Market Overview:

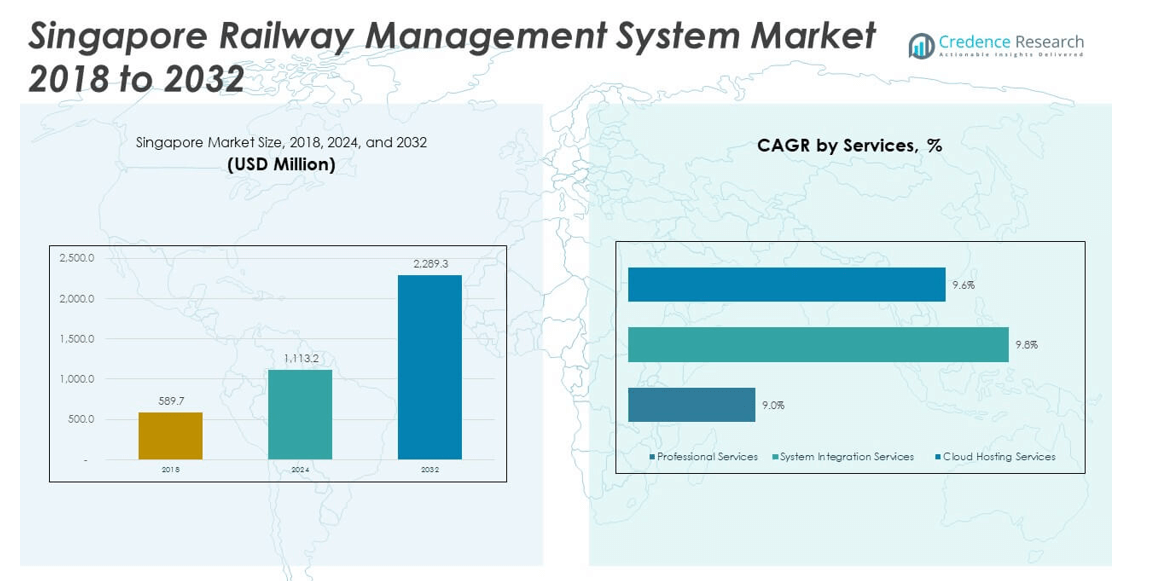

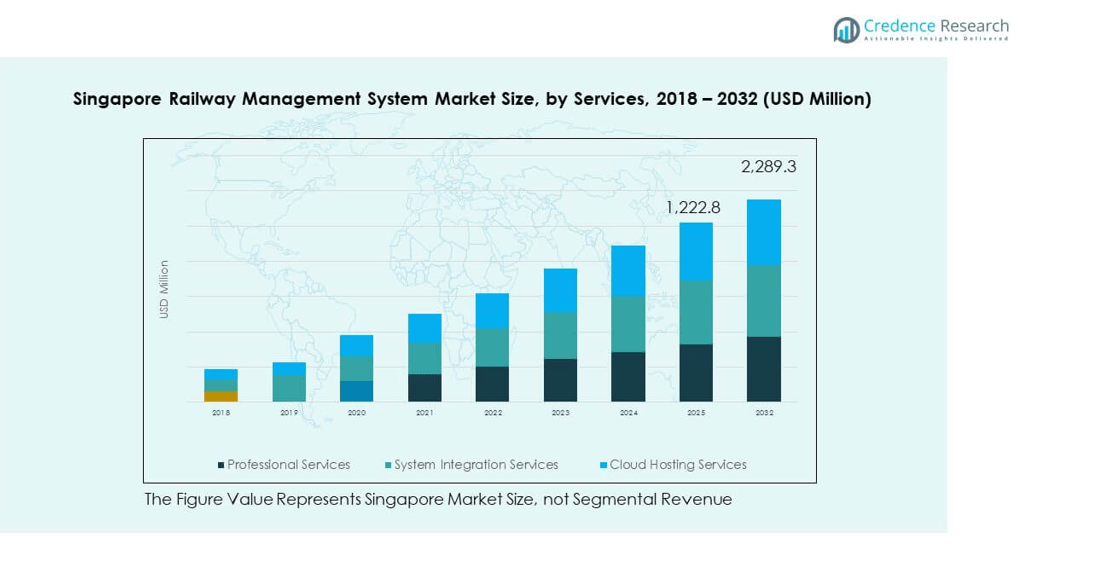

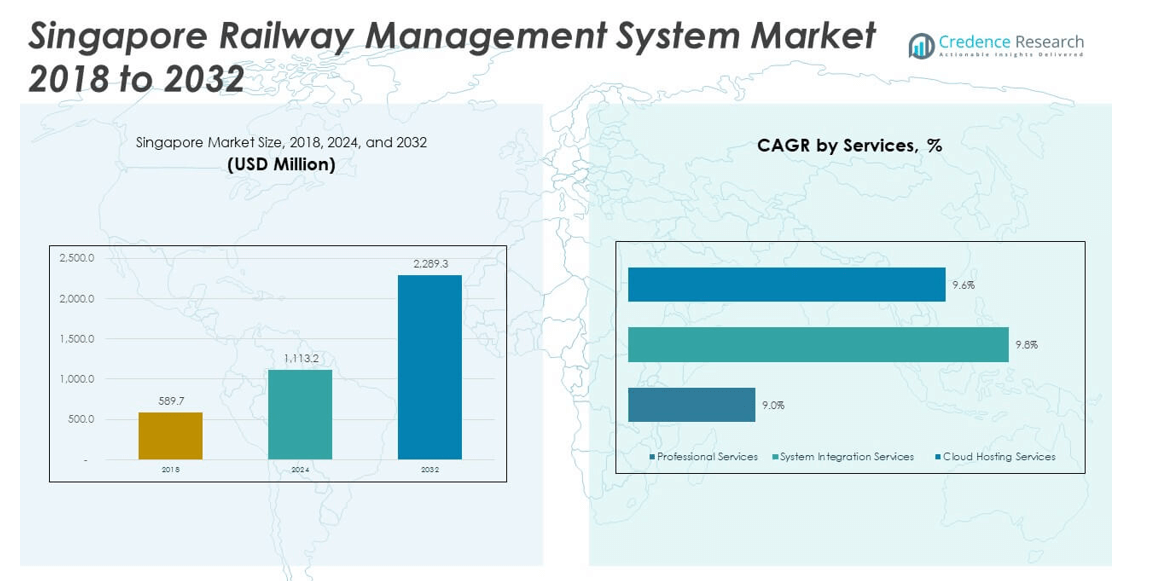

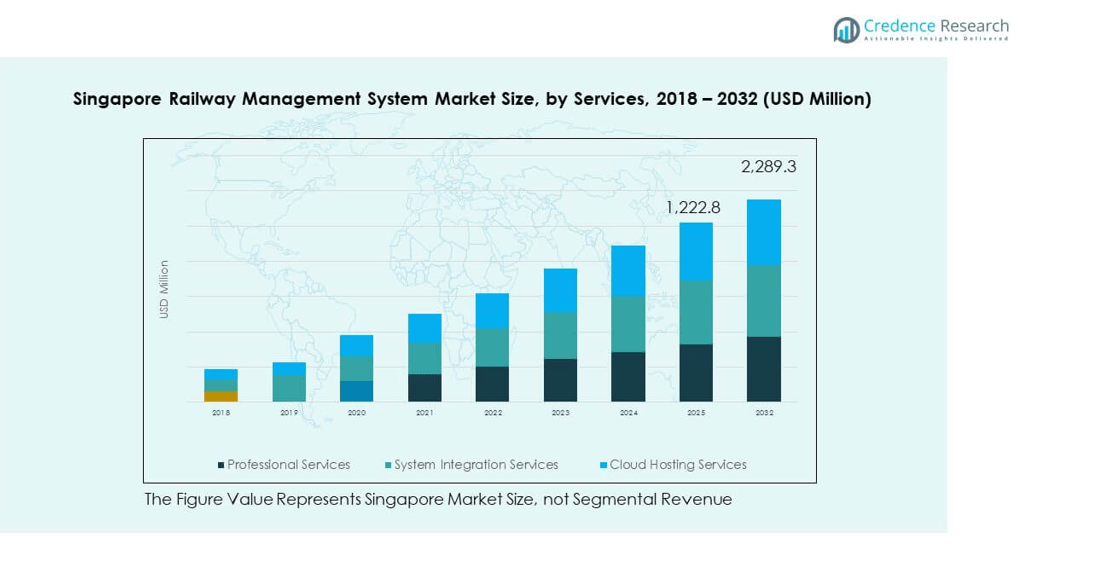

The Singapore Railway Management System Market size was valued at USD 589.7 million in 2018 to USD 1,113.2 million in 2024 and is anticipated to reach USD 2,289.3 million by 2032, at a CAGR of 9.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Singapore Railway Management System Market Size 2024 |

