Market Overviews

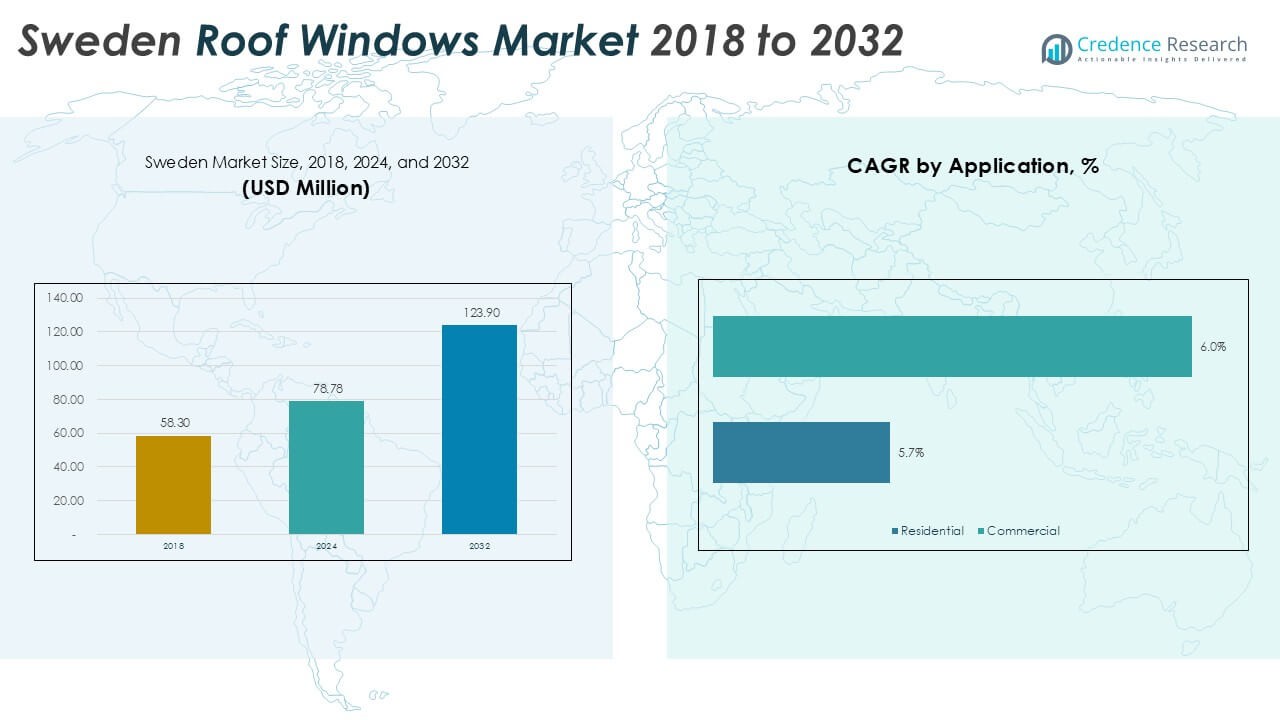

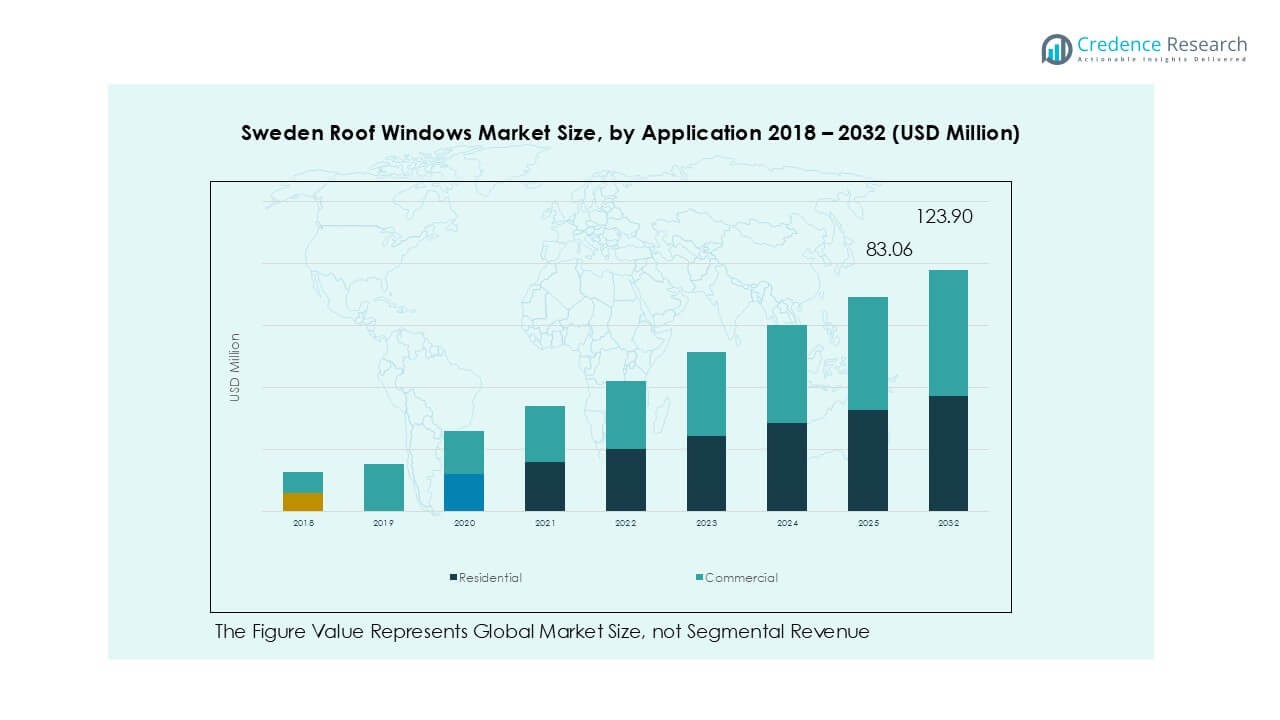

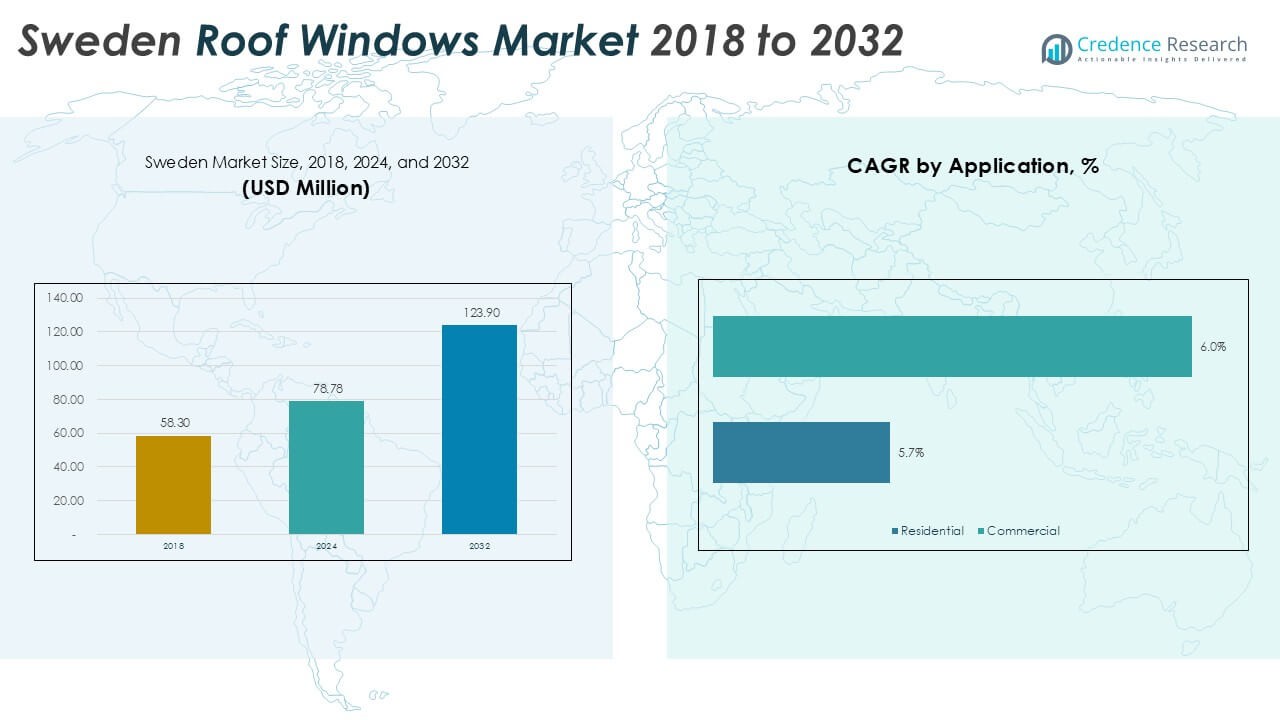

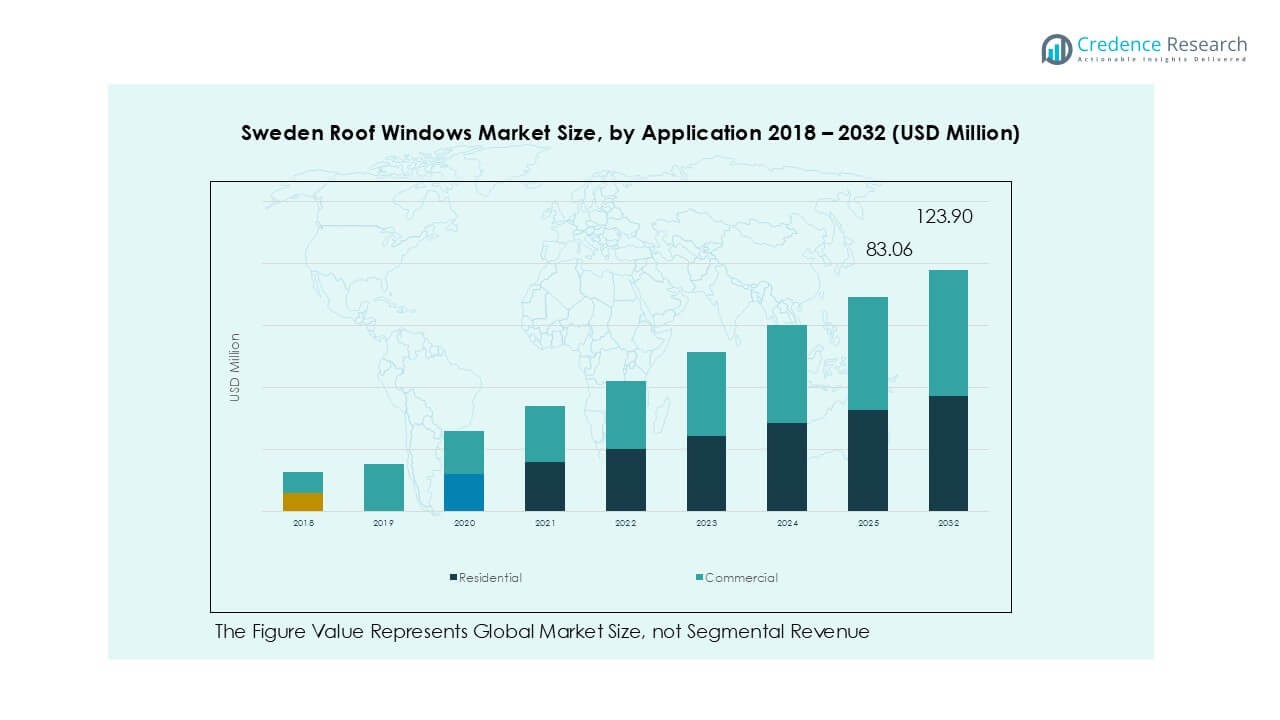

Sweden Roof Windows market size was valued at USD 58.30 million in 2018 to USD 78.78 million in 2024 and is anticipated to reach USD 123.90 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sweden Roof Windows Market Size 2024 |

USD 78.78 Million |

| Sweden Roof Windows Market, CAGR |

5.8% |

| Sweden Roof Windows Market Size 2032 |

USD 123.90 Million |

The Sweden roof windows market is led by Velux Group, Fakro, and Roto Frank AG, which dominate with extensive product portfolios and strong dealer networks. Velux Group holds the largest share, driven by advanced glazing solutions and energy-efficient designs. Fakro focuses on expanding automated and smart roof window offerings, while Roto Frank AG emphasizes durable, high-performance frames for residential and commercial use. Local players such as GlasLindberg and Lamilux strengthen regional supply with customized solutions. Southern Sweden leads with approximately 45% market share, followed by Central Sweden at 30%, and North Sweden at 25%, reflecting strong urban housing and renovation demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sweden Roof Windows market was valued at USD 78.78 million in 2024 and is projected to reach USD 123.90 million by 2032, growing at a CAGR of 8%.

- Growth is driven by rising demand for energy-efficient housing, government incentives for green buildings, and increasing renovation of older residential properties across Sweden.

- Trends include adoption of smart roof windows with sensors, rising popularity of triple glazing for superior insulation, and growing use of sustainable materials such as wood and polyurethane.

- The market is moderately consolidated, with Velux Group, Fakro, and Roto Frank AG leading through innovation, automated solutions, and compliance with strict energy efficiency regulations.

- Southern Sweden leads with 45% share, followed by Central Sweden with 30% and North Sweden with 25%; wood type dominates by over 40% share, and double-glazing accounts for 55% of installations, reflecting strong focus on cost-effective thermal performance.

Market Segmentation Analysis:

By Type

Wood holds the dominant share in the Sweden roof windows market, accounting for over 40% of total installations in 2024. Its popularity stems from superior insulation properties, aesthetic appeal, and compatibility with Sweden’s sustainable building practices. Demand is supported by rising adoption of energy-efficient wooden frames that meet Nordic thermal standards. Polyurethane (PU) follows as the preferred choice in moisture-prone areas like kitchens and bathrooms due to its durability. PVC and metal segments are gaining traction in cost-sensitive projects, while hybrid options expand to meet growing demand for customizable and eco-friendly solutions.

- For instance, Westcoast Windows in Sweden offers triple-glazed windows with U-values down to 0.8 W/m²K, enabling high thermal performance in cold climates.

By Application

Residential applications lead the market with more than 65% share in 2024, driven by increasing demand for natural lighting and improved ventilation in single-family homes and apartments. Sweden’s strong focus on green housing initiatives and energy-efficient renovations supports higher adoption of roof windows. Commercial use, including offices, educational facilities, and retail buildings, is also growing with the trend of daylight-optimized workspaces. Demand in commercial spaces is further driven by compliance with EU building regulations that promote energy performance, encouraging developers to integrate roof windows into modern sustainable architecture projects.

- For instance, Westcoast Windows’ composite windows are hand-assembled and built to withstand Scandinavian climates, with a whole-window U-value for double glazing of 1.4 W/m²K.

By Glazing Type

Double glazing dominates the Sweden roof windows market, holding approximately 55% market share in 2024. It offers an ideal balance of thermal insulation, sound reduction, and affordability, making it the preferred choice for most residential and small commercial projects. Triple glazing is witnessing faster growth in northern regions where superior thermal performance is crucial to reduce heating costs during long winters. Single glazing is largely limited to non-heated spaces or budget projects. The push for passive house standards and reduced carbon footprints continues to drive upgrades toward advanced multi-glazed roof window systems.

Key Growth Drivers

Rising Energy-Efficient Housing Projects

Sweden’s commitment to energy-efficient building construction drives demand for advanced roof windows. Government incentives and strict energy codes encourage homeowners and builders to adopt windows that improve insulation and reduce heating costs. Roof windows with low-emissivity coatings and multi-glazing options align with Sweden’s zero-energy building targets. Increased renovation of older housing stock further supports replacement demand, as homeowners prioritize energy performance upgrades. This trend significantly boosts market growth, especially in urban areas where sustainable living standards are a priority.

- For instance, Chalmers University research shows fixed windows in energy-efficient Swedish buildings achieving U-values as low as 0.7 W/m²K and operable ones around 0.8 W/m²K.

Growing Consumer Preference for Natural Light

Homeowners increasingly seek improved indoor comfort and natural daylight, fueling roof window adoption. Roof windows create bright, ventilated interiors that align with Sweden’s design preference for open, airy spaces. Research links natural light to improved well-being, productivity, and energy savings, making it a strong selling point. This driver is prominent in both new residential constructions and home renovation projects. The rising popularity of daylight optimization solutions in Scandinavian architecture strengthens the market outlook for premium roof window installations.

