Market Overview

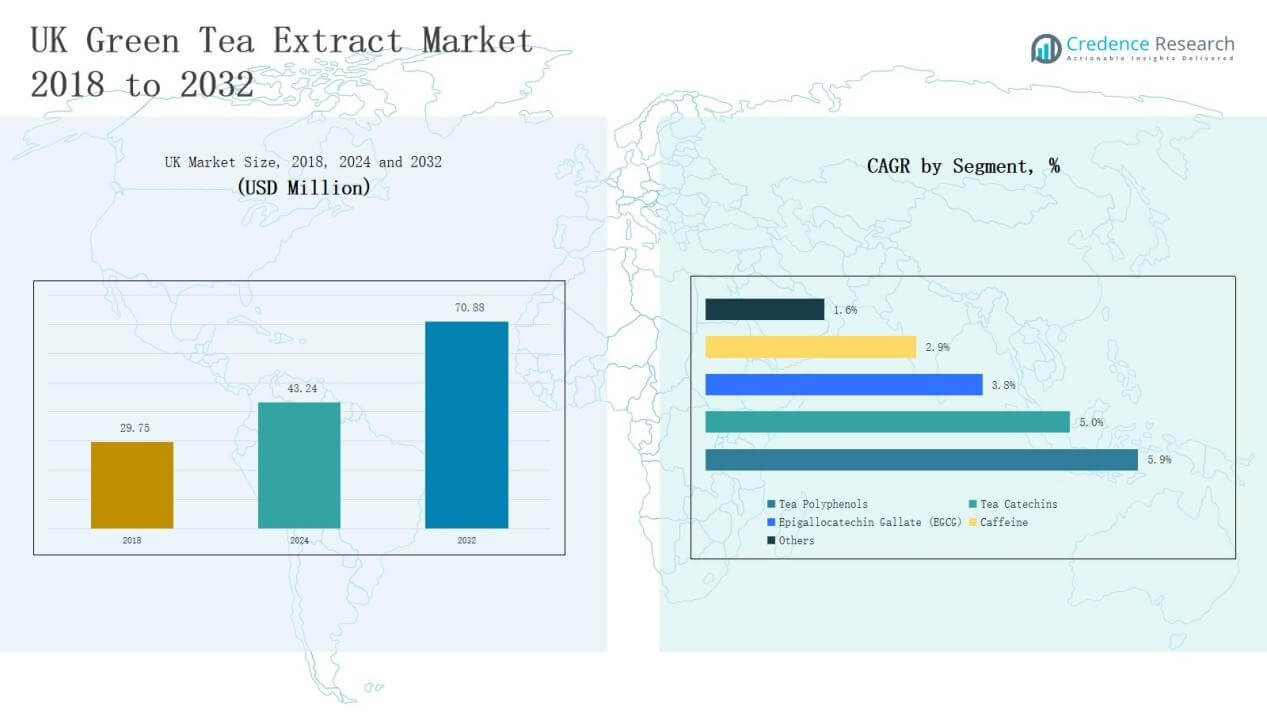

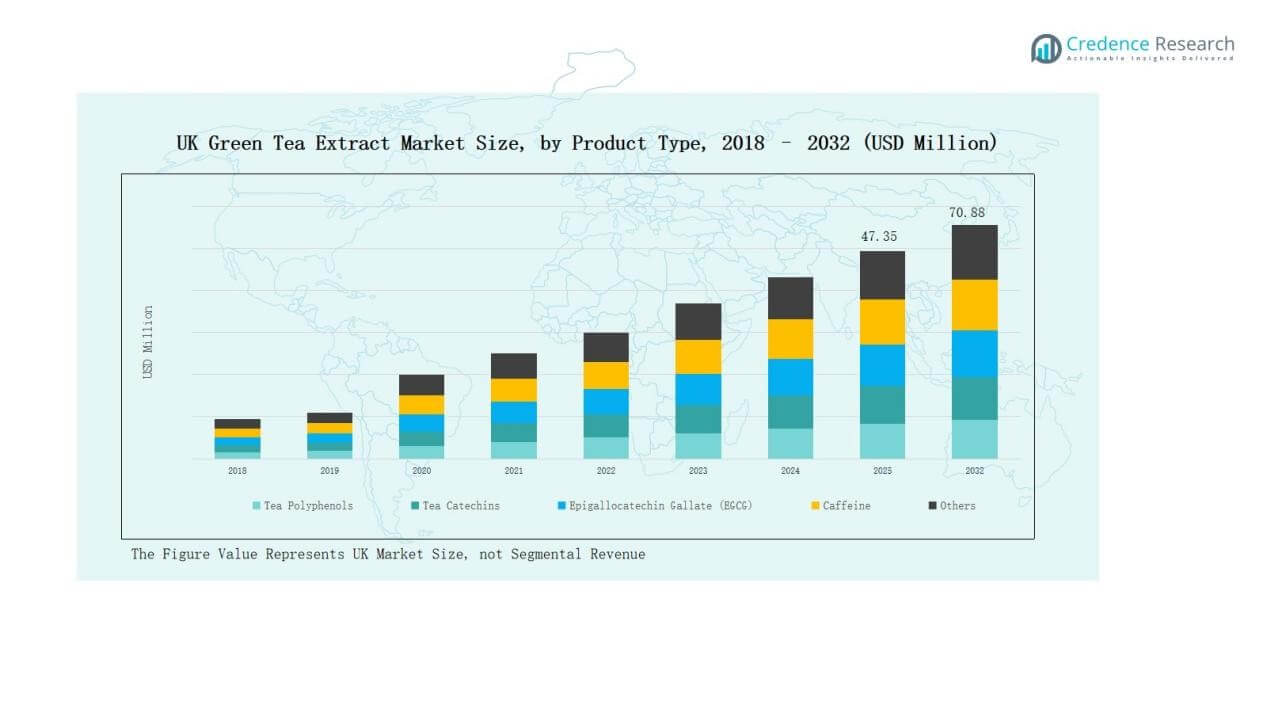

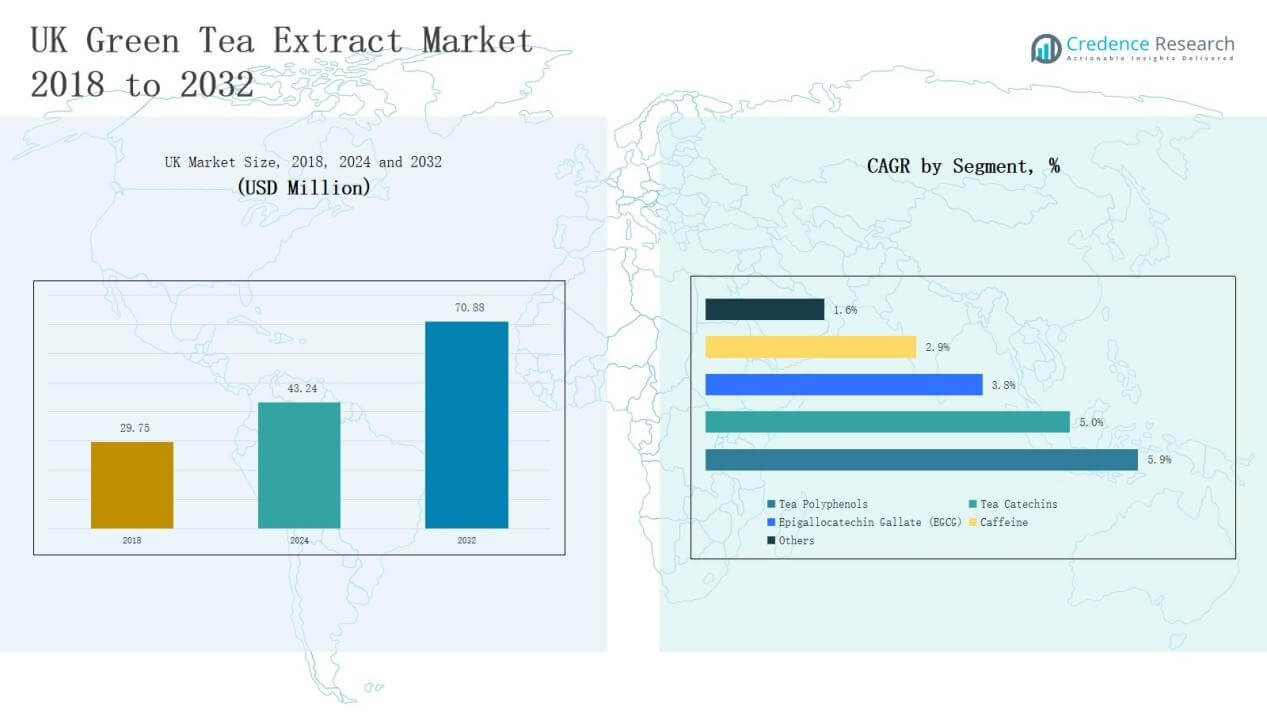

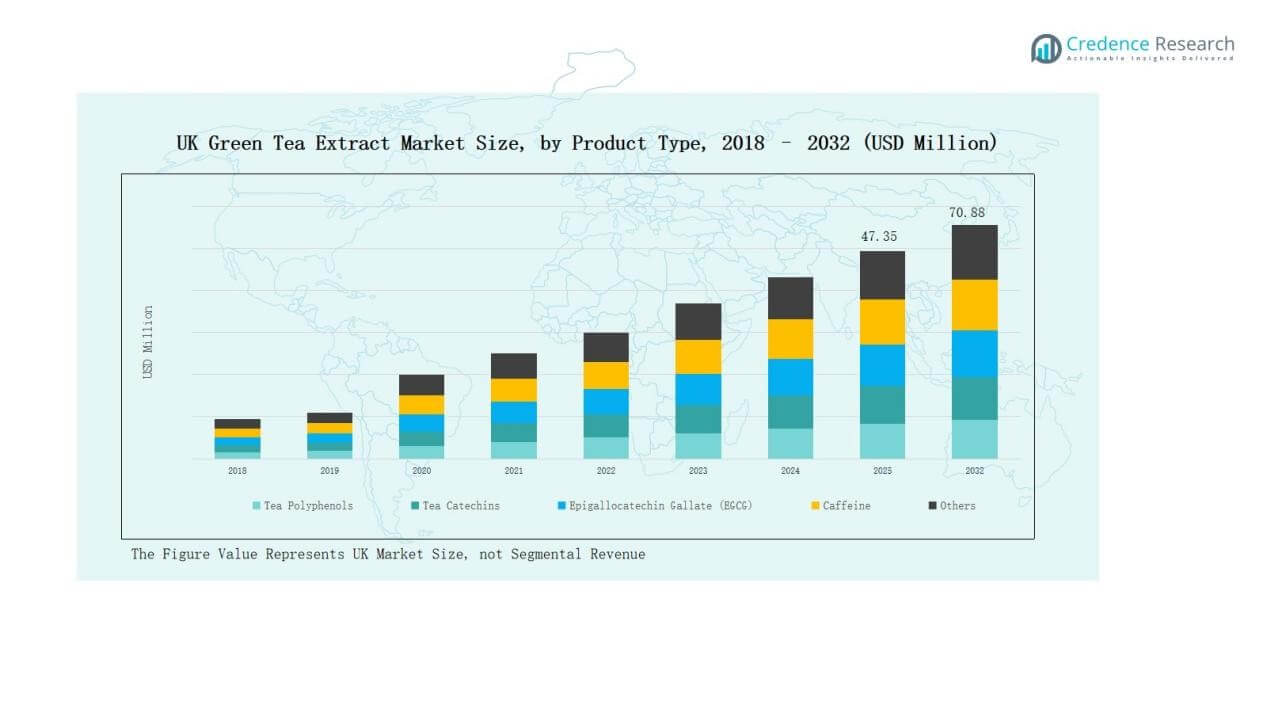

UK Green Tea Extract Market size was valued at USD 29.75 million in 2018, reaching USD 43.24 million in 2024, and is anticipated to attain USD 70.88 million by 2032, at a CAGR of 5.93% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Green Tea Extract Market Size 2024 |

USD 43.24 Million |

| UK Green Tea Extract Market, CAGR |

5.93% |

| UK Green Tea Extract Market Size 2032 |

USD 70.88 Million |

The UK Green Tea Extract Market is led by established players such as Tate & Lyle PLC, Twinings, Unilever’s Lipton brand, MartinBauer Group, DSM Nutritional Products, and Givaudan, alongside regional specialists including Pukka Herbs, Clipper Teas, Yogi Tea Europe GmbH, and Finlays. These companies strengthen their market positions through diversified product portfolios, sustainable sourcing, and continuous investment in clean-label and functional formulations. England emerges as the leading region with a 59% share in 2024, driven by strong retail infrastructure, advanced R&D facilities, and high consumer demand for nutraceuticals and functional beverages. This dominance highlights the region’s role as the central hub for innovation, distribution, and long-term market expansion.

