Market Overview:

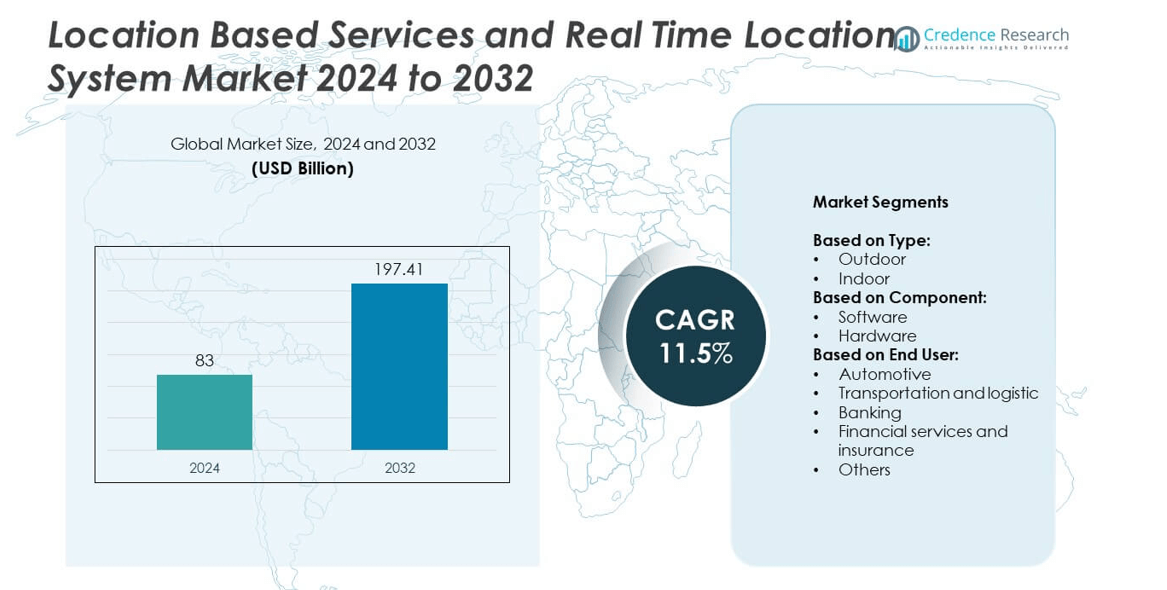

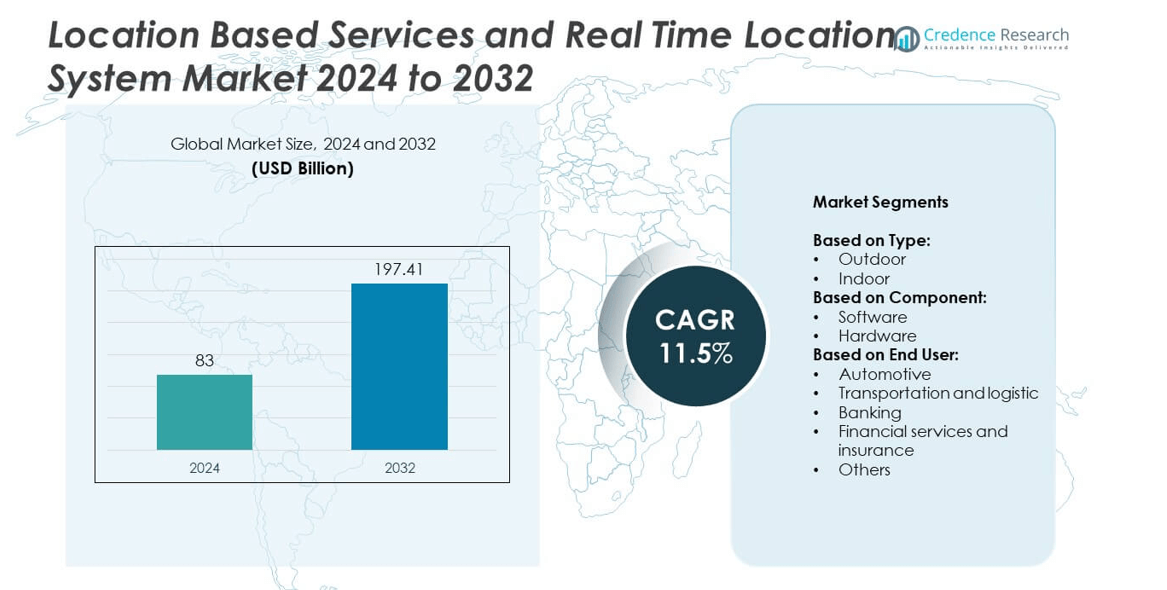

Location Based Services and Real Time Location System market size was valued USD 83 Billion in 2024 and is anticipated to reach USD 197.41 Billion by 2032, at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Location Based Services and Real Time Location System Market Size 2024 |

