Market Overview

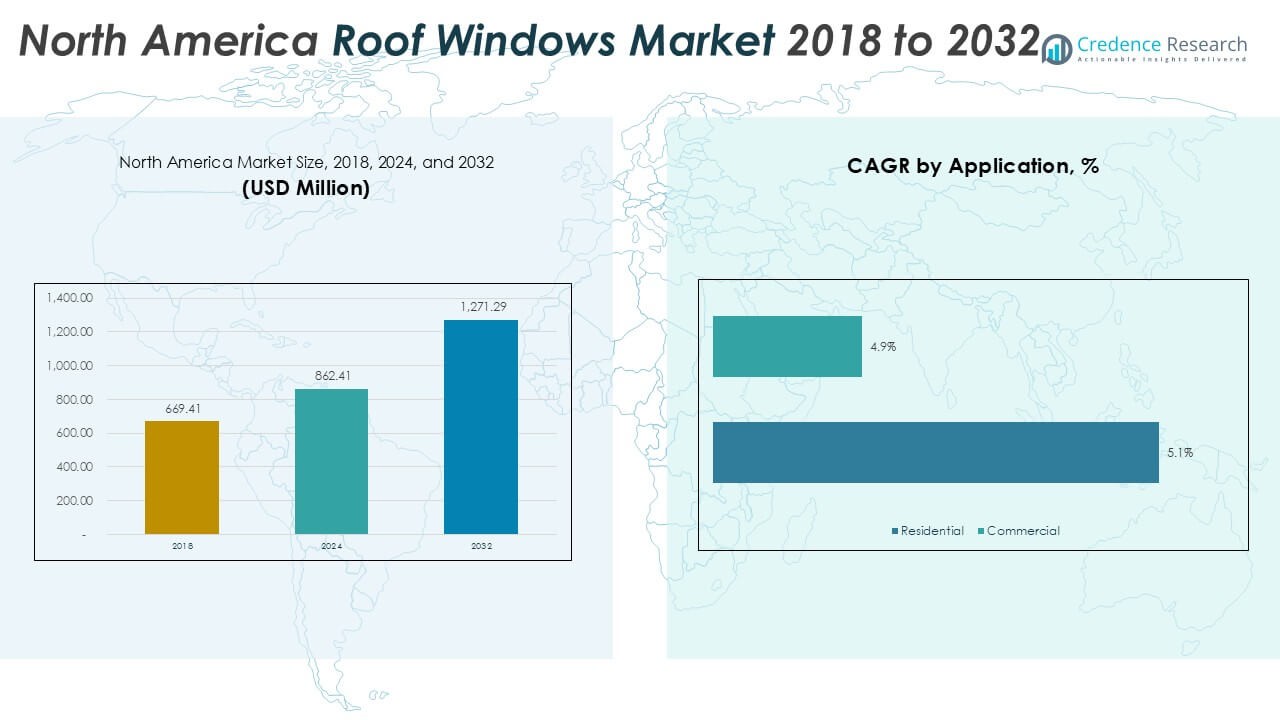

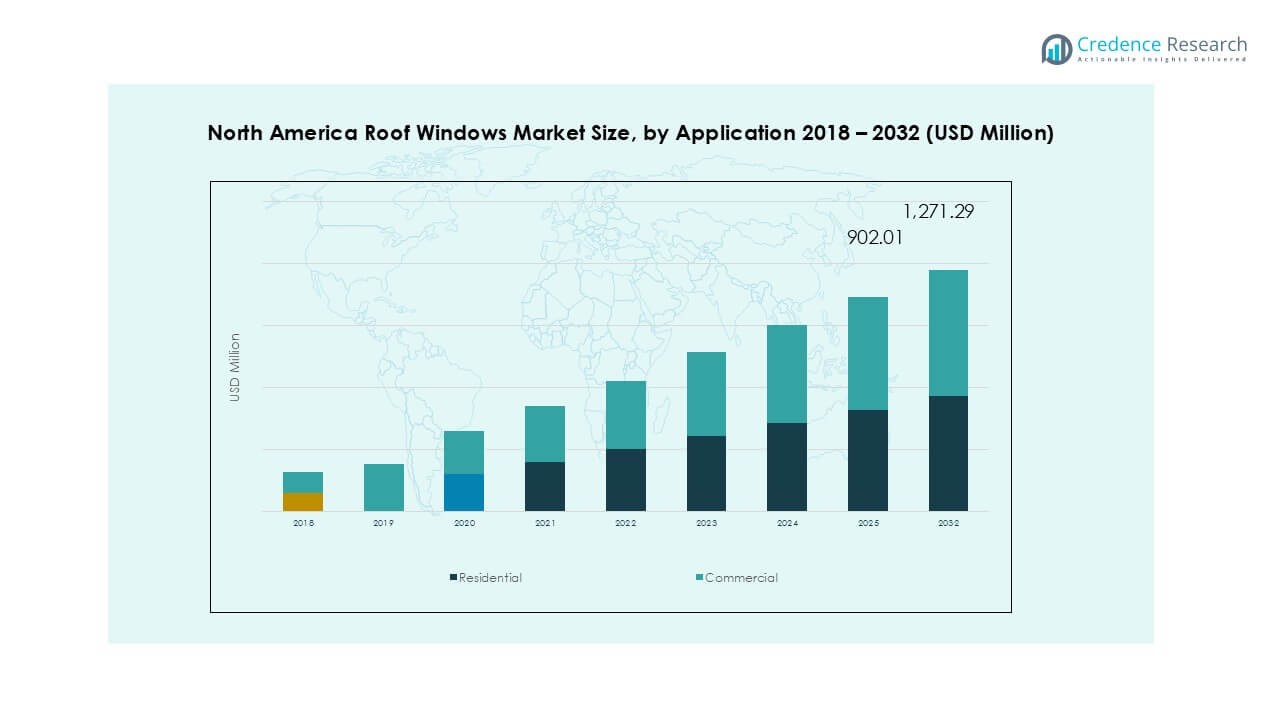

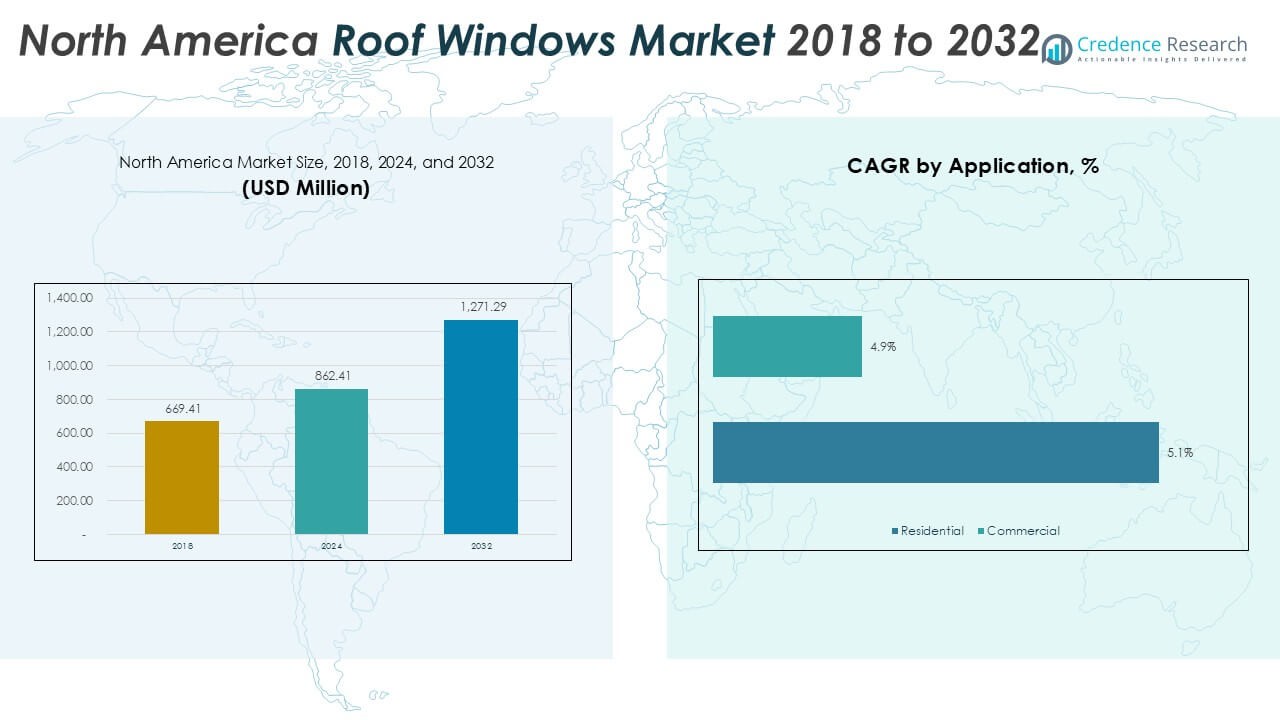

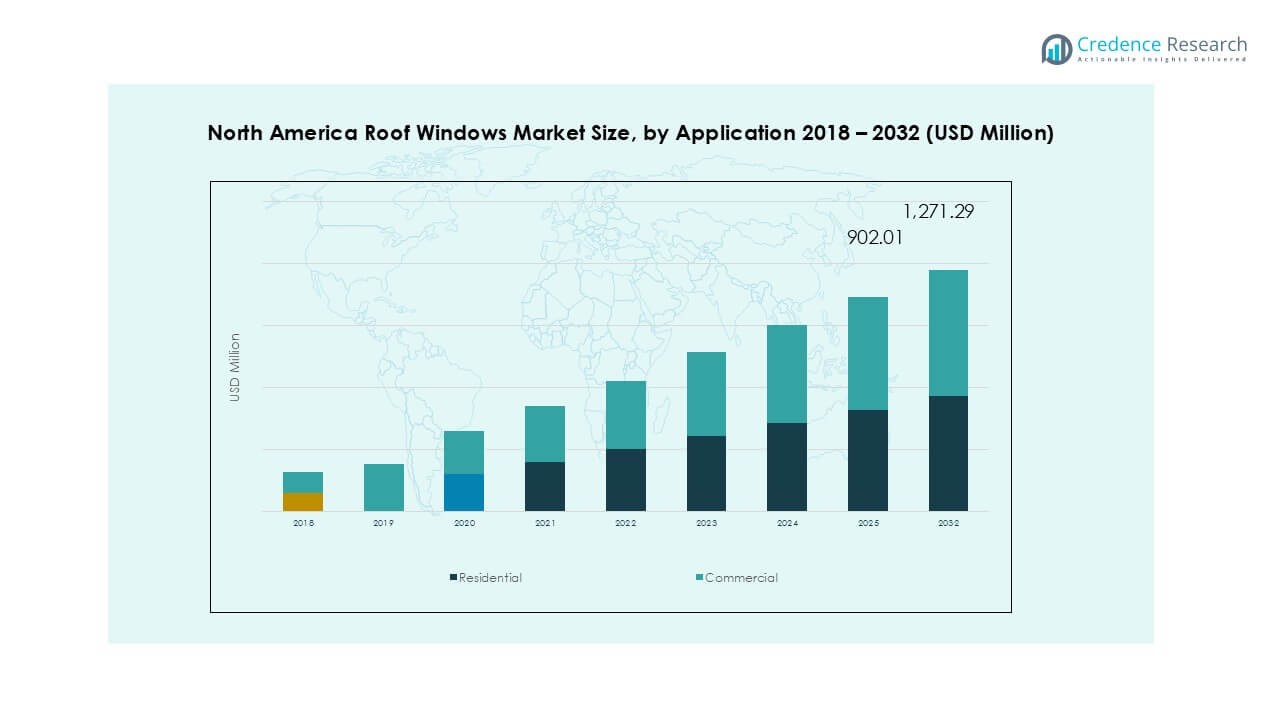

The North America Roof Windows market size was valued at USD 669.41 million in 2018, grew to USD 862.41 million in 2024, and is anticipated to reach USD 1,271.29 million by 2032, at a CAGR of 5.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Roof Windows Market Size 2024 |

USD 862.41 Million |

| North America Roof Windows Market, CAGR |

5.0% |

| North America Roof Windows Market Size 2032 |

USD 1,271.29 Million |

The North America roof windows market is led by Velux Group, Fakro, and Roto Frank AG, which dominate through strong distribution networks and advanced product portfolios. Other notable players include Keylite Roof Windows, Sunlux Roof Windows, Lamilux, Pella Corporation, and Marco Skylights, offering competitive solutions across residential and commercial segments. The United States accounts for over 70% of the regional market share, driven by high demand for energy-efficient construction and remodeling projects. Canada contributes around 20%, supported by triple-glazing adoption in cold climates, while Mexico holds close to 10%, showing steady growth with urbanization and new housing developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America roof windows market was valued at USD 862.41 million in 2024 and is projected to reach USD 1,271.29 million by 2032, growing at a CAGR of 5.0%.

