Market Overview

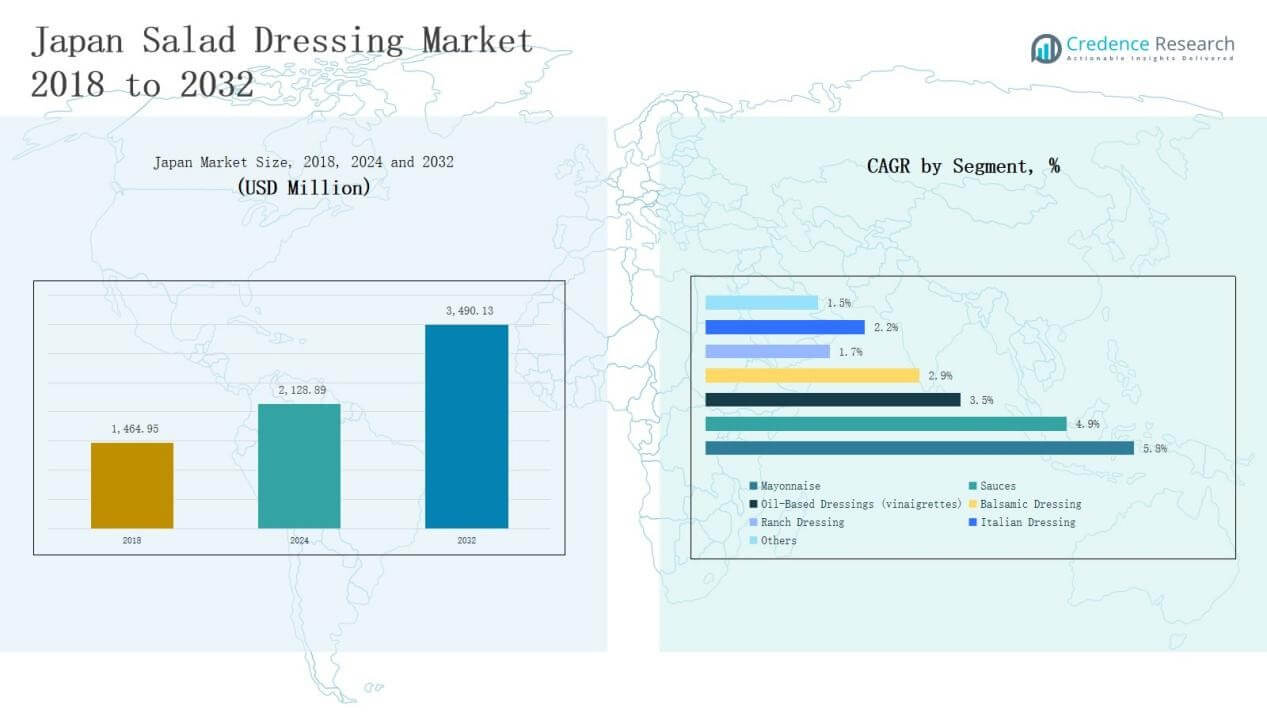

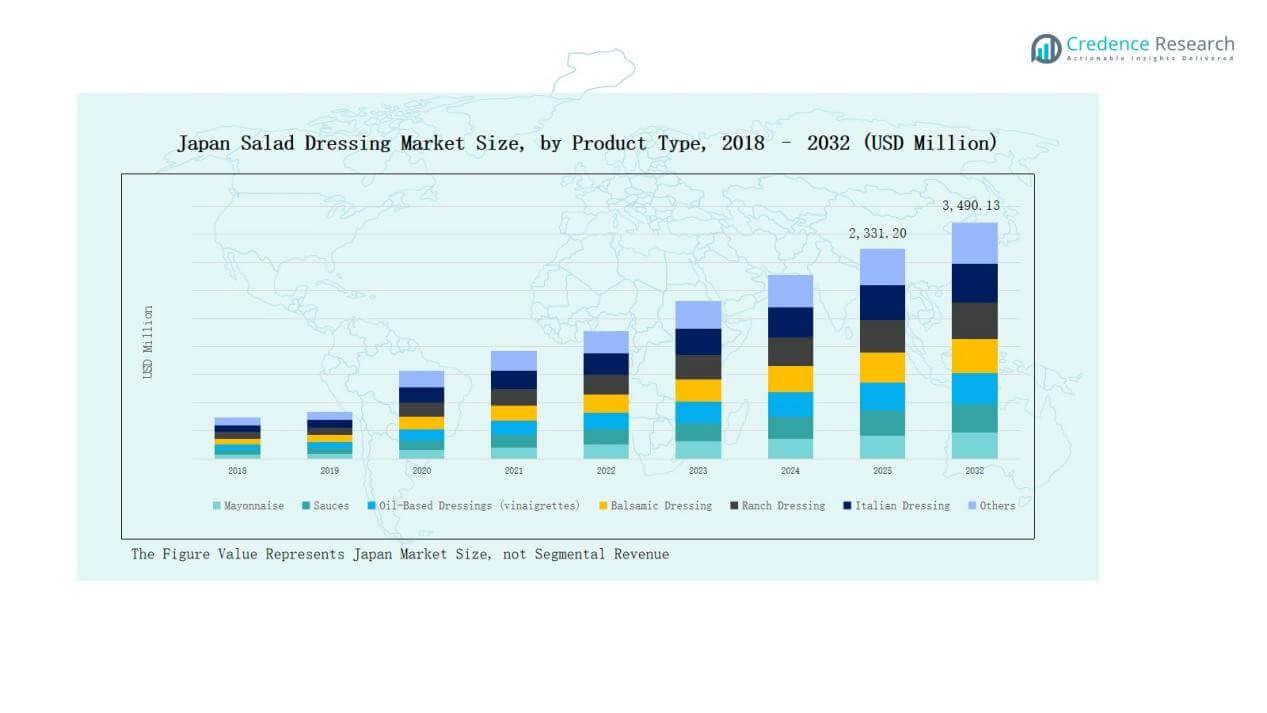

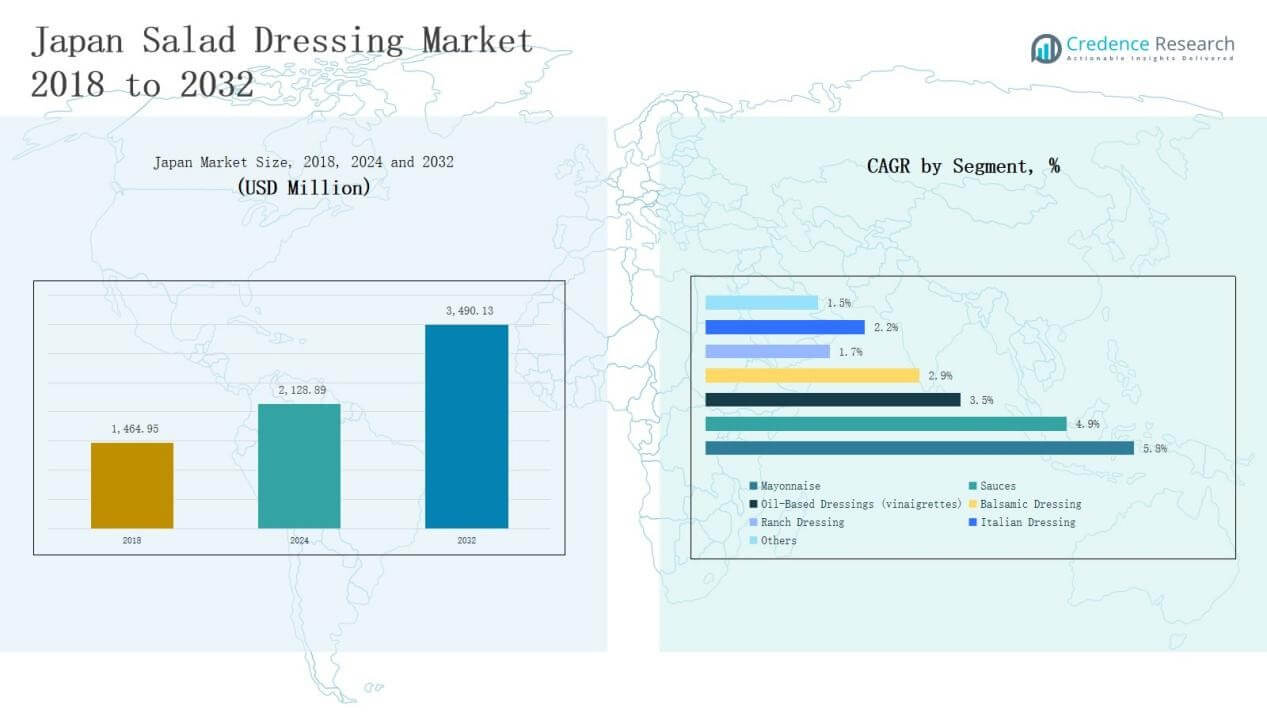

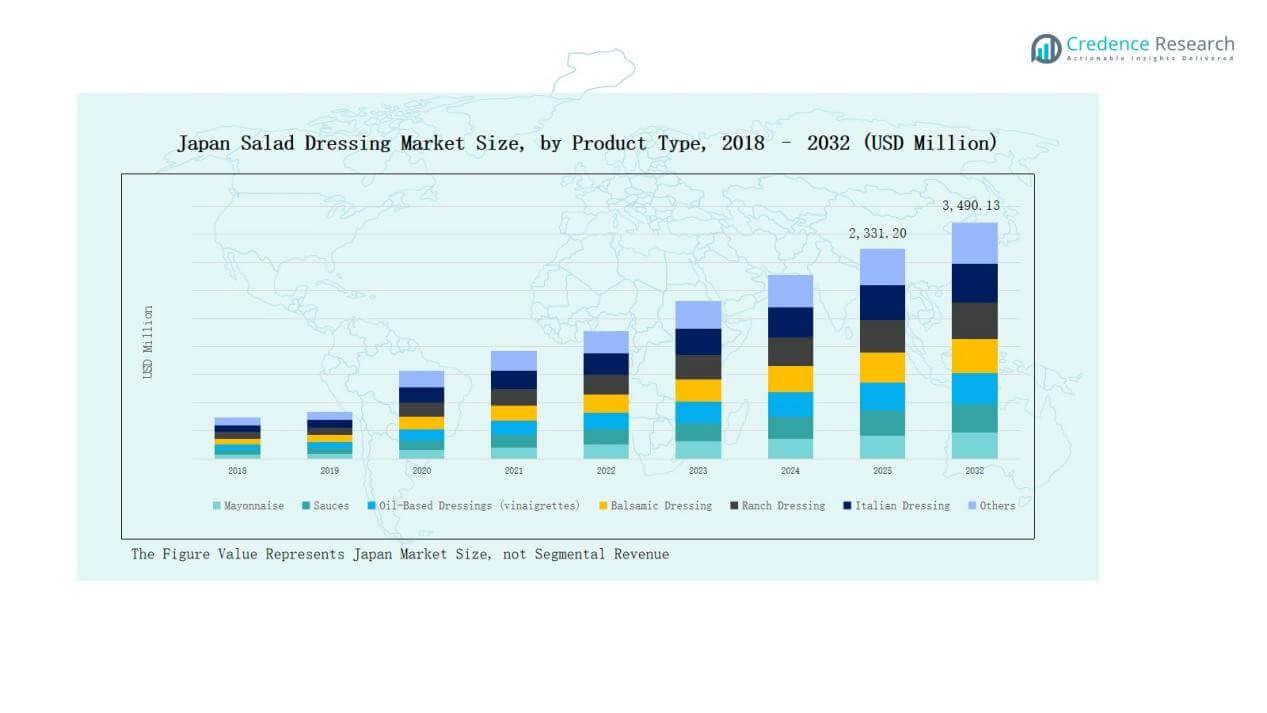

The Japan Salad Dressing Market size was valued at USD 1,464.95 million in 2018, reaching USD 2,128.89 million in 2024, and is anticipated to reach USD 3,490.13 million by 2032, at a CAGR of 5.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Salad Dressing Market Size 2024 |

USD 2,128.89 Million |

| Japan Salad Dressing Market, CAGR |

5.93% |

| Japan Salad Dressing Market Size 2032 |

USD 3,490.13 Million |

The Japan Salad Dressing Market is dominated by established domestic players and select multinational companies that leverage strong brand portfolios and extensive distribution networks. Kewpie Corporation leads the industry with its wide mayonnaise range and deep consumer trust, while Mizkan Holdings and Ajinomoto Co., Inc. strengthen their positions through diversified offerings in sauces, vinaigrettes, and premium dressings. Kagome Co., Ltd. and House Foods Group focus on health-oriented innovations, while Nippon Shokken Holdings and Yamasa Corporation expand through expertise in seasonings and sauces. Otsuka Foods Co., Ltd. and Maruha Nichiro Corporation add to the competitive landscape by offering specialized and value-driven products. Regionally, Kanto emerges as the leading market, commanding 36% share in 2024, supported by its large urban population, advanced retail infrastructure, and strong foodservice adoption, making it the most influential region shaping national consumption trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Salad Dressing Market grew from USD 1,464.95 million in 2018 to USD 2,128.89 million in 2024 and is expected to reach USD 3,490.13 million by 2032.

- Kewpie Corporation leads the market, while Mizkan Holdings, Ajinomoto Co., Ltd., Kagome, and House Foods strengthen competition through diversified portfolios and health-oriented product innovations.

- By product type, mayonnaise dominates with 42.5% share in 2024, followed by sauces, while oil-based vinaigrettes and organic dressings gain traction among health-conscious consumers.

- Conventional dressings contribute 76.8% share in 2024, while organic options expand steadily, supported by clean-label demand and younger urban consumers seeking healthier alternatives.

- Kanto leads regionally with 36% share in 2024, followed by Kansai at 24%, reflecting strong urban consumption, advanced retail networks, and vibrant dining-out culture.

Market Segment Insights

Market Segment Insights

By Product Type

Mayonnaise dominates the Japan Salad Dressing Market, accounting for 42.5% of total revenue in 2024. Its leadership is supported by strong consumer preference for creamy textures and versatile applications across both home and foodservice meals. Sauces follow with a notable share, driven by fusion cuisine trends and rising use in convenience foods. Oil-based dressings such as vinaigrettes hold growing relevance as health-conscious consumers shift toward lighter alternatives. Balsamic, ranch, and Italian dressings remain niche but steadily gain traction through premium positioning and restaurant offerings. The “Others” category includes specialty and regional dressings that cater to evolving taste diversity.

For instance, Kewpie Corporation launched its popular Deep-Roasted Sesame Dressing in Japan, tapping into consumer demand for premium flavor innovations.

By Category

Conventional salad dressings hold the majority, contributing 76.8% of market share in 2024. Their dominance comes from affordable pricing, easy availability in retail, and established consumer habits. Organic dressings, however, are expanding quickly, supported by rising health awareness and clean-label demand. Younger demographics in urban areas prefer organic and natural products, enhancing growth momentum for this segment. Although conventional products continue to lead, the premium positioning of organic dressings creates profitable opportunities for both local and international brands.

For instance, Kraft Heinz expanded its Kraft Real Mayo line with a new clean-label version free from artificial flavors and colors to capture health-aware consumers.

By Distribution Channel

Retail stores lead the market with 58.6% share in 2024, reflecting widespread supermarket penetration and consumer reliance on packaged dressing purchases. Foodservice channels contribute strongly, driven by quick-service restaurants and casual dining formats that use dressings as core ingredients in salads and sandwiches. Other off-trade channels, including online platforms and specialty stores, are gradually expanding their role as e-commerce adoption increases. Retail dominance remains intact due to strong shelf presence, brand visibility, and frequent promotional activities. Foodservice growth is tied to Japan’s vibrant dining-out culture and expanding Western-style restaurant formats.

Key Growth Drivers

Key Growth Drivers

Rising Preference for Convenience Foods

The growing demand for ready-to-eat and easy-to-use meal solutions significantly drives the Japan Salad Dressing Market. Busy urban lifestyles encourage consumers to opt for convenient meal accompaniments like dressings, particularly mayonnaise and sauces. Packaged dressings add flavor and save preparation time, making them appealing to working professionals and younger demographics. Supermarkets and convenience stores across Japan enhance accessibility, supporting consistent sales growth. The combination of convenience and taste firmly positions salad dressings as an everyday household essential, boosting overall market penetration.

For instance, Ajinomoto Co., Inc. expanded its “Cook Do” series by introducing low-sodium dressings tailored for health-conscious consumers, strengthening its presence in the ready-to-use condiments space.

Increasing Health and Wellness Awareness

Health-conscious consumers are shifting toward lighter and healthier options, particularly oil-based vinaigrettes and organic dressings. Rising awareness about calorie intake and nutritional content supports demand for products with reduced fat, sugar, and artificial additives. Companies respond with clean-label offerings, enriched with natural ingredients such as olive oil, balsamic vinegar, and herbs. This trend aligns with Japan’s strong focus on balanced diets and longevity. The growing adoption of health-driven products fosters premiumization in the segment, creating new opportunities for domestic and international brands.

Expansion of Foodservice and Dining-Out Culture

Japan’s strong dining-out culture fuels the adoption of salad dressings across restaurants, cafés, and quick-service outlets. Western-style menus, including salads, sandwiches, and pasta dishes, incorporate a variety of dressings, expanding product use beyond households. Foodservice operators prefer bulk packaging of mayonnaise and sauces, boosting sales volumes. Furthermore, fusion cuisine trends encourage experimentation with flavors, increasing demand for diverse dressing types. The thriving foodservice industry not only sustains consumption but also influences consumer preferences, creating a cycle of demand that benefits both retail and professional channels.

For instance, Mizkan Holdings expanded its Ajipon citrus-based ponzu dressing range to foodservice channels, catering to fusion menu applications in izakaya and Western-style casual dining.

Key Trends & Opportunities

Growing Shift Toward Premium and Specialty Dressings

Consumers in Japan increasingly seek premium products that deliver unique flavors and authentic international tastes. Demand for balsamic, Italian, and ranch dressings is rising as global cuisines gain popularity. Brands capitalize by launching specialty dressings with higher quality ingredients, often marketed in attractive packaging. Premiumization also allows companies to target affluent and health-conscious consumers willing to pay extra for authenticity and clean-label assurance. This trend represents a key opportunity for differentiation in a market dominated by conventional mayonnaise and sauces.

For instance, Mizkan Holdings introduced an “Authentic Italian Balsamic Dressing” featuring PDO-certified Modena balsamic vinegar, targeting Japanese consumers seeking imported taste authenticity.

E-Commerce and Direct-to-Consumer Expansion

The rapid growth of e-commerce in Japan creates significant opportunities for salad dressing brands. Online platforms enable wider reach, especially for niche organic and premium products that may not secure extensive retail shelf space. Direct-to-consumer channels allow companies to promote trial packs, subscription models, and personalized bundles. The convenience of doorstep delivery aligns with busy lifestyles, further encouraging adoption. This trend also helps brands engage directly with younger, digital-savvy consumers, enhancing brand loyalty and capturing incremental sales beyond traditional retail formats.

For instance, Mother Raw sells an organic plant-based Japanese dressing online, using ingredients like toasted sesame oil, ginger root, and apple cider vinegar.

Key Challenges

Strong Market Saturation

The Japan Salad Dressing Market is highly saturated, with established players like Kewpie, Mizkan, and Ajinomoto holding significant shares. Their extensive product portfolios and strong brand loyalty limit opportunities for new entrants. The mature nature of core segments, especially mayonnaise, creates barriers for innovation and pricing flexibility. Companies face the challenge of differentiating products in a market already crowded with similar offerings. This saturation restricts growth potential for smaller players and raises competitive intensity across all segments.

Rising Raw Material Costs

Fluctuating prices of key ingredients such as edible oils, eggs, and vinegar directly impact production costs. Imported raw materials are also vulnerable to global supply chain disruptions and currency fluctuations. These cost pressures squeeze profit margins for manufacturers, especially in price-sensitive categories like conventional dressings. Passing higher costs onto consumers risks reducing demand, while absorbing them erodes profitability. Managing raw material volatility remains a persistent challenge for both large and small producers in Japan’s salad dressing market.

