Market Overview

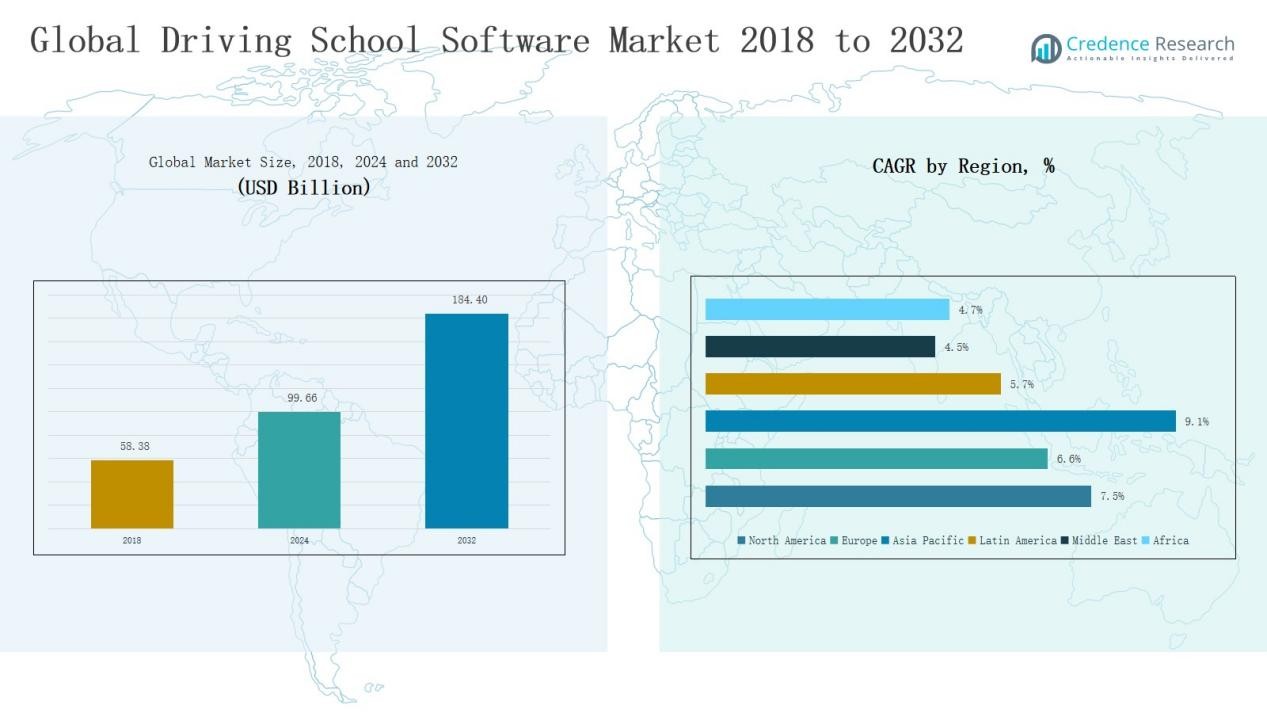

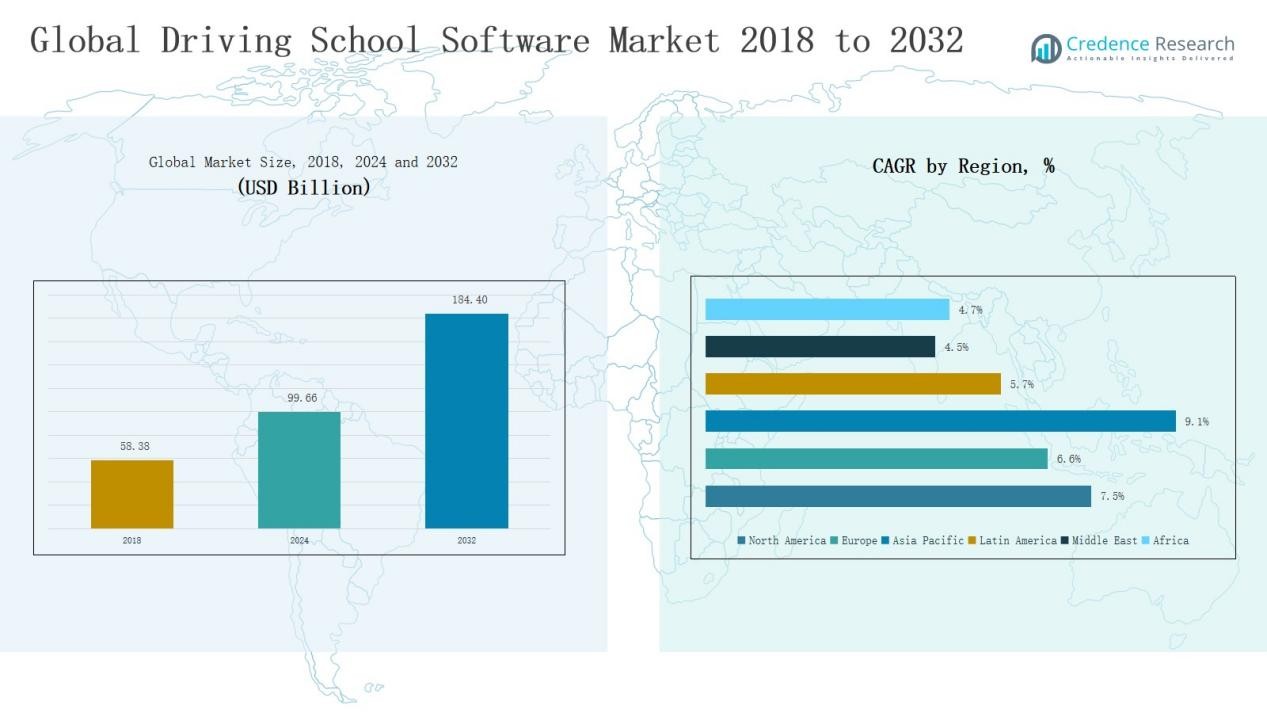

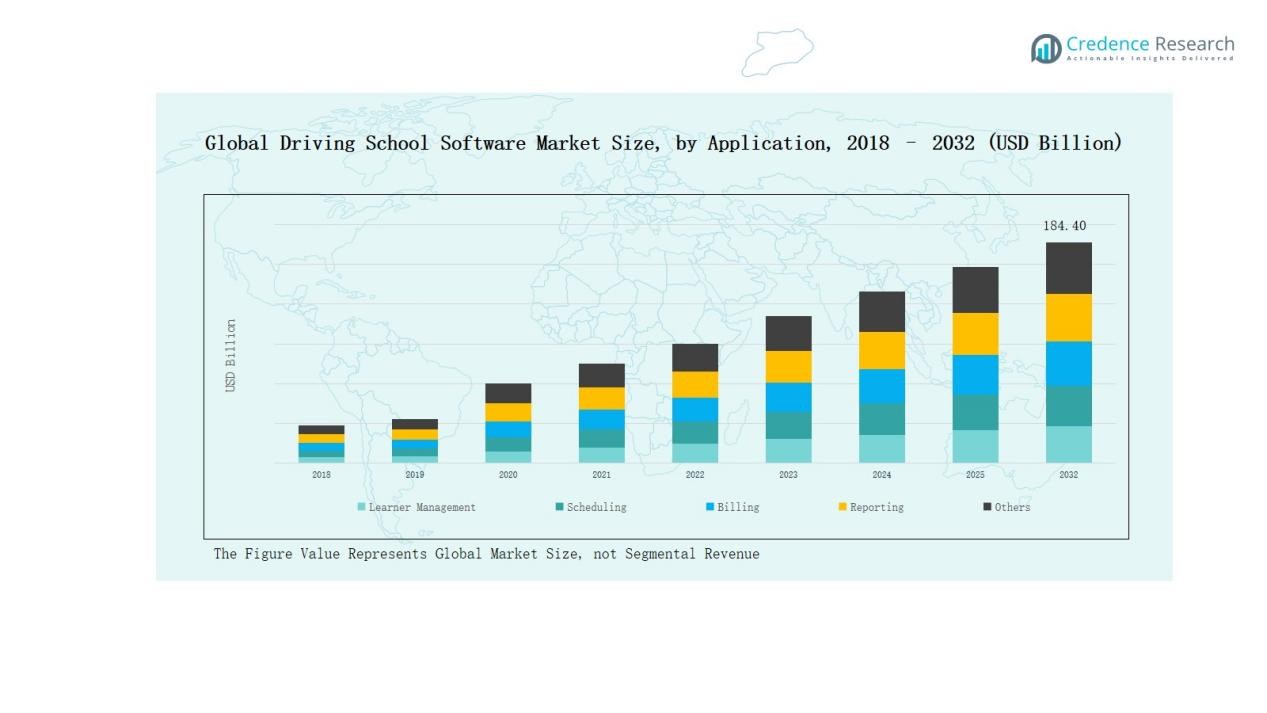

Driving School Software Market size was valued at USD 58.38 Billion in 2018 to USD 99.66 Billion in 2024 and is anticipated to reach USD 184.40 Billion by 2032, at a CAGR of 7.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Driving School Software Market Size 2024 |

USD 99.66 Billion |

| Driving School Software Market, CAGR |

7.45% |

| Driving School Software Market Size 2032 |

USD 184.40 Billion |

The Driving School Software Market is shaped by prominent players including SimplyBook.me, Bookitlive, DanubeNet, Drive Scout, Driving School Software Inc., IntelliShift, eDriving, MyDrivingSchool, Smart Driving School, and TutorCruncher. These companies compete by offering integrated platforms that streamline learner management, scheduling, billing, and reporting while focusing on cloud-based deployment and mobile-first solutions. Strategic initiatives such as partnerships, feature enhancements, and expansion into emerging regions help strengthen their market presence. Regionally, North America leads with a 36% share in 2024, driven by advanced digital infrastructure, strong regulatory compliance needs, and early adoption of cloud-based solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Driving School Software Market grew from USD 58.38 Billion in 2018 to USD 99.66 Billion in 2024 and is expected to reach USD 184.40 Billion by 2032.

- Key players include SimplyBook.me, Bookitlive, DanubeNet, Drive Scout, Driving School Software Inc., IntelliShift, eDriving, MyDrivingSchool, Smart Driving School, and TutorCruncher.

