Market Overview

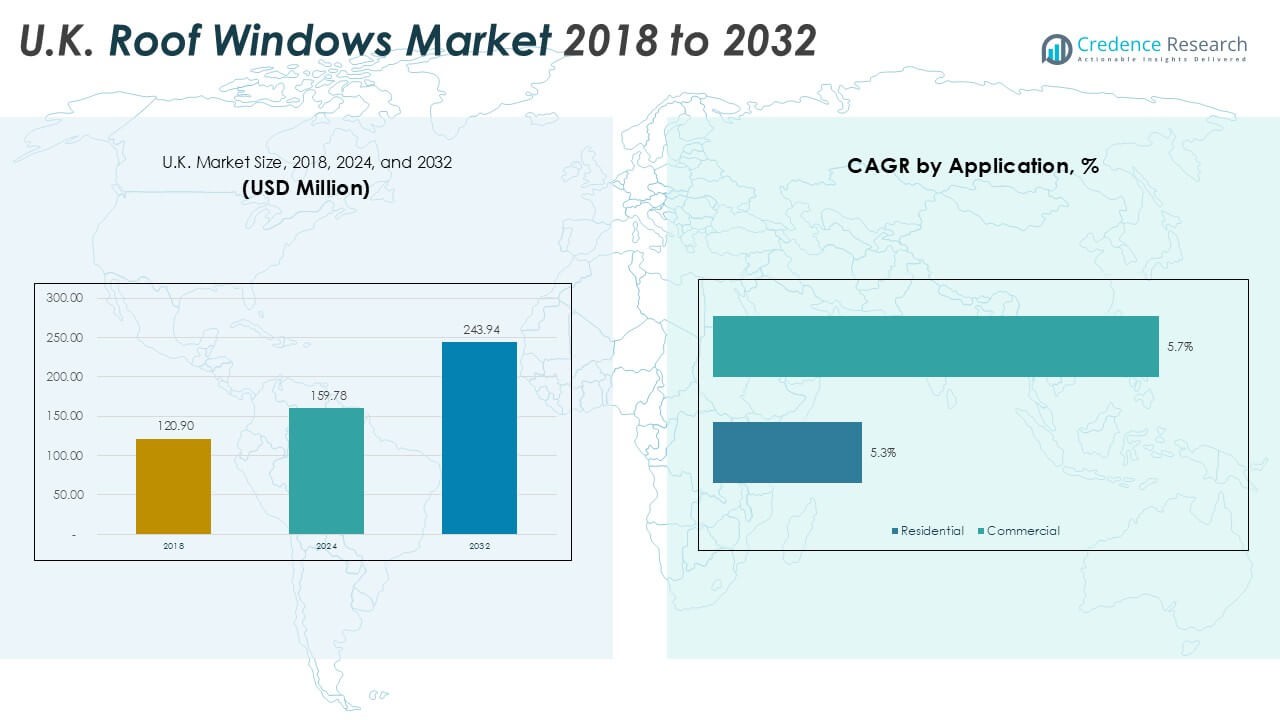

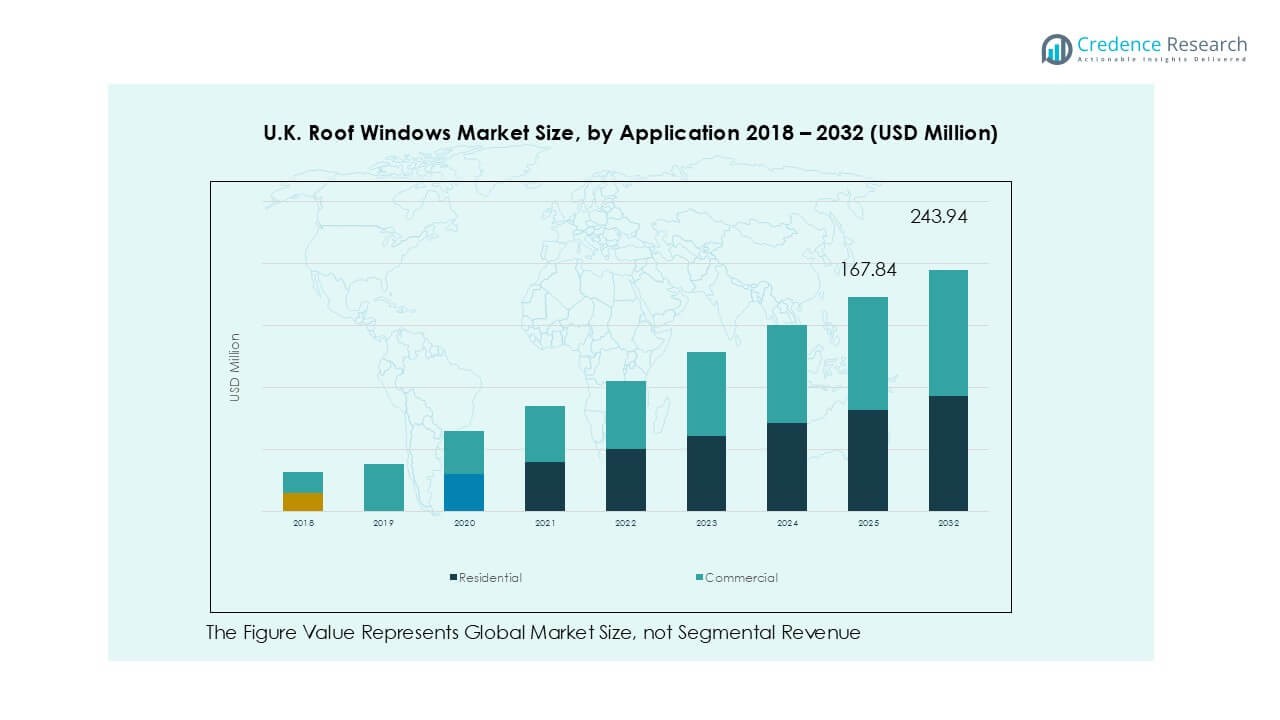

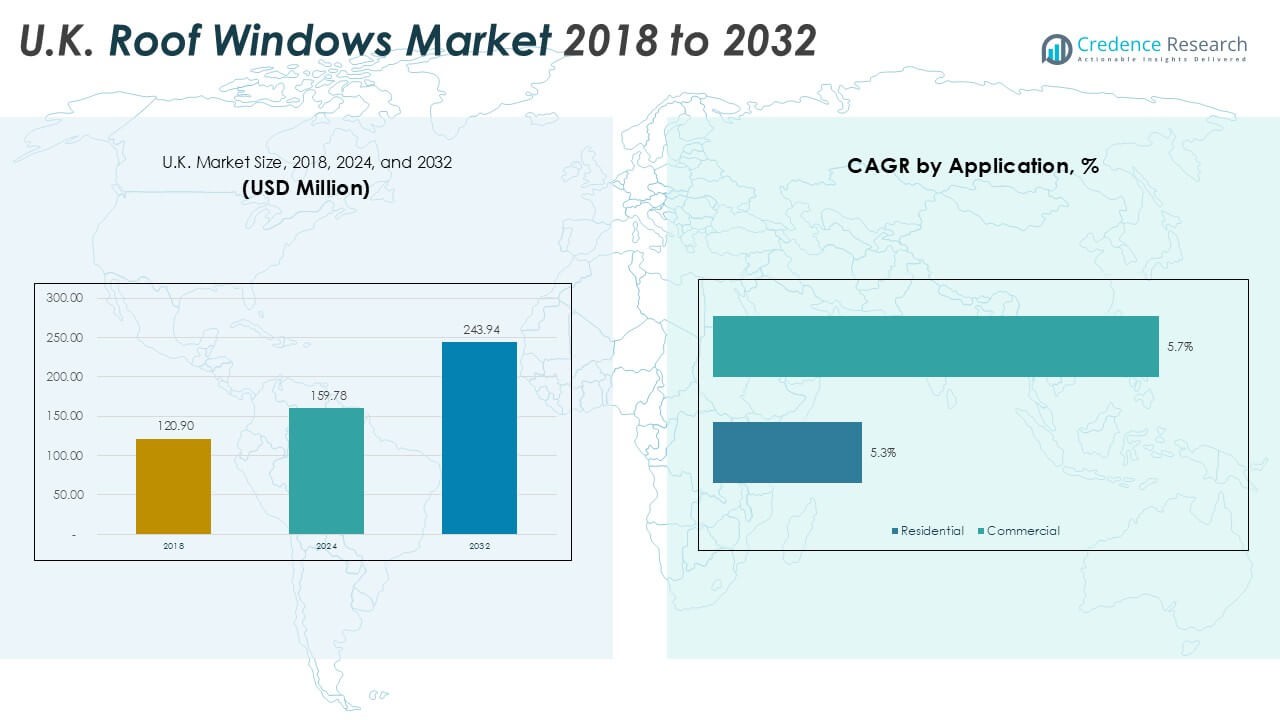

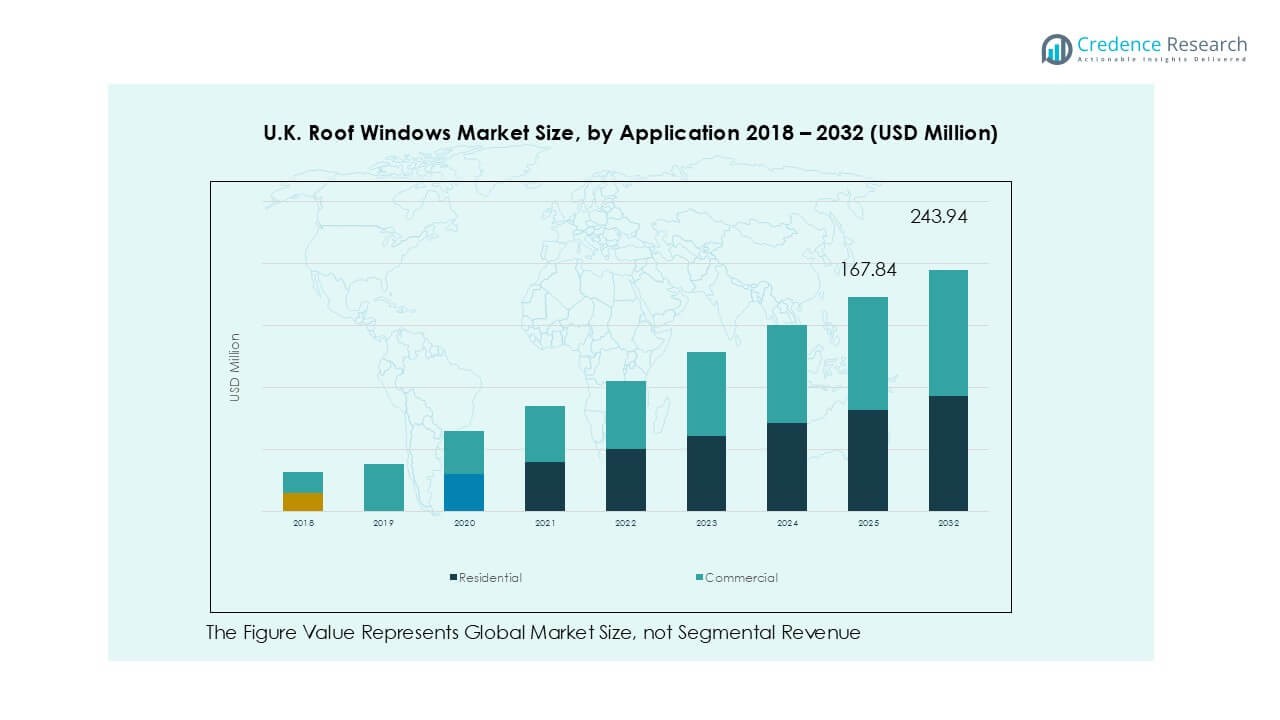

The U.K. Roof Windows market size was valued at USD 120.90 million in 2018, rose to USD 159.78 million in 2024, and is projected to reach USD 243.94 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Roof Windows Market Size 2024 |

USD 159.78 Million |

| U.K. Roof Windows Market, CAGR |

5.4% |

| U.K. Roof Windows Market Size 2032 |

USD 243.94 Million |

The U.K. roof windows market is led by Velux Group, Fakro, and Roto Frank AG, which together account for a large portion of total sales through their broad product portfolios and strong installer networks. Velux holds the leading position with advanced double- and triple-glazed solutions and dominates distribution across England. Fakro focuses on energy-efficient polyurethane and wooden roof windows, strengthening its presence in residential renovations. Roto Frank AG emphasizes precision-engineered fittings and fast-install systems, appealing to commercial and premium projects. Regional players such as Panoroof, Lamilux, and Brett Martin offer bespoke and industrial rooflight solutions, intensifying competition. England leads regionally with ~72% market share, supported by dense housing stock and high loft conversion activity, followed by Scotland with ~12%, Wales with ~ 9%, and Northern Ireland with ~7%, reflecting population concentration and renovation patterns across the U.K.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.K. Roof Windows market was valued at USD 159.78 million in 2024 and is projected to reach USD 243.94 million by 2032, growing at a CAGR of 4% during the forecast period.

- Market growth is driven by rising loft conversions, focus on energy efficiency, and compliance with Part L regulations encouraging double- and triple-glazed installations.

- Key trends include adoption of smart roof windows with rain sensors, solar-powered operation, and rising demand for sustainable materials such as FSC-certified wood and recyclable PVC.

- The market is moderately consolidated with major players like Velux Group, Fakro, and Roto Frank AG dominating, while regional players like Panoroof and Brett Martin strengthen competition with bespoke solutions.

- England leads with ~72% share, followed by Scotland (12%), Wales (9%) and Northern Ireland (7%); by type, wood accounts for over 40% share, while double-glazing dominates with more than 55% share.

Market Segmentation Analysis:

By Type

Wood roof windows hold the dominant share in the U.K. roof windows market, accounting for over 40% of total installations. Their popularity is driven by natural aesthetics, durability, and excellent insulation properties that support energy efficiency goals. Rising demand for sustainable construction materials also fuels adoption, as wood offers a renewable and recyclable option. PU and PVC types follow, preferred for low-maintenance needs and moisture resistance, particularly in bathrooms and kitchens. Metal frames, though durable, see limited use due to higher costs and lower thermal performance, restricting their share compared to wood-based solutions.

- For instance, VELUX manufactures more than 500,000 wood-framed roof windows annually for the U.K. market, using FSC-certified pine sourced from sustainable forests.

By Application

Residential applications lead the U.K. roof windows market with a share exceeding 65%, driven by home renovation projects and rising loft conversions. Homeowners seek improved daylighting, ventilation, and energy savings, which boosts installation of roof windows in single-family houses and apartments. Government incentives for energy-efficient upgrades further accelerate adoption in residential spaces. Commercial applications such as offices, educational institutions, and retail spaces are expanding steadily, as natural light improves occupant well-being and reduces electricity costs. However, the residential sector continues to dominate due to sustained urban housing development and growing preference for sustainable home designs.

- For instance, under the UK’s ECO4 scheme, thousands of energy efficiency upgrades were installed in 2024 with government-backed funding for retrofit projects, primarily for low-income and vulnerable households. While the scheme covers a range of measures, its main focus is on insulation, heating, and renewable energy, rather than a specific roof window initiative.

By Glazing Type

Double-glazing dominates the U.K. roof windows market, capturing more than 55% market share due to its balance of energy efficiency and affordability. It reduces heat loss, improves acoustic performance, and meets building regulations for thermal insulation, making it the preferred choice for most residential and commercial projects. Triple-glazed windows are gaining traction in new-build homes focused on superior insulation and low carbon footprints. Single-glazed options hold a minor share, primarily used in budget-sensitive renovation projects. Increasing focus on net-zero energy buildings is expected to further support demand for high-performance double and triple-glazed solutions.

Key Growth Drivers

Rising Focus on Energy Efficiency

Growing emphasis on energy-efficient buildings drives demand for roof windows in the U.K. The government’s net-zero carbon targets encourage homeowners and developers to install products that reduce heating costs and enhance insulation. Double and triple-glazed roof windows lower energy loss and support compliance with Building Regulations Part L. Increased awareness of sustainable construction materials further supports this shift. Manufacturers introduce advanced designs with improved thermal performance to meet strict energy standards, boosting adoption across residential and commercial projects and driving steady market expansion.

- For instance, VELUX manufactures triple-glazed roof windows with U-values as low as 1.0 W/m²K, which meets or exceeds the UK’s Building Regulations Part L requirements for energy efficiency.

Urban Housing and Loft Conversions

Expanding urban housing and rising loft conversion projects contribute significantly to market growth. Homeowners seek to maximize usable space while improving natural lighting and ventilation. Loft conversions with roof windows increase property value and align with space optimization trends in densely populated cities. Government planning reforms simplify approval for home extensions, further encouraging installations. This demand creates opportunities for suppliers offering customizable, easy-to-install roof window systems. Residential renovation projects, supported by low interest rates and green incentives, remain a major contributor to the segment’s revenue growth.

- For instance, VELUX roof windows are a key feature of loft conversions across the UK, allowing for a significant increase in natural light and ventilation. While the specific impact on daylight factor varies by project, VELUX has long promoted the health and energy-saving benefits of optimizing natural light in a room.

Product Innovation and Smart Solutions

Technological advancements in roof window design enhance market growth by improving user experience. Manufacturers launch smart roof windows with rain sensors, remote controls, and solar-powered operation for energy savings and convenience. Enhanced glazing solutions deliver superior UV protection and noise reduction, attracting environmentally conscious buyers. Integration with home automation systems also appeals to tech-savvy consumers. Continuous product development helps brands differentiate and meet strict performance requirements under U.K. construction regulations, encouraging higher adoption across new-build and retrofit applications.

Key Trends & Opportunities

Shift Toward Sustainable Materials

Rising preference for eco-friendly materials creates growth opportunities in the U.K. roof windows market. Manufacturers increasingly use sustainably sourced wood and recyclable PVC to meet environmental standards. Demand for low-VOC coatings and water-based finishes grows as green building certifications like BREEAM and LEED influence purchase decisions. Companies offering life-cycle assessments and carbon-neutral products gain a competitive edge. This shift toward sustainability is reshaping procurement strategies for developers and boosting uptake of premium roof window solutions designed to minimize environmental impact while ensuring durability and performance.

- For instance, FAKRO applies water-based polyurethane finishes with VOC levels below 50 g/L, meeting BREEAM Indoor Air Quality standards.

Growing Adoption of Triple-Glazed Systems

Triple-glazed roof windows are gaining popularity as builders aim to exceed minimum energy performance standards. These products offer superior thermal insulation and noise reduction, making them suitable for urban and cold-climate applications. Rising energy costs and stricter building codes drive homeowners to upgrade from single or double glazing. This trend opens opportunities for manufacturers to expand product portfolios with high-performance glazing solutions. Premium housing projects and passive house construction are expected to accelerate triple-glazing adoption over the next decade, creating a lucrative growth avenue for market players.

- For instance, VELUX offers specific triple-glazed roof windows that achieve a whole-window U-value (Uw) of 1.0 W/m²K, while other triple-glazed models have higher Uw values, such as 1.1 W/m²K.

Key Challenges

High Installation and Product Costs

The relatively high cost of roof window products and professional installation remains a barrier for budget-conscious homeowners. Triple-glazed and smart roof window systems carry higher upfront prices, limiti.ng adoption in price-sensitive segments. Installation complexity often requires skilled labor, adding to project expenses. These cost factors can delay purchase decisions, especially during periods of economic uncertainty. Market players must address affordability through modular designs, financing options, and targeted promotions to expand customer reach and encourage wider adoption across mid-income households.