Market Insights

- The UK Green Tea Extract Market grew from USD 29.75 million in 2018 to USD 43.24 million in 2024 and is projected to reach USD 70.88 million by 2032 at a CAGR of 5.93%.

- Leading companies include Tate & Lyle PLC, Twinings, Unilever’s Lipton brand, MartinBauer Group, DSM Nutritional Products, Givaudan, Pukka Herbs, Clipper Teas, Yogi Tea Europe GmbH, and Finlays.

- By product type, Tea Catechins dominate with a 36% share in 2024, followed by EGCG, while Polyphenols, Caffeine, and Others serve niche applications.

- By form, Powder leads with a 48% share in 2024 due to versatility, while Liquid supports RTD beverages and Soft Gel grows steadily in pharmaceutical applications.

- England holds the largest regional share at 59% in 2024, followed by Scotland at 16%, Wales at 13%, and Northern Ireland at 12%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Tea Catechins dominate the UK Green Tea Extract Market with a 36% share in 2024. Their strong demand is driven by proven antioxidant properties, applications in nutraceuticals, and rising consumer focus on preventive healthcare. Epigallocatechin Gallate (EGCG) follows closely, supported by its use in pharmaceuticals and functional foods. Tea Polyphenols and caffeine-based extracts hold steady shares, serving food and beverage applications, while the “Others” segment addresses niche formulations in cosmetics and wellness products.

For instance, DSM-Firmenich expanded its science-based nutraceutical portfolio by highlighting green tea catechin extracts rich in EGCG for cardiovascular and metabolic health benefits.

By Form

Powder leads with a 48% share in 2024, reflecting its versatility across supplements, food, and cosmetic formulations. The convenience of dosage, longer shelf life, and easy incorporation in tablets and capsules support its dominance. Liquid extracts hold the second-largest share due to their use in RTD teas and functional beverages, appealing to on-the-go consumers. Soft gels remain a smaller segment but show steady growth as pharmaceutical companies expand nutraceutical capsule offerings.

For instance, Glanbia Nutritionals expanded its whey- and plant-based powder blends under the BevEdge line, focused on improving dispersibility in functional beverages.

By Application

Pharmaceuticals represent the largest segment with a 42% share in 2024, fueled by clinical adoption of catechins and EGCG for cardiovascular, metabolic, and weight management benefits. Food & Beverages hold a significant portion, driven by functional food trends and fortified products. RTD teas account for rising shares as health-conscious consumers seek convenient antioxidant-rich drinks. Functional foods and other categories, including cosmetics, add further value through innovation in wellness-focused product lines.

Key Growth Drivers

Rising Demand for Nutraceuticals

The UK Green Tea Extract Market benefits from strong demand in nutraceuticals, supported by increasing consumer awareness of preventive healthcare. Green tea catechins and EGCG are recognized for their antioxidant, anti-inflammatory, and metabolic health benefits, driving adoption in supplements. Consumers seeking natural solutions for weight management, cardiovascular health, and immunity are expanding product usage. Pharmaceutical and wellness companies leverage this demand by launching capsules, tablets, and functional blends, reinforcing the position of nutraceuticals as a core growth driver.

Expansion in Functional Beverages

Functional beverages form a major growth pillar, with green tea extract widely used in ready-to-drink teas, fortified juices, and energy drinks. Health-conscious consumers are shifting from carbonated and high-sugar beverages to antioxidant-rich alternatives. The UK market’s large urban population, coupled with busy lifestyles, fuels demand for convenient formats such as RTD teas. Brands highlight clean-label and natural formulations, catering to consumers seeking both wellness and convenience. This shift continues to strengthen the extract’s role in the beverage sector.

