Market Overview

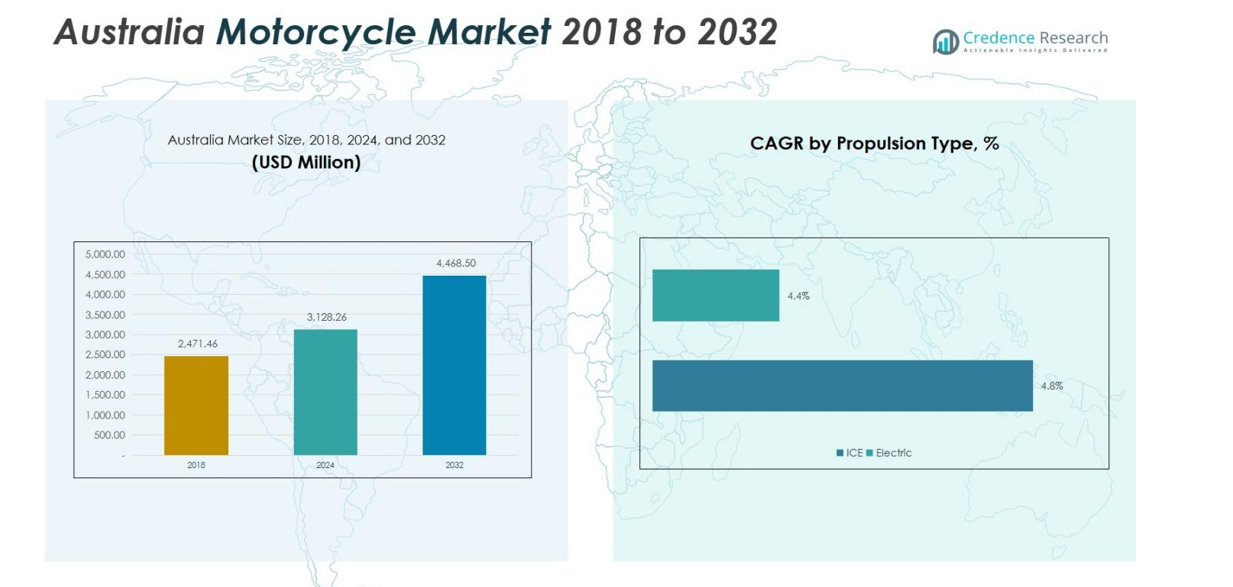

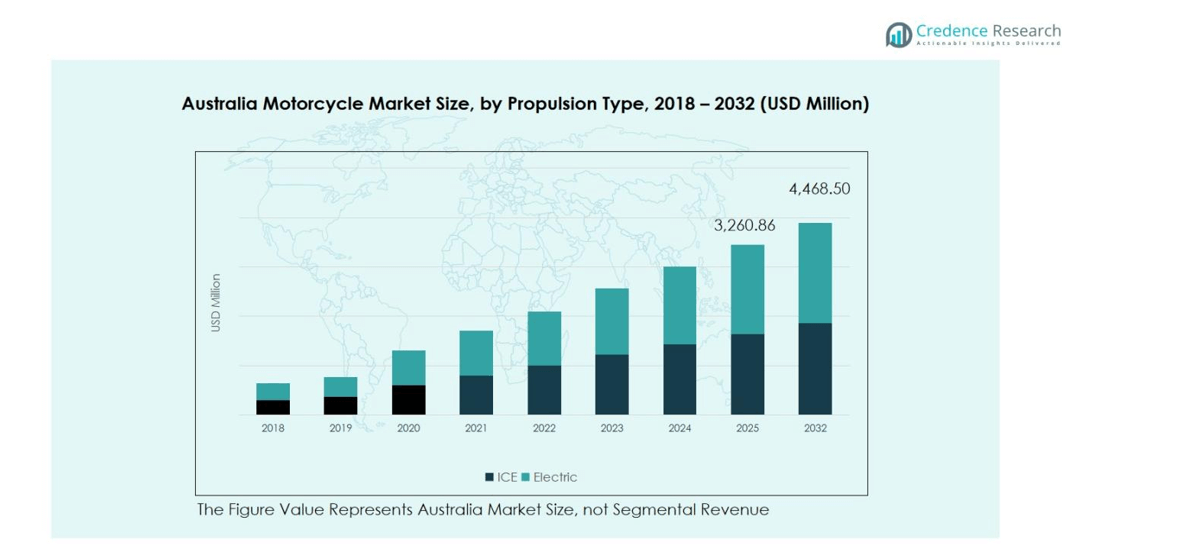

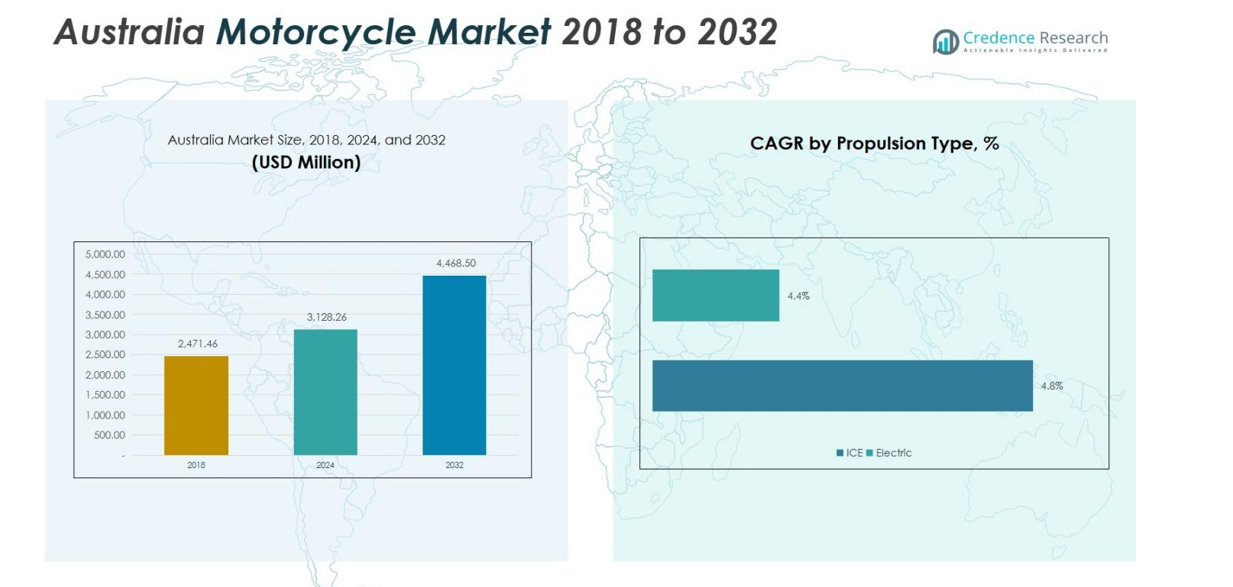

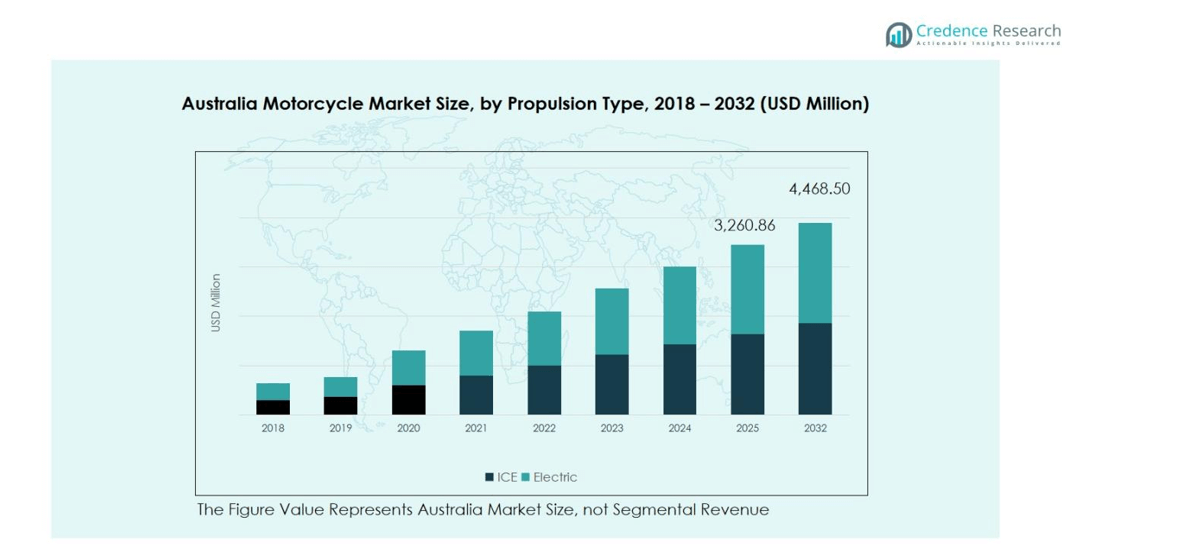

The Australia Motorcycle Market size was valued at USD 2,471.46 million in 2018, increasing to USD 3,128.26 million in 2024, and is anticipated to reach USD 4,468.50 million by 2032, growing at a CAGR of 4.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Motorcycle Market Size 2024 |

USD 3,128.26 million |

| Australia Motorcycle Market, CAGR |

4.52% |

| Australia Motorcycle Market Size 2032 |

USD 4,468.50 million |

The Australia Motorcycle Market is characterized by strong competition among key players such as Bennett & Barkell, TVS Motor Company Ltd., Bajaj Auto Ltd., Thumpstar, Suzuki Motor Corporation, Zero Motorcycles Inc., BMW AG, Harley-Davidson Inc., Piaggio Group, and Kawasaki Motors Corp. These companies focus on product innovation, electric mobility, and expanding dealership networks to strengthen their market presence. While premium brands like Harley-Davidson and BMW dominate the high-end segment, Bajaj, Suzuki, and TVS lead in affordable commuter categories. New South Wales emerges as the leading region, capturing 28% of the national market share, supported by strong commuter demand, advanced infrastructure, and a growing culture of recreational motorcycling.

Market Insights

- The Australia Motorcycle Market was valued at USD 3,128.26 million in 2024 and is projected to reach USD 4,468.50 million by 2032, growing at a CAGR of 4.52% during the forecast period.

- Market growth is driven by rising urban mobility needs, increasing adoption of commuter and leisure motorcycles, and expanding financing and after-sales service networks across the country.

- Emerging trends include the growing popularity of electric and connected motorcycles, along with a surge in demand for adventure and touring models among recreational riders.

- The competitive landscape features major players such as Bennett & Barkell, TVS Motor Company, Bajaj Auto, Suzuki, BMW, and Harley-Davidson, focusing on innovation, affordability, and premium product development.

- Regionally, New South Wales leads with a 28% share, while standard motorcycles dominate the market with a 40% segment share, supported by affordability and versatility for both commuting and leisure use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motorcycle Type

The standard motorcycle segment leads the Australian market with a 40% share, driven by its versatile design, affordability, and suitability for daily commuting and weekend leisure rides. Sports motorcycles follow with a 20% share, supported by growing enthusiasm for high-performance models among younger riders. Cruisers and touring bikes collectively account for around 25%, catering to comfort and long-distance travel preferences, while the remaining 15% is held by niche types such as adventure and off-road bikes. Rising lifestyle motorcycling trends and urban mobility needs continue to fuel diversity across type segments.

- For instance, Honda’s CB500X remains a popular choice among commuters for its fuel efficiency and balanced engine performance, supporting daily urban travel needs.

By Propulsion Type

The Internal Combustion Engine (ICE) segment dominates with over 90% market share, supported by well-established fuel infrastructure, brand familiarity, and affordability. Despite this dominance, electric motorcycles are rapidly emerging, holding nearly 10% share and recording the fastest growth rate. The shift is propelled by sustainability goals, rising fuel prices, and government incentives promoting electric mobility. Technological improvements in battery capacity and charging networks are enhancing the feasibility of electric two-wheelers for urban commuting, positioning them as a strong growth driver for the coming decade.

- For instance, Ather Energy unveiled its latest Gen 3 electric scooter, which offers a higher-range lithium-ion battery and rapid charging times, making it popular for city commuting and reflecting ongoing battery technology advancements.

By Engine Capacity

Motorcycles with up to 200cc engines hold the largest share at 45%, owing to their affordability, fuel efficiency, and suitability for city travel. The 200cc–400cc range follows with 25%, balancing power and cost for mid-level riders. Models in the 400cc–800cc category account for about 20%, appealing to experienced users seeking greater performance, while above 800cc motorcycles capture 10%, reflecting demand for premium touring and cruiser bikes. This segmentation highlights Australia’s broad rider base—from cost-conscious commuters to performance enthusiasts—driving steady demand across all engine classes.

Key Growth Drivers

Rising Demand for Commuter and Leisure Motorcycles

Australia’s growing urban population and increasing preference for cost-effective commuting solutions are driving motorcycle adoption. Standard and commuter bikes are particularly favored for their fuel efficiency, ease of parking, and lower ownership costs compared to cars. Additionally, leisure motorcycling for touring and recreational use has gained popularity among middle-aged riders, supported by scenic routes and motorcycle clubs. This dual-purpose demand from daily commuting to lifestyle riding continues to expand the overall motorcycle market across both urban and regional Australia.

- For instance, Honda also introduced its CB125F, specifically targeting urban commuters with a focus on low fuel consumption and ease of maneuvering in city environments.