USD 1,113.2 million |

| Singapore Railway Management System Market, CAGR |

9.43% |

| Singapore Railway Management System Market Size 2032 |

USD 2,289.3 million |

Growth in the Singapore Railway Management System Market is driven by rising urban density, expanding MRT projects, and strong government investment in smart transport infrastructure. The adoption of digital solutions such as automated ticketing, predictive maintenance, and real-time monitoring improves efficiency and enhances passenger safety. Integration of advanced technologies like AI and IoT supports optimization of rail networks, reduces downtime, and ensures reliable commuter services. Sustainability goals also drive deployment of eco-friendly signaling and energy-efficient systems. These drivers collectively strengthen the adoption of advanced railway management solutions.

Regionally, Singapore leads with advanced rail infrastructure and strong policy backing that accelerates technology deployment. The city-state emphasizes smart mobility solutions, making it a model for efficient urban transit in Asia. Neighboring countries such as Malaysia and Indonesia are emerging markets, focusing on expanding metro systems and adopting digital platforms for improved connectivity. Japan and South Korea remain regional benchmarks for innovation, shaping trends in signaling and control systems. These dynamics highlight Singapore’s pivotal role in advancing rail management solutions while reinforcing its influence across Southeast Asia’s evolving transport ecosystem.

Market Insights

- The Singapore Railway Management System Market was valued at USD 589.7 million in 2018, reached USD 1,113.2 million in 2024, and is anticipated to hit USD 2,289.3 million by 2032, registering a CAGR of 9.43% during the forecast period.

- Central Singapore held 42% share, driven by its dense urban core and MRT interchanges, while the Eastern region accounted for 31% due to airport connectivity and suburban growth, and the Northern and Western regions together contributed 27% supported by new housing and industrial corridors.

- The Eastern region is the fastest-growing area with 31% share, propelled by expansion projects, rising suburban population, and strong investments in predictive maintenance and traffic management systems.

- By services, professional services represent 41% of the market in 2024, as consultancy, planning, and operational support remain essential for large-scale projects.

- System integration services account for 36%, driven by demand for connecting legacy rail infrastructure with advanced signaling, monitoring, and digital platforms across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Urbanization and Expanding Passenger Demand

The Singapore Railway Management System Market benefits from rapid urbanization and a rising population density that increases pressure on public transport. More commuters depend on efficient rail networks for daily mobility. This trend creates significant demand for advanced management solutions that can handle growing ridership. Governments and operators focus on delivering seamless services to avoid overcrowding and delays. Technology adoption becomes essential to support operational excellence and reliability. It ensures systems remain sustainable while meeting peak-hour requirements. Urban expansion further drives investment in modern infrastructure. The market aligns itself with these demographic and societal shifts.

Government Investment and Smart Nation Goals

The government plays a leading role in strengthening the Singapore Railway Management System Market through consistent investments. Public agencies emphasize digital transformation to align with Singapore’s Smart Nation agenda. These policies encourage the adoption of automated fare collection, real-time data platforms, and predictive maintenance. Infrastructure upgrades remain central to improving safety and commuter convenience. Partnerships with technology providers create opportunities to integrate AI and IoT in transport systems. It also ensures the rail sector remains globally competitive in efficiency standards. Strong financial backing reduces risks in large-scale deployments. These policies form a vital pillar supporting market growth.

Integration of Digital Solutions for Operational Efficiency

Digital solutions provide strong momentum in shaping the Singapore Railway Management System Market. Operators deploy advanced signaling, communication, and monitoring tools to improve system reliability. Predictive analytics helps reduce downtime and prevent equipment failures before they disrupt services. Automation increases operational speed while reducing manual intervention and costs. Integration with cloud-based platforms enables better resource planning and passenger information systems. It also supports scalable solutions for future rail expansions. The digital layer ensures data-driven decision-making at every operational stage. This reliance on technology enhances system-wide productivity and safety standards.

- For instance, Singapore’s North-South and East-West Lines completed a major signaling system upgrade in 2018. This improvement boosted rail reliability, with Mean Kilometres Between Failure (MKBF) rising to 690,000 train-km in 2018 from 181,000 train-km in 2017, according to LTA’s official report.