- For instance, the “Smart Housing Småland” project uses large timber and glass panels with high visible light transmittance, promoting daylight deep inside homes.

Supportive Green Building Regulations

Sweden’s green building certifications and EU directives push demand for eco-friendly and energy-efficient windows. Programs like Miljöbyggnad and BREEAM encourage the use of sustainable construction materials and high-performance glazing solutions. Roof windows with superior U-values help projects achieve compliance and earn certification credits. Builders and developers are motivated to install compliant products to attract environmentally conscious buyers and meet carbon reduction goals. This regulatory support remains a key driver in boosting adoption across residential and commercial sectors, shaping market expansion over the next decade.

Key Trends & Opportunities

Adoption of Smart and Automated Roof Windows

The market is witnessing a surge in smart roof windows featuring sensors and remote controls. These systems enable automatic opening for ventilation, rain detection, and integration with home automation platforms. Growing smart home adoption in Sweden creates opportunities for manufacturers to offer IoT-enabled roof windows with energy monitoring features. Consumers are willing to invest in convenience-oriented solutions that improve air quality and thermal comfort. This trend favors premium product segments and encourages partnerships with home automation technology providers.

- For instance, Lamilux offers its Glass Skylight FE range with wind and rain sensors and an electric motor, enabling automatic closing in storm or rain events.

Increasing Use of Triple Glazing Solutions

Triple glazing adoption is rising as homeowners seek superior insulation and noise reduction. Harsh winters in northern Sweden make triple-glazed roof windows highly desirable to maintain indoor warmth and lower heating bills. The segment’s growth is supported by government initiatives promoting near-zero-energy buildings. Manufacturers are innovating to offer slimmer triple-glazed units without compromising aesthetics, helping boost residential and commercial uptake. This trend opens opportunities for suppliers to market energy performance as a key differentiator.

- For instance, Rooflite Trio PINE from VKR Group offers a triple glazed roof window with a package thickness of 34 mm, glazing U-value (Ug) of 0.8 W/m²K, and whole window U-value (Uw) of 1.1 W/m²K.

Key Challenges

High Installation and Product Costs

The relatively high cost of roof window installation remains a major barrier to adoption. Skilled labor requirements and complex roof integration increase project expenses. For price-sensitive homeowners and small commercial developers, upfront costs may outweigh long-term energy savings. This challenge slows penetration in rural areas and among budget-conscious consumers. Manufacturers must focus on cost-effective solutions and financing options to address affordability concerns and expand their customer base across diverse income segments.

Limited Awareness in Rural Areas

Many rural homeowners have limited awareness of the benefits of modern roof windows, such as energy savings and improved ventilation. Traditional skylights or no installations are still common in older houses, reducing market reach. Educational campaigns and dealer outreach are needed to increase adoption in these regions. Lack of awareness also delays renovation decisions, particularly for energy retrofitting programs. Addressing this challenge requires collaboration between manufacturers, local installers, and government agencies to promote benefits and offer incentives.

Regional Analysis

North Sweden

North Sweden accounts for nearly 25% of the roof windows market in 2024, driven by extreme winter conditions that increase demand for superior thermal insulation. Triple-glazed roof windows dominate installations as homeowners prioritize energy efficiency and lower heating costs. Renovation of aging housing stock in rural areas further boosts demand. The region’s adoption is supported by government-backed energy retrofit programs and incentives for low-energy buildings. Harsh climatic conditions also encourage the use of durable frame materials like wood and polyurethane. Growth is steady, with rising interest in smart automated solutions for ventilation and daylight optimization in residential projects.

Central Sweden

Central Sweden holds around 30% market share, making it a leading contributor to roof window demand. This region benefits from a balanced mix of residential and commercial projects, including new urban developments and renovation activities. Double-glazed roof windows remain the preferred choice due to their cost-effectiveness and strong insulation performance. Demand is supported by growing adoption of green building certifications, which push developers to integrate daylighting solutions. Central Sweden also shows early adoption of motorized roof windows in offices and schools to improve indoor air quality. The segment’s growth is enhanced by strong distribution networks and professional installation services.

Southern Sweden

Southern Sweden leads the market with approximately 45% share in 2024, supported by high construction activity in cities like Malmö, Lund, and Helsingborg. The region witnesses strong demand from residential sectors, especially single-family houses and modern apartment complexes. Double-glazing dominates but triple-glazed solutions are increasingly popular in energy-conscious households. The area benefits from a warmer climate, reducing extreme insulation needs but emphasizing ventilation and natural light solutions. Home renovation programs and growing disposable income encourage upgrades to premium roof windows. Southern Sweden is also at the forefront of integrating smart roof window technologies connected to home automation systems.

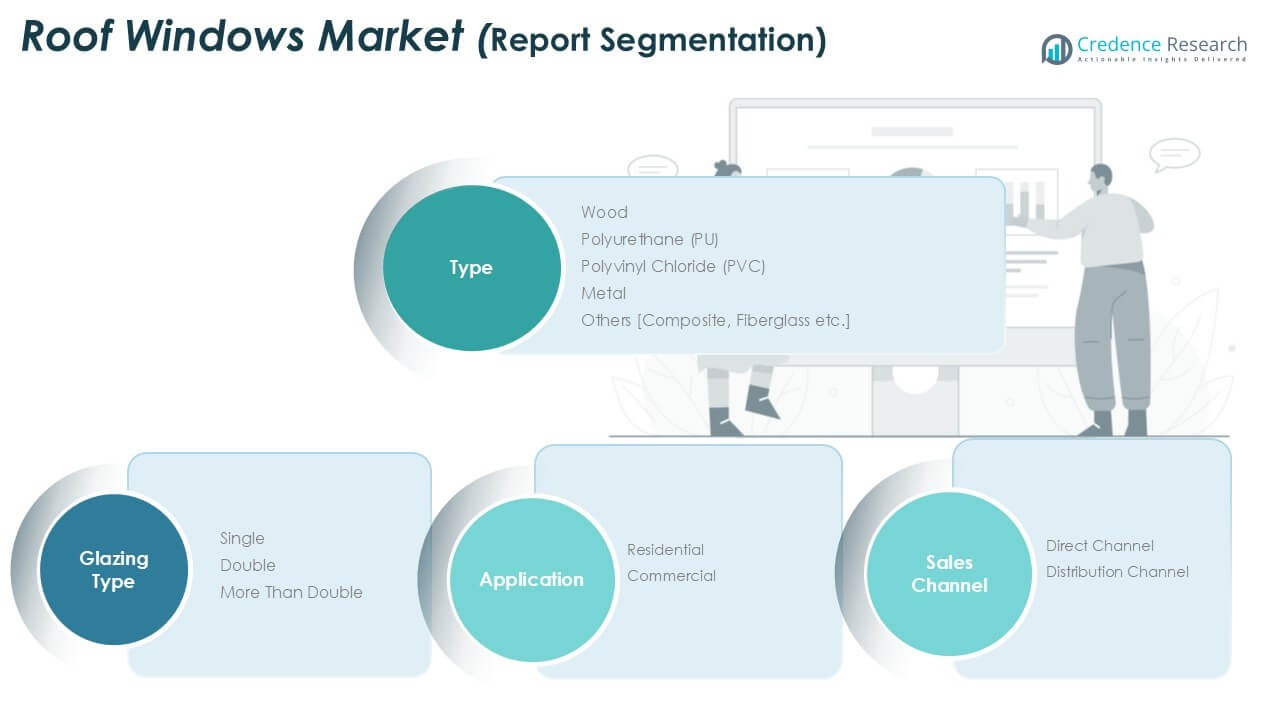

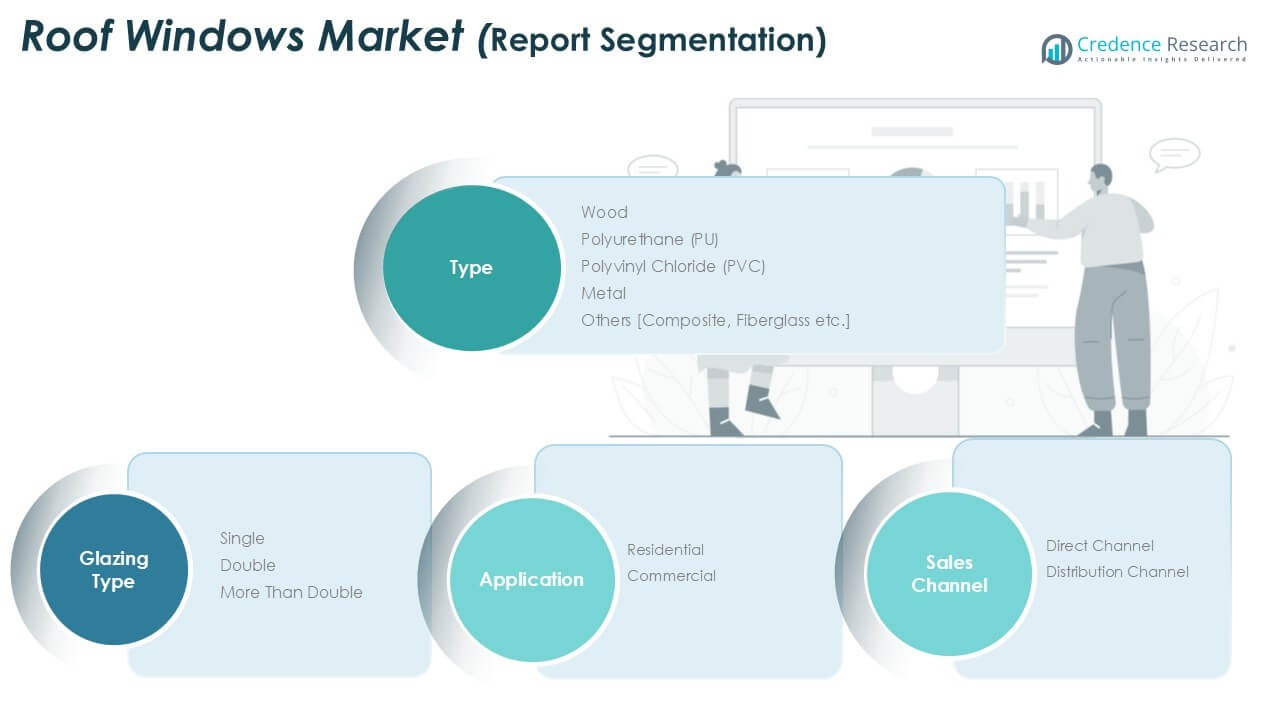

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- North Sweden

- Central Sweden

- Southern Sweden

Competitive Landscape

The Sweden roof windows market is moderately consolidated, with key players including Velux Group, Fakro, Roto Frank AG, GlasLindberg, and Lamilux holding significant market presence. Velux Group leads with a strong distribution network and a wide range of energy-efficient roof window solutions tailored to Scandinavian climates. Fakro and Roto Frank AG focus on expanding automated and smart roof window offerings to meet rising demand for convenience and sustainability. Local players like GlasLindberg and Skyfens cater to region-specific requirements, offering cost-effective solutions for residential projects. Companies compete on innovation, glazing technology, and compliance with Sweden’s strict energy