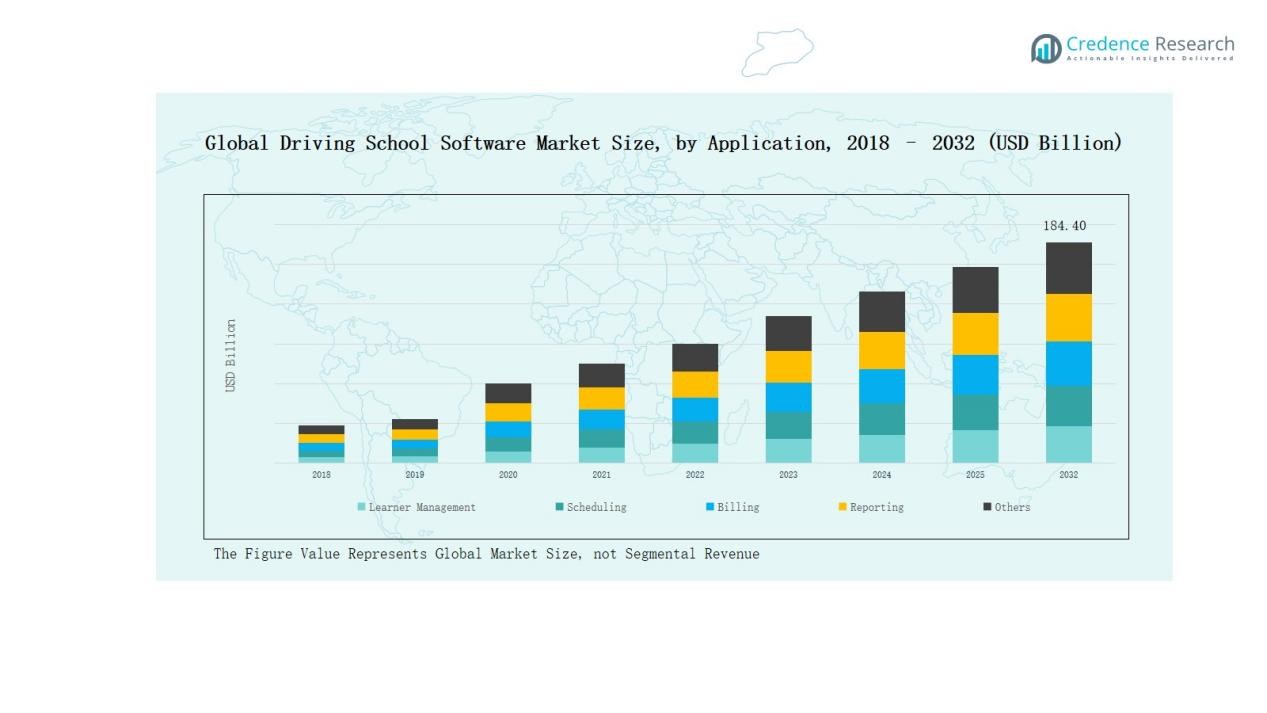

- By application, learner management leads with 42% share in 2024, followed by scheduling at 28%, billing at 15%, reporting at 10%, and others at 5%.

- By enterprise size, SMEs dominate with 63% share in 2024, while large enterprises account for 37%, reflecting the fragmented nature of the industry.

- By deployment mode, cloud-based solutions hold 71% share in 2024, compared to 29% for on-premises, driven by cost-effectiveness, flexibility, and SaaS adoption.