- Rising demand for energy-efficient homes, supported by tax incentives and green building programs, drives adoption of double- and triple-glazed roof windows.

- Key trends include smart, automated roof windows with rain sensors and solar-powered operation, along with growing use of eco-certified wood and recyclable materials.

- The market is moderately consolidated, with leading players like Velux Group, Fakro, and Roto Frank AG holding significant shares, while regional players compete with affordable, customizable solutions.

- The United States leads with over 70% share, followed by Canada with around 20% and Mexico with close to 10%; by type, wood holds over 40% share, while double glazing accounts for more than 55% of installations across the region.

Market Segmentation Analysis:

By Type

Wood dominates the North America roof windows market, holding over 40% share in 2024. Its popularity stems from natural aesthetics, strong insulation properties, and compatibility with traditional housing styles. Manufacturers offer advanced wood coatings that improve moisture resistance and extend service life. Polyurethane (PU) windows follow, driven by demand for low-maintenance and energy-efficient solutions. PVC and metal types gain traction in urban settings where durability and affordability are key. Rising use of sustainable, certified wood materials supports market growth, aligning with green building standards and eco-friendly construction practices across residential and light commercial projects.

- For instance, VELUX uses 100% FSC-certified wood in its products, including the pine used for its wood-framed roof windows, to meet its sustainability standards.

By Application

Residential applications lead the market, accounting for more than 65% share in 2024. The segment benefits from rising demand for natural light and improved ventilation in homes. Homeowners adopt roof windows to enhance interior comfort and reduce dependence on artificial lighting. Government incentives for energy-efficient renovations and growing interest in passive houses also fuel adoption. Commercial applications expand steadily in offices, educational buildings, and healthcare facilities seeking better daylighting solutions. Integration of smart automation features, including rain sensors and remote operation, supports growth in both new construction and retrofit projects.

- For instance, FAKRO introduced electrically operated roof windows with solar-powered controls, increasing adoption in smart home retrofits.

By Glazing Type

Double glazing holds the largest share, exceeding 55% of the market in 2024, due to its balance of thermal insulation and cost-effectiveness. It reduces heat loss, enhances energy efficiency, and complies with modern building codes. Triple glazing is gaining momentum in colder regions as stricter energy standards push for superior performance. Single glazing, while declining, remains relevant in cost-sensitive renovations and sheds. Advancements in low-emissivity coatings and gas-filled cavities are further boosting adoption of multi-glazed units. The trend toward net-zero energy buildings is expected to accelerate the shift to higher-performance glazing solutions.

Key Growth Drivers

Rising Demand for Energy-Efficient Homes

Energy-efficient construction is a major driver for roof windows in North America. Homeowners and builders prioritize solutions that reduce heating and cooling costs. Roof windows improve insulation and maximize natural light, cutting energy consumption. Incentives like tax credits and rebates under programs such as ENERGY STAR boost adoption. Growing focus on sustainable building design and net-zero energy homes strengthens demand. Manufacturers develop high-performance glazing and insulated frames to meet evolving standards, positioning roof windows as a key component of modern, eco-conscious construction projects.

- For instance, FAKRO offers triple-glazed roof windows with a Uw value of 0.97 W/m²K. FAKRO’s product catalogs confirm that certain triple-glazed roof windows, such as the FTP-V U5, have this Uw rating.

Increasing Home Renovation and Remodeling Activities

The rise in residential remodeling projects fuels significant market growth. Homeowners invest in upgrading older properties to improve aesthetics and functionality. Roof windows offer enhanced daylighting, better ventilation, and a sense of openness, making them popular in attic conversions and loft renovations. Renovation spending continues to rise across the U.S. and Canada, supported by favorable mortgage rates and increasing disposable incomes. Builders and architects promote roof windows as an easy retrofit solution, which drives their use in both single-family homes and multi-family residential units.

- For instance, in 2023, VELUX continued to provide roof window and skylight products for both new construction and retrofit projects across North America.

Technological Advancements and Smart Features

Innovation in smart and automated roof window systems supports strong growth. Manufacturers integrate features like rain sensors, solar-powered operation, and smartphone controls to improve user convenience. Automated systems enhance indoor air quality by enabling scheduled ventilation. Consumers prefer these solutions for their ability to regulate temperature and light automatically. Integration with home automation platforms such as Google Home or Amazon Alexa adds appeal. These innovations not only meet rising consumer expectations but also align with the trend toward connected, energy-efficient homes, further boosting adoption rates.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Materials

Sustainability remains a strong market trend, driving adoption of eco-certified wood and recyclable materials. Builders seek solutions that comply with LEED and other green building certifications. Manufacturers introduce water-based finishes and low-VOC coatings to meet environmental regulations. Growing awareness of the benefits of natural daylighting also supports this shift. This trend presents opportunities for players offering products with transparent environmental product declarations (EPDs). Companies focusing on lifecycle sustainability and energy-efficient glazing solutions are well positioned to capture growing demand from environmentally conscious consumers and institutional buyers.

- For instance, VELUX sources 100% of its wood from forests certified by the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC).

Growth of Smart and Automated Roof Window Solutions

The rising popularity of smart homes creates significant opportunities for automated roof windows. Consumers favor solutions that integrate with home monitoring systems and offer remote operation. Manufacturers respond with Bluetooth, Wi-Fi, and solar-powered models that eliminate manual operation. These systems provide improved comfort, reduced energy usage, and increased safety during adverse weather conditions. Demand is particularly strong in premium residential segments and high-end renovations. As technology prices become more accessible, adoption is expected to expand into mid-market and mass-market applications, driving steady market penetration.

- For instance, FAKRO has long offered Z-Wave compatible roof windows and other products that can be controlled via remote or integrated into smart home hubs.

Key Challenges

High Installation and Maintenance Costs

Roof window installation involves significant structural modifications, which increases project costs. Skilled labor shortages can further raise expenses, especially in complex roof designs. Maintenance requirements for wooden frames and multi-glazed units also add to long-term ownership costs. These factors often discourage price-sensitive homeowners from adopting roof windows. Market players address this challenge by offering prefabricated installation kits and low-maintenance frame materials, but cost remains a barrier, especially in markets with slower construction growth or where budget-conscious buyers dominate.

Limited Awareness in Developing Residential Areas

Consumer awareness about the benefits of roof windows remains limited in some regions. Many homeowners still perceive roof windows as a premium feature rather than a practical investment. Lack of education on energy savings, ventilation benefits, and available incentives restricts demand. Builders and retailers play a critical role in promoting these solutions during planning stages. Expanding marketing campaigns, showroom demonstrations, and collaboration with home improvement channels can help overcome this barrier and accelerate adoption in untapped suburban and semi-urban markets.

Regional Analysis

United States

The United States dominates the North America roof windows market with over 70% share in 2024. High demand stems from residential construction, energy-efficient renovation projects, and adoption of daylighting solutions in urban housing. Government programs promoting ENERGY STAR-certified windows drive replacement and retrofit activities. Consumers increasingly prefer double and triple-glazed roof windows to reduce heating and cooling costs. Strong presence of leading manufacturers like Velux and Fakro ensures easy product availability. Rising popularity of smart home integrations, including motorized and solar-powered roof windows, continues to strengthen market growth across single-family homes and multi-family residential developments.

Canada

Canada accounts for around 20% of the market share in 2024, supported by rising demand in both new construction and renovation projects. Extreme cold weather drives adoption of triple-glazed roof windows with superior insulation properties. Federal and provincial incentives encouraging energy-efficient retrofits further boost the market. Urban housing developments in Toronto, Vancouver, and Calgary fuel significant installation volumes. Growing awareness of the benefits of natural lighting for health and productivity also supports demand. Manufacturers expand their offerings with low-emissivity coatings and energy-efficient frames to meet Canada’s stringent building code requirements and sustainability targets.

Mexico

Mexico represents close to 10% share of the North America market in 2024, showing steady growth driven by rising residential construction and urbanization. Demand is concentrated in mid-to-high income segments seeking improved ventilation and daylighting in modern homes. Roof windows are increasingly installed in hospitality and commercial spaces such as hotels and resorts to enhance interior aesthetics. Adoption is supported by rising disposable incomes and growing awareness of energy-saving benefits. Manufacturers explore distribution partnerships and localized production to make products more affordable and accessible, further encouraging adoption in developing regions and emerging smart city projects.

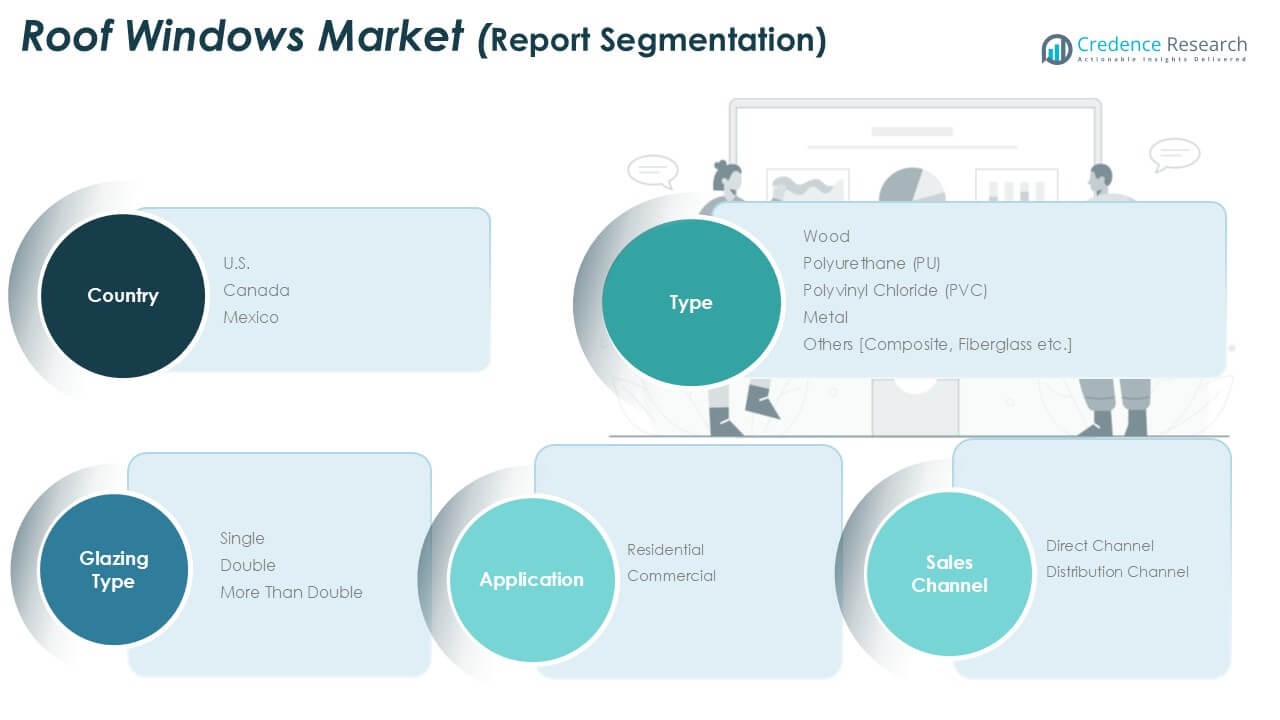

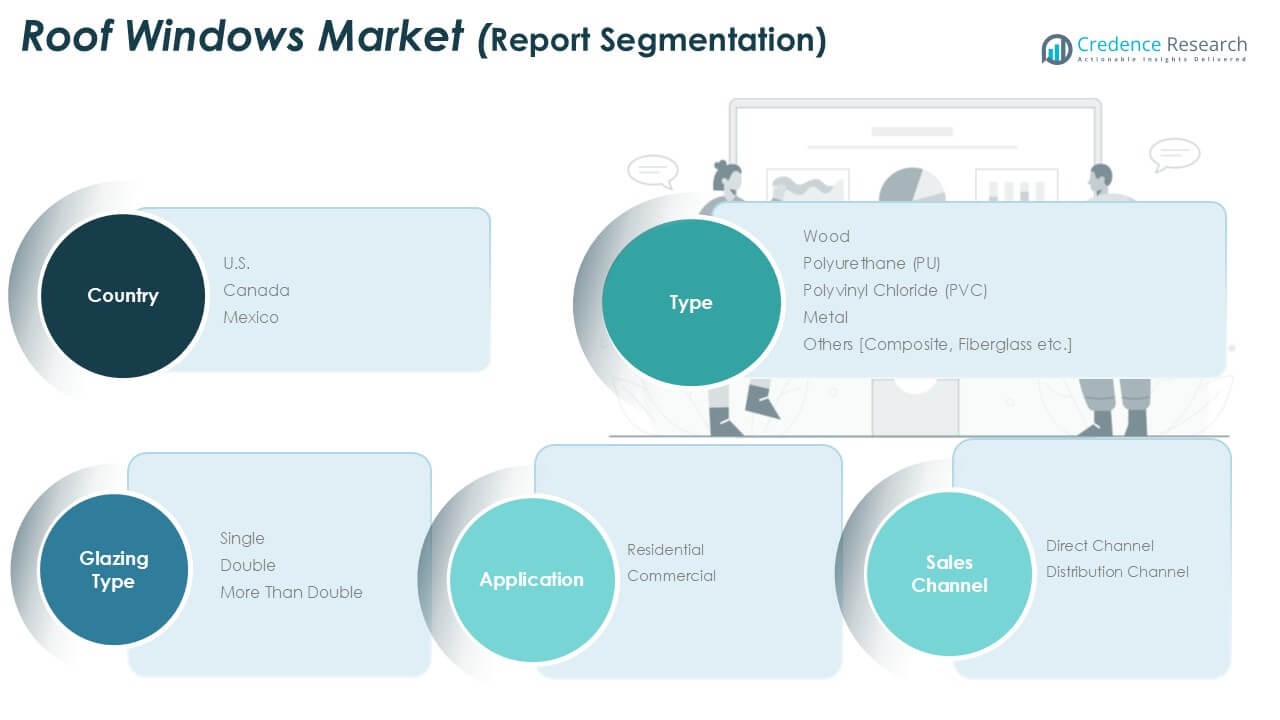

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America roof windows market is moderately consolidated, with leading players such as Velux Group, Fakro, and Roto Frank AG holding significant market share through extensive distribution networks and innovative product offerings. These companies focus on energy-efficient, double- and triple-glazed windows that meet stringent building codes and sustainability standards. Regional players like Keylite Roof Windows, Sunlux Roof Windows, and Marco Skylights strengthen competition by offering cost-effective and customizable solutions. Manufacturers invest in automation and smart control technologies, including solar-powered and app-controlled roof windows, to capture demand in premium residential and commercial projects. Strategic partnerships with builders and distributors, along with expansion of e-commerce channels, enhance market penetration. Companies are also emphasizing product differentiation through sustainable materials and low-VOC coatings to align with green building trends. Continuous R&D efforts and acquisitions remain key strategies to maintain market leadership and expand product portfolios across North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fakro

- Velux Group

- Roto Frank AG

- Sunlux Roof Windows

- Lamilux

- Keylite Roof Windows

- Skylights Plus

- Dakea

- RoofLITE

- AHRD

- Pella Corporation

- Marco Skylights

- Artistic Skylight

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient roof windows will rise with stricter building codes.

- Smart and automated roof windows will gain wider adoption in residential projects.

- Triple-glazed units will see higher demand in colder regions like Canada.

- Use of sustainable and recyclable materials will become a key differentiator.

- E-commerce and direct-to-consumer sales channels will expand product accessibility.

- Manufacturers will focus on solar-powered and app-controlled solutions for convenience.

- Renovation and retrofit projects will drive steady growth across urban markets.

- Partnerships with builders and architects will strengthen market penetration.

- Product innovation with low-maintenance frames and improved coatings will accelerate adoption.

- Rising urbanization in Mexico will create new opportunities for mid-range roof windows.