Commitment to Environmental Sustainability and Efficiency

Sustainability efforts are becoming critical in shaping the Singapore Railway Management System Market. Energy-efficient signaling, electric-powered systems, and eco-friendly infrastructure support climate action goals. Operators adopt green solutions to minimize carbon emissions and enhance efficiency. Sustainable practices resonate with global and regional environmental commitments. Investments in low-energy technologies also reduce operational costs for long-term use. It reflects a shift toward cleaner urban mobility that meets commuter and policy expectations. Such commitments improve the reputation of Singapore’s transport ecosystem. Sustainability becomes both a driver of growth and a competitive differentiator in regional markets.

- For instance, Singapore’s Land Transport Authority outlined in its Master Plan 2040 that the entire public bus and taxi fleet will transition to cleaner energy by 2040. Early measures include large-scale deployment of BlueSG electric car-sharing fleets and trials of electric and diesel hybrid buses.

Market Trends

Adoption of Artificial Intelligence and Predictive Analytics

The Singapore Railway Management System Market is experiencing a strong shift toward AI-based solutions. Predictive analytics supports condition-based monitoring and maintenance scheduling, reducing service disruptions. Machine learning models analyze passenger behavior to optimize scheduling and crowd management. AI-based surveillance enhances safety by detecting irregular activity across stations and trains. It improves resource allocation and supports more efficient deployment of staff and systems. Predictive insights also help reduce maintenance costs and downtime. AI’s role continues to expand as rail operators invest in smarter infrastructure. This trend reflects the industry’s movement toward data-driven transport systems.

- For instance, SMRT officially launched its Overwatch AI-enabled decision support system on the Circle Line in August 2023, providing real-time monitoring and anomaly detection for unmanned MRT operations. Overwatch was developed fully in-house and awarded Operational Excellence by UITP in June 2023. By the end of 2024, Overwatch will be extended to the North-South and East-West Lines, boosting reliability and supporting SMRT’s commitment to enhanced operational awareness and swift service recovery.

Expansion of Smart Ticketing and Passenger-Centric Systems

Passenger convenience is shaping the Singapore Railway Management System Market through smart ticketing solutions. Contactless payments and mobile ticketing apps offer commuters faster and more secure travel options. Seamless integration across different modes of transport ensures smoother journeys. Personalization features allow tailored travel recommendations and enhanced commuter experiences. It ensures improved customer loyalty and satisfaction across the transport ecosystem. Passenger feedback platforms also contribute to operational improvements. Enhanced ticketing systems reduce waiting times while boosting operational transparency. Smart ticketing continues to gain momentum as a defining market trend.

Integration of Cybersecurity in Rail Operations

With growing digital reliance, cybersecurity is becoming central to the Singapore Railway Management System Market. Advanced rail control and communication systems require strong protection from cyber risks. Operators deploy secure architectures based on international standards such as IEC 62443. Multi-layered defenses safeguard data integrity and system functionality. It ensures resilience against threats that could disrupt critical operations. Cybersecurity investments also build commuter confidence in safe travel. Integration of cybersecurity in early planning stages strengthens long-term rail sustainability. This trend reflects the industry’s shift toward securing its digital backbone.

- For instance, in November 2023, SBS Transit appointed ST Engineering as system integrator to implement Cervello’s end-to-end AI-driven cybersecurity solutions, aiming to secure its entire rail infrastructure against modern threats. This included new monitoring, behavioral threat detection, and operational insights across the full rail network, as confirmed in railway sector news outlets and press releases.

Development of Smart Mobility and Connected Ecosystems

Smart mobility concepts are reshaping the Singapore Railway Management System Market with connected transport ecosystems. Integration with buses, taxis, and micromobility platforms provides commuters with multimodal travel choices. Digital platforms offer real-time updates and route planning across systems. It enhances journey flexibility and reduces overall congestion in urban areas. Connected systems also support national sustainability goals by optimizing traffic flow. Partnerships between rail operators and mobility providers drive new innovations. This trend positions Singapore as a leader in integrated smart transport. The expansion of connected ecosystems highlights the growing role of rail within wider mobility frameworks.

