Market Overview

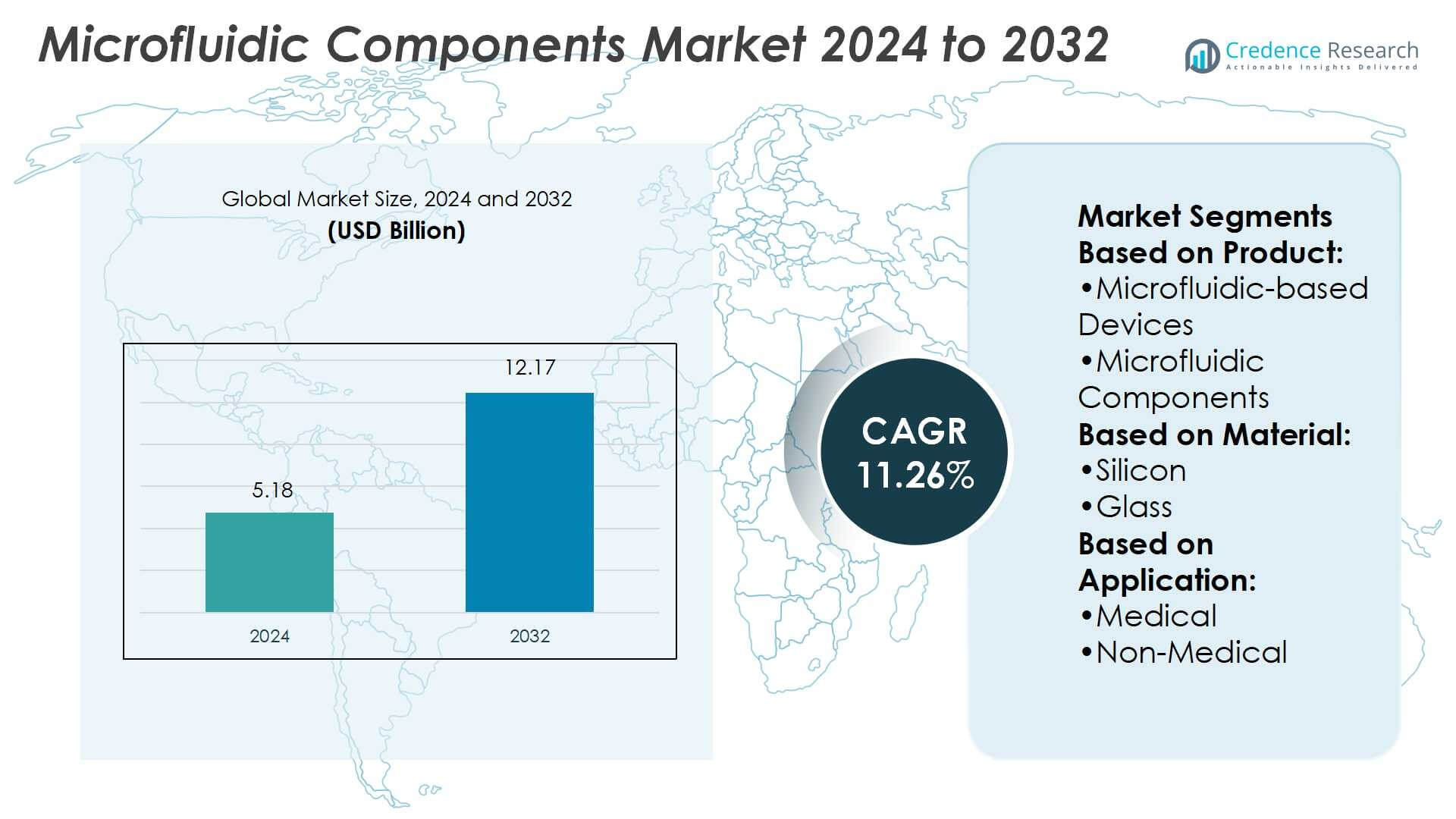

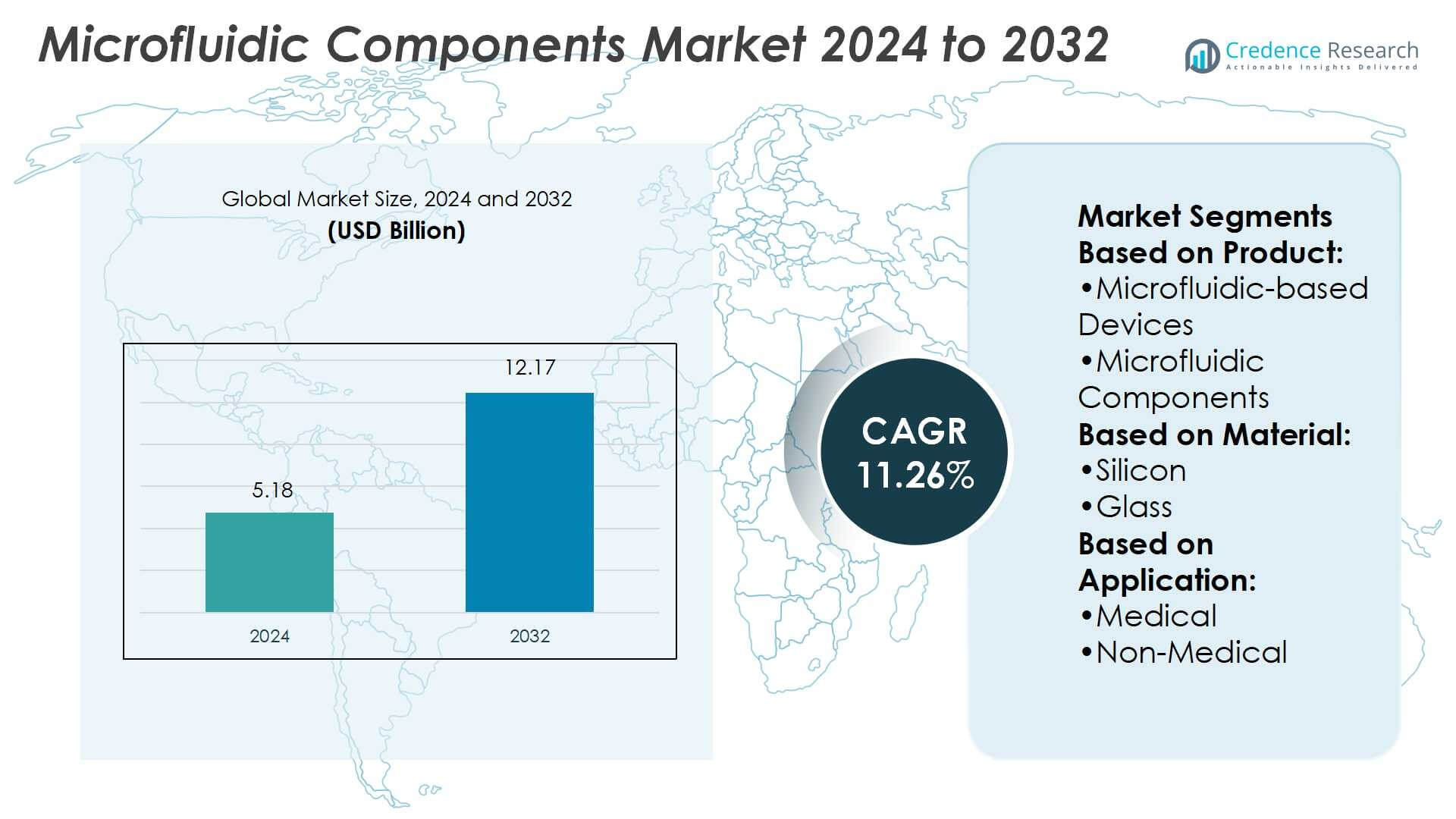

Microfluidic Components Market size was valued at USD 5.18 billion in 2024 and is anticipated to reach USD 12.17 billion by 2032, at a CAGR of 11.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microfluidic Components Market Size 2024 |

USD 5.18 Billion |

| Microfluidic Components Market, CAGR |

11.26% |

| Microfluidic Components Market Size 2032 |

USD 12.17 Billion |

The Microfluidic Components Market grows with rising demand for point-of-care diagnostics, drug discovery, and personalized medicine, supported by precision, speed, and low sample requirements. It benefits from increasing healthcare investments, expanding applications in genomics and proteomics, and strong focus on miniaturization to improve portability. Integration with automation, sensors, and artificial intelligence enhances performance and reliability. The market also advances with adoption of 3D printing and advanced manufacturing techniques that reduce costs and enable customization. Expanding applications in environmental monitoring, food safety testing, and industrial analysis strengthen its reach, ensuring a dynamic landscape shaped by innovation and evolving global healthcare needs.

The Microfluidic Components Market shows strong geographical presence, with North America leading due to advanced healthcare infrastructure, Europe focusing on regulatory compliance and precision research, and Asia Pacific emerging as the fastest-growing region with rising healthcare investments. Latin America and the Middle East & Africa hold smaller shares but offer growth potential through expanding diagnostic adoption. Key players shaping the market include Agilent Technologies, Illumina, PerkinElmer, Danaher, Bio-Rad Laboratories, Hoffmann-La Roche, Abbott, Fluidigm, Qiagen, and Life Technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Microfluidic Components Market was valued at USD 5.18 billion in 2024 and is projected to reach USD 12.17 billion by 2032, registering a CAGR of 11.26%.

- Rising demand for point-of-care diagnostics, drug discovery, and personalized medicine drives market expansion.

- Miniaturization, portability, and integration with automation, sensors, and artificial intelligence shape market trends.

- Competitive landscape is defined by innovation from leading players including Agilent Technologies, Illumina, PerkinElmer, Danaher, Bio-Rad Laboratories, Hoffmann-La Roche, Abbott, Fluidigm, Qiagen, and Life Technologies.

- High development costs, regulatory hurdles, and technical complexities act as restraints for broader adoption.

- North America leads with advanced infrastructure, Europe emphasizes compliance and precision, and Asia Pacific records the fastest growth; Latin America and the Middle East & Africa show emerging potential.

- Expanding applications in genomics, proteomics, environmental monitoring, and food safety testing strengthen long-term opportunities.

Market Drivers

Rising Demand for Point-of-Care Diagnostics Drives Market Growth

The Microfluidic Components Market benefits from the strong expansion of point-of-care diagnostics. It supports rapid testing for conditions such as infectious diseases and chronic disorders. Growing adoption in hospitals, clinics, and home care settings strengthens its importance. Healthcare providers rely on microfluidics for faster diagnosis with smaller sample volumes. This demand fuels higher investments in portable diagnostic platforms. Rising prevalence of chronic diseases worldwide ensures long-term growth momentum for the industry.

- For instance, Rising prevalence of chronic diseases worldwide ensures long-term growth momentum for the industry. For instance, Qiagen QIAcuity digital PCR plates support up to 26,000 partitions per well for precise quantification of low abundance targets.

Expanding Use in Drug Discovery and Pharmaceutical Research Accelerates Adoption

Drug discovery and pharmaceutical research represent another strong driver for the Microfluidic Components Market. It enables researchers to conduct high-throughput screening with reduced reagent usage. This efficiency lowers costs and shortens timelines for clinical trials. Pharmaceutical companies deploy microfluidic platforms to model complex biological environments. The ability to generate reliable data at scale enhances their appeal. Expanding R&D budgets from global drug manufacturers further accelerates adoption.

- For instance, Danaher Life Sciences offers microbioreactor systems with 48-well microtiter plates (MTPs) that permit real-time measurement of biomass, pH, dissolved oxygen (DO), and fluorescent markers simultaneously in each well, using proprietary microfluidic sensors.

Integration with Advanced Technologies Enhances Efficiency and Performance

Integration with artificial intelligence, sensors, and automation systems strengthens the Microfluidic Components Market. It allows real-time monitoring of biological and chemical reactions with high precision. Manufacturers focus on compact, user-friendly designs that improve workflow in laboratories. Technological advances increase sensitivity and accuracy across applications in genomics, proteomics, and cell analysis. Automated platforms help scale testing capacity for research and healthcare use. Rising demand for personalized medicine amplifies the importance of such integrations.

Growing Application in Life Sciences and Healthcare Expands Market Reach

The Microfluidic Components Market expands with rising applications in life sciences and healthcare. It supports organ-on-chip models, cancer research, and advanced therapeutic studies. Growing reliance on microfluidics enhances development of innovative treatment methods. Hospitals and laboratories adopt these systems to manage higher testing volumes efficiently. Public and private investments into healthcare infrastructure strengthen adoption. Increasing focus on precision medicine creates sustained demand across diverse clinical and research settings.

Market Trends

Market Trends

Increasing Focus on Miniaturization and Portable Devices Shapes Market Direction

The Microfluidic Components Market shows a strong shift toward miniaturization and portable systems. It aligns with growing demand for compact diagnostic tools in remote and home settings. Smaller devices improve patient accessibility while reducing costs for healthcare providers. Companies prioritize portability to enhance usability outside traditional laboratory environments. Rising demand for decentralized healthcare solutions accelerates this transition. The trend strengthens opportunities in telemedicine and personalized care applications.

- For instance, Abbott’s ARCHITECT i1000SR immunoassay analyzer accommodates 65 sample cups, holds reagents in 25 refrigerated positions, and processes sample volumes ranging from 10-150 µL, average about 62 µL, per test.

Rising Integration of Microfluidics with Personalized Medicine Expands Application Scope

The Microfluidic Components Market benefits from increasing alignment with personalized medicine. It enables precise testing and monitoring tailored to individual patient profiles. This capability supports drug dosing optimization and treatment selection in oncology and chronic disease care. Researchers deploy microfluidic platforms to replicate patient-specific cellular conditions. Such systems enhance accuracy of experimental outcomes and therapeutic strategies. Growth in genomic and proteomic research strengthens this trend further.

- For Instance, The Agilent Seahorse XF Flex Analyzer supports measurements in 3D models (organoids, spheroids) to track cellular respiration and glycolysis, and uses a 24-well plate format for each run.

Growing Adoption of 3D Printing and Advanced Manufacturing Techniques Improves Innovation

The Microfluidic Components Market witnesses expanding use of 3D printing and precision manufacturing. It supports faster prototyping and reduces development timelines for new devices. Complex microchannel structures become easier to design and replicate through additive methods. Manufacturers achieve higher customization, improving flexibility for research and clinical needs. The adoption of advanced manufacturing raises efficiency and lowers production costs. This trend fosters rapid innovation across academic and commercial environments.

Expanding Role in Environmental and Food Testing Strengthens Market Reach

The Microfluidic Components Market broadens its scope with growing use in environmental and food testing. It enables detection of contaminants, pathogens, and toxins with high accuracy. Portable devices allow faster field-based testing in agricultural and water safety applications. Food manufacturers adopt microfluidic platforms to enhance quality control processes. Governments emphasize monitoring of environmental hazards, further encouraging adoption. The trend extends market presence beyond healthcare into diverse industrial sectors.

Market Challenges Analysis

High Cost of Development and Complex Manufacturing Processes Limit Wider Adoption

The Microfluidic Components Market faces strong challenges from high development costs and complex production requirements. It demands advanced equipment and precise fabrication methods that increase initial investment. Many manufacturers encounter barriers in scaling production while maintaining accuracy and consistency. Limited standardization across platforms raises costs further by requiring customized solutions. These expenses restrict adoption by small laboratories and startups with limited budgets. High cost pressure slows commercialization despite strong innovation efforts.

Regulatory Barriers and Technical Limitations Hinder Market Expansion

The Microfluidic Components Market encounters challenges from stringent regulatory approvals and unresolved technical issues. It must comply with strict healthcare and diagnostic standards, extending timelines for product launch. Many devices face difficulties with material compatibility, fluid leakage, and integration of sensors. These technical constraints reduce performance reliability in real-world applications. Regulatory delays also affect investor confidence, lowering funding for emerging companies. The combination of technical and compliance barriers limits faster expansion across global regions.

Market Opportunities

Expanding Role in Emerging Healthcare Applications Creates Strong Growth Pathways

The Microfluidic Components Market presents opportunities through its rising role in emerging healthcare applications. It supports growth in areas such as organ-on-chip models, cancer diagnostics, and infectious disease monitoring. These applications demand high precision and smaller sample volumes, which microfluidics delivers effectively. Hospitals and laboratories are adopting microfluidic platforms to meet the need for rapid, reliable testing. Growing investment in personalized and precision medicine further expands market potential. Strong government and private funding in biomedical research accelerates commercialization of innovative devices.

Increasing Industrial and Environmental Applications Broaden Market Scope

The Microfluidic Components Market gains opportunities from rising adoption across industrial and environmental sectors. It offers efficient solutions for water quality monitoring, chemical analysis, and food safety testing. Portable devices make on-site testing faster and more accurate, strengthening adoption in agriculture and environmental management. Manufacturers in food and beverage industries invest in microfluidic technologies to improve quality control. Expansion beyond healthcare diversifies revenue streams and reduces dependency on a single sector. Growing interest from industries in cost-efficient testing platforms strengthens long-term growth prospects.

Market Segmentation Analysis:

By Product

The Microfluidic Components Market is segmented by product into microfluidic-based devices and microfluidic components. Microfluidic-based devices hold strong demand due to their integration in diagnostics, drug discovery, and life sciences research. They support high-throughput screening, point-of-care testing, and lab-on-chip solutions, which are increasingly used in hospitals and research institutions. Microfluidic components, such as pumps, valves, and sensors, form the backbone of system performance. These components enable accuracy, fluid control, and scalability for diverse applications. Growing demand for reliable and customizable components drives innovation and strengthens adoption across industries.

- For Instance, The system is explicitly marketed to streamline real-time PCR workflows and produce up to 46,080 datapoints per 8-hour shift. The Biomark X9 is also capable of producing up to 384 barcoded libraries per day for Next-Generation Sequencing (NGS) needs.

By Material

The market is segmented by material into silicon and glass. Silicon dominates due to its durability, high thermal conductivity, and compatibility with semiconductor fabrication techniques. It enables miniaturized designs that improve efficiency and accuracy in complex biological processes. Glass holds significant potential due to its chemical stability, optical transparency, and suitability for applications requiring strong chemical resistance. It supports advanced imaging techniques and precision diagnostics in medical research. Manufacturers leverage material strengths to meet the varied requirements of healthcare, industrial, and environmental applications. Growing interest in hybrid platforms combining multiple materials further strengthens opportunities.

- For Instance, Bio-Rad’s Experion™ system, microfluidic chips are built with glass plates etched with microchannels then bonded to plastic wells; these chips use sample volumes as low as 1 µL for RNA/DNA analysis.

By Application

The Microfluidic Components Market is segmented by application into medical and non-medical. The medical segment leads due to extensive use in diagnostics, drug development, and personalized medicine. It supports advancements in oncology, infectious disease monitoring, and genomics, where accuracy and speed are critical. Non-medical applications include food safety, chemical testing, and environmental monitoring. These areas benefit from portable, cost-effective solutions that enable real-time analysis outside laboratory settings. Growth in non-medical use cases broadens the scope of microfluidics and diversifies revenue opportunities. Strong demand across both segments ensures sustained expansion of the industry.

Segments:

Based on Product:

- Microfluidic-based Devices

- Microfluidic Components

Based on Material:

Based on Application:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounted for the largest share of the Microfluidic Components Market with nearly 38% in 2023. The United States dominates within this region due to its advanced healthcare infrastructure, strong research ecosystem, and a large presence of biotechnology and pharmaceutical companies. The demand for diagnostic devices, point-of-care solutions, and lab-on-chip platforms continues to expand, fueled by high healthcare expenditure and an increasing focus on precision medicine. Academic institutions and research laboratories also contribute significantly through strong R&D initiatives. Government support and favorable regulatory frameworks provide further encouragement to device manufacturers. Canada complements the U.S. with growing adoption in medical diagnostics and healthcare modernization programs, although at a smaller scale. The combination of established industry leaders, innovation-driven startups, and advanced clinical adoption makes North America a consistent growth hub for microfluidic technologies.

Europe

Europe held a market share of 20% in 2023, reflecting its strong base in precision engineering, medical technology, and regulatory compliance. Countries such as Germany, the United Kingdom, and France lead adoption with advanced diagnostic infrastructure and investment in research projects. The region benefits from strict healthcare standards that encourage manufacturers to develop highly reliable and safe devices. Universities and research centers in Europe have been at the forefront of innovations in microfluidic materials such as glass and silicon, which enhance the accuracy of diagnostics and analytical applications. Pharmaceutical companies in this region also integrate microfluidics into drug development pipelines to improve efficiency and reduce costs. While the growth rate is slower compared to Asia Pacific, Europe maintains a steady position with strong value contribution per device. Its focus on sustainable manufacturing, medical innovation, and advanced laboratory solutions continues to strengthen its share in the global market.

Asia Pacific

Asia Pacific captured nearly 30% of the global Microfluidic Components Market in 2023, and it is expected to show the fastest growth among all regions. China, Japan, India, and South Korea play a major role, driven by heavy investments in healthcare infrastructure, diagnostics, and life sciences. Governments across the region encourage domestic manufacturing of medical technologies, reducing dependence on imports and driving cost competitiveness. The large population base, rising chronic disease burden, and increasing awareness of early diagnosis create strong demand for microfluidic devices and components. Pharmaceutical and biotechnology companies across Asia Pacific adopt microfluidic platforms for high-throughput drug testing, cancer research, and personalized medicine. Japan and South Korea are recognized for their precision engineering and advanced manufacturing capabilities, while China and India provide cost-effective production and large-scale adoption potential. This mix of technological strength and large-scale demand positions Asia Pacific as the most dynamic growth region in the market.

Latin America

Latin America represented nearly 6% of the total Microfluidic Components Market share in 2023, with Brazil and Mexico standing out as the leading countries. These nations invest in healthcare modernization and diagnostic infrastructure, which supports gradual adoption of microfluidic platforms. Public health challenges such as infectious diseases and the need for affordable diagnostic tools drive demand for point-of-care devices. The region, however, faces limitations in terms of high costs of advanced technologies and a lack of widespread research facilities compared to North America and Europe. Still, partnerships with global players and the growing presence of multinational pharmaceutical companies in the region create favorable conditions for adoption. Brazil’s expanding biotech sector and Mexico’s role as a manufacturing base for medical devices position Latin America for moderate but steady growth. Rising awareness of early diagnosis and growing private investment in healthcare will further encourage uptake of microfluidic systems across the region.

Middle East & Africa

The Middle East & Africa accounted for nearly 6% of the global Microfluidic Components Market share in 2023, reflecting a smaller but developing role in global adoption. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are emerging as key markets due to growing healthcare investments and research initiatives. Governments in the Middle East invest heavily in advanced medical technologies as part of broader strategies to modernize healthcare infrastructure. South Africa leads adoption in the African continent, particularly in diagnostics and disease monitoring. Despite these efforts, the region faces challenges such as limited infrastructure, affordability issues, and regulatory complexities that slow widespread adoption. International collaborations and partnerships with global companies are helping to bridge gaps in technology access. Over the coming years, demand for affordable, portable diagnostic devices is expected to grow, making the region an important area of long-term opportunity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qiagen N.V.

- Danaher

- Abbott Laboratories

- Agilent Technologies, Inc.

- Hoffmann-La Roche Ltd

- Fluidigm Corporation

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Perkinelmer, Inc.

- Life Technologies Corporation

Competitive Analysis

The competitive landscape of the Microfluidic Components Market players include Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Inc., Life Technologies Corporation, Danaher, Bio-Rad Laboratories, Inc., Hoffmann-La Roche Ltd, Abbott Laboratories, Fluidigm Corporation, and Qiagen N.V. The Microfluidic Components Market shows intense competition driven by rapid technological innovation and diverse application needs. Companies focus on advancing device performance, integrating automation, and enabling miniaturization to meet rising demand in diagnostics, life sciences, and environmental testing. Strong emphasis is placed on precision, speed, and cost efficiency, which define product differentiation and customer adoption. Strategic collaborations with research institutes and healthcare providers help expand application scope and accelerate commercialization. Investments in research and development remain central to sustaining competitiveness, while global expansion into emerging markets supports long-term growth. The landscape is shaped by continuous innovation, regulatory compliance, and the pursuit of broader market penetration across medical and non-medical sectors.

Recent Developments

- In December 2024, Dapu Biotechnology (DPBIO) and Leveragen announced a strategic partnership to advance antibody discovery. DPBIO’s Cytospark platform utilizes droplet microfluidics to rapidly screen millions of single cells, reducing antibody discovery timelines from months to just 1-2 days.

- In November 2024, Parallel Fluidics secured a seed round to accelerate the development of its microfluidic manufacturing platform for life science applications. The company aims to solve engineering challenges in diagnostics, drug discovery, and precision medicine by delivering production-ready devices, reducing development time and cost.

- In June 2024, Bio-Rad Laboratories launched Celselect Slides 2.0, a microfluidics-based solution designed to enhance the capture of rare and circulating tumor cells (CTCs) for cancer research. The upgrade leverages the power of microfluidic technology to drive advancements in cancer research by enabling higher throughput and better recovery of valuable CTCs.

- In May 2024, Takara Bio USA Inc. introduced the dissolvable microfluidic transduction enhancer Lenti-X Transduction Sponge, which is incorporated with in vitro lentivirus-mediated gene delivery techniques. This sponge streamlines the workflow and provides high transduction efficiency in any cell type, facilitating downstream research applications in the gene and cell therapy domain.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for point-of-care diagnostics.

- It will gain traction from growing applications in personalized medicine.

- Advancements in automation will enhance accuracy and efficiency of devices.

- Research adoption will increase with wider use in genomics and proteomics.

- Miniaturized and portable systems will support decentralized healthcare growth.

- Integration with artificial intelligence will strengthen data analysis capabilities.

- Adoption will rise in environmental monitoring and food safety testing.

- Investments in drug discovery will drive broader usage across pharmaceuticals.

- Cost reduction strategies will make devices more accessible in emerging markets.

- Global collaborations will accelerate innovation and regulatory compliance.

Market Trends

Market Trends