Market Overview

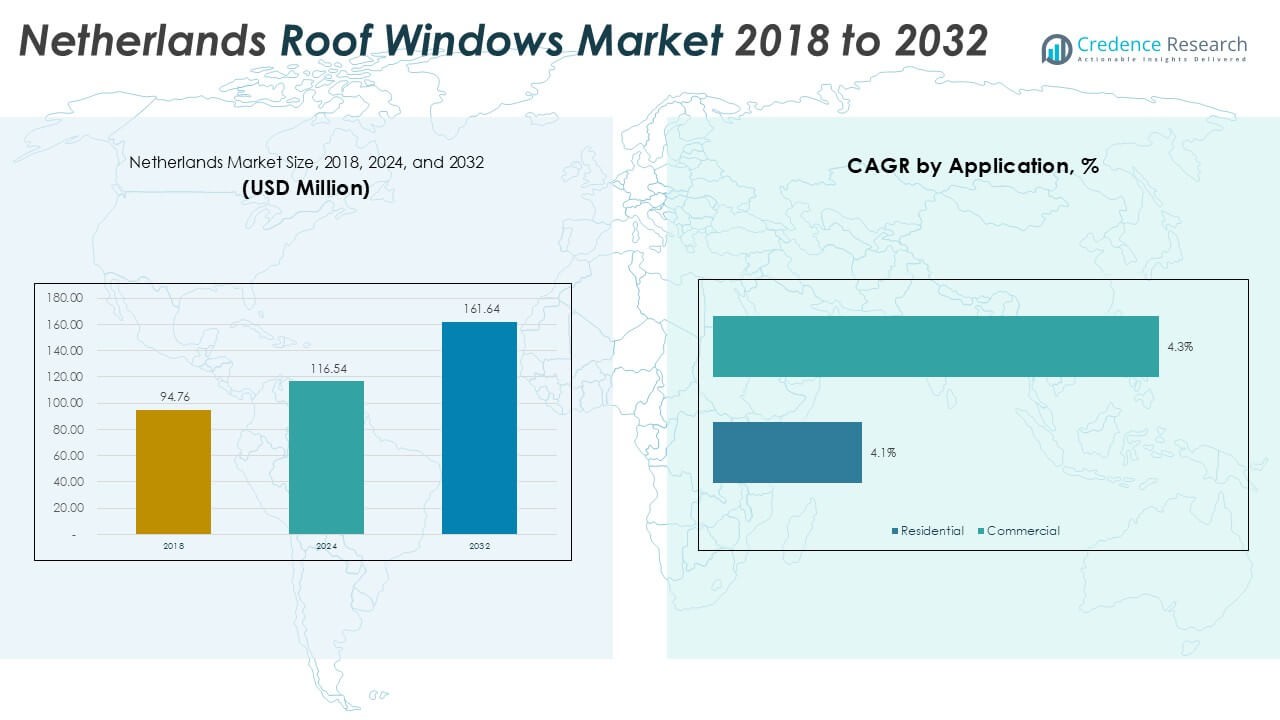

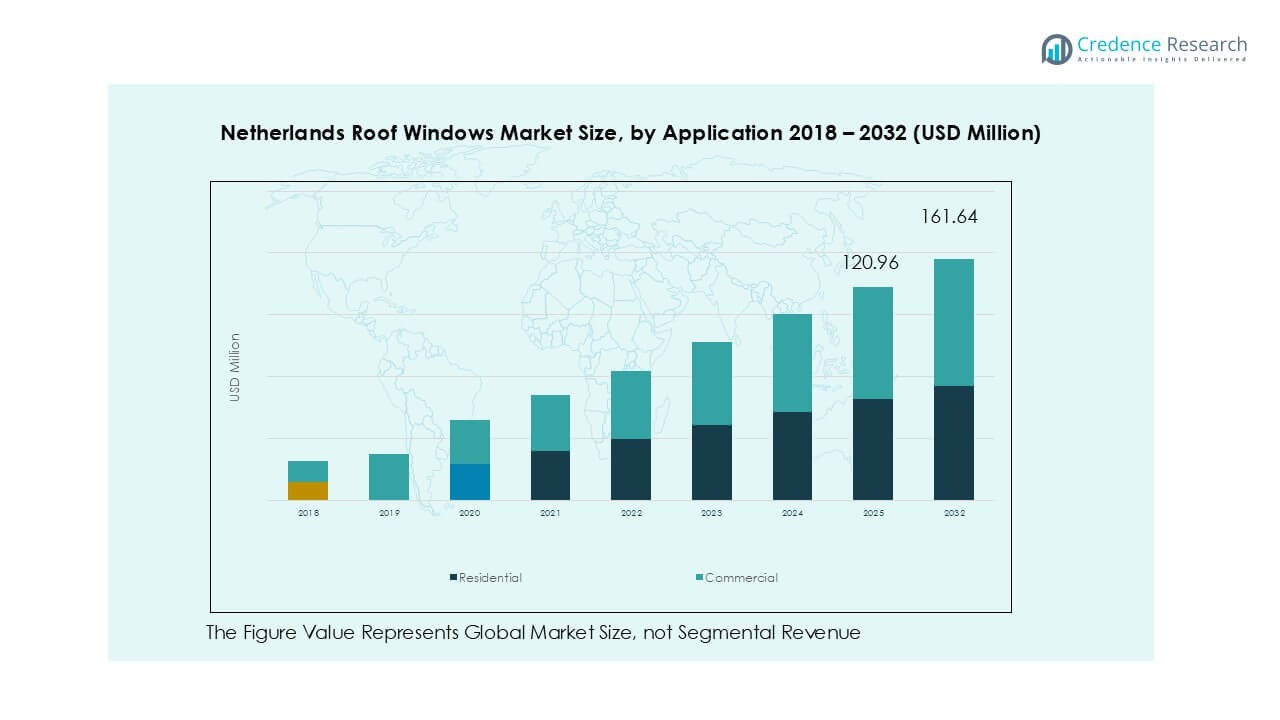

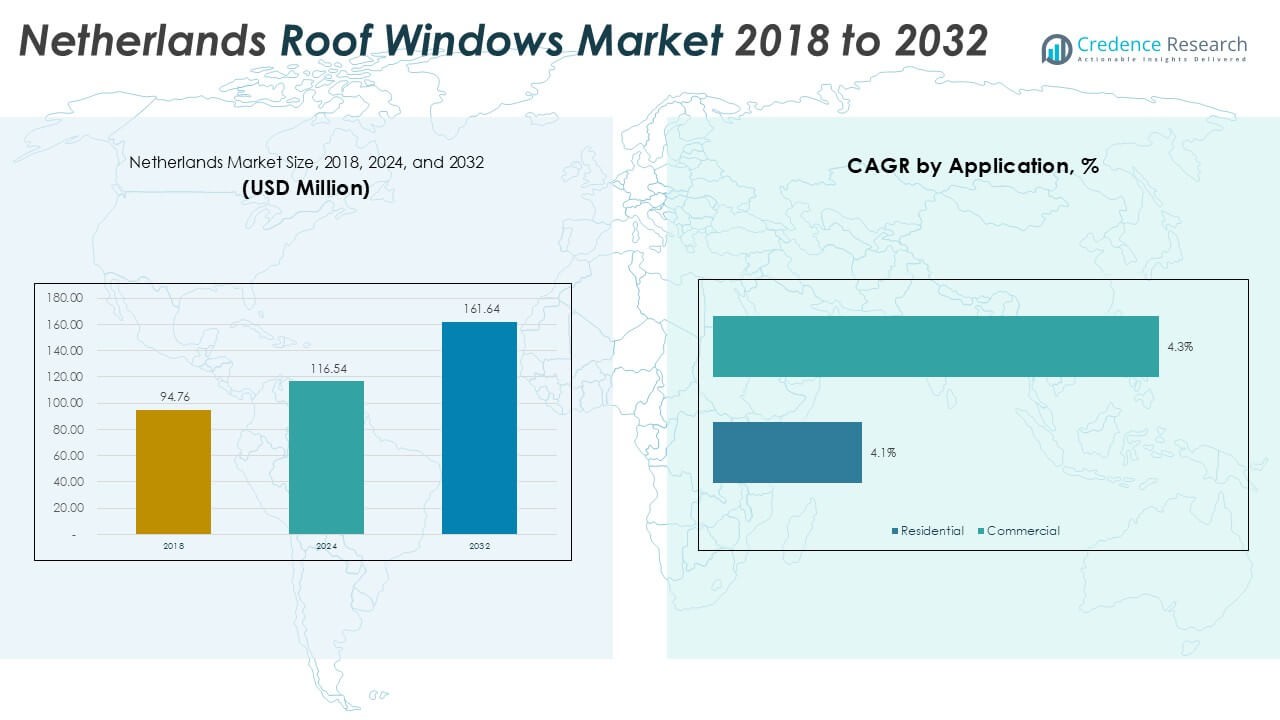

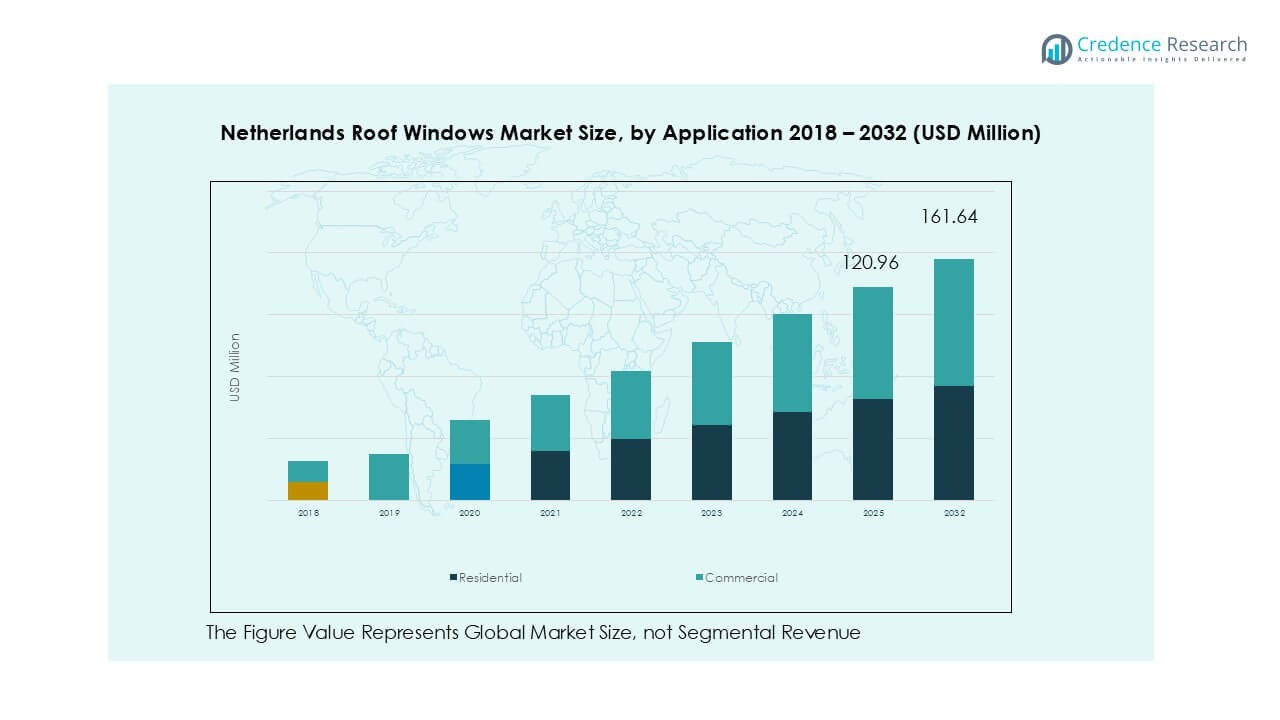

The Netherlands Roof Windows Market size was valued at USD 94.76 million in 2018 and grew to USD 116.54 million in 2024. It is anticipated to reach USD 161.64 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherlands Roof Windows Market Size 2024 |

USD 116.54 Million |

| Netherlands Roof Windows Market, CAGR |

4.2% |

| Netherlands Roof Windows Market Size 2032 |

USD 161.64 Million |

The Netherlands Roof Windows market is led by key players such as Velux Group, Roto Frank AG, Lamilux, Farko, Skyfens, Tulderhof, Skylights One B.V., Heuveling Dakgroep BV, Beckmann GmbH, Arcolux, Dakota Group, and Dutch Roof Design. Velux