Market Challenges Analysis

High Implementation Costs and Complex Integration

The Singapore Railway Management System Market faces challenges due to high capital requirements for advanced systems. Initial investment in AI-driven tools, automated fare collection, and predictive maintenance platforms remains substantial. Smaller operators face difficulties in adopting such solutions due to budget constraints. Integration of new technologies with legacy systems adds complexity and potential delays. It requires specialized expertise and long-term planning for successful implementation. Maintenance costs also rise with increased dependence on high-tech infrastructure. Financial strain can slow down expansion and innovation efforts. This challenge emphasizes the need for balanced resource allocation and government support.

Cybersecurity Risks and Regulatory Pressures

Cybersecurity risks represent a growing challenge for the Singapore Railway Management System Market. Increasing digital adoption exposes networks to potential cyberattacks and operational disruptions. Regulatory bodies impose strict compliance requirements that demand constant monitoring. Meeting international standards requires significant investment and skilled workforce development. It creates operational hurdles for both public and private rail stakeholders. The dynamic nature of threats means systems must evolve continuously. Regulatory pressures also increase accountability, leaving no room for error. These factors highlight the dual challenge of ensuring resilience while maintaining cost efficiency.

Market Opportunities

Expansion of Smart Infrastructure and Digital Upgrades

Opportunities for the Singapore Railway Management System Market lie in the development of smart infrastructure. Expansion of metro and light rail projects provides scope for adopting advanced management platforms. Digital upgrades in signaling, ticketing, and monitoring systems enhance operational excellence. It creates possibilities for global partnerships with technology leaders. Passenger-focused innovations like integrated journey planners expand service appeal. Sustainability-focused investments also present strong business opportunities. Market players can differentiate by offering scalable and eco-friendly solutions. Expansion projects continue to open doors for long-term growth potential.

Regional Leadership in Smart Mobility Solutions

The Singapore Railway Management System Market has strong opportunities to strengthen regional leadership. Singapore’s advanced infrastructure and Smart Nation initiatives position it as a hub for innovation. Neighboring countries looking to expand rail systems create export opportunities for Singapore’s expertise. It allows companies to leverage proven models for system design and integration. Regional collaboration also enhances technology transfer and knowledge sharing. Demand from Southeast Asia strengthens the business case for cross-border partnerships. This positions Singapore as both a consumer and exporter of smart rail solutions. Future opportunities are rooted in its role as a regional technology leader.

Market Segmentation Analysis

By Services, the Singapore Railway Management System Market is segmented into professional services, system integration services, and cloud hosting services. Professional services lead the segment due to the need for consultancy, planning, and continuous support to ensure efficient project delivery. System integration services are gaining strong traction, driven by the complexity of linking legacy systems with modern digital platforms. Cloud hosting services are expanding as operators demand scalable, cost-effective, and real-time management tools to enhance operational performance. It reflects the increasing role of digital infrastructure in supporting seamless commuter experiences and data-driven decisions.

- For instance, SMRT Corporation reported in its 2023/24 Group Review that both the North-South and East-West Lines achieved over 1 million mean kilometres between failures (MKBF) for the fifth consecutive year, reinforcing Singapore’s global benchmark in rail reliability. This milestone highlights the effectiveness of system integration services in bridging legacy infrastructure with modern digital platforms.

By System & Solution, the Singapore Railway Management System Market includes rail operations management systems, rail traffic management systems, rail asset management systems, rail control systems, and rail maintenance management systems. Rail operations management systems dominate as they support scheduling, ticketing, and passenger information functions critical to daily services. Rail traffic management systems are witnessing growth with rising investments in signaling and safety frameworks. Asset management systems contribute by extending the lifecycle of rolling stock and infrastructure through predictive maintenance. Rail control systems and maintenance management solutions remain essential for minimizing downtime, ensuring compliance, and securing long-term reliability. This segmentation highlights how each category addresses specific functional needs to create an integrated and resilient railway ecosystem.

- For instance, SMRT’s Maintenance Engineering Centre (MEC) at Kim Chuan Depot, established in 2023, functions as a 24/7 control hub utilizing predictive maintenance and real-time condition monitoring. The centre supports SMRT’s sustained achievement of over 1 million MKBF on its main lines by enabling rapid response to maintenance issues and minimizing service disruptions.

