Market Overview

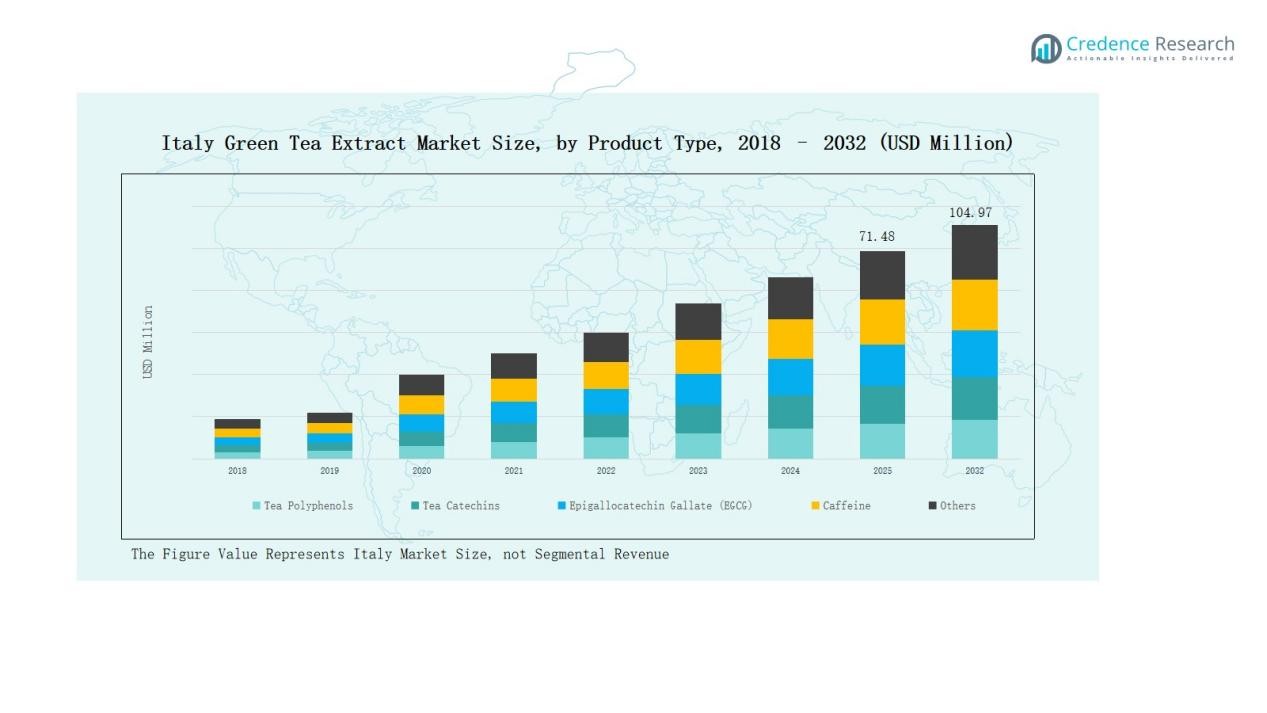

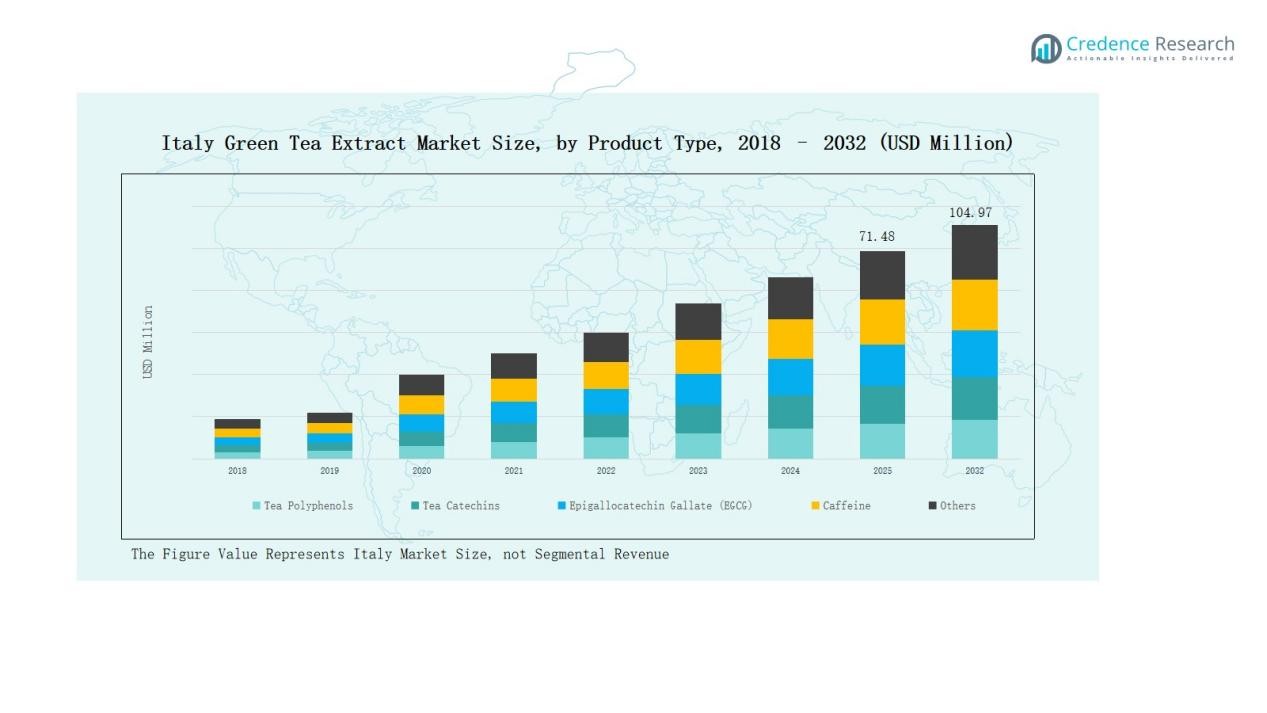

Italy Green Tea Extract Market size was valued at USD 45.82 million in 2018 and grew to USD 65.55 million in 2024. It is anticipated to reach USD 104.97 million by 2032, at a CAGR of 5.64% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Green Tea Extract Market Size 2024 |

USD 65.55 Billion |

| Italy Green Tea Extract Market, CAGR |

5.64% |

| Italy Green Tea Extract Market Size 2032 |

USD 104.97 Billion |

The Italy Green Tea Extract Market is shaped by a mix of multinational leaders and domestic specialists, with Indena S.p.A., Givaudan, IMA Group, and Faravelli Group driving growth through advanced research, diverse portfolios, and established global networks. Local players such as Biosearch S.p.A., Bios Fer srl, Botanic S.r.l, Martini Spa, Satori S.r.l, and Vevy Europe S.p.A. strengthen competition by focusing on organic formulations, specialized extracts, and partnerships with pharmaceutical and nutraceutical firms. Among regional markets, Northern Italy leads with a 42% share in 2024, supported by strong consumer awareness, robust retail infrastructure, and high adoption of premium green tea-based products.

Market Insights

- The Italy Green Tea Extract Market grew from USD 45.82 million in 2018 to USD 65.55 million in 2024 and is projected to reach USD 104.97 million by 2032.

- Tea Catechins lead with 38% share in 2024, supported by nutraceutical and pharmaceutical demand, while EGCG follows with 27%, driven by cardiovascular and metabolic health applications.

- Powder form dominates with 52% share due to stability, ease of formulation, and wide use in supplements, while liquid extracts hold 32% and soft gels 16%.

- Pharmaceuticals account for 36% share, followed by food and beverages at 28% and RTD teas at 18%, reflecting strong adoption in health-focused product categories.

