Market Overview

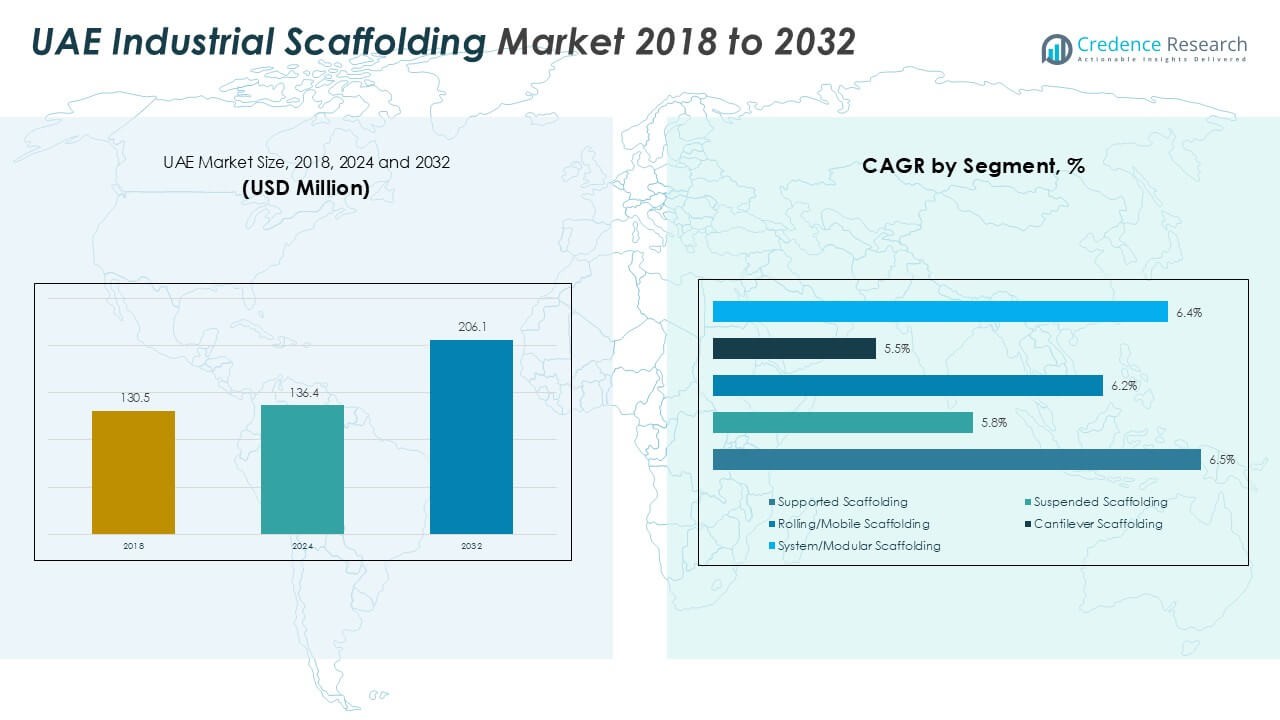

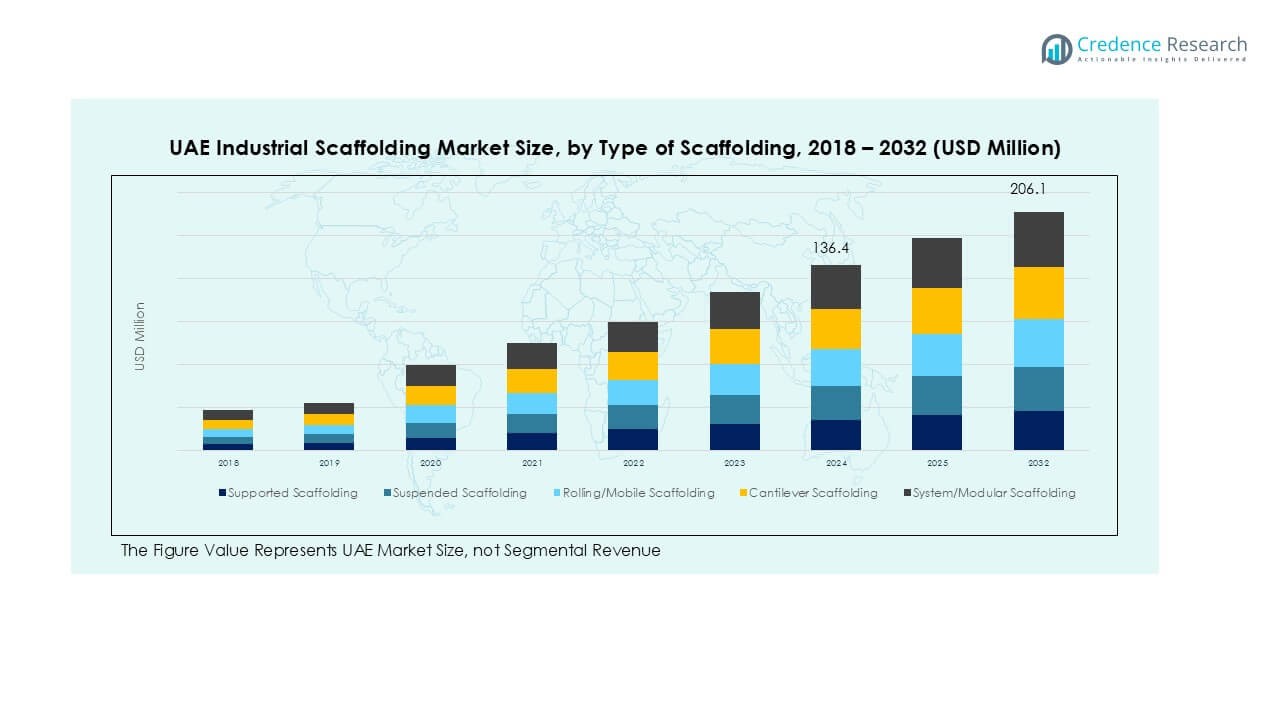

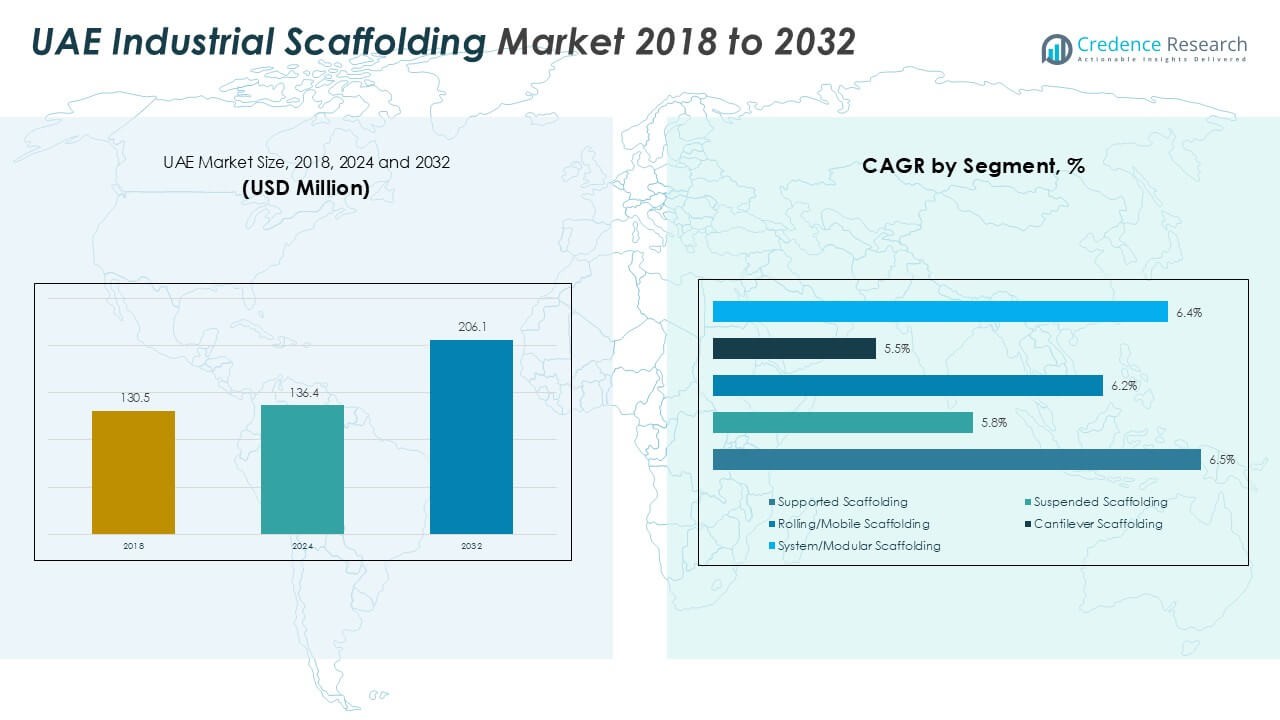

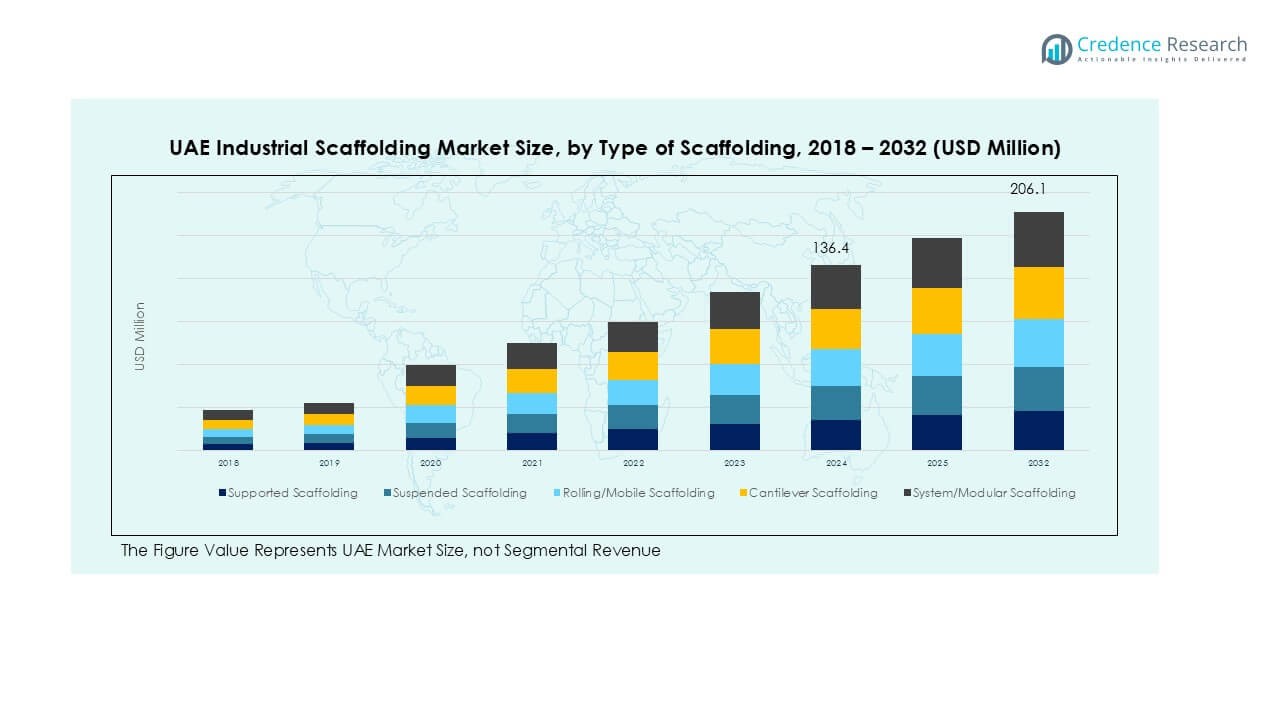

UAE Industrial Scaffolding market size was valued at USD 130.5 million in 2018 to USD 136.4 million in 2024 and is anticipated to reach USD 206.1 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Industrial Scaffolding Market Size 2024 |

USD 136.4 Million |

| UAE Industrial Scaffolding Market, CAGR |

5.2% |

| UAE Industrial Scaffolding Market Size 2032 |

USD 206.1 Million |

The UAE industrial scaffolding market is led by key players such as ABN Scaffolds LLC, Scaxa Scaffolds Trading Co LLC, Decagon Scaffolding & Engineering Co LLC, Ascend Access System Scaffolding LLC, and ACE Aluminium Scaffolding, along with global leaders PERI SE, Layher Holding GmbH & Co. KG, BrandSafway, and Altrad Group. These companies focus on modular scaffolding systems, rental services, and compliance with strict safety standards. Abu Dhabi dominates with over 40% market share, driven by oil and gas projects and refinery maintenance. Dubai follows with nearly 30% share, supported by infrastructure, logistics, and power plant developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Industrial Scaffolding market was valued at USD 4 million in 2024 and is projected to reach USD 206.1 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Growth is driven by expanding oil and gas maintenance projects, power plant upgrades, and infrastructure development, increasing demand for supported and modular scaffolding systems.

- The market shows a strong shift toward modular and system scaffolding, favored for quick assembly, enhanced safety, and reduced downtime across industrial applications.

- Competition includes ABN Scaffolds LLC, PERI SE, Layher Holding GmbH & Co. KG, BrandSafway, and Altrad Group, focusing on innovation, safety compliance, and rental services to secure large industrial contracts.

- Abu Dhabi leads with over 40% share, followed by Dubai at nearly 30%; supported scaffolding dominates by type with over 40% share, and steel remains the preferred material with more than 60% share.

Market Segmentation Analysis:

