Market Overview:

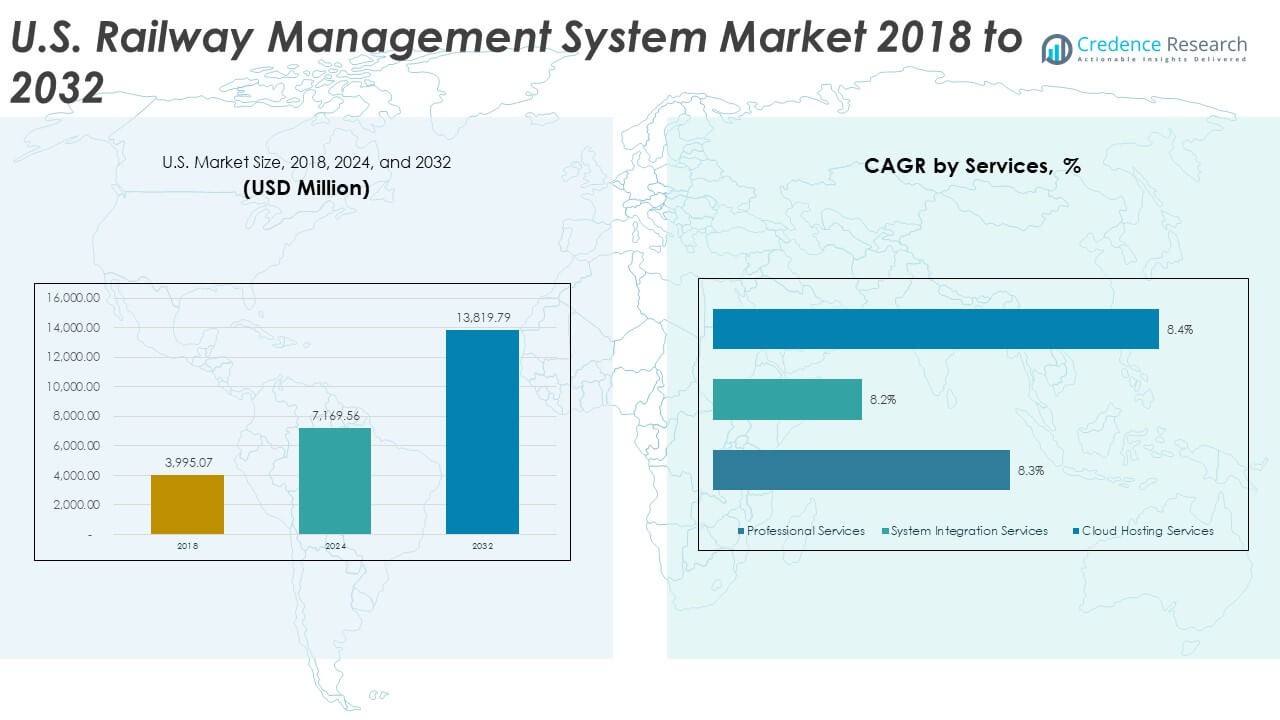

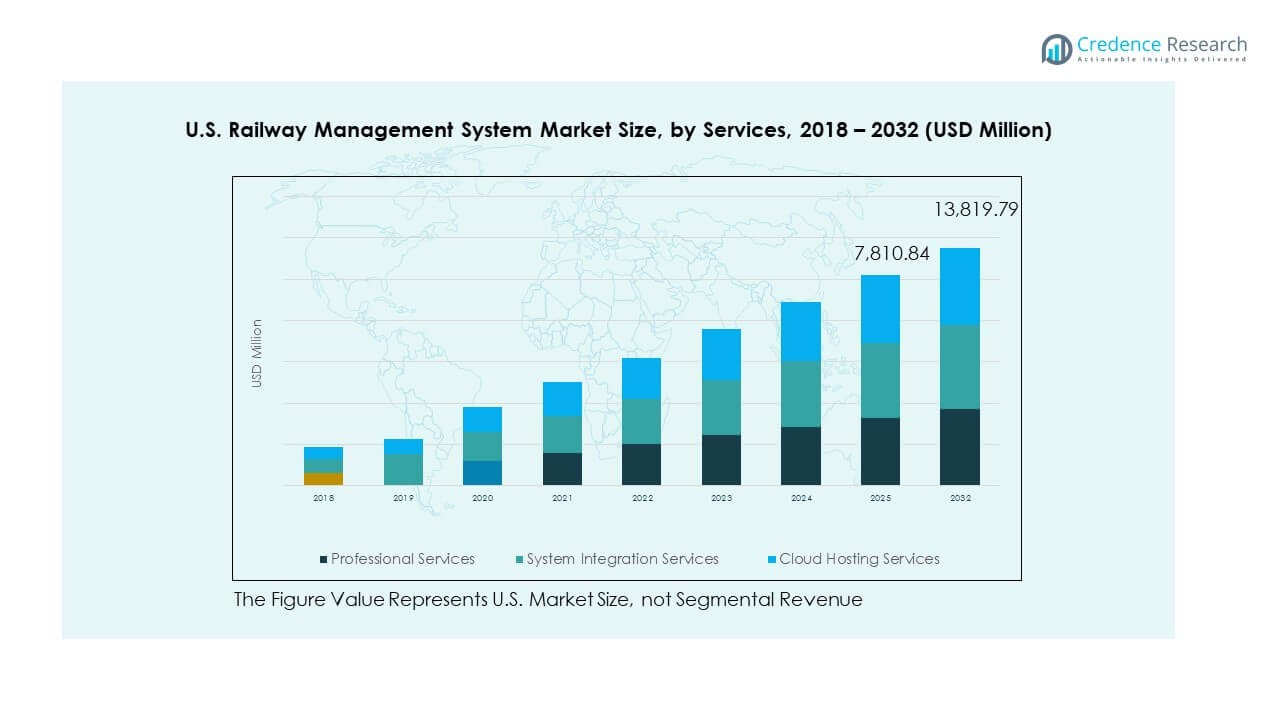

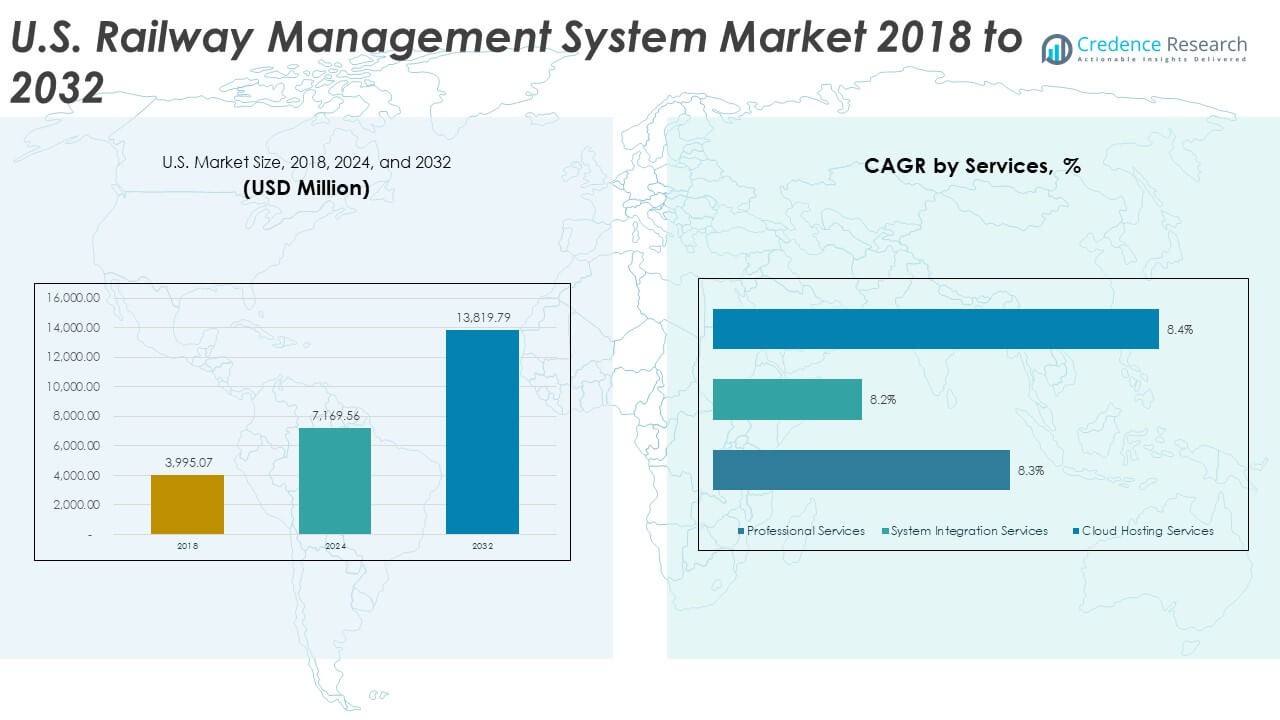