USD 83 Billion |

| Location Based Services and Real Time Location System Market, CAGR |

11.5% |

| Location Based Services and Real Time Location System Market Size 2032 |

USD 197.41 Billion |

Key players in the Location Based Services and Real Time Location System market include Qualcomm, Baidu, Zebra Technologies, IBM, Microsoft, Google, AutoNavi, ESRI, Teldio, Cisco Systems, Oracle, and Ericsson. These companies focus on advanced GPS, Bluetooth, and Wi-Fi-enabled solutions to enhance real-time tracking and location accuracy. Their strategies emphasize AI integration, 5G-enabled connectivity, and cloud-based platforms to meet growing enterprise demand. North America led the market with over 35% share in 2024, supported by strong IoT adoption, smart city projects, and well-developed infrastructure. Asia-Pacific followed closely, emerging as the fastest-growing region due to rapid digitalization and expanding e-commerce logistics.

Market Insights

- The Location Based Services and Real Time Location System market was valued at USD 83 Billion in 2024 and is projected to reach USD 197.41 Billion by 2032, growing at a CAGR of 11.5%.

- Rising adoption of connected devices, fleet tracking solutions, and indoor positioning systems are major drivers supporting market growth across industries.

- Key trends include integration with AI and predictive analytics, expansion of 5G networks, and rising use in smart city projects to improve public safety and mobility.

- The market is highly competitive with players focusing on product innovation, strategic partnerships, and cloud-based platforms to strengthen their position and improve solution scalability.

- North America led with over 35% share in 2024, followed by Europe with 25% and Asia-Pacific with 28%; the outdoor segment dominated with over 60% share, supported by demand for navigation, logistics optimization, and location-based marketing services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Outdoor location-based services dominated the market, capturing over 60% share in 2024. Demand is driven by the growing use of GPS-enabled devices for navigation, fleet management, and location-based advertising. Outdoor solutions support large-scale applications such as route optimization and geo-marketing, which are critical for industries like logistics and ride-hailing. Advancements in satellite positioning and 5G connectivity are enhancing accuracy and real-time tracking capabilities. Indoor solutions are gaining momentum in retail, healthcare, and manufacturing for asset tracking and visitor navigation but remain a smaller segment due to limited deployment infrastructure.

- For instance, Esri’s ArcGIS platform is used by hundreds of thousands of organizations globally, including Fortune 500 companies, national governments, and thousands of universities.

By Component

Software held the largest share, exceeding 55% of the market in 2024, driven by rising adoption of analytics and mapping platforms. Companies rely on software to process large volumes of geospatial data and deliver actionable insights. Cloud-based platforms enable scalable, real-time location tracking across industries, improving operational efficiency and customer engagement. Hardware components, including beacons, RFID tags, and sensors, support indoor navigation and precise asset monitoring but face slower growth due to higher installation costs. The shift toward software-as-a-service models continues to boost recurring revenues and accelerate deployment for enterprises of all sizes.

- For instance, General Motors’ OnStar service does provide millions of customers with connected features and safety services like Automatic Crash Response and navigation assistance. In July 2015, OnStar announced it reached its one-billionth customer interaction, which included more than 270 million turn-by-turn navigation requests. Starting in February 2024, GM began standardizing certain OnStar services, including Automatic Crash Response, for up to eight years on all 2025 model year vehicles. While a directory listing cited 20 million members as of June 2024, General Motors’ official site now states that OnStar provides services to 22 million members globally.

By End User

The automotive sector led the market with over 30% share in 2024, supported by growing demand for in-vehicle navigation, telematics, and connected car services. Automakers integrate real-time tracking for fleet management, driver assistance, and emergency response systems, improving safety and performance. Transportation and logistics follow closely, using LBS and RTLS for route planning and asset visibility. Banking and financial services adopt geolocation to enable fraud detection and location-based customer services. Other industries, including retail and healthcare, are deploying indoor tracking solutions to improve operational workflows and enhance customer experience.

Market Overview

Rising Adoption of Connected Devices

The growing use of smartphones, IoT sensors, and GPS-enabled devices is a key growth driver. Increased connectivity allows businesses to collect real-time location data and optimize operations. Industries like retail and transportation use these devices for navigation, asset tracking, and targeted marketing. The rollout of 5G networks further enhances data transmission speed and accuracy, enabling seamless location services. This connectivity supports predictive analytics and automation, which improves customer experience and operational efficiency, making connected devices a major force driving the LBS and RTLS market forward.

- For instance, Apple’s Find My network is a global, crowdsourced network of 100 of millions of Apple devices that helps users locate their misplaced or stolen belongings.

