Market Overview:

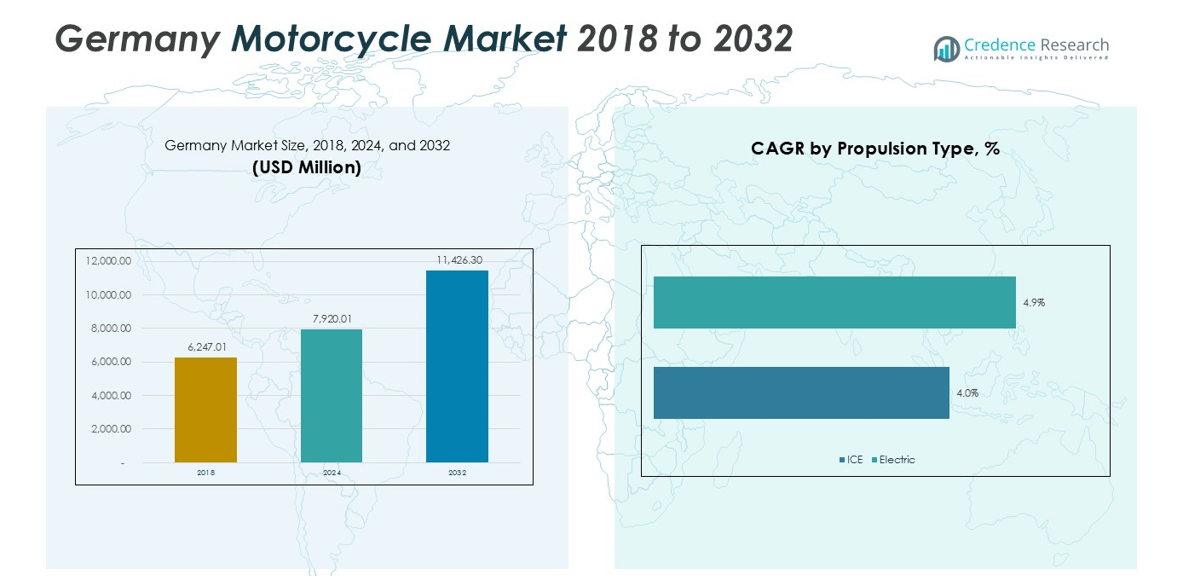

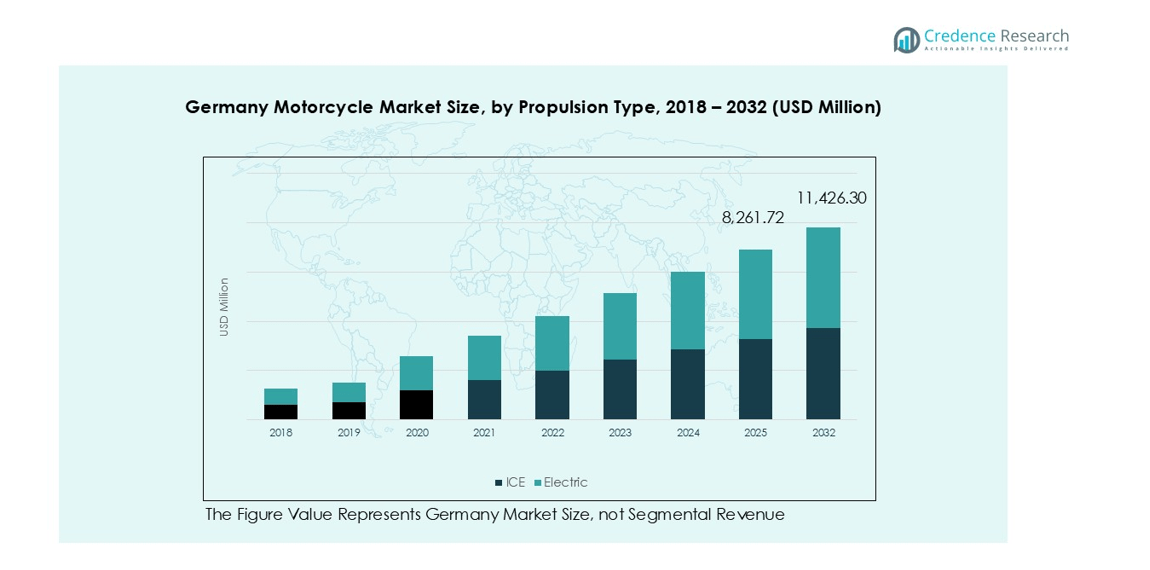

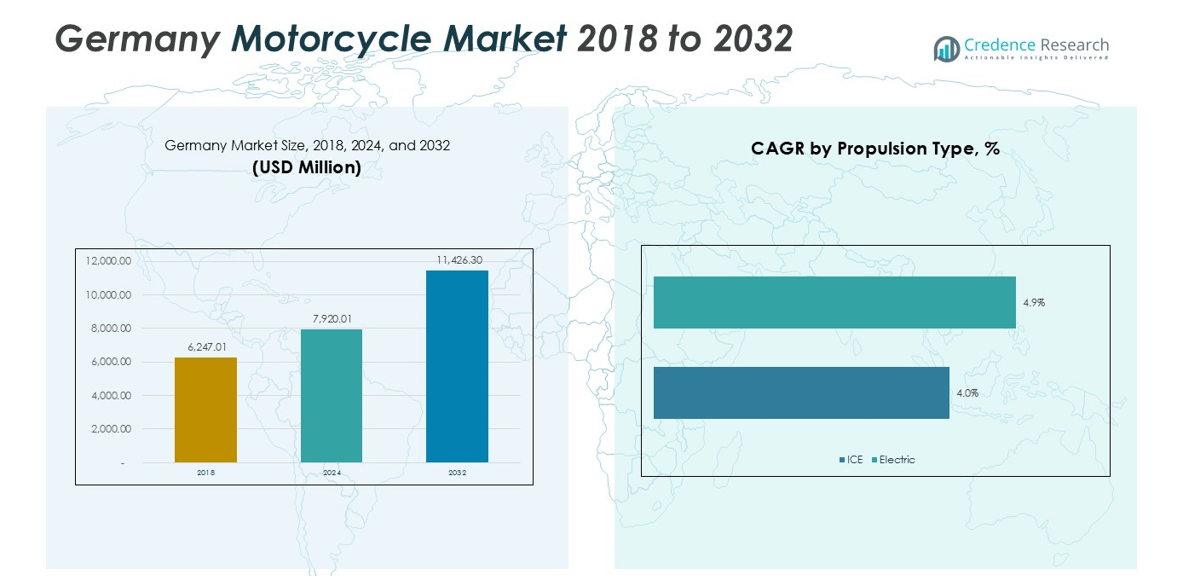

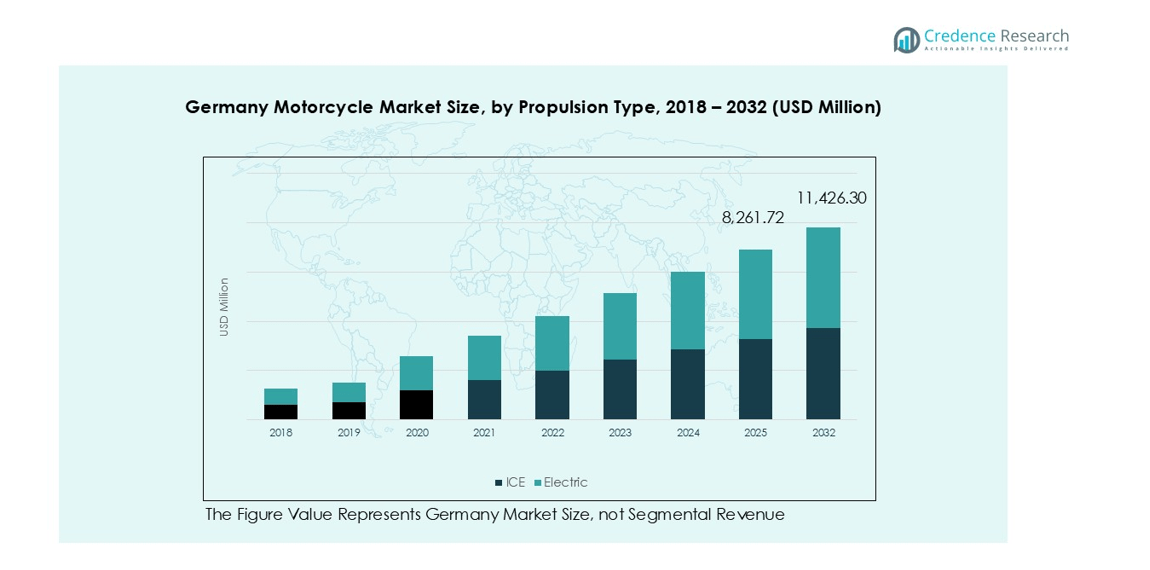

Germany Motorcycle Market size was valued at USD 6,247.01 million in 2018, reaching USD 7,920.01 million in 2024, and is anticipated to reach USD 11,426.30 million by 2032, growing at a CAGR of 4.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Motorcycle Market Size 2024 |

USD 7,920.01 million |

| Germany Motorcycle Market, CAGR |

4.60% |

| Germany Motorcycle Market Size 2032 |

USD 11,426.30 million |

The Germany Motorcycle Market is dominated by leading manufacturers such as BMW AG, KTM AG, Harley-Davidson, Triumph Motorcycles, Piaggio Group, and Polaris Inc., which collectively hold a substantial share of the national market. BMW AG leads with its strong domestic presence, advanced engineering, and premium touring models, while KTM AG excels in performance-oriented and adventure motorcycles. Harley-Davidson and Triumph Motorcycles maintain strong positions in cruiser and classic segments, supported by loyal customer bases and lifestyle branding. Piaggio Group and Polaris Inc. enhance market diversity with electric and leisure-oriented offerings. Regionally, Southern Germany dominates the market, accounting for the largest share driven by affluent consumers, robust dealer networks, and an engineering-focused ecosystem. Western Germany follows with around 33.0% of the total market share, supported by dense urban populations, strong financing options, and active rider communities sustaining demand across both commuter and premium motorcycle categories.

Market Insights

- The Germany Motorcycle Market was valued at USD 7,920.01 million in 2024 and is projected to reach USD 11,426.30 million by 2032, growing at a CAGR of 4.60% during the forecast period.

- Market growth is driven by rising demand for premium and touring motorcycles, increasing recreational riding culture, and expanding adoption of electric models aligned with Germany’s sustainability goals.

- Key trends include technological integration such as smart connectivity, digital dashboards, and AI-based safety systems, along with the rising popularity of customization and aftermarket services across cruiser and touring segments.

- The market is highly competitive, with major players like BMW AG, KTM AG, Harley-Davidson, Triumph, and Piaggio Group dominating through innovation, brand loyalty, and expanding electric portfolios.

- Southern Germany leads the market, followed by Western Germany with around 33% share, while the Cruiser segment holds the largest share at 9%, driven by lifestyle and leisure-focused buyers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motorcycle Type

In the German motorcycle market, the Cruiser segment leads in revenue share with 30.9% of the market in 2022, clustering with the Adventure segment to form about 60.5% of total value. Cruiser models benefit from strong demand for relaxed-posture machines tailored for leisure and long-distance rides. Drivers include rising disposable income, the growth of leisure-riding culture among mature riders, and strong domestic heritage brands reinforcing the cruiser DNA. As urban and commuting travel patterns stabilise, cruisers serve the lifestyle-oriented buyer seeking comfort and brand identity.

- For instance, Harley-Davidson’s Pan America 1250, a blend of cruiser and adventure touring design, remains popular in Germany, with new 2025 models widely available.

By Propulsion Type

In Germany and broader Europe, the Internal Combustion Engine (ICE) segment remains dominant, commanding 91% of the two-wheeler market share as of 2024. This dominance is underpinned by mature fuel-infrastructure, technician familiarity, and a wide portfolio of petrol-engined motorcycles from established OEMs. Drivers sustaining the ICE segment include strong aftermarket ecosystems, higher resale values, and commuter-oriented buyer preferences resistant to range anxiety. Meanwhile, electric motorcycles gain traction mainly for urban mobility and image-driven segments, but have yet to displace conventional powertrains in Germany’s mainstream market.

- For instance, BMW Motorrad remains a key player with a broad portfolio of petrol motorcycles, maintaining strong market presence through continuous innovation and customer loyalty in the ICE segment.

By Engine Capacity

Focusing on engine-capacity segments, the Up to 200 cc category remains the largest in comparable European markets, with 50.4% share globally and similar trends likely in Germany. This high share reflects affordability, ease of licence regimes and suitability for urban commuting. Drivers for this segment include rising fuel costs, growing environmental awareness favouring smaller displacements, and entry-level riders’ lower total cost of ownership. During the forecast period, mid-sized and premium capacities (>400 cc) may grow faster, but the up to 200 cc band retains primacy in volume and value among economy-driven segments.

Key Growth Drivers

Rising Demand for Premium and Touring Motorcycles

The increasing consumer shift toward premium and touring motorcycles is driving the growth of the Germany Motorcycle Market. Riders prefer high-performance and comfort-oriented models for long-distance travel across scenic routes such as the Alps and the Black Forest. Leading brands like BMW, Harley-Davidson, and Triumph dominate this segment through frequent model innovations and enhanced rider experiences. Higher disposable incomes, lifestyle preferences, and growing enthusiasm for recreational motorcycling continue to strengthen sales of premium and touring motorcycles nationwide.

- For instance, BMW’s 2025 touring lineup includes models like the K 1600 B, K 1600 Grand America, and R 1250 RT, emphasizing luxury, comfort, and long-distance cruising capabilities.

Expansion of Electric Mobility and Charging Infrastructure

The growing focus on electric mobility serves as a major driver, supported by Germany’s sustainability goals and favorable government incentives. Expanding charging infrastructure, urban emission regulations, and improved battery technology are accelerating the adoption of electric motorcycles. Cities like Berlin and Hamburg are leading in EV-friendly initiatives, attracting commuters seeking eco-friendly two-wheelers. Key manufacturers such as BMW Motorrad and KTM are actively investing in electric models and smart features, aligning with national decarbonization targets and reshaping Germany’s motorcycle landscape.

- For instance, BMW Motorrad’s CE 04 electric scooter, launched in 2022, offers a 130 km range and fast-charging capability from 0–80% in 65 minutes, catering to urban commuters.

Growing Motorcycle Tourism and Recreational Riding Culture

Motorcycle tourism significantly contributes to the market’s expansion, fueled by Germany’s extensive scenic routes and vibrant riding culture. Popular destinations in Bavaria, the Rhine Valley, and the Black Forest attract touring enthusiasts throughout the year. The rise of organized motorcycle clubs, rallies, and events has strengthened brand engagement and boosted sales of mid- and large-capacity motorcycles. Regional tourism boards also promote motorcycle-friendly infrastructure, increasing seasonal demand and positioning Germany as one of Europe’s leading markets for leisure-oriented riding experiences.

Key Trends and Opportunities

Technological Advancements and Smart Connectivity

Technological innovation is reshaping the German motorcycle market as consumers demand enhanced safety, performance, and connectivity. Manufacturers are integrating features such as adaptive cruise control, digital displays, GPS navigation, and smartphone compatibility. The trend toward connected mobility is attracting younger, tech-driven buyers seeking comfort and convenience. Smart helmets, advanced diagnostics, and ride data analytics further elevate the riding experience. Brands focusing on digital innovation and AI-powered systems are gaining a competitive advantage, especially within the premium motorcycle segment.

- For instance, Kosmos Smart Helmets have incorporated voice-enabled technology to provide hands-free control and emergency support, significantly elevating rider safety.

Rising Aftermarket and Customization Potential

Germany’s robust aftermarket industry presents strong growth opportunities for parts suppliers and service providers. Riders increasingly invest in customization, from performance upgrades to aesthetic modifications, particularly in the cruiser and touring segments. The popularity of certified pre-owned motorcycles and personalized accessories boosts recurring sales for workshops and component manufacturers. This growing trend enhances brand loyalty and extends the motorcycle’s lifecycle. As customization becomes part of Germany’s riding identity, it continues to drive aftermarket expansion and overall market value.

- For instance, Motorrad Burchard GmbH is a leading German manufacturer offering TÜV-certified custom parts like chrome handlebars and luggage solutions, recognized for their quality and durability in the aftermarket segment.

Key Challenges

High Ownership Costs and Economic Uncertainty

High ownership and operational costs remain a major challenge in the German motorcycle market. Rising expenses related to insurance, maintenance, and fuel reduce affordability, especially among younger and entry-level riders. Economic fluctuations and inflationary pressures further limit discretionary spending on leisure vehicles. Although manufacturers introduce flexible financing and leasing programs to mitigate cost barriers, affordability continues to restrict broader adoption in commuter and budget segments, impacting overall market volume growth.

Stringent Emission Norms and Regulatory Compliance

Tight emission regulations and evolving EU environmental standards create significant challenges for motorcycle manufacturers in Germany. Compliance with Euro 5 and forthcoming emission norms increases R&D and production costs, particularly for smaller ICE models. The transition toward zero-emission mobility requires substantial investments in electric technologies and infrastructure. Smaller OEMs face resource constraints in adapting to these standards, reducing their competitiveness. While regulations encourage sustainability, they simultaneously pressure manufacturers to balance innovation with cost efficiency across the product portfolio.

Regional Analysis

Southern Germany

Southern Germany dominates the motorcycle marke hile Baden-Württemberg benefits from an engineering-rich ecosystem supporting advanced designs and performance models. Scenic routes across the Alps and the Black Forest further stimulate sales of touring and cruiser motorcycles. High disposable incomes, strong dealer networks, and a well-developed tourism sector continue to drive regional market growth and reinforce dominance in premium motorcycle segments.

Western Germany

Western Germany holds around 33.0% of the market, led by North Rhine-Westphalia, which alone contributes 20.0% of national motorcycle sales. The region’s dense population, robust infrastructure, and vibrant rider culture sustain demand for both commuter and leisure motorcycles. Hesse, with Frankfurt as its core hub, supports premium and mid-capacity segments through strong financing and leasing options. Meanwhile, Rhineland-Palatinate benefits from scenic touring routes that attract both local and tourist riders. These states collectively drive high sales volume due to urban connectivity, active rider clubs, and expanding aftermarket services.

Northern Germany

Northern Germany accounts for 14.0% of the motorcycle market, with strong adoption of touring and adventure models. Lower Saxony, the leading contributor, benefits from its mix of industrial buyers and recreational riders, while Schleswig-Holstein sees consistent seasonal demand from coastal tourism and weekend riders. The region’s flat terrain and extensive road network support commuter and long-distance motorcycle use. Competitive financing options and a growing used-bike market help sustain sales momentum. Despite shorter riding seasons, northern regions remain key for mid-capacity and touring motorcycle segments due to their scenic open-road appeal.

Eastern Germany

Eastern Germany collectively represents 20.0% of the national motorcycle market, led by Berlin and Saxony. Berlin contributes 5.0%, driven by electric and small-capacity motorcycles catering to urban commuters. Saxony adds momentum with growing demand for sports and mid-capacity models, supported by motorsport traditions and improved regional incomes. Cities like Leipzig and Dresden foster vibrant motorcycle communities and emerging EV adoption. The combination of urban electrification and rural touring potential positions Eastern Germany as an evolving growth region for both sustainable mobility and performance-oriented motorcycles.

Central and Other Regions

Remaining states contribute 10.0% of Germany’s motorcycle market, showing steady growth in commuter and entry-level segments. These areas, encompassing Thuringia, Saarland, and Brandenburg, benefit from increasing affordability and access to second-hand markets. Expanding road infrastructure and government tourism initiatives promote regional mobility and leisure riding. Local dealerships play a pivotal role by offering flexible financing and maintenance support, fostering ownership among new riders. Though smaller in scale, these markets collectively enhance nationwide penetration and support long-term sales diversification for motorcycle manufacturers across Germany.

Market Segmentations:

By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- Southern Germany

- Western Germany

- Eastern Germany

- Northern Germany

- Central Geramny

- Other Regions

Competitive Landscape

The competitive landscape of the Germany Motorcycle Market is characterized by the presence of leading manufacturers such as BMW AG, KTM AG, Harley-Davidson, Triumph Motorcycles, Piaggio Group, and Polaris Inc., which collectively dominate the market through strong brand positioning and extensive product portfolios. BMW AG continues to lead with advanced engineering, premium models, and a strong domestic brand image, while KTM and Triumph emphasize performance and design innovation. Harley-Davidson maintains a loyal customer base in the cruiser and touring segments. Companies are increasingly investing in electric mobility, with BMW Motorrad and KTM advancing electric model development to align with Germany’s sustainability goals. Partnerships with technology providers, expansion of dealer networks, and digital retail strategies are key competitive approaches. The market also features emerging players and niche manufacturers focusing on electric motorcycles and customization, intensifying competition and driving innovation across performance, design, and eco-friendly mobility solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Polaris Inc.

- Peugeot

- Ariel Motor Company Limited

- Triumph Motorcycles Ltd.

- Benda

- KTM AG

- Bayerische Motoren Werke (BMW) AG

- Harley-Davidson, Inc.

- Piaggio Group

- BSA Motorcycles

- Other Key Players

Recent Developments

- In March 2025, Yamaha Motor Co., Ltd. signed an agreement to acquire the e-kit business of German automotive parts manufacturer Brose, establishing a new entity named YMESG in Germany.

- In January 2025, ADVIK Hi-Tech Pvt. Ltd. completed the acquisition of Germany-based Powersports MTG GmbH, a specialist in braking and clutch actuation systems.

- On July 3 2025, BMW Motorrad presented an updated version of the CE 04 electric scooter in Germany with new colours and features, further enhancing its urban mobility portfolio.

- In February 2025, Benda officially debuted in Germany at the IMOT 2025 show, introducing models such as the LFC 700 and Napoleonbob 500 to the German market.

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany Motorcycle Market is expected to witness steady growth driven by increasing demand for premium and electric models.

- Rising adoption of electric motorcycles will reshape urban mobility and support the nation’s sustainability goals.

- Advancements in battery technology and charging infrastructure will enhance consumer confidence in electric two-wheelers.

- Premium and touring motorcycle segments will continue to dominate due to lifestyle-driven purchases and higher disposable incomes.

- Growing motorcycle tourism and leisure riding culture will strengthen long-distance and adventure bike sales.

- Integration of smart connectivity, digital dashboards, and AI-based safety systems will redefine rider experience.

- Expansion of dealer networks and online retail platforms will improve market accessibility and aftersales service.

- Manufacturers will focus on local production and partnerships to meet evolving emission standards and reduce costs.

- The aftermarket and customization segment will expand as riders seek personalized performance and design features.

- Overall market growth will remain supported by innovation, sustainability initiatives, and evolving consumer preferences.