Market Overview:

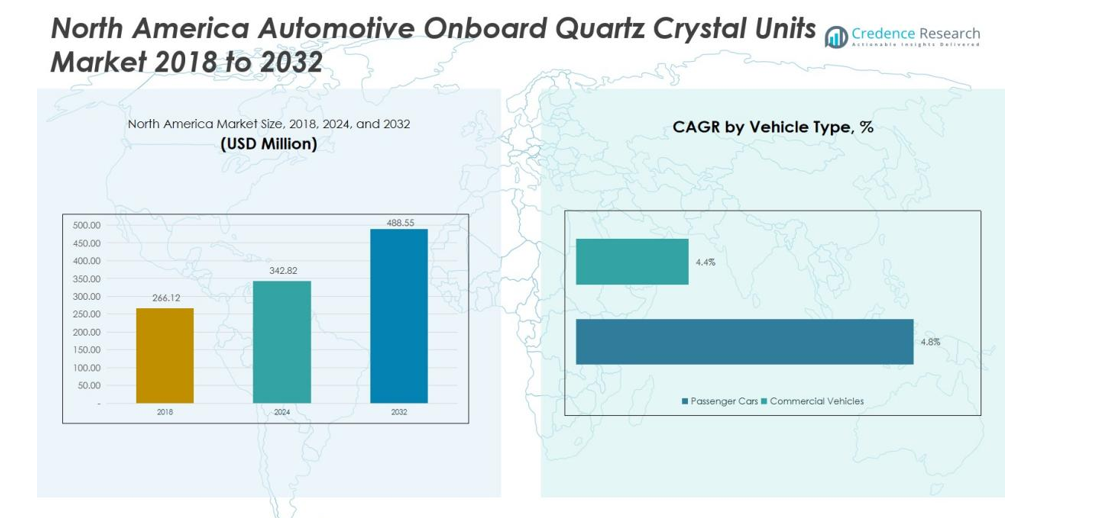

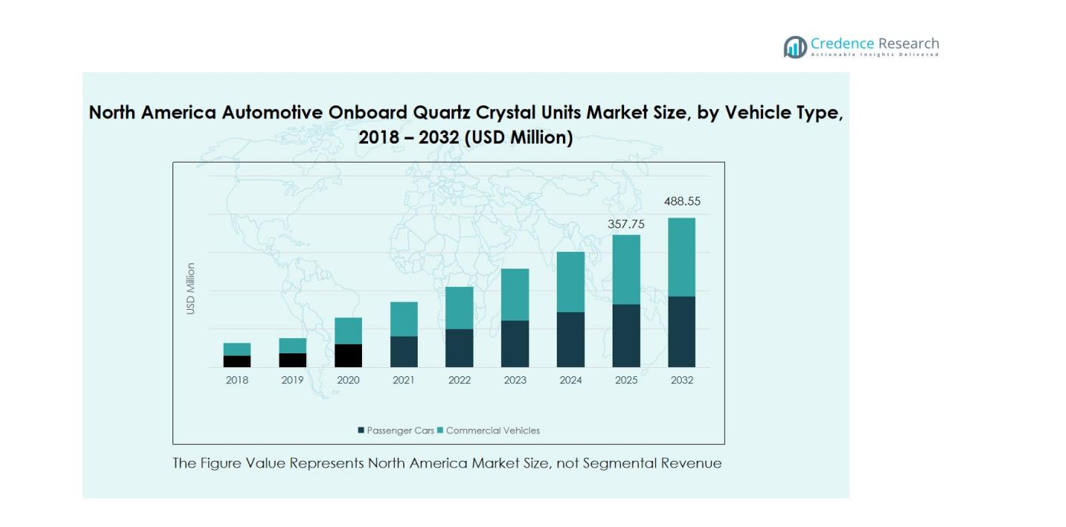

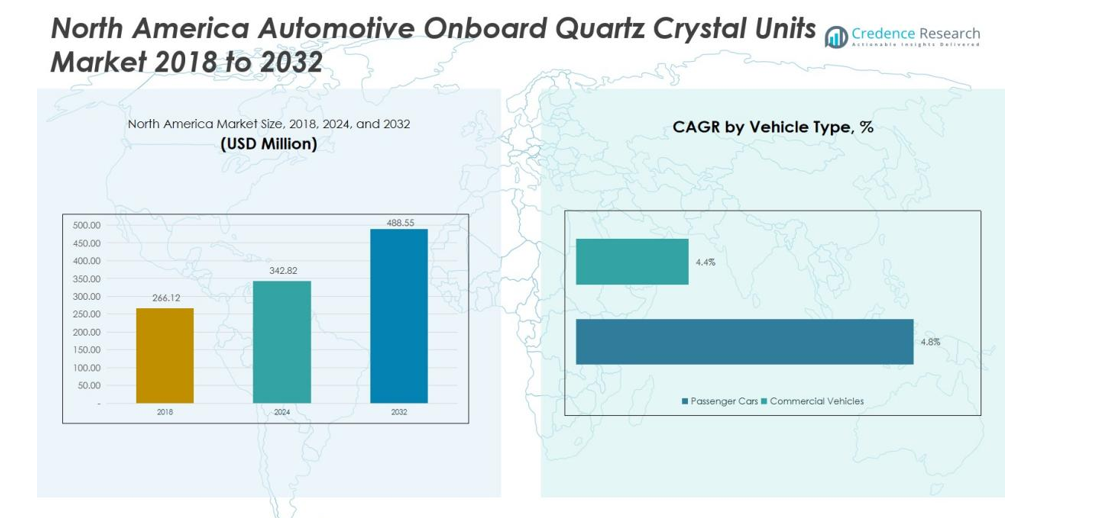

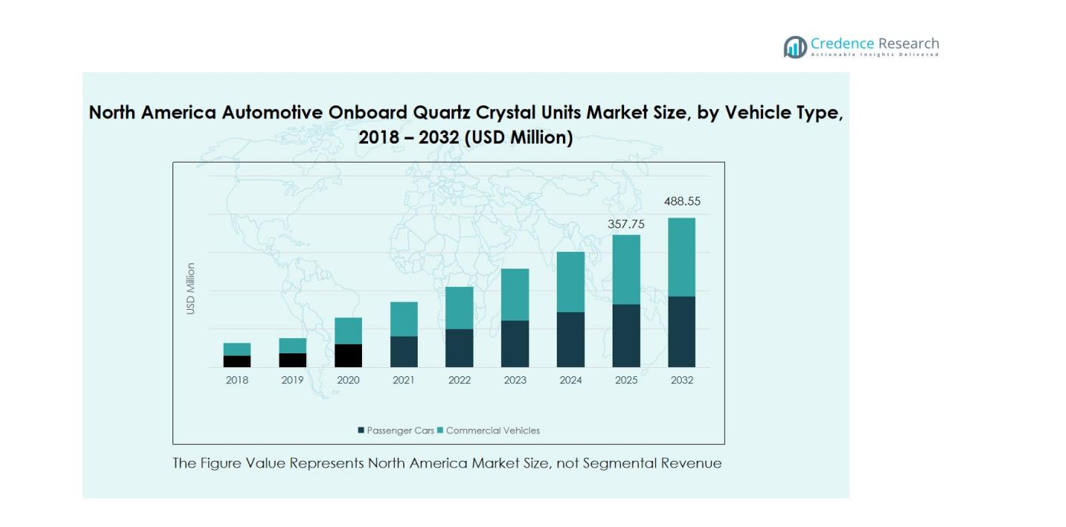

The North America Automotive Onboard Quartz Crystal Units Market size was valued at USD 266.12 million in 2018 to USD 342.82 million in 2024 and is anticipated to reach USD 488.55 million by 2032, at a CAGR of 4.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Automotive Onboard Quartz Crystal Units Market Size 2024 |

USD 342.82 million |

| North America Automotive Onboard Quartz Crystal Units Market, CAGR |

4.53% |

| North America Automotive Onboard Quartz Crystal Units Market Size 2032 |

USD 488.55 million |

Growing electrification of vehicles, rapid development of autonomous driving technologies, and expanding production of EVs are key growth drivers. Quartz crystal units play a vital role in ensuring stable frequency control in ECUs and power management systems. The ongoing shift toward advanced driver assistance and smart infotainment systems is increasing the need for highly reliable and temperature-resistant crystal components across automotive OEMs and Tier-1 suppliers.

The United States dominates the regional market, supported by strong automotive production, innovation in EV and autonomous systems, and presence of key manufacturers. Canada and Mexico show steady growth due to expanding automotive component manufacturing and increasing adoption of advanced electronic systems across passenger and commercial vehicles.

Market Insights:

- The North America Automotive Onboard Quartz Crystal Units Market was valued at USD 266.12 million in 2018, reached USD 342.82 million in 2024, and is projected to reach USD 488.55 million by 2032, growing at a CAGR of 4.53%.

- The United States holds the largest share of 63% due to advanced automotive production, strong electronics integration, and continuous innovation in EV and ADAS technologies.

- Canada accounts for 22% of the market, supported by sustainable mobility programs and growing EV manufacturing, while Mexico contributes 15%, driven by cost-effective production and expansion of automotive assembly operations.

- The fastest-growing region is Canada, expanding at a steady pace with increasing demand for quartz-based components in electric and hybrid vehicles.

- Passenger cars hold 68% of the segment share, driven by smart infotainment and connectivity systems, while commercial vehicles account for 32%, supported by rising telematics and powertrain monitoring adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Precision Electronic Components in Modern Vehicles

The North America Automotive Onboard Quartz Crystal Units Market is expanding due to the growing use of advanced electronic systems in vehicles. These components provide stable frequency control essential for functions such as infotainment, navigation, and engine management. Automakers are focusing on electronic accuracy and synchronization to support complex control systems. The demand for high-performance crystal units increases with each new generation of connected and intelligent vehicles.

- For Instance, Seiko Epson Corporation began mass production of its AEC-Q100-compliant XV4311BD quartz-based yaw rate sensor. The sensor offers a high level of precision, with a bias instability of 0.9°/h and a non-linearity of ±0.05%FS, designed to enhance automotive navigation and stability systems.

Growth of Electric and Hybrid Vehicle Production Across the Region

Expanding electric and hybrid vehicle manufacturing is a major driver of the market. Quartz crystal units are used in EV power inverters, battery management, and communication modules. The focus on reducing emissions and increasing energy efficiency supports steady integration of quartz timing devices in EV architectures. It benefits from the strong push toward sustainable mobility in the United States and Canada.

- For Instance, NDK offers AEC-Q200 compliant automotive quartz crystal oscillators that feature frequency stability ratings suitable for next-generation EV and ADAS applications.

Advancements in ADAS and Vehicle Connectivity Technologies

Increasing adoption of advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) technologies fuels market growth. These systems rely on precise timing for sensor synchronization and real-time data communication. Quartz crystal units ensure accuracy in radar, LiDAR, and telematics systems that enhance safety and connectivity. Continuous innovation in autonomous and semi-autonomous platforms reinforces long-term demand across OEMs.

Expansion of Automotive Electronics Manufacturing and Supply Chains

The region’s strong presence of automotive electronics manufacturers supports large-scale adoption of quartz crystal units. North American suppliers focus on developing compact, high-frequency, and temperature-resistant components for harsh vehicle environments. The presence of Tier-1 electronic system suppliers and R&D hubs accelerates local sourcing. It strengthens the region’s position as a leading market for automotive-grade frequency control components.

Market Trends:

Integration of Quartz Crystal Units in Advanced Vehicle Electronics and Connectivity Systems

The North America Automotive Onboard Quartz Crystal Units Market is witnessing strong integration of crystal timing components in advanced vehicle electronics. Automakers are increasingly using these units in telematics, infotainment, and communication control modules to improve reliability and synchronization. Demand is rising due to the shift toward connected, autonomous, shared, and electric (CASE) mobility systems. The growing adoption of 5G connectivity and in-vehicle communication networks such as CAN, LIN, and Ethernet supports consistent use of crystal oscillators. It benefits from the need for precise timing and signal integrity across multiple vehicle subsystems. The trend reflects a broader movement toward intelligent mobility solutions that depend on high-frequency stability and low phase noise. Manufacturers are also developing miniaturized components to meet design constraints in next-generation automotive electronics.

- For Instance, Murata announced it had commercialized the high-precision XRCGE_FXA series of automotive crystal units, with mass production having begun. These crystal units support the use of automotive Ethernet in vehicle-mounted networks and are available in a 2.0mm x 1.6mm package size.

Shift Toward Automotive-Grade, High-Temperature, and Miniaturized Quartz Devices

Rising demand for high-temperature and vibration-resistant crystal units defines the ongoing market transformation. Automotive applications now require quartz components capable of functioning under extreme thermal and mechanical stress. The market is experiencing a gradual shift toward automotive-grade devices compliant with AEC-Q200 standards to ensure performance and durability. It reflects the growing focus on quality and reliability among vehicle manufacturers and suppliers. Miniaturization remains a key trend, driven by the reduction in PCB space and the adoption of compact ECUs in electric and hybrid vehicles. The emergence of surface-mount technology and MEMS-based alternatives also influences design evolution across the region. This trend continues to strengthen the role of quartz crystal units in supporting next-generation automotive platforms.