Growing Demand for Fleet and Asset Tracking

Fleet operators and logistics providers are adopting LBS and RTLS solutions to improve visibility and efficiency. Real-time tracking reduces fuel costs, optimizes routes, and enhances delivery timelines. Companies benefit from predictive maintenance and driver performance monitoring, lowering operational risks. Increasing e-commerce shipments and last-mile delivery demand further fuel adoption. Government regulations for vehicle safety and compliance are also encouraging telematics integration. This trend ensures better resource utilization, supporting businesses in reducing downtime and improving service quality, making fleet and asset tracking a strong driver for market growth.

- For instance, DHL’s SmarTrucking service in India, launched in 2018 with the aim of creating a large IoT-enabled fleet, was sold in 2021 as the company exited the asset-heavy trucking market there. Following this change, DHL Supply Chain announced a €500 million investment in 2022 to enhance its warehousing and logistics infrastructure in India, planning to transition its intra-city fleet to green fuel and electric vehicles by 2025.

Advancements in Indoor Positioning Technologies

The development of advanced indoor positioning systems using Bluetooth Low Energy (BLE), RFID, and Ultra-Wideband (UWB) is a key growth driver. These technologies enable accurate asset tracking and navigation inside buildings where GPS signals fail. Hospitals, manufacturing facilities, and retail stores are using RTLS to locate equipment, manage inventory, and improve worker safety. Enhanced accuracy, often below one-meter precision, supports critical use cases like emergency response. This rising focus on high-precision indoor tracking solutions is creating significant opportunities and driving rapid adoption across multiple sectors.

Key Trends & Opportunities

Integration with AI and Predictive Analytics

Artificial intelligence is transforming location-based services by enabling predictive insights and automation. AI-driven analytics help businesses forecast demand, predict customer behavior, and optimize logistics operations. In retail, AI integration allows hyper-personalized marketing campaigns using real-time location data. Predictive maintenance powered by RTLS helps manufacturing and healthcare facilities reduce downtime and improve equipment reliability. This trend is creating opportunities for solution providers to offer smarter, data-driven platforms that improve decision-making and enhance ROI for enterprises across industries.

- For instance, Zebra Technologies provides Ultra-Wideband (UWB) Real-Time Location Systems (RTLS) that deliver accuracy better than 30 cm for applications across multiple industries, including healthcare.

Growing Use in Smart Cities and Public Safety

Smart city initiatives are fueling demand for LBS and RTLS solutions to manage urban mobility and safety. Municipalities deploy real-time tracking for public transport systems, traffic monitoring, and emergency response coordination. Location data improves disaster management by helping authorities track people and resources during crises. Integration with IoT sensors and 5G infrastructure enhances coverage and accuracy. This creates significant opportunities for technology providers to collaborate with governments, driving large-scale deployments and improving citizen services through efficient city planning and resource allocation.

- For instance, In January 2023, the Irish Data Protection Commission (DPC) fined Meta €390 million for General Data Protection Regulation (GDPR) violations on its Facebook and Instagram platforms related to personalized advertising. The DPC ruled that Meta’s practice of relying on a “contractual necessity” clause in its terms of service was an insufficient legal basis for using personal data for targeted advertising. The fine was comprised of €210 million for the Facebook breaches and €180 million for the Instagram breaches.

Key Challenges

Data Privacy and Security Concerns

Data privacy is a key challenge as location tracking involves sensitive user information. Businesses must comply with regulations like GDPR and CCPA to avoid penalties. Concerns about unauthorized access or misuse of data limit user adoption in some regions. Enterprises are investing in encryption and secure platforms to address these risks. Balancing personalized services with privacy protection remains complex, and any breach can harm brand reputation. Solving security challenges is crucial to maintain user trust and support long-term market growth.

High Deployment and Maintenance Costs

The cost of deploying RTLS infrastructure, including sensors, beacons, and network upgrades, is a major challenge. Small and medium enterprises often struggle with the high upfront investment required for large-scale implementations. Ongoing maintenance, software updates, and hardware replacement further add to operational expenses. These costs can slow adoption, especially in price-sensitive markets. Vendors are focusing on offering subscription-based and cloud solutions to reduce capital expenditure, but affordability remains a barrier for widespread adoption in emerging economies.

Regional Analysis

North America

North America held the largest share of over 35% in 2024, driven by high adoption of GPS-enabled devices, strong 5G infrastructure, and advanced IoT deployment. The U.S. leads the region with widespread use of LBS for fleet management, connected vehicles, and location-based advertising. Enterprises in logistics, healthcare, and retail actively invest in real-time tracking to improve operational efficiency. Government initiatives for smart city development and public safety also support market growth. Canada follows with rising adoption of RTLS solutions in healthcare and manufacturing sectors, further strengthening the region’s position as a leading market for LBS and RTLS technologies.