- Northern Italy leads with 42% share, driven by consumer health awareness and advanced retail infrastructure, while Central Italy holds 33% and Southern Italy captures 25% of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Tea Catechins dominate the Italy Green Tea Extract Market with a 38% share in 2024, driven by their strong use in nutraceuticals and pharmaceutical formulations. Their antioxidant and weight management benefits increase adoption in preventive healthcare. Epigallocatechin Gallate (EGCG) holds a 27% share, supported by rising demand in cardiovascular and metabolic health applications. Tea Polyphenols account for 20%, driven by functional food and beverage formulations. Caffeine contributes 10%, favored in energy-boosting products, while Others capture the remaining 5% through niche applications.

For instance, Döhler Group expanded its polyphenol-rich green tea extract portfolio for functional beverages, highlighting antioxidant stability in ready-to-drink teas.

By Form

Powder form leads the market with a 52% share, as it is widely used across dietary supplements, pharmaceuticals, and food products. Its stability, ease of formulation, and longer shelf life strengthen its dominance. Liquid extracts represent a 32% share, supported by demand in ready-to-drink teas and functional beverages. Soft Gel form accounts for 16%, driven by its convenience and absorption benefits, particularly in the nutraceutical sector.

For instance, Amway expanded its Nutrilite Botanical Beverages line in Southeast Asia using liquid herbal extracts to target the functional beverage segment.

By Application

Pharmaceuticals hold the largest share at 36%, driven by rising adoption in cardiovascular, metabolic, and anti-inflammatory treatments. Food & Beverages follow with a 28% share, supported by the growing demand for natural and functional ingredients. Ready-to-Drink (RTD) Teas contribute 18%, driven by consumer preference for convenience and healthy beverages. Functional Foods account for 12%, with steady growth from fortified snacks and dairy products. Others, including cosmetics and personal care, represent 6%, reflecting niche but expanding opportunities.