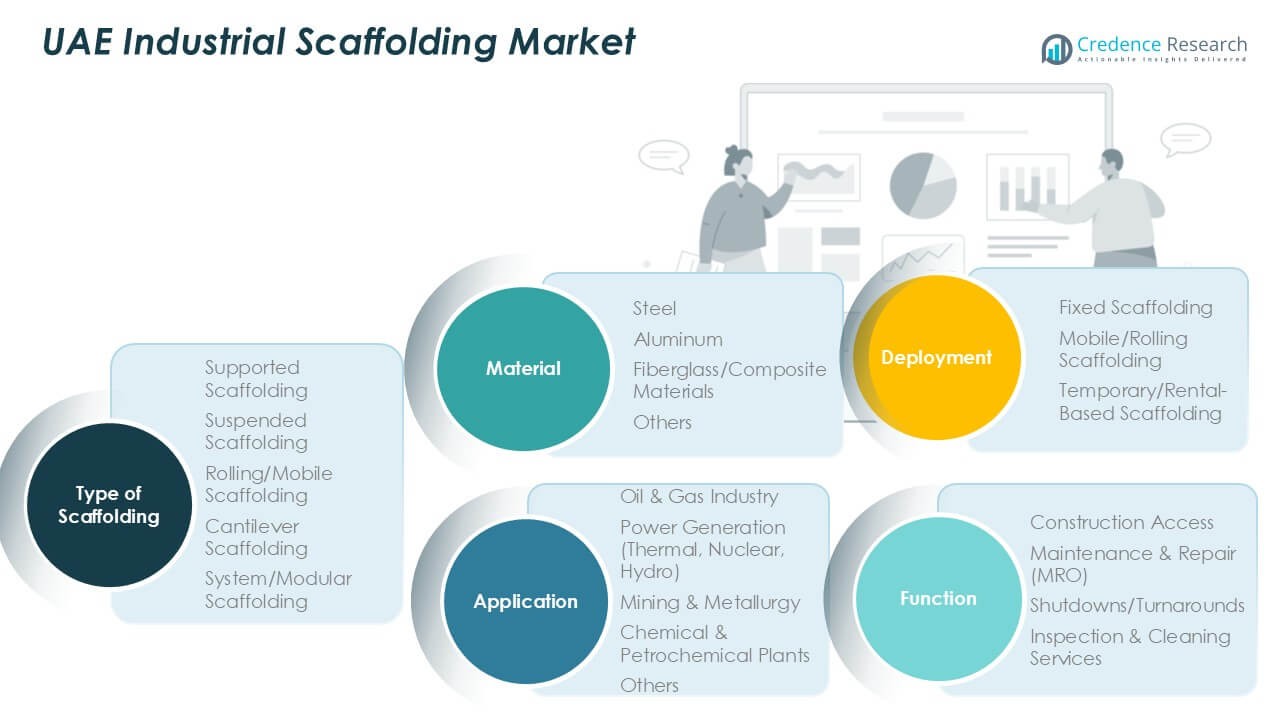

By Type of Scaffolding

Supported scaffolding holds the largest share of the UAE industrial scaffolding market, accounting for over 40% of total demand. Its dominance is driven by its stability, cost-effectiveness, and suitability for large-scale industrial projects. Supported scaffolding is widely used in oil and gas facilities, power plants, and construction sites due to its ability to handle heavy loads and ensure worker safety. Modular and system scaffolding follows closely, supported by rising demand for quick assembly and dismantling in time-sensitive industrial maintenance projects, which helps reduce downtime and operational costs.

- For instance, Arabian Spar supplies Cuplock and steel tube supported scaffolding for oil & gas shutdowns, and has the capacity and experience to handle very large-scale projects, such as refinery shutdowns.

By Application

The oil and gas industry dominate the market with more than 45% share, supported by the UAE’s strong focus on refinery upgrades and offshore field development. Scaffolding is extensively used for inspection, maintenance, and shutdown activities in refineries and petrochemical complexes. Power generation facilities are the second-largest segment, driven by continuous maintenance of thermal and nuclear plants. Mining and metallurgy, along with chemical and petrochemical plants, contribute steadily to demand, as industrial expansion and turnaround projects in these sectors require safe, durable, and high-capacity scaffolding systems.

- For instance, Al Hassan Engineering contracted scaffolding for a refinery pipe-rack section covering 15,000 cubic meters, with erection and dismantling costs reaching AED 390,750.

By Material

Steel scaffolding represents the dominant material segment, holding over 60% market share due to its strength, durability, and reusability. It is preferred for heavy-duty applications in oil and gas, power, and industrial sectors where load-bearing capacity and safety are critical. Aluminum scaffolding is gaining traction due to its lightweight nature and ease of transport, especially for maintenance activities requiring frequent relocation. Fiberglass and composite scaffolding remain niche but are used in chemical plants and areas requiring non-conductive or corrosion-resistant solutions, which helps ensure worker safety in high-risk environments.

Key Growth Drivers

Expanding Oil and Gas Maintenance Activities

The UAE industrial scaffolding market grows with rising maintenance and turnaround projects in the oil and gas sector. Refinery expansions, offshore platform upgrades, and periodic shutdowns create consistent demand for heavy-duty scaffolding solutions. Operators prioritize worker safety and efficiency, driving investment in robust scaffolding systems. Increased exploration and production activities in Abu Dhabi further boost demand. The need for safe access solutions during inspections and repairs ensures long-term growth potential for supported and modular scaffolding in this core sector.

- For instance, De Pretto Industrie & Multiline JV carried out a major overhaul of the 300 MWe steam turbine + generator at Umm Al Naar, Abu Dhabi, completing the work in 31.5 days.

Infrastructure and Power Sector Development

Large-scale infrastructure projects and power generation capacity expansions are key contributors to market growth. The UAE invests heavily in thermal, nuclear, and renewable power facilities, requiring extensive scaffolding for construction and routine maintenance. Industrial scaffolding supports turbine overhauls, boiler inspections, and plant retrofits. Growth in industrial zones and manufacturing hubs further fuels demand for scaffolding solutions that can handle diverse and complex structures. The combination of public and private investment drives a steady pipeline of projects supporting the market.

- For instance, Al Taweelah Combined Cycle Power Plant in Abu Dhabi has a capacity of 2,620 MW, requiring scaffolding for turbine installation, insulation, and external plant access.

Preference for Modular and System Scaffolding

The shift toward modular and system scaffolding drives adoption across major industries. These systems offer faster assembly, enhanced safety, and reduced downtime, which are crucial for time-sensitive operations. Industrial players value the flexibility of modular solutions that can be customized for complex plant layouts. Rising emphasis on cost optimization and worker safety encourages replacement of traditional scaffolding with modern systems. The adoption trend is particularly strong in oil, gas, and chemical plants, where shutdown periods must be minimized.

Key Trend and Opportunity

Technological Integration in Scaffolding Systems

Digital tools and IoT-enabled monitoring are gaining traction in scaffolding management. Contractors adopt software for scaffold design, planning, and inventory tracking to reduce errors and delays. Integration of 3D modeling and digital twins enhances project visualization and improves safety compliance. These technologies help optimize resource use, cut costs, and streamline inspection procedures. The trend supports adoption of smarter, data-driven scaffolding solutions that improve operational efficiency for industrial clients in the UAE’s highly competitive energy and infrastructure sectors.

- For instance, the Abu Dhabi Digital Twin project by the Department of Municipalities & Transport uses LiDAR scans and aerial photography to build 3D models of thousands of buildings in the emirate, supporting internal-navigation and emergency access mapping.

Rising Demand for Lightweight and Sustainable Materials

Growing focus on sustainability and ease of handling drives demand for aluminum and composite scaffolding. Lightweight scaffolding enables faster transport, assembly, and disassembly, reducing labor costs. Composite materials also provide corrosion resistance, making them ideal for chemical and offshore environments. Regulatory initiatives promoting safer and environmentally friendly construction materials further encourage adoption. Manufacturers invest in innovative scaffolding designs that balance strength, weight, and reusability, creating opportunities for differentiated products and expanding their presence in niche industrial applications.

- For instance, an ARES Double Width Aluminum Mobile Scaffolding Tower, with a width of 1.45m and a platform length of 2.50m, has a maximum total load capacity of 600 kg.

Key Challenge

High Labor and Compliance Costs

The market faces pressure from rising labor costs and strict safety compliance requirements. Scaffolding erection and dismantling demand skilled workers, increasing project expenses. Frequent regulatory updates require training and certification, adding to operational costs. Companies must invest in workforce safety programs and equipment inspection to meet stringent UAE occupational safety standards. These requirements, while essential, pose challenges for smaller contractors with limited budgets, potentially slowing adoption of advanced scaffolding systems across price-sensitive industrial segments.

Fluctuating Raw Material Prices

Volatility in steel and aluminum prices directly impacts scaffolding costs, affecting contractor margins. Price fluctuations create budgeting challenges for large-scale projects and may delay procurement decisions. Smaller suppliers struggle to absorb cost increases, reducing their competitiveness. Import dependency for certain materials adds exposure to global supply chain disruptions. This challenge forces market players to explore alternative materials, improve recycling practices, and adopt efficient production methods to maintain profitability while meeting project deadlines and quality standards.

Regional Analysis

Abu Dhabi

Abu Dhabi holds the largest share of the UAE industrial scaffolding market, accounting for over 40% of total demand. The emirate’s dominance stems from its extensive oil and gas activities, including refinery expansions, offshore platform upgrades, and petrochemical projects. Large-scale maintenance shutdowns in ADNOC facilities generate consistent demand for heavy-duty supported and modular scaffolding. Abu Dhabi’s focus on infrastructure development, industrial zones, and power plant upgrades further strengthens its position. The government’s continued investment in energy diversification and manufacturing ensures a steady pipeline of projects requiring reliable scaffolding systems and skilled erection services.

Dubai

Dubai represents nearly 30% of the UAE industrial scaffolding market, driven by its robust construction and industrial sectors. The emirate’s focus on logistics, aviation, and free zone development generates strong demand for modular scaffolding systems for industrial facilities and maintenance works. Power generation and desalination plants also require frequent scaffolding for maintenance activities. Dubai’s adoption of smart technologies and preference for system scaffolding boost efficiency and safety compliance. Continuous investment in transport infrastructure, industrial clusters, and renewable energy projects supports long-term scaffolding demand, making Dubai a key growth hub in the UAE scaffolding industry.

Sharjah

Sharjah accounts for around 15% of the UAE industrial scaffolding market, supported by its manufacturing and logistics hubs. The emirate’s petrochemical plants, ports, and power facilities require regular scaffolding for maintenance and expansion projects. Growth in industrial zones such as Hamriyah Free Zone and Sharjah Airport International Free Zone adds to market potential. Sharjah-based contractors increasingly adopt modular scaffolding systems to meet project deadlines efficiently. Investments in waste-to-energy plants and infrastructure upgrades are expected to contribute further to demand, solidifying Sharjah’s role as a significant secondary market within the UAE scaffolding landscape.

Northern Emirates (Ajman, Umm Al-Quwain, Ras Al Khaimah, Fujairah)

The Northern Emirates collectively contribute about 15% of the UAE industrial scaffolding market, driven by industrial and port-related projects. Ras Al Khaimah and Fujairah play leading roles due to cement plants, quarries, and oil storage terminals requiring scaffolding solutions. Fujairah’s refinery and tank farm expansion projects generate additional demand. Ajman and Umm Al-Quwain show moderate activity, primarily in infrastructure and light manufacturing. The region is witnessing increased adoption of cost-effective scaffolding solutions to support ongoing industrial development. Strategic investments in ports and energy infrastructure will continue to drive scaffolding requirements in these emirates.

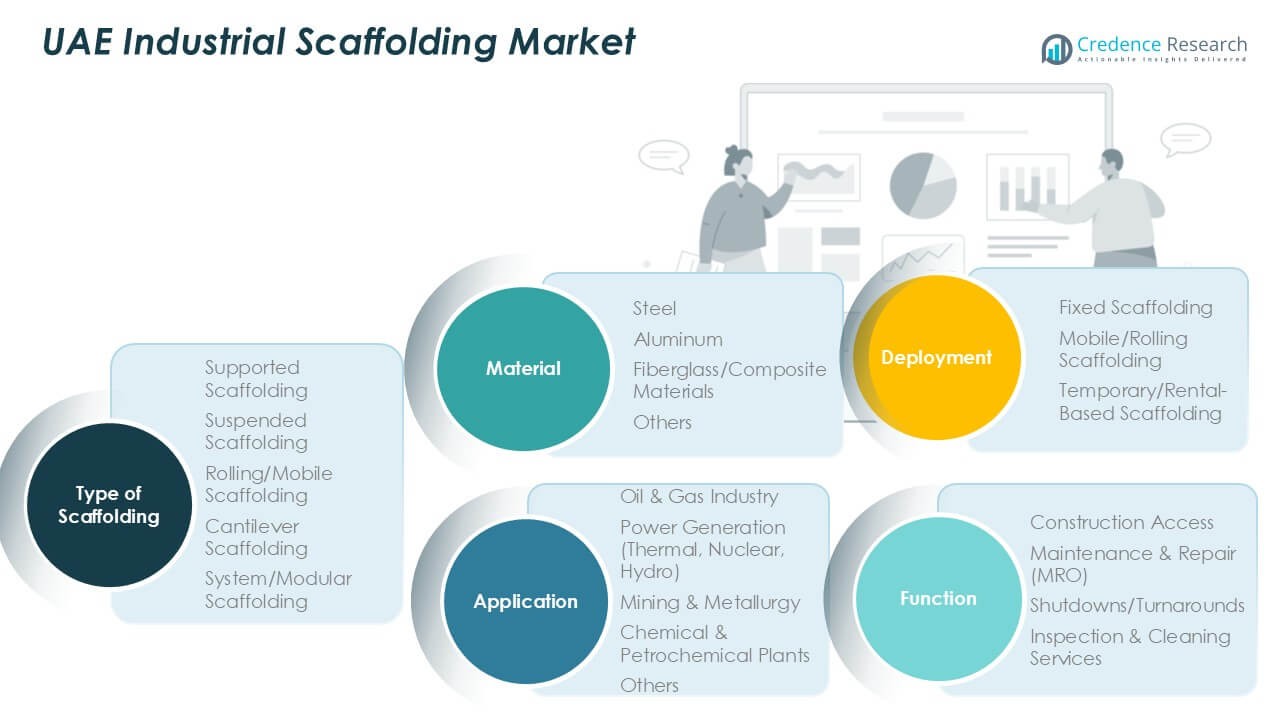

Market Segmentations:

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- Abu Dhabi

- Dubai

- Sharjah

- Northern Emirates (Ajman, Umm Al-Quwain, Ras Al Khaimah, Fujairah)

Competitive Landscape

The UAE industrial scaffolding market is moderately consolidated, with a mix of regional players and international companies competing for market share. Local firms such as ABN Scaffolds LLC, Scaxa Scaffolds Trading Co LLC, and Decagon Scaffolding & Engineering Co LLC hold strong positions by offering tailored solutions and quick project turnaround. Global players like PERI SE, Layher Holding GmbH & Co. KG, BrandSafway, and Altrad Group contribute advanced modular systems and digital scaffolding management tools, enhancing efficiency and safety standards. Competition focuses on pricing, project execution speed, and compliance with strict UAE safety regulations. Strategic partnerships with oil and gas operators, power utilities, and EPC contractors are common to secure long-term contracts. Companies invest in training programs, innovative materials, and rental services to meet growing demand. The market is seeing a shift toward modular and system scaffolding, pushing firms to upgrade technology and expand service portfolios.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABN Scaffolds LLC

- Scaxa Scaffolds Trading Co LLC

- Decagon Scaffolding & Engineering Co LLC

- Ascend Access System Scaffolding LLC

- ACE Aluminium Scaffolding

- Wellgate Scaffolding Trading Co LLC

- Emirates Technical Services LLC

- Brogan Group

- PERI SE

- Layher Holding GmbH & Co. KG

- BrandSafway

- Altrad Group

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice.

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continued oil and gas maintenance and refinery expansion projects.

- Modular and system scaffolding adoption will grow due to faster assembly and higher safety.

- Power generation and infrastructure projects will sustain steady scaffolding requirements.

- Digital tools for scaffold design and tracking will see wider integration across projects.

- Aluminum and composite scaffolding will gain traction for lightweight and corrosion-resistant applications.

- Rental-based scaffolding services will expand as industries focus on cost efficiency.

- Workforce training and safety certification programs will become more critical for compliance.

- Competition will intensify, driving innovation in materials and modular solutions.

- Abu Dhabi and Dubai will remain the primary demand centers for industrial scaffolding.

- Market players will explore partnerships and acquisitions to strengthen regional presence and service offerings.