Market Overview

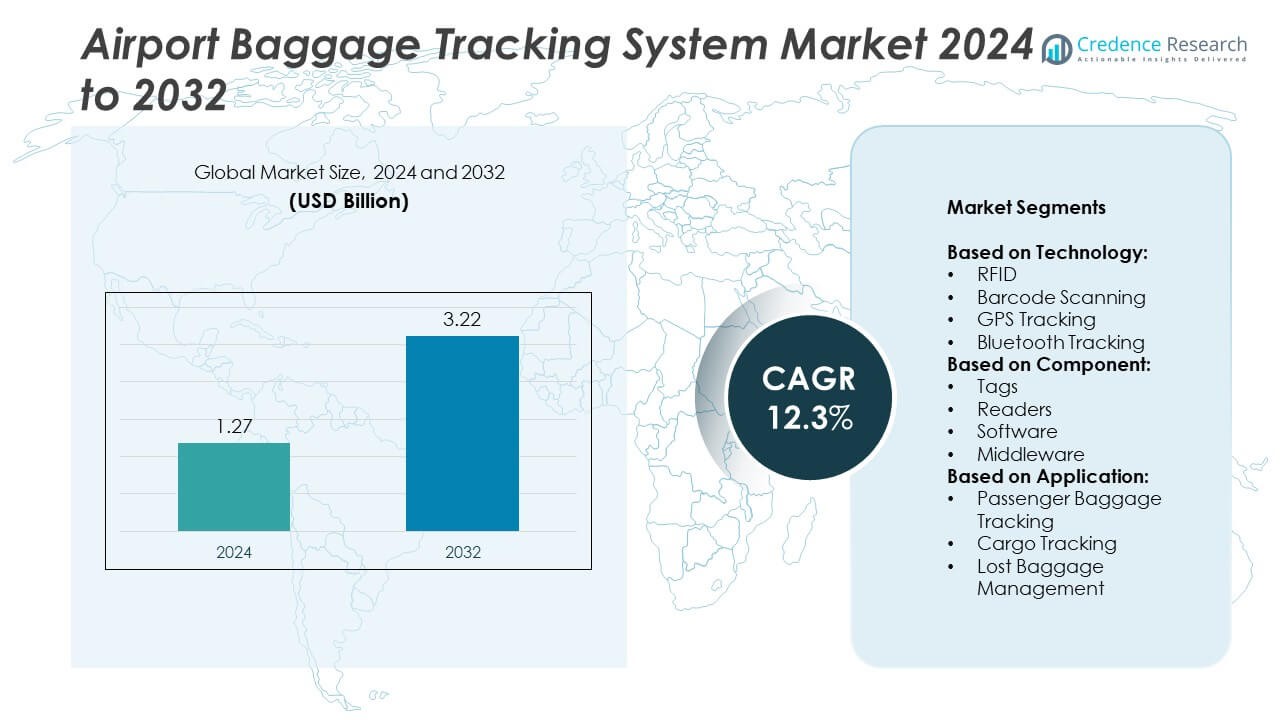

Airport Baggage Tracking System market size was valued USD 1.27 Billion in 2024 and is anticipated to reach USD 3.22 Billion by 2032, at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Baggage Tracking System Market Size 2024 |

USD 1.27 Billion |

| Airport Baggage Tracking System Market, CAGR |

12.3% |

| Airport Baggage Tracking System Market Size 2032 |

USD 3.22 Billion |

The airport baggage tracking system market is shaped by leading players such as Toshiba, Thales Group, HID Global, Zebra Technologies, SITA, Rockwell Collins, Amadeus IT Group, Panasonic, Siemens, and Checkpoint Systems. These companies focus on developing RFID, IoT-enabled, and software-driven solutions to enhance baggage visibility and reduce mishandling rates. North America leads the market with a 35.2% share in 2024, supported by high airport automation levels and early compliance with IATA Resolution 753. Europe follows with a 29.7% share, driven by strict aviation regulations, while Asia-Pacific holds 25.5% and remains the fastest-growing region due to airport expansion projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The airport baggage tracking system market was valued at USD 1.27 billion in 2024 and is projected to reach USD 3.22 billion by 2032, growing at a CAGR of 12.3%.

- Rising air passenger traffic, IATA Resolution 753 compliance, and smart airport development are key drivers boosting demand for RFID and IoT-enabled baggage tracking solutions.

- Key trends include adoption of AI-powered analytics, mobile-enabled baggage notifications, and cloud-based software platforms for centralized data management.

- The market is moderately competitive, with players focusing on RFID innovation, software integration, and partnerships with airports and airlines to strengthen global presence.

- North America leads with 35.2% share, followed by Europe at 29.7% and Asia-Pacific at 25.5%, while the RFID technology segment dominates with over 45% share in 2024.

Market Segmentation Analysis:

By Technology

RFID technology dominates the airport baggage tracking system market, accounting for over 45% share in 2024. Airports favor RFID for its ability to provide real-time tracking, reduce mishandled baggage rates, and improve operational efficiency. RFID tags enable faster scanning compared to barcodes and require minimal line-of-sight, making them ideal for large-scale baggage handling. Barcode scanning remains widely used for cost-sensitive airports, while GPS and Bluetooth tracking are gaining traction for premium passenger services and smart luggage integration. Rising investments in airport digitization and IATA’s Resolution 753 compliance continue to drive RFID adoption globally.

- For instance, Delta Air Lines became the first U.S. airline to implement a large-scale RFID baggage tracking system, announcing the initiative in 2016. The rollout involved placing RFID bag tags on all luggage handled by the airline across its global network of 344 airports. Initial installations focused on key locations, including the deployment of 1,500 automated belt loader readers at 84 of the airline’s largest U.S. stations.

By Component

Tags hold the largest share in the component segment, representing nearly 40% of the market in 2024. RFID and barcode tags are deployed in high volumes as they are critical for baggage identification and tracking. Their widespread use across multiple touchpoints, from check-in counters to baggage claim, ensures seamless operations and passenger satisfaction. Readers and software follow, supported by demand for automation, analytics, and IoT-enabled infrastructure. Middleware solutions are gaining importance as airports integrate multiple data streams to create centralized baggage tracking systems, improving decision-making and reducing operational delays.

- For instance, Delta Air Lines deployed 3,800 RFID bag-tag printers, 600 pier & claim RFID readers, and 1,500 belt loader readers to support baggage tracking.

By Application

Passenger baggage tracking leads the application segment, capturing over 55% share in 2024. Airlines and airports prioritize end-to-end tracking to minimize lost baggage cases and enhance passenger experience. The integration of RFID and mobile apps allows travelers to receive real-time updates about baggage location, improving transparency and reducing service complaints. Cargo tracking continues to expand with the growth of air freight, while lost baggage management systems are being modernized with AI-driven solutions that quickly locate and reroute misplaced items, reducing compensation costs for airlines and improving turnaround times.

Key Growth Drivers

Rising Air Passenger Traffic

Growing global air passenger traffic is a major driver of the airport baggage tracking system market. The increase in international travel and tourism has amplified baggage volumes, creating higher demand for efficient tracking solutions. Airports are implementing RFID and IoT-based systems to reduce mishandled luggage rates, which IATA reports have dropped by over 50% in the last decade due to improved tracking. This focus on seamless passenger experience and reduced compensation costs continues to push airlines and airports to invest in advanced baggage tracking technologies.

- For instance, In its investment plan for the 2027–2031 period, Heathrow Airport set a target that 99% of bags will travel with their passengers. This goal is part of a £10 billion privately funded investment plan aimed at improving infrastructure and technology, including the modernization of baggage systems.

Regulatory Mandates and Compliance

Compliance with global aviation standards such as IATA Resolution 753 drives adoption of baggage tracking systems. Resolution 753 requires end-to-end baggage tracking, compelling airports and airlines to deploy RFID and barcode solutions. This regulatory push ensures transparency and enhances passenger confidence. Major hubs worldwide have invested in large-scale RFID implementation to meet compliance deadlines. Such regulations create a consistent global framework that accelerates technology adoption, standardizes baggage handling procedures, and improves data sharing between airlines and airport operators.

- For instance, Lufthansa and Virgin Atlantic integrated Apple AirTags in their baggage trace-systems, part of over 15 airlines collaborating with Apple for real-time luggage location sharing.

Smart Airport Initiatives

The rise of smart airport initiatives is another key driver shaping the market. Airports are investing in digital infrastructure, automation, and data analytics to streamline operations. Baggage tracking is a core element of these projects, with real-time data integration improving efficiency and reducing manual interventions. Integration with mobile apps allows passengers to track luggage on their devices, enhancing satisfaction. Smart baggage systems also support predictive maintenance and operational planning, reducing downtime and optimizing resource allocation, making them a key focus for future airport upgrades.

Key Trends & Opportunities

Integration of AI and IoT

AI and IoT integration is a major trend in the baggage tracking market. Airports are deploying predictive analytics to anticipate baggage flow bottlenecks and reduce mishandling. IoT sensors provide real-time updates, allowing operators to monitor location and status continuously. AI-powered systems can quickly detect anomalies, such as misplaced or delayed bags, and automatically trigger corrective actions. This digitalization trend is creating opportunities for solution providers to offer advanced software platforms and predictive maintenance tools that enhance operational efficiency and passenger experience.

- For instance, Delta’s implementation of RFID at 344 stations supports its compliance with IATA’s Resolution 753.

Growth of Bluetooth and GPS Tracking

Bluetooth and GPS-based tracking solutions are gaining momentum as airlines focus on offering premium passenger services. Smart luggage with embedded GPS trackers and Bluetooth-enabled baggage tags allow travelers to receive real-time location alerts on mobile devices. This technology provides additional security and peace of mind for passengers. It also creates new revenue streams for airlines through value-added services. The increasing affordability of Bluetooth beacons and smartphone adoption supports rapid market growth for this segment, particularly in business and international travel markets.

- For instance, Air France will tag about 8 million pieces of baggage per year with RFID chips at Paris-Charles de Gaulle airport starting in 2020.

Key Challenges

High Implementation Costs

The high initial cost of deploying baggage tracking systems remains a key challenge. Large-scale RFID implementation requires significant investment in tags, readers, software, and integration with existing airport infrastructure. Smaller regional airports often struggle to justify these expenses due to limited passenger volumes. This cost barrier slows adoption in developing regions, where budget constraints are significant. Solution providers are working to offer scalable, modular systems and subscription-based models to help smaller airports overcome cost challenges and comply with international tracking standards.

Data Integration and Interoperability Issues

Data integration across multiple airline and airport systems poses a major challenge. Many airports still operate on legacy IT infrastructure that struggles to integrate real-time baggage tracking data. Lack of interoperability between different systems can create data silos and tracking gaps. This results in inefficiencies and occasional baggage mishandling. Industry players are addressing this by developing middleware and standardized data-sharing protocols, but achieving seamless global integration remains a work in progress, particularly in regions with varying levels of technological maturity.

Regional Analysis

North America

North America holds about 35.2% share of the airport baggage tracking system market in 2024, driven by widespread RFID adoption and compliance with IATA Resolution 753. Major airports in the U.S. and Canada, such as Atlanta and Toronto Pearson, have invested heavily in RFID and barcode-based systems to improve efficiency. Government funding and large-scale modernization programs continue to fuel demand. The presence of leading technology providers and high passenger traffic levels strengthen the region’s position. Expanding terminal infrastructure and the rising focus on passenger experience further support consistent growth through the forecast period.

Europe

Europe accounts for nearly 29.7% share of the market in 2024, supported by strict aviation regulations and a strong focus on sustainability. Major airports in the UK, Germany, and France have deployed RFID baggage tracking to meet compliance standards and reduce mishandling rates. The region benefits from established infrastructure and government-backed digitization programs. Growth in low-cost carriers and an increase in intra-European travel continue to raise baggage volumes, encouraging airports to invest in advanced tracking solutions. Collaborative data-sharing systems between airlines and airports play a vital role in driving further adoption across the region.

Asia-Pacific

Asia-Pacific captures 25.5% share of the market in 2024, making it the fastest-growing regional segment. Rapid air passenger traffic growth in China, India, and Southeast Asia fuels demand for efficient baggage handling systems. Massive airport expansion projects, including Beijing Daxing and Delhi’s IGI Terminal 3 upgrades, are integrating RFID and IoT-enabled solutions. Regional governments are investing heavily in smart airport initiatives, further accelerating adoption. Partnerships between global technology providers and regional airport authorities are enabling advanced baggage automation, which reduces delays and enhances operational efficiency, positioning Asia-Pacific as the key growth engine for the market.