Key Growth Drivers

Rising Demand for Nutraceuticals

The increasing preference for preventive healthcare is boosting demand for nutraceuticals in Italy. Green tea extract, rich in catechins and EGCG, is widely incorporated into dietary supplements targeting cardiovascular, metabolic, and immune health. Consumers are seeking natural alternatives to synthetic ingredients, creating strong momentum for green tea-based products. Regulatory approval of plant-derived compounds and growing distribution through pharmacies and online platforms further strengthen adoption. This driver solidifies green tea extract’s role in the expanding Italian nutraceutical market.

For instance, ESI Italia offers a green tea dietary supplement with a concentrated 500 mg formula containing 40% polyphenols, marketed to support antioxidant intake and weight management.

Expanding Functional Food and Beverage Applications

Green tea extract is increasingly integrated into food and beverage formulations across Italy. Functional products such as fortified snacks, dairy, and ready-to-drink teas appeal to health-conscious consumers seeking convenience. Rising awareness of antioxidants and weight management benefits supports broader use in clean-label and organic products. The food service industry also contributes, with cafés and restaurants offering green tea-based innovations. Strong urban demand and growing investment in wellness-focused formulations further accelerate growth within this segment.

Pharmaceutical Sector Adoption

The pharmaceutical industry plays a central role in advancing the Italy green tea extract market. Extracts are used in cardiovascular, metabolic, and inflammatory disorder treatments due to their scientifically proven bioactive properties. Pharmaceutical companies are expanding research into EGCG-based formulations, reinforcing clinical applications. Italy’s aging population, coupled with rising incidences of chronic diseases, supports strong demand for natural therapeutic solutions. Partnerships between extract suppliers and pharmaceutical manufacturers enhance scalability, ensuring continuous growth within this segment.

For instance, a pharmaceutical company utilizing the Phytofare® extraction method reported higher bioavailability and sustained plasma levels of EGCG, enhancing cardiovascular and metabolic disorder treatments

Key Trends & Opportunities

Shift Toward Clean-Label and Organic Products

Consumer preference for transparency and natural ingredients is shaping Italy’s green tea extract market. Clean-label and organic formulations are gaining traction, particularly in functional foods and beverages. Manufacturers are reformulating products to exclude artificial additives, highlighting antioxidant-rich green tea as a natural wellness solution. This trend opens opportunities for premium product positioning, targeting health-focused millennials and urban consumers. Organic-certified extracts are also attracting strong demand from export markets, driving long-term growth.

For instance, BIOGENA launched Green Tea EpiVerde® 222 in April 2023, a clean-label, decaffeinated green tea extract standardized for high epigallocatechin gallate content, free from artificial additives and tested for aluminum residues, catering to health-conscious consumers.

Innovation in Ready-to-Drink Teas

The ready-to-drink (RTD) tea segment is witnessing strong innovation fueled by green tea extracts. Italian beverage companies are launching flavored, sugar-free, and functional RTD teas to appeal to consumers seeking convenience and health benefits. Growing popularity among younger demographics, coupled with strong retail and online distribution networks, supports rapid adoption. The opportunity lies in developing low-calorie, antioxidant-rich beverages aligned with fitness and lifestyle trends. This segment presents untapped growth potential for both domestic brands and international entrants.

Form, in November 2023, Coca-Cola expanded its ready-to-drink (RTD) portfolio to include iced green tea in new fruit-infused flavors like Lemon-Tulsi and Mango.

Key Challenges

Raw Material Supply Constraints

Sourcing high-quality green tea leaves for extract production remains a challenge in Italy. Dependence on imports from Asia exposes manufacturers to supply fluctuations and rising costs. Weather conditions, trade regulations, and quality variations affect consistent availability. Companies must invest in strong supplier networks and diversify sourcing strategies to mitigate risks. This challenge directly impacts pricing stability and production scalability, limiting the ability to meet rising demand in food, pharmaceutical, and beverage sectors.

High Production and Processing Costs

The extraction and purification of catechins and EGCG require advanced processing technologies. These processes increase production costs, making green tea extract more expensive than synthetic alternatives. Small and medium-sized enterprises face difficulties in maintaining competitive pricing while ensuring product quality. Limited economies of scale and high equipment investments also create barriers for new entrants. Managing cost efficiency without compromising bioactive content remains a key challenge for Italian producers.

Regulatory and Compliance Barriers

Strict regulations in Italy and across the EU affect the approval and marketing of green tea extracts. Compliance with safety, labeling, and health claim standards adds complexity to product launches. Pharmaceutical and nutraceutical firms must provide substantial clinical evidence to validate functional claims, increasing R&D expenses. Delays in regulatory approvals can slow product commercialization and limit innovation speed. Navigating this regulatory environment requires significant resources, creating challenges for smaller companies in the market.