For instance, Nestlé launched its Nescafé Ready-to-Drink (RTD) range in Southeast Asia and other markets, targeting wellness-oriented younger consumers with convenient, on-the-go coffee options like lattes, cappuccinos, and mochas, with some variants containing added vitamins

Growing Pharmaceutical Applications

Pharmaceutical use of green tea extract is expanding rapidly, with a focus on standardized catechin and EGCG formulations. Clinical evidence supports applications in metabolic disorders, cardiovascular health, and cognitive wellness, encouraging integration in therapeutic products. UK healthcare providers and biotech firms are exploring new formulations, particularly in weight management and anti-carcinogenic research. Regulatory emphasis on natural and plant-based therapeutics further boosts adoption. This positions the pharmaceutical sector as a long-term driver of extract demand across medical and wellness domains.

For instance, A clinical trial in Beijing showed that oral and topical mixed tea extracts led to a decrease in oral leukoplakia lesions in 37.9% of patients over a six-month period.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Clean-Label and Organic Products

A major trend shaping the UK market is the preference for clean-label, organic, and sustainably sourced green tea extracts. Consumers increasingly scrutinize product labels, driving demand for formulations free from artificial additives. Organic-certified extracts align with environmental values and health-conscious preferences, creating premium market opportunities. Manufacturers investing in sustainable sourcing and eco-friendly extraction processes are capturing stronger loyalty. This trend highlights a structural shift in consumer behavior, offering growth for brands aligning with natural wellness priorities.

For instance, Unilever Plc., a major player, emphasizes sustainability by ethically sourcing tea leaves and employing water-efficient processing in its instant green tea powder extracts, responding to wellness and transparency demands in over 190 countries as of 2023.

Innovation in Functional Foods and Cosmetics

The use of green tea extract in functional foods and cosmetic formulations is rising, supported by its versatility and wellness positioning. Food manufacturers integrate extracts into protein bars, cereals, and dairy products, while cosmetic brands use polyphenol-rich formulations for anti-aging and skin protection benefits. This diversification beyond supplements and beverages opens new revenue streams. Innovation-driven companies in the UK are launching multifunctional products that bridge health and lifestyle needs, creating opportunities for long-term expansion across emerging applications.

For instance, Unilever introduced multifunctional green tea extract-infused beverages and skincare products combining wellness and lifestyle benefits, illustrating a growing trend towards bridging food and cosmetic applications with natural ingredients.

Key Challenges

Regulatory Compliance and Quality Standards

Strict UK and EU regulations on nutraceuticals and food supplements present compliance challenges for market participants. Companies must adhere to detailed safety, purity, and labeling requirements, increasing operational costs. Ensuring consistent active compound levels in extracts, particularly EGCG, is critical for product approval. Smaller firms often struggle with regulatory burdens, slowing market entry. These compliance demands limit speed-to-market and create barriers for emerging players, shaping a competitive environment dominated by established companies with stronger resources.

Intense Market Competition

The UK Green Tea Extract Market faces intense competition from multinational corporations, established nutraceutical firms, and domestic specialists. Price pressure from private labels and alternative herbal extracts increases challenges for differentiation. Strong brand recognition of global leaders such as Unilever and Givaudan makes it harder for smaller players to gain visibility. Innovation is essential but requires significant investment in R&D and marketing. This competitive intensity forces companies to continuously upgrade formulations and expand distribution to sustain market share.

Supply Chain and Raw Material Constraints

The market relies heavily on stable sourcing of quality green tea leaves, which are subject to climatic and geopolitical uncertainties. Volatility in raw material prices directly impacts production costs and profit margins for UK-based companies. Import dependence on tea-growing regions such as China and India exposes players to fluctuations in supply. Delays in logistics and rising transportation costs add further challenges. Addressing these supply risks requires strategic partnerships and investment in sustainable sourcing strategies to ensure continuity.

Regional Analysis

England

England dominates the UK Green Tea Extract Market with a 59% share in 2024. Strong consumer demand for nutraceuticals and functional beverages drives growth, supported by widespread retail penetration and established distribution networks. The region benefits from the presence of multinational players, advanced R&D facilities, and high adoption of clean-label formulations. Pharmaceutical and food manufacturers are investing in new product launches to capture health-conscious consumers. Rising demand for ready-to-drink teas further strengthens the segment. It continues to set the pace for product innovation and category expansion.