Segmentation

By Services

- Professional Services

- System Integration Services

- Cloud Hosting Services

By System & Solution

- Rail Operations Management Systems

- Rail Traffic Management Systems

- Rail Asset Management Systems

- Rail Control Systems

- Rail Maintenance Management Systems

Regional Analysis

Central Singapore’s Dominant Position

Central Singapore holds the largest share of the Singapore Railway Management System Market with 42%. This dominance is driven by high commuter volumes, dense urban development, and major transit interchanges. The presence of the Mass Rapid Transit (MRT) core network enhances demand for advanced management systems. It also benefits from continuous government funding to improve service quality and system efficiency. Digital upgrades in signaling and monitoring strengthen reliability across central lines. Integration of smart ticketing platforms further boosts operational excellence. Central Singapore remains the key hub for technological deployment in the market.

Eastern Region’s Growing Momentum

The Eastern region accounts for 31% share of the Singapore Railway Management System Market. Expansion projects in Changi, Tampines, and surrounding areas fuel adoption of advanced systems. The demand is supported by airport connectivity needs and suburban commuter growth. It benefits from investments in traffic management and predictive maintenance platforms. Operators prioritize reliability to meet passenger expectations during peak flows. It also attracts partnerships for system integration and cloud-based solutions. The Eastern region’s steady growth reflects a balance of urban development and transport expansion.

Northern and Western Contributions

The Northern and Western regions together contribute 27% share of the Singapore Railway Management System Market. These areas experience growth from new residential developments and industrial corridors. Expanding MRT lines into northern districts strengthen system demand. The Western region supports freight and industrial transport, creating opportunities for asset management and control systems. It emphasizes integration of digital monitoring tools to reduce downtime. Both subregions gain momentum from government-backed expansion projects. Their contribution enhances the balanced distribution of market opportunities across Singapore.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Systra

- WSP

- Alstom

- Hitachi Ltd.

- Siemens AG

- Rail Systems Singapore Pte. Ltd.

- Pilz South East Asia Pte. Ltd.

- GE Transportation

- Indra Sistemas

- Other Key Players

Competitive Analysis

The Singapore Railway Management System Market features strong competition among global leaders and local specialists. Companies such as Siemens AG, Alstom, Hitachi Ltd., and WSP drive innovation with advanced signaling, automation, and digital management systems. It is supported by local firms like Rail Systems Singapore Pte. Ltd. and Pilz South East Asia Pte. Ltd., which provide integration expertise and tailored services. International players invest in partnerships and technology transfer to strengthen their presence. Local firms benefit from government collaborations, ensuring responsiveness to Singapore’s Smart Nation goals. Competitive strategies focus on digitalization, cloud adoption, and predictive maintenance solutions. Market players emphasize sustainable technologies, enhancing efficiency while meeting environmental standards. The mix of global expertise and local adaptability keeps the market highly dynamic and forward-looking.

Recent Developments

- In August 2025, Alstom secured a major $400–500 million contract with Singapore’s Land Transport Authority to deploy its driverless Urbalis CBTC signaling system on the Thomson-East Coast Line extensions. Additionally, Alstom continues manufacturing 106 Movia trains for Singapore’s North-South and East-West Lines, with ongoing deliveries scheduled through 2026. These projects are part of Alstom’s strategic push to align with Singapore’s 2040 transport vision and sustainability goals.

- In Oct 2024, Systra’s strategic ownership structure shifted as SNCF and RATP entered exclusive negotiations to sell a majority stake in Systra to Latour Capital and Fimalac. This move is intended to accelerate Systra’s global growth through new acquisitions, further strengthening its expertise in international rail consulting, including activities in South-East Asia such as Singapore.

Report Coverage

The research report offers an in-depth analysis based on Services and System & Solution. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Singapore Railway Management System Market will see rapid expansion driven by ongoing MRT network upgrades.

- Investments in predictive maintenance platforms will strengthen operational efficiency and reduce service disruptions.

- Integration of artificial intelligence will optimize traffic flow and improve passenger experience.

- Cloud-based hosting services will gain traction, supporting scalability and digital resource planning.

- Strong focus on cybersecurity will shape future investments to safeguard rail infrastructure.

- Eco-friendly signaling and energy-efficient systems will align with sustainability and climate goals.

- Demand for professional and integration services will increase as projects expand nationwide.

- Partnerships between global players and local firms will accelerate technology transfer and innovation.

- Passenger-centric features such as seamless ticketing and multimodal integration will enhance user satisfaction.

- Regional leadership in smart mobility solutions will position Singapore as a model for advanced rail management.