Changing Consumer Preferences

Rapidly shifting consumer preferences pose a challenge to maintaining product relevance. While mayonnaise remains dominant, growing interest in lighter, organic, and specialty options demands constant product innovation. Brands that fail to adapt risk losing market share to agile competitors offering healthier or trendier alternatives. Additionally, younger demographics show more openness to global flavors, requiring diversification beyond traditional dressings. Balancing established demand with evolving tastes requires strategic innovation, continuous reformulation, and targeted marketing efforts, adding complexity to long-term growth strategies.

Regional Analysis

Kanto

Kanto holds the largest share of the Japan Salad Dressing Market with 36% in 2024. The dominance is supported by high urban population density, strong retail infrastructure, and the presence of leading foodservice chains. Consumers in Tokyo and surrounding cities drive demand for mayonnaise and sauces due to their integration in both home and restaurant meals. The expansion of supermarkets and convenience stores further accelerates accessibility to a wide variety of dressings. Health-conscious segments in metropolitan areas increasingly prefer oil-based and organic products. Kanto remains a key hub for innovation, influencing nationwide trends in product development.

Kansai

Kansai accounts for 24% of the market share, making it the second most significant region. The presence of large cities like Osaka and Kyoto sustains strong consumer demand through vibrant dining-out culture and diverse food habits. Traditional food preferences are complemented by increasing acceptance of international dressings such as Italian and ranch. Retail penetration is robust, with major chain stores offering an extensive variety of products. Foodservice demand remains high due to quick-service restaurants and family dining outlets. Kansai plays a critical role in balancing traditional consumption with the adoption of premium and specialty dressings.

Chubu

Chubu represents 15% of the Japan Salad Dressing Market in 2024. Strong household consumption in Nagoya and surrounding cities supports steady sales of mayonnaise and conventional sauces. The region benefits from its central location, making it an important distribution hub. Rising preference for oil-based dressings highlights consumer interest in healthier options. Food manufacturers also leverage the industrial base of Chubu to expand production and distribution networks. Retail channels remain dominant, but e-commerce adoption is gradually rising, particularly among younger households.

Kyushu

Kyushu captures 13% of the total market share. It benefits from an expanding retail network and a growing interest in Western-style cuisines. Urban centers such as Fukuoka play a central role in driving consumer demand for both conventional and specialty dressings. Foodservice sales are increasing due to the popularity of dining-out culture in the region. Household demand is primarily concentrated on mayonnaise, but organic and premium offerings are beginning to gain visibility. Kyushu provides opportunities for manufacturers to tap into emerging urban markets.

Hokkaido & Tohoku

Hokkaido and Tohoku together hold 12% of the Japan Salad Dressing Market in 2024. Consumption is supported by traditional household demand, with mayonnaise and sauces leading the category. The colder climate influences food habits, supporting hearty dishes that pair well with dressings. Retail availability is expanding, although distribution remains less dense compared to Kanto or Kansai. Organic and specialty dressings have lower penetration, but growing health awareness offers potential for expansion. Foodservice demand is concentrated in urban areas like Sapporo and Sendai, creating pockets of steady growth.