Market Segment Insights

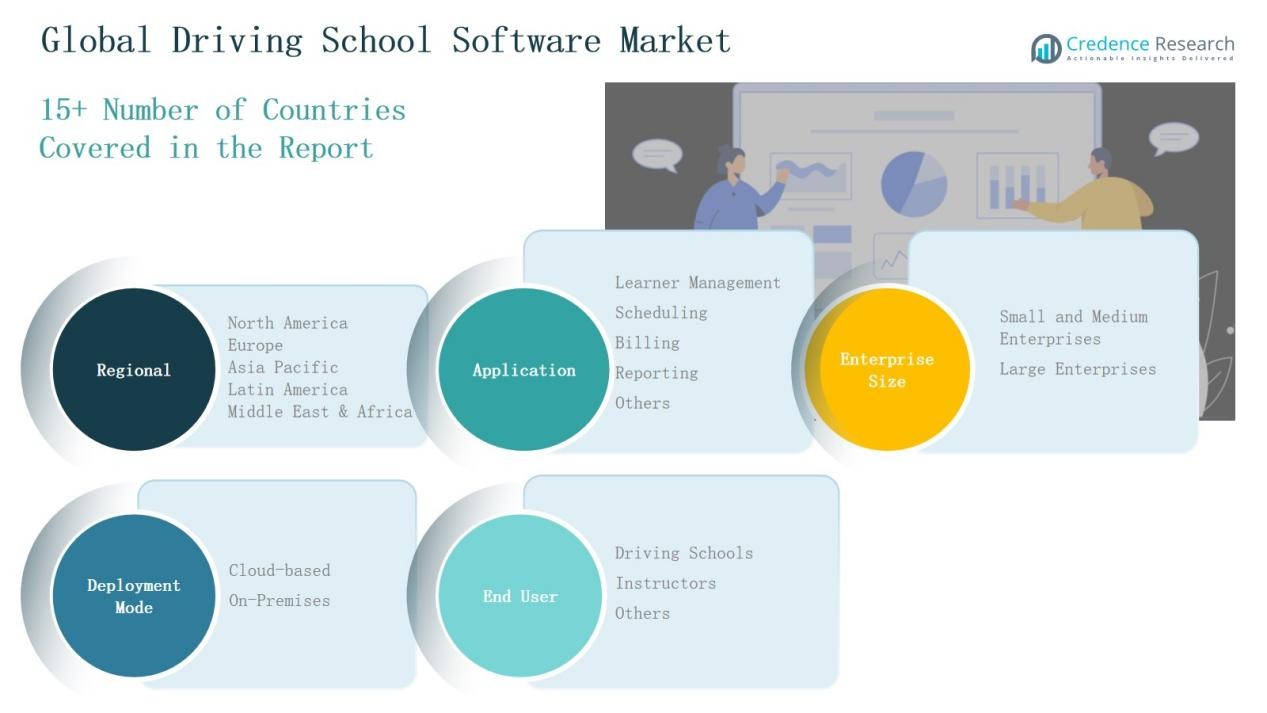

By Application

Learner management dominates the application segment with a 42% revenue share in 2024. Its leadership is driven by the rising demand for streamlined student enrollment, progress tracking, and personalized learning paths. Scheduling follows with 28% share, supported by automation of class bookings and instructor allocation. Billing and reporting contribute 15% and 10%, respectively, as schools adopt digital invoicing and data-driven insights. The remaining 5% is captured by other functions such as communication and compliance tools.

For instance, Leigh Academies Trust enhanced staff development and compliance by adopting Thrive’s LMS platform across 31 schools, resulting in a measurable improvement in training completion rates and regulatory adherence.

By Enterprise Size

Small and medium enterprises (SMEs) account for a 63% share in 2024, leading the enterprise size segment. Growth is supported by increasing adoption of affordable subscription-based platforms that improve operational efficiency for independent schools and regional chains. Large enterprises hold the remaining 37%, focusing on scalable, integrated solutions to manage multi-branch operations and enhance compliance. The dominance of SMEs reflects the fragmented nature of the driving school industry.

For instance, Picktime provides features for online class scheduling and SMS notifications for businesses, including driving schools, which helps them reduce no-show rates and streamline instructor management.

By Deployment Mode

Cloud-based deployment holds a commanding 71% share in 2024, making it the dominant segment. Its growth is propelled by demand for cost-effective, flexible, and scalable solutions that enable remote access and real-time updates. On-premises deployment captures 29%, driven by institutions with strict data control needs and limited internet infrastructure. The rapid expansion of SaaS models and preference for minimal upfront investment continue to strengthen the shift toward cloud adoption.

Key Growth Drivers

Rising Demand for Digital Learning and Automation

The driving school industry is increasingly adopting digital tools to improve operational efficiency and learner engagement. Software platforms streamline enrollment, scheduling, progress tracking, and billing, reducing administrative workload. The shift toward digital-first solutions aligns with rising learner expectations for convenience and personalized training. Automation enables instructors to manage larger student volumes without compromising quality. This demand continues to fuel market expansion, especially as schools seek cost-effective solutions that integrate multiple functions into one centralized platform.

For instance, Pedal Mobility’s cloud-based management system in the UAE integrated driving instructor booking, student progress tracking, and audit-ready compliance reporting for multi-branch schools.

Expansion of Cloud-Based Deployment

Cloud-based solutions dominate the market due to their scalability, affordability, and flexibility. Driving schools and instructors prefer cloud platforms for remote accessibility, real-time updates, and seamless integration with mobile devices. Subscription-based models reduce upfront costs, allowing small and medium-sized enterprises to adopt advanced systems. Continuous upgrades and data security features add to the appeal. As internet penetration increases globally, the adoption of cloud-based software accelerates, making it a critical growth driver in both developed and emerging regions.

For instance, Fleet Complete upgraded its fleet management software with real-time driver performance tracking and safety analytics, supporting driving schools to optimize vehicle usage and improve safety compliance.

Growing Focus on Compliance and Safety Standards

Increasing regulatory requirements in driver training programs are driving software adoption. Governments emphasize structured learning and transparent record-keeping, encouraging schools to adopt digital solutions for compliance. Software platforms offer reporting tools, attendance logs, and certification tracking that align with safety standards. By ensuring accurate documentation, schools reduce risks of penalties and build credibility with learners. This regulatory push, combined with a growing emphasis on road safety, continues to create strong demand for robust driving school software solutions.

Key Trends & Opportunities

Integration of Advanced Analytics and AI

Driving school software providers are increasingly embedding AI and analytics tools to enhance decision-making. Predictive insights optimize scheduling, identify learner performance patterns, and improve instructor efficiency. AI-powered assessments provide real-time feedback, allowing students to address weaknesses more effectively. This trend creates opportunities for providers to differentiate their offerings through intelligent automation. As schools prioritize data-driven improvements, solutions that combine ease of use with advanced analytics stand to gain higher adoption across competitive markets.

For instance, Virtual Driving School launched an AI-powered assessment system that provides real-time corrective feedback during simulation training, enabling instructors to spot weaknesses quickly.

Mobile-First and Remote Learning Solutions

The rising penetration of smartphones supports the shift toward mobile-enabled driving school software. Learners expect flexible training experiences with features like mobile booking, progress updates, and digital communication with instructors. Remote learning modules and e-learning content are gaining traction, enabling hybrid training models. Providers offering mobile-first platforms unlock new growth opportunities, especially in regions where smartphone adoption outpaces desktop usage. This trend reflects the broader digital learning landscape and positions mobile solutions as a critical growth frontier.

For instance, Aceable launched updates to its mobile-first driver’s education app, reporting over 2 Billion students trained through smartphones since its inception, emphasizing app-based coursework and certificates.

Key Challenges

High Cost of Implementation for Small Operators

While cloud deployment lowers upfront costs, many small schools still face financial barriers in adopting advanced software. Subscription fees, integration expenses, and training requirements create challenges for budget-constrained operators. This cost sensitivity often leads to reliance on manual processes or low-cost, less-featured platforms. Limited financial resources hinder full-scale adoption, particularly in developing regions, restraining the market’s growth potential despite the availability of scalable solutions.

Data Security and Privacy Concerns

Driving school software platforms handle sensitive learner data, including personal details, payment information, and certification records. Security breaches or weak compliance with data protection regulations undermine user trust. Schools remain cautious about shifting to fully digital systems if data security is uncertain. Vendors must address these concerns through stronger encryption, compliance frameworks, and transparent data handling practices. Without robust safeguards, potential buyers may hesitate, limiting wider adoption of digital solutions in the market.

Resistance to Digital Transformation

Many traditional driving schools and independent instructors remain reluctant to adopt software solutions. Resistance stems from limited digital literacy, fear of operational disruption, and preference for manual methods. This mindset slows adoption rates, particularly in regions with older training structures. Overcoming this challenge requires targeted awareness campaigns, simplified user interfaces, and strong customer support. Until adoption barriers are reduced, resistance to digital transformation remains a key challenge restraining overall market penetration.

Regional Analysis

North America

North America leads the global Driving School Software Market with a 36% share in 2024, valued at USD 43.23 billion, up from USD 25.59 billion in 2018. The region benefits from advanced infrastructure, digital adoption, and high demand for automated scheduling and learner management systems. The United States dominates due to strong cloud integration and regulatory support for structured driver training. Canada and Mexico show steady growth, particularly among SMEs. With a CAGR of 7.5%, the market is projected to reach USD 80.22 billion by 2032, maintaining its leadership through early technology adoption and product innovation.

Europe

Europe holds a 23% share in 2024, valued at USD 27.41 billion, rising from USD 16.65 billion in 2018. The region’s growth is driven by strict safety regulations, compliance requirements, and strong adoption in the UK, Germany, France, and Italy. Cloud-based learner management and analytics platforms gain traction among small and mid-sized enterprises. Europe is forecast to expand at a CAGR of 6.6%, reaching USD 47.76 billion by 2032, consolidating its position as the second-largest regional market.

Asia Pacific

Asia Pacific accounts for a 17% share in 2024, with a market size of USD 20.68 billion, up from USD 11.17 billion in 2018. It is the fastest-growing region, projected to reach USD 43.36 billion by 2032 at a CAGR of 9.1%. Growth stems from increasing urbanization, rising middle-class income, and high smartphone usage supporting mobile-first driver training modules. China, India, and Japan lead adoption, with SMEs favoring affordable cloud-based learning platforms.

Latin America

Latin America represents a 9% share in 2024, valued at USD 4.45 billion, compared to USD 2.64 billion in 2018. Brazil leads the region, followed by Argentina and Mexico, as digital learning initiatives and road safety programs expand. Although affordability remains a challenge, rising internet access and preference for cloud deployment models fuel progress. The market is projected to grow at a CAGR of 5.7%, reaching USD 7.24 billion by 2032.

Middle East

The Middle East holds a 6% share in 2024, worth USD 2.00 billion, up from USD 1.31 billion in 2018. Growth is concentrated in GCC countries, driven by government-backed driver training reforms and investments in digital learning infrastructure. Israel and Turkey are emerging markets with gradual SME adoption. The market is expected to expand at a CAGR of 4.5%, reaching USD 2.96 billion by 2032, with cloud deployment leading demand.

Africa

Africa contributes 5% of the global share in 2024, valued at USD 1.89 billion, up from USD 1.02 billion in 2018. South Africa dominates regional adoption, followed by Egypt and Nigeria, supported by improving digital literacy and expanding urban training centers. Rural limitations persist, but mobile-first and low-cost cloud solutions create new opportunities. With a CAGR of 4.7%, the African market is projected to reach USD 2.86 billion by 2032, signaling gradual yet promising expansion.

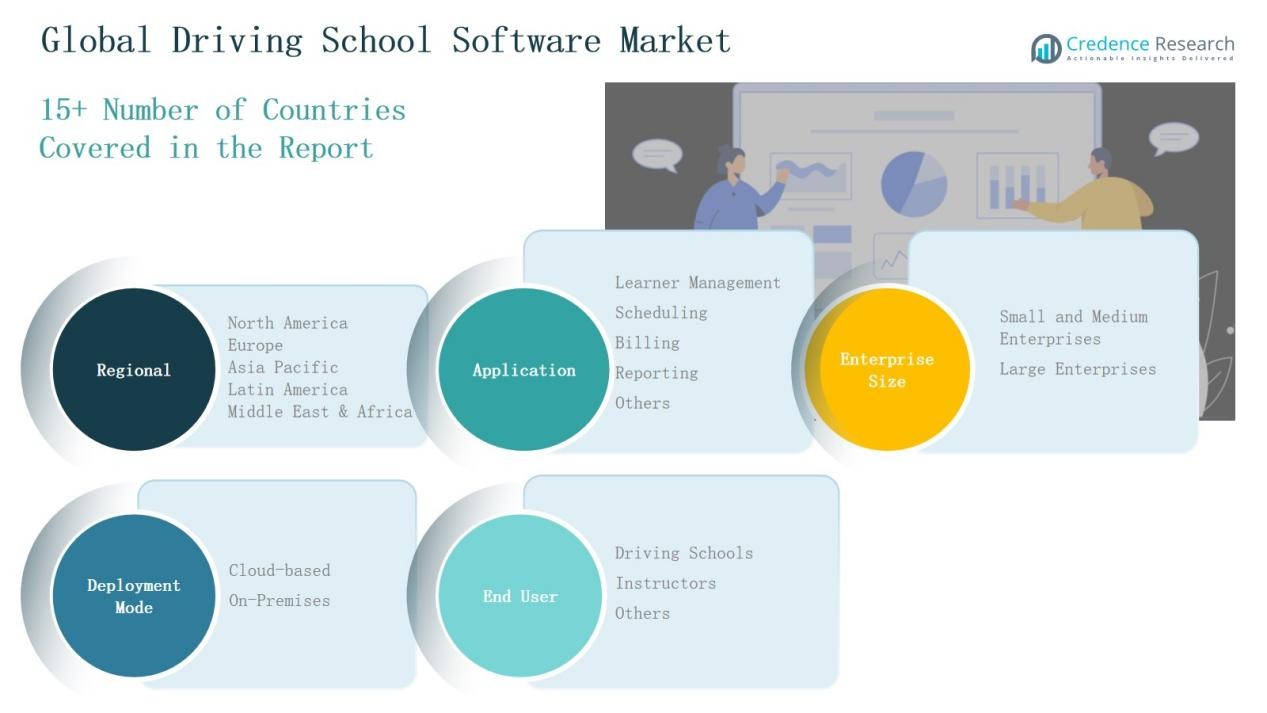

Market Segmentations:

By Application

- Learner Management

- Scheduling

- Billing

- Reporting

- Others

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Mode

By End User

- Driving Schools

- Instructors

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Driving School Software Market is moderately fragmented, with a mix of global providers and niche regional players. Companies such as SimplyBook.me, Bookitlive, DanubeNet, Drive Scout, Driving School Software Inc., IntelliShift, eDriving, MyDrivingSchool, Smart Driving School, and TutorCruncher lead the market through comprehensive service portfolios and scalable platforms. Competition centers on offering integrated solutions that combine learner management, scheduling, billing, and reporting within user-friendly interfaces. Cloud-based deployment dominates strategies, enabling cost-effective and flexible adoption for SMEs and large enterprises alike. Vendors are also investing in mobile-first solutions, AI-enabled analytics, and compliance-focused tools to address evolving customer needs and regulatory requirements. Strategic moves include partnerships with driving schools, expansion into emerging regions, and continuous feature enhancements. Market players aim to differentiate through affordability, automation, and customer support, while consolidation and innovation are expected to intensify competition as adoption of digital solutions grows globally.

Key Players

- me

- Bookitlive

- DanubeNet

- Drive Scout

- Driving School Software Inc.

- IntelliShift

- eDriving

- MyDrivingSchool

- Smart Driving School

- TutorCruncher

Recent Developments

- In July 2024, Vertus Group acquired Teachworks, a provider of scheduling and management software for driving schools, to strengthen its presence in education and driver training software solutions.

- In July 2025, Jungle Driving relaunched under new leadership with a revamped program that introduced real-time vehicle tracking and announced plans for national franchise expansion.

- In 2023, Fleet Complete launched an enhanced version of its fleet management software, adding new features for real-time driver performance tracking and safety analytics.

- In May 2025, Audi India introduced its “Drive Sure” training program, designed to equip drivers and chauffeurs with skills to handle advanced vehicle technologies safely.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Enterprise Size, Deployment Mode, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of cloud-based platforms will expand as schools prioritize scalability and remote access.

- Mobile-enabled solutions will gain traction with rising smartphone penetration and learner demand for flexibility.

- Integration of AI and analytics will improve learner performance tracking and operational decision-making.

- Digital payment and billing solutions will see wider adoption to streamline financial management.

- Regulatory compliance requirements will drive demand for structured reporting and certification tools.

- SMEs will remain the primary adopters, supported by cost-effective subscription-based models.

- Strategic partnerships between software vendors and training institutes will strengthen market presence.

- Customizable platforms will gain preference as schools seek solutions tailored to local needs.

- Expansion into emerging regions will open new opportunities for affordable cloud solutions.

- Enhanced customer support and training features will become key differentiators among providers.