Market Overview

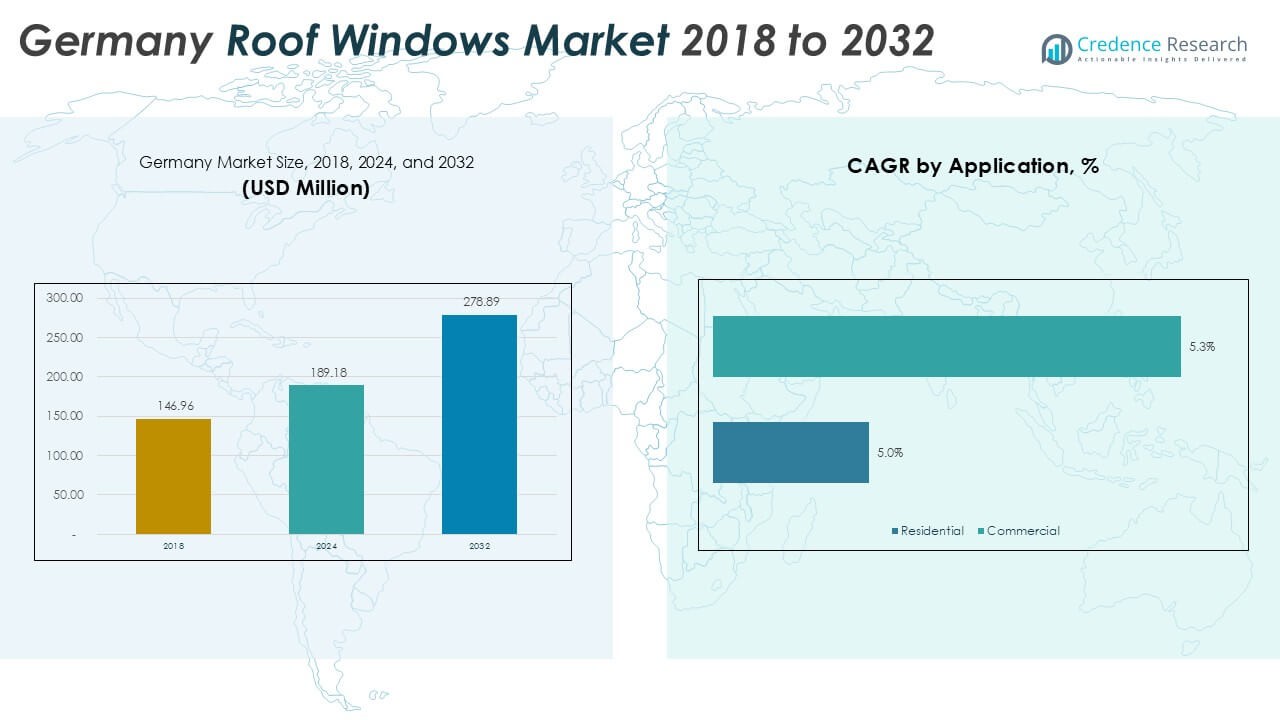

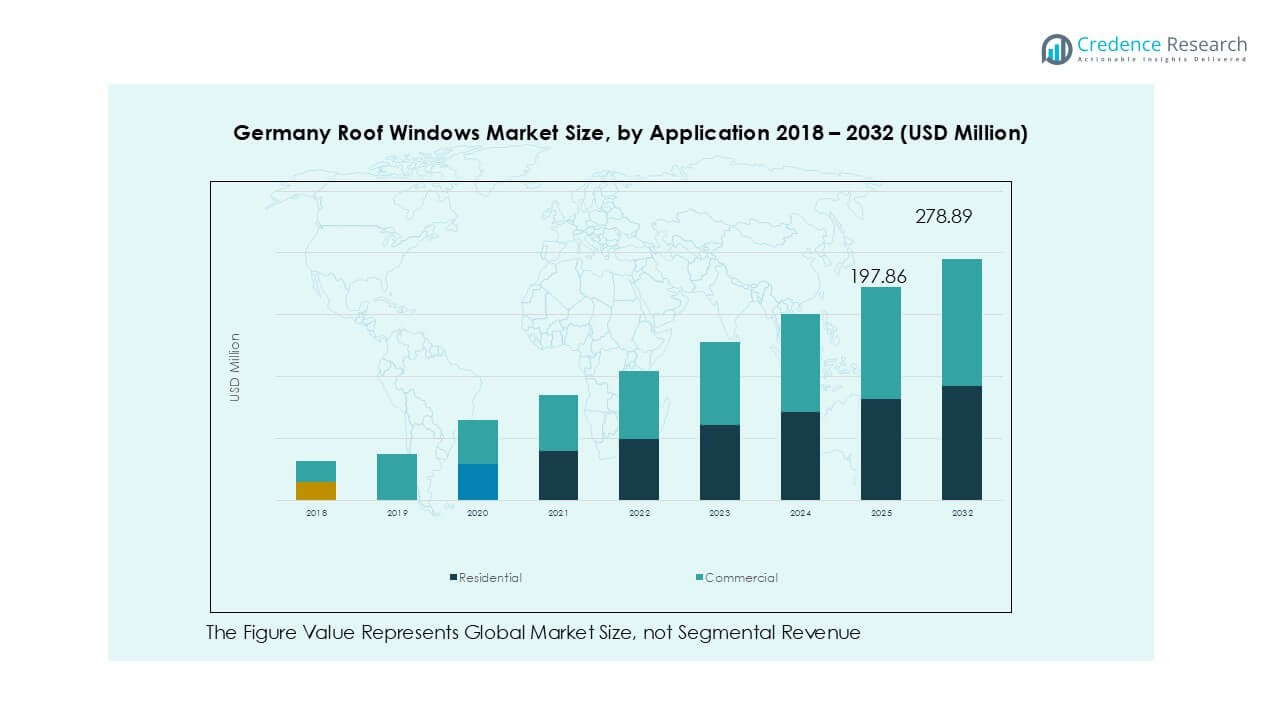

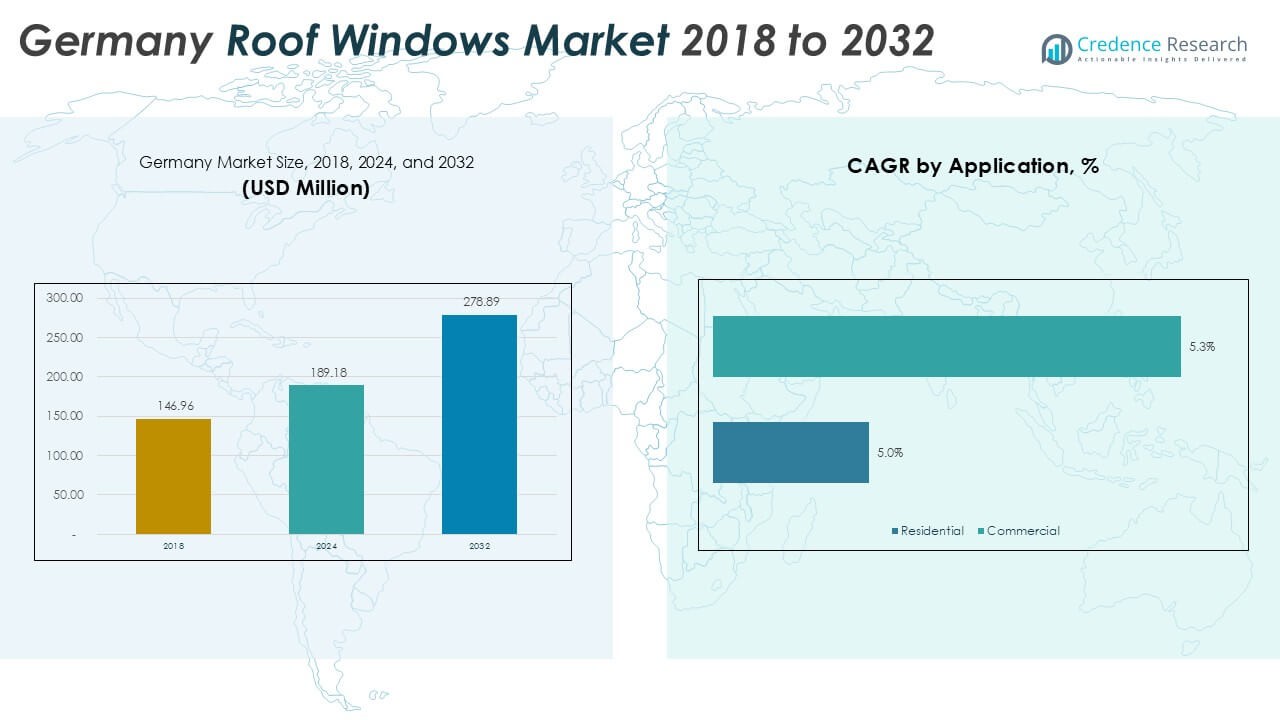

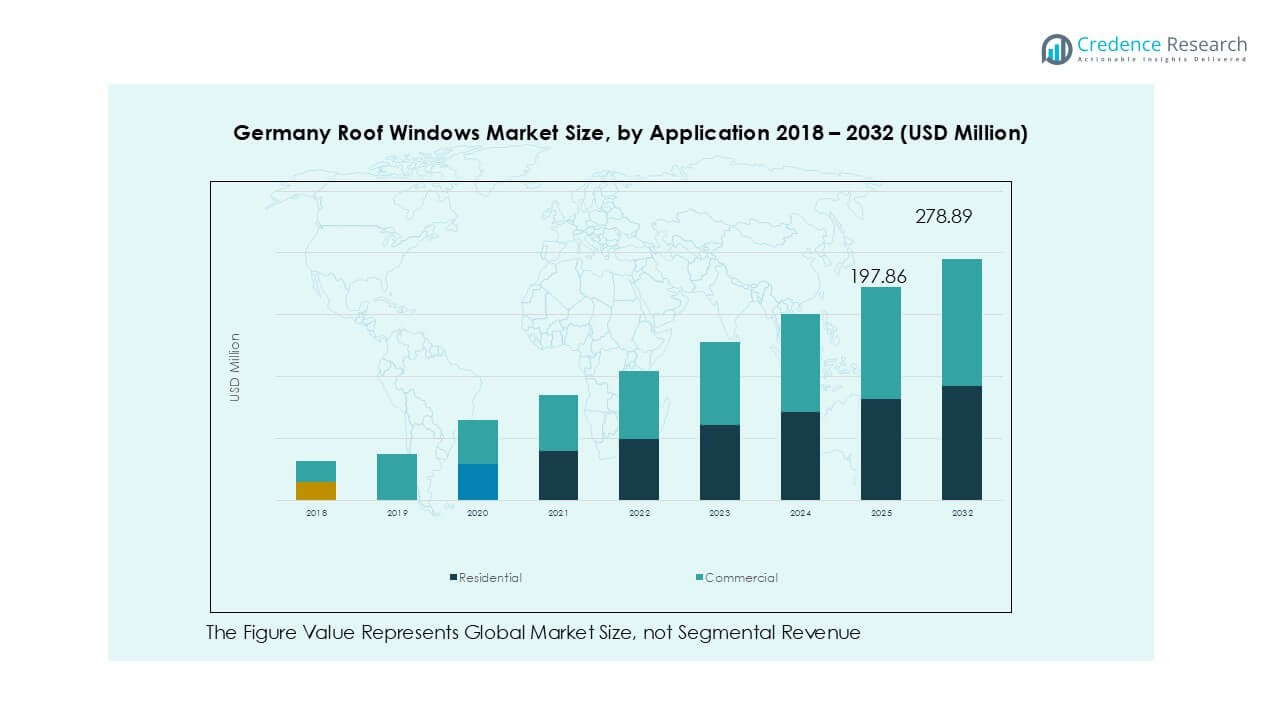

Germany Roof Windows Market size was valued at USD 146.96 million in 2018 and grew to USD 189.18 million in 2024. It is anticipated to reach USD 278.89 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Roof Windows Market Size 2024 |

USD 189.18 Million |

| Germany Roof Windows Market, CAGR |

4.3% |

| Germany Roof Windows Market Size 2032 |

USD 278.89 Million |

The Germany roof windows market is led by major players such as Velux Group, Fakro, Roto Frank AG, Lamilux, and Mage Roof & Building Components GmbH, which together account for over 65% of the market share. Velux Group dominates the premium segment with advanced glazing and smart automation solutions, while Fakro focuses on eco-friendly and cost-effective models. Roto Frank AG leverages strong distribution networks and customization capabilities for residential and commercial projects. South Germany leads with 32% market share, driven by high construction activity and adoption of energy-efficient housing solutions, followed by North Germany with 28% share, supported by renovation projects and coastal climate needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Roof Windows Market was valued at USD 189.18 million in 2024 and is projected to reach USD 278.89 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Growth is driven by rising demand for energy-efficient homes, attic conversions, and government incentives supporting sustainable building renovations.

