Market Overview:

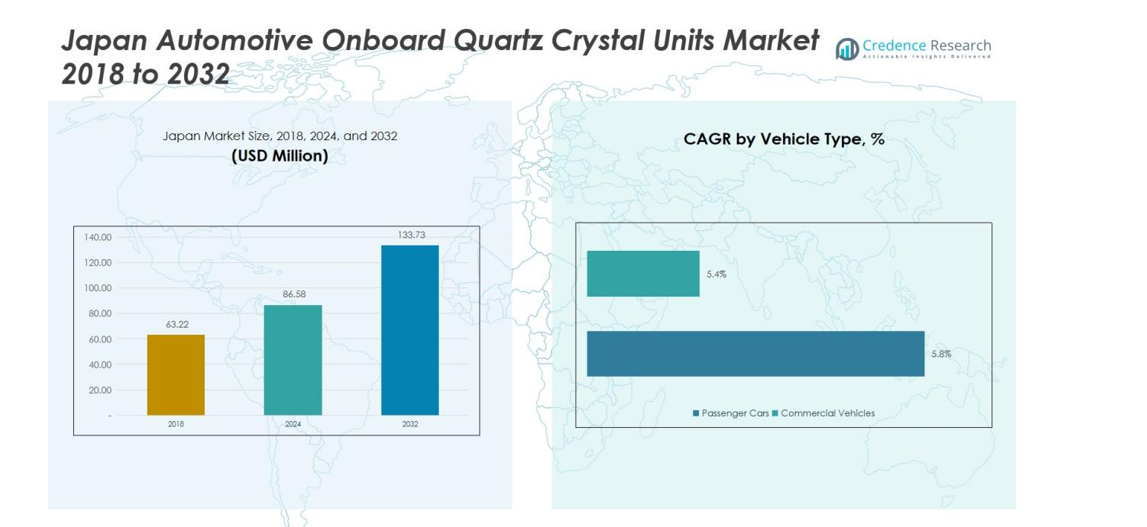

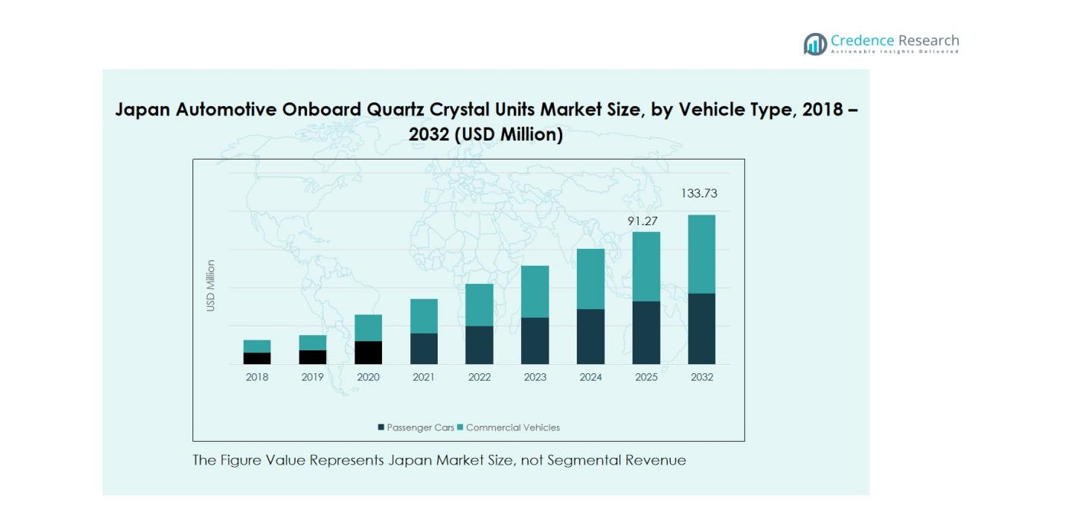

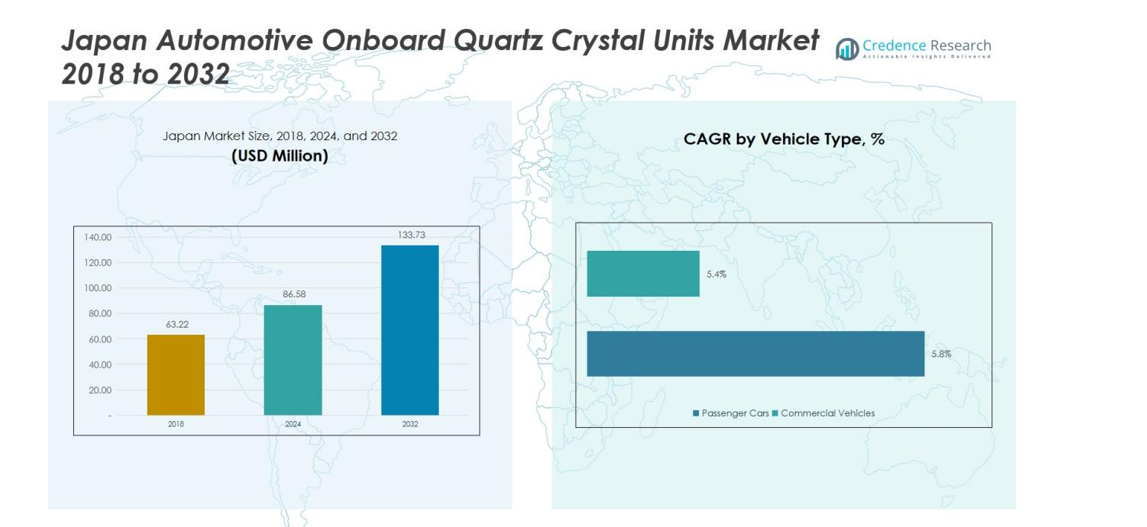

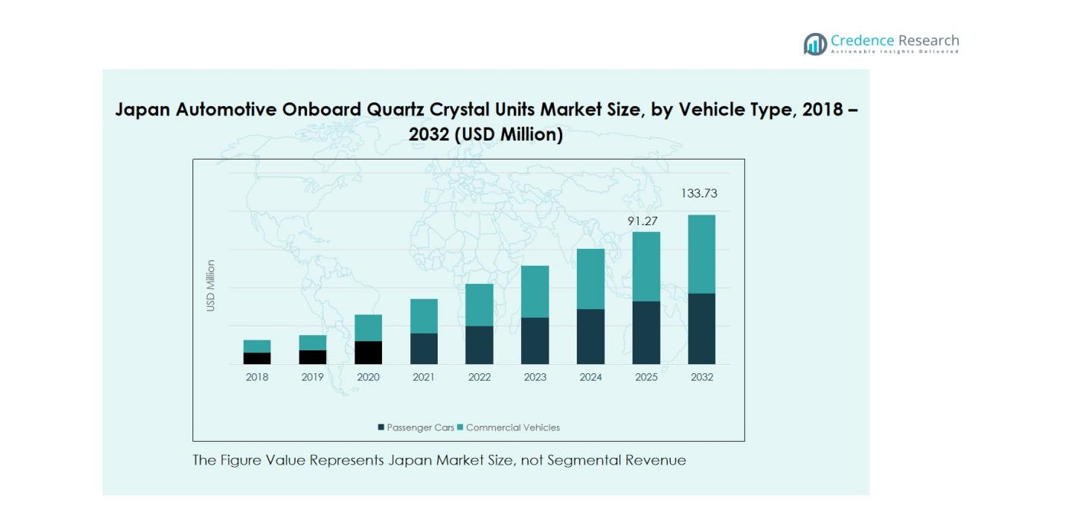

The Japan Automotive Onboard Quartz Crystal Units Market size was valued at USD 63.22 million in 2018 to USD 86.58 million in 2024 and is anticipated to reach USD 133.73 million by 2032, at a CAGR of 5.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Automotive Onboard Quartz Crystal Units Market Size 2024 |

USD 86.58 million |

| Japan Automotive Onboard Quartz Crystal Units Market, CAGR |

5.61% |

| Japan Automotive Onboard Quartz Crystal Units Market Size 2032 |

USD 133.73 million |

The market is driven by rising demand for precision timing components in electric, hybrid, and autonomous vehicles. Japan’s automotive manufacturers are focusing on miniaturized, high-temperature-resistant, and vibration-tolerant quartz crystal units to enhance reliability and efficiency. The continuous shift toward connected and software-defined vehicles further fuels adoption, as automakers integrate high-performance electronic systems requiring accurate frequency stability.

Regionally, Japan maintains a leading position in Asia’s automotive electronics industry, supported by its strong domestic manufacturing ecosystem and advanced R&D capabilities. The presence of major automakers, semiconductor suppliers, and electronics firms fosters innovation in high-performance quartz-based components. Growing government support for electrification and smart mobility initiatives continues to strengthen Japan’s role as a hub for automotive frequency control technologies.

Market Insights:

- The Japan Automotive Onboard Quartz Crystal Units Market was valued at USD 63.22 million in 2018, reached USD 86.58 million in 2024, and is projected to attain USD 133.73 million by 2032, expanding at a CAGR of 5.61%.

- Japan holds the largest regional share at 45%, supported by its strong automotive manufacturing base and technological leadership in electronic component production. China follows with 28%, driven by high EV output and domestic electronic innovation, while South Korea accounts for 15% due to its advanced semiconductor ecosystem.

- Asia-Pacific excluding Japan is the fastest-growing region with a 6.4% CAGR, supported by rising EV penetration, industrial expansion, and growing demand for frequency control components across connected vehicles.

- By vehicle segment, passenger cars dominate with a 68% share, driven by widespread integration of infotainment, safety, and connectivity systems.

- By application, powertrain and engine control units lead with 32% share, followed by safety and ADAS at 26%, reflecting Japan’s focus on reliability, automation, and efficient vehicle performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Advanced Automotive Electronics

The Japan Automotive Onboard Quartz Crystal Units Market is driven by the growing integration of electronic systems in modern vehicles. Increasing use of electronic control units (ECUs), infotainment systems, and advanced driver assistance systems (ADAS) creates demand for precise and reliable frequency components. Quartz crystal units ensure timing accuracy and signal stability, which are vital for real-time communication and control. Their ability to perform under high temperature and vibration enhances reliability in critical automotive functions.

- For instance, in September 2025, Nihon Dempa Kogyo (NDK) launched the NX1612SA crystal oscillator for automotive use, offering ±40 parts per million (ppm) frequency stability across -40°C to +125°C, marking the world’s smallest 1.6×1.2 mm design optimized for ADAS and ECU timing precision.

Electrification of Vehicles and Demand for High-Precision Components

The rapid shift toward electric and hybrid vehicles accelerates the adoption of quartz crystal units. Electric vehicles require precise synchronization of control systems, including battery management and inverter circuits. It supports stable performance by providing consistent frequency signals across power electronics. Manufacturers are emphasizing compact, energy-efficient, and thermally stable designs to match evolving EV architecture needs.

- For Instance, Murata Manufacturing develops and supplies automotive quartz crystal units with frequency accuracies that support the precise timing requirements in battery management systems for various EV manufacturers.

Expansion of Connected and Autonomous Vehicle Ecosystem

Rising deployment of connected and autonomous vehicles strengthens demand for high-frequency and temperature-tolerant quartz components. These vehicles rely on advanced communication, navigation, and sensor systems that demand accurate frequency control. It enables real-time data transmission and system synchronization across multiple electronic modules. The growing focus on safety, communication reliability, and autonomous driving capability continues to enhance market potential.

Technological Advancements and Miniaturization Trends

Continuous innovation in material science and manufacturing is improving the performance and design of quartz crystal units. Miniaturization allows integration of multiple functions into compact automotive modules, improving efficiency and reducing space consumption. It also supports lightweight vehicle design goals and improved power efficiency. Increasing R&D investment in precision components and semiconductor integration strengthens Japan’s leadership in automotive electronics development.

Market Trends:

Growing Integration of Quartz Components in Smart and Connected Vehicles

The Japan Automotive Onboard Quartz Crystal Units Market is witnessing steady expansion with the increasing adoption of smart and connected vehicle technologies. Automakers are integrating advanced electronics for communication, navigation, and infotainment functions, driving demand for precise timing components. It plays a key role in supporting synchronization of sensors, processors, and telematics systems required for vehicle-to-everything (V2X) communication. The rising number of electronic control units in vehicles amplifies the need for compact and reliable quartz components. The growing use of real-time data applications and autonomous driving functions enhances the importance of frequency accuracy. Automakers and semiconductor companies are collaborating to develop customized quartz solutions that align with emerging automotive communication standards.

- For Instance, Murata Manufacturing Co., Ltd., introduced its first V2X communication modules, the Type 1YL and Type 2AN. These modules support both IEEE 802.11p DSRC and 3GPP Release 15 C-V2X standards, using a chipset from Murata’s partner, Autotalks.

Shift Toward Miniaturized, High-Performance, and Energy-Efficient Designs

Ongoing miniaturization and high-temperature tolerance advancements are defining the latest design trends in quartz crystal units. Manufacturers are developing smaller, energy-efficient components without compromising stability or performance. It enables integration into compact vehicle systems such as ADAS, electric drivetrains, and infotainment units. The focus on sustainability and lower power consumption aligns with Japan’s energy efficiency goals. Increasing R&D investment in advanced materials and MEMS-based quartz technologies strengthens the market’s innovation pace. The trend toward semiconductor-based integration also promotes production of high-precision quartz devices tailored for next-generation automotive platforms. Growing collaboration between OEMs and electronic component suppliers continues to accelerate product evolution in this domain.

- For instance, Nihon Dempa Kogyo Co., Ltd. achieved the world’s smallest crystal unit size of 0.8 × 0.6 mm with their NX0806AA model. It enables significant current consumption reduction with a low ESR value of 21Ω at 76.8 MHz.

Market Challenges Analysis:

Supply Chain Volatility and Dependence on Raw Material Availability

The Japan Automotive Onboard Quartz Crystal Units Market faces challenges due to fluctuations in the supply of quartz and semiconductor materials. Dependence on imports for specialized raw materials exposes manufacturers to price volatility and geopolitical risks. It affects production continuity and cost competitiveness for domestic suppliers. Supply disruptions caused by trade restrictions or natural disasters also delay product delivery. The need for stable sourcing and diversified supplier networks has become a major focus for manufacturers seeking resilience.

High Manufacturing Costs and Technological Complexity

The production of automotive-grade quartz crystal units requires precision manufacturing, advanced testing, and strict quality control. These requirements increase operational costs and limit the entry of new players into the market. It demands continuous investment in R&D, cleanroom facilities, and miniaturization technologies. The pressure to meet automotive reliability standards while reducing cost further challenges profitability. Complex integration with vehicle electronics also necessitates high engineering expertise, which can slow innovation and scale-up processes for smaller companies.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Segments

The Japan Automotive Onboard Quartz Crystal Units Market presents strong opportunities through the rapid adoption of electric and autonomous vehicles. Growing EV production requires precise frequency control for battery management, motor control, and safety systems. It supports consistent power delivery and real-time data processing, vital for EV reliability. Autonomous vehicles further enhance demand for high-performance quartz components used in LiDAR, radar, and telematics. The focus on smart mobility and government-backed electrification programs is expected to expand domestic manufacturing capabilities and product innovation.

Advancements in MEMS and Semiconductor Integration Technologies

Rising investment in microelectromechanical systems (MEMS) and advanced semiconductor processes offers new growth pathways for quartz crystal applications. Integration of quartz with silicon-based platforms enhances miniaturization and energy efficiency. It allows seamless incorporation into advanced automotive modules requiring high precision and low latency. Local R&D collaborations between OEMs and technology firms are accelerating product development for next-generation vehicle systems. The growing trend toward compact, multifunctional electronic platforms will continue to open long-term opportunities for innovation-driven manufacturers in Japan.

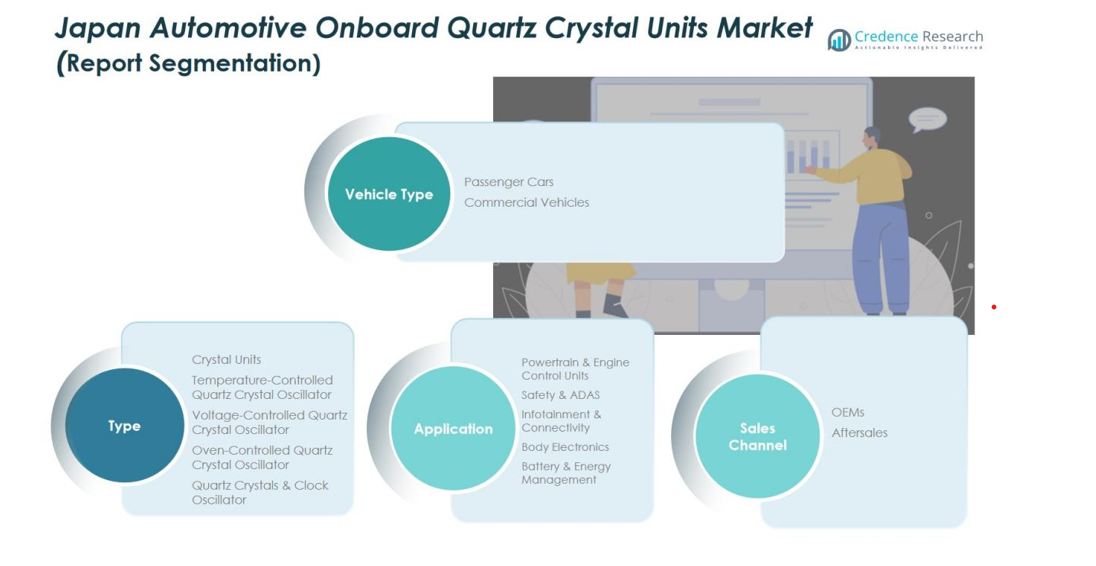

Market Segmentation Analysis:

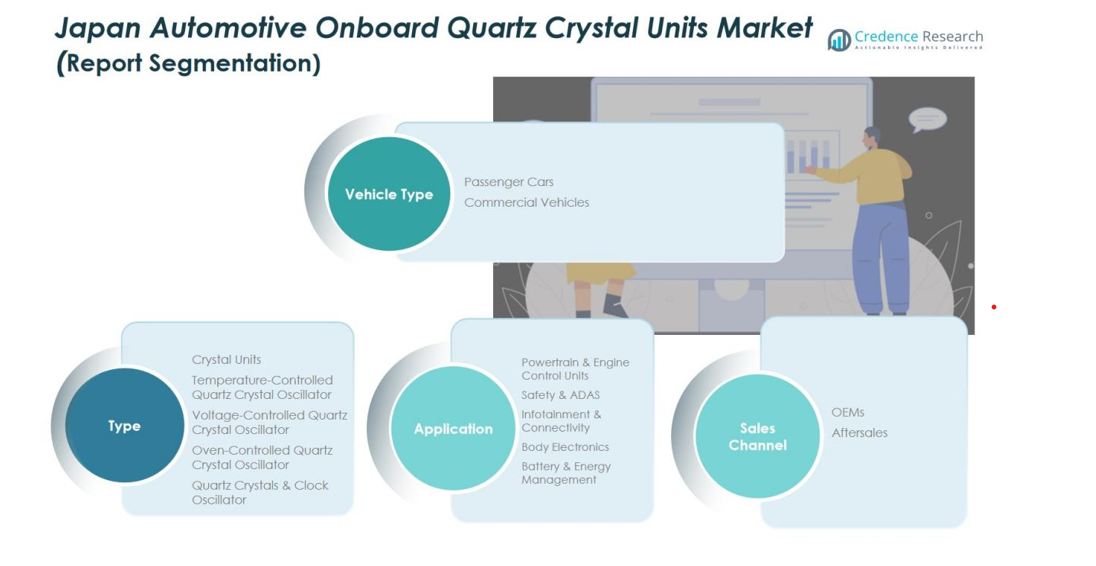

By Vehicle Segment

The Japan Automotive Onboard Quartz Crystal Units Market is segmented into passenger cars and commercial vehicles. Passenger cars account for a significant share due to the growing integration of advanced infotainment, safety, and driver assistance systems. Increasing electrification and demand for connectivity features strengthen adoption in this category. It continues to benefit from the country’s strong domestic vehicle production and technological innovation. Commercial vehicles also show rising use of quartz components to enhance reliability, powertrain control, and telematics functions.

- For Instance, For instance, the all-new 2026 Toyota RAV4 is set to feature a standard 12.3-inch digital instrument cluster and an available 12.9-inch central touchscreen with improved processing power.

By Application Segment

Key applications include powertrain and engine control units, safety and ADAS, infotainment and connectivity, body electronics, and battery management systems. Powertrain and engine control dominate the segment due to the growing focus on efficiency and emission control. Safety and ADAS systems are expanding rapidly with Japan’s push for autonomous and intelligent driving technologies. It supports precise signal synchronization across multiple sensors and modules. The infotainment and battery management categories continue to advance through higher demand for real-time performance and stable communication.

- For instance, in March 2025, Nissan Motor Co. demonstrated its latest autonomous driving system in Yokohama, showcasing multi-sensor fusion using LiDAR and radar arrays that achieved reliable real-time detection within a 250-meter range.

By Type Segment

Major types include crystal units, temperature-controlled, voltage-controlled, and oven-controlled quartz oscillators, along with clock oscillators. Crystal units lead the market due to their cost-effectiveness and stability. Temperature-controlled and voltage-controlled oscillators gain traction in high-performance automotive applications. It supports long-term reliability, frequency accuracy, and compatibility with compact electronic systems.

Segmentations:

By Vehicle Segment

- Passenger Cars

- Commercial Vehicles

By Application Segment

- Powertrain & Engine Control Units

- Safety & ADAS

- Infotainment & Connectivity

- Body Electronics

- Battery & Energy Management

By Type Segment

- Crystal Units

- Temperature-Controlled Quartz Crystal Oscillator

- Voltage-Controlled Quartz Crystal Oscillator

- Oven-Controlled Quartz Crystal Oscillator

- Quartz Crystals & Clock Oscillator

By Sales Channel Segment

Regional Analysis:

Strong Domestic Manufacturing Ecosystem and Technological Leadership

The Japan Automotive Onboard Quartz Crystal Units Market benefits from a robust domestic manufacturing base and advanced R&D ecosystem. Japan hosts leading automotive and electronic component manufacturers with established production capabilities and technological expertise. The country’s emphasis on precision engineering and quality standards supports large-scale adoption of quartz crystal units across vehicle systems. It remains a key hub for developing and testing high-performance frequency components tailored for automotive applications. Strategic collaboration between semiconductor firms and automakers continues to drive innovation and product customization.

Growing Role in Electric and Autonomous Vehicle Development

Japan’s focus on electric mobility and autonomous vehicle technologies strengthens the market’s regional position. Increasing production of hybrid and electric vehicles enhances demand for reliable frequency control components that ensure system stability and performance. It enables efficient synchronization of power electronics, communication modules, and safety systems. National policies encouraging vehicle electrification and advanced safety integration promote investment in domestic component manufacturing. Rising R&D funding in EV and ADAS technologies also accelerates innovation among Japanese suppliers and OEMs.

Export Expansion and Regional Supply Chain Integration

Japan’s strong export capabilities and global supplier networks expand its influence across Asia and other automotive markets. Local manufacturers are exporting high-precision quartz crystal units to meet growing international demand for automotive electronics. It benefits from established trade partnerships and advanced logistics infrastructure supporting global distribution. The country’s proximity to major manufacturing hubs such as South Korea, China, and Taiwan enhances regional cooperation and competitiveness. Continuous innovation and quality assurance strengthen Japan’s role as a preferred global source for automotive-grade quartz technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Murata

- NDK

- TXC Corporation

- Kyocera

- Euroquartz Limited

- Daishinku Corp (KDS)

- TKD Science

- Guoxin Micro

- Diodes Incorporated

- CTS Corporation

- Seiko Epson

Competitive Analysis:

The Japan Automotive Onboard Quartz Crystal Units Market features a highly competitive environment led by global and domestic manufacturers such as Murata, NDK, TXC Corporation, Kyocera, Euroquartz Limited, Daishinku Corp (KDS), and TKD Science. These companies compete through technological innovation, product customization, and supply chain efficiency. It focuses on developing compact, high-precision, and temperature-stable quartz components to meet the increasing demand for advanced automotive electronics. Japanese players like Murata and Kyocera leverage strong R&D capabilities and vertical integration to maintain product quality and cost advantage. Global participants including TXC Corporation and Euroquartz strengthen market presence through partnerships and export strategies. It continues to evolve through miniaturization, MEMS technology integration, and advanced material applications. The competitive landscape emphasizes innovation-driven growth, regional collaboration, and sustainable manufacturing to serve both domestic and international automotive OEMs effectively.

Recent Developments:

- In August 2024, NDK formed a strategic alliance with Rotakorn Electronics AB, enabling the supply of crystal units and oscillators to customers in Nordic countries.

- In October 2025, Kyocera partnered with iPrint to broaden its inkjet printing technology applications into new industrial sectors, bolstering its printhead business

Report Coverage:

The research report offers an in-depth analysis based on Vehicle, Application, Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Automotive Onboard Quartz Crystal Units Market is expected to expand steadily driven by advancements in automotive electronics.

- Rising adoption of electric and hybrid vehicles will continue to increase demand for precise frequency control components.

- Integration of quartz crystal units in connected and autonomous vehicles will strengthen their role in communication and safety systems.

- It will witness higher use of MEMS-based quartz technologies that enhance miniaturization and energy efficiency.

- Manufacturers are expected to focus on developing temperature-stable and vibration-resistant designs for next-generation vehicles.

- Collaboration between semiconductor firms and automakers will accelerate innovation and shorten product development cycles.

- Strong government support for electrification and smart mobility initiatives will promote domestic production capacity.

- Export opportunities will grow as Japan continues to supply high-quality components to global automotive markets.

- It will see rising investment in automation and precision manufacturing to improve quality and scalability.

- Continuous research in material science and semiconductor integration will shape the future of frequency control technologies in the automotive sector.