performance regulations. Strategic moves include partnerships with construction firms, expansion of digital sales channels, and product launches featuring improved insulation and noise reduction. Market participants also emphasize sustainability through recyclable materials and eco-friendly manufacturing, aligning with Sweden’s green building standards and strengthening their competitive edge in both residential and commercial segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fakro

- Velux Group

- Roto Frank AG

- GlasLindberg

- Lamilux

- Skyfens

- Skylights Plus

- Brett Martin

- Lonsdale Metal Co

- Marvin Windows and Doors

- Dakota Group

- Glazing Vision Ltd

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of energy-efficient and sustainable construction materials.

- Demand for triple-glazed roof windows will rise due to stricter building energy codes.

- Smart and automated roof windows will gain traction with increasing smart home integration.

- Renovation of older housing stock will create steady replacement demand across regions.

- Manufacturers will invest in recyclable and eco-friendly frame materials to meet green standards.

- Commercial projects will adopt daylight-optimized roof window solutions to enhance indoor environments.

- Digital sales channels and e-commerce will support wider product accessibility for consumers.

- Partnerships between window manufacturers and construction firms will accelerate product penetration.

- Innovation in noise reduction and insulation technologies will drive premium product demand.

- Southern Sweden will continue to dominate, but Central and Northern regions will show faster growth rates.