- For Instance, NDK (Nihon Dempa Kogyo) manufactures the AEC-Q200-compliant NX2012SA automotive crystal unit. This unit is rated for an operating temperature range of up to +125°C.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Supply Chain Constraints

The North America Automotive Onboard Quartz Crystal Units Market faces challenges due to volatile raw material prices and supply chain disruptions. Quartz and other electronic-grade materials often experience fluctuating availability, impacting production stability. The global semiconductor shortage continues to influence sourcing and lead times for frequency control components. It increases manufacturing costs and delays deliveries to automotive OEMs. Dependence on overseas suppliers for crystal blanks and precision-cut materials adds further risk. Manufacturers are focusing on diversifying suppliers and localizing production to reduce these uncertainties. Supply resilience remains a critical issue for sustaining consistent output in high-demand segments.

High Cost of Precision Manufacturing and Technological Complexity

Quartz crystal unit manufacturing requires advanced cutting, plating, and frequency calibration processes, which increase operational costs. The need for tight frequency tolerances and long-term stability under automotive conditions limits scalability. It makes cost optimization difficult for small and mid-sized suppliers. The market also faces competitive pressure from emerging MEMS oscillators offering compact size and energy efficiency. Meeting stringent automotive quality standards, including AEC-Q200 and ISO certifications, adds further complexity. These technical and cost-related barriers continue to restrict broader adoption across low-cost vehicle platforms.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Platforms Across the Region

The North America Automotive Onboard Quartz Crystal Units Market offers strong opportunities through the rapid adoption of electric and autonomous vehicles. Growth in EV manufacturing and the integration of advanced driver-assistance systems create consistent demand for precise timing components. Quartz crystal units support essential vehicle operations, including communication, power management, and control synchronization. It benefits from increasing investments by automakers in connected and smart mobility ecosystems. The expansion of EV charging infrastructure and software-defined vehicle architectures further strengthens growth potential. Continuous product innovation tailored to EV electronics presents new revenue streams for regional suppliers. The trend aligns with government incentives promoting clean and intelligent transportation.

Rising Adoption of Advanced Infotainment and Connectivity Solutions

Growing consumer preference for connected car features opens significant opportunities for quartz crystal manufacturers. Modern infotainment systems require high-frequency stability to maintain uninterrupted communication and multimedia performance. It drives adoption of advanced oscillators compatible with Bluetooth, GPS, and Wi-Fi modules. The transition toward 5G-enabled vehicles and in-vehicle data networks accelerates this demand. Regional suppliers investing in miniaturized, low-power crystal technologies are well-positioned to benefit. Expanding collaborations between automakers and electronics firms further enhance innovation and product integration. This evolving ecosystem supports long-term market expansion across North America.

Market Segmentation Analysis:

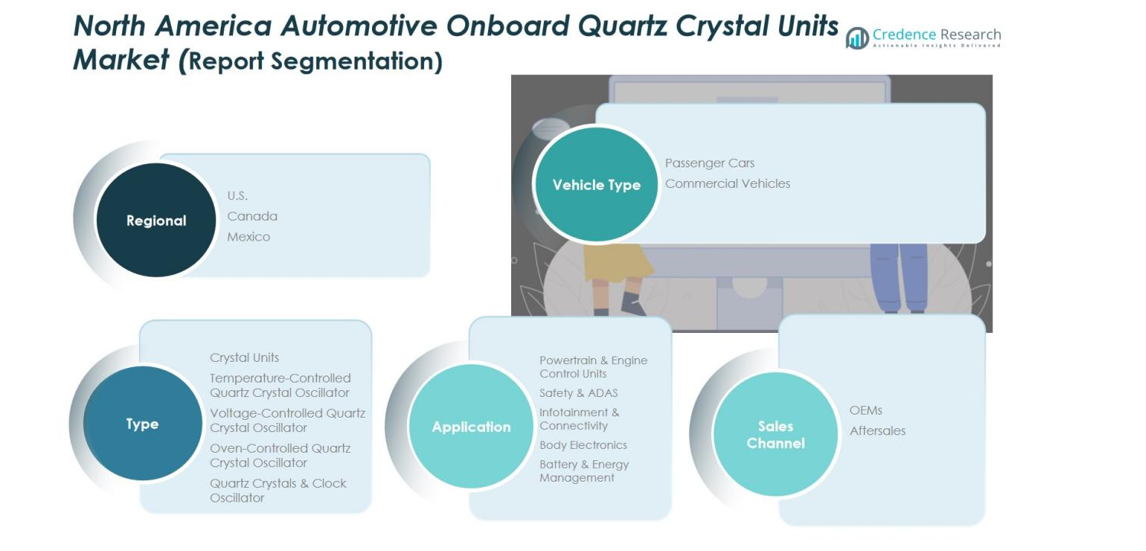

By Vehicle Segment

The North America Automotive Onboard Quartz Crystal Units Market is segmented into passenger cars and commercial vehicles. Passenger cars account for a major share due to the integration of advanced infotainment, ADAS, and connectivity systems. Rising production of electric and hybrid cars supports greater adoption of high-precision crystal units. Commercial vehicles show steady growth, driven by increasing use of telematics and powertrain monitoring systems. It continues to gain traction as fleet operators focus on performance reliability and real-time data transmission.

- For Instance, Continental AG’s Automotive division was formally approved for a spin-off in April 2025 and rebranded as Aumovio before its public listing in September 2025.

By Application Segment

Key applications include powertrain and engine control units, safety and ADAS, infotainment and connectivity, body electronics, and battery management. Powertrain and safety systems dominate due to the growing use of electronic control modules and high-frequency synchronization. Infotainment and connectivity segments expand rapidly with increasing demand for communication, navigation, and entertainment integration. It benefits from rising consumer preference for smart, connected vehicle interfaces.

- For instance, in 2025, Volkswagen, through its joint venture CARIZON with China’s Horizon Robotics, introduced its first in-house automated driving system. This system, developed as part of Volkswagen’s “In China, for China” strategy, offers Level 2+ functionality for highway driving, allowing hands-off operation under specific conditions.

By Type Segment

Based on type, the market includes crystal units, temperature-controlled (TCXO), voltage-controlled (VCXO), and oven-controlled quartz oscillators (OCXO), along with quartz crystals and clock oscillators. Crystal units hold the largest share due to their reliability and cost-effectiveness in automotive environments. Demand for TCXO and OCXO grows across EVs and ADAS systems requiring superior temperature stability. It reflects continuous innovation in miniaturized and high-performance oscillators to meet evolving vehicle electronic requirements.

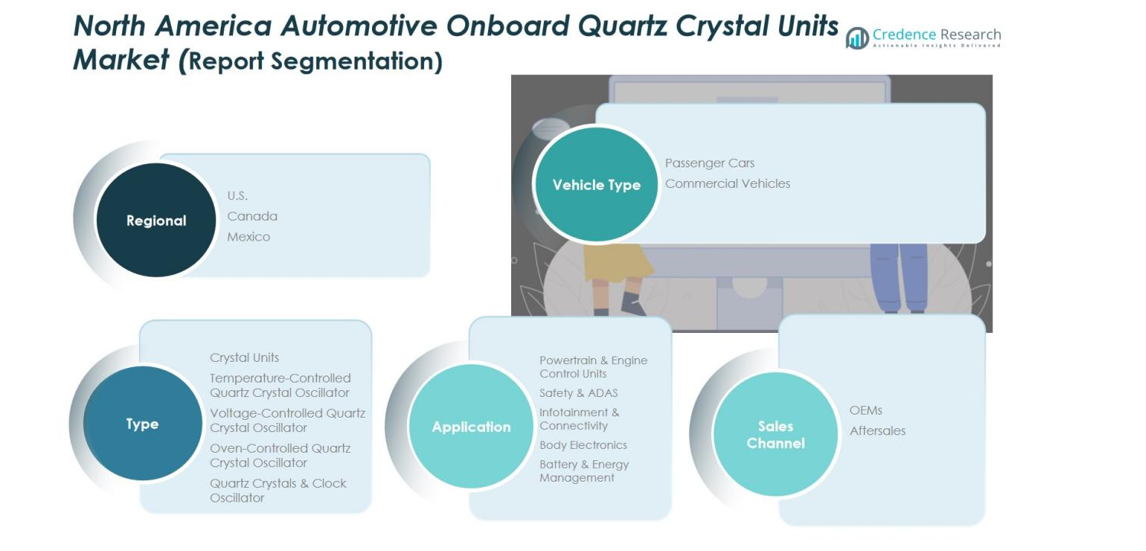

Segmentations:

By Vehicle Segment

- Passenger Cars

- Commercial Vehicles

By Application Segment

- Powertrain & Engine Control Units

- Safety & ADAS

- Infotainment & Connectivity

- Body Electronics

- Battery & Energy Management

By Type Segment

- Crystal Units

- Temperature-Controlled Quartz Crystal Oscillator (TCXO)

- Voltage-Controlled Quartz Crystal Oscillator (VCXO)

- Oven-Controlled Quartz Crystal Oscillator (OCXO)

- Quartz Crystals & Clock Oscillator

By Sales Channel Segment

By Country

Regional Analysis:

Strong Market Leadership of the United States in Automotive Electronics Integration

The North America Automotive Onboard Quartz Crystal Units Market is led by the United States, supported by high automotive production and rapid adoption of advanced electronic systems. Automakers focus on integrating precision timing components in ADAS, infotainment, and EV power control modules. The strong presence of semiconductor and automotive electronics companies strengthens domestic supply capabilities. It benefits from significant investments in autonomous and connected vehicle technologies. Continuous R&D efforts and government support for smart mobility accelerate local innovation and component manufacturing. The U.S. remains the largest contributor to regional revenue, setting technological standards across the industry.

Steady Expansion of Canada Through Electric Vehicle Adoption

Canada exhibits consistent growth driven by expanding electric vehicle manufacturing and government-backed sustainability programs. The country’s focus on clean transportation and advanced mobility encourages adoption of quartz-based oscillators for EV systems and battery management units. It benefits from collaborations between domestic suppliers and global component manufacturers. Increasing infrastructure development for EV charging networks also boosts demand for high-precision crystal devices. Canadian OEMs are incorporating compact, temperature-resistant quartz components to meet performance and reliability goals. This trend supports a growing ecosystem for frequency control components in automotive applications.

Emerging Role of Mexico as a Key Automotive Manufacturing Hub

Mexico continues to strengthen its position as a major automotive production and export base in North America. Expanding assembly operations and supplier networks are creating steady demand for quartz crystal units in vehicle electronics. It gains from the increasing localization of manufacturing to reduce import dependencies. Investments from international automotive and electronics firms enhance production capacity and technology transfer. Rising demand for infotainment and safety systems in locally assembled vehicles supports further market penetration. Mexico’s cost-competitive manufacturing environment ensures its long-term contribution to regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SiTime Corp

- NDK

- TXC Corporation

- Kyocera

- Seiko Epson Corp

- Daishinku Corp (KDS)

- TKD Science

- Guoxin Micro

- Diodes Incorporated

- CTS Corporation

- JGHC

Competitive Analysis:

The North America Automotive Onboard Quartz Crystal Units Market features a competitive landscape dominated by global and regional manufacturers focusing on product innovation and reliability. Key players include SiTime Corp, NDK, TXC Corporation, Kyocera, Seiko Epson Corp, Daishinku Corp (KDS), TKD Science, and Guoxin Micro. These companies compete through advancements in precision timing, miniaturization, and temperature-resistant quartz technologies. It benefits from rising demand for automotive-grade oscillators used in ADAS, EV systems, and infotainment modules. Leading firms emphasize R&D investments, strategic partnerships, and manufacturing localization to strengthen regional presence. Growing emphasis on AEC-Q200 compliance and high-performance design supports product differentiation across the competitive spectrum.

Recent Developments:

- In August 2024, NDK formed a strategic alliance with Rotakorn Electronics AB, enabling the supply of crystal units and oscillators to customers in Nordic countries.

- In January 2025, Kyocera Corporation exhibited groundbreaking innovations at CES 2025 in Las Vegas, including the world’s first camera-LiDAR fusion sensor for autonomous driving, along with an AI-based depth sensor and cutting-edge mobility solutions aimed at advancing automotive safety and smart transportation systems

Report Coverage:

The research report offers an in-depth analysis based on Segment 1, Segment 2, Segment 3, and Segment 3. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for quartz crystal units will continue to grow with expanding EV and autonomous vehicle adoption.

- Integration of high-frequency, temperature-stable oscillators will increase across ADAS and safety systems.

- Automakers will prioritize locally sourced and AEC-Q200-certified crystal components for supply security.

- Miniaturized and low-power crystal designs will gain popularity in compact ECU architectures.

- Smart infotainment and telematics advancements will drive consistent demand for precision timing devices.

- Collaboration between automotive OEMs and semiconductor firms will strengthen R&D for next-generation oscillators.

- Emerging MEMS-based timing technologies will complement quartz solutions rather than replace them.

- Regulatory focus on vehicle safety and reliability will encourage the use of advanced quartz components.

- Manufacturers will expand regional production and testing capabilities to reduce import dependencies.

- Sustained innovation in high-frequency stability and cost efficiency will define long-term market competitiveness.