Middle East & Africa

Middle East & Africa holds approximately 5.8% share of the market in 2024, with growth concentrated in major hubs such as Dubai International, Hamad International, and King Khalid International. These airports are deploying advanced baggage tracking systems to meet rising passenger numbers and support their role as global transit hubs. Africa is gradually adopting RFID and barcode-based systems as aviation infrastructure develops, especially in South Africa and Kenya. Growing tourism, new terminal construction, and government focus on improving aviation standards are driving gradual market expansion across this region despite budget limitations in smaller countries.

Latin America

Latin America represents around 3.8% share of the airport baggage tracking system market in 2024, with Brazil and Mexico leading adoption. Modernization projects at airports such as São Paulo-Guarulhos and Mexico City International are driving demand for baggage automation. Regional airlines are prioritizing passenger satisfaction and operational efficiency, leading to greater deployment of RFID and barcode tracking systems. Although economic constraints slow adoption in some countries, consistent air travel growth and increasing regional connectivity are creating opportunities for technology providers. Market growth is expected to strengthen as infrastructure upgrades expand across the region in the coming years.

Market Segmentations:

By Technology:

- RFID

- Barcode Scanning

- GPS Tracking

- Bluetooth Tracking

By Component:

- Tags

- Readers

- Software

- Middleware

By Application:

- Passenger Baggage Tracking

- Cargo Tracking

- Lost Baggage Management

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The airport baggage tracking system market features key players such as Toshiba, Thales Group, HID Global, Zebra Technologies, SITA, Rockwell Collins, Amadeus IT Group, Panasonic, Siemens, Checkpoint Systems, RIMD, Kris L. Seibert, Meat and Produce, and Crisp Thinking. The market is highly competitive, with companies focusing on technology innovation, strategic partnerships, and large-scale airport projects to strengthen their market presence. Players are investing in RFID, IoT, and AI-driven solutions to improve baggage traceability and reduce mishandling rates. Software upgrades, middleware integration, and predictive analytics are becoming critical to enhance airport operations and passenger experience. Many competitors are also pursuing collaborations with airlines and airport operators to enable seamless data sharing and compliance with IATA regulations. The emphasis is shifting toward end-to-end baggage visibility, cloud-based platforms, and mobile-enabled tracking systems, positioning companies to meet growing passenger expectations and regulatory requirements while capturing emerging opportunities in smart airport initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toshiba

- Thales Group

- HID Global

- Zebra Technologies

- SITA

- Rockwell Collins

- Amadeus IT Group

- Panasonic

- Siemens

- Checkpoint Systems

- RIMD

- Kris L. Seibert

- Meat and Produce

- Crisp Thinking

Recent Developments

- In 2025, HID acquired Intelligent Observation to strengthen its Real-Time Location System (RTLS) portfolio. This expands its solutions for tracking in environments requiring high accuracy.

- In 2025, Perth Airport selected Amadeus to deploy an end-to-end biometric passenger system, add ~100 check-in kiosks, and replace nearly 40 counters with bag-drop units, expanding self-service baggage processing.

- In 2024, SITA and IDEMIA partnered to integrate computer vision into baggage handling processes. This enhancement improves tracking from check-in through to destination, reducing risk of lost or delayed luggage.

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rapid adoption of RFID and IoT-enabled baggage tracking systems worldwide.

- Airports will focus on end-to-end baggage visibility to minimize mishandling rates.

- Integration of AI and predictive analytics will improve operational efficiency and real-time decision-making.

- Mobile-enabled passenger notifications will become standard for baggage location updates.

- Cloud-based software platforms will dominate, offering scalability and centralized data management.

- Growth will accelerate in Asia-Pacific with major airport expansion and smart airport projects.

- Airlines will invest in premium baggage tracking services to enhance passenger satisfaction.

- Collaboration between airports, airlines, and technology providers will strengthen for seamless data sharing.

- Regulatory compliance with IATA Resolution 753 will drive faster global technology adoption.

- Sustainability initiatives will promote digital tracking to reduce paper-based processes and improve efficiency.