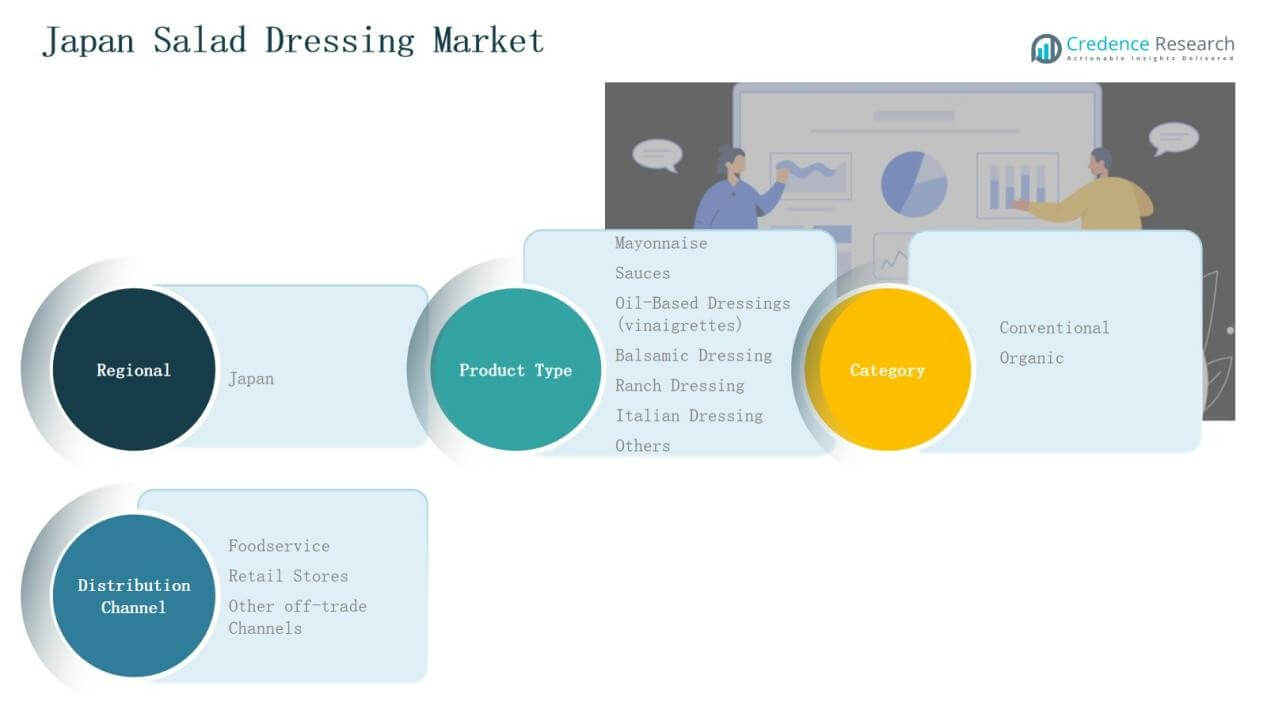

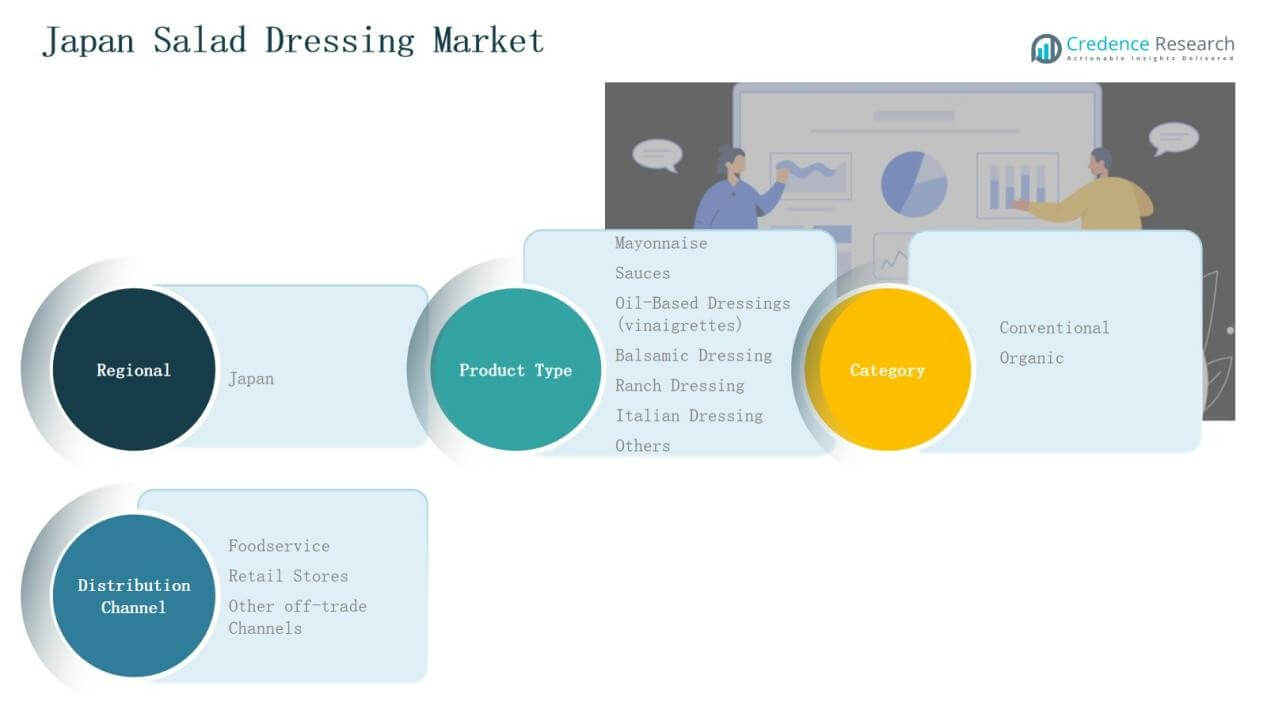

Market Segmentations:

Market Segmentations:

By Product Type

- Mayonnaise

- Sauces

- Oil-Based Dressings (Vinaigrettes)

- Balsamic Dressing

- Ranch Dressing

- Italian Dressing

- Others

By Category

By Distribution Channel

- Foodservice

- Retail Stores

- Other Off-trade Channels

By Region

- Kanto

- Kansai

- Chubu

- Kyushu

- Hokkaido & Tohoku

Competitive Landscape

The Japan Salad Dressing Market is characterized by strong competition among established domestic players and multinational food companies. Kewpie Corporation leads the market with a dominant share, supported by its extensive mayonnaise portfolio and strong retail presence. Mizkan Holdings and Ajinomoto Co., Inc. maintain significant positions through diversified offerings that span sauces, vinaigrettes, and specialty dressings. Kagome Co., Ltd. and House Foods Group focus on health-oriented and innovative product lines, strengthening their appeal to health-conscious consumers. Nippon Shokken Holdings and Yamasa Corporation leverage their expertise in sauces and seasonings to expand into dressing formats. International players, though present, face challenges competing against entrenched local brands with deep distribution networks and brand loyalty. Competitive intensity is reinforced by continuous product innovation, flavor diversification, and investment in organic and premium segments. Companies also prioritize partnerships with foodservice operators and leverage e-commerce channels to strengthen their reach in an evolving consumer landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Kewpie Corporation

- Mizkan Holdings Co.

- Kagome Co., Ltd

- Ajinomoto Co., Inc.

- House Foods Group Inc.

- Mizkan America Inc.

- Maruha Nichiro Corporation

- Nippon Shokken Holdings Co., Ltd.

- Yamasa Corporation

- Otsuka Foods Co., Ltd.

Recent Developments

- In April 2025, Kewpie Corporation expanded its salad dressing portfolio into ready-to-eat meals and bakery products across Asia.

- In September 2025, Leaft Foods partnered with Lacto Japan to introduce RuBisCO protein for use in salad dressings and other food applications.

- In 2023, Riken Vitamin Co., Ltd. launched Indo Kareya-san no Nazo Dressing. The product has a mellow taste with reduced saltiness and acidity and can be distributed at room temperature.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumer demand will continue to favor mayonnaise as the leading product segment.

- Health-conscious buyers will drive growth in oil-based and organic dressings.

- Retail stores will maintain dominance, supported by strong supermarket penetration.

- E-commerce sales will expand as younger consumers prefer online convenience.

- Foodservice operators will boost bulk demand through quick-service and casual dining outlets.

- Premium and specialty dressings will gain traction among urban affluent consumers.

- Product innovation will focus on clean-label, low-fat, and additive-free formulations.

- International flavor influences will expand demand for Italian, ranch, and balsamic dressings.

- Regional consumption patterns will diversify, with urban areas leading premium adoption.

- Intense competition among local and global brands will encourage strategic collaborations and product launches.

Market Segment Insights

Market Segment Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: