Market Overview:

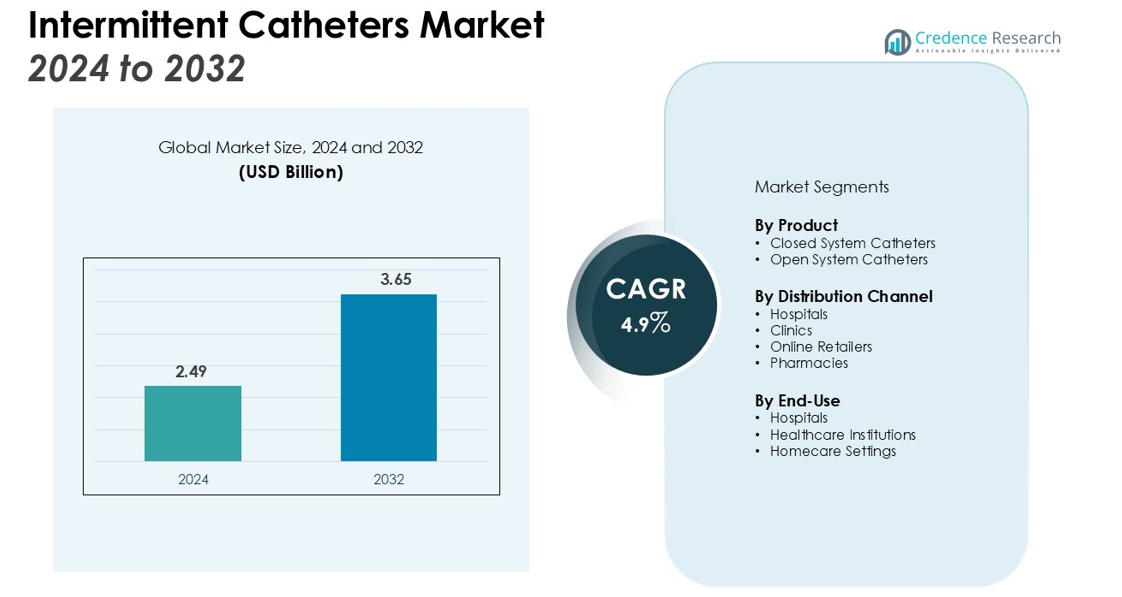

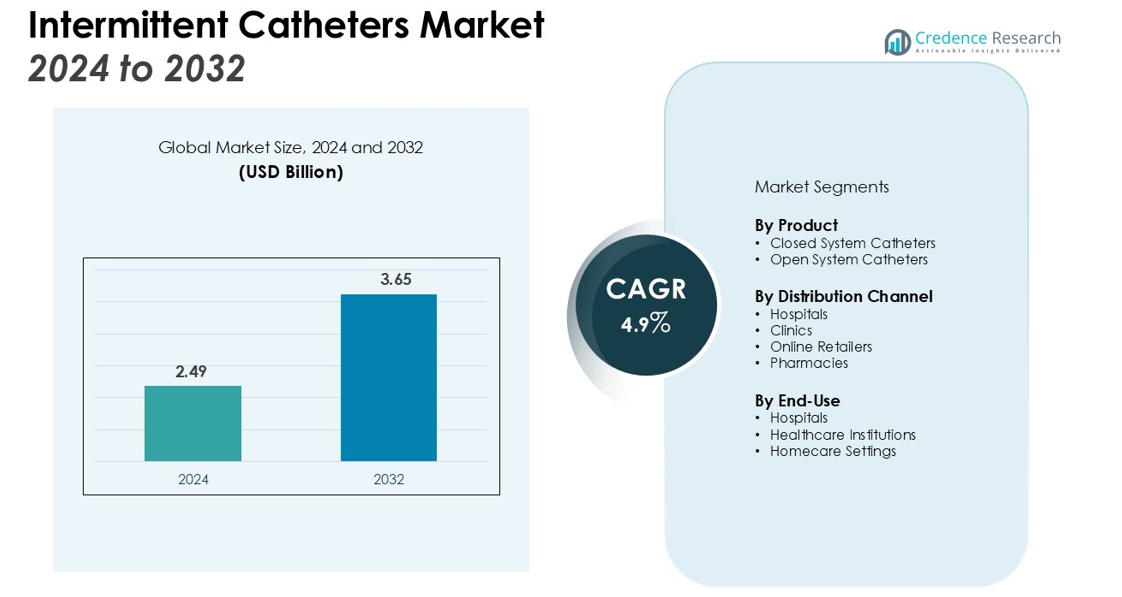

The Intermittent Catheters Market size was valued at USD 2.49 billion in 2024 and is anticipated to reach USD 3.65 billion by 2032, at a CAGR of 4.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intermittent Catheters Market Size 2024 |

USD 2.49 billion |

| Intermittent Catheters Market , CAGR |

4.9% |

| Intermittent Catheters Market Size 2032 |

USD 3.65 billion |

Key drivers of the market include an aging global population, which leads to a higher incidence of conditions that necessitate urinary catheters, such as prostate enlargement, multiple sclerosis, and stroke. Additionally, advancements in catheter materials, such as hydrophilic coatings that reduce discomfort and the risk of infections, are boosting market growth. The introduction of user-friendly, single-use, and eco-friendly intermittent catheters further supports the market’s expansion. Furthermore, increasing preference for homecare settings over hospital stays is driving the demand for these devices.

Geographically, North America holds the largest market share due to well-established healthcare systems and rising healthcare expenditure. Europe follows closely, with an increasing demand for advanced healthcare solutions. The Asia Pacific region is expected to witness the highest growth during the forecast period, attributed to improving healthcare infrastructure and increasing awareness in emerging economies like India and China.

Market Insights:

- The Intermittent Catheters Market is projected to grow from USD 2.49 billion in 2024 to USD 3.65 billion by 2032, at a CAGR of 4.9%.

- An aging global population is driving the demand for urinary catheters due to higher incidences of conditions like prostate enlargement and multiple sclerosis.

- Technological advancements, such as hydrophilic coatings, reduce discomfort and infection risks, making intermittent catheters safer and more comfortable.

- Increasing patient preference for homecare settings is fueling demand for easy-to-use and disposable intermittent catheters.

- Regulatory barriers and high production costs for advanced catheter designs are limiting market adoption, especially in cost-sensitive regions.

- Asia Pacific is expected to witness the highest market growth due to rising healthcare investments and an aging population in countries like China and India.

- North America holds the largest market share of 40%, supported by strong healthcare infrastructure, high spending, and technological adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Aging Population and Increased Prevalence of Chronic Diseases

The growing global aging population is a significant driver for the Intermittent Catheters Market. As people age, they are more likely to experience medical conditions such as prostate enlargement, multiple sclerosis, and stroke, which often necessitate the use of urinary catheters. These chronic conditions increase the demand for intermittent catheters as a long-term management solution for urinary retention and incontinence.

Technological Advancements in Catheter Design

Advancements in catheter materials and designs have played a critical role in boosting market growth. Modern intermittent catheters are equipped with hydrophilic coatings, which reduce friction and discomfort during insertion. These innovations also help minimize the risk of infections, providing a safer and more comfortable experience for patients. The availability of easy-to-use designs encourages more patients to adopt this solution for managing urinary conditions.

- For instance, Hollister’s Infyna Chic™ catheter features a hydrophilic coating that is ready to use and comes in a discrete, 5.5-inch-long case, which enhances convenience and user comfort.

Shift Toward Homecare Settings

There is a notable shift from hospital-based care to homecare for patients requiring urinary management. Intermittent catheters are increasingly being used in homecare settings due to their ease of use, disposable nature, and the growing trend of patient autonomy in healthcare. This shift has accelerated demand, particularly for single-use and compact catheters that are suitable for personal use at home.

- For instance, Teleflex’s Rüsch® MMG H2O® closed system includes a 1300 mL collection bag, allowing for a complete and self-contained catheterization process at home, which can reduce the risk of UTIs.

Rising Healthcare Awareness and Accessibility

Increasing awareness of urological health and improved access to healthcare services are contributing to the growth of the Intermittent Catheters Market. Public education on urinary conditions, along with better access to healthcare products and devices, encourages more people to seek appropriate treatments. Enhanced awareness, especially in emerging economies, continues to drive adoption and use of intermittent catheters globally.

Market Trends:

Growing Demand for Eco-Friendly and Single-Use Catheters

A significant trend in the Intermittent Catheters Market is the rising demand for eco-friendly and single-use devices. The healthcare industry is increasingly focusing on reducing environmental impact, driving manufacturers to develop sustainable and biodegradable catheter solutions. Single-use catheters, made from materials that minimize the risk of infections and contamination, are growing in popularity due to their convenience and safety. This shift aligns with global sustainability initiatives and the increased emphasis on minimizing healthcare-associated risks. Manufacturers are responding to consumer preferences by producing more environmentally friendly products without compromising on performance or patient comfort.

- For instance, Johnson & Johnson’s single-use medical device recycling program successfully recycled components from more than 25,000 of its products in Europe between 2021 and 2022, helping to keep valuable materials in the circular economy.

Advancements in Smart Catheters and Digital Integration

The integration of digital technology into intermittent catheter systems is another emerging trend in the market. Manufacturers are developing smart catheters equipped with sensors that monitor usage, fluid flow, and pressure, providing real-time feedback to patients and healthcare providers. These innovations enhance patient safety and comfort while offering better management of urinary conditions. The growing adoption of digital health solutions is pushing the market toward more intelligent devices that contribute to efficient healthcare delivery. With the incorporation of telemedicine and remote monitoring, these smart devices help patients manage their conditions more effectively and reduce hospital visits.

- For instance, in August 2021, Freudenberg Medical expanded its sensor integration capabilities for catheter manufacturing, incorporating technology for at least 3 types of sensors, including temperature, pressure, and fiber optic sensors.

Market Challenges Analysis:

Risk of Infection and Complications

One of the primary challenges facing the Intermittent Catheters Market is the risk of infections and other complications associated with catheter use. Although advancements in materials and coatings have minimized some of these risks, catheter-associated urinary tract infections (CAUTIs) remain a significant concern. Patients are at risk of developing infections due to improper usage, lack of hygiene, or prolonged catheterization. Manufacturers continue to focus on developing safer, more effective solutions, but the challenge of minimizing infections persists, especially in healthcare settings where patient management is critical.

Regulatory and Cost Constraints

Regulatory hurdles and cost limitations also impact the Intermittent Catheters Market. Stringent regulations for medical devices require compliance with safety and performance standards, which can delay product approval and market entry. High production costs, especially for advanced catheter designs and smart catheter technologies, can limit adoption in price-sensitive regions. Patients and healthcare providers often face financial barriers when seeking high-quality, innovative solutions, further limiting market growth. Cost-effectiveness remains a key factor for broader adoption, particularly in emerging markets.

Market Opportunities:

Expansion in Emerging Markets

The Intermittent Catheters Market holds significant opportunities in emerging economies, where healthcare infrastructure is improving rapidly. Increasing urbanization, better access to healthcare products, and rising awareness about urological health are contributing to the growth of the market in regions like Asia Pacific, Latin America, and the Middle East. As healthcare standards rise in these regions, there is greater demand for effective, affordable solutions for managing chronic urological conditions. The expanding middle class in these regions also opens doors for more people to access high-quality intermittent catheters, boosting market growth.

Growing Demand for Homecare Solutions

The growing trend toward homecare presents an opportunity for the Intermittent Catheters Market. With more patients opting for home-based care, especially for chronic conditions, there is an increasing need for user-friendly and disposable catheter products. Patients seek solutions that provide comfort, safety, and convenience in a home setting. This trend drives demand for portable and easy-to-use intermittent catheters that can be managed independently. As the preference for home healthcare increases globally, it presents a lucrative opportunity for companies to innovate and expand their product offerings to cater to this growing segment.

Market Segmentation Analysis:

By Product

The market is primarily divided into two product categories: closed system catheters and open system catheters. Closed system catheters are designed for easy and hygienic use, reducing the risk of infection, which makes them increasingly popular among patients and healthcare providers. Open system catheters, on the other hand, are cost-effective but require more manual handling. The preference for closed system catheters is expected to drive market growth due to their added convenience and safety features.

By Distribution Channel

The Intermittent Catheters Market is distributed through hospitals, clinics, online retailers, and pharmacies. Hospitals and clinics remain the primary distribution channels, driven by the demand from healthcare professionals for sterile and safe catheterization solutions. However, the rise in e-commerce and online pharmacies is contributing significantly to the market’s growth. Consumers are opting for the convenience of purchasing catheters online, making this channel increasingly popular, especially in regions with strong internet penetration.

- For instance, Boston Scientific supplies highly specialized catheters to hospitals, such as its Site Selective Pacing Catheter, which has a working length of 40 cm and is intended to introduce pacing leads in cardiovascular procedures.

By End-Use

The primary end-users of intermittent catheters are individuals requiring long-term care for conditions such as spinal cord injuries, neurological disorders, and urinary retention. Hospitals and healthcare institutions are the leading end-users due to their infrastructure for patient care. However, the growing shift toward homecare settings is expanding the market, as more patients opt for independent management of their conditions. Homecare adoption will continue to accelerate the demand for disposable and user-friendly intermittent catheters.

- For instance, Hollister Incorporated addresses the homecare market with its VaPro Plus Pocket™ intermittent catheter, which provides a completely no-touch system that includes an integrated 1000ml collection bag for convenient self-catheterization anywhere.

Segmentations:

By Product:

- Closed System Catheters

- Open System Catheters

By Distribution Channel:

- Hospitals

- Clinics

- Online Retailers

- Pharmacies

By End-Use:

- Hospitals

- Healthcare Institutions

- Homecare Settings

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

North America holds the largest share of the Intermittent Catheters Market, accounting for 40%. This dominance is due to well-established healthcare infrastructure, high healthcare spending, and advanced technological adoption. The U.S. and Canada continue to lead the market, driven by a growing aging population and the prevalence of chronic conditions that require catheterization. The region benefits from strong healthcare policies, which support the availability and accessibility of advanced medical devices. The presence of key market players in North America also fosters innovation and product development, further strengthening its market position.

Europe

Europe accounts for 30% of the Intermittent Catheters Market share, with strong healthcare systems and a focus on patient care and urological health. The rising prevalence of age-related diseases, such as prostate enlargement and stroke, contributes to the demand for intermittent catheters. Countries like Germany, the UK, and France are key contributors to market growth. Regulations focusing on quality standards and safety also drive the development of more effective and safer catheter solutions. Europe’s commitment to improving healthcare access and reducing hospital-associated infections promotes the adoption of advanced catheter technologies.

Asia Pacific

The Asia Pacific region holds 20% of the Intermittent Catheters Market share and is expected to experience the highest growth in the forecast period. Factors such as rising healthcare investments, improving medical infrastructure, and increasing healthcare awareness in countries like China, India, and Japan are major drivers. The growing incidence of chronic diseases in this region, combined with a large aging population, fuels the demand for urological products like intermittent catheters. As healthcare accessibility improves and patient education increases, the market is poised for rapid expansion in these emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Intermittent Catheters Market is highly competitive, with key players like Coloplast, ConvaTec, B. Braun Melsungen AG, BD (Becton Dickinson), Medtronic, and Hollister Incorporated leading the market. These companies maintain strong positions through extensive product portfolios, large distribution networks, and continuous investments in research and development. Innovations such as ConvaTec’s GentleCath Air catheter and Coloplast’s expanded manufacturing capabilities address specific patient needs, while emerging companies like Hunter Urology and Pennine Healthcare focus on niche markets. Competitive strategies include adopting advanced materials, improving product comfort and safety, and integrating digital health technologies. The market remains dynamic, driven by continuous product innovations and regulatory compliance.

Recent Developments:

- In July 2025, Hollister Incorporated announced an €80 million investment in its facility in Ballina, County Mayo, Ireland, to support research and development as well as digital transformation, creating approximately 50 new positions.

- In February 2025, Teleflex Incorporated announced its intention to separate into two independent, publicly traded companies, with one company focusing on its Urology, Acute Care, and OEM businesses.

- In September 2025, Medline UNITE is scheduled to launch its new FORCECORD™ and DEXLOCK® Achilles repair systems at the American Orthopedic Foot and Ankle Society (AOFAS) Annual Meeting.

Report Coverage:

The research report offers an in-depth analysis based on Product, Distribution Channel, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for intermittent catheters will continue to grow due to the rising prevalence of chronic conditions, such as prostate enlargement, multiple sclerosis, and stroke.

- Technological advancements in catheter materials, including hydrophilic coatings and biocompatible designs, will enhance patient comfort and safety.

- The shift towards homecare settings will drive growth, as more patients seek convenient and user-friendly solutions for managing urinary retention and incontinence.

- Increasing healthcare awareness globally will lead to higher adoption rates, especially in emerging economies.

- Strong growth in online sales and e-commerce platforms will make catheters more accessible to patients in both developed and developing regions.

- The development of eco-friendly and disposable catheters will address sustainability concerns, further driving adoption.

- Increased focus on patient education and self-care will empower individuals to manage their conditions independently, creating a larger market for home-use devices.

- North America will continue to dominate the market, with significant contributions from healthcare infrastructure and high healthcare spending.

- Asia Pacific is expected to witness rapid market expansion, driven by improving healthcare infrastructure and a growing aging population in countries like India and China.

- Partnerships between catheter manufacturers and healthcare providers will foster innovations and expand market reach, particularly in developing regions.