- Key trends include adoption of smart roof windows with automation, growing use of recyclable materials, and preference for double and triple glazing for superior thermal performance.

- The market is moderately consolidated with leading players such as Velux Group, Fakro, Roto Frank AG, and Lamilux holding over 65% market share, competing through innovation and distribution partnerships.

- South Germany leads with 32% share, followed by North Germany with 28%; residential applications dominate with more than 65% share, while double-glazed roof windows hold about 55% of total installations across the country.

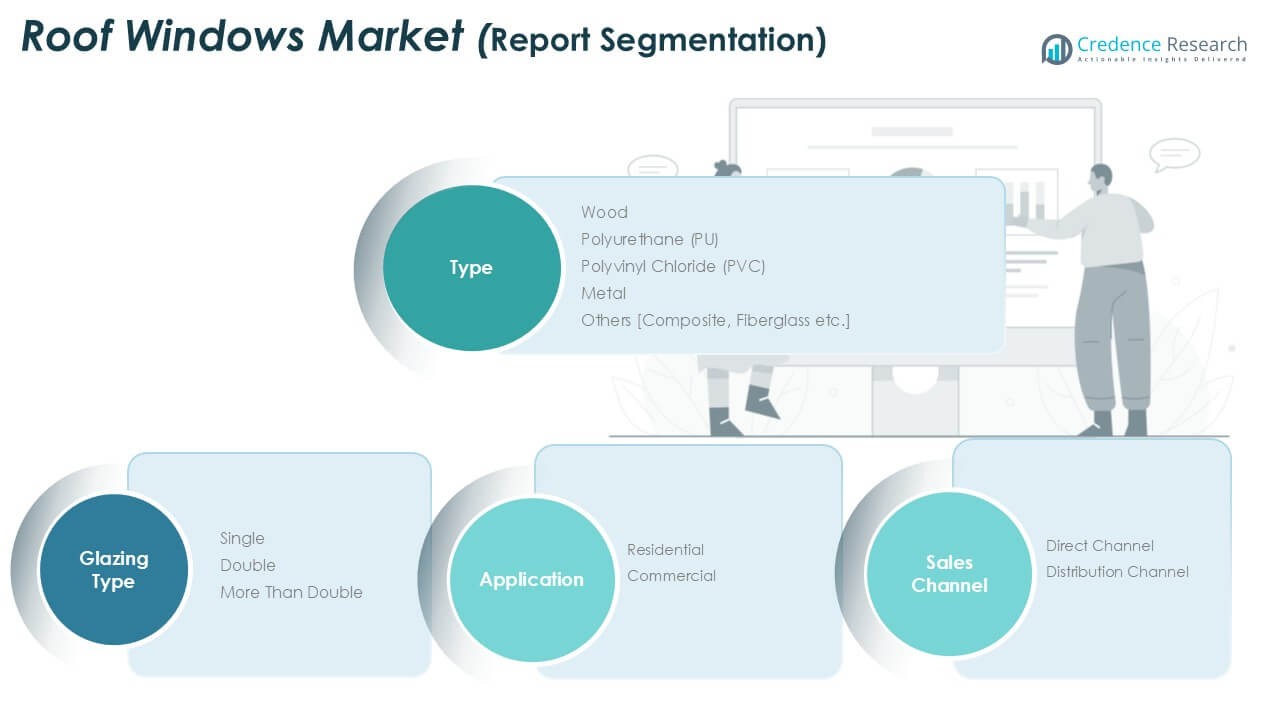

Market Segmentation Analysis:

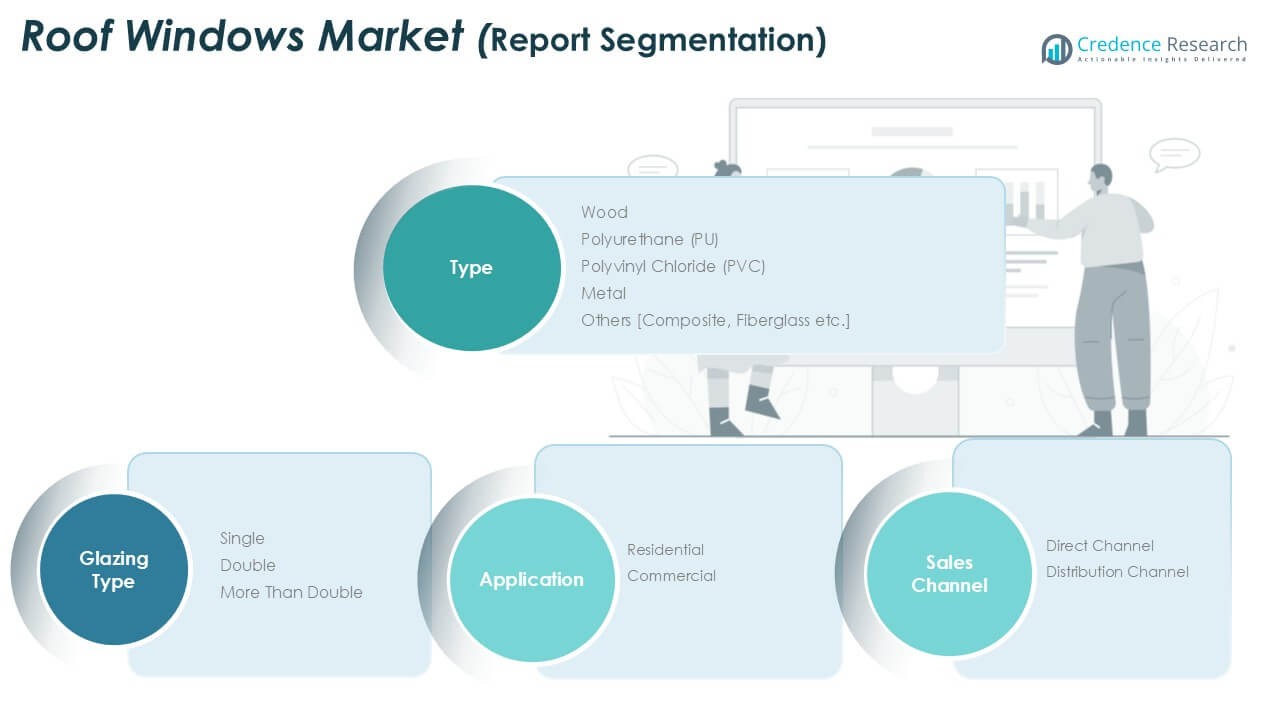

By Type

The Germany roof windows market is segmented into wood, polyurethane (PU), polyvinyl chloride (PVC), metal, and others. Wood-based roof windows dominate with over 40% market share, driven by their aesthetic appeal and superior insulation properties. Consumers prefer wood for its natural look and compatibility with premium residential interiors. However, PVC roof windows are gaining traction due to their durability, low maintenance, and affordability. PU frames remain popular in moisture-prone areas like bathrooms and kitchens, while metal variants find niche applications in industrial and commercial buildings where structural strength is critical.

- For instance, Keylite’s Polar PVC roof windows, which feature a moisture-resistant polyurethane (PU) finish, have an extremely low water absorption rating of less than 1% on the frame material.

By Application

The market is segmented into residential and commercial applications. Residential applications lead with more than 65% market share, supported by Germany’s growing focus on energy-efficient homes and daylight optimization. Rising adoption of roof windows in attic conversions, renovations, and new housing projects drives demand. Government incentives promoting sustainable construction also fuel market growth. Commercial applications, including offices, educational facilities, and hospitality projects, contribute steadily, with architects integrating roof windows to enhance natural light and reduce dependency on artificial lighting, aligning with green building standards.

- For instance, in 2023, around 75,000 founders were supported by KfW in Germany to launch their businesses, creating approximately 180,000 jobs. Germany saw a record number of solar systems installed in 2023, with over one million new systems, including rooftop solar, contributing to the energy-efficient building trend.

By Glazing Type

Based on glazing type, the market is divided into single, double, and triple or more glazing. Double-glazed roof windows dominate with approximately 55% share, offering an optimal balance between insulation, cost, and performance. Consumers favor double glazing for its ability to minimize heat loss and improve energy efficiency in Germany’s cold climate. Triple-glazed options are expanding rapidly due to strict energy regulations and demand for superior thermal performance, particularly in passive houses. Single glazing holds a small share, primarily used in low-cost or temporary structures where thermal insulation is less critical.

Key Growth Drivers

Rising Demand for Energy-Efficient Buildings

Germany’s focus on energy-efficient construction fuels demand for advanced roof windows. The Energy Saving Ordinance (EnEV) and KfW funding programs encourage homeowners to invest in solutions that reduce heating costs and improve insulation. Roof windows with double and triple glazing help achieve higher thermal efficiency ratings. Renovation of older housing stock and attic conversions also boost installation rates. Consumers increasingly view energy-efficient roof windows as a long-term cost-saving measure, driving steady replacement demand across residential and small commercial projects nationwide.

- For instance, VELUX emphasizes its focus on energy-efficient products, including double- and triple-glazed windows with low U-values, and has introduced models to meet the German market’s demand for high thermal performance.

Growing Renovation and Remodeling Activities

The rising number of renovation projects in Germany significantly contributes to market growth. Older homes, particularly those built before modern energy regulations, are being upgraded to improve energy performance and natural lighting. Roof windows are key elements in loft conversions and attic refurbishments, which remain popular in urban areas with limited new construction space. Incentives from government programs such as BEG (Federal Funding for Efficient Buildings) further motivate homeowners to replace outdated windows with modern, thermally insulated roof windows that meet sustainability targets.

- For instance, Attic conversions in German cities like Berlin are a recognized area for potential housing development, driving demand for products like roof windows, especially those with high energy efficiency.

Preference for Natural Light and Ventilation

German consumers show growing preference for living spaces with ample daylight and fresh air circulation. Roof windows offer an efficient way to brighten interiors, reduce artificial lighting costs, and enhance indoor air quality. This aligns with increasing awareness of wellness and productivity benefits linked to natural light exposure. Architects and developers are integrating roof windows into residential projects to create open, healthy, and energy-optimized interiors. These preferences are further supported by urban design trends that emphasize sustainable, light-filled living spaces and reduced energy consumption.

Key Trends & Opportunities

Adoption of Smart and Automated Roof Windows

Smart roof windows with remote control, rain sensors, and integration with home automation systems are gaining traction in Germany. Consumers value convenience and enhanced comfort through automated ventilation and shading functions. Manufacturers invest in digital solutions that enable energy optimization by adjusting opening and closing based on indoor climate data. This trend creates opportunities for premium offerings and aftermarket upgrades. Growing interest in smart homes across German urban centers further drives adoption, opening avenues for connected roof window ecosystems and energy management integration.

- For instance, Roto Frank AG’s Designo i8 Comfort electric roof windows promote healthier indoor air quality by facilitating automated, scheduled ventilation. This helps reduce levels of indoor pollutants, including carbon dioxide, though the specific amount of reduction depends on various environmental factors.

Increasing Use of Sustainable and Recyclable Materials

Sustainability remains a critical trend shaping product innovation in the roof window market. Manufacturers focus on recyclable PVC frames, responsibly sourced wood, and low-carbon glazing to meet green building requirements. Eco-label certifications and compliance with EU sustainability directives provide a competitive edge. This focus creates opportunities for brands to position themselves as environmentally responsible and attract eco-conscious consumers. The trend also supports Germany’s broader carbon reduction goals and aligns with the country’s transition toward climate-neutral building practices by 2045.

- For instance, in 2023, FAKRO pursued its sustainability goals by obtaining Environmental Product Declarations (EPDs) for key product lines, including its wooden roof windows, aluminium-clad plastic roof windows, loft ladders, and flat roof windows. The company did not claim that EPDs were issued for over 90% of its total product portfolio.

Key Challenges

High Installation and Product Costs

The relatively high cost of premium roof windows and skilled installation acts as a barrier, especially in price-sensitive segments. Triple-glazed models, smart features, and custom sizing further increase expenses for homeowners. These costs can slow adoption despite long-term energy savings benefits. Small contractors may also lack expertise in installing advanced roof windows, raising labor costs. Overcoming this challenge requires cost optimization, wider availability of standardized models, and training programs to expand the pool of qualified installers in the German market.

Stringent Compliance and Regulatory Requirements

Germany’s strict energy efficiency and building regulations, while driving market growth, also create compliance challenges for manufacturers. Roof windows must meet high standards for U-value, air tightness, and durability, which increases R&D and production costs. Frequent updates to regulatory frameworks demand constant product innovation and certification efforts. Smaller players may struggle to keep up with these requirements, limiting their competitiveness. Streamlined certification processes and technical support can help manufacturers adapt quickly and reduce time-to-market for compliant products.

Regional Analysis

North Germany

North Germany accounts for nearly 28% of the market share, supported by a strong renovation culture and high demand for energy-efficient housing. Coastal cities such as Hamburg and Bremen experience higher adoption of triple-glazed roof windows due to harsh weather conditions and the need for superior insulation. Historic housing stock and attic conversions contribute significantly to demand, as homeowners seek to optimize space and improve daylight penetration. Government incentives for energy efficiency upgrades further boost replacement sales, making the region an attractive market for manufacturers focusing on premium and sustainable roof window solutions.

South Germany

South Germany leads with over 32% of the market share, driven by strong construction activity in Bavaria and Baden-Württemberg. The region has a large base of detached houses and premium residential projects where wood-framed roof windows are highly preferred. Demand is also fueled by passive house standards and stricter energy-efficiency regulations. Urban centers such as Munich and Stuttgart show high adoption of smart and automated roof windows, aligning with the growing smart home trend. The region benefits from a robust distribution network and a higher spending capacity, supporting sales of triple-glazed and premium roof window models.

East Germany

East Germany holds around 15% market share, with growth led by residential renovation projects in Saxony, Thuringia, and Brandenburg. The region has a significant number of older housing units, creating demand for replacement of single-glazed windows with modern double-glazed variants. Government funding programs for energy-efficient refurbishment and attic conversions play a critical role in stimulating demand. Rising interest in daylight optimization in multi-family housing projects also supports market expansion. However, price sensitivity in certain areas encourages adoption of PVC roof windows, which offer a cost-effective solution while meeting insulation and durability requirements.

West Germany

West Germany captures about 25% of the market share, with strong demand in populous states like North Rhine-Westphalia and Hesse. High levels of urbanization and commercial construction activity drive adoption of roof windows in residential and mixed-use projects. Double-glazed roof windows dominate installations, balancing affordability with compliance to energy-efficiency norms. The presence of leading manufacturers and distributors ensures a steady supply chain, supporting large-scale renovation programs. The region’s construction market benefits from public investments in sustainable infrastructure, encouraging both residential homeowners and developers to integrate roof windows for improved energy performance and indoor comfort.

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The Germany roof windows market is moderately consolidated, with leading players such as Velux Group, Fakro, Roto Frank AG, and Lamilux holding a significant share. These companies compete on product innovation, energy efficiency, and advanced glazing technologies to meet strict German building standards. Velux dominates the premium segment with a wide range of smart and automated roof windows, while Fakro focuses on sustainable materials and cost-effective solutions. Roto Frank AG leverages its strong distribution network and customized offerings for residential and commercial projects. Emerging players like Skyfens and Skylights Plus target niche markets with competitively priced solutions, driving price competition. Partnerships with builders, architects, and distributors remain a key growth strategy to expand market reach. Companies are investing in R&D to develop triple-glazed and smart roof windows that align with Germany’s energy transition goals and appeal to consumers prioritizing comfort, efficiency, and modern design.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fakro

- Velux Group

- Roto Frank AG

- Mage Roof & Building Components GmbH

- Lamilux

- Skyfens

- Skylights Plus

- Josef Meeth Fensterfabrik GmbH & Co KG

- Beckmann GmbH

- Müller u. Sohn GmbH

- Dakota Group

- Schlegel Innenausbau GmbH

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by energy-efficient construction and renovation projects.

- Demand for smart and automated roof windows will expand with rising smart home adoption.

- Triple-glazed roof windows will gain more share due to stricter energy efficiency regulations.

- Residential applications will continue to dominate as homeowners focus on daylight optimization.

- Commercial installations will grow with sustainable building certifications and green office designs.

- Manufacturers will invest in recyclable materials to align with Germany’s climate-neutral building goals.

- Partnerships with architects and contractors will strengthen distribution and market penetration.

- Digital tools for design visualization and installation planning will enhance customer experience.

- Price-competitive PVC and PU roof windows will see rising adoption in cost-sensitive projects.

- Innovation in rain-sensor automation and remote-control systems will create premium product demand.