Europe

Europe accounted for more than 25% of the market share in 2024, supported by stringent regulatory frameworks and advanced digital infrastructure. Countries like Germany, the U.K., and France are at the forefront of adopting LBS and RTLS solutions for smart transportation, asset tracking, and retail analytics. The growing implementation of Industry 4.0 technologies is boosting adoption across manufacturing facilities. Investments in connected vehicles and public safety solutions also contribute to market growth. The presence of major technology providers and emphasis on compliance with GDPR ensure secure deployment, enhancing user trust and increasing penetration across multiple industries in the region.

Asia-Pacific

Asia-Pacific captured over 28% of the market share in 2024, driven by rapid urbanization, growing smartphone penetration, and expanding e-commerce operations. China, Japan, and India are leading adopters of LBS and RTLS solutions, focusing on smart city projects, logistics optimization, and indoor navigation. The growth of connected vehicles and government-led digitalization initiatives further boost demand. Affordable smartphones and expanding internet connectivity in developing nations are accelerating adoption among small and medium enterprises. Rising investments in 5G networks enhance location accuracy, positioning Asia-Pacific as one of the fastest-growing regions in the market with strong potential over the forecast period.

Latin America

Latin America held a market share of over 7% in 2024, with growth fueled by expanding logistics networks, increasing smartphone usage, and adoption of location-based marketing solutions. Brazil and Mexico are leading markets, leveraging LBS and RTLS for transportation, retail, and public safety applications. The region is witnessing increased use of fleet management systems to optimize delivery operations and reduce costs. Government initiatives for smart city projects and traffic management also support adoption. Despite challenges such as infrastructure gaps, rising investment in digital transformation by enterprises is expected to boost market growth across key industries in the coming years.

Middle East and Africa

The Middle East and Africa accounted for around 5% of the market share in 2024, supported by rising investments in smart city infrastructure and digital transformation initiatives. Countries like the UAE and Saudi Arabia are deploying LBS solutions for intelligent transportation systems, security monitoring, and tourism applications. The healthcare sector is adopting RTLS to enhance patient flow and asset utilization. Africa is seeing gradual adoption driven by mobile connectivity growth and logistics expansion. While cost constraints limit large-scale deployment in some areas, ongoing infrastructure development and government support are expected to create new opportunities in the coming years.

Market Segmentations:

By Type:

By Component:

By End User:

- Automotive

- Transportation and logistic

- Banking

- Financial services and insurance

- Others

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

Key players in the Location Based Services and Real Time Location System market include Qualcomm, Baidu, Zebra Technologies, IBM Corp, Microsoft Corp, Google Inc, AutoNavi, ESRI, Teldio, Cisco Systems, Oracle Corp, and Ericsson. These companies focus on delivering advanced solutions that integrate GPS, Wi-Fi, Bluetooth, and cellular technologies to enhance accuracy and scalability. They invest heavily in R&D to develop software platforms, analytics tools, and cloud-based systems for real-time data processing. Strategic partnerships with telecom operators, automakers, and logistics providers strengthen their market presence. Continuous innovation in indoor positioning, 5G-enabled services, and AI-powered analytics enables them to serve industries such as transportation, retail, healthcare, and manufacturing. Competitive intensity is driven by new product launches, acquisitions, and collaborations aimed at expanding solution portfolios and improving performance. The market remains highly dynamic, with leading vendors competing on technology differentiation, data security, and integration capabilities to capture greater share globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qualcomm

- Baidu

- Zebra Technologies

- IBM Corp

- Microsoft Corp

- Google Inc

- AutoNavi

- ESRI

- Teldio

- Cisco Systems

- Oracle Corp

- Ericsson

Recent Developments

- In 2025, Qualcomm introduced new observability, monitoring, and location services under its “Aware” product line to enhance connected intelligence in IoT.

- In 2025, Cisco unveiled a secure network architecture designed for campus, branch, and industrial environments that embeds advanced security and unified management to support AI workloads.

- In 2024, Microsoft unified its enterprise mapping offerings under Azure Maps, announcing that Bing Maps for Enterprise will retire, and adding features like custom indoor maps, enhanced authentication, and geolocation services.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth with rising adoption of connected devices and IoT solutions.

- Advancements in 5G networks will improve accuracy and support real-time tracking applications.

- Demand for indoor positioning systems will expand in healthcare, manufacturing, and retail sectors.

- Integration of AI and predictive analytics will enhance decision-making and operational efficiency.

- Smart city projects will drive large-scale deployments of location-based and tracking solutions.

- Automotive and logistics sectors will continue to invest in fleet management and telematics systems.

- Cloud-based platforms will dominate as enterprises shift to scalable subscription-based models.

- Data privacy regulations will encourage vendors to develop more secure and compliant solutions.

- Partnerships between technology providers and telecom operators will expand service coverage globally.

- Emerging markets will offer significant opportunities due to rising smartphone penetration and digitalization.