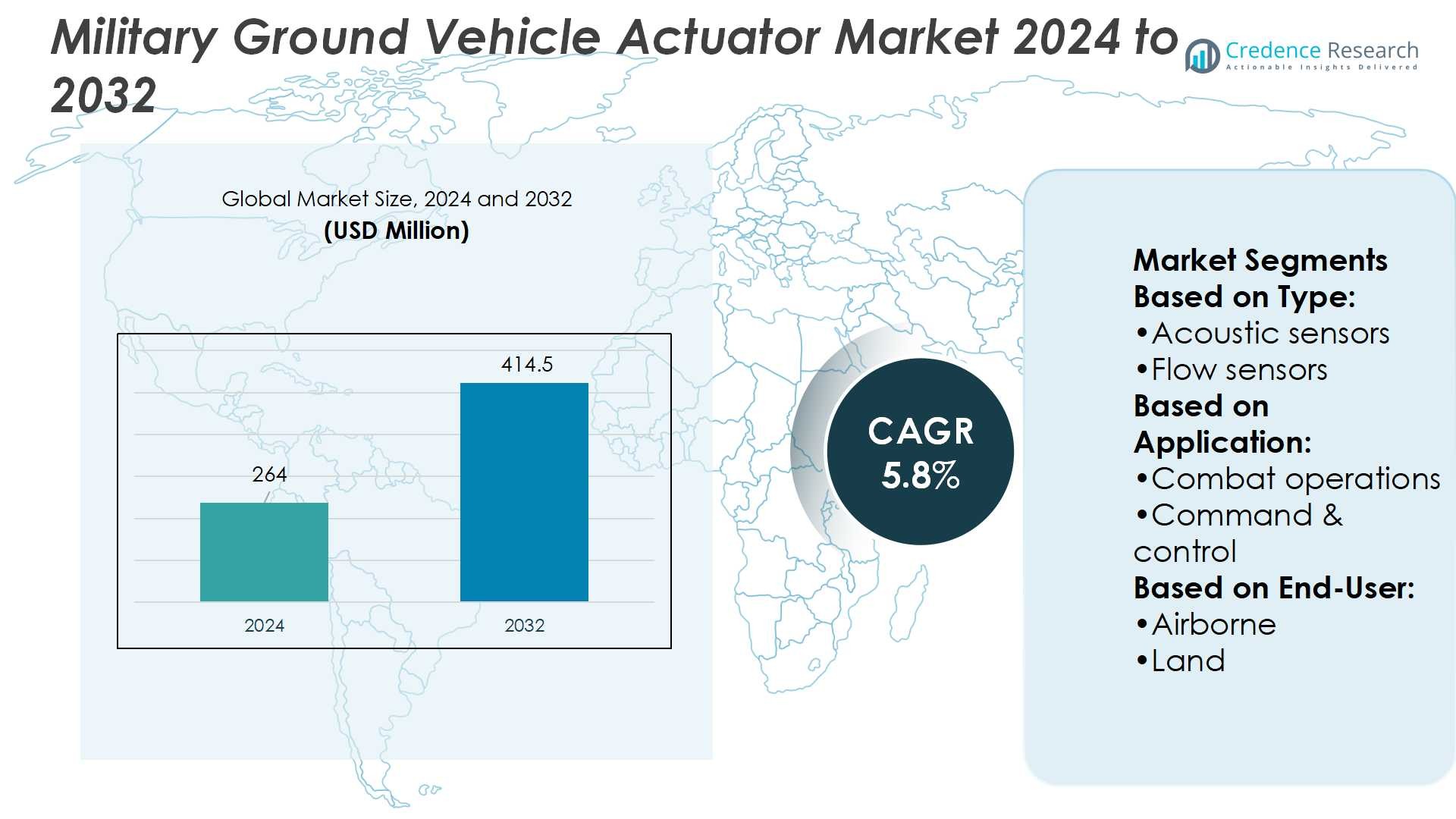

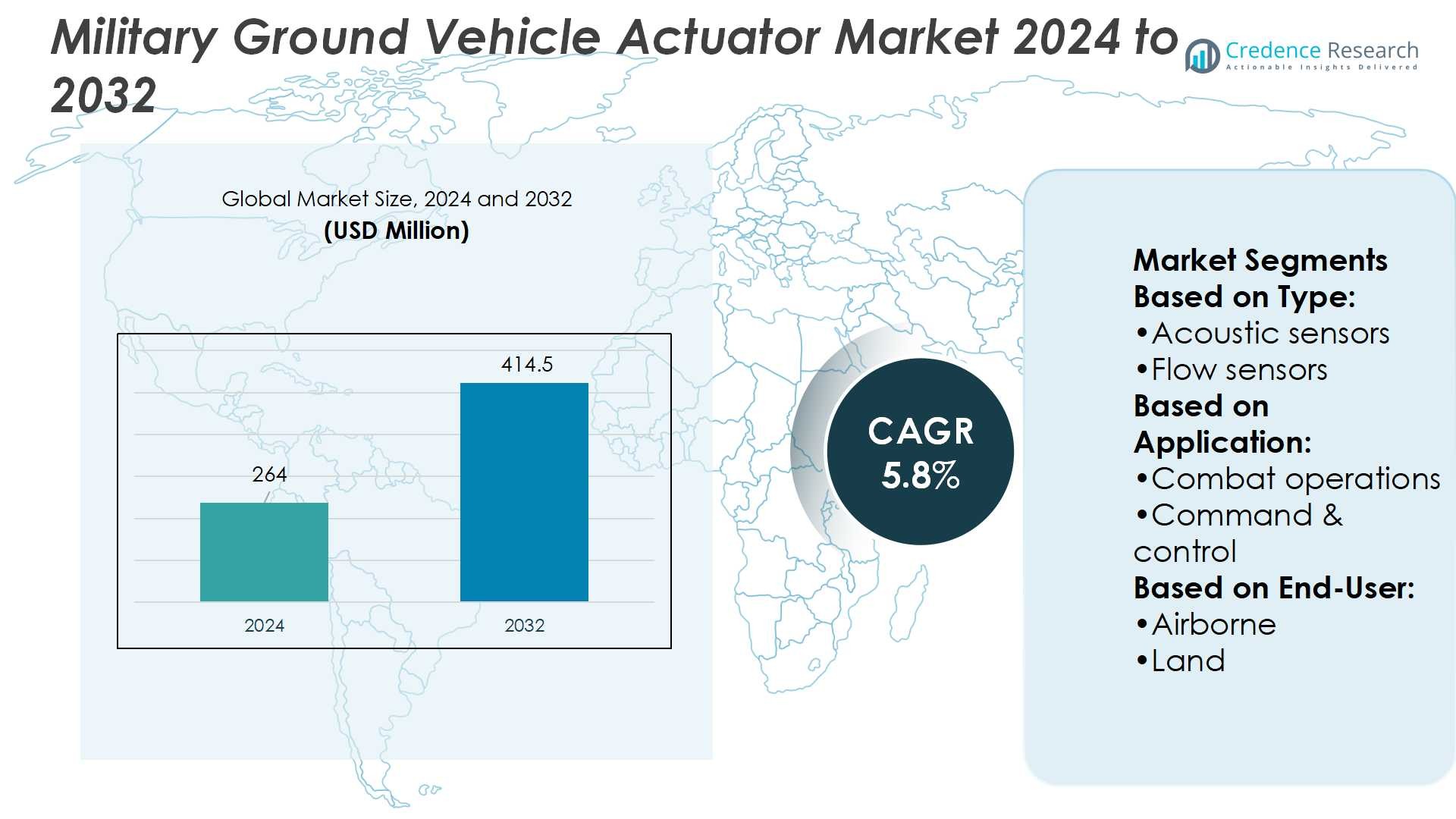

Military Ground Vehicle Actuator Market size was valued at USD 264 million in 2024 and is anticipated to reach USD 414.5 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Military Ground Vehicle Actuator Market Size 2024 |

USD 264 Million |

| Military Ground Vehicle Actuator Market, CAGR |

5.8% |

| Military Ground Vehicle Actuator Market Size 2032 |

USD 414.5 Million |

The Military Ground Vehicle Actuator Market is driven by rising demand for automation, precision control, and energy-efficient solutions in defense vehicles. Advanced actuators enhance mobility, targeting accuracy, and operational safety, while electrification supports stealth operations and reduced maintenance needs. Growing investments in modernization programs and unmanned ground platforms further strengthen adoption. The market also shows trends toward smart actuators with embedded sensors, enabling predictive maintenance and real-time monitoring. Lightweight and modular designs gain traction to improve efficiency and adaptability across platforms. Increasing collaborations between defense agencies and manufacturers accelerate innovation and expand the role of actuators in future combat readiness.

The Military Ground Vehicle Actuator Market shows strong geographical presence, with North America leading due to advanced defense infrastructure, followed by Europe focusing on modernization and Asia Pacific emerging as the fastest-growing region. The Middle East and Africa emphasize fleet upgrades under harsh conditions, while Latin America records steady but moderate growth. Key players include Curtiss-Wright, Moog Inc., Parker Hannifin, Triumph Group, AMETEK, Nook Industries, Ultra Motion, EME Elektro-Metall, Whippany Actuation Systems, and Beaver Aerospace & Defense.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Military Ground Vehicle Actuator Market was valued at USD 264 million in 2024 and is projected to reach USD 414.5 million by 2032, registering a CAGR of 5.8%.

- Rising demand for automation, precision control, and energy-efficient solutions drives market growth across defense platforms.

- Smart actuators with embedded sensors support predictive maintenance, real-time monitoring, and improved operational safety.

- Competition is shaped by key players including Curtiss-Wright, Moog Inc., Parker Hannifin, Triumph Group, AMETEK, Nook Industries, Ultra Motion, EME Elektro-Metall, Whippany Actuation Systems, and Beaver Aerospace & Defense.

- High costs of advanced technologies and complex integration with legacy platforms restrain market expansion.

- North America leads due to strong defense infrastructure, Europe focuses on modernization, and Asia Pacific emerges as the fastest-growing region.

- The Middle East and Africa emphasize fleet upgrades under harsh environments, while Latin America shows steady but moderate growth.

Market Drivers

Rising Demand for Advanced Vehicle Automation and Precision Control

The Military Ground Vehicle Actuator Market grows with the increasing need for automation in defense platforms. Defense forces prioritize actuators that enhance mobility, improve targeting precision, and support weapon stabilization. It ensures consistent performance in harsh conditions where accuracy is critical. Advanced actuators also contribute to reduced human error, faster response times, and improved operational efficiency. Modern military operations depend heavily on automation to reduce risks in complex battlefields. The demand for precise control systems continues to fuel investments in advanced actuator technologies.

- For instance, one actuator by Superior Motion Control achieved speed of 16 inches per minute while sustaining environmental testing per MIL-STD-810, maintaining performance at high altitudes.

Emphasis on Electrification and Energy-Efficient Defense Platforms

Global defense agencies adopt energy-efficient solutions to reduce fuel dependency and enhance sustainability. The Military Ground Vehicle Actuator Market benefits from the shift toward electric and hybrid military vehicles. It supports higher torque, longer operational life, and reduced maintenance requirements compared to hydraulic systems. Electrification provides quieter operations, lowering acoustic signatures crucial for stealth missions. The integration of energy-efficient actuators aligns with military modernization initiatives worldwide. Defense budgets increasingly allocate resources to upgrade fleets with advanced electric actuators.

- For instance, Beaver builds ball screws as small as 3/16 inch diameter and as large as 24-inch diameter — and lengths from 1 inch to 70 feet. These assemblies use special materials and finishes to operate reliably at temperatures exceeding 300°F.

Integration of Smart Technologies and Real-Time Monitoring Capabilities

Actuator manufacturers integrate sensors, IoT, and AI-driven systems to strengthen vehicle performance. The Military Ground Vehicle Actuator Market advances with real-time monitoring and predictive maintenance features. It allows armed forces to track actuator health, prevent failures, and reduce downtime. Smart actuators enhance situational awareness by transmitting performance data directly to operators. This level of intelligence improves mission readiness and reliability. Defense organizations value these technologies for ensuring operational safety and continuity during extended deployments.

Rising Investments in Modernization Programs and Battlefield Readiness

Global militaries invest heavily in modernization programs to address evolving threats. The Military Ground Vehicle Actuator Market expands as defense departments demand robust, adaptable, and durable actuator solutions. It supports next-generation vehicles designed for higher speed, payload, and mission versatility. Ongoing upgrades across armored vehicles, infantry carriers, and unmanned platforms drive demand for cutting-edge actuators. Governments prioritize technologies that extend service life and enhance tactical flexibility. Strategic collaborations between defense agencies and suppliers reinforce market growth.

Market Trends

Growing Adoption of Electric and Hybrid Actuators in Defense Vehicles

The Military Ground Vehicle Actuator Market shows a strong trend toward electric and hybrid systems. Defense agencies adopt these actuators for higher energy efficiency, reduced emissions, and lower maintenance costs. It provides consistent performance while reducing reliance on hydraulic systems that demand frequent servicing. Electric actuators also support stealth operations with quieter functionality. The transition aligns with broader military goals of reducing fuel dependency. Countries modernizing fleets prefer electric solutions to enhance long-term operational readiness.

- For instance, Ultra Motion’s A-Series Servo Cylinder offers continuous force up to 270 lbf (≈1.20 kN), with peak force up to 530 lbf (≈2.36 kN), a stroke length reaching 7.75 inches (197 mm), and speeds up to 14 in/s (356 mm/s).

Rising Use of Smart Actuators with Embedded Sensing Capabilities

Smart actuators embedded with sensors and real-time monitoring systems gain traction in defense platforms. The Military Ground Vehicle Actuator Market benefits from demand for advanced data-driven solutions. It enables predictive maintenance, fault detection, and performance optimization across combat vehicles. Sensor-enabled actuators improve situational awareness and operational safety. The integration of AI and IoT technologies supports autonomous and semi-autonomous operations. Defense forces increasingly prioritize actuators that provide both mechanical function and intelligence.

- For instance, Moog’s Integrated Smart Actuator family includes hydraulic actuators with built-in servo valves, control electronics, force and position sensors, and bus communications such as EtherCAT and CAN. These units deliver stall forces up to 10,300 N at working pressures up to 210 bar, with piston diameters ranging from 10 mm to 25 mm and strokes between 80 mm and 200 mm.

Increasing Demand for Lightweight and Compact Actuator Designs

Global militaries require actuators that balance durability with weight reduction for improved vehicle efficiency. The Military Ground Vehicle Actuator Market advances with compact actuators designed to save space and reduce load. It supports faster maneuverability and higher payload capacity in armored vehicles. Lightweight designs also improve fuel efficiency, which is critical for long missions. Modern battlefield needs push suppliers to innovate in compact form factors. Ongoing research focuses on materials that deliver both strength and reduced mass.

Strong Focus on Modular and Customizable Actuator Solutions

Defense forces prefer modular actuators adaptable to different platforms and missions. The Military Ground Vehicle Actuator Market develops solutions with high flexibility for integration into diverse vehicles. It allows faster upgrades and simplified maintenance, supporting long-term fleet modernization. Customizable actuators meet specialized defense requirements, from weapon control to suspension systems. This trend encourages collaboration between defense agencies and manufacturers for tailored designs. Modular systems also lower lifecycle costs while enhancing deployment efficiency.

Market Challenges Analysis

High Cost of Advanced Technologies and Complex Integration Requirements

The Military Ground Vehicle Actuator Market faces challenges linked to high costs of advanced actuators. Modern electric and smart actuators require expensive materials, precision engineering, and integration with digital systems. It creates budget pressures for defense departments that operate under strict financial allocations. Complex integration with vehicle electronics and communication networks also increases development timelines. Many defense agencies delay large-scale adoption due to compatibility issues with legacy platforms. The cost factor often limits access for countries with constrained defense budgets.

Reliability Concerns in Harsh Environments and Maintenance Limitations

Actuators must perform reliably under extreme battlefield conditions, including high temperatures, dust, and heavy vibrations. The Military Ground Vehicle Actuator Market encounters challenges when systems fail to maintain consistent output in such environments. It raises concerns about mission safety and vehicle dependability. Frequent exposure to stress can shorten actuator lifespan and increase maintenance needs. Limited availability of spare parts in remote or conflict zones makes timely repairs difficult. These challenges emphasize the need for robust designs that reduce failure risks and extend operational durability.

Market Opportunities

Expanding Role of Autonomous and Unmanned Ground Vehicles

The Military Ground Vehicle Actuator Market presents strong opportunities with the growing deployment of autonomous and unmanned ground vehicles. Defense agencies invest in actuators that deliver precise control for navigation, targeting, and mission support. It enhances vehicle adaptability in hazardous environments where human presence is limited. Advanced actuators integrated with AI and sensor systems support the shift toward automation. Rising defense budgets in major economies accelerate adoption of such technologies. This creates sustained demand for actuators capable of supporting next-generation unmanned platforms.

Rising Investments in Modernization and Global Defense Collaborations

Modernization programs across global militaries open significant opportunities for actuator manufacturers. The Military Ground Vehicle Actuator Market benefits from projects aimed at upgrading armored vehicles, combat carriers, and support fleets. It enables suppliers to develop customized, modular solutions that meet diverse military specifications. Cross-border collaborations and joint development programs expand the scope for technology sharing. Suppliers gain access to new contracts through government-industry partnerships. These modernization and collaboration initiatives create pathways for long-term growth in advanced actuator adoption.

Market Segmentation Analysis:

By Type

The Military Ground Vehicle Actuator Market covers a wide range of sensor-based solutions that enhance vehicle functionality and mission reliability. Acoustic sensors detect and analyze sound patterns to identify threats and improve situational awareness. Flow sensors regulate hydraulic and fuel systems to ensure operational efficiency. Force sensors deliver precise measurement of load and pressure during heavy maneuvers. Gyroscopes stabilize navigation systems and improve orientation accuracy in combat conditions. Image sensors support night vision, surveillance, and targeting systems with high-resolution data. Position or displacement sensors improve weapon alignment and turret control. Pressure and proximity sensors protect vehicles from terrain-related risks, while temperature sensors regulate thermal conditions in mission-critical systems. It shows that the growing use of sensor-based actuators drives demand across defense platforms.

- For instance, Force sensors from AMETEK Test & Calibration measure loads with high precision. Their Chatillon gauge systems provide accuracy of ±0.25 % full scale over ranges from 0 to 1,000 lbf and interchangeable sensors for load up to 10,000 lbf.

By Application

The Military Ground Vehicle Actuator Market demonstrates strong adoption in combat operations, where actuators play a vital role in mobility and firepower precision. Command and control systems rely on actuators to ensure accurate positioning and communications. Communication and navigation platforms benefit from actuators that regulate antennas and guidance systems. Electronic warfare operations integrate actuators to support countermeasure deployment and system adjustments under threat. Intelligence, Surveillance & Reconnaissance (ISR) missions depend on actuators for stable imaging, data collection, and environmental sensing. Target recognition systems also use actuators to align optical devices and improve strike accuracy. It highlights how actuators serve as essential components across a wide spectrum of defense operations.

- For instance, Triumph Actuation Products & Services makes landing gear actuators for Boeing 787 and Airbus A380 aircraft, supplying nose wheel steering, extend/retract actuation, truss bracing, truck positioning, uplocks, door actuation, and control valves as part of the full hydraulic actuation suite.

By End User

The Military Ground Vehicle Actuator Market spans airborne, land, and naval domains, with land systems accounting for the highest usage. Armored vehicles, infantry carriers, and unmanned ground platforms integrate actuators for steering, braking, and weapons control. Airborne systems rely on actuators for stability control and tactical sensor management. Naval platforms deploy actuators in communication arrays, navigation controls, and surveillance systems. It reinforces the cross-domain importance of actuators in modern defense strategies. The adaptability of actuator technologies across land, air, and sea underscores their role in supporting multi-dimensional military operations. This diverse adoption ensures consistent growth across all major end-user categories.

Segments:

Based on Type:

- Acoustic sensors

- Flow sensors

Based on Application:

- Combat operations

- Command & control

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Military Ground Vehicle Actuator Market with 34.2% in 2024. The region benefits from advanced defense infrastructure, significant military budgets, and strong innovation in actuator technologies. The United States leads with extensive investments in armored vehicle upgrades, unmanned ground vehicles, and modernization programs for command and control systems. Canada also contributes with ongoing fleet renewal projects and cross-border defense collaborations. It emphasizes automation, electrification, and integration of smart actuators across tactical vehicles and combat platforms. Stringent safety and performance standards in North America further drive demand for reliable and durable actuator solutions. The presence of leading defense contractors and technology suppliers reinforces regional dominance.

Europe

Europe accounts for 27.5% of the Military Ground Vehicle Actuator Market in 2024, supported by strong investments in defense modernization across NATO member states. Countries such as Germany, the United Kingdom, and France lead procurement of advanced actuators for armored personnel carriers, infantry fighting vehicles, and command systems. It highlights a growing emphasis on electrification and sustainability in military fleets. Europe also prioritizes modular and customizable actuator designs to ensure compatibility across multinational operations. Rising geopolitical tensions in Eastern Europe accelerate defense spending, which strengthens demand for next-generation actuators. Ongoing collaborations between European defense manufacturers and research institutes expand the scope of actuator innovation. The market reflects Europe’s dual focus on operational capability and long-term durability.

Asia Pacific

Asia Pacific represents 22.1% of the Military Ground Vehicle Actuator Market in 2024, making it the fastest-growing regional segment. Countries such as China, India, South Korea, and Japan increase defense budgets to expand ground vehicle fleets and introduce advanced automation technologies. It supports demand for actuators with higher precision, compact form factors, and energy-efficient performance. China leads with strong domestic manufacturing capabilities, while India emphasizes indigenous development through government initiatives. Rising border tensions and regional conflicts further boost demand for military modernization. Asia Pacific demonstrates strong interest in unmanned and semi-autonomous ground vehicles, creating opportunities for actuator manufacturers. Expanding defense collaborations and joint ventures with Western suppliers strengthen the regional technology base.

Latin America

Latin America accounts for 7.1% of the Military Ground Vehicle Actuator Market in 2024, supported by moderate but steady investments in defense systems. Brazil and Mexico drive most of the demand, focusing on armored vehicle upgrades and surveillance operations. It highlights growing interest in integrating smart actuators for improved communication and navigation systems. Limited defense budgets in the region restrict large-scale adoption but emphasize cost-effective and durable actuator solutions. Governments pursue modernization programs aimed at enhancing mobility and combat readiness. Rising collaborations with global defense suppliers create pathways for technology transfer and capability expansion. Latin America’s gradual defense reforms sustain consistent, though moderate, market growth.

Middle East and Africa

The Middle East and Africa hold 9.1% of the Military Ground Vehicle Actuator Market in 2024, driven by rising investments in defense modernization and regional security challenges. Countries such as Saudi Arabia, the United Arab Emirates, and Israel lead in procurement of armored vehicles equipped with advanced actuator systems. It reflects a strong focus on upgrading fleets for combat readiness and enhanced tactical performance. Increasing reliance on imported defense technologies creates opportunities for global suppliers to establish partnerships in the region. Governments prioritize actuators that deliver reliability under extreme heat, dust, and desert conditions. Ongoing geopolitical tensions in the Middle East maintain steady demand for military ground vehicle modernization. Africa, while smaller in scale, gradually increases adoption as countries strengthen defense infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Military Ground Vehicle Actuator Market players including Curtiss-Wright, Moog Inc., Parker Hannifin, Triumph Group, Nook Industries, AMETEK, Ultra Motion, EME EleKTro-Metall, Whippany Actuation Systems, and Beaver Aerospace & Defense. The Military Ground Vehicle Actuator Market is driven by leading players such as Curtiss-Wright, Moog Inc., Parker Hannifin, Triumph Group, Nook Industries, AMETEK, Ultra Motion, EME Elektro-Metall, Whippany Actuation Systems, and Beaver Aerospace & Defense. These companies play a central role in advancing actuator technologies that improve mobility, precision, and operational safety across modern defense vehicles. Curtiss-Wright and Moog Inc. maintain strong market presence with extensive portfolios in motion control and high-reliability actuator systems. Parker Hannifin emphasizes hydraulic and electromechanical solutions designed to withstand extreme operating conditions. Triumph Group and AMETEK focus on supplying robust systems that meet the demands of armored and tactical vehicles. Nook Industries and Ultra Motion expand their presence through precision actuators and tailored solutions for unmanned and semi-autonomous platforms. EME Elektro-Metall and Whippany Actuation Systems strengthen their market position with specialized actuators for mission-critical defense functions, while Beaver Aerospace & Defense offers decades of expertise in flight and ground actuation solutions. The competitive environment highlights continuous investment in R&D, product innovation, and integration of smart technologies. Growing demand for electric, lightweight, and sensor-enabled actuators creates further opportunities for these players to expand their global footprint and secure long-term defense contracts.

Recent Developments

- In July 2024, Metso decided to acquire the privately owned Australian company, Jindex Pty Ltd, a valves and process flow control provider. The experience of Metso in providing slurry handling, hydrocyclones, and minerals equipment processing.

- In May 2024, Emerson launched a series of AVENTICS high-power, high-precision pressure regulator valves, which are used to increase effectiveness, versatility, and precision of the manufacturing systems, where pneumatic power is applied.

- In May 2024, Engineering and scientific technology company Leidos was granted a contract worth by the U.S. Army Contracting Command – Aberdeen Proving Grounds. This contract is for services related to the Army’s DIABLO (Development, Integration, Acquisitions, Bridging to Logistics & Operations) sensors initiative.

- In October 2023, the Lower Tier Air and Missile Defense Sensor developed by Raytheon, an RTX business, achieved significant technical and performance milestones while completing the Contractor Verification Testing at the U.S. Army’s White Sands Missile Range.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of electric actuators to improve energy efficiency in defense vehicles.

- Smart actuators with sensor integration will gain demand for predictive maintenance and performance monitoring.

- Autonomous and unmanned ground vehicles will drive the need for advanced actuator solutions.

- Lightweight and compact actuator designs will support higher payload capacity and improved maneuverability.

- Defense modernization programs worldwide will continue to create consistent procurement opportunities.

- Hybrid and modular actuator systems will expand adoption across multiple vehicle platforms.

- Growth in artificial intelligence integration will enhance actuator precision and responsiveness.

- Strategic collaborations between defense agencies and suppliers will accelerate technology development.

- Durability and reliability under extreme environments will remain a key focus for manufacturers.

- Increasing investments in battlefield readiness will sustain long-term market growth.