Group dominates with an extensive product portfolio and strong distribution network across the country, followed by Roto Frank AG and Lamilux, which focus on premium and automated roof window solutions. Regionally, Western Netherlands holds the largest share at 35%, driven by dense urban housing and commercial projects in Amsterdam, Rotterdam, and The Hague. Eastern Netherlands follows with 28%, supported by strong residential renovation activity. Northern and Southern Netherlands account for 18% and 19% respectively, with demand driven by energy-efficient glazing adoption and growing loft conversions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Netherlands Roof Windows market was valued at USD 116.54 million in 2024 and is expected to reach USD 161.64 million by 2032, growing at a CAGR of 2% during the forecast period.

- Rising demand for energy-efficient renovations and natural lighting solutions drives market growth, with strong adoption of double-glazed windows in residential projects and attic conversions.

- Smart and automated roof windows with rain sensors and solar-powered operation are emerging as key trends, aligning with growing smart home adoption and green building certifications.

- The market is moderately consolidated, led by Velux Group, Roto Frank AG, and Lamilux, with regional players like Tulderhof and Skylights One B.V. offering customized solutions.

- Western Netherlands leads with 35% share, followed by Eastern Netherlands at 28%, Southern at 19%, and Northern at 18%; by type, wooden roof windows dominate, supported by their superior insulation and aesthetic appeal.

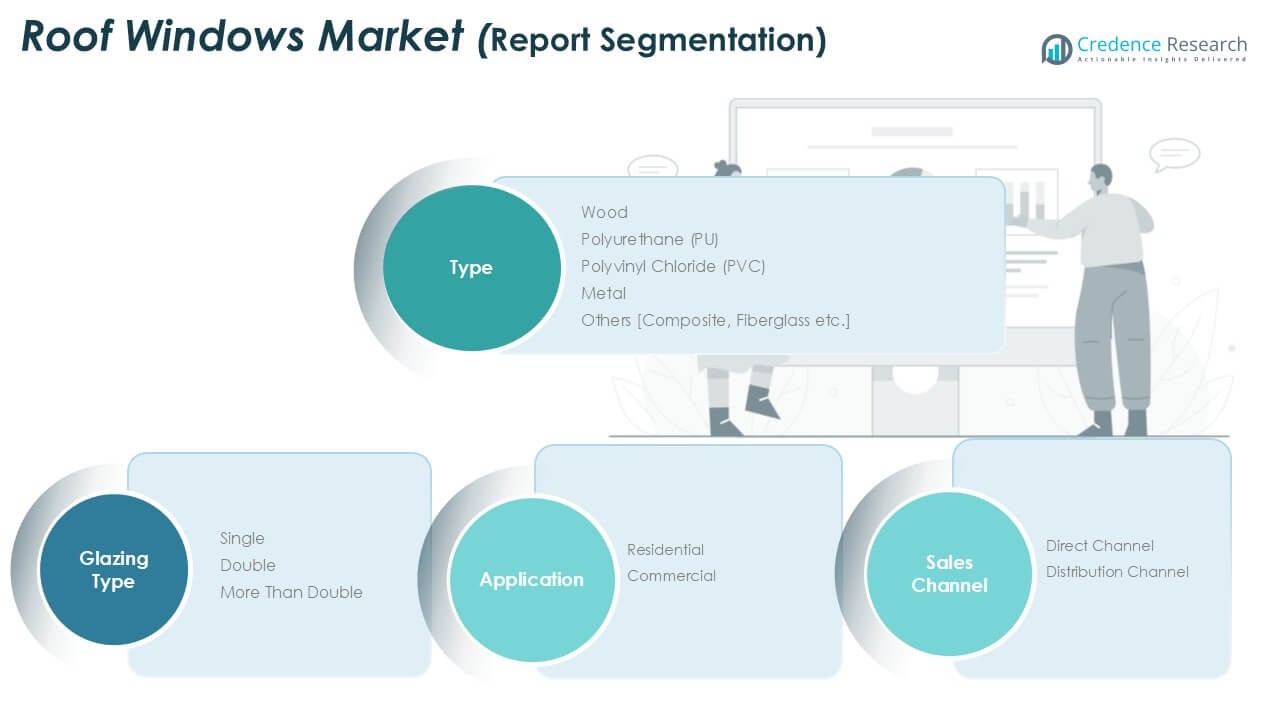

Market Segmentation Analysis:

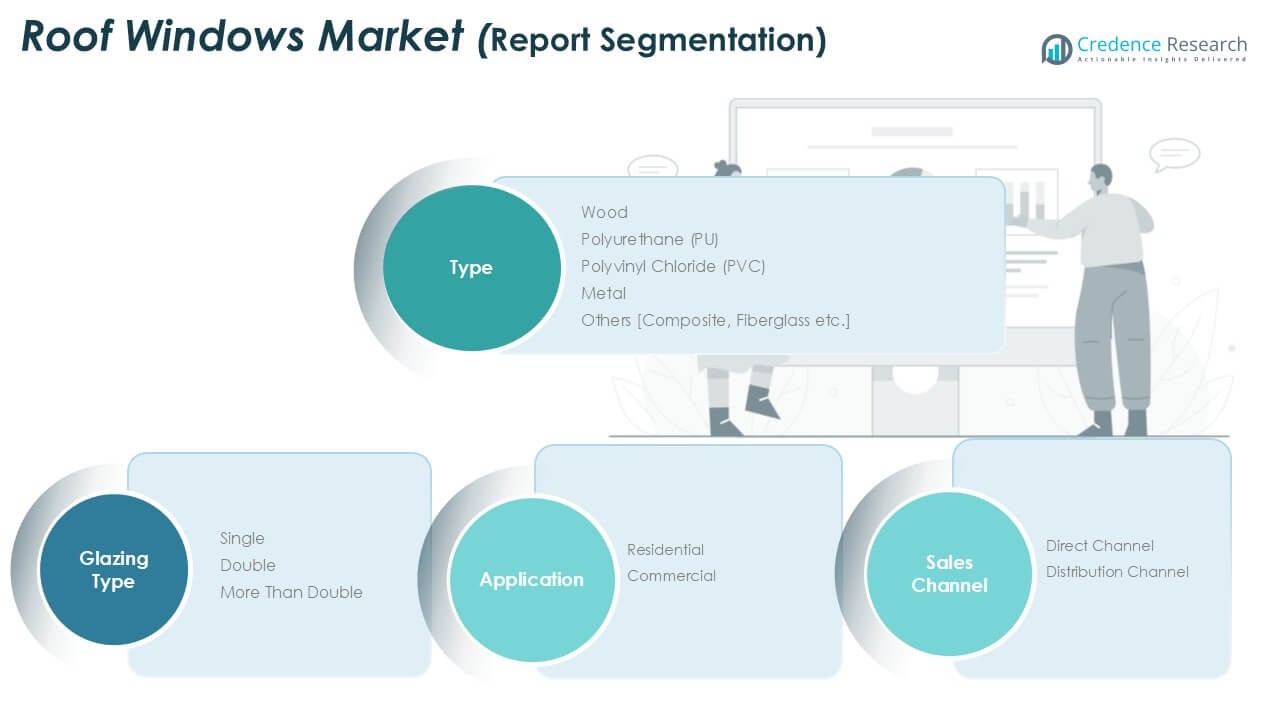

By Type

The Netherlands Roof Windows market by type is dominated by wood roof windows, holding the largest market share due to their aesthetic appeal and superior insulation properties. Wood frames are preferred in residential projects where natural finishes and sustainability are key priorities. Polyurethane (PU) windows follow, favored for their moisture resistance and low maintenance in bathrooms and kitchens. PVC windows gain traction for cost-effectiveness and durability, especially in budget-conscious projects. Metal frames serve industrial and commercial settings, while other niche materials cater to custom architectural needs, supporting diverse applications across construction projects.

- For instance, VELUX manufactures wood-framed roof windows using FSC-certified wood, in line with its sustainability strategy and European Union standards. As a major manufacturer in Europe, VELUX supplies its products to various national markets, including the Netherlands.

By Application

The residential segment leads the Netherlands Roof Windows market, accounting for the majority of installations. Rising urban housing developments and attic conversions drive strong demand, supported by government incentives for energy-efficient renovation projects. Commercial applications, including offices, educational institutions, and healthcare facilities, are growing steadily as natural lighting becomes a priority in sustainable building design. Increased focus on occupant well-being and productivity encourages the integration of roof windows in commercial buildings, though residential demand remains the primary growth engine for the market during the forecast period.

- For instance, in 2023, VELUX showcased its “Living Places” concept in Copenhagen, which was visited by more than 8,000 professional partners. Separately, VELUX also has a partnership with a Dutch construction company to build sustainable housing in the Netherlands.

By Glazing Type

Double-glazed roof windows hold the dominant share in the Netherlands market, offering an optimal balance of insulation performance and affordability. They reduce heat loss, improve energy efficiency, and support compliance with stringent building regulations. Triple and more glazing options are gaining traction in passive houses and high-performance buildings seeking superior thermal and acoustic insulation. Single-glazed windows see limited use, mainly in low-cost renovations or unheated spaces. Rising energy costs and sustainability goals continue to shift demand toward advanced multi-glazing solutions, reinforcing the dominance of double and triple-glazed variants.

Key Growth Drivers

Rising Energy-Efficient Renovations

Government incentives and strict EU energy regulations drive adoption of roof windows in renovations. Homeowners seek better insulation and natural lighting to reduce heating and cooling costs. Roof windows play a vital role in improving energy performance ratings of residential properties. Programs promoting energy-efficient retrofits, such as subsidies for insulation upgrades, further accelerate demand. This growth is strongest in urban housing, where attic conversions and loft renovations are common. Energy-conscious consumers and contractors favor double and triple-glazed roof windows that meet stringent thermal performance standards.

- For instance, in 2023, VELUX participated in energy-efficient construction initiatives, including a partnership with Dutch house builder Bouwgroep Dijkstra Draisma to apply the “Living Places” concept to sustainable housing projects in the Netherlands. The company also achieved broader sustainability milestones, such as securing 100% renewable electricity for its operations.

Increased Preference for Natural Lighting

Growing focus on occupant well-being boosts demand for roof windows in homes and offices. Natural daylight improves mood, productivity, and indoor comfort, making roof windows an attractive choice. Architectural trends favor open spaces and light-filled interiors, driving installations in new builds. Dutch building codes also encourage daylight penetration for healthier living spaces. This shift aligns with green building certifications like BREEAM, which prioritize natural light. Manufacturers respond with roof windows offering larger glazing areas and smart opening features, making them more appealing for both residential and commercial projects.

- For instance, the FPP-V preSelect MAX is a top-hung and pivot roof window that Fakro introduced in 2020. It allows the sash to open up to 45°, which is nearly 30% wider than the previous model.

Urban Housing Development and Loft Conversions

Rapid urbanization fuels construction of new residential projects and conversion of unused attic spaces. Roof windows offer an effective solution to create habitable rooms under pitched roofs. Loft conversions add valuable living space without expanding the building footprint, supporting demand. Municipal planning policies encourage efficient use of space in dense cities. As housing prices rise, homeowners increasingly invest in conversions to boost property value. Roof windows with enhanced thermal performance and sound insulation address urban noise concerns, strengthening their role in residential modernization projects across Dutch cities.

Key Trends & Opportunities

Adoption of Smart Roof Windows

Integration of IoT and automation drives adoption of smart roof windows with remote operation. Automated models feature rain sensors, solar-powered controls, and integration with home management systems. Consumers value convenience, energy savings, and improved ventilation control offered by these solutions. Manufacturers focus on developing app-connected windows that adjust based on indoor climate data. This trend opens opportunities for partnerships with smart home solution providers. As connected living gains traction in the Netherlands, demand for intelligent roof window solutions is expected to expand further in residential and commercial sectors.

- For instance, VELUX launched the VELUX App Control in 2021, enabling users to control windows and blinds via smartphone.

Sustainability and Eco-Friendly Materials

Sustainability is a key trend shaping product design and procurement choices. Manufacturers invest in responsibly sourced wood, recyclable PVC, and energy-efficient glazing. Consumers prioritize eco-friendly construction products that align with circular economy principles. Green building projects prefer roof windows with Environmental Product Declarations (EPDs) and low-carbon manufacturing footprints. Opportunities exist for companies offering cradle-to-cradle certified solutions and improved lifecycle performance. This sustainability shift also drives demand for products compatible with passive house standards, supporting growth in the premium segment of the Netherlands roof window market.

- For instance, Roto Frank compiled its first group-wide CO₂ balance in 2022, and this serves as the base year for the company’s climate target. In 2023, the company optimized and expanded its data collection.

Key Challenges

High Installation and Maintenance Costs

Roof windows require professional installation, which adds to project costs. Skilled labor shortages in the construction sector can further increase expenses. Complex installations in existing structures raise renovation budgets and delay project timelines. Maintenance requirements, including periodic sealing and cleaning, deter price-sensitive homeowners. In competitive housing markets, upfront costs influence decision-making, sometimes favoring cheaper alternatives like skylights. Manufacturers and installers face pressure to offer cost-effective solutions and simplified installation systems to overcome this barrier and make roof windows more accessible to a wider customer base.

Competition from Alternative Daylighting Solutions

The market faces competition from cheaper and simpler daylighting options like skylights and light tubes. These alternatives offer easier installation and lower maintenance, making them appealing for cost-conscious projects. For some homeowners, traditional skylights meet the basic need for natural light at a lower price point. Commercial projects may also opt for modular skylight systems for large roof areas. This competition challenges roof window manufacturers to highlight superior ventilation, insulation, and aesthetic benefits to justify the premium cost and maintain their competitive edge in the market.

Regional Analysis

Eastern Netherlands

Eastern Netherlands holds 28% market share in the roof windows market, driven by strong residential construction and renovation activities in cities like Arnhem, Enschede, and Apeldoorn. The region sees high adoption of roof windows in single-family homes and farmhouses converted into modern residences. Demand is further fueled by energy-efficiency programs supporting attic insulation and natural lighting solutions. Double-glazed windows dominate due to their cost-effectiveness and compliance with energy standards. Local builders and installers focus on offering sustainable wooden and PU-framed windows, aligning with the growing preference for eco-friendly materials in rural and suburban housing projects.

Western Netherlands

Western Netherlands accounts for the largest share at 35%, supported by high population density and urban housing developments in Amsterdam, Rotterdam, and The Hague. The region’s growing trend of loft conversions and multi-story residential projects drives roof window installations. Commercial adoption is also strong, with offices and schools prioritizing natural lighting solutions for healthier environments. Demand is concentrated on double and triple-glazed windows to meet strict energy performance regulations. Manufacturers target this region with smart and automated roof windows, catering to the tech-savvy consumer base and sustainability-driven construction projects prevalent in the western cities.

Northern Netherlands

Northern Netherlands represents 18% of market share, led by residential demand in Groningen, Leeuwarden, and Assen. The region’s colder climate supports higher uptake of energy-efficient glazing solutions to minimize heat loss. Roof windows are increasingly used in attic conversions and small housing developments, particularly in suburban areas. Wooden frames are popular for their insulation performance and compatibility with traditional architecture. Government subsidies for sustainable renovation projects have boosted replacement demand. The adoption of triple-glazed windows is higher than the national average, as homeowners prioritize thermal comfort and long-term energy savings in colder northern conditions.

Southern Netherlands

Southern Netherlands holds 19% share of the roof windows market, with strong activity in cities like Eindhoven, Maastricht, and Tilburg. Residential projects dominate demand, though the region also sees growth in commercial building retrofits emphasizing daylight penetration. Double-glazed roof windows remain the preferred choice, supported by affordability and strong compliance with energy codes. Industrial and logistics hubs in the south are integrating roof windows to improve natural light in workspaces, contributing to employee well-being. Sustainability initiatives and a focus on low-maintenance materials are driving interest in PVC and PU frames across both residential and light commercial projects.

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- Eastern Netherlands

- Western Netherlands

- Northen Netherlands

- Southern Netherlands

Competitive Landscape

The Netherlands Roof Windows market is moderately consolidated, with global leaders and regional players competing on product innovation, energy efficiency, and smart technology integration. Velux Group holds a leading position with a broad range of wooden, PU, and PVC roof windows, emphasizing energy-efficient double and triple glazing solutions. Roto Frank AG and Lamilux focus on premium-quality, automated roof windows designed for residential and commercial projects, strengthening their share through advanced manufacturing. Local companies like Tulderhof, Skylights One B.V., and Heuveling Dakgroep BV cater to customized solutions, offering region-specific designs and installation services. Competition centers on sustainability, compliance with Dutch building regulations, and ease of installation. Companies actively invest in smart, sensor-based roof windows with rain and climate control features, appealing to tech-savvy consumers. Strategic collaborations with construction firms and distributors help players expand their presence, while mergers and acquisitions enhance product portfolios and regional distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tulderhof

- Velux Group

- Roto Frank AG

- Farko

- Lamilux

- Skyfens

- Skylights One B.V.

- Heuveling Dakgroep BV

- Beckmann GmbH

- Arcolux

- Dakota Group

- Dutch Roof Design

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and triple-glazed roof windows will rise with stricter building codes.

- Smart and automated roof windows with climate control features will see wider adoption.

- Residential attic conversions will continue to drive installations in urban and suburban areas.

- Commercial buildings will increasingly integrate roof windows to improve natural lighting and employee well-being.

- Manufacturers will focus on recyclable materials and low-carbon production processes to meet sustainability goals.

- Partnerships with construction firms will strengthen distribution and installation networks across all regions.

- Digital tools and online configurators will enhance customer experience and drive direct sales.

- Competition will intensify as global and local players expand product portfolios with advanced solutions.

- Western Netherlands will remain the largest market, supported by high urban development and renovation activity.

- Government incentives for energy-efficient renovations will continue to support steady market growth through 2032.