Technological Advancements and Electric Transition

Continuous innovation in motorcycle design, safety systems, and electric mobility is accelerating market growth. Manufacturers are integrating smart features such as ABS, traction control, and connectivity for enhanced rider safety and convenience. The growing introduction of electric motorcycles with improved battery range, lower maintenance needs, and government-backed incentives is further reshaping consumer preferences. These advancements are encouraging adoption across both traditional and new rider segments, positioning the Australian motorcycle market on a technologically progressive trajectory.

- For instance, Triumph Motorcycles confirmed a record schedule to launch 29 new and updated bikes, including electric and cross-country models, with global unveil events and new reservation technology now rolling out in Australia in late 2025.

Expansion of Motorcycle Financing and After-Sales Networks

Easier access to financing, leasing options, and insurance services has boosted motorcycle affordability in Australia. Financial institutions and manufacturers are offering flexible repayment plans, attracting young and first-time buyers. Simultaneously, the expansion of after-sales service networks, availability of spare parts, and brand-backed maintenance programs are enhancing consumer confidence. This improved service ecosystem not only increases customer retention but also strengthens brand loyalty, contributing significantly to sustained market expansion.

Key Trends & Opportunities

Growing Popularity of Adventure and Touring Motorcycles

Adventure and touring motorcycles are witnessing rapid uptake in Australia, driven by consumer interest in long-distance travel and off-road exploration. Brands are launching models tailored to the country’s diverse terrain, combining durability with advanced navigation and comfort features. The trend reflects a lifestyle shift, with riders seeking outdoor adventure experiences and domestic travel alternatives. This niche yet fast-growing category presents strong opportunities for premium manufacturers and accessory providers catering to touring enthusiasts.

- For instance, BMW Motorrad rolled out the R 1300 GS with adaptive cruise control and connectivity features to meet the increasing demand for technologically advanced touring bikes among Australian riders.

Emergence of Connected and Smart Motorcycles

The adoption of connected motorcycles equipped with IoT-based systems is transforming rider experience and safety standards. Features like GPS tracking, smartphone integration, and predictive maintenance alerts are gaining traction among tech-savvy consumers. Manufacturers are leveraging these technologies to offer real-time data, performance insights, and security functions. The shift toward digital integration presents new revenue streams for software developers, telematics providers, and OEMs, opening lucrative opportunities within Australia’s evolving mobility ecosystem.

- For instance, RGNT Electric Motorcycles a Swedish company partnered with Telenor IoT to integrate real-time GPS tracking, software updates, and security features into their connected electric motorcycles.

Key Challenges

High Ownership Costs and Maintenance Expenses

Despite rising demand, high upfront purchase prices and maintenance costs remain major deterrents for many potential buyers. Premium motorcycle models, particularly those above 800cc, require specialized servicing and costly spare parts, which elevate long-term ownership expenses. Additionally, rising fuel prices and insurance premiums further constrain affordability. These financial barriers limit broader market penetration, especially among younger consumers and entry-level riders seeking economical transport solutions.

Infrastructure Limitations and Safety Concerns

Insufficient dedicated motorcycle lanes, limited charging infrastructure for electric models, and higher accident risks hinder market expansion. Safety remains a key issue, as Australia’s vast road network often exposes riders to unpredictable weather and road conditions. The lack of robust infrastructure and public awareness about motorcycle safety discourages adoption in some regions. Addressing these concerns through government initiatives, improved road design, and rider training programs is critical to ensuring sustainable market growth.

Regional Analysis

New South Wales

New South Wales holds the largest share of the Australia Motorcycle Market, accounting for 28% of total revenue. The region’s strong urban infrastructure, high commuter density, and thriving leisure motorcycling culture support sustained demand. Sydney and its surrounding metropolitan areas lead in registrations of standard and sports motorcycles, driven by daily commuting needs and growing recreational use. The presence of established dealerships, favorable road networks, and government emphasis on sustainable mobility further reinforce market growth across both internal combustion and emerging electric motorcycle segments.

Victoria

Victoria represents around 24% of the national motorcycle market, fueled by high urbanization, supportive riding infrastructure, and active participation in motorcycling events. Melbourne’s increasing commuter congestion has pushed consumers toward motorcycles as practical urban transport solutions. Demand for touring and adventure models is also rising due to scenic regional routes and weekend leisure rides. Ongoing investments in road safety, rider education, and the availability of financing options enhance accessibility. The region’s balanced mix of commuter and premium motorcycles positions Victoria as a major growth hub within Australia’s two-wheeler landscape.

Queensland

Queensland accounts for 20% of the motorcycle market, supported by its vast road network and strong recreational riding culture. The region’s warm climate and open-road terrain encourage higher ownership of cruisers, touring, and off-road models. Major urban centers like Brisbane and the Gold Coast are witnessing a steady shift toward electric motorcycles as part of sustainable transport initiatives. Increasing tourism, rural connectivity needs, and the popularity of motorcycle events further strengthen Queensland’s position as a significant contributor to market expansion across various motorcycle categories.

Western Australia

Western Australia contributes around 15% of the national motorcycle market, characterized by high demand for touring and adventure motorcycles suited for long-distance travel. The state’s expansive geography and mining-driven economy generate strong demand for durable and high-performance models. Perth remains the key urban hub for standard and commuter motorcycles, while rural areas favor heavy-duty bikes for longer routes. The region’s emerging adoption of electric motorcycles, supported by renewable energy policies, indicates growth potential despite challenges from limited charging infrastructure and service availability across remote areas.

South Australia and Others

South Australia, along with Tasmania and the Northern Territory, collectively represents 13% of the Australia Motorcycle Market. These regions demonstrate moderate but consistent growth, driven by increasing recreational use and gradual electrification efforts. Adelaide’s rising interest in sustainable mobility and rural connectivity needs across smaller states support steady demand. Though smaller in scale, these regions benefit from expanding dealership networks and tourism-driven motorcycle rentals. Continued improvements in infrastructure and regional road safety initiatives are expected to enhance motorcycle adoption, particularly among leisure riders and adventure enthusiasts.

Market Segmentations:

By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The competitive landscape of the Australia Motorcycle Market features prominent players such as Bennett & Barkell, TVS Motor Company Ltd., Bajaj Auto Ltd., Thumpstar, Suzuki Motor Corporation, Zero Motorcycles Inc., BMW AG, Harley-Davidson Inc., Piaggio Group, and Kawasaki Motors Corp. These companies compete across diverse segments including standard, sports, cruiser, and electric motorcycles, focusing on innovation, brand loyalty, and customer experience. Market leaders emphasize technological integration, fuel efficiency, and performance upgrades to attract both commuter and leisure riders. Strategic initiatives such as dealership expansion, after-sales service enhancement, and financing support strengthen their regional presence. The growing adoption of electric and connected motorcycles has also encouraged partnerships and R&D investments among manufacturers. Premium brands like Harley-Davidson and BMW dominate the high-end segment, while Bajaj, Suzuki, and TVS continue to lead in affordable commuter categories, reflecting a balanced competitive environment driven by innovation, accessibility, and evolving consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bennett & Barkell

- TVS Motor Company Ltd.

- Bajaj Auto Ltd.

- Thumpstar

- Suzuki Motor Corporation

- Zero Motorcycles Inc.

- Bayerische Motoren Werke (BMW) AG

- Harley-Davidson, Inc.

- Piaggio Group

- Kawasaki Motors Corp.

- Other Key Players

Recent Developments

- In May 2025, Royal Enfield expanded its footprint in Australia by opening its first Premier Store in Queensland, in collaboration with GRID Motorcycles, enhancing accessibility for its growing customer base in the country.

- In July 2025, MV Agusta announced the establishment of a wholly-owned subsidiary in Australia, headquartered in Sydney, to manage sales, marketing and customer support in Australia and New Zealand.

- In February 2025, Kawasaki secured naming-rights sponsorship of the 2025 Australian Supersport Championship, reinforcing its racing credentials and brand positioning in the Australian market.

- In September 2025, Savic Motorcycles began ramping production of its electric C-Series motorcycle and announced plans for global expansion from its Melbourne base, strengthening its presence in the Australian electric-motorcycle segment

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising urban mobility needs and lifestyle-oriented riding culture.

- Electric motorcycles will gain momentum as technology improves and charging infrastructure expands nationwide.

- Standard motorcycles will continue to dominate due to their affordability and versatility for daily commuting.

- Adventure and touring models will see increasing adoption, supported by Australia’s expanding recreational riding community.

- Manufacturers will focus on introducing connected and smart features to enhance rider safety and convenience.

- Premium motorcycle demand will rise among experienced riders seeking performance and comfort upgrades.

- Government initiatives promoting sustainable transportation will accelerate the transition toward electric two-wheelers.

- Financing and leasing options will expand motorcycle accessibility for younger and first-time buyers.

- Dealership and service network expansion will strengthen brand presence across regional and rural areas.

- Strategic collaborations and product diversification will remain key to maintaining competitiveness in the evolving market.