Regional Analysis

Northern Italy

Northern Italy dominates the Italy Green Tea Extract Market with a 42% share in 2024. Strong consumer awareness of health and wellness drives consistent adoption across pharmaceuticals, nutraceuticals, and functional beverages. Urban centers such as Milan and Turin act as hubs for product innovation and distribution. It benefits from a well-developed retail infrastructure and higher disposable incomes that support premium product demand. Pharmaceutical companies in the region are also integrating EGCG and catechins into advanced formulations. Rising interest in clean-label supplements further sustains market leadership in Northern Italy.

Central Italy

Central Italy holds a 33% share of the market, supported by a balanced mix of food, beverage, and pharmaceutical applications. Rome and Florence are major demand centers where functional foods and RTD teas are gaining traction. It shows strong growth in retail-driven categories, with pharmacies and specialty health stores boosting consumer access. Local manufacturers are actively introducing organic and natural extracts, aligned with consumer preferences. Central Italy also benefits from rising collaborations between research institutions and nutraceutical companies. Expanding urban populations in this region ensure steady growth momentum for the market.

Southern Italy

Southern Italy accounts for a 25% share of the market, driven by rising adoption of functional beverages and dietary supplements. Naples and Palermo represent key cities contributing to demand through retail and distribution expansion. It faces challenges from lower consumer awareness compared to the North and Central regions but benefits from increasing health campaigns and growing online sales channels. Price-sensitive consumers lean toward affordable nutraceuticals, fueling growth in mid-range product segments. Manufacturers are gradually expanding distribution in this region to capture untapped opportunities. Rising preference for natural extracts positions Southern Italy as a region with significant long-term potential.

Market Segmentations:

Market Segmentations:

By Product Type

- Tea Polyphenols

- Tea Catechins

- Epigallocatechin Gallate (EGCG)

- Caffeine

- Others

By Form

By Application

- Pharmaceuticals

- Food & Beverages

- Ready-to-Drink (RTD) Teas

- Functional Foods

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

Competitive Landscape

The Italy Green Tea Extract Market is moderately consolidated, with both multinational and domestic companies shaping competition. Leading players such as Indena S.p.A., Givaudan, IMA Group, and Faravelli Group dominate through strong research capabilities, diversified product portfolios, and established supply chains. Local firms including Biosearch S.p.A., Bios Fer srl, Botanic S.r.l, Martini Spa, Satori S.r.l, and Vevy Europe S.p.A. enhance competitiveness by focusing on specialized extracts, organic formulations, and customized solutions for pharmaceuticals and nutraceuticals. Companies invest heavily in R&D to strengthen clinical validation of catechins and EGCG, supporting their use in pharmaceuticals and functional foods. Strategic partnerships with food, beverage, and pharmaceutical manufacturers help expand market presence and distribution. Rising consumer demand for clean-label and organic products is pushing firms to innovate formulations and improve sustainability in sourcing. The competitive landscape reflects a balance between global expertise and regional specialization, ensuring consistent growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Indena S.p.A.

- Givaudan

- IMA Group

- Faravelli Group

- Biosearch S.p.A.

- Bios Fer srl

- Botanic S.r.l

- Martini Spa

- Satori S.r.l

- Vevy Europe S.p.A.

Recent Developments

- In 2022, Firmenich signed a partnership agreement to market Finlay’s tea and coffee extracts portfolio across Europe, extending the high-quality green tea extracts availability in the region, including Italy. This partnership leverages combined expertise in natural ingredients and extracts.

- In October 2024, PLT Health Solutions introduced Cellflo6, a patented green tea extract designed to support energy and sports performance, which is part of innovative green tea product developments relevant to markets including Italy.

- In September 2025, Deimos Group acquired Variati, a Lombardy-based distributor of personal care and nutraceutical ingredients, strengthening its position in Italy’s wellness sector.

- In August 2025, Greenexta, backed by Wise Equity, signed a binding agreement to acquire Alba Milagro International S.p.A., expanding its portfolio in biostimulants and specialty formulations.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label and organic green tea extracts will continue to expand.

- Pharmaceutical applications of EGCG and catechins will see stronger clinical adoption.

- Functional food and beverage formulations will drive steady product innovation.

- Ready-to-drink teas with fortified extracts will gain traction among younger consumers.

- E-commerce platforms will become a key channel for supplement distribution.

- Collaborations between research institutions and nutraceutical firms will enhance product development.

- Local manufacturers will focus on sustainable sourcing to meet regulatory requirements.

- Premium extracts will capture growth in urban markets with higher health awareness.

- Cosmetic and personal care applications will expand as natural ingredients gain preference.

- Rising health campaigns will boost consumer awareness in Southern Italy and rural areas.

Market Segmentations:

Market Segmentations: