Market Overview:

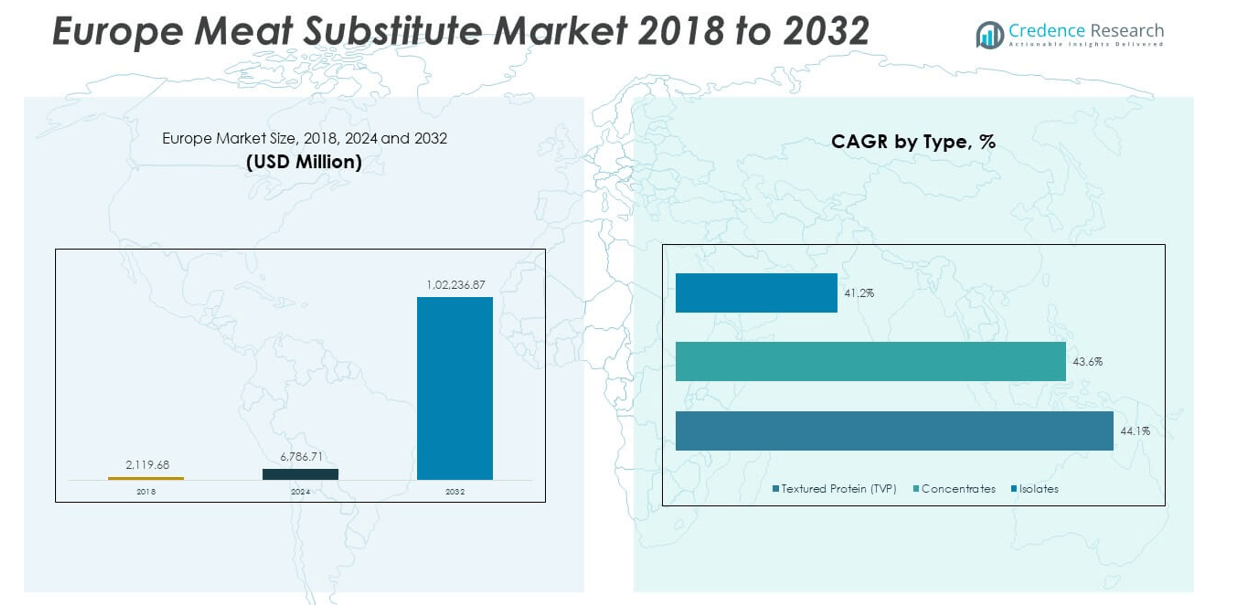

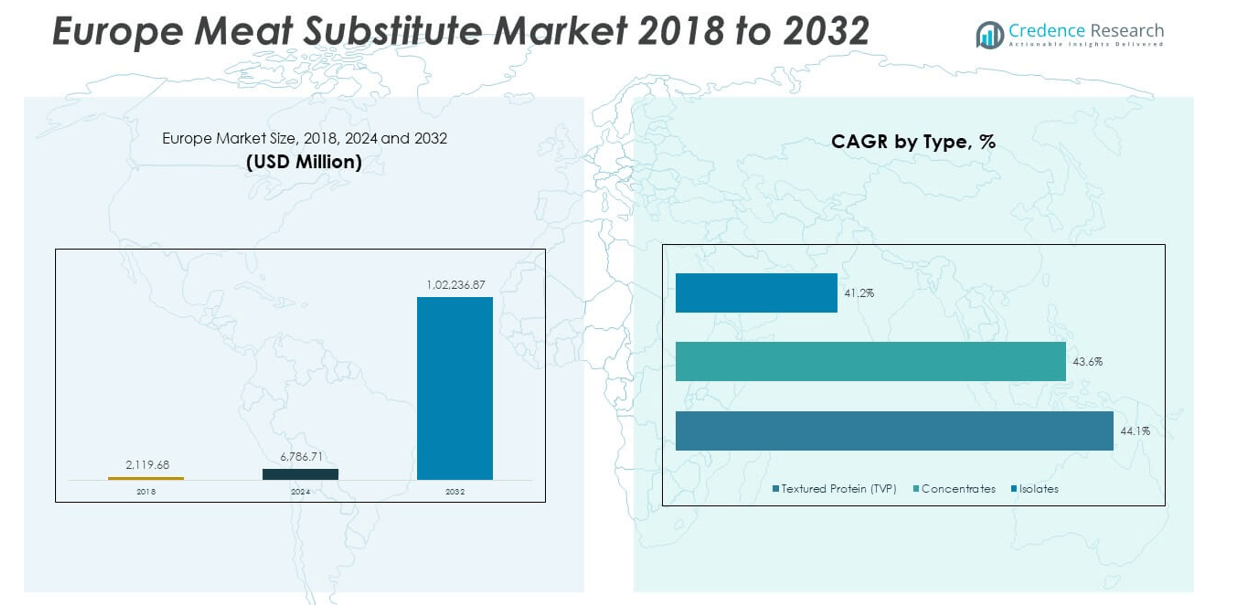

The Europe Meat Substitute Market size was valued at USD 2,119.68 million in 2018 to USD 6,786.71 million in 2024 and is anticipated to reach USD 102,236.87 million by 2032, at a CAGR of 40.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Meat Substitute Market Size 2024 |

USD 6,786.71 million |

| Europe Meat Substitute Market, CAGR |

40.37% |

| Europe Meat Substitute Market Size 2032 |

USD 102,236.87 million |

Growth in the Europe Meat Substitute Market is driven by shifting consumer preferences toward healthier and sustainable diets. Rising awareness of environmental concerns and animal welfare has encouraged consumers to choose plant-based and alternative protein options. Expanding vegan and flexitarian populations, combined with improved taste and texture of new products, further support adoption. Investments in innovation, government support for sustainable food production, and strong retail distribution are also key factors enhancing demand. Foodservice outlets and supermarkets are strengthening product visibility, helping the sector accelerate.

Within Europe, Western countries such as Germany, the U.K., and France are leading the market due to strong consumer demand and well-established plant-based brands. Nordic countries are also advancing, supported by sustainability-driven policies and high health consciousness. Meanwhile, Eastern Europe is emerging as a growth region as awareness spreads and disposable incomes rise. The market is benefiting from both mature economies adopting premium alternatives and developing areas gradually integrating plant-based diets into mainstream food culture.

Market Insights:

- The Europe Meat Substitute Market was valued at USD 2,119.68 million in 2018, grew to USD 6,786.71 million in 2024, and is projected to reach USD 102,236.87 million by 2032, expanding at a CAGR of 40.37%.

- Western Europe held 45% share in 2024, led by Germany, the UK, and France due to high consumer adoption, advanced retail, and strong innovation ecosystems.

- Northern Europe captured 25% share, driven by Nordic countries where sustainability policies and eco-conscious consumers strongly support plant-based diets.

- Southern and Eastern Europe together represented 30% share, emerging as high-potential regions supported by rising incomes, improving retail access, and localized flavor offerings.

- By product segmentation, tofu and Quorn accounted for nearly 40% combined share in 2024, while tempeh, seitan, and others shared the remaining 60%, showing diversity in consumer preferences across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Plant-Based and Health-Oriented Diets

Consumers across Europe are showing a strong preference for plant-based and health-focused diets. Growing awareness of the link between nutrition and lifestyle-related diseases is fueling this shift. The Europe Meat Substitute Market is benefiting from rising numbers of flexitarians, vegans, and vegetarians. Consumers are motivated by the appeal of healthier protein sources with reduced fat and cholesterol. Increasing urbanization is also accelerating access to these products in supermarkets and food outlets. Marketing campaigns highlighting health advantages reinforce this trend. It is driving both younger and older demographics toward alternative proteins.

Environmental Sustainability and Climate Change Awareness

Environmental concerns are acting as a significant driver in this market. Consumers in Europe are highly aware of the environmental impact of traditional meat production. The Europe Meat Substitute Market benefits from demand linked to reduced carbon footprints and sustainable practices. Plant-based proteins are widely viewed as eco-friendly alternatives to meat. European governments and NGOs also promote awareness through campaigns and guidelines. These efforts align with consumer values on sustainability and responsibility. It reinforces trust in brands offering low-impact protein solutions. Market growth is strengthened by these consistent eco-driven initiatives.

- For instance, the Good Food Institute Europe has reported that plant-based meat production can reduce greenhouse gas emissions by up to 90% compared to conventional meat. While GFI and other research indicate consumer interest in sustainable eating, this is just one of several drivers, along with taste, health, and price. European governments are involved through some funding for R&D and broad sustainability goals

Innovation in Taste, Texture, and Product Range

Improved product innovation has enhanced adoption in the Europe Meat Substitute Market. Consumers once hesitant due to taste and texture now find better options. Advanced food technologies have led to realistic flavors and meat-like textures. Expanding ranges include sausages, burgers, nuggets, and deli slices catering to diverse tastes. Food manufacturers are investing in R&D to improve sensory experience and nutritional content. Strong collaborations with chefs and food scientists are fueling creativity. It has increased consumer satisfaction and repeat purchases. This focus on quality and innovation continues to build trust in substitute products.

Expansion of Retail and Foodservice Distribution Channels

Retailers and foodservice providers are playing a crucial role in market expansion. Supermarkets and hypermarkets are dedicating more shelf space to plant-based proteins. Restaurants and quick-service chains are adding meat-free options to menus across Europe. The Europe Meat Substitute Market benefits from this wider distribution network. E-commerce platforms are also creating convenient access to plant-based offerings. Increased visibility of products encourages trial and adoption by mainstream consumers. Partnerships between producers and retailers are strengthening brand recognition. It enables companies to reach larger audiences and expand their market presence effectively.

Market Trends:

Growing Investment in Food Technology and Alternative Proteins

Food technology is shaping the evolution of meat substitutes in Europe. Companies are investing in advanced fermentation, cultured meat, and precision biology. These innovations create more realistic substitutes that appeal to wider audiences. The Europe Meat Substitute Market is gaining from improved nutritional value and functionality. Startups and established players are collaborating with research institutions to fast-track development. Technology-driven improvements enhance both scalability and affordability. It attracts investors interested in sustainable solutions. Continuous innovation ensures the market stays dynamic and competitive.

- For instance, European alternative protein companies raised nearly $509 million in investment during 2024, with $130 million directed specifically towards precision fermentation technologies accelerating the production of animal-free ingredients that mimic meat’s flavor and texture.

Premiumization and Introduction of Gourmet Plant-Based Products

Premium positioning is becoming a key trend in the Europe Meat Substitute Market. Brands are introducing gourmet burgers, steaks, and specialty items with enhanced quality. Consumers are willing to pay for better texture, taste, and culinary appeal. Restaurants and retailers promote premium options targeting health-conscious urban buyers. The trend is reinforced by growing middle-class demand for indulgence with sustainability. It signals the shift of plant-based proteins from niche to mainstream dining. Celebrity chefs and influencers are endorsing gourmet offerings, adding cultural relevance. Premiumization expands consumer loyalty and strengthens market penetration.

- For instance, the European plant-based food market is experiencing robust growth driven by increasing consumer demand for natural and sustainable plant-based options. This demand has encouraged various food producers, including those in the meat alternative sector, to expand their product lines to cater to health-conscious consumers across the continent.

Expansion of Private Labels and Retailer-Led Offerings

Retailers across Europe are strengthening their private label plant-based product lines. Supermarkets see rising profit potential in offering in-house substitutes at competitive prices. The Europe Meat Substitute Market is witnessing growing competition between private labels and established brands. These products often combine affordability with acceptable quality. Retailer-backed marketing ensures strong visibility on shelves and online platforms. It creates opportunities for first-time consumers to try plant-based diets. Widespread presence of private labels drives affordability and accessibility. This trend is reinforcing volume sales across regional markets.

Integration of Sustainability Certifications and Clean Label Products

Clean labels and sustainability certifications are influencing consumer decisions strongly. Buyers prefer products with transparent sourcing, natural ingredients, and eco-friendly packaging. The Europe Meat Substitute Market is moving toward labeling that highlights minimal processing. Certifications like vegan, organic, and carbon-neutral resonate with European consumers. Brands use these certifications to differentiate and build trust. It enhances credibility in markets where health and sustainability drive purchase behavior. Demand for transparency pressures companies to improve supply chain practices. This trend is reshaping marketing strategies and long-term positioning.

Market Challenges Analysis:

High Production Costs and Price Sensitivity of Consumers

Cost remains a critical challenge in the Europe Meat Substitute Market. Advanced technologies and ingredients raise production expenses compared to traditional meat. Higher retail prices restrict adoption among price-sensitive buyers. Consumers in emerging European economies face affordability barriers, slowing expansion. Limited economies of scale for startups also impact profitability. It pressures companies to balance innovation with cost-efficiency. Achieving mass-market acceptance requires competitive pricing strategies. Overcoming these challenges is vital for long-term market growth.

Cultural Preferences and Consumer Skepticism Toward Alternatives

Cultural attachment to meat consumption limits growth in some European regions. Traditional cuisines often center around meat-based dishes, slowing substitute adoption. The Europe Meat Substitute Market faces skepticism regarding taste, nutrition, and processing. Some consumers perceive products as overly artificial or lacking authenticity. Addressing these concerns requires transparent communication and consistent quality improvements. Educational campaigns by brands and policymakers can reduce resistance. It demands ongoing effort to align substitutes with cultural values. Overcoming skepticism is key to unlocking broader acceptance.

Market Opportunities:

Emerging Demand from Eastern and Southern Europe

Untapped markets in Eastern and Southern Europe present strong opportunities. Rising disposable incomes and awareness of sustainable diets encourage adoption. The Europe Meat Substitute Market can expand by targeting these growing regions. Companies introducing affordable and accessible options will capture new audiences. Localized flavors adapted to cultural preferences enhance acceptance. It creates openings for regional players to compete with global brands. Building early presence in these areas secures long-term growth potential. Opportunities lie in education and distribution improvements across these markets.

Expansion into Foodservice and Institutional Catering Segments

Foodservice and institutional catering are becoming major opportunity areas. Schools, hospitals, and corporate cafeterias are adopting sustainable food menus. The Europe Meat Substitute Market benefits from this structured demand shift. Partnerships with institutional buyers ensure consistent volume sales. Menu diversification allows operators to meet sustainability targets effectively. It encourages large-scale adoption beyond retail markets. Brands gain credibility by being part of responsible food systems. Expanding into these channels strengthens visibility and positions substitutes as mainstream choices.

Market Segmentation Analysis:

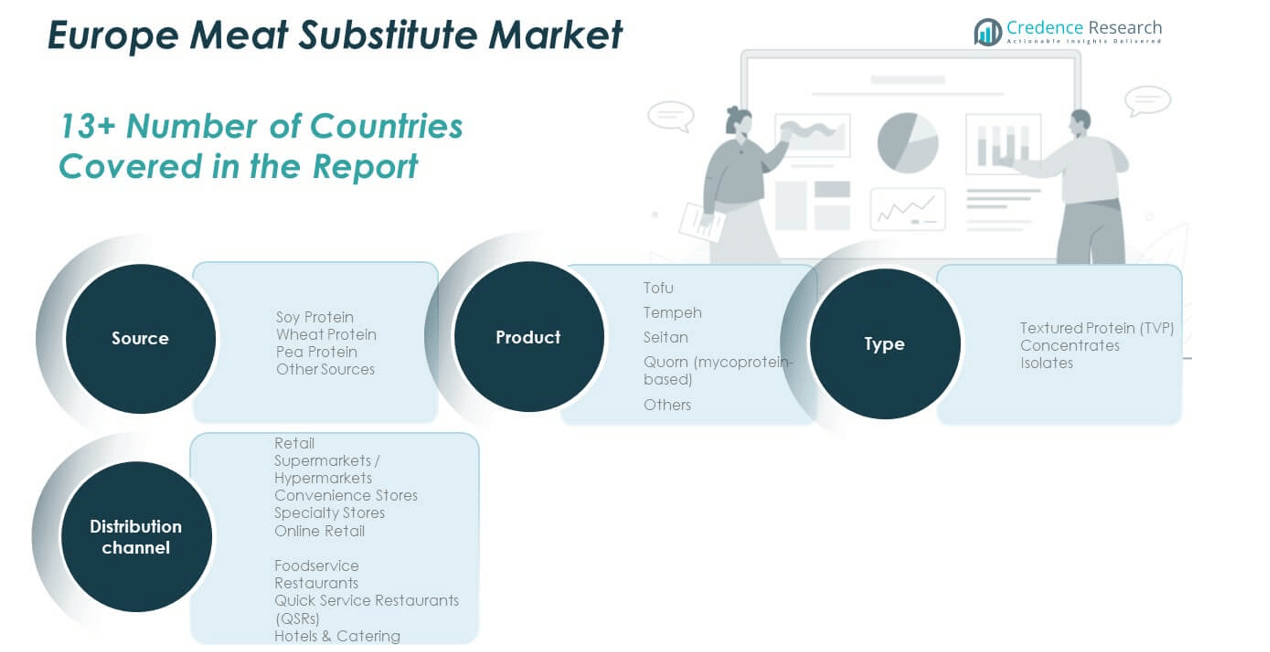

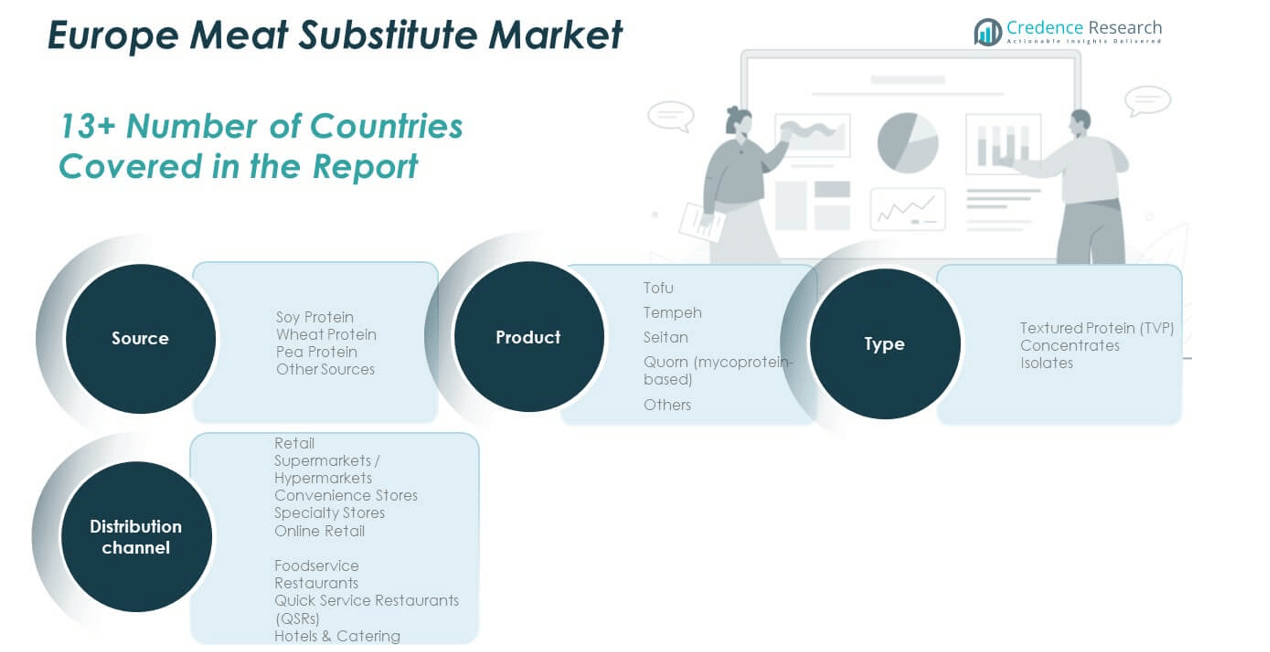

By Type

The Europe Meat Substitute Market is segmented into textured protein (TVP), concentrates, and isolates. Textured protein leads due to its versatility in processed foods and ability to mimic meat texture. Concentrates hold a strong share in functional food applications, supported by cost efficiency and nutritional value. Isolates are gaining traction for premium products because of their high protein content and improved digestibility. Each type caters to distinct consumer groups, ensuring balanced demand across the category.

- For instance, production records show textured vegetable protein accounts for plant-based meat formulations in several European countries, with isolates increasingly incorporated into specialty health supplements and beverages.

By Source

Soy protein dominates the source segment due to its widespread acceptance and established production base. Wheat protein contributes significantly, driven by applications in baked goods and ready meals. Pea protein is expanding rapidly because of allergen-free benefits and sustainability credentials. Other sources, including rice and lentil proteins, are gradually finding place in niche markets. It strengthens the portfolio diversity across Europe.

- For instance, data from 2024 indicate soy protein products represented about 61% of the European plant protein ingredients market, while pea protein products showed remarkable growth and accounted for a smaller, though increasing, share of total plant-based launches, reflecting their rising popularity due to being allergen-conscious and sustainably sourced.

By Product

Tofu and tempeh remain traditional staples, supported by strong consumer familiarity. Seitan offers high protein density and appeals to consumers seeking meat-like textures. Quorn, based on mycoprotein, holds a unique position with strong brand recognition. Other products, including burgers and nuggets, are expanding variety and boosting market penetration. It reflects Europe’s evolving consumer preferences.

By Distribution Channel

Retail dominates with supermarkets and hypermarkets leading the category due to wide accessibility. Convenience and specialty stores target urban buyers seeking specific plant-based options. Online retail is expanding rapidly with growing digital adoption. Foodservice, including restaurants, QSRs, and catering, is creating new opportunities through menu diversification. It strengthens mainstream visibility of meat substitutes across the region.

Segmentation:

- By Type

- Textured Protein (TVP)

- Concentrates

- Isolates

- By Source

- Soy Protein

- Wheat Protein

- Pea Protein

- Other Sources

- By Product

- Tofu

- Tempeh

- Seitan

- Quorn (mycoprotein-based)

- Others

- By Distribution Channel

- Retail

- Supermarkets / Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Foodservice

- Restaurants

- Quick Service Restaurants (QSRs)

- Hotels & Catering

- By Country (within Europe)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe – Market Leader with Strong Consumer Demand

Western Europe holds the largest market share in the Europe Meat Substitute Market, accounting for nearly 45%. Countries such as Germany, the UK, and France drive this dominance with strong consumer adoption and advanced retail networks. High awareness of sustainability and health benefits encourages demand across these nations. Supermarkets and foodservice outlets in this region dedicate substantial space to plant-based products. Innovation hubs and leading brands are headquartered here, supporting product development and distribution strength. It positions Western Europe as the most mature and influential regional market.

Northern Europe – Growth Driven by Sustainability and Policy Support

Northern Europe represents close to 25% of the market, with strong influence from Nordic countries. Governments in Sweden, Denmark, and Finland actively promote sustainable diets and low-carbon food options. Consumers in this region show high awareness of climate impact, fueling preference for plant-based alternatives. Retailers are highly responsive, ensuring diverse product availability across stores. The Europe Meat Substitute Market benefits from the alignment of public policy and consumer values here. It reinforces long-term growth momentum supported by eco-conscious populations.

Southern and Eastern Europe – Emerging Regions with Rising Potential

Southern and Eastern Europe together account for nearly 30% of the Europe Meat Substitute Market. Countries such as Italy and Spain are expanding adoption through traditional food adaptations and rising health awareness. Eastern European nations, including Poland and Russia, are witnessing steady growth due to improving retail infrastructure and rising disposable incomes. Consumer education remains a key factor in these areas, gradually shifting preferences toward substitutes. Regional players are entering with affordable options tailored to local tastes. It is helping accelerate market penetration in these developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Quorn Foods

- Ingredion Incorporated

- Roquette Frères

- Crespel & Deiters

- Beyond Meat

- Impossible Foods

- Amy’s Kitchen

- Conagra Brands

- International Flavors & Fragrances (IFF)

- Associated British Foods

- Unilever (The Vegetarian Butcher)

- Maple Leaf Foods (Field Roast, Lightlife)

- Monde Nissin (Quorn, Cauldron)

- Plant Meat Ltd

Competitive Analysis:

The Europe Meat Substitute Market is highly competitive, with global and regional players focusing on innovation, product expansion, and distribution strength. Established brands such as Quorn, Beyond Meat, and Impossible Foods hold strong positions, supported by continuous investment in R&D. Companies are emphasizing improved taste, texture, and nutritional content to attract a wider consumer base. Retail partnerships and collaborations with foodservice providers enhance visibility across Europe. The Europe Meat Substitute Market benefits from strong competition that accelerates product diversification and affordability. It drives companies to strengthen sustainability credentials and deliver premium quality. Competitive intensity ensures ongoing innovation and consumer-centric strategies.

Recent Developments:

- In August 2025, Quorn Foods expanded its frozen product range by removing all artificial ingredients from its core mince and pieces SKUs, now boasting high protein content with minimal ingredients. This reformulated range includes Quorn Mince and Quorn Pieces, featuring simplified recipes with three to four ingredients, alongside updated packaging highlighting health claims such as high fiber and low saturated fat. The new packs launched in August 2025 and are supported by a major campaign starting October 2025 aimed at promoting nutritious plant-based swaps to consumers.

- Ingredion Incorporated deepened its collaboration in the European plant-based protein sector by forming a long-term strategic partnership with Lantmännen, announced in November 2024.

- Roquette Frères completed the acquisition of IFF Pharma Solutions on May 1, 2025, further strengthening its position in the health and nutrition sectors, including plant-based ingredients. This acquisition enhances Roquette’s portfolio for pharmaceutical and nutrition applications, supporting its long-term strategy to innovate in high-growth markets.

- Ingredion Incorporated also expanded its partnership with Univar Solutions to broaden its distribution of plant-based and clean-label food ingredients in the Benelux region, effective October 1, 2025. This expansion aims to serve approximately 16,000 food producers with Ingredion’s premium starches, plant proteins, and stevia sweeteners, strengthening market presence in Belgium, Netherlands, and Luxembourg.

Report Coverage:

The research report offers an in-depth analysis based on type, source, product, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for sustainable diets will fuel long-term adoption.

- Technological advancements will enhance taste, texture, and nutritional profiles.

- Expansion of private labels will intensify competition in retail.

- Growth of e-commerce platforms will improve accessibility across Europe.

- Institutional catering and foodservice will boost mainstream visibility.

- Premiumization will drive demand for gourmet plant-based products.

- Sustainability certifications will become key purchase influencers.

- Local players will emerge strongly in Eastern and Southern Europe.

- Partnerships between producers and QSR chains will expand menu diversity.

- Continuous investment in R&D will secure product innovation leadership.