Regulatory Compliance and Building Standards

Stringent building regulations and compliance requirements present challenges for manufacturers and installers. Products must meet strict thermal performance, fire safety, and ventilation standards under U.K. building codes. Frequent updates to regulations demand continuous product testing and certification, increasing time-to-market and development costs. Smaller manufacturers may struggle with compliance investments, creating competitive pressure. Ensuring installers remain updated on regulatory changes is critical to avoid project delays or non-compliance penalties. These regulatory complexities can slow market growth if not effectively managed by stakeholders.

Regional Analysis

England

England leads the U.K. roof windows market with a 72% share. High housing density and loft conversions sustain upgrade cycles. New-builds prioritize daylighting to meet Part L targets. Homeowners favor double and triple glazing for energy savings. Renovation finance and green grants support uptake in older stock. London and the South East drive premium specification demand. Builders prefer integrated flashing kits that reduce labor time. Distribution breadth and short lead times strengthen brand loyalty across merchants.

Scotland

Scotland holds a 12% share, supported by energy-efficiency mandates. Colder climates favor triple glazing and deeper frames. Renovations target insulation gains in pre-1919 stone housing. Self-build activity in rural areas increases premium skylight adoption. Developers specify laminated panes for coastal wind exposure. Off-site timber systems integrate factory-fitted roof windows. Public sector retrofits prioritize ventilation and daylight credits. Installers highlight moisture-resistant finishes for bathrooms and kitchens.

Wales

Wales accounts for 9% of demand, led by retrofit projects. Rural housing stock benefits from daylight upgrades in roof spaces. Coastal regions require enhanced weatherproofing and corrosion resistance. Social housing programs specify low-U-value glazing. Self-builders adopt solar-powered opening units for ventilation. Merchants report steady sales of PVC and PU frames. Tourism lets encourage attic conversions for additional rooms. Installers value quick-fit flashing solutions for slate roofs.

Northern Ireland

Northern Ireland captures 7% of the market, with stable renovation activity. Detached homes add roof windows during attic conversions. Builders favor double glazing for cost and compliance balance. Harsh weather drives demand for laminated and toughened panes. Housing associations pursue energy savings through targeted retrofits. Merchants expand stock of moisture-resistant PU frames. Contractors emphasize airtight installation to reduce heat loss. Logistics partnerships improve availability and shorten project timelines.

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The U.K. roof windows market is moderately consolidated, with leading players such as Velux Group, Fakro, and Roto Frank AG holding significant market shares through strong distribution networks and extensive product portfolios. Velux dominates with advanced double- and triple-glazed systems, smart automation options, and widespread merchant partnerships. Fakro focuses on energy-efficient designs and moisture-resistant polyurethane frames to cater to bathroom and kitchen applications. Roto Frank AG differentiates with precision-engineered hardware and durable, easy-to-install flashing systems. Regional players such as Panoroof, Lamilux, and Brett Martin strengthen competition by supplying bespoke and commercial rooflight solutions for industrial projects. Companies actively invest in product innovation, including solar-powered and sensor-driven roof windows, to meet energy regulations and appeal to sustainability-conscious buyers. Strategic collaborations with builders’ merchants and online retail channels improve accessibility, while aftersales services and extended warranties help build brand loyalty and expand market presence across both residential and commercial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fakro

- Velux Group

- Roto Frank AG

- Panoroof

- Lamilux

- Skyfens

- Skylights Plus

- Brett Martin

- Lonsdale Metal Co

- Duplus Architectural Systems Ltd

- Dakota Group

- The Metal Window Company Limited

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient double and triple-glazed roof windows will keep rising.

- Smart roof windows with automation and rain sensors will see stronger adoption.

- Loft conversions and home extensions will remain a key driver of installations.

- Sustainable materials like FSC-certified wood and recyclable PVC will gain more market share.

- Online retail channels and direct-to-consumer sales will expand product accessibility.

- Manufacturers will focus on faster installation systems to reduce labor costs.

- Commercial projects will increasingly specify roof windows for daylighting and energy savings.

- Product innovation will include enhanced UV protection and acoustic insulation features.

- Partnerships with builders’ merchants and housing developers will strengthen distribution networks.

- Government energy efficiency targets will continue to encourage replacement and retrofit activity.