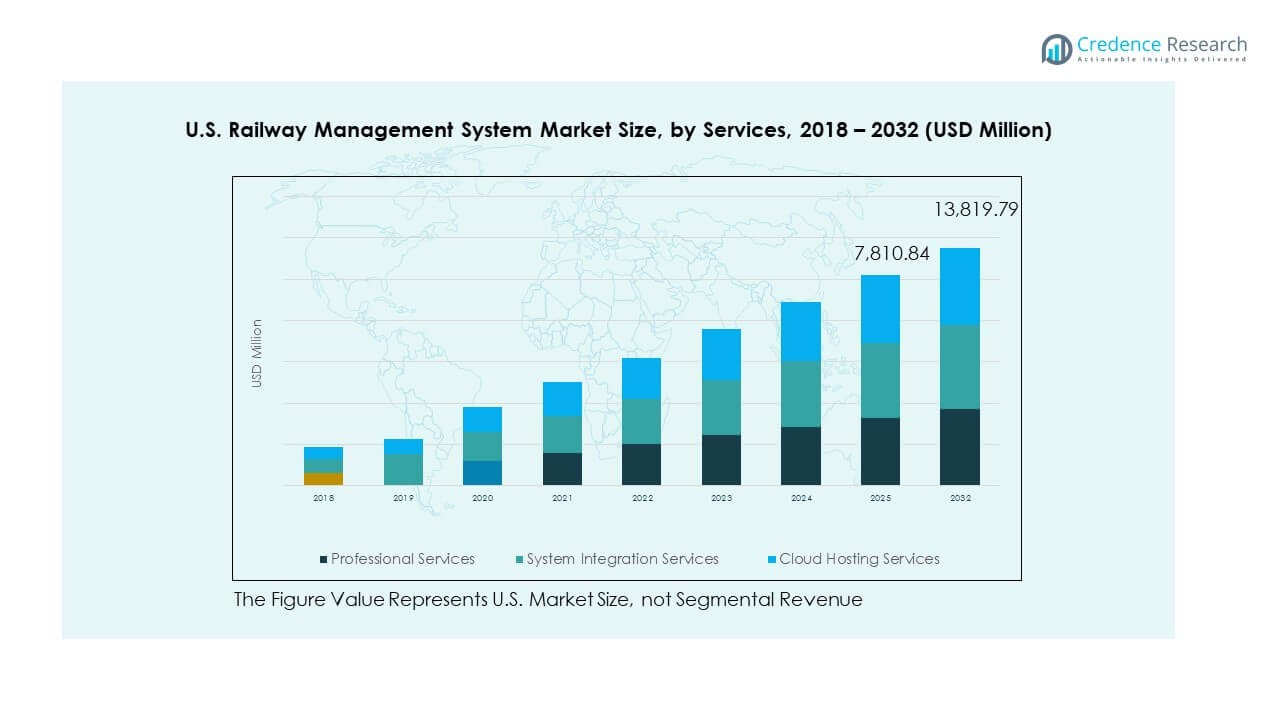

The U.S. Railway Management System Market size was valued at USD 3,995.07 million in 2018 to USD 4,424.53 million in 2024 and is anticipated to reach USD 4,894.06 million by 2032, at a CAGR of 1.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Railway Management System Market Size 2024 |

USD 4,424.53 Million |

| U.S. Railway Management System Market, CAGR |

1.27% |

| U.S. Railway Management System Market Size 2032 |

USD 4,894.06 Million |

The market is advancing due to modernization efforts across rail networks, rising demand for operational efficiency, and growing commuter expectations. Operators are integrating digital signaling, automated scheduling, and predictive maintenance to improve reliability. Investments in smart technologies, including IoT, AI, and cloud platforms, are reshaping operations. Government support through infrastructure upgrades also drives adoption of advanced systems. It strengthens safety, improves resource allocation, and ensures sustainable growth.

Regionally, the market is led by the Northeast and West Coast, where dense urban populations and high commuter traffic create strong demand for advanced solutions. These areas prioritize smart ticketing, real-time monitoring, and sustainability-driven initiatives. The Midwest and Southern regions are emerging, supported by freight-focused adoption and expanding urban transit projects. It shows strong potential as these regions modernize logistics networks and invest in digital transformation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Railway Management System Market was valued at USD 3,995.07 million in 2018, reached USD 4,424.53 million in 2024, and is projected to hit USD 4,894.06 million by 2032, growing at a CAGR of 1.27%.

- The Northeast held the largest share of 38.5%, driven by dense commuter populations and advanced infrastructure projects. The Midwest followed with 29.4%, supported by strong freight operations, while the West and South together accounted for 32.1%, fueled by passenger demand and logistics networks.

- The fastest-growing region is the West, supported by investments in smart ticketing, sustainability-focused projects, and expanding urban transit networks, contributing 18.6% to the total market share.

- By services, professional services represented 37% of the market share in 2024, supported by consulting, training, and ongoing support functions that enable modernization programs.

- System integration services accounted for 34% in 2024, reflecting high demand for unifying legacy infrastructure with advanced digital systems, while cloud hosting services steadily expanded their share at 29%.

Market Drivers

Adoption of Digital Signaling and Advanced Control Systems

The U.S. Railway Management System Market is driven by the shift toward digital signaling and advanced control systems that improve safety and operational accuracy. Rail operators are replacing legacy signaling infrastructure with computer-based interlocking and communication-based train control systems to enhance reliability. This adoption reduces human errors and supports real-time decision-making. It enables seamless integration of passenger and freight operations across busy corridors. Government investments in safety modernization further strengthen the implementation of these systems. The use of AI-based analytics for predictive fault detection also boosts confidence among operators. It strengthens operational efficiency and minimizes unexpected disruptions. This growing demand for modern signaling technology is a primary driver for the market.

Integration of Predictive Maintenance and Asset Monitoring Solutions

Rail operators are increasingly adopting predictive maintenance platforms that help extend asset life and reduce downtime. IoT-enabled sensors and real-time condition monitoring provide valuable insights into track, rolling stock, and signaling performance. Predictive analytics prevents costly breakdowns by identifying potential failures early. It helps railway companies optimize maintenance schedules and allocate resources effectively. The U.S. Railway Management System Market benefits from these advancements as operators seek cost-effective methods to improve service reliability. Investments in smart asset management also align with sustainability goals by lowering energy usage and extending infrastructure longevity. Predictive maintenance improves customer trust through consistent service availability. This integration has become a major driver of technology adoption.

- For example, Siemens Mobility’s Railigent platform uses advanced data analytics to support predictive maintenance. It has demonstrated over 99% fleet availability and reduced unplanned downtime by 30–50% in documented case studies.

Rising Passenger Expectations and Commuter Demand for Efficiency

The U.S. Railway Management System Market is experiencing growth due to rising passenger expectations for seamless, safe, and efficient travel. Commuters demand punctuality, real-time updates, and convenient digital services for ticketing and journey planning. This demand compels railway operators to deploy intelligent traffic management systems and data-driven customer platforms. It helps improve passenger flow management at busy urban stations. Rail operators invest in integrated solutions that reduce delays, optimize timetables, and ensure better crowd control. These enhancements create stronger commuter satisfaction, driving further adoption of railway management systems. The focus on user experience also leads to higher ridership levels. This shift in passenger behavior is an important growth driver for the industry.

Government Policies and Infrastructure Modernization Programs

Government support through infrastructure modernization initiatives plays a critical role in shaping the U.S. Railway Management System Market. Federal and state-level programs focus on upgrading rail networks, expanding high-speed corridors, and adopting smart technologies. It strengthens the safety and capacity of the national rail infrastructure. Funding support encourages adoption of integrated railway management systems, particularly in high-density passenger routes. These policies also emphasize sustainability by promoting greener transport alternatives. Digital upgrades under public initiatives encourage partnerships between technology providers and rail operators. The integration of cybersecurity in policy frameworks ensures safe system deployment. Strong policy backing remains a central driver for accelerating digital railway transformation.

- For example, in November 2024, Amtrak secured federal grants to fund 13 key infrastructure projects along the Northeast Corridor (NEC). These include signal system upgrades between New Brunswick and Elizabeth, NJ; and between South Bowie, Maryland and Washington Union Station.

Market Trends

Deployment of Artificial Intelligence and Machine Learning Applications

The U.S. Railway Management System Market is witnessing increasing deployment of artificial intelligence and machine learning to optimize rail operations. These technologies enhance demand forecasting, traffic prediction, and resource allocation. AI-powered tools enable rail operators to analyze large data sets for improved operational planning. It also allows real-time detection of anomalies across rolling stock and infrastructure. The use of AI enhances safety and reduces risks by enabling predictive security frameworks. Machine learning supports adaptive scheduling based on passenger flows and freight volumes. Operators leverage these insights to maximize asset utilization. The trend of embedding AI in railway operations continues to gain momentum.

- For example, Union Pacific reported freight car velocity increased to about 208 daily miles per car in 2024, aided by reduced terminal dwell and higher train speed. It raised locomotive productivity to 135 GTMs per horsepower-day that year.

Integration of Cloud-Based Platforms for Enhanced Scalability

Cloud platforms are transforming the U.S. Railway Management System Market by enabling scalable and flexible data management. Rail companies are shifting away from siloed legacy systems toward unified cloud-based solutions. It supports centralized monitoring and real-time information sharing across the network. Cloud adoption reduces infrastructure costs while improving operational resilience. These platforms allow seamless integration with ticketing, signaling, and predictive maintenance modules. Operators benefit from better disaster recovery capabilities and faster software updates. Cloud solutions also enhance cybersecurity measures by providing advanced protection features. This integration of cloud technology defines a key market trend.

Growing Role of Cybersecurity in Railway Digitalization

Cybersecurity has become a crucial trend as railways expand their digital infrastructure. The U.S. Railway Management System Market recognizes the need for strong defenses against cyber threats. It involves protecting signaling systems, control centers, and passenger data from potential attacks. Operators implement multi-layered security frameworks and regular system audits. The adoption of international standards, such as IEC 62443, ensures compliance and reliability. AI-enabled cybersecurity tools detect and respond to anomalies faster. The importance of cybersecurity grows with the integration of cloud platforms and IoT devices. Strengthening cybersecurity remains a leading trend in safeguarding digital railway systems.

- For example, at InnoTrans 2024, Siemens showcased its Railigent X platform, emphasizing predictive maintenance and cloud-based diagnostics. The solution was presented as enhancing asset reliability and reducing unscheduled maintenance through advanced digital monitoring tools.

Expansion of Smart Ticketing and Passenger-Centric Platforms

Smart ticketing solutions are gaining traction as operators focus on improving passenger convenience. The U.S. Railway Management System Market emphasizes seamless payment, mobile ticketing, and biometric-based access systems. It provides commuters with faster boarding and reduced queuing times at stations. Integration with multimodal platforms supports unified travel experiences. Smart ticketing also improves revenue assurance for operators by reducing fraud. The popularity of contactless and digital wallets accelerates adoption. Passenger-centric platforms offer real-time journey information, enhancing transparency and satisfaction. This trend strengthens the digital transformation of railway passenger services.

Market Challenges Analysis

High Costs of Implementation and Modernization Barriers

The U.S. Railway Management System Market faces challenges due to high costs associated with system deployment and infrastructure upgrades. Advanced signaling, predictive maintenance platforms, and cybersecurity solutions require significant capital investment. It restricts smaller operators from adopting full-scale digital solutions. Complex integration with legacy infrastructure also creates technical barriers. Upgrading older rail networks demands long timelines and careful planning, slowing progress. Limited funding in certain regions delays adoption of intelligent traffic management and cloud-based systems. Balancing cost efficiency while meeting passenger expectations remains difficult. High implementation costs represent a central obstacle in this market.

Technical Complexity and Workforce Skill Limitations

Technical complexity poses another challenge, with operators struggling to integrate diverse systems into a unified platform. The U.S. Railway Management System Market requires skilled professionals to handle advanced digital tools. It faces a shortage of trained personnel capable of managing predictive analytics, AI integration, and cybersecurity frameworks. Legacy systems often lack compatibility with new technologies, creating operational inefficiencies. Workforce retraining programs progress slowly, delaying the transition toward digital railway operations. Operators encounter challenges in scaling digital systems while maintaining uninterrupted services. These technical and workforce-related gaps limit the pace of adoption. Bridging these issues is essential for long-term growth.

Market Opportunities

Expansion of High-Speed Rail and Urban Transit Networks

The U.S. Railway Management System Market presents opportunities through the expansion of high-speed rail corridors and urban transit systems. Demand for faster, reliable, and sustainable transport fuels investment in new projects. It encourages adoption of advanced management platforms to handle high passenger volumes. Integration of smart signaling and traffic management systems supports these developments. Opportunities arise as states plan urban mobility upgrades and cross-regional connectivity. Public-private partnerships also stimulate deployment of digital solutions. The market is well-positioned to capitalize on these long-term infrastructure projects.

Adoption of Sustainable and Green Railway Solutions

Sustainability goals create strong opportunities for the U.S. Railway Management System Market. Operators seek eco-friendly practices that reduce energy consumption and emissions. It encourages adoption of digital solutions that improve efficiency and minimize resource waste. Integration of renewable energy-based operations also drives system innovation. Railways invest in low-carbon technologies and smart monitoring platforms. Consumers support greener alternatives, increasing the demand for modernized railway systems. Sustainable transport initiatives provide new avenues for growth. This alignment with environmental policies enhances market opportunities.

Market Segmentation Analysis

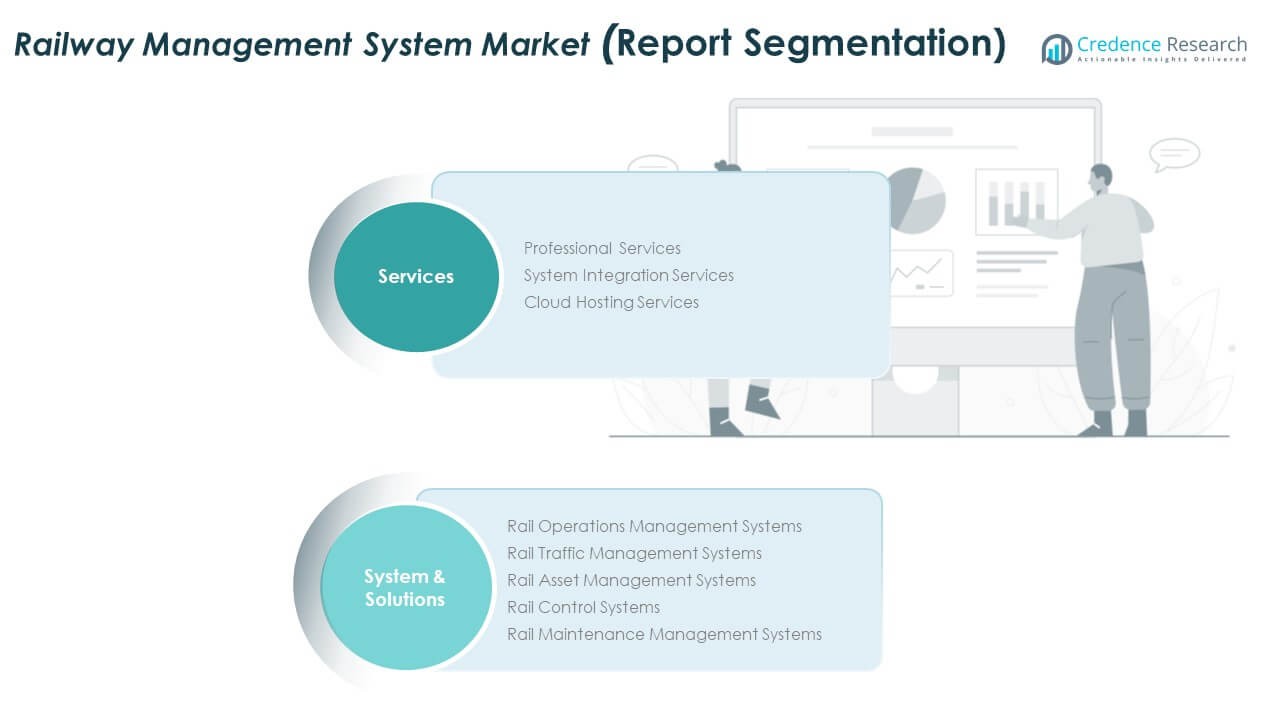

The U.S. Railway Management System Market is segmented

By services

Into professional services, system integration services, and cloud hosting services. Professional services remain vital, providing consulting, training, and support to railway operators seeking modernization. System integration services hold strong demand as operators aim to unify legacy infrastructure with advanced digital platforms. Cloud hosting services are gaining traction for scalability, cost efficiency, and enhanced data accessibility across railway networks. Each service segment plays a distinct role in supporting the digital transformation of the rail sector.

- For instance, Railinc a subsidiary of the Association of American Railroads manages digital operations, software, and data standards for U.S. freight rail, processing over 300 million digital transactions daily to ensure network-wide safety, interoperability, and predictive maintenance through services like Umler® and EHMS, which collectively support all major U.S. railroads.

By system and solution

The U.S. Railway Management System Market is categorized into rail operations management systems, rail traffic management systems, rail asset management systems, rail control systems, and rail maintenance management systems. Rail traffic management systems dominate due to their ability to enhance network capacity and ensure real-time operational control. Rail operations management systems are widely adopted to optimize scheduling, passenger flow, and freight management. Asset management systems focus on maximizing lifecycle performance of rolling stock and infrastructure. Rail control systems ensure signaling safety and operational reliability. Maintenance management systems continue to expand, driven by predictive maintenance strategies. Each segment supports efficiency, safety, and reliability across U.S. railway operations.

- For instance, U.S. operator BNSF is investing $2.84 billion in 2025 for maintenance and digital asset tracking, covering over 11,400 miles of track surfacing and replacement of 2.5 million rail ties, supported by digital diagnostics and predictive maintenance systems for continuous lifecycle optimization.

Segmentation

By Services Segment

- Professional Services

- System Integration Services

- Cloud Hosting Services

By System & Solution Segment

- Rail Operations Management Systems

- Rail Traffic Management Systems

- Rail Asset Management Systems

- Rail Control Systems

- Rail Maintenance Management Systems

Regional Analysis

Northeast U.S. Market Share and Urban Rail Adoption

The Northeast holds a significant share of the U.S. Railway Management System Market, accounting for 38.5%. Dense urban populations and heavy commuter reliance on rail systems drive adoption of advanced management solutions. Operators focus on digital signaling, predictive maintenance, and passenger-centric services to meet demand. Investments in upgrading existing corridors, such as Amtrak’s Northeast Corridor, highlight the region’s commitment to modernization. It continues to lead through government funding and public-private partnerships that support infrastructure renewal. The region’s emphasis on safety, reliability, and sustainability ensures consistent growth in system deployment.

Midwest Market Share and Freight-Focused Growth

The Midwest commands 29.4% of the U.S. Railway Management System Market, driven largely by freight operations. Strong logistics networks and intermodal hubs require advanced traffic and asset management platforms. Operators prioritize integration of digital systems that streamline freight scheduling and improve operational efficiency. It benefits from predictive analytics that reduce downtime and optimize asset utilization. Growing demand for rail freight to support agriculture and manufacturing enhances system adoption. Regional focus on efficiency ensures steady expansion of modern railway management solutions.

West and South Market Share with Emerging Opportunities

The West and South collectively represent 32.1% of the U.S. Railway Management System Market, supported by passenger growth and expanding freight demand. The West Coast focuses on smart ticketing, urban rail transit, and sustainability-driven projects, especially in California. Southern states emphasize freight transport, where management systems improve operational reliability. It shows potential for growth due to expanding commuter networks in major metropolitan areas. Investment in multimodal integration also supports market expansion in these regions. Together, these areas provide emerging opportunities for broader system deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alstom S.A.

- SYSTRA Group

- Ansaldo STS S.p.A

- Computer Sciences Corporation

- Siemens AG

- GE Transportation

- IBM Corporation

- Indra Sistemas S.A.

- Cisco Systems

- Other Key Players

Competitive Analysis

The U.S. Railway Management System Market is characterized by strong competition among global and domestic players offering digital and integrated rail solutions. Leading companies such as Siemens AG, Alstom S.A., IBM Corporation, Cisco Systems, and GE Transportation dominate through advanced technology portfolios. It focuses on delivering end-to-end solutions that cover traffic management, signaling, asset monitoring, and predictive maintenance. Companies emphasize innovation in AI, IoT, and cloud-based platforms to improve safety, reliability, and operational efficiency. Mergers, acquisitions, and partnerships remain common strategies to strengthen regional presence and expand service offerings. Smaller players compete by providing specialized services such as cybersecurity, cloud hosting, and system integration, aligning with operator needs. The market reflects a balance between established multinationals and emerging vendors aiming to capture opportunities in modernization projects and sustainable rail initiatives.

Recent Developments

- In August 2025, Alstom S.A. launched the new Amtrak NextGen Acela high-speed trains for the Northeast Corridor in the United States, marking the debut of the fastest trains in the country operating at up to 160 mph and featuring 27% more seating and advanced energy-efficient technologies. The trainsets were manufactured in Hornell, New York, by American labor, leveraging a domestic supply chain that spanned 180 businesses across 29 states and created an estimated 15,000 jobs nationwide.

- In May 2025, a major update in the U.S. railway management system sector was marked by RTRI introducing an autonomous onboard train operation system specifically designed to handle safety assessments and level crossing operations. This innovation is expected to enhance operational safety and efficiency across commuter and freight rail networks, providing a significant step toward increased automation in U.S. rail transport.

- In June 2023, it was reported that Siemens Mobility, a key player in the global railway management system market, acquired the Italian technology firm Optrail. This acquisition aims to enhance Siemens’ capabilities in the area of advanced traffic management solutions for rail networks and is expected to accelerate the integration of predictive analytics and AI-driven systems into U.S. railway management operations.

Report Coverage

The research report offers an in-depth analysis based on Services and System & Solution. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital signaling and automation will continue to shape the efficiency of rail operations.

- Predictive maintenance powered by IoT and AI will reduce downtime and improve asset longevity.

- Cybersecurity integration will become essential to safeguard interconnected railway systems from risks.

- Cloud adoption will accelerate, supporting scalable platforms and seamless system integration.

- Passenger-centric solutions such as biometric ticketing and real-time updates will gain strong traction.

- Freight corridors will adopt intelligent traffic management to strengthen logistics and supply chain reliability.

- Public-private partnerships will increase, driving modernization across both urban and regional railways.

- Sustainability initiatives will encourage adoption of energy-efficient management platforms nationwide.

- Investments in smart infrastructure will expand, linking railway systems with multimodal transport solutions.

- Market competition will intensify as global players and niche vendors introduce innovative services.