Scotland

Scotland holds a 16% share in 2024, supported by increasing awareness of preventive healthcare and wellness. The market benefits from demand for organic and sustainably sourced extracts, particularly among younger consumers. Food and beverage companies are expanding product offerings with fortified drinks and functional foods. Pharmaceutical applications remain smaller but are gradually gaining traction due to rising demand for natural remedies. It leverages growing consumer trust in premium and authentic formulations. The region shows steady momentum with scope for further expansion.

Wales

Wales accounts for a 13% share in 2024, led by demand for dietary supplements and fortified beverages. Nutraceutical companies are introducing affordable green tea extract-based capsules and powders to cater to a cost-sensitive population. Health campaigns and rising interest in natural weight management solutions are increasing product adoption. Food and beverage manufacturers are integrating extracts into functional snacks and ready-to-drink products. It reflects growth potential driven by consumer focus on holistic health. The region is expected to maintain stable growth supported by lifestyle shifts.

Northern Ireland

Northern Ireland represents a 12% share in 2024, shaped by increasing demand for clean-label and organic wellness products. Growing penetration of retail chains and online distribution strengthens consumer access to supplements and functional foods. Pharmaceutical applications are expanding, with rising interest in catechin-rich extracts for cardiovascular and metabolic health. Local producers and distributors are collaborating with global suppliers to ensure product availability. It faces challenges from limited domestic production but benefits from expanding cross-border trade. The region shows long-term potential for category diversification.

Market Segmentations:

Market Segmentations:

By Product Type

- Tea Polyphenols

- Tea Catechins

- Epigallocatechin Gallate (EGCG)

- Caffeine

- Others

By Form

By Application

- Pharmaceuticals

- Food & Beverages

- Ready-to-Drink (RTD) Teas

- Functional Foods

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Green Tea Extract Market is highly competitive, shaped by multinational corporations, established nutraceutical firms, and specialized domestic players. Leading companies such as Tate & Lyle PLC, Twinings, Unilever’s Lipton brand, and MartinBauer Group leverage strong distribution networks, broad product portfolios, and established consumer trust to maintain dominance. Firms like Pukka Herbs, Clipper Teas, and Yogi Tea Europe GmbH emphasize organic and clean-label extracts to appeal to health-conscious buyers. Innovation in formulations, sustainable sourcing, and integration into pharmaceuticals, functional foods, and beverages serve as key strategies to capture market share. Global suppliers including Givaudan and DSM Nutritional Products invest in R&D to enhance polyphenol-rich and EGCG-standardized extracts, aligning with clinical and nutraceutical demand. Smaller regional companies compete through niche offerings and partnerships with healthcare and wellness brands. The market reflects intense rivalry, where differentiation depends on product quality, regulatory compliance, and branding strength in both domestic and international channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Tate & Lyle PLC

- Finlays

- Twinings

- MartinBauer Group

- Givaudan

- DSM Nutritional Products

- Unilever (Lipton Brand)

- Yogi Tea Europe GmbH

- Clipper Teas

- Pukka Herbs Ltd

Recent Developments

- In May 2025, Finlays introduced Finlays Solutions, an evolved extracts business designed to strengthen its position in the food and beverage sector.

- In October 2024, PLT Health Solutions partnered with CellFlo6 to commercialize a patented green tea extract globally.

- In August 2025, TrimIQ launched in the UK & Ireland a weight-loss supplement featuring a Green Tea Probiotic Complex plus Garcinia.

- In December 2024, Supreme PLC acquired Typhoo Tea Ltd, a historic UK tea brand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for nutraceutical supplements with catechins and EGCG will continue to expand.

- Functional beverage launches with fortified teas and juices will drive wider adoption.

- Pharmaceutical applications will gain traction in cardiovascular, metabolic, and cognitive health.

- Clean-label and organic extracts will capture a larger share of consumer demand.

- E-commerce channels will strengthen distribution and boost direct-to-consumer sales.

- Partnerships between global suppliers and local brands will enhance market penetration.

- Sustainable sourcing practices will become a critical factor for brand differentiation.

- Cosmetic and personal care applications of green tea extracts will grow steadily.

- Rising health awareness among younger consumers will accelerate adoption across categories.

- Innovation in ready-to-drink teas and functional snacks will support long-term market growth.

Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: